Professional Documents

Culture Documents

Philex Mining Vs CIR

Philex Mining Vs CIR

Uploaded by

Sui GenerisOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philex Mining Vs CIR

Philex Mining Vs CIR

Uploaded by

Sui GenerisCopyright:

Available Formats

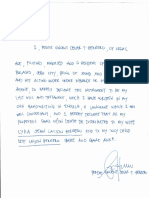

Philex Mining vs CIR

GR No. 125704, August 28, 1998

294 SCRA 687

FACTS:

Petitioner Philex Mining Corp. assails the decision of the Court of Appeals affirming the Court of Tax

Appeals decision ordering it to pay the amount of P110.7 M as excise tax liability for the period from the

2nd quarter of 1991 to the 2nd quarter of 1992 plus 20% annual interest from 1994 until fully paid

pursuant to Sections 248 and 249 of the Tax Code of 1977. Philex protested the demand for payment of

the tax liabilities stating that it has pending claims for VAT input credit/refund for the taxes it paid for the

years 1989 to 1991 in the amount of P120 M plus interest. Therefore these claims for tax credit/refund

should be applied against the tax liabilities.

ISSUE: Can there be an off-setting between the tax liabilities vis-a-vis claims of tax refund of the

petitioner?

HELD:

No. Philex's claim is an outright disregard of the basic principle in tax law that taxes are the lifeblood of

the government and so should be collected without unnecessary hindrance. Evidently, to countenance

Philex's whimsical reason would render ineffective our tax collection system. Too simplistic, it finds no

support in law or in jurisprudence.

To be sure, Philex cannot be allowed to refuse the payment of its tax liabilities on the ground that it has

a pending tax claim for refund or credit against the government which has not yet been granted. Taxes

cannot be subject to compensation for the simple reason that the government and the taxpayer are not

creditors and debtors of each other. There is a material distinction between a tax and debt. Debts are due

to the Government in its corporate capacity, while taxes are due to the Government in its sovereign

capacity. xxx There can be no off-setting of taxes against the claims that the taxpayer may have against

the government. A person cannot refuse to pay a tax on the ground that the government owes him an

amount equal to or greater than the tax being collected. The collection of a tax cannot await the results of

a lawsuit against the government.

You might also like

- Philex Mining Vs Cir DigestDocument3 pagesPhilex Mining Vs Cir DigestRyan Acosta100% (2)

- Maquilan v. MaquilanDocument2 pagesMaquilan v. MaquilanSui GenerisNo ratings yet

- Philex MiningDocument1 pagePhilex MiningFrancis Anthony UrbiztondoNo ratings yet

- Philex Mining Vs CIRDocument3 pagesPhilex Mining Vs CIRpreciousrain07100% (1)

- Philex Mining Corporation vs. Commissioner of Internal Revenue, Court of AppealsDocument2 pagesPhilex Mining Corporation vs. Commissioner of Internal Revenue, Court of AppealsCloie TapelNo ratings yet

- Philex Mining Corporation vs. CIR, G.R. No. 125704Document8 pagesPhilex Mining Corporation vs. CIR, G.R. No. 125704Shay GCNo ratings yet

- Philex Mining Corporation V CIR DigestsDocument1 pagePhilex Mining Corporation V CIR Digestspinkblush717No ratings yet

- Philex VS CirDocument2 pagesPhilex VS CirKath LeenNo ratings yet

- Philex Mining Vs CIRDocument6 pagesPhilex Mining Vs CIRArjay PuyotNo ratings yet

- Philex Mining Corporation vs. CIR, G.R. No. 125704 August 28, 1998Document2 pagesPhilex Mining Corporation vs. CIR, G.R. No. 125704 August 28, 1998piptipaybNo ratings yet

- Philex Mining v. CIRDocument2 pagesPhilex Mining v. CIRAngelique Padilla UgayNo ratings yet

- Philex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Court of Appeals, and The Court of Tax Appeals, RespondentsDocument4 pagesPhilex Mining Corporation, Petitioner, Commissioner of Internal Revenue, Court of Appeals, and The Court of Tax Appeals, RespondentsVan CazNo ratings yet

- Philex VS CirDocument2 pagesPhilex VS CirNikko Ryan C'zare AbalosNo ratings yet

- Philex Mining Corporation v. Commissioner of Internal Revenue, G.R. No. 125704, August 28, 1998Document6 pagesPhilex Mining Corporation v. Commissioner of Internal Revenue, G.R. No. 125704, August 28, 1998AkiNiHandiongNo ratings yet

