Professional Documents

Culture Documents

General IELTS - Reading Sample Test 2

General IELTS - Reading Sample Test 2

Uploaded by

JonathanCopyright:

Available Formats

You might also like

- Class 17 B2 - Extra ActivitiesDocument2 pagesClass 17 B2 - Extra ActivitiesJonathanNo ratings yet

- An Example of A Marketing PlanDocument8 pagesAn Example of A Marketing PlanJannie Aldrin SiahaanNo ratings yet

- Help With Your Rent and Council Tax: ProofsDocument28 pagesHelp With Your Rent and Council Tax: Proofsjason_preciousNo ratings yet

- HC1 April 2016 PDFDocument20 pagesHC1 April 2016 PDFWill RogersNo ratings yet

- Notify For ChangesDocument1 pageNotify For Changesyip90No ratings yet

- E Selfhelp RedundancyDocument12 pagesE Selfhelp RedundancykabulibazariNo ratings yet

- HC 1Document20 pagesHC 1multiekNo ratings yet

- Universal Credit What You'Ll Get - GOV - UkDocument1 pageUniversal Credit What You'Ll Get - GOV - UkkarenfergieNo ratings yet

- Loan Information Sheet Amended 02.04.2020aDocument2 pagesLoan Information Sheet Amended 02.04.2020aSzabolcs HunyadiNo ratings yet

- HC1 December 2019Document20 pagesHC1 December 2019TomNo ratings yet

- Housing Options: A Guide To Housing Options Available Through Local AuthoritiesDocument20 pagesHousing Options: A Guide To Housing Options Available Through Local AuthoritieswoodworkmailboxNo ratings yet

- Sponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaDocument1 pageSponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaTheRefepNo ratings yet

- Study of Reverse MortgageDocument46 pagesStudy of Reverse MortgageManav VishNo ratings yet

- Information For Ukrainian Red CrossDocument8 pagesInformation For Ukrainian Red CrossKonstantin IvanovNo ratings yet

- A Briefing For Self Employed Uc Claimants Member BriefingDocument7 pagesA Briefing For Self Employed Uc Claimants Member BriefingLiv Darcey HawthorneNo ratings yet

- A - Comprehensive Guide To Tax Free ChildcareDocument19 pagesA - Comprehensive Guide To Tax Free Childcaredolors.mayencoNo ratings yet

- Ncic ch09Document18 pagesNcic ch09vivianNo ratings yet

- Know Your Rights Housing: 1. What Are Disabled Facilities Grants (DFGS) ?Document2 pagesKnow Your Rights Housing: 1. What Are Disabled Facilities Grants (DFGS) ?LinaceroNo ratings yet

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakNo ratings yet

- 2022-12-19 Cost of Living SupportDocument5 pages2022-12-19 Cost of Living SupportisleworthsyonNo ratings yet

- Tax Planning 0611Document2 pagesTax Planning 0611GLSTaxAdviceUKNo ratings yet

- Use This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceDocument22 pagesUse This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceafacewithoutanameNo ratings yet

- HTB Isa WelcomeDocument12 pagesHTB Isa WelcomesdsdwewesdNo ratings yet

- DivorceDocument5 pagesDivorceAlthea SorianoNo ratings yet

- 2023-12-21 Start of Spring Term 2024 and Cost of Living SupportDocument5 pages2023-12-21 Start of Spring Term 2024 and Cost of Living SupportisleworthsyonNo ratings yet

- Pension CreditDocument22 pagesPension CreditIan ChristieNo ratings yet

- L1e Universal Credit SimpleDocument2 pagesL1e Universal Credit Simpleapi-656243125No ratings yet

- Universal CreditDocument8 pagesUniversal Creditapi-511966504No ratings yet

- Reference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceDocument12 pagesReference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceJohnny AlfaNo ratings yet

- Family Friendly Facts BookletDocument32 pagesFamily Friendly Facts BookletPhyo ThihabookNo ratings yet

- fs21_council_tax_fcsDocument20 pagesfs21_council_tax_fcsLauna McentyreNo ratings yet

