Professional Documents

Culture Documents

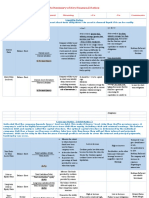

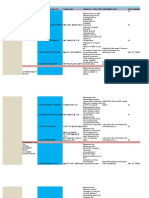

Accounting Ratios: Entity's Ability To Survive Over A Long Period of Time

Accounting Ratios: Entity's Ability To Survive Over A Long Period of Time

Uploaded by

kulsum0 ratings0% found this document useful (0 votes)

4 views1 pageThis document provides definitions and interpretations for various financial ratios used to analyze a company's liquidity, solvency, profitability, and operating efficiency. Key ratios discussed include the current ratio, quick ratio, debt-to-total assets ratio, times interest earned, cash debt coverage, receivables turnover, inventory turnover, return on equity, return on assets, profit margin, and asset turnover. The document also provides guidance on how to properly analyze and answer questions about financial ratios.

Original Description:

Original Title

ACCOUNTING_RATIOS_cloud

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides definitions and interpretations for various financial ratios used to analyze a company's liquidity, solvency, profitability, and operating efficiency. Key ratios discussed include the current ratio, quick ratio, debt-to-total assets ratio, times interest earned, cash debt coverage, receivables turnover, inventory turnover, return on equity, return on assets, profit margin, and asset turnover. The document also provides guidance on how to properly analyze and answer questions about financial ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

4 views1 pageAccounting Ratios: Entity's Ability To Survive Over A Long Period of Time

Accounting Ratios: Entity's Ability To Survive Over A Long Period of Time

Uploaded by

kulsumThis document provides definitions and interpretations for various financial ratios used to analyze a company's liquidity, solvency, profitability, and operating efficiency. Key ratios discussed include the current ratio, quick ratio, debt-to-total assets ratio, times interest earned, cash debt coverage, receivables turnover, inventory turnover, return on equity, return on assets, profit margin, and asset turnover. The document also provides guidance on how to properly analyze and answer questions about financial ratios.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Indicates the degree of leverage (percentage of total

assets funded through creditors)

The lower , the better

CURRENT RATIO/ DEBT TO

WORKING CAPITAL TOTAL ASSETS

RATIO (Leverage)

RATIO

indicates short-term debt-paying ability

The higher the ratio, the better

TIMES INTEREST

QUICK EARNED Indicates entity's ability to sustain debt by measuring its

RATIO/ACID-TEST SOLVENCY ability to meet interest payments from operating

RATIO entity's ability to profit as they fall due

indicates immediate short-term liquidity survive over a long CASH DEBT The higher, the better

The higher the ratio, the better period of time COVERAGE Indicates entity's ability to repay liabilities from cash

excludes inventory, prepaid assets which are LEAST generated from operating activities without having

current assets CURRENT liquidate assets used in operations

CASH DEBT The higher, the better

COVERAGE

Indicates short-term debt paying ability on a cash basis Indicates entity's ability to pay dividends or expand

operations

The higher the ratio, the better FREE CASH FLOW

reflects the whole period and does not just use year end The higher, the better

balances, it combines cash and accrual figures

RECEIVABLES

TURNOVER

Indicates the effectiveness of credit collection policies LIQUIDITY PROFITABILITY RETURN ON EQUITY RATIO

Indicates profitability of ordinary shareholders'

(how fast money is collected from debtors) short-term ability to pay profit/operatin success investment (earnings per dollar invested by the owners)

measures the number of times trade receivables are debts and meet unexpected of entity for a period of

converted into cash during the period The higher, the better

needs for cash time

The higher, the better

ACCOUNTING RATIOS Indicates overall profitability with respect to investment

in assets

RETURN ON ASSETS The higher, the better

indicates the liquidity of receivables and collection HOW TO ANSWER RATIO QUES

success

AVERAGE

the shorter the duration, the better COLLECTION Indicates profit generated by each dollar of sales

PERIOD

1. Explain what the ratio means (defn) PROFIT MARGIN It depends on the volume of firms but generally, the

indicates the liquidity of inventory (effectiveness of higher, the better

2. Give correct interpretation for the

inventory management) increase/decrease in the ratio. Is it good or bad?

