Professional Documents

Culture Documents

SSRN-Improving The Accounting and Auditing of Payroll Calculations

SSRN-Improving The Accounting and Auditing of Payroll Calculations

Uploaded by

ThanhTungOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN-Improving The Accounting and Auditing of Payroll Calculations

SSRN-Improving The Accounting and Auditing of Payroll Calculations

Uploaded by

ThanhTungCopyright:

Available Formats

International Journal of Management (IJM)

Volume 11, Issue 5, May 2020, pp. 307-319, Article ID: IJM_11_05_030

Available online at http://www.iaeme.com/ijm/issues.asp?JType=IJM&VType=11&IType=5

Journal Impact Factor (2020): 10.1471 (Calculated by GISI) www.jifactor.com

ISSN Print: 0976-6502 and ISSN Online: 0976-6510

DOI: 10.34218/IJM.11.5.2020.030

© IAEME Publication Scopus Indexed

IMPROVING THE ACCOUNTING AND

AUDITING OF PAYROLL CALCULATIONS

Valentyna Panasyuk

Department of Accounting and Taxation, Ternopil National Economic University,

Ternopil, Ukraine

Mariya Lalakulych

Department of Accounting, Uzhgorod Trade and Economic Institute of Kyiv National

University of Trade and Economics, Uzhhorod, Ukraine

Erika Yuhas

Department of Accounting, Uzhgorod Trade and Economic Institute of Kyiv National

University of Trade and Economics, Uzhhorod, Ukraine

Lesya Rybakova

Uzhgorod Trade and Economic Institute of Kyiv National University of Trade and

Economics, Uzhhorod, Ukraine

Vitaliy Bobrivets

Department of Economic Expertise and Business Audit, Ternopil National Economic

University, Ternopil, Ukraine

ABSTRACT

The study is devoted to the methodological foundations of accounting and audit of

settlements with employees. The organization of accounting and audit of agreements

with employees at Ukrainian enterprises is studied, and ways to improve the

accounting of settlements with employees and cases of erroneous accounting, as well

as the lack of internal audit are identified. On the example of two real enterprises, the

authors demonstrated how to improve and refine: proposed to use CLN contracts,

proposed a schedule of primary accounting documents, analytical sub-accounts and

an audit program for payroll.

Key words: Accounting, Auditing, CLN Contract, Payroll, Wages

Cite this Article: Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas,

Lesya Rybakova, Vitaliy Bobrivets, Improving the Accounting and Auditing of

Payroll Calculations. International Journal of Management, 11 (5), 2020, pp. 307-319.

http://www.iaeme.com/IJM/issues.asp?JType=IJM&VType=11&IType=5

http://www.iaeme.com/IJM/index.asp 307 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

1. INTRODUCTION

To function successfully in a market economy, the company must have a type of economic

behaviour that would adapt to dynamic environmental conditions. At the same time, a unique

role is played by the use of effective methods of labour management, which would ensure the

interest of employees in highly productive work and improve the results of the enterprise. At

the present stage, the primary means of forming such an interest is wages, which reflects the

quantity and quality of labour expended by the employee [1-4].

The problem of organizing settlements with employees at the enterprise is one of the most

acute because in decline in sales, reduction in the number of employees there are changes in

the organization of labour and its payment [5-7]. That is why the problem of improving

payroll calculations is relevant.

The issues that remain controversial include the organization of accounting for deductions

and deductions from employees' salaries, automation of settlements with staff. Many scholars

[8-12] have dealt with this issue, and there are many sources for defining the concept of

wages, its types and taxation. Still, the task of our study is to study the problems of

accounting and auditing of payroll calculations in real enterprises and offer recommendations

to help improve it and avoid penalties for improper accounting.

2. IDENTIFYING AREAS FOR POSSIBLE IMPROVEMENT OF

ACCOUNTING AND AUDIT OF PAYROLL CALCULATIONS

The analysis of accounting for settlements with employees at Ukrainian enterprises revealed

several cases of incorrect settlements with employees:

1. At the enterprise "Techinmash" PJSC (Ternopil) there is an hourly wage – 25.13 UAH /

hour. If the month is less than the norm of working hours in hours, the company pays such

workers a minimum wage – 4173.00 UAH. Thus, additional losses of the enterprise can

amount to UAH 4,147.87 in 2019.

2. In January 2020, a new department was established at "Aparan" LLC (Uzhhorod), the head

of which, by prior agreement, does not receive a salary, but only interest in sales. There were

no sales in January and February, so nothing was charged to the manager. This is wrong

because there is a constitutionally guaranteed remuneration for work, as well as the

requirements of the Labour Code of Ukraine and the Law of Ukraine "On Remuneration of

Labour". From 02.02.2020, fines for violations of labour legislation and wages increased.

Thus, for such a breach of labour legislation, the company will incur, first, an administrative

penalty – from 1700 UAH; secondly, financial sanctions – from 1 (from 01.01.2020 it is 4723

UAH) to 10 minimum salaries (it is 47230 UAH). The company does not conduct an audit of

settlements with employees, and it would be able to identify the above cases on time to enable

the company to correct errors on time.

3. RESULTS AND DISCUSSION

3.1. Accounting and Auditing of Payroll Calculations for "Techinmash" PJSC

For "Techinmash" PJSC we suggest two ways out of the situation:

a) pay for work only within the hours worked. The laws on the State Budget for the respective

year determine the minimum wage in monthly and time amounts. In 2020, it is set at UAH

4723.00. and UAH 28.31. in accordance. When the employee's work is paid by the hour, the

reference point for compliance with the minimum wage is the minimum wage in the amount

set by the Law on the State Budget for the year; this is stated in the letter of the Ministry of

Social Policy of Ukraine dated 21.02.17 № 242/0/102-17/282: for employees who have

monthly salaries with the norm of a month, the minimum state guarantee in remuneration is

http://www.iaeme.com/IJM/index.asp 308 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

the minimum wage in the monthly amount, and for employees with hourly wages – the

minimum wage in the amount of time.

Thus, if the hourly wage of an employee is UAH 28.31 / hour, then the requirement for the

level of the minimum wage is met, and the amount of the minimum wage in the monthly

amount is not taken into account in payments.

However, in the collection of a single social contribution in all cases, you need to focus on

the minimum wage in the monthly amount – 4723.00 UAH. Thus, Part 5 of Article 8 of the

Law of Ukraine "On Collection and Accounting of the Single Contribution for Compulsory

State Social Insurance" dated 08.07.10 № 2464-VI provides: if the basis for accrual of the

single contribution does not exceed the amount of the minimum wage, established by law for

the month for which the income is received, the amount of the contribution is calculated as the

product of the minimum wage, determined by law for the month for the income (profit), and

the single contribution rate (except for cases specified, for example, in the SFSU letter of

29.01.16 № 1394/5/99-99.17-03-03-1). So, in cases where the working time is less than 166

works hours and, as a result, the amount of salary for the month may be less than 4723.00

UAH, you need to add a single contribution to the minimum tax base.

b) to build relationships with such employees on another legal basis, in particular, it is

possible to perform work under contracts of civil law nature. CLN is concluded in writing and

contains information about the description of the work that the contractor undertakes to

perform to the customer, the timing of these works, as well as the terms of their payment.

