Professional Documents

Culture Documents

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Uploaded by

Angel Kaye Nacionales JimenezCopyright:

Available Formats

You might also like

- 1.1 Introduction To CAP 1 Financial AccountingDocument112 pages1.1 Introduction To CAP 1 Financial AccountingKelvin KanengoniNo ratings yet

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- Fundamentals of AccountingDocument512 pagesFundamentals of AccountingCalmguy Chaitu91% (35)

- This Study Resource WasDocument5 pagesThis Study Resource WasStephanie LeeNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Applied Audit Chapter 16Document20 pagesApplied Audit Chapter 16Nannette RomaNo ratings yet

- MAS 2 Case Analysis SampleDocument3 pagesMAS 2 Case Analysis Sampleshin ruña100% (2)

- Union Bank Limited Internship ReportDocument60 pagesUnion Bank Limited Internship Reportsaleemkhp50% (2)

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- FAR03 - Accounting For Property, Plant, and EquipmentDocument4 pagesFAR03 - Accounting For Property, Plant, and EquipmentDisguised owlNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Activity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDocument5 pagesActivity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDanna VargasNo ratings yet

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- P1 GEN 009 Quiz 3Document11 pagesP1 GEN 009 Quiz 3itsayuhthingNo ratings yet

- PAS 33-Earnings Per Share PAS 33-Earnings Per ShareDocument27 pagesPAS 33-Earnings Per Share PAS 33-Earnings Per ShareHazel PachecoNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Ppe Problems 1Document4 pagesPpe Problems 1venice cambryNo ratings yet

- Sol. Man. - Chapter 20 - Investment Property - Ia Part 1bDocument7 pagesSol. Man. - Chapter 20 - Investment Property - Ia Part 1bMiguel AmihanNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- Intangible Asset Sample ProblemsDocument3 pagesIntangible Asset Sample ProblemsJan Jan100% (1)

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Acc107 Quiz 2-P1Document9 pagesAcc107 Quiz 2-P1itsayuhthingNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Saint Louis CollegeDocument55 pagesSaint Louis CollegeKonrad Lorenz Madriaga UychocoNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Activity 8 - CFAS AnswerDocument2 pagesActivity 8 - CFAS AnswerRocel Casilao DomingoNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Investment Properties ComputationDocument4 pagesInvestment Properties ComputationUNKNOWNNNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument21 pagesNotes Receivable: Problem 1: True or FalseAbegail Joy De GuzmanNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- CFI 10 Problems With SolutionsDocument4 pagesCFI 10 Problems With SolutionsPola PolzNo ratings yet

- Intermediate 1-Assessment ExamDocument20 pagesIntermediate 1-Assessment ExamAllen KateNo ratings yet

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- PAS34 Questio N& Answer!: Welcome To..Document18 pagesPAS34 Questio N& Answer!: Welcome To..Faker MejiaNo ratings yet

- Sol. Man. - Chapter 21 - Agriculture - Ia Part 1BDocument9 pagesSol. Man. - Chapter 21 - Agriculture - Ia Part 1BRezzan Joy Camara MejiaNo ratings yet

- 8Document8 pages8Crizlen Flores100% (1)

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Sol. Man. - Chapter 11 - Investments - Additional ConceptsDocument10 pagesSol. Man. - Chapter 11 - Investments - Additional ConceptsChristian James RiveraNo ratings yet

- Revaluation-Accounting CompressDocument13 pagesRevaluation-Accounting CompressEunice Buenaventura100% (1)

- Examination About Investment 10Document2 pagesExamination About Investment 10BLACKPINKLisaRoseJisooJennieNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Ppe Problems 2Document4 pagesPpe Problems 2venice cambryNo ratings yet

- InventoriesDocument19 pagesInventoriesNoella Marie BaronNo ratings yet

- Retake: Financial Accounting and ReportingDocument21 pagesRetake: Financial Accounting and ReportingJan ryanNo ratings yet