INVENTORY What does it mean?

the higher the turnover, the better

TURNOVER 3 . Trend analysis from year to year - improving or Indicates how efficiently assets are used to generate

worsening? sales

ASSET TURNOVER

indicates the liquidity of inventory and inventory 3.A) Comparison between 2 or 3 entities - which is The higher, the better

management better?

AVERAGE DAYS

the shorter the duration, the better IN INVENTORY

converts inventory turnover into a measure of day for Indicates entity's ability to maintain an adequate selling

inventory to be sold price above its cost

GROSS PROFIT RATE

The higher, the better

This mindmap is downloaded from

dineshbakshi.com

Indicates the costs incurred to support each dollar of

sales

OPERATING EXPENSES TO SALES RATIO

The lower , the better

Indicates the net cash flow generated by each dollar of

sales

CASH RETURN ON SALES RATIO

The higher, the better

Indicates profit per ordinary share

EARNINGS PER SHARE The higher, the better

Indicates relationship between market price per share

and earnings per share

PRICE EARNING RATIO

You might also like

- Rh134 9.0 Student GuideDocument434 pagesRh134 9.0 Student Guidehorvtoys100% (1)

- CIMA Case Study Exam - Cheat SheetDocument4 pagesCIMA Case Study Exam - Cheat SheetkulsumNo ratings yet

- Etsy Shop Success: Free Training WorkbookDocument11 pagesEtsy Shop Success: Free Training Workbookkulsum0% (1)

- IFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesDocument6 pagesIFT Notes For Level I CFA Program: R24 Financial Analysis TechniquesashwingrgNo ratings yet

- Financial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018Document26 pagesFinancial Ratio Analysis: Helmi Salam S C1H017001 Carissa Sandra S C1H017007 Salma Meidiana C1H017018salma_meiNo ratings yet

- Financial RatiosDocument13 pagesFinancial Ratiosakash ThakurNo ratings yet

- Ratio Analysis: Submitted in Partial Towards The Degree ofDocument17 pagesRatio Analysis: Submitted in Partial Towards The Degree ofWhite HatNo ratings yet

- Key Financial Ratios (VIP)Document10 pagesKey Financial Ratios (VIP)Ahmed HeshamNo ratings yet

- FABM2 - Q1 - V2a Page 102 114Document12 pagesFABM2 - Q1 - V2a Page 102 114Kate thilyNo ratings yet

- Debt To Asset: Consolidated Ratios 2020 2019 2018 Averag e Favorable or Unfavorable CommentDocument2 pagesDebt To Asset: Consolidated Ratios 2020 2019 2018 Averag e Favorable or Unfavorable CommentfavourNo ratings yet

- Formula Financial RatioDocument4 pagesFormula Financial RatioRubiatul Adawiah Zainal AriffinNo ratings yet

- Ratio Summary TableDocument11 pagesRatio Summary TableMaika NarcisoNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Financial Ratio AnalysisDocument18 pagesFinancial Ratio Analysissarangpethe100% (4)

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- Note On Financial Ratio FormulaDocument5 pagesNote On Financial Ratio FormulachthakorNo ratings yet

- Accounting TermsDocument2 pagesAccounting TermsWatashi Wa HitodesuNo ratings yet

- Key Financial Ratios (M.N) FinialDocument10 pagesKey Financial Ratios (M.N) FinialYousab KaldasNo ratings yet

- Ratio Analysis - FACDocument4 pagesRatio Analysis - FACPravallika NadakuditiNo ratings yet

- For 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision PracticeDocument67 pagesFor 2021 DSE: HKCWCC BAFS Accounting Accounting Ratios Summary and Revision Practice6D10 NG YAN HUNG 吳欣鴻No ratings yet