Under the CLN contract, the executor (contractor) does not obey the rules of internal labour

regulations, he organizes his work and performs it at his own risk. A natural person who has

entered into a CLN contract is not included in the customer's staff. It is not covered by the

guarantees and benefits established by labour legislation. Under the CLN contract, it is not the

work process that is paid for, but its results. Hourly wages cannot be applied to CLN

contracts.

The results of work under the CLN contracts are determined after the end of the work and

formalized by acts of acceptance-delivery of the performed works (rendered services), based

on which their payment is made. However, the CLN contract may provide for advance (or

phased) remuneration. When performing works (services) under the CLN agreements, no

entries are made in the contractor's employment record book.

At the same time, the law does not prohibit the conclusion of contracts of a civil nature

between the company and its employees from performing work or providing services in free

time from the main work under the employment contract, i.e. in free time; other employees

can also tell guests about the sights architecture. In particular, the Ministry of Labour and

Social Policy of Ukraine in its letter of August 6, 2004, № 18-429 clarifies that the employer

may enter into a contract with its employee who is on regular leave for the period of leave for

the employee to perform certain work.

In practice, the most commonly used two types of contracts under the Civil Code of

Ukraine, under which individuals can be involved in the work of both legal entities and

individuals. This is a contract and a contract for the provision of services, but we are

interested in the latter. Consider in more detail the procedure for concluding this contract for

the provision of services to understand its differences from the employment contract.

The concept of a contract for the provision of services and the procedure for its

application are defined by the Central Committee of Ukraine (Chapter 63).

Under the contract for the provision of services following Article 901 of the Civil Code of

Ukraine, one party (performer) undertakes on behalf of the other party (customer) to provide a

http://www.iaeme.com/IJM/index.asp 309 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

service consumed in the course of a certain action or activity. The customer undertakes to pay

the contractor unless otherwise provided by the contract.

The contractor must provide the service in person. In cases established by the contract, the

contractor has the right to entrust the performance of the contract for the provision of services

to another person, remaining fully liable to the customer for breach of contract. If the contract

provides for the provision of services for a fee, the customer is obliged to pay for the service

provided to him in the amount, on time and in the manner prescribed by this contract. The

term of the contract for the provision of services is set by agreement of the parties unless

otherwise provided by law or other regulations. Losses caused to the customer by non-

performance, or improper performance of the contract for the provision of services for a fee

shall be reimbursed by the contractor, in the presence of his fault, in full, unless otherwise

provided by the contract. The contract for the provision of services may be terminated, in

particular through unilateral withdrawal from the contract, in the manner and on the grounds

established by the Central Committee of Ukraine, another law or by agreement of the parties.

The procedure and consequences of termination of the contract for the provision of services

are determined by agreement of the parties or by law.

Despite some similarities between the contract and the service contract, the main

difference between them is that under the service contract the result of work is usually not

transferred to the customer, because the service provided under such a contract is inseparable

from the process of its provision (such as excursion services, services for the protection of the

object or own protection, services for legal support of the activity of a certain subject, services

for cleaning of the premises or territory, etc.).

The difference between a civil contract and an employment contract. Sometimes the

nature and procedure of certain works (in particular, the provision of services) resemble the

functional responsibilities of the employee under the employment contract, which, in turn,

makes it difficult in practice to distinguish between civil and employment contracts, and often

generates in this regard, disputes between the parties.

Since the conclusion of an employment contract and a contract of a civil nature have

different legal consequences, the latter should be distinguished from employment contracts on

certain grounds (Table 1).

Table 1 Differences between the employment contract and the contract of a civil law nature

Contract of a civil law nature (contract or

Employment contract

provision of services)

Legislative regulation of relations

The employment contract is concluded following The contract (provision of services) is

the Labor Code of Ukraine and regulations adopted concluded following the provisions of the

on its basis Civil Code of Ukraine

The concept of contract

CLN contract is an agreement between two or

more parties aimed at establishing, changing

An employment contract is an agreement between or terminating civil rights and obligations as

an employee and an employer under which the defined (Art. 626 of the CCU). Under the

employee undertakes to perform the work specified contract, one party (contractor) undertakes to

in this agreement, subject to internal labour perform specific work at the risk of the other

regulations, and the employer undertakes to pay the party (customer), and the customer undertakes

employee wages and provide working conditions to accept and pay for the work performed (Art.

necessary for work provided by law labour, 837 of the CCU). Under the contract for the

collective agreement and agreement of the parties provision of services, one party (performer)

(Art. 21 of the LCU). undertakes on behalf of the other party

(customer) to provide a service that is

consumed in the process of performing a

http://www.iaeme.com/IJM/index.asp 310 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

specific action or carrying out certain

activities, and the customer undertakes to pay

the contractor (Art. 901 of the CCU).

The scope of the contract

The subject of the employment contract is the

Under a CLN contract, the subject of the

labour process, i.e., the employee performs a

contract is the final result, i.e. the performance

specific job function in a particular speciality,

by the contractor/executor of the agreed work

qualification, position, usually without achieving

aimed at achieving the final result.

any result.

The term of the contract

A contract or provision of services may not be

An employment contract can be: indefinite, concluded for an indefinite period, as the

concluded for an indefinite period; for a specified performance of a particular job is conditioned

period set by agreement of the parties; such that is by a specific time of its production. Therefore,

concluded at the time of performance of individual in such contracts, as a rule, by agreement of

work. In this case, a fixed-term employment the parties, the terms of performance of work

contract is concluded in cases where the or its separate stages are established. If the

employment relationship can not be established for contract does not set such deadlines, the

an indefinite period, taking into account the nature contractor must perform the job, and the

of subsequent work, or conditions of its customer has the right to demand its

implementation, or the interests of the employee performance within a reasonable time, which

and in other cases provided by law (Art. 23 of the would correspond to the nature of the

LCU). obligation, nature and scope of work and

practice of business relations (p. 2 of Art. 846

of the CCU).

