Professional Documents

Culture Documents

Response Models: 3 Gradient Descent Framework

Response Models: 3 Gradient Descent Framework

Uploaded by

Andres EliasCopyright:

Available Formats

You might also like

- CP CmbokDocument78 pagesCP CmbokSreejith Unnimon92% (12)

- Sale Deed 608Document8 pagesSale Deed 608Akshay Gupte100% (1)

- Multiple Linear Regressioin Part 1Document27 pagesMultiple Linear Regressioin Part 1Adesola Adepoju0% (1)

- Bolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationDocument1 pageBolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationAndres EliasNo ratings yet

- 18neb RulesDocument12 pages18neb RulesbobprobstNo ratings yet

- 2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingDocument1 page2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingAndres EliasNo ratings yet

- Multiple Linear Regression: Step 1: Initialize ValuesDocument3 pagesMultiple Linear Regression: Step 1: Initialize ValuesAkshatha ShenoyNo ratings yet

- Cfe Bbva Price Strategy OptimizationDocument16 pagesCfe Bbva Price Strategy OptimizationSarbani DasguptsNo ratings yet

- Multiple Linear Regression: Step 1: Initialize ValuesDocument3 pagesMultiple Linear Regression: Step 1: Initialize ValuesAkshatha ShenoyNo ratings yet

- Topic Four:: Portfolio Optimization: Analytical TechniquesDocument50 pagesTopic Four:: Portfolio Optimization: Analytical Techniquesendu wesenNo ratings yet

- Vickrey AuctionDocument9 pagesVickrey Auctionmatchman6No ratings yet

- LP Methods.S2 Sensitivity Analysis: K-Dimensional Polyhedron Results. The Only Exception Is Proportional Ranging WhichDocument10 pagesLP Methods.S2 Sensitivity Analysis: K-Dimensional Polyhedron Results. The Only Exception Is Proportional Ranging Whichtheeppori_gctNo ratings yet

- Lecture 11 Consumer SurplusDocument17 pagesLecture 11 Consumer SurplusPreeti SubudhiNo ratings yet

- Sensityvity AnalysisDocument44 pagesSensityvity AnalysisArnab ShyamalNo ratings yet

- Demand EstimationDocument27 pagesDemand EstimationAnonymous FmpblcLw0No ratings yet

- Bidding Strategy and Markup EstimationDocument43 pagesBidding Strategy and Markup Estimationmerna nabilNo ratings yet

- Econometrics 2Document69 pagesEconometrics 2Navyashree B MNo ratings yet

- "Examen Final 3er Corte - Planeación de Producción" 1Document6 pages"Examen Final 3er Corte - Planeación de Producción" 1Juan Camilo AlfonsoNo ratings yet

- Exercises: Capital Asset Pricing Model (SOLUTIONS) : Department of Finance University of Basel Fall 2009Document4 pagesExercises: Capital Asset Pricing Model (SOLUTIONS) : Department of Finance University of Basel Fall 2009aftab20No ratings yet

- 12 AbsDocument15 pages12 AbsAngelica PostreNo ratings yet

- Online Ad AuctionsDocument5 pagesOnline Ad AuctionsRishabh SomaniNo ratings yet

- IcasDocument54 pagesIcasfbxurumelaNo ratings yet

- Lecture4 BODocument14 pagesLecture4 BOgjadhaoNo ratings yet

- 5-LR Doc - R Sqared-Bias-Variance-Ridg-LassoDocument26 pages5-LR Doc - R Sqared-Bias-Variance-Ridg-LassoMonis KhanNo ratings yet

- Patricia Tebogo Siwela - 7419051 - 0Document5 pagesPatricia Tebogo Siwela - 7419051 - 0Tawanda MakombeNo ratings yet

- Business Statistics Canadian 3rd Edition Sharpe Solutions Manual DownloadDocument41 pagesBusiness Statistics Canadian 3rd Edition Sharpe Solutions Manual DownloadCharles Brickner100% (30)

- Nonlinear ProgrammingDocument34 pagesNonlinear ProgrammingAngeline OdayaNo ratings yet

- Chapter 5Document73 pagesChapter 5jayroldparcedeNo ratings yet

- Capital Asset Pricing Model: Dan SaundersDocument4 pagesCapital Asset Pricing Model: Dan SaundersR Shyaam KumarNo ratings yet