- Handout - CashDocument17 pagesHandout - CashPenelope PalconNo ratings yet

- Liabilities and Equity Sample Problems Premiums and Warranty Liability - CompressDocument93 pagesLiabilities and Equity Sample Problems Premiums and Warranty Liability - CompressKiahna Clare ArdaNo ratings yet

- Property Plant Equipment May SagotDocument9 pagesProperty Plant Equipment May SagotRNo ratings yet

- iNTANGIBLES PROBLEMSDocument3 pagesiNTANGIBLES PROBLEMStough mamaNo ratings yet

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDocument7 pagesName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Recession Below Average Average Above Average Boom Expected Rate of ReturnDocument2 pagesRecession Below Average Average Above Average Boom Expected Rate of ReturnAngel Kaye Nacionales JimenezNo ratings yet

- September 3, 2020, 730AM Group # 4 Members: Cagape, Patrice Cercado, Geran Jimenez, Angel Quiñanola, Alana Resabal, Mariel Sarmillo, WenzelDocument3 pagesSeptember 3, 2020, 730AM Group # 4 Members: Cagape, Patrice Cercado, Geran Jimenez, Angel Quiñanola, Alana Resabal, Mariel Sarmillo, WenzelAngel Kaye Nacionales JimenezNo ratings yet

- Trail Balance As On 31-3-10Document9 pagesTrail Balance As On 31-3-10Uday AkbariNo ratings yet

- Ipsas 2 Notes 2021Document9 pagesIpsas 2 Notes 2021Wilson Mugenyi KasendwaNo ratings yet

- Photovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsDocument66 pagesPhotovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsOle Johan BondahlNo ratings yet

- Laporan Arus KasDocument74 pagesLaporan Arus KasDian Permata SariNo ratings yet

- 5 Year Financial Plan Calculation ForsendingDocument33 pages5 Year Financial Plan Calculation ForsendingBernard James TandangNo ratings yet

- Advance Account MCQ BookDocument78 pagesAdvance Account MCQ Bookcloudstorage567No ratings yet

- Pintaras-AnnualReport 2000Document50 pagesPintaras-AnnualReport 2000Alex PutuhenaNo ratings yet

- Annual Report 2010-11 APILDocument140 pagesAnnual Report 2010-11 APILraju4444No ratings yet

- Int. Acctg. 3 - Valix2019 - Chapter 3Document12 pagesInt. Acctg. 3 - Valix2019 - Chapter 3Toni Rose Hernandez Lualhati100% (1)

- AUD589 Tutorial Aud of SOPL SOFPDocument4 pagesAUD589 Tutorial Aud of SOPL SOFPRABIATULNAZIHAH NAZRINo ratings yet

- 2012 Final Exam SolutionDocument14 pages2012 Final Exam SolutionOmar Ahmed ElkhalilNo ratings yet

- Eco 02Document6 pagesEco 02rykaNo ratings yet

- The Statement of Cash Flows: Weygandt - Kieso - KimmelDocument40 pagesThe Statement of Cash Flows: Weygandt - Kieso - Kimmel023- TARANNUM SHIREEN GHAZINo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- School AFS SampleDocument31 pagesSchool AFS SampleKezza Marie LuengoNo ratings yet

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaNo ratings yet

- RTDocument58 pagesRTKyaw Htin WinNo ratings yet

- DepreciationDocument25 pagesDepreciationIvyJoyce50% (2)

- Accounting SoalDocument4 pagesAccounting SoalTendy WatoNo ratings yet

- Production of Vinegar From Coconut (Cocos Nucifera)Document66 pagesProduction of Vinegar From Coconut (Cocos Nucifera)Jagna LannaoNo ratings yet

- Schedule of Non Current Assets - AsDocument4 pagesSchedule of Non Current Assets - AsMUSTHARI KHANNo ratings yet