Conditions and procedure for work

The employee must perform the task assigned to

him personally and has no right to delegate its

performance to another person, except as provided The contractor has the right unless otherwise

by law (Art. 30 of the LCU). At the same time, he provided by contract, to involve third parties

must also work honestly and conscientiously, (subcontractors) in the performance of work,

timely and accurately comply with the instructions while remaining responsible to the customer

of the employer, comply with labour and for the result of their work (Art. 838 of the

technological discipline, the requirements of CCU). Under the service agreement, the

regulations on labour protection, treat the property contractor must provide the service in person.

with care (Art. 139 of the LCU). In turn, the But, in the cases established by the contract,

employer must properly organize the work of the executor has the right to put the

workers, create conditions for productivity growth, performance of the contract on another person,

ensure labour and production discipline, strictly remaining responsible before the customer in

comply with labour laws and labour protection full for breach of the contract (Art. 902 of the

rules, pay attention to the needs and demands of CCU).

workers, improve their working and living

conditions (Art. 141 of the LCU).

Remuneration

The amount of wages depends on the complexity

and conditions of work performed, professional and

business qualities of the employee, the results of his

work and economic activity of the enterprise and

may not be less than the minimum wage established

The amount, procedure and terms of payment

by law. Wages are paid to employees regularly on

of remuneration for work performed (services

working days within the time limits set by the

provided) are determined by the parties and

collective agreement or regulatory act of the

specified in the contract and do not depend on

employer, agreed with the elected body of the

the amount of the minimum wage.

primary trade union, but at least twice a month for a

period not exceeding 16 calendar days and not later

than seven days after the end of the period for

which the payment is made (Article 115 of the

LCU).

http://www.iaeme.com/IJM/index.asp 311 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

The above list of differences between the employment contract and contracts of a civil

nature, under which citizens can be involved in work, is not exhaustive. Understanding the

legal nature of these types of agreements, their proper application - the key to avoiding

possible misunderstandings and disputes between the parties.

According to court practice, contractors or contractors who did not understand the

consequences of concluding these contracts often go to court to refuse leave, pay for

temporary incapacity for work, make entries in the employment record book, etc. In some

cases, the court satisfies such claims by recognizing the concluded employment contracts, if,

during the consideration of the case in court, they establish appropriate evidence that the

relationship had signs of labour.

Therefore, it is necessary to avoid such situations in which the relationship between the

parties to the CLN contract can be regarded as labour:

the owner acquainted the employee with the working conditions against a receipt;

in the agreement of civil law nature, it is specified that the executor has to adhere to industrial

discipline, safety measures, fire safety;

the executor undertook to comply with the rules of internal labour regulations;

with the executor, whose services are related to the storage or maintenance of tangible assets,

entered into an agreement on full liability, issued an order stating the amount of remuneration;

the name of the executor is in the timesheet, and he was regularly paid wages and so on.

The conclusion of a document called an "employment agreement" does not always

indicate that the relationship between the contractor and the owner was of a civil nature.

Therefore, the civil contract on the involvement of an individual in work must have the

appropriate name defined by the Central Committee of Ukraine: "contract" or "contract for the

provision of services".

Also, it is advisable in the preamble of the contract to emphasize its civil nature and the

fact that the relationship arising from the conclusion of such an agreement is subject to

regulation by civil law. The content of the contract should not include the conditions specific

to the employment contract.

The procedure for concluding CLN contracts will look like this (Fig. 1).

At the enterprise it will be accounted for as follows: for example, a civil law agreement

was signed on February 8, 2020, with an individual K.L. Klimenko for the provision of

electrical installation services for UAH 3,000. The works were performed by February 20,

2020, in full within the stipulated period, the act of acceptance-transfer of the completed

works was signed, so the company makes the necessary calculations (Table 2).

The advantage of this method is that CLN contracts do not provide for hourly payment,

payment is made for a certain amount of work according to the act of work performed, i.e.

employees do not make sense to "cool down" at the facility, increasing their remuneration for

time worked.

The second advantage is that the CLN contracts provide for compliance with the work

schedule, which is extremely important, because the company, in turn, when concluding

contracts for work specifies the delivery date of the object and non-compliance leads to

penalties.

http://www.iaeme.com/IJM/index.asp 312 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

Customer apply for repair work of construction

equipment

Enterprise

finds out the scope of work, which of the main No

staff is free and whether there is a need for

additional workers

Yes

employees are selected from the database, and CLN

contracts are signed with them, where the scope of work,

term and remuneration must be clearly established.

repair works are carried out and handed

over to the client for inspection

the act of performed works is signed

the company makes the necessary

calculations, deductions and issues

worked on CLN

contracts remuneration to the contractor employees worked

Figure 1 The procedure for concluding CLN contracts

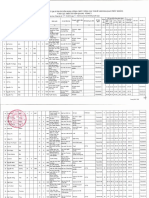

Table 2 Correspondence of accounts for accounting settlements with employees under the CLN contract

Accounting Taxation

The content of the business transaction Amount, Expenses,

Dt Ct

UAH UAH

1. Accrued remuneration under the CLN contract 93 685 3000,00 3000,00

2. Collected a single social contribution (at a rate of 22%

on the actual accumulated remuneration under the

93 65/SSC 660,00 660,00

contract of a civil nature, regardless of its size, but taking

into account the maximum value of the accrual base).

3. Income tax was deducted from the remuneration under 641/ Personal

685 540,00 –

the CLN contract (18%) income tax

642/ military

4. Withheld military duty (1.5%) 631 45,00 –

duty

5. Published by K.L. Klimenko from the box office

685 301 2415,00 –

reward under the CLN contract

3.2. Accounting and Auditing of Payroll Calculations for Aparan LLC

As already mentioned, a new department was established at Aparan LLC in January, the head

of which, by prior agreement, does not receive a salary, but only a percentage of sales. There

were no sales in January and February, so nothing was charged to the manager. This is wrong

because there is a constitutionally guaranteed remuneration for work, as well as the

requirements of the Labour Code of Ukraine and the Law of Ukraine "On Remuneration of

Labour".

1. It clearly follows from the content of these regulations: the employer has no right not to

accrue and/or pay salaries to employees employed under an employment contract, in

http://www.iaeme.com/IJM/index.asp 313 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

particular when it comes to the head of the department. In this case, there is a rule on the

minimum wage. Payment of the same less than the minimum size is admissible only at

registration of performance of labour duties in incomplete volume. It is possible to make,

depending on the company's profit, for example, bonuses to employees, but not their salaries.

Even more, an integral consequence of the accrual and payment of wages are the

corresponding accruals (withholding), payment and declaration (reporting) of personal

income tax, single contribution and military duty. The employer also has no right to evade

such fiscal obligations.