- Digest-Philex Mining Corporation, Petitioner, vs. Commissioner of Internal Revenue, Court of AppealsDocument3 pagesDigest-Philex Mining Corporation, Petitioner, vs. Commissioner of Internal Revenue, Court of AppealsRon Chris Lastimoza100% (2)

- Philex Mining Corp Vs CIRDocument2 pagesPhilex Mining Corp Vs CIRPat EspinozaNo ratings yet

- Cases For TaxDocument546 pagesCases For TaxChrysta FragataNo ratings yet

- Taxation 1 Case DigestsDocument71 pagesTaxation 1 Case DigestsKatherine Janice De Guzman-PineNo ratings yet

- Philex Mining V CIRDocument7 pagesPhilex Mining V CIRJeunaj LardizabalNo ratings yet

- Philex Mining Corp v. CIRDocument2 pagesPhilex Mining Corp v. CIRautumn moon100% (1)

- Philex Mining Corp. v. CIR, CA, and CTADocument2 pagesPhilex Mining Corp. v. CIR, CA, and CTAHappy Dreams PhilippinesNo ratings yet

- 1 BellDocument14 pages1 Belleinel dcNo ratings yet

- Philex Mining Corporation v. CIRDocument3 pagesPhilex Mining Corporation v. CIRAila AmpNo ratings yet

- Philex Mining Corporation V. Cir, G.R. No. 125704, August 28, 1998 FactsDocument8 pagesPhilex Mining Corporation V. Cir, G.R. No. 125704, August 28, 1998 FactsBleizel TeodosioNo ratings yet

- 136-Philex Mining Corp. v. CIR, August 28, 1988Document5 pages136-Philex Mining Corp. v. CIR, August 28, 1988Jopan SJNo ratings yet

- Final Paper For TaxDocument43 pagesFinal Paper For TaxRaymond AlhambraNo ratings yet

- 19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestDocument1 page19.d Philex Mining Corporation vs. CIR (G.R. No. 125704 August 28, 1998) - H DigestHarleneNo ratings yet

- Refund of Input TaxesDocument2 pagesRefund of Input TaxesRaziel Xyrus FloresNo ratings yet

- Philex Mining Corporation vs. CIRDocument3 pagesPhilex Mining Corporation vs. CIRRobNo ratings yet

- Philex Mining vs. CIR, 294 SCRA 687Document12 pagesPhilex Mining vs. CIR, 294 SCRA 687KidMonkey2299No ratings yet

- PHILEX Mining Corp vs. CIRDocument1 pagePHILEX Mining Corp vs. CIRANTHONY SALVADICONo ratings yet

- CHAPTER 1 Notes TaxDocument6 pagesCHAPTER 1 Notes TaxCherie PastoresNo ratings yet

- Philex Mining v. CirDocument1 pagePhilex Mining v. CirJohn Lorie BacalingNo ratings yet

- Tax Cases DigestsDocument3 pagesTax Cases DigestsMonique LhuillierNo ratings yet

- G.R. No. 125704 Philex Mining Corporation vs. Commissioner of Internal RevenueDocument17 pagesG.R. No. 125704 Philex Mining Corporation vs. Commissioner of Internal RevenuenanatanfitnessNo ratings yet

- Philex Mining Corp vs. CIRDocument1 pagePhilex Mining Corp vs. CIRI took her to my penthouse and i freaked itNo ratings yet

- Philex Mining Corp. v. CIRDocument1 pagePhilex Mining Corp. v. CIRromelamiguel_2015No ratings yet

- Taxation CasesDocument87 pagesTaxation CasesDazzle DuterteNo ratings yet

- 029 - Philex v. CIRDocument2 pages029 - Philex v. CIRJaerelle HernandezNo ratings yet

- Taxation I Case Digest Compilation: Philex Mining v. CADocument2 pagesTaxation I Case Digest Compilation: Philex Mining v. CAPraisah Marjorey PicotNo ratings yet

- Philex Mining Corporation V CIR GR No 125704, August 28, 1998Document1 pagePhilex Mining Corporation V CIR GR No 125704, August 28, 1998John Roel VillaruzNo ratings yet

- Final Tax CasesDocument319 pagesFinal Tax CasesCris Margot LuyabenNo ratings yet

- Philex Mining Corporation Vs Commissioner of Internal RevenueDocument1 pagePhilex Mining Corporation Vs Commissioner of Internal RevenueViviene Junic CambaNo ratings yet

- Philex Mining Corporation Vs Commissioner of Internal Revenue GR No. 125704 August 28, 1998Document6 pagesPhilex Mining Corporation Vs Commissioner of Internal Revenue GR No. 125704 August 28, 1998nildin danaNo ratings yet

- Tax Amnesty Doctrines in Taxation DigestDocument9 pagesTax Amnesty Doctrines in Taxation DigestJuralexNo ratings yet