- RA Guidance Notes Nov 22Document8 pagesRA Guidance Notes Nov 22y.lohvynenkoNo ratings yet

- Section 8 HousingDocument40 pagesSection 8 HousingJon SmithNo ratings yet

- What Is Universal Credit?Document2 pagesWhat Is Universal Credit?Sarah MinhasNo ratings yet

- Joint Home LoanDocument6 pagesJoint Home Loantoton33No ratings yet

- Tax PlaningDocument9 pagesTax PlaningGaurav Singh JadaunNo ratings yet

- Studying Full Time - Benefits You Can ClaimDocument6 pagesStudying Full Time - Benefits You Can ClaimRashad HallNo ratings yet

- SP Fairer Charging LeafletDocument2 pagesSP Fairer Charging LeafletFauzan Luthfi A MNo ratings yet

- Unit #9 Assessment ReviewsDocument10 pagesUnit #9 Assessment ReviewsHazmina WadivalaNo ratings yet

- NY COVID Rent ReliefDocument2 pagesNY COVID Rent ReliefJoe SpectorNo ratings yet

- HCV Homeownership FAQDocument4 pagesHCV Homeownership FAQuserNo ratings yet

- US Social Housing Bond (Colonial Capital) PDFDocument6 pagesUS Social Housing Bond (Colonial Capital) PDFSo LokNo ratings yet

- Winter Fuel PaymentDocument3 pagesWinter Fuel PaymentKirsty BanksNo ratings yet

- From Child To Work With ParentsDocument24 pagesFrom Child To Work With ParentsSvetlana HarazNo ratings yet

- Documents You Must Include With Your Application:: Mortgage Pre-QualificationDocument8 pagesDocuments You Must Include With Your Application:: Mortgage Pre-QualificationAnonymous RtqTxAn7wNo ratings yet

- Online Cash Lifetime ISA: Summary Box - Key Savings Account InformationDocument7 pagesOnline Cash Lifetime ISA: Summary Box - Key Savings Account Informationwd216No ratings yet

- Calculate SalaryDocument15 pagesCalculate SalaryShahjahan MohammedNo ratings yet

- Tax Penalty Fact SheetDocument2 pagesTax Penalty Fact SheetOutboundEngineNo ratings yet

- Protect Your Home From Predatory LendersDocument2 pagesProtect Your Home From Predatory LendersSC AppleseedNo ratings yet

- Co029 2022Document110 pagesCo029 2022Audrey TaylorNo ratings yet

- Accommodation 2014Document12 pagesAccommodation 2014sunchit1986No ratings yet

- Medicaid HCBS and Stimulus ChecksDocument2 pagesMedicaid HCBS and Stimulus ChecksIndiana Family to FamilyNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- Finance 1050 Final ProjectDocument7 pagesFinance 1050 Final Projectapi-388916709No ratings yet

- Housing Assistance Benefits - Quick Reference Guide: Assistance For General Relief (GR) RecipientsDocument4 pagesHousing Assistance Benefits - Quick Reference Guide: Assistance For General Relief (GR) RecipientsdonkroxldiphyvcNo ratings yet

- Sfe New FT Guide 1516 DDocument15 pagesSfe New FT Guide 1516 DAureliaNo ratings yet

- Faqs Council Tax 111110Document2 pagesFaqs Council Tax 111110Vibhu GautamNo ratings yet

- 5 Vital Tips On Home LoansDocument16 pages5 Vital Tips On Home LoansnabemduNo ratings yet

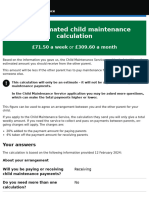

- Child Maintenance Calculation 12 February 2024Document3 pagesChild Maintenance Calculation 12 February 2024rumbidzamakuvazaNo ratings yet

- 5 Vital Tips On Home LoansDocument16 pages5 Vital Tips On Home Loansnabemdu100% (1)

- Class 108 A1 - Extra ActivitiesDocument2 pagesClass 108 A1 - Extra ActivitiesJonathanNo ratings yet