If we talk about liability for non-payment of wages to an employee hired under an

employment contract (including the director of the department), the current legislation

indicates primarily two types:

a) it is an administrative fine imposed on the head of the enterprise in the amount from 1700

UAH (Part 1 of Article 41 of the Code of Ukraine on Administrative Offenses).

b) There is a basis for imposing financial sanctions on the company:

for violation of the established terms of payment of wages to employees for more than one

month, its payment is not in full - in three times the minimum wage established by law at the

time of detection of the violation;

for non-compliance with the minimum state guarantees in remuneration - in ten times the

minimum wage established by law at the time of detection of the violation, for each employee

in respect of whom the violation was committed (paragraph 3.4 of Part 2 of Article 265 of the

Labour Code).

In addition, since the employer had at least one employee under an employment contract,

but it did not report on personal income tax, military duty and single contribution, in our

opinion, there are grounds for bringing the head of the company to administrative

responsibility. for the relevant violations following the requirements of the Administrative

Code, and the company itself, the supervisory authorities will apply the financial sanctions

provided by the Tax Code of Ukraine Law of Ukraine "On the collection and accounting of a

single contribution to the general mandatory state social insurance "from 08.07.10 № 24b4-

U1,

To avoid such troubles with small amounts of income, employees, including directors,

should be hired on a part-time basis with an appropriate proportional salary. After all, part-

time pay is carried out in proportion to the time worked or depending on production. The

employer, with the consent of the employee, has the right to establish part-time work by

reducing the length of the working day or the number of working days per week. It is possible

to provide even working hours lasting at least one hour a week.

To accurately organize the accounting of payroll, we propose to the company to develop

and approve at the company a schedule of primary documents for the accounting of payroll,

which could strengthen the system of internal control in the enterprise. The document flow

schedule will allow optimizing the ways of processing the primary document from the

beginning of its creation to transfer to the archive, outline the timing of the processing of

primary materials for accounting for payroll.

The document flow schedule should be a mandatory appendix to the order of the

accounting policy of the enterprise, and its use should be controlled by the chief accountant of

the enterprise. The proposed form of the schedule of document circulation of primary

documents on the accounting of remuneration at Aparan LLC given in Table 3.

http://www.iaeme.com/IJM/index.asp 314 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

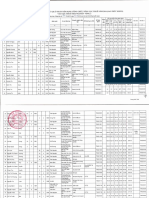

Table 3 The proposed schedule of primary accounting documents

Document Who is Documents based on Assembly Place of Storage

name composed which it is compiled period transfer location

Recordkeeping, letters

accounting Daily on accounting accounting

Timesheet of incapacity for work,

department weekdays department department

certificates

No later than the

Recruitme accounting accounting accounting

Employee statement first working

nt order department department department

day

Order of acceptance of Immediately

personal accounting accounting accounting

the employee, personal after hiring an

card department department department

data of the employee employee

As of the date of

Tariff and qualification

establishment of

Staff accounting directory of works and accounting accounting

the organization

schedule department professions, tariff grid, department department

and introduction

organizational structure

of changes

Order to When

accounting accounting accounting

transfer to Employee statement transferring an

department department department

another job employee

Three days

Leave accounting accounting accounting

Employee statement before the

order department department department

holiday

Annually no

Vacation accounting accounting accounting

Employee statement later than

schedule department department department

January 5

Order on

termination

accounting No later than the accounting accounting

of the Employee statement

department last working day department department

employme

nt contract

Settlement Three days

and before the accounting

accountant Timesheet cass

payment payment of department

statement wages

Payment The day before

accountant Settlement statement cass cass

statement the salary

As for the synthetic accounting of payroll calculations, it is conducted at the company on

account 66 "Payments to employees":

on sub-account №661 "Payroll" reflects the accrual of wages for the current month;

on sub-account №662 "Settlements with depositors" - wages that were not paid on time;

Having analyzed the works of leading scientists [29; 38; 49], we can not fully agree with

the proposed methods and models of analytical accounting of payroll, as each of these options

does not fully take into account the types of payments to employees made following the

current legislation of Ukraine.

To improve the model of analytical accounting of payments to employees, we propose to

enter the following sub-accounts to the account №66 "Settlements of payments to

employees", which are presented in Table 4.

http://www.iaeme.com/IJM/index.asp 315 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

Table 4 The proposed structure of the account 66 "Calculations of employee benefits"

Subaccount Name

661 Payroll calculations

6611 Basic salary

6612 Dismissal payments

6613 Post-employment benefits

6614 Calculations for the payment of leave

662 Settlements with depositors

663 Calculations for other payments

664 Calculations of wage payments in kind

We describe the proposed analytical accounts of the first and second-order, and determine

their composition:

Basic salary – accrued salary, remuneration for work performed by established labour

standards. It is set in the form of tariff rates (salaries) and piece rates for workers and wages

for employees;

Dismissal benefits – payments to the employee, which are payable by the decision of the

company upon dismissal of the employee, or upon voluntary termination until he reaches

retirement age. These include severance pay, cash compensation for all unused days of annual

leave and the average salary for the period of employment;

Post-employment benefits – payments to an employee that is payable at the end of an

employee's work. Such benefits include: pension benefits (old-age pensions); other post-

employment benefits, post-employment life insurance and post-employment medical care;

Calculations for the payment of leave – the amount of annual and additional leave or

payment of compensation for unused leave, leave in connection with training without

separation from work;

Settlements with depositors – wages not paid on time;

Settlements for other payments – for payments related to the recognition of the employee's

income as an additional benefit;

Payroll payments in kind – the introduction of this sub-account will provide separate

analytical accounting for cash and in kind.

The use in the practice of the proposed model of analytical accounting of payroll will

improve the methodology of accounting for payments to employees; strengthen information,

control and management functions; to systematize the accrual, accounting and issuance of

benefits to employees; expand the possibilities of using accounting information in

management; increase the efficiency of interaction of different users of information and the

efficiency of analytical work.

2. In order to improve both the audit as a whole at the enterprise, in particular from the

company's payroll and to ensure control over the implementation of practical activities of

participants by applicable law, as well as accounting policies and internal procedures,

systematic analysis and evaluation each participant in general, assessing the effectiveness of

the management system, timeliness, accuracy, completeness and accuracy of the primary and

other activities in the reporting, will provide Asset protection, we propose to create an internal

audit service.

The internal audit auditor must be an independent staff member in the structure of the

enterprise. Because the level of organization of the independence of the internal audit service

directly affects the objectivity of internal auditors.

The purpose of the audit of payroll is to establish compliance with the method of

accounting for payroll transactions per the current legislation of Ukraine, to identify errors or

http://www.iaeme.com/IJM/index.asp 316 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

violations, the degree of their impact on the reliability of financial statements to express an

independent audit opinion on the safety of accounting on wages.

The general plan of the audit of operations on payment of work and settlements with the

personnel of the enterprise includes:

audit of registration of primary documents;

audit of the payroll system;

audit of the validity of deductions from wages and benefits;

audit of the identity of accounting indicators and accounting registers;

audit of calculations of withheld and accrued taxes and fees.

