Professional Documents

Culture Documents

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Uploaded by

Vijay ChandranCopyright:

Available Formats

You might also like

- Yieldbook LMM Term ModelDocument20 pagesYieldbook LMM Term Modelphilline2009100% (1)

- EngagementDocument47 pagesEngagementJean CabigaoNo ratings yet

- Caf 7 Far2 QB PDFDocument262 pagesCaf 7 Far2 QB PDFZahid100% (1)

- Volatilitypreads PDFDocument164 pagesVolatilitypreads PDFAmeerHamsa100% (1)

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- Axis Short Term Retail Growth: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190720091735Document1 pageMorning Star Report 20190720091735SunNo ratings yet

- Morning Star Report 20190720091752Document1 pageMorning Star Report 20190720091752YumyumNo ratings yet

- Axis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Parag Parikh Long TermDocument1 pageParag Parikh Long TermYogi173No ratings yet

- Morning Star Report 20190720091834Document1 pageMorning Star Report 20190720091834Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102434Document1 pageMorning Star Report 20190726102434YumyumNo ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- Morning Star Report 20190720091751Document1 pageMorning Star Report 20190720091751YumyumNo ratings yet

- Morning Star Report 20191102055140Document1 pageMorning Star Report 20191102055140Yogi173No ratings yet

- Morning Star Report 20190720091835Document1 pageMorning Star Report 20190720091835Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumNo ratings yet

- Axis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityChaitanya VyasNo ratings yet

- HDFC Fact SheetDocument1 pageHDFC Fact SheetAdityaNo ratings yet

- Morning Star Report 20190726102135Document1 pageMorning Star Report 20190726102135YumyumNo ratings yet

- Morning Star Report 20190726102715Document1 pageMorning Star Report 20190726102715YumyumNo ratings yet

- Morning Star Report 20190726102724Document1 pageMorning Star Report 20190726102724YumyumNo ratings yet

- Morningstarreport 20231123045134Document1 pageMorningstarreport 20231123045134SHUBHAM STAR PatilNo ratings yet

- Morningstarreport 20231222043231Document1 pageMorningstarreport 20231222043231vinodNo ratings yet

- Baroda Pioneer Short Term BondDocument1 pageBaroda Pioneer Short Term BondYogi173No ratings yet

- Morningstarreport20230426061738 PDFDocument1 pageMorningstarreport20230426061738 PDFmaahirNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Morning Star Report 20190725103353Document1 pageMorning Star Report 20190725103353SunNo ratings yet

- ICICI Prudential Value Discovery Fund GrowthDocument1 pageICICI Prudential Value Discovery Fund GrowthYogi173No ratings yet

- L&T Equity Fund GrowthDocument1 pageL&T Equity Fund GrowthYogi173No ratings yet

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026No ratings yet

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunNo ratings yet

- Morning Star Report 20190725103349Document1 pageMorning Star Report 20190725103349SunNo ratings yet

- Morning Star Report 20190726102445Document1 pageMorning Star Report 20190726102445YumyumNo ratings yet

- Axis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y UDocument1 pageAxis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y Ukishore13No ratings yet

- BNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionDocument1 pageBNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionSunNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Morning Star Report 20190720091758Document1 pageMorning Star Report 20190720091758YumyumNo ratings yet

- Morningstarreport20221024033734 Canara Robeco SmallDocument1 pageMorningstarreport20221024033734 Canara Robeco SmallNiaz Abdul KarimNo ratings yet

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173No ratings yet

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026No ratings yet

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- Morning Star Report 20230811063830Document1 pageMorning Star Report 20230811063830ishaniagheraNo ratings yet

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheeNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- Axis Focused 25 FundDocument1 pageAxis Focused 25 FundYogi173No ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Morningstarreport20221024033540 PGIMINDIA MIDOPPDocument2 pagesMorningstarreport20221024033540 PGIMINDIA MIDOPPNiaz Abdul KarimNo ratings yet

- Kotak Bluechip FundDocument1 pageKotak Bluechip FundSunny AhujaNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumNo ratings yet