- Statements With Verb To Be Possessive Adjectives: For Example: ItDocument1 pageStatements With Verb To Be Possessive Adjectives: For Example: ItJonathanNo ratings yet

- Seasons 1Document12 pagesSeasons 1JonathanNo ratings yet

- Class 14 A2 - Extra ActivitiesDocument2 pagesClass 14 A2 - Extra ActivitiesJonathanNo ratings yet

- General IELTS - Reading Test 1Document3 pagesGeneral IELTS - Reading Test 1JonathanNo ratings yet

- Academic IELTS - Writing Sample Test 2Document1 pageAcademic IELTS - Writing Sample Test 2JonathanNo ratings yet

- General IELTS - Reading Sample Test 1Document2 pagesGeneral IELTS - Reading Sample Test 1JonathanNo ratings yet

- Fabm2-3 Statement of Changes in EquityDocument24 pagesFabm2-3 Statement of Changes in EquityJacel GadonNo ratings yet

- GMM (Ashwath)Document66 pagesGMM (Ashwath)SiddharthaNo ratings yet

- Internship Report OGDCLDocument63 pagesInternship Report OGDCLZohaib GondalNo ratings yet

- Vicom 2Document7 pagesVicom 2johnsolarpanelsNo ratings yet

- SFM Short Revision - Formula BookDocument153 pagesSFM Short Revision - Formula Bookqamaraleem1_25038318No ratings yet

- DTC Agreement Between Cyprus and United StatesDocument30 pagesDTC Agreement Between Cyprus and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Prelim ExamDocument13 pagesPrelim ExamNah HamzaNo ratings yet

- MCQ QuestionsDocument8 pagesMCQ Questionsvarma pranjalNo ratings yet

- Chapter 1Document28 pagesChapter 1Gazi JayedNo ratings yet

- Existing Company - First CalgaryDocument38 pagesExisting Company - First CalgaryPal ACNo ratings yet

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallNo ratings yet

- Global Leaders, Challengers, and Champions: The Engines of Emerging MarketsDocument35 pagesGlobal Leaders, Challengers, and Champions: The Engines of Emerging MarketsGriffithNo ratings yet

- Food TripDocument16 pagesFood TripArjay ArellanoNo ratings yet

- Commercial ArithmeticDocument10 pagesCommercial Arithmetictalk2naureenNo ratings yet

- Vault-Finance Interview QuestionsDocument22 pagesVault-Finance Interview QuestionsSandeep Chowdhury100% (1)

- Auditing Problems Final Term Exam 3.14.2013Document10 pagesAuditing Problems Final Term Exam 3.14.2013Vel JuneNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- DPR-Chatiisgarh For Club DevelopmentDocument22 pagesDPR-Chatiisgarh For Club Developmentsohalsingh1No ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- Resume Balance ScorecardDocument17 pagesResume Balance ScorecardNatya PratyaksaNo ratings yet

- Solution - Problems and Solutions Chap 3Document4 pagesSolution - Problems and Solutions Chap 3Ajeet YadavNo ratings yet

- Assessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Document3 pagesAssessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Shamim IqbalNo ratings yet

- Circlular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Document63 pagesCirclular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Kirit J Patel100% (1)

- Fundamental of Financial Management May 1, 2020: Tutorial: Capital Cash Flow ProjectionDocument14 pagesFundamental of Financial Management May 1, 2020: Tutorial: Capital Cash Flow ProjectionNgân Võ Trần TuyếtNo ratings yet

- Direct Marketing Data AnalysisDocument15 pagesDirect Marketing Data AnalysisShruti MaindolaNo ratings yet

- FAR 2841 - Equity-summary-DIYDocument4 pagesFAR 2841 - Equity-summary-DIYEira Shane100% (1)

- EFU LIFE PresentationDocument20 pagesEFU LIFE PresentationZawar Afzal Khan0% (1)

- CS 280323 Prog Bil 2022 KME EnglDocument14 pagesCS 280323 Prog Bil 2022 KME EnglChipasha MwelwaNo ratings yet

General IELTS - Reading Sample Test 2

General IELTS - Reading Sample Test 2

Uploaded by

JonathanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General IELTS - Reading Sample Test 2

General IELTS - Reading Sample Test 2

Uploaded by

JonathanCopyright:

Available Formats

Read the article of housing benefit and answer the questions.