The working document of the Program of the audit of calculations on payment of work

can look as follows (Fig. 2).

Audit Program for Calculation of Payments

Enterprise Aparan LLC

establishing compliance of the applied methodology of accounting for

Task

remuneration operations with the current legislation of Ukraine

Audit period 10-30/01/2020

N. List of audit procedures Contractor Index Notes

1 Conducting an internal control test

Existence of a collective agreement, provisions on the remuneration of

2 labour, regulations on vacations, regulations on bonuses, internal

regulations, job descriptions, etc.

Availability of personnel documents:

– orders on admission, dismissal, granting leave

– timesheets

3

– staff list (for hourly pay)

– orders and prices (for piecework payment)

– contracts of civil law nature

Checking the availability of employment records, employment records.

4

books

Checking the correctness of the calculation of wages for salaries, checking

5

the fact charges by orders, timesheets and other documents

Checking the schedule of vacations, vacation orders, the correctness of the

calculations of the days of proper vacation and accrual of vacations,

6

compensation for unused vacation. Checking the legitimacy of additional

leave. Creating a reserve to pay for vacations.

Checking the availability of sick leaves and the adequacy of their

7 completion, the calculation of temporary disability benefits, maternity

benefits

8 Checking the correctness of wage indexation

Checking the validity of the award and the availability of orders for their

9

award

10 Checking the correctness of the content of the writs of execution

Checking compliance with the current legislation of accruals and

11

deductions, contributions and fees to the State Pension Fund.

Checking the completeness and timeliness of transfers of contributions and

12

fees to the State Pension Fund

13 Checking the timeliness of payment of wages

Comparison of the amounts reflected in the fin. reporting, with the balance

14

in the accounting registers and in the General Ledger

15 Compiling a list of detected errors and violations

Date ________

Auditor_____________________________ /_______________/

Checked: The head of the working group__________ /________/ Date _______

Figure 2 Proposed program of auditing of payroll calculations

http://www.iaeme.com/IJM/index.asp 317 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Valentyna Panasyuk, Mariya Lalakulych, Erika Yuhas, Lesya Rybakova, Vitaliy Bobrivets

This Program lists not only the main audit procedures for verifying payroll calculations

for the average enterprise, but also takes into account the specifics of payroll accounting in an

industrial enterprise, but in the process of auditing, the Program can always be finalized.

The implementation of the planned procedures in the audit should be carried out

systematically in a specific sequence, which is defined as the audit process and is

conditionally divided into stages.

To develop an effective audit approach to audit at the planning stage is necessary not only

to develop and document an overall audit plan and program, but also to assess audit risk,

having previously collected the minimum necessary information to understand and evaluate

accounting and control systems. When auditing employee benefits, special attention should be

paid to assessing the risk of control and its components. This is due to the high probability of

errors in the accounting system due to lack of understanding of legislation governing labour

relations, employee income tax and payroll and their ambiguous interpretation, violation of

paperwork, processing large amounts of information that causes arithmetic errors.

Thus, considering the issue of improving the audit of payroll in the enterprises, we can

conclude that today one of the urgent needs is to hire an internal auditor in the enterprise,

which will significantly improve the organization of accounting for payroll and eliminate

existing shortcomings. This will increase the information potential, provide knowledge of all

the intricacies of the activity and, in turn, greater responsibility for the recommendations

provided.

4. CONCLUSION

Thus, the proposed recommendations can help the company to streamline and improve

accounting and introduce an audit of payments to employees, save the company financial

resources because the identified violations are quite severe and will lead to penalties for

inspection. Thus, the effectiveness of the proposed recommendations ranges from UAH 4,723

to UAH 47,230 and more.

The conducted researches allow making a basis for further improvement of questions on

the account and audit of calculations with employees of "Techinmash" PJSC (Ternopil) and

"Aparan" LLC (Uzhhorod). A promising area for improving the accounting of payments to

employees is the further improvement of analytical accounting, consistency of financial

reporting of costs under International Accounting Standards.

REFERENCES

[1] Dzwigol H., Dzwigol-Barosz M., Kwilinski A. (2020). Formation of Global Competitive

Enterprise Environment Based on Industry 4.0 Concept, International Journal of

Entrepreneurship, 24(1), pp. 1-5.

[2] Yang Zili (2003). Dual-rate discounting in dynamic economic–environmental modeling,

Economic Modelling, 20(5), pp. 941-957. DOI: 10.1016/S0264-9993(02)00060-3

[3] Nekrasenko L., Pittman R., Doroshenko O., Chumak V., Doroshenko A. (2019). Grain

logistics in Ukraine: the main challenges and effective ways to reach sustainability,

Economic Annals-XXI, 7-8, pp. 70-83.

[4] Lilia Rejeb, Zahia Guessoum (2006). Firms Adaptation in Dynamic Economic Systems,

DOI: 10.1007/3-540-28547-4_5

[5] Ocheretko L. M., Khokhlova I. A. (2018). Problems of accounting and taxation of

payments for employee payments and ways to solve them, DOI: 10.32702/2307-2105-

2018.10.65

http://www.iaeme.com/IJM/index.asp 318 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

Improving the Accounting and Auditing of Payroll Calculations

[6] Król Henryk, Rafaląt Iwona (2007). Methods of Employees Payments – Empirical

Research Results, DOI: 10.5709/ce.1897-9254.o10

[7] Tarasova H., Misyachnuy V. (2019). Organizational and methodological aspects of

analysis of calculations on payments to employees, DOI: 10.25313/2520-2057-2019-4-

4781

[8] Кwilinski, A. (2019). Implementation of Blockchain Technology in Accounting Sphere.

Academy of Accounting and Financial Studies Journal, 23(SI2), 1528-2635-23-SI-2-412:

1-6

[9] Kobushko Ihor, Кobushko Iana (2015). The tax instruments of Ukraine's investment

market regulation improving, Economic Annals-XXI, 1-2 (1), pp. 82-85.

[10] Kwilinski, A., Ruzhytskyi, I., Patlachuk, V., Patlachuk, O., & Kaminska, B. (2019).

Environmental Taxes as a Condition of Business Responsibility in the Conditions of

Sustainable Development. Journal of Legal, Ethical and Regulatory Issues, 22(SI2) 1544-

0044-22-SI-2-354: 1-6.

[11] Kovalenko Y. M. (2014) ‘Research toolkit for transformations in financial activities ’,

Actual Problems of Economics, № 4 (154), 51–58.