- Regression Analysis-NwDocument6 pagesRegression Analysis-NwHassan TahamidNo ratings yet

- Solution 897614Document8 pagesSolution 897614hansikav327No ratings yet

- Drawdown Constraints and Portfolio Optimization: Marcus DavidssonDocument13 pagesDrawdown Constraints and Portfolio Optimization: Marcus Davidssondeepblue004No ratings yet

- Lecture Notes 2: Applications: 1 Maximum FlowDocument10 pagesLecture Notes 2: Applications: 1 Maximum FlownkapreNo ratings yet

- EC2066 - Microeconomics - 2007 Examiners Commentaries - Zone-BDocument16 pagesEC2066 - Microeconomics - 2007 Examiners Commentaries - Zone-BAishwarya PotdarNo ratings yet

- CS550 Regression Aug12Document63 pagesCS550 Regression Aug12dipsresearch100% (1)

- 1.1 Road Map: (K, C) T T TDocument16 pages1.1 Road Map: (K, C) T T Tdamla87No ratings yet

- CH 5 Diversification, Integration and MergerDocument16 pagesCH 5 Diversification, Integration and MergerkirubelNo ratings yet

- What Is Optimization?Document15 pagesWhat Is Optimization?MHARLOU TORINGNo ratings yet

- Question: 4. Suppose A Manufacturer and Its Retailer Face The Problem of Double Marginalization Described I..Document2 pagesQuestion: 4. Suppose A Manufacturer and Its Retailer Face The Problem of Double Marginalization Described I..PaaforiNo ratings yet

- Linear RegressionDocument38 pagesLinear RegressionHabiba SamehNo ratings yet

- U02Lecture06 RegressionDocument25 pagesU02Lecture06 Regressiontunio.bscsf21No ratings yet

- Textbook Scan0001Document17 pagesTextbook Scan0001MoNa MatoutNo ratings yet

- Bidding Strategy and Markup EstimationDocument22 pagesBidding Strategy and Markup EstimationMekuannint DemekeNo ratings yet

- Numerical Approximation of The Implied Volatility Under Arithmetic Brownian MotionDocument8 pagesNumerical Approximation of The Implied Volatility Under Arithmetic Brownian Motionandrea85p100% (1)

- Ebook Business Statistics Canadian 3Rd Edition Sharpe Solutions Manual Full Chapter PDFDocument63 pagesEbook Business Statistics Canadian 3Rd Edition Sharpe Solutions Manual Full Chapter PDFhuyenquyen9eemjd100% (12)

- Notes On The Myerson-Satterthwaite Theorem 1Document8 pagesNotes On The Myerson-Satterthwaite Theorem 1Charles Yue YuanNo ratings yet

- Finance & InvestmentsDocument22 pagesFinance & InvestmentsLodhi AmmanNo ratings yet

- Online Ad Auctions: UC Berkeley and Google. Hal@ischool - Berkeley.edu 1Document6 pagesOnline Ad Auctions: UC Berkeley and Google. Hal@ischool - Berkeley.edu 1Salman SufiNo ratings yet

- Integer ProgrammingDocument5 pagesInteger ProgramminghachanNo ratings yet

- Linear Regression - Least-SquaresDocument5 pagesLinear Regression - Least-SquaresRongrong FuNo ratings yet

- Portfolio RiskDocument24 pagesPortfolio RiskABC DEFNo ratings yet

- Linear Regression - Lok - 2Document31 pagesLinear Regression - Lok - 2LITHISH RNo ratings yet

- 04MB0206 Mid2 (3rdjune22) AnswerKeyDocument6 pages04MB0206 Mid2 (3rdjune22) AnswerKeyTom CruiseNo ratings yet

- Biasing Approximate Dynamic Programming With A Lower Discount FactorDocument8 pagesBiasing Approximate Dynamic Programming With A Lower Discount FactorAfshin SamiaNo ratings yet

- Assignment 2: Portfolio Optimisation: The Markowitz Framework For Portfolio CompositionDocument3 pagesAssignment 2: Portfolio Optimisation: The Markowitz Framework For Portfolio CompositionMayam AyoNo ratings yet