You will have 20 minutes to complete these tasks.

Housing Benefit

Who is eligible

You may get Housing Benefit if you pay rent and your income and capital (savings and investments) are below a

certain level. You could qualify if you are out of work, or in work and earning a wage.

Use the online benefits adviser to get an estimate of the benefits, including Housing Benefit, you may get.

Who isn't eligible

You can't usually get Housing Benefit if:

you have savings of over £16,000, unless you are getting the “guarantee credit” of Pension Credit

you live in the home of a close relative

you're a full-time student (unless you're disabled or have children)

you're an asylum seeker or are sponsored to be in the UK

Other restrictions

If you live with a partner or civil partner only one of you can get Housing Benefit.

If you're single and aged under 25 you can only get Housing Benefit for bed-sit accommodation or one room in

shared accommodation.

How to check eligibility

If you think you may be eligible for Housing Benefit, the following link will let you enter details of where you live

and then take you to your local authority website where you can find out more.

Check your eligibility for Housing Benefit with your local council.

Important changes for people receiving Child Benefit

Child Benefit is no longer counted as income when working out how much Housing Benefit or Council Tax Benefit

you can get.

This means that some people currently receiving Housing Benefit and Council Tax Benefit payments will receive

more benefit with which to pay their rent and council tax.

In addition, some low income families may now get Housing Benefit and Council Tax Benefit as a result of this

change. If you think you may now be entitled, contact your local council.

How much do you get?

If you rent a property or room from a private landlord, your Housing Benefit will be calculated with the Local

Housing Allowance rules.

If you live in council accommodation or other social housing, the most Housing Benefit you can get is the same as

your 'eligible' rent.

What is “eligible” rent?

Eligible rent includes:

rent for the accommodation.

charges for some services, such as lifts, communal laundry facilities or play areas.

Extracted from: https://www.examenglish.com/IELTS/IELTS_general_reading_test3_2.htm

Even if it's included in your rent, you won't get any Housing Benefit for:

water charges.

charges for heating, hot water, lighting, or cooking.

payments for food or fuel in board and lodgings or hostels.

How it's paid

If you are a council tenant, your council will pay any Housing Benefit straight into your rent account.

If you're not a council tenant, your Housing Benefit will be paid:

to you by cheque.

by Direct Payment into your bank or building society account.

Contact your council if you're worried about how Housing Benefit is paid.

Complete the sentences below.

Choose NO MORE THAN TWO WORDS and/or a NUMBER from the text for each answer.

1) If your savings are more than £16,000, you receive Housing Benefit.

2) You may get Housing Benefit if you are a full-time student with .

3) When calculating Housing Benefit, Child Benefit is not any more.

4) The change to Child Benefits means that some families may get more benefits.

5) Children's are included in 'eligible' rent.

6) Housing Benefit will be paid into your if you are a council tenant.

7) If you are not a council tenant, payments can be made by Direct Payment or .

Extracted from: https://www.examenglish.com/IELTS/IELTS_general_reading_test3_2.htm

You might also like

- Class 17 B2 - Extra ActivitiesDocument2 pagesClass 17 B2 - Extra ActivitiesJonathanNo ratings yet

- An Example of A Marketing PlanDocument8 pagesAn Example of A Marketing PlanJannie Aldrin SiahaanNo ratings yet

- Help With Your Rent and Council Tax: ProofsDocument28 pagesHelp With Your Rent and Council Tax: Proofsjason_preciousNo ratings yet

- HC1 April 2016 PDFDocument20 pagesHC1 April 2016 PDFWill RogersNo ratings yet

- Notify For ChangesDocument1 pageNotify For Changesyip90No ratings yet

- E Selfhelp RedundancyDocument12 pagesE Selfhelp RedundancykabulibazariNo ratings yet

- HC 1Document20 pagesHC 1multiekNo ratings yet

- Universal Credit What You'Ll Get - GOV - UkDocument1 pageUniversal Credit What You'Ll Get - GOV - UkkarenfergieNo ratings yet