[12] Dźwigoł H. & Wolniak R. (2018). Controlling w procesie zarządzania chemicznym

przedsiębiorstwem produkcyjnym [Controlling in the management process of a chemical

industry production company]. Przemysl Chemiczny, 97(7), 1114—1116.

http://www.iaeme.com/IJM/index.asp 319 editor@iaeme.com

Electronic copy available at: https://ssrn.com/abstract=3629188

You might also like

- TAX 2 - COMPLETE - Entire Semlecture and Book Based PDFDocument95 pagesTAX 2 - COMPLETE - Entire Semlecture and Book Based PDFChaze CerdenaNo ratings yet

- Income Tax Palnning With The Respect of Individual Salaried EmployeesDocument67 pagesIncome Tax Palnning With The Respect of Individual Salaried EmployeesShamika Koshe71% (7)

- Audit Project TAX AUDIT PDFDocument38 pagesAudit Project TAX AUDIT PDFYogesh Sahani100% (3)

- Phil Tax System and Income Taxation FQ1-FQ2Document12 pagesPhil Tax System and Income Taxation FQ1-FQ2Sherina ManlisesNo ratings yet

- Other Comrehensive Income, Accounting Structure and Their ImprovementDocument3 pagesOther Comrehensive Income, Accounting Structure and Their ImprovementOpen Access JournalNo ratings yet

- Tax Accounting Equation (TAE)Document14 pagesTax Accounting Equation (TAE)Joko Ismuhadi Soewarsono100% (1)

- Errors and Abuses in Financial Accounting and Results: SciencedirectDocument7 pagesErrors and Abuses in Financial Accounting and Results: SciencedirectAnonymous 90K2swQNo ratings yet

- Lecture 1 - Accounting in The Czech RepublicDocument12 pagesLecture 1 - Accounting in The Czech RepublicUmar SulemanNo ratings yet

- Aplikasi Komputer 1: Jawaban Tes HarianDocument16 pagesAplikasi Komputer 1: Jawaban Tes Harianelsa arnitiNo ratings yet

- Tax Revenues Estimation and Forecast For State Tax AuditEntrepreneurship and Sustainability IssuesDocument17 pagesTax Revenues Estimation and Forecast For State Tax AuditEntrepreneurship and Sustainability Issuesdalapan dalapanNo ratings yet

- Income TaxDocument48 pagesIncome Tax044Lohar Veena GUNI VMPIMNo ratings yet

- Brihanu - Research Paper-CommentsDocument20 pagesBrihanu - Research Paper-CommentsAddisu TeshomeNo ratings yet

- Description and Classification of Receipts As An Audit Object Based On International StandardsDocument5 pagesDescription and Classification of Receipts As An Audit Object Based On International StandardsOpen Access JournalNo ratings yet

- Dysfunctionalities of Faulty Fiscal Inspections For Tax - 2014 - Procedia EconomDocument8 pagesDysfunctionalities of Faulty Fiscal Inspections For Tax - 2014 - Procedia EconomsajiytradersNo ratings yet

- AlexDocument13 pagesAlexAyana YosephNo ratings yet

- ResearchGate FA DL-01 2019 ENG-A.zaharievDocument63 pagesResearchGate FA DL-01 2019 ENG-A.zaharievcnvb alskNo ratings yet

- Problems of Accounting and Auditing of Fixed Assets and Solutions With The Use of International StandardsDocument6 pagesProblems of Accounting and Auditing of Fixed Assets and Solutions With The Use of International StandardsOpen Access JournalNo ratings yet

- Prospects For Creating Favorable Conditions For Business by Reducing The Tax BurdenDocument8 pagesProspects For Creating Favorable Conditions For Business by Reducing The Tax BurdenCentral Asian StudiesNo ratings yet

- How To Calculate The Average Number of EmployeesDocument8 pagesHow To Calculate The Average Number of EmployeesштттNo ratings yet

- Perlakuan Akuntansi PPH Pasal 21 Dan Pasal 25 Terhadap Laporan Keuangan KoperasiDocument19 pagesPerlakuan Akuntansi PPH Pasal 21 Dan Pasal 25 Terhadap Laporan Keuangan Koperasirainvo tjiongNo ratings yet

- Improvement of Accounting Forms in Multi-Industry FarmsDocument9 pagesImprovement of Accounting Forms in Multi-Industry FarmsCentral Asian StudiesNo ratings yet

- Analysis of The Notes To The Financial Statement Related To Balance Sheet in Case of Hungarian Information-Technology Service CompaniesDocument13 pagesAnalysis of The Notes To The Financial Statement Related To Balance Sheet in Case of Hungarian Information-Technology Service CompaniesMD HABIBNo ratings yet

- TAMBAHAN - 50-Article Text-179-1-10-20211130Document11 pagesTAMBAHAN - 50-Article Text-179-1-10-20211130loveyouu awwNo ratings yet

- Status and Prospects of Effective Use of Financial Resources by Small Business Entities in Our CountryDocument5 pagesStatus and Prospects of Effective Use of Financial Resources by Small Business Entities in Our CountryIJRASETPublicationsNo ratings yet

- Abraham Beyene RESEARCHDocument46 pagesAbraham Beyene RESEARCHAbdi Mucee Tube0% (1)

- International School of Management and EconomicsDocument12 pagesInternational School of Management and EconomicsK59 NGUYEN NGOC MAINo ratings yet

- Ways To Develop A Competitive Environment in The Field of EntrepreneurshipDocument5 pagesWays To Develop A Competitive Environment in The Field of EntrepreneurshipIJRASETPublicationsNo ratings yet

- PDF&Rendition 1Document72 pagesPDF&Rendition 1Abhipsa DashNo ratings yet

- Concepts of The Accounting Basis of Government Accounting: September 2018Document7 pagesConcepts of The Accounting Basis of Government Accounting: September 2018Jon LangajedNo ratings yet

- UntitledDocument18 pagesUntitledaddisu tolinaNo ratings yet

- Taxation ResearchDocument25 pagesTaxation ResearchberhanuoromanNo ratings yet

- Cost and Management Accounting in Budget-Funded orDocument13 pagesCost and Management Accounting in Budget-Funded orRizan MohamedNo ratings yet

- CA Final Case LawsDocument0 pagesCA Final Case LawsKhemchand DevnaniNo ratings yet

- SDG 8Document10 pagesSDG 8hassan anwerNo ratings yet

- IJMIE2March24 11581Document6 pagesIJMIE2March24 11581editorijmieNo ratings yet

- Vol 16 N 06 27Document5 pagesVol 16 N 06 27Oumar GOÏTANo ratings yet

- TOPIC 1 Fundamentals of AccountingDocument10 pagesTOPIC 1 Fundamentals of AccountingAnastasia MelnicovaNo ratings yet

- BETELHEM ABEBE ResearchDocument61 pagesBETELHEM ABEBE ResearchAmbelu AberaNo ratings yet