- Beta, WACCDocument12 pagesBeta, WACCmumssrNo ratings yet

- Constrained Cost MinimisationDocument3 pagesConstrained Cost MinimisationYogish PatgarNo ratings yet

- Revision Questions and Classwork 9Document3 pagesRevision Questions and Classwork 9Sams HaiderNo ratings yet

- Sample Exam II PDFDocument2 pagesSample Exam II PDFArsen DuisenbayNo ratings yet

- The Under and Overestimation of RiskDocument18 pagesThe Under and Overestimation of RiskHhp YmNo ratings yet

- High Frequency Trading in A Limit Order BookDocument13 pagesHigh Frequency Trading in A Limit Order BookKwok Chung ChuNo ratings yet

- Reserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeDocument1 pageReserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeAndres EliasNo ratings yet

- Mchugh1956 5Document1 pageMchugh1956 5Andres EliasNo ratings yet

- Mchugh1956 2Document1 pageMchugh1956 2Andres EliasNo ratings yet

- Mchugh1956 3Document1 pageMchugh1956 3Andres EliasNo ratings yet

- Reserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeDocument1 pageReserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeAndres EliasNo ratings yet

- Rawlins1983 2Document1 pageRawlins1983 2Andres EliasNo ratings yet

- Mchugh1956 4Document1 pageMchugh1956 4Andres EliasNo ratings yet

- Mchugh1956 1Document1 pageMchugh1956 1Andres EliasNo ratings yet

- Ymax/d.: Peak-To-Peak Mid-Loop Ymax/d Ymax/dDocument1 pageYmax/d.: Peak-To-Peak Mid-Loop Ymax/d Ymax/dAndres EliasNo ratings yet

- Systems, PAS-102, 963: FSD/V N FsDocument1 pageSystems, PAS-102, 963: FSD/V N FsAndres EliasNo ratings yet

- 1 2 3 T+1 + T T T T T T T T T TDocument1 page1 2 3 T+1 + T T T T T T T T T TAndres EliasNo ratings yet

- Calculation With The Minimum Required Assembly Preload, Tightening Factor: 1.00Document1 pageCalculation With The Minimum Required Assembly Preload, Tightening Factor: 1.00Andres EliasNo ratings yet

- 2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingDocument1 page2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingAndres EliasNo ratings yet

- ResultsDocument1 pageResultsAndres EliasNo ratings yet

- Bolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationDocument5 pagesBolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationAndres EliasNo ratings yet

- Online Modeling of Proactive Moderation System For Auction Fraud DetectionDocument4 pagesOnline Modeling of Proactive Moderation System For Auction Fraud DetectionBubul ChoudhuryNo ratings yet

- Bank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Document36 pagesBank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Anil Kumar YadavNo ratings yet

- Asian Works of Art - Skinner Auction 2591BDocument180 pagesAsian Works of Art - Skinner Auction 2591BSkinnerAuctions100% (2)

- GN 106 - The Court Brokers and Process Servers (Appointment, Remuneration (12429)Document5 pagesGN 106 - The Court Brokers and Process Servers (Appointment, Remuneration (12429)stan NyamleNo ratings yet

- Bartolata Vs RepDocument5 pagesBartolata Vs RepFritz Sapon100% (2)

- GeM Bidding 4712220Document10 pagesGeM Bidding 4712220METS Port BlairNo ratings yet

- 7 - Challenges in Power MarketDocument132 pages7 - Challenges in Power MarketsaaraanNo ratings yet

- Bayleys Residential Auction Results 25 November 2009Document2 pagesBayleys Residential Auction Results 25 November 2009Ariel LevinNo ratings yet

- Ivalua - Sourcing ManagementDocument41 pagesIvalua - Sourcing ManagementAlexandru IgnatNo ratings yet

- Terms & Conditions of E-Auction-DDADocument10 pagesTerms & Conditions of E-Auction-DDADev ChauhanNo ratings yet

- Bayleys Real Estate Auction Results 24 Feb 2010Document2 pagesBayleys Real Estate Auction Results 24 Feb 2010Ariel LevinNo ratings yet

- Codex Whitepaper Draft A&C - MasterDocument35 pagesCodex Whitepaper Draft A&C - MasterAnoukLancestremèreNo ratings yet