- Ilanchelian (P121958) - ZCMC6122 - Individual Assignment 2Document24 pagesIlanchelian (P121958) - ZCMC6122 - Individual Assignment 2Ilanchelian ChandranNo ratings yet

- Century Enka Limited: Analysis of Company's Financial StatementDocument24 pagesCentury Enka Limited: Analysis of Company's Financial StatementAnand PurohitNo ratings yet

- Asset Accounting IMGDocument314 pagesAsset Accounting IMGrrkabraNo ratings yet

- Inventory Depreciation Expense RecognitionDocument9 pagesInventory Depreciation Expense RecognitionZulu MasukuNo ratings yet

- 9 QuijanoDocument3 pages9 QuijanoARISNo ratings yet

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Uploaded by

Angel Kaye Nacionales JimenezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Jimenez, Angel Kaye October 8, 2020 Bsa 2 Year ACC 216 9:45-11:45 Assignment-Depreciation Methods

Uploaded by

Angel Kaye Nacionales JimenezCopyright:

Available Formats

Jimenez, Angel Kaye October 8, 2020

BSA 2nd year ACC 216 9:45-11:45

Assignment- Depreciation Methods

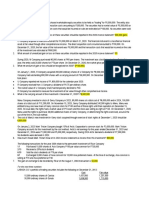

Problem 1

Gianina Company takes a full year’s depreciation in the year of an assets acquisition, and no

depreciation in the year of disposition. Data relating to one depreciable asset acquired in 2003,

with residual value of P900,000 and estimated useful life of 8 years, at December 31, 2004 are:

Cost 9,900,000

Accumulated depreciation 3,750,000

Using the same depreciation method in 2003 and 2004, how much depreciation should Gianina

record in 2005 for this asset?

a. 1,125,000

b. 1,250,000

c. 1,650,000

d. 1,500,000

Depreciable Amount = Cost – Residual Value

Depreciable Amount = 9,900,000 – 900,000

Depreciable Amount = 9,000,000

Depreciation based on Time: Accelerated Depreciation Method

Sum-of-the-years’ Digits (SYD):

✓ SYD Denominator = Life x [(Life + 1) / 2]

✓ SYD Denominator = 8 x [(8 + 1) / 2] = 36

*Alternatively: (8+7+6+5+4+3+2+1) = 36

Year Depreciable Amount SYD Rate Depreciation Expense

2003 P9,000,000 8/36 P2,000,000

2004 P9,000,000 7/36 P1,750,000

2005 P9,000,000 6/36 P1,500,000

*In 2005, the depreciation Expense should be recorded P1,500,000.

Problem 2

On January 1, 2000 Vladimir Company purchased a machine for P4,800,000 and depreciated it by the

straight-line method using an estimated useful life of 8 years with no salvage value. On January 1, 2003,

Vladimir determined that the machine had a useful life of 6 years from the date of acquisition and will

have a salvage value of P150,000. An accounting change was made in 2003 to reflect these additional

data. What should be the accumulated depreciation on December 31, 2003?

a. 2,750,000

b. 2,800,000

c. 1,000,000

d. 900,000

Year Depreciation Accumulated Depreciation Carrying Amount

01/01/00 - - P4,800,000

12/31/00 P 600,000 600,000 4,200,000

12/31/01 600,000 1,200,000 3,600,000

12/31/02 600,000 1,800,000 3,000,000

12/31/03 950,000 2,750,000 2,050,000

P2,750,000

Year 2003

Depreciation: Depreciable amount = Carrying Amount – Residual Value

Depreciable amount = 3,000,000 – 150,000

Depreciable amount = 2,850,000

Depreciation for the year = Depreciable amount / Remaining useful life

Depreciation for the year = 2,850,000 / 3 year

Depreciation for the year = 950,000

On December 31, 2003 the total accumulated depreciation is P 2,750,000.