- Morning Star Report 20190725103334Document1 pageMorning Star Report 20190725103334SunNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Morning Star Report 20190720091852Document1 pageMorning Star Report 20190720091852Chaitanya VyasNo ratings yet

- Morning Star Report 20190720091725Document1 pageMorning Star Report 20190720091725SunNo ratings yet

- Nippon India Gold Savings Fund - Direct Plan - GrowthDocument1 pageNippon India Gold Savings Fund - Direct Plan - GrowthKeval ShahNo ratings yet

- Morning Star Report 20190720091759Document1 pageMorning Star Report 20190720091759Chaitanya VyasNo ratings yet

- Axis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- S&P 500 Dividend Aristocrats: MethodologyDocument18 pagesS&P 500 Dividend Aristocrats: MethodologyCalvin YeohNo ratings yet

- Tutorial 1 Week 1 - SolutionsDocument13 pagesTutorial 1 Week 1 - SolutionsXiaohan LuNo ratings yet

- TreasuryDocument17 pagesTreasurySanjay PriyadarshiNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Chapter 7 - 2022Document20 pagesChapter 7 - 2022Linh KhánhNo ratings yet

- Music Mart FormatDocument3 pagesMusic Mart FormatSana LeeNo ratings yet

- 5.2 AC Lawn Care - BlankDocument9 pages5.2 AC Lawn Care - Blankridak3003No ratings yet

- Submission1 - P&G Acquisition of GilletteDocument9 pagesSubmission1 - P&G Acquisition of GilletteAryan AnandNo ratings yet

- Time Value of Money - DamodaranDocument16 pagesTime Value of Money - DamodaranVivek KumarNo ratings yet

- RatingsDocument6 pagesRatingssheinaNo ratings yet

- Microsoft PowerPoint Presentation NouDocument6 pagesMicrosoft PowerPoint Presentation NouTatiana BuruianaNo ratings yet

- Loan CollateralDocument3 pagesLoan CollateralAhmed AlhaddadNo ratings yet

- Dow Theory The Key To Stock MarketDocument7 pagesDow Theory The Key To Stock MarketPiyush KumarNo ratings yet

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

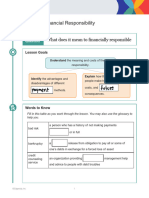

- 3108 13 06 FinancialResponsibility GN SEDocument9 pages3108 13 06 FinancialResponsibility GN SENEEVE SHETHNo ratings yet

- Components of A Balance Sheet AssetsDocument3 pagesComponents of A Balance Sheet AssetsAhmed Nawaz KhanNo ratings yet

- Valuation - Multiples and EV Value DriversDocument27 pagesValuation - Multiples and EV Value DriversstrokemeNo ratings yet

- Forexgrail EbookDocument52 pagesForexgrail EbookAkram Shah50% (2)

- Introduction To Cash Flow Statement Acc Project Term 2Document7 pagesIntroduction To Cash Flow Statement Acc Project Term 2ANCHAL YADAVNo ratings yet

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- STT Vocab Pronun Example Family Word Synonym/Ant Onym DeregulationDocument3 pagesSTT Vocab Pronun Example Family Word Synonym/Ant Onym DeregulationDANG PHAM HAINo ratings yet

- Valuation of Singer Bangladesh LTDDocument22 pagesValuation of Singer Bangladesh LTDFarzana Fariha LimaNo ratings yet

- Dangote Cement - Benue Cement Company OfferDocument2 pagesDangote Cement - Benue Cement Company OfferbiodNo ratings yet

- Interest Rates Chapter 4 (Part1) : Geng NiuDocument52 pagesInterest Rates Chapter 4 (Part1) : Geng NiuegaNo ratings yet

- SBUX DNKN Final ReportDocument17 pagesSBUX DNKN Final ReportKostia RiabkovNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Uploaded by

Vijay ChandranOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Aditya Birla Sun Life Short Term Fund Regular Plan Growth: Interest Rate Sensitivity

Uploaded by

Vijay ChandranCopyright:

Available Formats

Report as of 20 Oct 2020

Aditya Birla Sun Life Short Term Fund Regular Plan Growth

Morningstar® Category Morningstar® Benchmark Fund Benchmark Morningstar Rating™

India OE Short-term Bond CRISIL Short Term Bond Fund TR INR CRISIL Short Term Bond Fund TR INR QQQQQ

Used throughout report

Investment Objective Performance

The investment objective of the Scheme is to generate

16,000

income and capital appreciation by investing 100% of

14,500

the corpus in a diversified portfolio of debt and money

market securities. 13,000

11,500

10,000

2015 2016 2017 2018 2019 2020-09

8.42 11.32 5.60 6.50 8.50 8.36 Fund

8.66 9.85 6.05 6.65 9.53 7.79 Benchmark

6.91 8.33 4.78 5.03 3.46 6.46 Category

Risk Measures Trailing Returns % Fund Bmark Cat Quarterly Returns % Q1 Q2 Q3 Q4

3Y Alpha -0.39 3Y Sharpe Ratio 1.92 3 Months 2.74 1.35 1.25 2020 0.98 3.99 3.19 -

3Y Beta 1.08 3Y Std Dev 2.17 6 Months 8.10 4.90 5.32 2019 2.05 1.99 2.70 1.51

3Y R-Squared 67.46 3Y Risk Avg 1 Year 10.46 9.89 8.35 2018 1.47 0.39 1.91 2.59

3Y Info Ratio -0.18 5Y Risk Avg 3 Years Annualised 8.25 8.23 5.33 2017 0.78 2.26 1.84 0.62

3Y Tracking Error 1.29 10Y Risk Avg 5 Years Annualised 8.50 8.32 5.97 2016 2.52 2.31 4.00 2.05

Calculations use CRISIL Short Term Bond Fund TR INR (where applicable)

Portfolio 30/09/2020

Asset Allocation % Net Fixed Income Fund Credit Quality % Fund Credit Quality % Fund

Stocks 0.00 Style Box™ Modified Duration 2.54

AAA 89.66 BBB 0.00

Bonds 89.65 Yield to Maturity 5.78

High Med Low

Credit Quality

AA 8.45 BB 0.00

Cash 10.35 Average Credit Quality AA

A 1.66 B 0.00

Other 0.00

Below B 0.23

Not Rated 0.00

Ltd Mod Ext

Interest Rate Sensitivity

Top Holdings Fixed Income Sector Weightings % Fund Maturity Distribution % Fund

Holding Name Sector %

⁄ Government 36.06 1 to 3 Years 56.46

Reliance Industries Limited - 3.00 › Corporate 54.91 3 to 5 Years 12.98

6.79% Govt Stock 2027 - 2.64 u Securitized 0.00 5 to 7 Years 11.94

Rural Electrification... - 2.58 ‹ Municipal 0.00 7 to 10 Years 11.47

8.15% Govt Stock 2026 - 2.50 y Cash & Equivalents 9.03 10 to 15 Years 2.08

7.32% Govt Stock 2024 - 2.42 ± Derivative 0.00 15 to 20 Years 0.00

20 to 30 Years 0.00

5.77% GOI 2030 - 2.39 Coupon Range % Fund Over 30 Years 0.00

7.27% Govt Stock 2026 - 1.94

6.45% Govt Stock 2029 - 1.93 0 4.44

HDB Financial Services Limited - 1.91 0 to 4 0.00

Power Finance Corporation... - 1.80 4 to 6 8.96

6 to 8 54.74

Assets in Top 10 Holdings % 23.11 8 to 10 30.09

Total Number of Equity Holdings 0 10 to 12 1.77

Total Number of Bond Holdings 126 Over 12 0.00

Operations

Fund Company Aditya Birla Sun Life AMC Share Class Size (mil) - Minimum Initial Purchase 1,000 INR