- Trading Mechanism - LOB-AuctionDocument13 pagesTrading Mechanism - LOB-AuctionAwsaf bin hashemNo ratings yet

- SUMMER 2023 BUS 498 EXIT Marketing AssesmentDocument15 pagesSUMMER 2023 BUS 498 EXIT Marketing AssesmentRakibul Islam 1911961042No ratings yet

- Sales Reviewer: Nelson Mora JR Roselyn Hundangan Merryl Bercide Beatrice Abit Charina TeberioDocument36 pagesSales Reviewer: Nelson Mora JR Roselyn Hundangan Merryl Bercide Beatrice Abit Charina TeberioMerrylNo ratings yet

- Marteve Guest House Limited V Njenga & 3 Others (Civil Appeal 400 of 2018)Document38 pagesMarteve Guest House Limited V Njenga & 3 Others (Civil Appeal 400 of 2018)gkaniuNo ratings yet

- LocksmithDocument83 pagesLocksmithEdwin100% (1)

- Jeetender Joshi - SCMDocument3 pagesJeetender Joshi - SCMJeet JoshiNo ratings yet

- Rolodex For Domain FlippingDocument4 pagesRolodex For Domain FlippingTimur KhasanovNo ratings yet

- Cooperative Rural MarketsDocument42 pagesCooperative Rural MarketsPriteshPanchalNo ratings yet

- Has Not Sold - vs. - Didn't Sell - English Language Learners Stack ExchangeDocument4 pagesHas Not Sold - vs. - Didn't Sell - English Language Learners Stack ExchangeremovableNo ratings yet

- Yankee Module (Without DSC)Document27 pagesYankee Module (Without DSC)3dicNo ratings yet

- Discovery Featuring Studio Paintings & Country Americana - Skinner Auction 2570MDocument88 pagesDiscovery Featuring Studio Paintings & Country Americana - Skinner Auction 2570MSkinnerAuctionsNo ratings yet

- 5 FOD Catalogue (13.12.2022)Document6 pages5 FOD Catalogue (13.12.2022)AakashSamaddarNo ratings yet

- Social Networking Auction and Portal GaryDocument64 pagesSocial Networking Auction and Portal GaryANo ratings yet

- Scheme For The Lease of Evacuee Trust Agricultural Land, 1975 PDFDocument9 pagesScheme For The Lease of Evacuee Trust Agricultural Land, 1975 PDFPawan Kumar MaheshwariNo ratings yet

- Information Sheet - DSK - Vehicles - Part 5Document14 pagesInformation Sheet - DSK - Vehicles - Part 5sanket rajoleNo ratings yet

Response Models: 3 Gradient Descent Framework

Response Models: 3 Gradient Descent Framework

Uploaded by

Andres EliasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Response Models: 3 Gradient Descent Framework

Response Models: 3 Gradient Descent Framework

Uploaded by

Andres EliasCopyright:

Available Formats

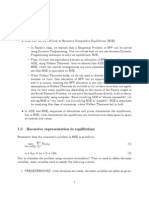

Response Models

We begin by describing some general properties of bidding functions that hold for any utility-

maximizing bidders (see [22] for further discussion).

Definition 2.1. A bidding function b(r, v) satisfies the following properties: 1) b(r, v) ≤ v for all

v; 2) b(r, v) ≥ r for v ≥ r; 3) b(r, v) = 0 for v < r; 4) b(r, v) is non-decreasing in v for all r.

In some of our algorithms, we would like to impose additional constraints on the response model

which, while not a consequence of utility-maximizing behavior, are likely to hold in practice. One

such constraint is the diminishing sensitivity in value of bid to reserve. This says that bidders with

a larger value will change their bid less in response to a change in reserves.

Definition 2.2 (Diminishing sensitivity of bid to reserve). If vH > vL ≥ r, then for δ > 0 and

vL ≥ r + δ we have b(r + δ, vH ) − b(r, vH ) ≤ b(r + δ, vL ) − b(r, vL ).

One natural and concrete example of a response model is a bidder that increases its bid to the

reserve as long as the reserve is below its value. We refer to this as the perfect response model,

formally defined as follows.

Definition 2.3. A perfect response bidding function takes the form:

b(0, v) if b(0, v) ≥ r

b(r, v) = r if b(0, v) < r ≤ v

0 if v < r

Note that the perfect response model is based on the original bid of the bidder under reserve price 0,

namely b(0, v). If b(0, v) is already above the reserve, then this bidder is unaffected by the reserve.