- Tasks and Principles of Accounting For Lease TransactionsDocument3 pagesTasks and Principles of Accounting For Lease TransactionsOpen Access JournalNo ratings yet

- Directions For Improving The Audit of Obligations in The Field of Information and Communication TechnologiesDocument7 pagesDirections For Improving The Audit of Obligations in The Field of Information and Communication TechnologiesResearch ParkNo ratings yet

- Samrawit ProposalsDocument19 pagesSamrawit ProposalsDESSIE FIKIRNo ratings yet

- Factors Affecting The Realization of Blud Capital Expenditure (Case Study at Lamongan Regencyhealth Center 2018-2020)Document17 pagesFactors Affecting The Realization of Blud Capital Expenditure (Case Study at Lamongan Regencyhealth Center 2018-2020)aijbmNo ratings yet

- ANITANSDocument82 pagesANITANSHijrah NASNo ratings yet

- The Role of Financial Statement in Performance ManDocument11 pagesThe Role of Financial Statement in Performance ManApoorva A NNo ratings yet

- Where Did The Accounting Proffesion in Macedonia HaltDocument8 pagesWhere Did The Accounting Proffesion in Macedonia HaltСметководство & Ревизија «Калиман»No ratings yet

- 7725 24232 1 PBIgorZdravkoskiDocument10 pages7725 24232 1 PBIgorZdravkoskiDilshi WarnakulasuriyaNo ratings yet

- Chiều - 8 - Bùi Hồng NgọcDocument33 pagesChiều - 8 - Bùi Hồng NgọcDinh DongNo ratings yet

- Impact of The Tax System On The Financial Activity of Business EntitiesDocument6 pagesImpact of The Tax System On The Financial Activity of Business EntitiesOpen Access JournalNo ratings yet

- Jurnal InternaionalDocument12 pagesJurnal InternaionalYona FfadilaNo ratings yet

- HTTPS://WWW - Scribd.com/doc/47229810/zahid Finance Thesis 9642Document11 pagesHTTPS://WWW - Scribd.com/doc/47229810/zahid Finance Thesis 9642sobia anwarNo ratings yet

- Detecting Earnings Manipulation and FraudulentDocument24 pagesDetecting Earnings Manipulation and FraudulentRosa Noelia Gutierrez CaroNo ratings yet

- Analisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaDocument11 pagesAnalisis Penerapan E-Faktur Dalam Prosedur Dan Pembuatan Faktur Pajak Dan Pelaporan SPT Masa PPN Pada Cv. Wastu Citra PratamaThata AgathaNo ratings yet

- MANOJ KUMAR - CfsDocument16 pagesMANOJ KUMAR - CfsMOHAMMED KHAYYUMNo ratings yet

- 38-Article Text-63-1-10-20200115 PDFDocument14 pages38-Article Text-63-1-10-20200115 PDFEstifanos SisayNo ratings yet

- Tooba DocumentDocument97 pagesTooba Documentjitendra kumarNo ratings yet

- Статья Крупельницкая,Document3 pagesСтатья Крупельницкая,NATALIA ANTOCINo ratings yet

- Project Report On: "A Study On Financial Planning For Salaried Employee and Strategies For Tax Savings"Document76 pagesProject Report On: "A Study On Financial Planning For Salaried Employee and Strategies For Tax Savings"Sonal AgrawalNo ratings yet

- Analysis of The Influence of "Business Tax To VAT" On Financial Management of EnterprisesDocument4 pagesAnalysis of The Influence of "Business Tax To VAT" On Financial Management of EnterprisesAncuta AncutzaNo ratings yet

- IJSBAR Financial Statement AuditDocument10 pagesIJSBAR Financial Statement AuditAkademski ServisNo ratings yet

- Legal Regulation of Business Creation in Ukrain1.DocxNikaDocument12 pagesLegal Regulation of Business Creation in Ukrain1.DocxNikaikki1425niNo ratings yet

- A Comparative Analysis on Tax Administration in Asia and the PacificFrom EverandA Comparative Analysis on Tax Administration in Asia and the PacificNo ratings yet

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersFrom EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersNo ratings yet

- Continuous Auditing: An Effective Tool For Internal AuditorsDocument23 pagesContinuous Auditing: An Effective Tool For Internal AuditorsThanhTungNo ratings yet

- F6ffi: Ruvix RuufDocument3 pagesF6ffi: Ruvix RuufThanhTungNo ratings yet

- Auditing in The Era of Big DataDocument52 pagesAuditing in The Era of Big DataThanhTungNo ratings yet

- Ilffi:, RRTXDocument2 pagesIlffi:, RRTXThanhTungNo ratings yet

- Iffifr$'-N: Ffiss$Document4 pagesIffifr$'-N: Ffiss$ThanhTungNo ratings yet

- Rinn: r6xc RnufDocument6 pagesRinn: r6xc RnufThanhTungNo ratings yet

- Tlffi"s) ,) ), J: Ruvtx RnufDocument4 pagesTlffi"s) ,) ), J: Ruvtx RnufThanhTungNo ratings yet

- RHL Coxc CNRLC Xuaol: R6Xc Rhuf Ronc RnufDocument6 pagesRHL Coxc CNRLC Xuaol: R6Xc Rhuf Ronc RnufThanhTungNo ratings yet

- ffiq: C$XC Rhlruynn CDXCDocument5 pagesffiq: C$XC Rhlruynn CDXCThanhTungNo ratings yet

- Pce (I: S c6xcDocument2 pagesPce (I: S c6xcThanhTungNo ratings yet

- R ei'TT"$rn: /'ii$rr - 'I#/"Document4 pagesR ei'TT"$rn: /'ii$rr - 'I#/"ThanhTungNo ratings yet

- R6Xc Lslu: RNR CDNC CNTFC Xixn NixhDocument6 pagesR6Xc Lslu: RNR CDNC CNTFC Xixn NixhThanhTungNo ratings yet

- 'Iffi: Dwvs WDocument3 pages'Iffi: Dwvs WThanhTungNo ratings yet

- Ruvtx: X6R Cnilc Rhuf Rhuf VDXCDocument2 pagesRuvtx: X6R Cnilc Rhuf Rhuf VDXCThanhTungNo ratings yet

- Xer Tuytn Vao: Cuc Rhuf Vinh JfiDocument2 pagesXer Tuytn Vao: Cuc Rhuf Vinh JfiThanhTungNo ratings yet

- Ruytn: RHR CHT/C CQC Vao Cuc RhufDocument5 pagesRuytn: RHR CHT/C CQC Vao Cuc RhufThanhTungNo ratings yet

- R6Nc Rhui: Ruynn Oqxc-C0Xc (Slu VinnDocument4 pagesR6Nc Rhui: Ruynn Oqxc-C0Xc (Slu VinnThanhTungNo ratings yet