Problem 3

On October 1, 2018, Miami Company bought machinery under a contract that required a down payment

of P500,000 plus 12 monthly payments of P300,000 for total payments of P4,100,000. The cash price of

the machinery was P3,800,000. The machinery has an estimated useful life of five years and residual

value of P200,000. Daryl uses the SYD method of depreciation. In its 2019 income statement, what

amount should Daryl report as depreciation for this machinery?

Depreciation based on Time: Accelerated Depreciation Method

Sum-of-the-years’ Digits (SYD):

✓ SYD Denominator = Life x [(Life + 1) / 2]

✓ SYD Denominator = 5 x [(5 + 1) / 2] = 15

*Alternatively: (5+4+3+2+1) = 15

Full year Depreciation Charges:

Year Depreciable Amount SYD Rate Depreciation Accumulated Carrying

Depreciation Amount

(a) (b) C= (a)(b) d e=historical

cost - d

1 - - - - P3,800,000

1 P3,600,000 5/15 P1,200,000 P1,200,000 2,600,000

2 3,600,000 4/15 960,000 2,160,000 1,640,000

3 3,600,000 3/15 720,000 2,880,000 920,000

4 3,600,000 2/15 480,000 3,360,000 440,000

5 3,600,000 1/15 240,000 3,600,000 200,000

P3,600,000

Partial year Depreciation Charges:

Year Depreciable Amount SYD Rate Depreciation

2018 P1,200,000 3/12 P300,000

2019 1,200,000 9/12 900,000

960,000 3/12 240,000

Depreciation Expense for 2019

P 900,000 + 240,000 = P 1,140,000

Problem 4

LA Company purchased a boring machine on January 1, 2019 for P8,100,000. The useful life of the

machine is estimated at 3 years with a residual value at the end of this period of P600,000. During its

useful life, the expected units of production from the machine are 10,000 units for 2019; 9,000 units for

2020 and 6,000 units for 2021. What is the depreciation expense for 2020 using the most appropriate

depreciation method?

Depreciation based on Actual Physical Use: Units of Production Method

Output Method (based on units produced):

✓ Depreciation rate = Depreciable amount / Estimated total units

✓ Depreciation rate = (8,100,000 – 600,000) / (25,000)

✓ Depreciation rate = (7,500,000 / 25,000)

✓ Depreciation rate = 300 per unit of output

Year Actual Units x Depreciation Accumulated Carrying Amount

Depreciation Rate Depreciation

1/1/19 - - - P8,100,000

12/31/19 (10,000 x 300) P3,000,000 P3,000,000 5,100,000

12/31/20 (9,000 x 300) 2,700,000 5,700,000 2,400,000

12/31/21 (6,000 x 300) 1,800,000 7,500,000 600,000

P7,500,000

The Depreciation expense for 2020 is P 2,700,000.

You might also like

- 1.1 Introduction To CAP 1 Financial AccountingDocument112 pages1.1 Introduction To CAP 1 Financial AccountingKelvin KanengoniNo ratings yet

- Accounting 111B (Journalizing)Document3 pagesAccounting 111B (Journalizing)Yrica100% (1)

- Fundamentals of AccountingDocument512 pagesFundamentals of AccountingCalmguy Chaitu91% (35)

- This Study Resource WasDocument5 pagesThis Study Resource WasStephanie LeeNo ratings yet

- Intermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesDocument20 pagesIntermediate Accounting 1 Solution Manual: Chapter 15 - Property, Plant and Equipment To Chapter 17 - Depletion of Mineral ResourcesMckenzieNo ratings yet

- SDASDDocument9 pagesSDASDRocelle LAQUINo ratings yet

- Applied Audit Chapter 16Document20 pagesApplied Audit Chapter 16Nannette RomaNo ratings yet

- MAS 2 Case Analysis SampleDocument3 pagesMAS 2 Case Analysis Sampleshin ruña100% (2)

- Union Bank Limited Internship ReportDocument60 pagesUnion Bank Limited Internship Reportsaleemkhp50% (2)

