Professional Documents

Culture Documents

Lets Analyze

Lets Analyze

Uploaded by

Junzen Ralph YapCopyright:

Available Formats

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOd - in A NutshellDocument1 pageYap - ACP312 - ULOd - in A NutshellJunzen Ralph YapNo ratings yet

- (Yap, Jun Zen Ralph V.) - NSTP 1Document5 pages(Yap, Jun Zen Ralph V.) - NSTP 1Junzen Ralph YapNo ratings yet

- C. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaDocument17 pagesC. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaJunzen Ralph YapNo ratings yet

- NCI in Net Income of SubsidiaryDocument2 pagesNCI in Net Income of SubsidiaryJunzen Ralph YapNo ratings yet

- National Service Training Program 1 First ExaminationDocument2 pagesNational Service Training Program 1 First ExaminationJunzen Ralph YapNo ratings yet

- When It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodDocument1 pageWhen It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument1 pageYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument1 pageYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument2 pagesYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- 10 Major Problems in Measuring National IncomeDocument4 pages10 Major Problems in Measuring National IncomeJunzen Ralph YapNo ratings yet

- Gain On Acquisition (Bargain Purchase) - 105,000Document2 pagesGain On Acquisition (Bargain Purchase) - 105,000Junzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument2 pagesYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Actual Cost (240,000 + 162,000) + 35,000Document1 pageActual Cost (240,000 + 162,000) + 35,000Junzen Ralph YapNo ratings yet

- Bumps of K To 12 EducationDocument4 pagesBumps of K To 12 EducationJunzen Ralph YapNo ratings yet

- Reflection - Yap, Jun Zen RalphDocument1 pageReflection - Yap, Jun Zen RalphJunzen Ralph YapNo ratings yet

- 5th PageDocument4 pages5th PageJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's AnalyzeDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's AnalyzeJunzen Ralph YapNo ratings yet

- Alliah P. Elviña Grade 12-ABM1 Security Bank Code of Right ConductDocument14 pagesAlliah P. Elviña Grade 12-ABM1 Security Bank Code of Right ConductJunzen Ralph YapNo ratings yet

- Junzen Ralph V. Yap: ObjectivesDocument3 pagesJunzen Ralph V. Yap: ObjectivesJunzen Ralph YapNo ratings yet

- Excuse-Letter FinalsDocument1 pageExcuse-Letter FinalsJunzen Ralph YapNo ratings yet

- Uts 2ND ExamDocument2 pagesUts 2ND ExamJunzen Ralph YapNo ratings yet

- I Speak For DemocracyDocument2 pagesI Speak For DemocracyJunzen Ralph YapNo ratings yet

Lets Analyze

Lets Analyze

Uploaded by

Junzen Ralph YapCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Lets Analyze

Lets Analyze

Uploaded by

Junzen Ralph YapCopyright:

Available Formats

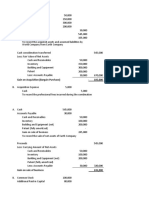

A. Investment in Craig Co.

950,000

Cash 950,000

To record the acquisition of Craig Company's oustanding shares

A. Land 50,000

Building 100,000

Goodwill 50,000

Bonds Payable 20,000

Deferred Tax Liability 10,000

Retained Earnings - C. Co. 420,000

Additional Paid-In Capital 650,000

To adjust the assets and liabilities of Craig Company

A. Common Stock 300,000

Additional Paid-In Capital 650,000

Investment in Craig Co. 950,000

To eliminate the subsidiary account against the equity accounts

Knight (100%)