- Taxation DigestsDocument87 pagesTaxation DigestsEngelbertNo ratings yet

- TAX1 Compilation of CasesDocument3 pagesTAX1 Compilation of CasesYvet KatNo ratings yet

- Tax DigestsDocument9 pagesTax DigestsShigella MarieNo ratings yet

- CIR V PinedaDocument6 pagesCIR V PinedaMyra De Guzman PalattaoNo ratings yet

- Tax Digest CompilationDocument37 pagesTax Digest CompilationVerine SagunNo ratings yet

- Tax Review CasesDocument20 pagesTax Review CasesNeri DelfinNo ratings yet

- Tax - Digest 2Document11 pagesTax - Digest 2Gela Bea BarriosNo ratings yet

- Case DigestsDocument10 pagesCase Digestsricky nebatenNo ratings yet

- Digest-Philex Mining vs. CirDocument1 pageDigest-Philex Mining vs. CirJunivenReyUmadhayNo ratings yet

- VOL. 294, AUGUST 28, 1998 687: Philex Mining Corporation vs. Commissioner of Internal RevenueDocument15 pagesVOL. 294, AUGUST 28, 1998 687: Philex Mining Corporation vs. Commissioner of Internal RevenueAntonio Acaylar, Jr.No ratings yet

- Philex Mining Corporation v. CIR, 551 SCRA 428, 28 August 1998Document6 pagesPhilex Mining Corporation v. CIR, 551 SCRA 428, 28 August 1998RPSA CPANo ratings yet

- GEN PRIN TaxationDocument12 pagesGEN PRIN Taxationtaktak69No ratings yet

- Gen Principles DigestDocument12 pagesGen Principles DigestCzarina Joy PenaNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Van Dorn V RomilloDocument1 pageVan Dorn V RomilloSui GenerisNo ratings yet

- Aznar VS GarciaDocument1 pageAznar VS GarciaSui GenerisNo ratings yet

- Bank of America v. American Realty CorporationDocument2 pagesBank of America v. American Realty CorporationSui GenerisNo ratings yet

- GREGORIO B. HONASAN II vs. THE PANEL OF INVESTIGATING PROSECUTORS OF THE DEPARTMENT OF JUSTICEDocument4 pagesGREGORIO B. HONASAN II vs. THE PANEL OF INVESTIGATING PROSECUTORS OF THE DEPARTMENT OF JUSTICESui GenerisNo ratings yet

- GADRINAB v. SALAMANCA GR No. 194560 2014 06 11Document12 pagesGADRINAB v. SALAMANCA GR No. 194560 2014 06 11Sui GenerisNo ratings yet

- Damages Actual & Compensatory DamagesDocument10 pagesDamages Actual & Compensatory DamagesSui GenerisNo ratings yet

- Vieska Vs GilinskyDocument2 pagesVieska Vs GilinskySui GenerisNo ratings yet

- JOHN H. OSMEÑA vs. OSCAR ORBOS Et AlDocument1 pageJOHN H. OSMEÑA vs. OSCAR ORBOS Et AlSui GenerisNo ratings yet

- Holographic WillDocument1 pageHolographic WillSui GenerisNo ratings yet

- Republic Vs CA & PrecisionDocument1 pageRepublic Vs CA & PrecisionSui GenerisNo ratings yet

- Miguel V Montanez G.R. No. 191336. January 25, 2012 Facts: PetitionerDocument2 pagesMiguel V Montanez G.R. No. 191336. January 25, 2012 Facts: PetitionerSui GenerisNo ratings yet

- MATEO CARIÑO Vs Insular GovernmentDocument1 pageMATEO CARIÑO Vs Insular GovernmentSui GenerisNo ratings yet

- Remulla vs. Maliksi GR 171633Document2 pagesRemulla vs. Maliksi GR 171633Sui GenerisNo ratings yet

- Cruz Vs Secretary of DENRDocument1 pageCruz Vs Secretary of DENRSui GenerisNo ratings yet

- Estela L. Crisostomo vs. Court of Appeal G.R. No. 138334Document33 pagesEstela L. Crisostomo vs. Court of Appeal G.R. No. 138334Sui GenerisNo ratings yet

- CSC vs. DacoycoyDocument1 pageCSC vs. DacoycoySui GenerisNo ratings yet

- CIR Vs Benguet Corp.Document1 pageCIR Vs Benguet Corp.Sui GenerisNo ratings yet

- Case Digest: Jose C. Miranda vs. Hon. SandiganbayanDocument1 pageCase Digest: Jose C. Miranda vs. Hon. SandiganbayanSui GenerisNo ratings yet