Note that the perfect response model satisfies the diminishing sensitivity property.

In practice, bidders are unlikely to exactly follow the perfect response model; for example,

bidders will often increase their bid to some amount strictly above the reserve r so as to remain

competitive with other bidders. For this reason, we propose a relaxation of the perfect response

model which we call the ε-bounded response model : the bid is at most ε greater than what it would

have been under the perfect response model if b(0, v) < r ≤ v (see also Definition C.6). Note that

the ε-bounded response model becomes the perfect response model when ε = 0.

3 Gradient Descent Framework

The first-price auction setting introduces several challenges for setting reserve prices. First, the

seller cannot observe true bidder values because truthful bidding is not a dominant strategy in

a first-price auction. Second, how the bidders will react to different reserves is unknown to the

seller—the only information that the seller receives is bids drawn from distribution B(r) when the

seller sets a reserve price r.

One natural idea, and the approach we take in this paper, is to optimize the reserve price via

gradient descent. Gradient descent is only guaranteed to converge to the optimal reserve when

our objective is convex (or at least, unimodal), which is not necessarily true for an arbitrary

revenue function. However, gradient descent has a number of practical advantages for reserve price

optimization, including:

1. Gradient descent allows us to incorporate prior information we may have about the location

of a good reserve price (possibly significantly reducing the overall search cost).

You might also like

- CP CmbokDocument78 pagesCP CmbokSreejith Unnimon92% (12)

- Sale Deed 608Document8 pagesSale Deed 608Akshay Gupte100% (1)

- Multiple Linear Regressioin Part 1Document27 pagesMultiple Linear Regressioin Part 1Adesola Adepoju0% (1)

- Bolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationDocument1 pageBolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationAndres EliasNo ratings yet

- 18neb RulesDocument12 pages18neb RulesbobprobstNo ratings yet

- 2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingDocument1 page2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingAndres EliasNo ratings yet

- Multiple Linear Regression: Step 1: Initialize ValuesDocument3 pagesMultiple Linear Regression: Step 1: Initialize ValuesAkshatha ShenoyNo ratings yet

- Cfe Bbva Price Strategy OptimizationDocument16 pagesCfe Bbva Price Strategy OptimizationSarbani DasguptsNo ratings yet

- Multiple Linear Regression: Step 1: Initialize ValuesDocument3 pagesMultiple Linear Regression: Step 1: Initialize ValuesAkshatha ShenoyNo ratings yet

- Topic Four:: Portfolio Optimization: Analytical TechniquesDocument50 pagesTopic Four:: Portfolio Optimization: Analytical Techniquesendu wesenNo ratings yet

- Vickrey AuctionDocument9 pagesVickrey Auctionmatchman6No ratings yet

- LP Methods.S2 Sensitivity Analysis: K-Dimensional Polyhedron Results. The Only Exception Is Proportional Ranging WhichDocument10 pagesLP Methods.S2 Sensitivity Analysis: K-Dimensional Polyhedron Results. The Only Exception Is Proportional Ranging Whichtheeppori_gctNo ratings yet

- Lecture 11 Consumer SurplusDocument17 pagesLecture 11 Consumer SurplusPreeti SubudhiNo ratings yet

- Sensityvity AnalysisDocument44 pagesSensityvity AnalysisArnab ShyamalNo ratings yet

- Demand EstimationDocument27 pagesDemand EstimationAnonymous FmpblcLw0No ratings yet

- Bidding Strategy and Markup EstimationDocument43 pagesBidding Strategy and Markup Estimationmerna nabilNo ratings yet

- Econometrics 2Document69 pagesEconometrics 2Navyashree B MNo ratings yet

- "Examen Final 3er Corte - Planeación de Producción" 1Document6 pages"Examen Final 3er Corte - Planeación de Producción" 1Juan Camilo AlfonsoNo ratings yet

- Exercises: Capital Asset Pricing Model (SOLUTIONS) : Department of Finance University of Basel Fall 2009Document4 pagesExercises: Capital Asset Pricing Model (SOLUTIONS) : Department of Finance University of Basel Fall 2009aftab20No ratings yet