- Loan Information Sheet Amended 02.04.2020aDocument2 pagesLoan Information Sheet Amended 02.04.2020aSzabolcs HunyadiNo ratings yet

- HC1 December 2019Document20 pagesHC1 December 2019TomNo ratings yet

- Housing Options: A Guide To Housing Options Available Through Local AuthoritiesDocument20 pagesHousing Options: A Guide To Housing Options Available Through Local AuthoritieswoodworkmailboxNo ratings yet

- Sponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaDocument1 pageSponsor Your Spouse, Common-Law Partner, Conjugal Partner or Dependent Child - Complete Guide (IMM 5289) - Canada - CaTheRefepNo ratings yet

- Study of Reverse MortgageDocument46 pagesStudy of Reverse MortgageManav VishNo ratings yet

- Information For Ukrainian Red CrossDocument8 pagesInformation For Ukrainian Red CrossKonstantin IvanovNo ratings yet

- A Briefing For Self Employed Uc Claimants Member BriefingDocument7 pagesA Briefing For Self Employed Uc Claimants Member BriefingLiv Darcey HawthorneNo ratings yet

- A - Comprehensive Guide To Tax Free ChildcareDocument19 pagesA - Comprehensive Guide To Tax Free Childcaredolors.mayencoNo ratings yet

- Ncic ch09Document18 pagesNcic ch09vivianNo ratings yet

- Know Your Rights Housing: 1. What Are Disabled Facilities Grants (DFGS) ?Document2 pagesKnow Your Rights Housing: 1. What Are Disabled Facilities Grants (DFGS) ?LinaceroNo ratings yet

- All About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Document10 pagesAll About Home Loan - Razabpn@gmail - Com - Biswa Prakash Nayak - 21apr2011Biswa Prakash NayakNo ratings yet

- 2022-12-19 Cost of Living SupportDocument5 pages2022-12-19 Cost of Living SupportisleworthsyonNo ratings yet

- Tax Planning 0611Document2 pagesTax Planning 0611GLSTaxAdviceUKNo ratings yet

- Use This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceDocument22 pagesUse This Form To Claim Housing Benefit, Council Tax Benefit, Free School Meals and School Clothing AllowanceafacewithoutanameNo ratings yet

- HTB Isa WelcomeDocument12 pagesHTB Isa WelcomesdsdwewesdNo ratings yet

- DivorceDocument5 pagesDivorceAlthea SorianoNo ratings yet

- 2023-12-21 Start of Spring Term 2024 and Cost of Living SupportDocument5 pages2023-12-21 Start of Spring Term 2024 and Cost of Living SupportisleworthsyonNo ratings yet

- Pension CreditDocument22 pagesPension CreditIan ChristieNo ratings yet

- L1e Universal Credit SimpleDocument2 pagesL1e Universal Credit Simpleapi-656243125No ratings yet

- Universal CreditDocument8 pagesUniversal Creditapi-511966504No ratings yet

- Reference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceDocument12 pagesReference Id: Entitledto-10957291 Your Income: Entitlement Yearly Weekly Notes and GuidanceJohnny AlfaNo ratings yet

- Family Friendly Facts BookletDocument32 pagesFamily Friendly Facts BookletPhyo ThihabookNo ratings yet

- fs21_council_tax_fcsDocument20 pagesfs21_council_tax_fcsLauna McentyreNo ratings yet

- RA Guidance Notes Nov 22Document8 pagesRA Guidance Notes Nov 22y.lohvynenkoNo ratings yet

- Section 8 HousingDocument40 pagesSection 8 HousingJon SmithNo ratings yet

- What Is Universal Credit?Document2 pagesWhat Is Universal Credit?Sarah MinhasNo ratings yet

- Joint Home LoanDocument6 pagesJoint Home Loantoton33No ratings yet

- Tax PlaningDocument9 pagesTax PlaningGaurav Singh JadaunNo ratings yet

- Studying Full Time - Benefits You Can ClaimDocument6 pagesStudying Full Time - Benefits You Can ClaimRashad HallNo ratings yet