- Return On Net Assets Pait/Net Assets X 100Document18 pagesReturn On Net Assets Pait/Net Assets X 100neuroemg100% (1)

- Financial RatiosDocument2 pagesFinancial Ratiosyohan_phillipsNo ratings yet

- Cash Flow AnalysisDocument5 pagesCash Flow AnalysisJayanta SarkarNo ratings yet

- Financial Ratio AnalysisDocument2 pagesFinancial Ratio AnalysisFayad CalúNo ratings yet

- Ratio Analysis Cheat SheetDocument2 pagesRatio Analysis Cheat SheetcinkayunramNo ratings yet

- Ratio AnalysisDocument4 pagesRatio AnalysisJayaNo ratings yet

- Liquidity Debt Management Asset Management Profitability Return To InvestorsDocument5 pagesLiquidity Debt Management Asset Management Profitability Return To InvestorsJayNo ratings yet

- Example:: Basis Assets LiabilitiesDocument23 pagesExample:: Basis Assets LiabilitiesAmbika Prasad ChandaNo ratings yet

- Basic Accounting RatiosDocument47 pagesBasic Accounting RatiosSUNYYRNo ratings yet

- 8 Financial RatiosDocument3 pages8 Financial Ratios- fridaNo ratings yet

- ch6 + CH 3+ FormulaDocument23 pagesch6 + CH 3+ Formulaalien0077naqviNo ratings yet

- Previous Years Questions and AnswersDocument26 pagesPrevious Years Questions and Answerslucky420024No ratings yet

- Chapter 7Document49 pagesChapter 7Natasha GhazaliNo ratings yet

- Ratio Analysis: It Is Concerned With The Calculation ofDocument19 pagesRatio Analysis: It Is Concerned With The Calculation ofsajithNo ratings yet

- Chapter 3 Fs AnalysisDocument8 pagesChapter 3 Fs AnalysisYlver John YepesNo ratings yet

- Ratio Analysis InterpretationDocument10 pagesRatio Analysis Interpretationpre.meh21No ratings yet

- Accoutning and 21st NotesDocument12 pagesAccoutning and 21st NotesLouie Ryker LeodyNo ratings yet

- Liquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Document3 pagesLiquidity Ratio: Analysis - Overview, Uses, Categories of Financial Ratios, 2022)Akinola WinfulNo ratings yet

- Ratio Report Excel Template Copy El - Copy 2Document21 pagesRatio Report Excel Template Copy El - Copy 2api-736389893No ratings yet

- CH 4 Part 1 Ratio AnalysisDocument28 pagesCH 4 Part 1 Ratio AnalysisMuhammad iqbal HakiimNo ratings yet

- Ratios: Interpreting Financial StatementsDocument3 pagesRatios: Interpreting Financial StatementsMr RizviNo ratings yet

- How Formula Expressed Meaning: Current Assets Current LiabilitiesDocument5 pagesHow Formula Expressed Meaning: Current Assets Current LiabilitiesHemraj VermaNo ratings yet

- Ratios FormulaDocument2 pagesRatios FormulaMURSYIDAH ABD RASIDNo ratings yet

- Leverage and Excess Risk Acivity Based Costing: BusinessDocument1 pageLeverage and Excess Risk Acivity Based Costing: Businessjavier apodacaNo ratings yet

- Difference Between Accounts & FinanceDocument4 pagesDifference Between Accounts & Financesameer amjadNo ratings yet

- Ratio Analysis: Broad Categories of RatiosDocument7 pagesRatio Analysis: Broad Categories of RatiosAkhil NigudkarNo ratings yet

- Financial Statement AnalysisDocument4 pagesFinancial Statement AnalysisGina FabunanNo ratings yet

- 9 Valuation Cheat SheetDocument1 page9 Valuation Cheat SheetHan Htun Oo100% (1)

- Compute and Interpret Liquidity RatiosDocument3 pagesCompute and Interpret Liquidity RatiosANKITA SHENDRENo ratings yet