- Acc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long QuizDocument5 pagesAcc 205-Intermediate Accounting I Part Ii Ppe Part 2: Long Quizemielyn lafortezaNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- FAR03 - Accounting For Property, Plant, and EquipmentDocument4 pagesFAR03 - Accounting For Property, Plant, and EquipmentDisguised owlNo ratings yet

- Unit 4 Accounting For Investments: Topic 5 - Investment in PropertyDocument7 pagesUnit 4 Accounting For Investments: Topic 5 - Investment in PropertyRey HandumonNo ratings yet

- PPE Initial Meas Assignment With Answers FormattedDocument5 pagesPPE Initial Meas Assignment With Answers FormattedCJ IbaleNo ratings yet

- Problem 5 and 6Document4 pagesProblem 5 and 6Lalaina EnriquezNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo Lel100% (3)

- Activity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDocument5 pagesActivity 03 Depletion Exploration and Evaluation Asset Ramirezlawrenz 1 - CompressDanna VargasNo ratings yet

- Rezy Pablio Mabao - SAS 3Document7 pagesRezy Pablio Mabao - SAS 3Reymark BaldoNo ratings yet

- P1 GEN 009 Quiz 3Document11 pagesP1 GEN 009 Quiz 3itsayuhthingNo ratings yet

- PAS 33-Earnings Per Share PAS 33-Earnings Per ShareDocument27 pagesPAS 33-Earnings Per Share PAS 33-Earnings Per ShareHazel PachecoNo ratings yet

- Examination About Investment 7Document3 pagesExamination About Investment 7BLACKPINKLisaRoseJisooJennieNo ratings yet

- Ppe Problems 1Document4 pagesPpe Problems 1venice cambryNo ratings yet

- Sol. Man. - Chapter 20 - Investment Property - Ia Part 1bDocument7 pagesSol. Man. - Chapter 20 - Investment Property - Ia Part 1bMiguel AmihanNo ratings yet

- Sol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aDocument6 pagesSol. Man. - Chapter 8 - Inventory Estimation - Ia Part 1aRezzan Joy Camara MejiaNo ratings yet

- Intangible Asset Sample ProblemsDocument3 pagesIntangible Asset Sample ProblemsJan Jan100% (1)

- Module 13 Present ValueDocument10 pagesModule 13 Present ValueChristine Elaine LamanNo ratings yet

- Notes Receivable - Ia 1Document4 pagesNotes Receivable - Ia 1Aldrin CabangbangNo ratings yet

- Acc107 Quiz 2-P1Document9 pagesAcc107 Quiz 2-P1itsayuhthingNo ratings yet

- LeasesDocument5 pagesLeasesCamille BacaresNo ratings yet

- 62230126Document20 pages62230126ROMULO CUBIDNo ratings yet

- Saint Louis CollegeDocument55 pagesSaint Louis CollegeKonrad Lorenz Madriaga UychocoNo ratings yet

- Chapters 10 and 11Document51 pagesChapters 10 and 11Carlos VillanuevaNo ratings yet

- This Study Resource Was: Assessment Task 3Document5 pagesThis Study Resource Was: Assessment Task 3maria evangelistaNo ratings yet

- Activity 8 - CFAS AnswerDocument2 pagesActivity 8 - CFAS AnswerRocel Casilao DomingoNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Investment Properties ComputationDocument4 pagesInvestment Properties ComputationUNKNOWNNNo ratings yet

- 2nd Grading Exams Key AnswersDocument19 pages2nd Grading Exams Key AnswersUnknown WandererNo ratings yet

- Cae05-Chapter 4 Notes Receivables & Payable Problem DiscussionDocument12 pagesCae05-Chapter 4 Notes Receivables & Payable Problem DiscussionSteffany RoqueNo ratings yet