- SP Fairer Charging LeafletDocument2 pagesSP Fairer Charging LeafletFauzan Luthfi A MNo ratings yet

- Unit #9 Assessment ReviewsDocument10 pagesUnit #9 Assessment ReviewsHazmina WadivalaNo ratings yet

- NY COVID Rent ReliefDocument2 pagesNY COVID Rent ReliefJoe SpectorNo ratings yet

- HCV Homeownership FAQDocument4 pagesHCV Homeownership FAQuserNo ratings yet

- US Social Housing Bond (Colonial Capital) PDFDocument6 pagesUS Social Housing Bond (Colonial Capital) PDFSo LokNo ratings yet

- Winter Fuel PaymentDocument3 pagesWinter Fuel PaymentKirsty BanksNo ratings yet

- From Child To Work With ParentsDocument24 pagesFrom Child To Work With ParentsSvetlana HarazNo ratings yet

- Documents You Must Include With Your Application:: Mortgage Pre-QualificationDocument8 pagesDocuments You Must Include With Your Application:: Mortgage Pre-QualificationAnonymous RtqTxAn7wNo ratings yet

- Online Cash Lifetime ISA: Summary Box - Key Savings Account InformationDocument7 pagesOnline Cash Lifetime ISA: Summary Box - Key Savings Account Informationwd216No ratings yet

- Calculate SalaryDocument15 pagesCalculate SalaryShahjahan MohammedNo ratings yet

- Tax Penalty Fact SheetDocument2 pagesTax Penalty Fact SheetOutboundEngineNo ratings yet

- Protect Your Home From Predatory LendersDocument2 pagesProtect Your Home From Predatory LendersSC AppleseedNo ratings yet

- Co029 2022Document110 pagesCo029 2022Audrey TaylorNo ratings yet

- Accommodation 2014Document12 pagesAccommodation 2014sunchit1986No ratings yet

- Medicaid HCBS and Stimulus ChecksDocument2 pagesMedicaid HCBS and Stimulus ChecksIndiana Family to FamilyNo ratings yet

- Unemployment and Other Assistance ProgramDocument10 pagesUnemployment and Other Assistance ProgramMaimai Durano100% (1)

- Finance 1050 Final ProjectDocument7 pagesFinance 1050 Final Projectapi-388916709No ratings yet

- Housing Assistance Benefits - Quick Reference Guide: Assistance For General Relief (GR) RecipientsDocument4 pagesHousing Assistance Benefits - Quick Reference Guide: Assistance For General Relief (GR) RecipientsdonkroxldiphyvcNo ratings yet

- Sfe New FT Guide 1516 DDocument15 pagesSfe New FT Guide 1516 DAureliaNo ratings yet

- Faqs Council Tax 111110Document2 pagesFaqs Council Tax 111110Vibhu GautamNo ratings yet

- 5 Vital Tips On Home LoansDocument16 pages5 Vital Tips On Home LoansnabemduNo ratings yet

- Child Maintenance Calculation 12 February 2024Document3 pagesChild Maintenance Calculation 12 February 2024rumbidzamakuvazaNo ratings yet

- 5 Vital Tips On Home LoansDocument16 pages5 Vital Tips On Home Loansnabemdu100% (1)

- Class 108 A1 - Extra ActivitiesDocument2 pagesClass 108 A1 - Extra ActivitiesJonathanNo ratings yet

- Statements With Verb To Be Possessive Adjectives: For Example: ItDocument1 pageStatements With Verb To Be Possessive Adjectives: For Example: ItJonathanNo ratings yet

- Seasons 1Document12 pagesSeasons 1JonathanNo ratings yet

- Class 14 A2 - Extra ActivitiesDocument2 pagesClass 14 A2 - Extra ActivitiesJonathanNo ratings yet

- General IELTS - Reading Test 1Document3 pagesGeneral IELTS - Reading Test 1JonathanNo ratings yet

- Academic IELTS - Writing Sample Test 2Document1 pageAcademic IELTS - Writing Sample Test 2JonathanNo ratings yet