- Financial Management RatiosDocument6 pagesFinancial Management RatiosCharlotte PalmaNo ratings yet

- Fin FormulaDocument16 pagesFin FormulaShabab ZarifNo ratings yet

- Cash Flow Cheat SheetDocument1 pageCash Flow Cheat SheetSuresh KumarNo ratings yet

- Dmart AccountsDocument18 pagesDmart AccountsDrishti KataraNo ratings yet

- Liquidity Only.: Ex Payable AmountDocument12 pagesLiquidity Only.: Ex Payable AmountPranshu SahasrabuddheNo ratings yet

- Ind As 102Document12 pagesInd As 102Remaining lifeNo ratings yet

- Bsfin FinalsDocument5 pagesBsfin FinalsKate LlanetaNo ratings yet

- UntitledDocument3 pagesUntitledTanmay DubeyNo ratings yet

- Business Math DictionaryDocument25 pagesBusiness Math DictionaryReinan Ezekiel Sotto Llagas100% (1)

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisyukiNo ratings yet

- Cost Recovery: Turning Your Accounts Payable Department into a Profit CenterFrom EverandCost Recovery: Turning Your Accounts Payable Department into a Profit CenterNo ratings yet

- Korean Business Dictionary: American and Korean Business Terms for the Internet AgeFrom EverandKorean Business Dictionary: American and Korean Business Terms for the Internet AgeNo ratings yet

- The Ultimate SEO ChecklistDocument48 pagesThe Ultimate SEO ChecklistkulsumNo ratings yet

- Ear Form May June 2014 Final 0Document4 pagesEar Form May June 2014 Final 0kulsumNo ratings yet

- Stay Informed: Year 13 Exam & Uni Changes 2021Document1 pageStay Informed: Year 13 Exam & Uni Changes 2021kulsumNo ratings yet

- Digital Storytelling Vanni Korpela UIINDocument16 pagesDigital Storytelling Vanni Korpela UIINkulsumNo ratings yet

- Alliance Manchester Business School: Undergraduate Study - 2021 EntryDocument52 pagesAlliance Manchester Business School: Undergraduate Study - 2021 EntrykulsumNo ratings yet

- The Ultimate SEO ChecklistDocument1 pageThe Ultimate SEO ChecklistkulsumNo ratings yet

- Unit 1 Market in ActionDocument40 pagesUnit 1 Market in ActionkulsumNo ratings yet

- Primary and Lowersecondary Curriculum.: Integrated. Individual. International. Are You In?Document20 pagesPrimary and Lowersecondary Curriculum.: Integrated. Individual. International. Are You In?kulsumNo ratings yet

- IAL Business Editable Scheme of WorkDocument40 pagesIAL Business Editable Scheme of WorkkulsumNo ratings yet

- CommunicationDocument1 pageCommunicationkulsumNo ratings yet

- Percent of Numbers: Name: Date: Class: TeacherDocument2 pagesPercent of Numbers: Name: Date: Class: TeacherkulsumNo ratings yet

- HPCT311 Unit Task #15Document3 pagesHPCT311 Unit Task #15Evelyn BuenNo ratings yet

- Nanofiltration of Textile Plant Effluent For Color Removal and Reduction in CODDocument11 pagesNanofiltration of Textile Plant Effluent For Color Removal and Reduction in CODOmaya TariqNo ratings yet

- Robertson v. Gordon, 226 U.S. 311 (1912)Document5 pagesRobertson v. Gordon, 226 U.S. 311 (1912)Scribd Government DocsNo ratings yet

- Basic Science Jss 3 Second TermDocument27 pagesBasic Science Jss 3 Second Termjulianachristopher959No ratings yet

- Lesson Plan in Business FinanceDocument9 pagesLesson Plan in Business FinanceEmelen VeranoNo ratings yet

- Datesheet Class 11 TH Annual Exam (2022-23) PDFDocument1 pageDatesheet Class 11 TH Annual Exam (2022-23) PDFSudhanshu ShekharNo ratings yet