Ltd Domicile India Minimum Additional Purchase 1,000 INR

Phone +91 22 43568000 Currency INR Exit Load 0.00% - >0 days

Website www.adityabirlacapital.co UCITS - Expense Ratio 1.13%

m Inc/Acc Acc

Inception Date 09/05/2003 ISIN INF209K01942

Manager Name Mohit Sharma

Manager Start Date 06/08/2020

NAV (19/10/2020) INR 35.97

Total Net Assets (mil) 55,458.85 INR

(30/09/2020)

© 2020 Morningstar. All Rights Reserved. The information, data, analyses and opinions (“Information”) contained herein: (1) include the proprietary information of Morningstar and Morningstar’s third party licensors; (2) may ®

not be copied or redistributed except as specifically authorised;(3) do not constitute investment advice;(4) are provided solely for informational purposes; (5) are not warranted to be complete, accurate or timely; and (6) may

be drawn from fund data published on various dates. Morningstar is not responsible for any trading decisions, damages or other losses related to the Information or its use. Please verify all of the Information before using it

ß

and don’t make any investment decision except upon the advice of a professional financial adviser. Past performance is no guarantee of future results. The value and income derived from investments may go down as well

as up.

You might also like

- Yieldbook LMM Term ModelDocument20 pagesYieldbook LMM Term Modelphilline2009100% (1)

- EngagementDocument47 pagesEngagementJean CabigaoNo ratings yet

- Caf 7 Far2 QB PDFDocument262 pagesCaf 7 Far2 QB PDFZahid100% (1)

- Volatilitypreads PDFDocument164 pagesVolatilitypreads PDFAmeerHamsa100% (1)

- Nippon India Low Duration FundDocument1 pageNippon India Low Duration FundYogi173No ratings yet

- Axis Short Term Retail Growth: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Growth: Interest Rate SensitivitySunNo ratings yet

- Morning Star Report 20190720091735Document1 pageMorning Star Report 20190720091735SunNo ratings yet

- Morning Star Report 20190720091752Document1 pageMorning Star Report 20190720091752YumyumNo ratings yet

- Axis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Short Term Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- Parag Parikh Long TermDocument1 pageParag Parikh Long TermYogi173No ratings yet

- Morning Star Report 20190720091834Document1 pageMorning Star Report 20190720091834Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102434Document1 pageMorning Star Report 20190726102434YumyumNo ratings yet

- Morning Star Report 20190726102604Document1 pageMorning Star Report 20190726102604YumyumNo ratings yet

- Morning Star Report 20190720091751Document1 pageMorning Star Report 20190720091751YumyumNo ratings yet

- Morning Star Report 20191102055140Document1 pageMorning Star Report 20191102055140Yogi173No ratings yet

- Morning Star Report 20190720091835Document1 pageMorning Star Report 20190720091835Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102609Document1 pageMorning Star Report 20190726102609YumyumNo ratings yet

- Axis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Liquid Fund Weekly Dividend Payout: Interest Rate SensitivityChaitanya VyasNo ratings yet

- HDFC Fact SheetDocument1 pageHDFC Fact SheetAdityaNo ratings yet

- Morning Star Report 20190726102135Document1 pageMorning Star Report 20190726102135YumyumNo ratings yet

- Morning Star Report 20190726102715Document1 pageMorning Star Report 20190726102715YumyumNo ratings yet

- Morning Star Report 20190726102724Document1 pageMorning Star Report 20190726102724YumyumNo ratings yet

- Morningstarreport 20231123045134Document1 pageMorningstarreport 20231123045134SHUBHAM STAR PatilNo ratings yet

- Morningstarreport 20231222043231Document1 pageMorningstarreport 20231222043231vinodNo ratings yet

- Baroda Pioneer Short Term BondDocument1 pageBaroda Pioneer Short Term BondYogi173No ratings yet

- Morningstarreport20230426061738 PDFDocument1 pageMorningstarreport20230426061738 PDFmaahirNo ratings yet

- Morning Star Report 20190726102443Document1 pageMorning Star Report 20190726102443YumyumNo ratings yet

- Morning Star Report 20190725103353Document1 pageMorning Star Report 20190725103353SunNo ratings yet