- 12 AbsDocument15 pages12 AbsAngelica PostreNo ratings yet

- Online Ad AuctionsDocument5 pagesOnline Ad AuctionsRishabh SomaniNo ratings yet

- IcasDocument54 pagesIcasfbxurumelaNo ratings yet

- Lecture4 BODocument14 pagesLecture4 BOgjadhaoNo ratings yet

- 5-LR Doc - R Sqared-Bias-Variance-Ridg-LassoDocument26 pages5-LR Doc - R Sqared-Bias-Variance-Ridg-LassoMonis KhanNo ratings yet

- Patricia Tebogo Siwela - 7419051 - 0Document5 pagesPatricia Tebogo Siwela - 7419051 - 0Tawanda MakombeNo ratings yet

- Business Statistics Canadian 3rd Edition Sharpe Solutions Manual DownloadDocument41 pagesBusiness Statistics Canadian 3rd Edition Sharpe Solutions Manual DownloadCharles Brickner100% (30)

- Nonlinear ProgrammingDocument34 pagesNonlinear ProgrammingAngeline OdayaNo ratings yet

- Chapter 5Document73 pagesChapter 5jayroldparcedeNo ratings yet

- Capital Asset Pricing Model: Dan SaundersDocument4 pagesCapital Asset Pricing Model: Dan SaundersR Shyaam KumarNo ratings yet

- Regression Analysis-NwDocument6 pagesRegression Analysis-NwHassan TahamidNo ratings yet

- Solution 897614Document8 pagesSolution 897614hansikav327No ratings yet

- Drawdown Constraints and Portfolio Optimization: Marcus DavidssonDocument13 pagesDrawdown Constraints and Portfolio Optimization: Marcus Davidssondeepblue004No ratings yet

- Lecture Notes 2: Applications: 1 Maximum FlowDocument10 pagesLecture Notes 2: Applications: 1 Maximum FlownkapreNo ratings yet

- EC2066 - Microeconomics - 2007 Examiners Commentaries - Zone-BDocument16 pagesEC2066 - Microeconomics - 2007 Examiners Commentaries - Zone-BAishwarya PotdarNo ratings yet

- CS550 Regression Aug12Document63 pagesCS550 Regression Aug12dipsresearch100% (1)

- 1.1 Road Map: (K, C) T T TDocument16 pages1.1 Road Map: (K, C) T T Tdamla87No ratings yet

- CH 5 Diversification, Integration and MergerDocument16 pagesCH 5 Diversification, Integration and MergerkirubelNo ratings yet

- What Is Optimization?Document15 pagesWhat Is Optimization?MHARLOU TORINGNo ratings yet

- Question: 4. Suppose A Manufacturer and Its Retailer Face The Problem of Double Marginalization Described I..Document2 pagesQuestion: 4. Suppose A Manufacturer and Its Retailer Face The Problem of Double Marginalization Described I..PaaforiNo ratings yet

- Linear RegressionDocument38 pagesLinear RegressionHabiba SamehNo ratings yet

- U02Lecture06 RegressionDocument25 pagesU02Lecture06 Regressiontunio.bscsf21No ratings yet

- Textbook Scan0001Document17 pagesTextbook Scan0001MoNa MatoutNo ratings yet

- Bidding Strategy and Markup EstimationDocument22 pagesBidding Strategy and Markup EstimationMekuannint DemekeNo ratings yet

- Numerical Approximation of The Implied Volatility Under Arithmetic Brownian MotionDocument8 pagesNumerical Approximation of The Implied Volatility Under Arithmetic Brownian Motionandrea85p100% (1)

- Ebook Business Statistics Canadian 3Rd Edition Sharpe Solutions Manual Full Chapter PDFDocument63 pagesEbook Business Statistics Canadian 3Rd Edition Sharpe Solutions Manual Full Chapter PDFhuyenquyen9eemjd100% (12)

- Notes On The Myerson-Satterthwaite Theorem 1Document8 pagesNotes On The Myerson-Satterthwaite Theorem 1Charles Yue YuanNo ratings yet

- Finance & InvestmentsDocument22 pagesFinance & InvestmentsLodhi AmmanNo ratings yet