- General IELTS - Reading Sample Test 1Document2 pagesGeneral IELTS - Reading Sample Test 1JonathanNo ratings yet

- Fabm2-3 Statement of Changes in EquityDocument24 pagesFabm2-3 Statement of Changes in EquityJacel GadonNo ratings yet

- GMM (Ashwath)Document66 pagesGMM (Ashwath)SiddharthaNo ratings yet

- Internship Report OGDCLDocument63 pagesInternship Report OGDCLZohaib GondalNo ratings yet

- Vicom 2Document7 pagesVicom 2johnsolarpanelsNo ratings yet

- SFM Short Revision - Formula BookDocument153 pagesSFM Short Revision - Formula Bookqamaraleem1_25038318No ratings yet

- DTC Agreement Between Cyprus and United StatesDocument30 pagesDTC Agreement Between Cyprus and United StatesOECD: Organisation for Economic Co-operation and DevelopmentNo ratings yet

- Prelim ExamDocument13 pagesPrelim ExamNah HamzaNo ratings yet

- MCQ QuestionsDocument8 pagesMCQ Questionsvarma pranjalNo ratings yet

- Chapter 1Document28 pagesChapter 1Gazi JayedNo ratings yet

- Existing Company - First CalgaryDocument38 pagesExisting Company - First CalgaryPal ACNo ratings yet

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- Fin 517 - Take Home ExamDocument3 pagesFin 517 - Take Home ExamJennifer PearsallNo ratings yet

- Global Leaders, Challengers, and Champions: The Engines of Emerging MarketsDocument35 pagesGlobal Leaders, Challengers, and Champions: The Engines of Emerging MarketsGriffithNo ratings yet

- Food TripDocument16 pagesFood TripArjay ArellanoNo ratings yet

- Commercial ArithmeticDocument10 pagesCommercial Arithmetictalk2naureenNo ratings yet

- Vault-Finance Interview QuestionsDocument22 pagesVault-Finance Interview QuestionsSandeep Chowdhury100% (1)

- Auditing Problems Final Term Exam 3.14.2013Document10 pagesAuditing Problems Final Term Exam 3.14.2013Vel JuneNo ratings yet

- Inter CA Direct Tax Homework SolutionsDocument67 pagesInter CA Direct Tax Homework SolutionsAbhijit HoroNo ratings yet

- DPR-Chatiisgarh For Club DevelopmentDocument22 pagesDPR-Chatiisgarh For Club Developmentsohalsingh1No ratings yet

- Cost AccountingDocument59 pagesCost AccountingMuhammad UsmanNo ratings yet

- Resume Balance ScorecardDocument17 pagesResume Balance ScorecardNatya PratyaksaNo ratings yet

- Solution - Problems and Solutions Chap 3Document4 pagesSolution - Problems and Solutions Chap 3Ajeet YadavNo ratings yet

- Assessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Document3 pagesAssessment Year: 2020 - 2021: Form of Return of Income Under The Income-Tax Ordinance, 1984 (XXXVI OF 1984)Shamim IqbalNo ratings yet

- Circlular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Document63 pagesCirclular No 1 - 2010 F No 275 - 192 - 2009 - IT - B Dated 11 - 01 - 2010Kirit J Patel100% (1)

- Fundamental of Financial Management May 1, 2020: Tutorial: Capital Cash Flow ProjectionDocument14 pagesFundamental of Financial Management May 1, 2020: Tutorial: Capital Cash Flow ProjectionNgân Võ Trần TuyếtNo ratings yet

- Direct Marketing Data AnalysisDocument15 pagesDirect Marketing Data AnalysisShruti MaindolaNo ratings yet

- FAR 2841 - Equity-summary-DIYDocument4 pagesFAR 2841 - Equity-summary-DIYEira Shane100% (1)

- EFU LIFE PresentationDocument20 pagesEFU LIFE PresentationZawar Afzal Khan0% (1)

- CS 280323 Prog Bil 2022 KME EnglDocument14 pagesCS 280323 Prog Bil 2022 KME EnglChipasha MwelwaNo ratings yet