- ICICI Prudential Value Discovery Fund GrowthDocument1 pageICICI Prudential Value Discovery Fund GrowthYogi173No ratings yet

- L&T Equity Fund GrowthDocument1 pageL&T Equity Fund GrowthYogi173No ratings yet

- Morningstarreport 20230327061731Document1 pageMorningstarreport 20230327061731arian2026No ratings yet

- Morning Star Report 20190726101759Document1 pageMorning Star Report 20190726101759SunNo ratings yet

- Morning Star Report 20190725103349Document1 pageMorning Star Report 20190725103349SunNo ratings yet

- Morning Star Report 20190726102445Document1 pageMorning Star Report 20190726102445YumyumNo ratings yet

- Axis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y UDocument1 pageAxis Long Term Equity Fund Direct Plan Growth Option: y y y R y T y T y H R T y Ukishore13No ratings yet

- BNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionDocument1 pageBNP Paribas Short Term Fund Direct Plan Weekly Dividend Payout OptionSunNo ratings yet

- Quant Focused Fund Growth Option Direct Plan: H R T y UDocument1 pageQuant Focused Fund Growth Option Direct Plan: H R T y UYogi173No ratings yet

- Morning Star Report 20190720091758Document1 pageMorning Star Report 20190720091758YumyumNo ratings yet

- Morningstarreport20221024033734 Canara Robeco SmallDocument1 pageMorningstarreport20221024033734 Canara Robeco SmallNiaz Abdul KarimNo ratings yet

- Kotak Bond Growth Direct: Interest Rate SensitivityDocument1 pageKotak Bond Growth Direct: Interest Rate SensitivityYogi173No ratings yet

- Axis Bluechip FundDocument1 pageAxis Bluechip Fundarian2026No ratings yet

- Morning Star Report 20190725103125Document1 pageMorning Star Report 20190725103125SunNo ratings yet

- Morning Star Report 20190725103333Document1 pageMorning Star Report 20190725103333SunNo ratings yet

- Morning Star Report 20230811063830Document1 pageMorning Star Report 20230811063830ishaniagheraNo ratings yet

- Morningstarreport 20230114061338Document1 pageMorningstarreport 20230114061338hkratheeNo ratings yet

- Morning Star Report 20190726102150Document1 pageMorning Star Report 20190726102150YumyumNo ratings yet

- Axis Focused 25 FundDocument1 pageAxis Focused 25 FundYogi173No ratings yet

- Morning Star Report 20190726102118Document1 pageMorning Star Report 20190726102118YumyumNo ratings yet

- Morning Star Report 20190726102621Document1 pageMorning Star Report 20190726102621YumyumNo ratings yet

- Morning Star Report 20190726102105Document1 pageMorning Star Report 20190726102105YumyumNo ratings yet

- Morningstarreport20221024033540 PGIMINDIA MIDOPPDocument2 pagesMorningstarreport20221024033540 PGIMINDIA MIDOPPNiaz Abdul KarimNo ratings yet

- Kotak Bluechip FundDocument1 pageKotak Bluechip FundSunny AhujaNo ratings yet

- DSP Smallcap Closed Morningstarreport20180402100029Document1 pageDSP Smallcap Closed Morningstarreport20180402100029shareonline2010No ratings yet

- Essel Regular Savings Fund GrowthDocument1 pageEssel Regular Savings Fund GrowthYogi173No ratings yet

- Morning Star Report 20190720091802Document1 pageMorning Star Report 20190720091802Chaitanya VyasNo ratings yet

- Morning Star Report 20190726102129Document1 pageMorning Star Report 20190726102129YumyumNo ratings yet

- Morning Star Report 20190725103334Document1 pageMorning Star Report 20190725103334SunNo ratings yet

- Morning Star Report 20190726102710Document1 pageMorning Star Report 20190726102710YumyumNo ratings yet

- Morning Star Report 20190720091852Document1 pageMorning Star Report 20190720091852Chaitanya VyasNo ratings yet