- Online Ad Auctions: UC Berkeley and Google. Hal@ischool - Berkeley.edu 1Document6 pagesOnline Ad Auctions: UC Berkeley and Google. Hal@ischool - Berkeley.edu 1Salman SufiNo ratings yet

- Integer ProgrammingDocument5 pagesInteger ProgramminghachanNo ratings yet

- Linear Regression - Least-SquaresDocument5 pagesLinear Regression - Least-SquaresRongrong FuNo ratings yet

- Portfolio RiskDocument24 pagesPortfolio RiskABC DEFNo ratings yet

- Linear Regression - Lok - 2Document31 pagesLinear Regression - Lok - 2LITHISH RNo ratings yet

- 04MB0206 Mid2 (3rdjune22) AnswerKeyDocument6 pages04MB0206 Mid2 (3rdjune22) AnswerKeyTom CruiseNo ratings yet

- Biasing Approximate Dynamic Programming With A Lower Discount FactorDocument8 pagesBiasing Approximate Dynamic Programming With A Lower Discount FactorAfshin SamiaNo ratings yet

- Assignment 2: Portfolio Optimisation: The Markowitz Framework For Portfolio CompositionDocument3 pagesAssignment 2: Portfolio Optimisation: The Markowitz Framework For Portfolio CompositionMayam AyoNo ratings yet

- Beta, WACCDocument12 pagesBeta, WACCmumssrNo ratings yet

- Constrained Cost MinimisationDocument3 pagesConstrained Cost MinimisationYogish PatgarNo ratings yet

- Revision Questions and Classwork 9Document3 pagesRevision Questions and Classwork 9Sams HaiderNo ratings yet

- Sample Exam II PDFDocument2 pagesSample Exam II PDFArsen DuisenbayNo ratings yet

- The Under and Overestimation of RiskDocument18 pagesThe Under and Overestimation of RiskHhp YmNo ratings yet

- High Frequency Trading in A Limit Order BookDocument13 pagesHigh Frequency Trading in A Limit Order BookKwok Chung ChuNo ratings yet

- Reserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeDocument1 pageReserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeAndres EliasNo ratings yet

- Mchugh1956 5Document1 pageMchugh1956 5Andres EliasNo ratings yet

- Mchugh1956 2Document1 pageMchugh1956 2Andres EliasNo ratings yet

- Mchugh1956 3Document1 pageMchugh1956 3Andres EliasNo ratings yet

- Reserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeDocument1 pageReserve Price Optimization For First Price Auctions: Zhe Feng, S Ebastien Lahaie, Jon Schneider, and Jinchao YeAndres EliasNo ratings yet

- Rawlins1983 2Document1 pageRawlins1983 2Andres EliasNo ratings yet

- Mchugh1956 4Document1 pageMchugh1956 4Andres EliasNo ratings yet

- Mchugh1956 1Document1 pageMchugh1956 1Andres EliasNo ratings yet

- Ymax/d.: Peak-To-Peak Mid-Loop Ymax/d Ymax/dDocument1 pageYmax/d.: Peak-To-Peak Mid-Loop Ymax/d Ymax/dAndres EliasNo ratings yet

- Systems, PAS-102, 963: FSD/V N FsDocument1 pageSystems, PAS-102, 963: FSD/V N FsAndres EliasNo ratings yet

- 1 2 3 T+1 + T T T T T T T T T TDocument1 page1 2 3 T+1 + T T T T T T T T T TAndres EliasNo ratings yet

- Calculation With The Minimum Required Assembly Preload, Tightening Factor: 1.00Document1 pageCalculation With The Minimum Required Assembly Preload, Tightening Factor: 1.00Andres EliasNo ratings yet

- 2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingDocument1 page2 Preliminaries: This Is Without Loss of Generality, Our Analysis Can Easily Be Applied To Any Bounded Valuation SettingAndres EliasNo ratings yet

- ResultsDocument1 pageResultsAndres EliasNo ratings yet

- Bolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationDocument5 pagesBolt Calculation According To VDI 2230:2015: Important Hint: at Least One Warning Has Occurred During The CalculationAndres EliasNo ratings yet

- Online Modeling of Proactive Moderation System For Auction Fraud DetectionDocument4 pagesOnline Modeling of Proactive Moderation System For Auction Fraud DetectionBubul ChoudhuryNo ratings yet