- Notes Receivable: Problem 1: True or FalseDocument21 pagesNotes Receivable: Problem 1: True or FalseAbegail Joy De GuzmanNo ratings yet

- For Reg 1Document7 pagesFor Reg 1Shynne MabantaNo ratings yet

- Module 2a - AR RecapDocument10 pagesModule 2a - AR RecapChen HaoNo ratings yet

- AC - IntAcctg1 Quiz 03 With AnswersDocument3 pagesAC - IntAcctg1 Quiz 03 With AnswersSherri BonquinNo ratings yet

- Property, Plant and Equipment (Part 2) : Problem 1: True or FalseDocument13 pagesProperty, Plant and Equipment (Part 2) : Problem 1: True or FalseJannelle SalacNo ratings yet

- CFI 10 Problems With SolutionsDocument4 pagesCFI 10 Problems With SolutionsPola PolzNo ratings yet

- Intermediate 1-Assessment ExamDocument20 pagesIntermediate 1-Assessment ExamAllen KateNo ratings yet

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- PAS34 Questio N& Answer!: Welcome To..Document18 pagesPAS34 Questio N& Answer!: Welcome To..Faker MejiaNo ratings yet

- Sol. Man. - Chapter 21 - Agriculture - Ia Part 1BDocument9 pagesSol. Man. - Chapter 21 - Agriculture - Ia Part 1BRezzan Joy Camara MejiaNo ratings yet

- 8Document8 pages8Crizlen Flores100% (1)

- 9TH Bonds Payable Part IIDocument8 pages9TH Bonds Payable Part IIAnthony DyNo ratings yet

- Sol. Man. - Chapter 11 - Investments - Additional ConceptsDocument10 pagesSol. Man. - Chapter 11 - Investments - Additional ConceptsChristian James RiveraNo ratings yet

- Revaluation-Accounting CompressDocument13 pagesRevaluation-Accounting CompressEunice Buenaventura100% (1)

- Examination About Investment 10Document2 pagesExamination About Investment 10BLACKPINKLisaRoseJisooJennieNo ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Ppe Problems 2Document4 pagesPpe Problems 2venice cambryNo ratings yet

- InventoriesDocument19 pagesInventoriesNoella Marie BaronNo ratings yet

- Retake: Financial Accounting and ReportingDocument21 pagesRetake: Financial Accounting and ReportingJan ryanNo ratings yet

- Handout - CashDocument17 pagesHandout - CashPenelope PalconNo ratings yet

- Liabilities and Equity Sample Problems Premiums and Warranty Liability - CompressDocument93 pagesLiabilities and Equity Sample Problems Premiums and Warranty Liability - CompressKiahna Clare ArdaNo ratings yet

- Property Plant Equipment May SagotDocument9 pagesProperty Plant Equipment May SagotRNo ratings yet

- iNTANGIBLES PROBLEMSDocument3 pagesiNTANGIBLES PROBLEMStough mamaNo ratings yet

- Andiam: January 2, 2019Document5 pagesAndiam: January 2, 2019Avox EverdeenNo ratings yet

- Depreciation Expense - Asset A 3,900Document4 pagesDepreciation Expense - Asset A 3,900ZeeNo ratings yet

- Name: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsDocument7 pagesName: Shenielyn B. Napolitano BSA 3A Source: Roque Book: QuestionsEsse ValdezNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Jimenez - Act 3 FinalsDocument4 pagesJimenez - Act 3 FinalsAngel Kaye Nacionales JimenezNo ratings yet

- Recession Below Average Average Above Average Boom Expected Rate of ReturnDocument2 pagesRecession Below Average Average Above Average Boom Expected Rate of ReturnAngel Kaye Nacionales JimenezNo ratings yet

- September 3, 2020, 730AM Group # 4 Members: Cagape, Patrice Cercado, Geran Jimenez, Angel Quiñanola, Alana Resabal, Mariel Sarmillo, WenzelDocument3 pagesSeptember 3, 2020, 730AM Group # 4 Members: Cagape, Patrice Cercado, Geran Jimenez, Angel Quiñanola, Alana Resabal, Mariel Sarmillo, WenzelAngel Kaye Nacionales JimenezNo ratings yet