- Morning Star Report 20190720091725Document1 pageMorning Star Report 20190720091725SunNo ratings yet

- Nippon India Gold Savings Fund - Direct Plan - GrowthDocument1 pageNippon India Gold Savings Fund - Direct Plan - GrowthKeval ShahNo ratings yet

- Morning Star Report 20190720091759Document1 pageMorning Star Report 20190720091759Chaitanya VyasNo ratings yet

- Axis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivityDocument1 pageAxis Treasury Advantage Retail Monthly Dividend Payout: Interest Rate SensitivitySunNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- S&P 500 Dividend Aristocrats: MethodologyDocument18 pagesS&P 500 Dividend Aristocrats: MethodologyCalvin YeohNo ratings yet

- Tutorial 1 Week 1 - SolutionsDocument13 pagesTutorial 1 Week 1 - SolutionsXiaohan LuNo ratings yet

- TreasuryDocument17 pagesTreasurySanjay PriyadarshiNo ratings yet

- Finning Q3 2023 Interim Report Nov 6 2023Document64 pagesFinning Q3 2023 Interim Report Nov 6 2023Allan ShepherdNo ratings yet

- Chapter 7 - 2022Document20 pagesChapter 7 - 2022Linh KhánhNo ratings yet

- Music Mart FormatDocument3 pagesMusic Mart FormatSana LeeNo ratings yet

- 5.2 AC Lawn Care - BlankDocument9 pages5.2 AC Lawn Care - Blankridak3003No ratings yet

- Submission1 - P&G Acquisition of GilletteDocument9 pagesSubmission1 - P&G Acquisition of GilletteAryan AnandNo ratings yet

- Time Value of Money - DamodaranDocument16 pagesTime Value of Money - DamodaranVivek KumarNo ratings yet

- RatingsDocument6 pagesRatingssheinaNo ratings yet

- Microsoft PowerPoint Presentation NouDocument6 pagesMicrosoft PowerPoint Presentation NouTatiana BuruianaNo ratings yet

- Loan CollateralDocument3 pagesLoan CollateralAhmed AlhaddadNo ratings yet

- Dow Theory The Key To Stock MarketDocument7 pagesDow Theory The Key To Stock MarketPiyush KumarNo ratings yet

- Hedge Funds StrategiesDocument13 pagesHedge Funds StrategiesJoel FernandesNo ratings yet

- 3108 13 06 FinancialResponsibility GN SEDocument9 pages3108 13 06 FinancialResponsibility GN SENEEVE SHETHNo ratings yet

- Components of A Balance Sheet AssetsDocument3 pagesComponents of A Balance Sheet AssetsAhmed Nawaz KhanNo ratings yet

- Valuation - Multiples and EV Value DriversDocument27 pagesValuation - Multiples and EV Value DriversstrokemeNo ratings yet

- Forexgrail EbookDocument52 pagesForexgrail EbookAkram Shah50% (2)

- Introduction To Cash Flow Statement Acc Project Term 2Document7 pagesIntroduction To Cash Flow Statement Acc Project Term 2ANCHAL YADAVNo ratings yet

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- STT Vocab Pronun Example Family Word Synonym/Ant Onym DeregulationDocument3 pagesSTT Vocab Pronun Example Family Word Synonym/Ant Onym DeregulationDANG PHAM HAINo ratings yet

- Valuation of Singer Bangladesh LTDDocument22 pagesValuation of Singer Bangladesh LTDFarzana Fariha LimaNo ratings yet

- Dangote Cement - Benue Cement Company OfferDocument2 pagesDangote Cement - Benue Cement Company OfferbiodNo ratings yet

- Interest Rates Chapter 4 (Part1) : Geng NiuDocument52 pagesInterest Rates Chapter 4 (Part1) : Geng NiuegaNo ratings yet

- SBUX DNKN Final ReportDocument17 pagesSBUX DNKN Final ReportKostia RiabkovNo ratings yet

- Introducing "Varsity": CategoriesDocument25 pagesIntroducing "Varsity": CategoriesrohaNo ratings yet