- Bank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Document36 pagesBank of Baroda - Properties Scheduled For Mega E-Auction On 28th July 2021Anil Kumar YadavNo ratings yet

- Asian Works of Art - Skinner Auction 2591BDocument180 pagesAsian Works of Art - Skinner Auction 2591BSkinnerAuctions100% (2)

- GN 106 - The Court Brokers and Process Servers (Appointment, Remuneration (12429)Document5 pagesGN 106 - The Court Brokers and Process Servers (Appointment, Remuneration (12429)stan NyamleNo ratings yet

- Bartolata Vs RepDocument5 pagesBartolata Vs RepFritz Sapon100% (2)

- GeM Bidding 4712220Document10 pagesGeM Bidding 4712220METS Port BlairNo ratings yet

- 7 - Challenges in Power MarketDocument132 pages7 - Challenges in Power MarketsaaraanNo ratings yet

- Bayleys Residential Auction Results 25 November 2009Document2 pagesBayleys Residential Auction Results 25 November 2009Ariel LevinNo ratings yet

- Ivalua - Sourcing ManagementDocument41 pagesIvalua - Sourcing ManagementAlexandru IgnatNo ratings yet

- Terms & Conditions of E-Auction-DDADocument10 pagesTerms & Conditions of E-Auction-DDADev ChauhanNo ratings yet

- Bayleys Real Estate Auction Results 24 Feb 2010Document2 pagesBayleys Real Estate Auction Results 24 Feb 2010Ariel LevinNo ratings yet

- Codex Whitepaper Draft A&C - MasterDocument35 pagesCodex Whitepaper Draft A&C - MasterAnoukLancestremèreNo ratings yet

- Trading Mechanism - LOB-AuctionDocument13 pagesTrading Mechanism - LOB-AuctionAwsaf bin hashemNo ratings yet

- SUMMER 2023 BUS 498 EXIT Marketing AssesmentDocument15 pagesSUMMER 2023 BUS 498 EXIT Marketing AssesmentRakibul Islam 1911961042No ratings yet

- Sales Reviewer: Nelson Mora JR Roselyn Hundangan Merryl Bercide Beatrice Abit Charina TeberioDocument36 pagesSales Reviewer: Nelson Mora JR Roselyn Hundangan Merryl Bercide Beatrice Abit Charina TeberioMerrylNo ratings yet

- Marteve Guest House Limited V Njenga & 3 Others (Civil Appeal 400 of 2018)Document38 pagesMarteve Guest House Limited V Njenga & 3 Others (Civil Appeal 400 of 2018)gkaniuNo ratings yet

- LocksmithDocument83 pagesLocksmithEdwin100% (1)

- Jeetender Joshi - SCMDocument3 pagesJeetender Joshi - SCMJeet JoshiNo ratings yet

- Rolodex For Domain FlippingDocument4 pagesRolodex For Domain FlippingTimur KhasanovNo ratings yet

- Cooperative Rural MarketsDocument42 pagesCooperative Rural MarketsPriteshPanchalNo ratings yet

- Has Not Sold - vs. - Didn't Sell - English Language Learners Stack ExchangeDocument4 pagesHas Not Sold - vs. - Didn't Sell - English Language Learners Stack ExchangeremovableNo ratings yet

- Yankee Module (Without DSC)Document27 pagesYankee Module (Without DSC)3dicNo ratings yet

- Discovery Featuring Studio Paintings & Country Americana - Skinner Auction 2570MDocument88 pagesDiscovery Featuring Studio Paintings & Country Americana - Skinner Auction 2570MSkinnerAuctionsNo ratings yet

- 5 FOD Catalogue (13.12.2022)Document6 pages5 FOD Catalogue (13.12.2022)AakashSamaddarNo ratings yet

- Social Networking Auction and Portal GaryDocument64 pagesSocial Networking Auction and Portal GaryANo ratings yet

- Scheme For The Lease of Evacuee Trust Agricultural Land, 1975 PDFDocument9 pagesScheme For The Lease of Evacuee Trust Agricultural Land, 1975 PDFPawan Kumar MaheshwariNo ratings yet

- Information Sheet - DSK - Vehicles - Part 5Document14 pagesInformation Sheet - DSK - Vehicles - Part 5sanket rajoleNo ratings yet