- Tffirt - HF, L: RSR Ruyfn r6xcDocument3 pagesTffirt - HF, L: RSR Ruyfn r6xcThanhTungNo ratings yet

- 'T L (/I.Rn, Y' Vao Hoa /F Ti: Alih CHTFC VDNGDocument5 pages'T L (/I.Rn, Y' Vao Hoa /F Ti: Alih CHTFC VDNGThanhTungNo ratings yet

- R (I Iiw: FfimdDocument2 pagesR (I Iiw: FfimdThanhTungNo ratings yet

- Rffi /ilc$: RuyixDocument4 pagesRffi /ilc$: RuyixThanhTungNo ratings yet

- De Cuong KTC V2-Full PDFDocument234 pagesDe Cuong KTC V2-Full PDFThanhTungNo ratings yet

- (Đề thi có 04 trang) Thời gian làm bài: 90 phútDocument6 pages(Đề thi có 04 trang) Thời gian làm bài: 90 phútThanhTungNo ratings yet

- Trang PAGE 1/7 - Mã Trang PAGE 1/7 - MãDocument8 pagesTrang PAGE 1/7 - Mã Trang PAGE 1/7 - MãThanhTungNo ratings yet

- Mark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Correct Answer To Each of The Following Questions From 1 To 24Document12 pagesMark The Letter A, B, C, or D On Your Answer Sheet To Indicate The Correct Answer To Each of The Following Questions From 1 To 24ThanhTungNo ratings yet

- Test 5 I. Pronunciation and Stress A. Which Word Is Stressed Differently From The Others?Document4 pagesTest 5 I. Pronunciation and Stress A. Which Word Is Stressed Differently From The Others?ThanhTungNo ratings yet

- Test 4 A. Which Word Is Stressed Differently From The Others?Document4 pagesTest 4 A. Which Word Is Stressed Differently From The Others?ThanhTungNo ratings yet

- Đề Thi Thử Đại Học Môn: Tiếng AnhDocument14 pagesĐề Thi Thử Đại Học Môn: Tiếng AnhThanhTungNo ratings yet

- Chọn từ có trọng âm nhấn vào âm tiết ở vị trí khácDocument14 pagesChọn từ có trọng âm nhấn vào âm tiết ở vị trí khácThanhTungNo ratings yet

- Test 2 - Time: 90 Minutes de Luyen Thi Dai Hoc I. Choose The Word in Each Group That Has The Underlined Part Pronounced Differently From The RestDocument5 pagesTest 2 - Time: 90 Minutes de Luyen Thi Dai Hoc I. Choose The Word in Each Group That Has The Underlined Part Pronounced Differently From The RestThanhTungNo ratings yet

- Smart Platina Plus Brochure - BRDocument3 pagesSmart Platina Plus Brochure - BRSumit RpNo ratings yet

- Practical Guide For Integrated Financial PlanningDocument80 pagesPractical Guide For Integrated Financial Planningnaresh sNo ratings yet

- IT Compensation NotesDocument33 pagesIT Compensation NotesWinnie GiveraNo ratings yet

- Deed of Gift Free SampleDocument9 pagesDeed of Gift Free SampleRajabuhussein MbwanaNo ratings yet

- Business Mathematics 11 Q2 Week3 MELC20 MELC21 MOD Baloaloa, JeffersonDocument25 pagesBusiness Mathematics 11 Q2 Week3 MELC20 MELC21 MOD Baloaloa, JeffersonJefferson BaloaloaNo ratings yet

- Letter - No Ufbu 2023 5 Dated 02.06.2023Document2 pagesLetter - No Ufbu 2023 5 Dated 02.06.2023RaghunatahNo ratings yet

- Benefit Highlights+Summary PellaDocument2 pagesBenefit Highlights+Summary PellaSa MiNo ratings yet

- Permanent Partial Disability - Brito Types of DisabilityDocument10 pagesPermanent Partial Disability - Brito Types of DisabilityKaren Ryl Lozada BritoNo ratings yet

- Sea Tax Guide To Taxation in Sea 2022Document219 pagesSea Tax Guide To Taxation in Sea 2022JosephNo ratings yet

- 52595bos42131-inter-INCOME TAX PDFDocument8 pages52595bos42131-inter-INCOME TAX PDFHapi PrinceNo ratings yet

- BPJS Kesehatan (English)Document2 pagesBPJS Kesehatan (English)Atep PurnamaNo ratings yet

- Test Bank For Investments Analysis and Behavior 2nd Edition Mark HirscheyDocument13 pagesTest Bank For Investments Analysis and Behavior 2nd Edition Mark Hirscheyverityfelixl6e40No ratings yet

- Determining External Competitiveness & Benefits ManagementDocument31 pagesDetermining External Competitiveness & Benefits ManagementCherianXavierNo ratings yet

- GCM Challan - 10Document1 pageGCM Challan - 10neeraj bansalNo ratings yet

- Conceptual Framework of TaxDocument9 pagesConceptual Framework of Taxdpak bhusalNo ratings yet

- Find Study Resources: Answered Step-By-StepDocument12 pagesFind Study Resources: Answered Step-By-StepBisag AsaNo ratings yet

- Fox Mandal Tax Newsletter Tax Inform AugustDocument24 pagesFox Mandal Tax Newsletter Tax Inform AugustVarshaNo ratings yet

- Ifive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityDocument1 pageIfive Inc.: 8/F Zeta Tower Robinsons Bridgetowne C5 Road, Ugong Norte, 1110 Quezon CityReymar BanaagNo ratings yet

- Taxation Situational ProblemsDocument32 pagesTaxation Situational ProblemsMilo MilkNo ratings yet

- Income Tax Ordinance, 2001Document774 pagesIncome Tax Ordinance, 2001Ahmed Yar KhanNo ratings yet

- Session 1 Exercise DrillDocument5 pagesSession 1 Exercise DrillABBIE GRACE DELA CRUZNo ratings yet

- The Institute of Finance ManagementDocument4 pagesThe Institute of Finance ManagementSalim Abdulrahim BafadhilNo ratings yet

- Irs Gov Forms-SignedDocument2 pagesIrs Gov Forms-SignedKeller Brown JnrNo ratings yet

- DT Marathon PDFDocument161 pagesDT Marathon PDFAbhi JoshiNo ratings yet

- Income Tax Act 75.01Document228 pagesIncome Tax Act 75.01damian hardeoNo ratings yet

- Form PDF 179843840280722Document10 pagesForm PDF 179843840280722rakeshkaydalwarNo ratings yet

- A Report On Sandhani Insurance Ltd.Document26 pagesA Report On Sandhani Insurance Ltd.Shuva das0% (2)

- Volume - IIDocument264 pagesVolume - IIDalchand SharmaNo ratings yet