- DPP - (19) 13th IOC - (E) - WADocument1 pageDPP - (19) 13th IOC - (E) - WAassadfNo ratings yet

- 2005 Nicolet National Bank Annual ReportDocument16 pages2005 Nicolet National Bank Annual ReportNicolet BankNo ratings yet

- Vocabulary & Grammar Test Unit 6 Test ADocument4 pagesVocabulary & Grammar Test Unit 6 Test AStjepan RasicNo ratings yet

- Dhan Allyn Romero 11 Saturn ABM EAPPDocument7 pagesDhan Allyn Romero 11 Saturn ABM EAPPJhevie RanileNo ratings yet

- Dip One GoroDocument8 pagesDip One GoroanakayamNo ratings yet

- Cancer Latest NewsDocument10 pagesCancer Latest NewsREFINERY ENGINEERINGNo ratings yet

- Therapeutic Efficacy of Centella Asiatica PDFDocument9 pagesTherapeutic Efficacy of Centella Asiatica PDFJ C Torres FormalabNo ratings yet

- BCG MatrixDocument4 pagesBCG MatrixDevojit BoraNo ratings yet

- Water Supply & Sanitaion TM (V5) 2012Document79 pagesWater Supply & Sanitaion TM (V5) 2012Shafiqullah GowharyNo ratings yet

- Dean Quicho - Legal EthicsDocument31 pagesDean Quicho - Legal EthicsGlenda Lyn ArañoNo ratings yet

- History Conclusions + Important StatsDocument20 pagesHistory Conclusions + Important Statsemma karakaidouNo ratings yet

- Megillah 3Document70 pagesMegillah 3Julian Ungar-SargonNo ratings yet

- Discourse Society - The Ideological Construction of Solidarity in Translation ComentariesDocument31 pagesDiscourse Society - The Ideological Construction of Solidarity in Translation ComentariesThiago OliveiraNo ratings yet

- Asbasjsm College of Pharmacy BelaDocument23 pagesAsbasjsm College of Pharmacy Belaimrujlaskar111No ratings yet

- 3 Chapter 3 Part 1 Foundations.Document40 pages3 Chapter 3 Part 1 Foundations.Enanye AragawNo ratings yet

- Bank Reconciliation NotesDocument25 pagesBank Reconciliation NotesJohn Sue HanNo ratings yet

- Pokemon Fusion GeneratorDocument1 pagePokemon Fusion GeneratorFrost MourneNo ratings yet

- NeutraceuticalsDocument36 pagesNeutraceuticalsMir ImranNo ratings yet

- Amazon.com_ New Precision 5540 Mobile Workstation Laptop 9th Gen i9-9880H, 8 Core up to 4.80GHz vPro 1TB SSD 64GB Ram Nvidia Quadro P2000 4GB 15.6_ 4K UHD 3840x2160, Touch Display Win 10 Pro_ Computers & AccessoriesDocument12 pagesAmazon.com_ New Precision 5540 Mobile Workstation Laptop 9th Gen i9-9880H, 8 Core up to 4.80GHz vPro 1TB SSD 64GB Ram Nvidia Quadro P2000 4GB 15.6_ 4K UHD 3840x2160, Touch Display Win 10 Pro_ Computers & AccessoriesBirungi NelsonNo ratings yet

- Digital Literacy in The 21st CenturyDocument27 pagesDigital Literacy in The 21st CenturyMary Ann Dela CruzNo ratings yet

- Sequencing of EventsDocument19 pagesSequencing of EventsGleen PayotNo ratings yet

- Coal Policy: Prevailing Prospecting / Mining Concessions ProceduresDocument13 pagesCoal Policy: Prevailing Prospecting / Mining Concessions ProceduresZubair KhanNo ratings yet

- IPru Signature Online Brochure PDFDocument28 pagesIPru Signature Online Brochure PDFAjeet ThakurNo ratings yet