- Trail Balance As On 31-3-10Document9 pagesTrail Balance As On 31-3-10Uday AkbariNo ratings yet

- Ipsas 2 Notes 2021Document9 pagesIpsas 2 Notes 2021Wilson Mugenyi KasendwaNo ratings yet

- Photovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsDocument66 pagesPhotovoltaic (PV) Module Technologies: 2020 Benchmark Costs and Technology Evolution Framework ResultsOle Johan BondahlNo ratings yet

- Laporan Arus KasDocument74 pagesLaporan Arus KasDian Permata SariNo ratings yet

- 5 Year Financial Plan Calculation ForsendingDocument33 pages5 Year Financial Plan Calculation ForsendingBernard James TandangNo ratings yet

- Advance Account MCQ BookDocument78 pagesAdvance Account MCQ Bookcloudstorage567No ratings yet

- Pintaras-AnnualReport 2000Document50 pagesPintaras-AnnualReport 2000Alex PutuhenaNo ratings yet

- Annual Report 2010-11 APILDocument140 pagesAnnual Report 2010-11 APILraju4444No ratings yet

- Int. Acctg. 3 - Valix2019 - Chapter 3Document12 pagesInt. Acctg. 3 - Valix2019 - Chapter 3Toni Rose Hernandez Lualhati100% (1)

- AUD589 Tutorial Aud of SOPL SOFPDocument4 pagesAUD589 Tutorial Aud of SOPL SOFPRABIATULNAZIHAH NAZRINo ratings yet

- 2012 Final Exam SolutionDocument14 pages2012 Final Exam SolutionOmar Ahmed ElkhalilNo ratings yet

- Eco 02Document6 pagesEco 02rykaNo ratings yet

- The Statement of Cash Flows: Weygandt - Kieso - KimmelDocument40 pagesThe Statement of Cash Flows: Weygandt - Kieso - Kimmel023- TARANNUM SHIREEN GHAZINo ratings yet

- CA-Inter New Course: Advanced AccountingDocument121 pagesCA-Inter New Course: Advanced AccountingPankaj MeenaNo ratings yet

- School AFS SampleDocument31 pagesSchool AFS SampleKezza Marie LuengoNo ratings yet

- March 2010 Part 2 InsightDocument92 pagesMarch 2010 Part 2 InsightLegogie Moses AnoghenaNo ratings yet

- RTDocument58 pagesRTKyaw Htin WinNo ratings yet

- DepreciationDocument25 pagesDepreciationIvyJoyce50% (2)

- Accounting SoalDocument4 pagesAccounting SoalTendy WatoNo ratings yet

- Production of Vinegar From Coconut (Cocos Nucifera)Document66 pagesProduction of Vinegar From Coconut (Cocos Nucifera)Jagna LannaoNo ratings yet

- Schedule of Non Current Assets - AsDocument4 pagesSchedule of Non Current Assets - AsMUSTHARI KHANNo ratings yet

- Ilanchelian (P121958) - ZCMC6122 - Individual Assignment 2Document24 pagesIlanchelian (P121958) - ZCMC6122 - Individual Assignment 2Ilanchelian ChandranNo ratings yet

- Century Enka Limited: Analysis of Company's Financial StatementDocument24 pagesCentury Enka Limited: Analysis of Company's Financial StatementAnand PurohitNo ratings yet

- Asset Accounting IMGDocument314 pagesAsset Accounting IMGrrkabraNo ratings yet

- Inventory Depreciation Expense RecognitionDocument9 pagesInventory Depreciation Expense RecognitionZulu MasukuNo ratings yet

- 9 QuijanoDocument3 pages9 QuijanoARISNo ratings yet