Consideration Transferred 950,000

Less: Book Value of Interest Acquired

Common Stock (P10 par) 300,000

Retained Earnings 420,000

Total Equity Interest 720,000

Excess 230,000

Less: Adjustments of Identifiable Net Assets

Increase in Land 50,000

Increase in Building 100,000

Decrease in Bonds Payable 20,000

Decrease in Deferred Tax 10,000 180,000

Goodwill 50,000

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Jun Zen Ralph V. Yap 3 Year - BSA Let's CheckDocument4 pagesJun Zen Ralph V. Yap 3 Year - BSA Let's CheckJunzen Ralph YapNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Yap - ACP312 - ULOb - Let's CheckDocument4 pagesYap - ACP312 - ULOb - Let's CheckJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOd - in A NutshellDocument1 pageYap - ACP312 - ULOd - in A NutshellJunzen Ralph YapNo ratings yet

- (Yap, Jun Zen Ralph V.) - NSTP 1Document5 pages(Yap, Jun Zen Ralph V.) - NSTP 1Junzen Ralph YapNo ratings yet

- C. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaDocument17 pagesC. Let's Check: Pacalna, Anifah B. BSA-3 Year Week 1 UloaJunzen Ralph YapNo ratings yet

- NCI in Net Income of SubsidiaryDocument2 pagesNCI in Net Income of SubsidiaryJunzen Ralph YapNo ratings yet

- National Service Training Program 1 First ExaminationDocument2 pagesNational Service Training Program 1 First ExaminationJunzen Ralph YapNo ratings yet

- When It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodDocument1 pageWhen It Comes To Inventory Valuation of Expedia Industries Using The FIFO MethodJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument1 pageYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's CheckDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's CheckJunzen Ralph Yap100% (1)

- Polo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsDocument3 pagesPolo Company and Subsidiary Consolidated Statement of Financial Position As of December 31, 2020 AssetsJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument1 pageYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- Jun Zen Ralph V. Yap BSA - 3 Year Let's CheckDocument5 pagesJun Zen Ralph V. Yap BSA - 3 Year Let's CheckJunzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOa - in A NutshellDocument2 pagesYap - ACP312 - ULOa - in A NutshellJunzen Ralph YapNo ratings yet

- 10 Major Problems in Measuring National IncomeDocument4 pages10 Major Problems in Measuring National IncomeJunzen Ralph YapNo ratings yet

- Gain On Acquisition (Bargain Purchase) - 105,000Document2 pagesGain On Acquisition (Bargain Purchase) - 105,000Junzen Ralph YapNo ratings yet

- Yap - ACP312 - ULOb - in A NutshellDocument2 pagesYap - ACP312 - ULOb - in A NutshellJunzen Ralph YapNo ratings yet

- Actual Cost (240,000 + 162,000) + 35,000Document1 pageActual Cost (240,000 + 162,000) + 35,000Junzen Ralph YapNo ratings yet

- Bumps of K To 12 EducationDocument4 pagesBumps of K To 12 EducationJunzen Ralph YapNo ratings yet

- Reflection - Yap, Jun Zen RalphDocument1 pageReflection - Yap, Jun Zen RalphJunzen Ralph YapNo ratings yet

- 5th PageDocument4 pages5th PageJunzen Ralph YapNo ratings yet

- Jun Zen Ralph Yap BSA - 3 Year Let's AnalyzeDocument2 pagesJun Zen Ralph Yap BSA - 3 Year Let's AnalyzeJunzen Ralph YapNo ratings yet

- Alliah P. Elviña Grade 12-ABM1 Security Bank Code of Right ConductDocument14 pagesAlliah P. Elviña Grade 12-ABM1 Security Bank Code of Right ConductJunzen Ralph YapNo ratings yet

- Junzen Ralph V. Yap: ObjectivesDocument3 pagesJunzen Ralph V. Yap: ObjectivesJunzen Ralph YapNo ratings yet

- Excuse-Letter FinalsDocument1 pageExcuse-Letter FinalsJunzen Ralph YapNo ratings yet

- Uts 2ND ExamDocument2 pagesUts 2ND ExamJunzen Ralph YapNo ratings yet

- I Speak For DemocracyDocument2 pagesI Speak For DemocracyJunzen Ralph YapNo ratings yet