Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

59 views2017 Revised Anti-Money Laundering Operating Manual PDF

2017 Revised Anti-Money Laundering Operating Manual PDF

Uploaded by

mlnathalie4012Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Memorandum - 2023-013Document1 pageMemorandum - 2023-013mlnathalie4012No ratings yet

- Faith That WaversDocument24 pagesFaith That Waversmlnathalie4012No ratings yet

- Memo 2009-0202 PDFDocument3 pagesMemo 2009-0202 PDFmlnathalie4012No ratings yet

- Memo 2009-0047Document1 pageMemo 2009-0047mlnathalie4012No ratings yet

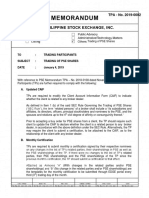

- TPA - No. 2019-0002: TO: Trading Participants Subject: Trading of Pse Shares Date: January 4, 2019Document5 pagesTPA - No. 2019-0002: TO: Trading Participants Subject: Trading of Pse Shares Date: January 4, 2019mlnathalie4012No ratings yet

- TO: Trading Participants Date: January 15, 2018 Subject: PSE Front-End Trading Sytem EnhancementsDocument5 pagesTO: Trading Participants Date: January 15, 2018 Subject: PSE Front-End Trading Sytem Enhancementsmlnathalie4012No ratings yet

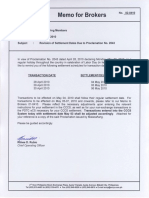

- Memo For Brokers: Secunrrres Clenntno Conpomrron of The Pxrr-RpprnesDocument2 pagesMemo For Brokers: Secunrrres Clenntno Conpomrron of The Pxrr-Rpprnesmlnathalie4012No ratings yet

- Keith Martin - Because of YouDocument3 pagesKeith Martin - Because of Youmlnathalie4012100% (1)

- Tpa 2018-0071Document2 pagesTpa 2018-0071mlnathalie4012No ratings yet

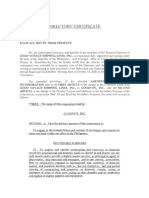

- GV Directors Certificate-Amendent To Articles of Incorporation DEFAULTDocument2 pagesGV Directors Certificate-Amendent To Articles of Incorporation DEFAULTmlnathalie4012No ratings yet

2017 Revised Anti-Money Laundering Operating Manual PDF

2017 Revised Anti-Money Laundering Operating Manual PDF

Uploaded by

mlnathalie40120 ratings0% found this document useful (0 votes)

59 views24 pagesOriginal Title

2017 Revised Anti-Money Laundering Operating Manual.pdf

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

59 views24 pages2017 Revised Anti-Money Laundering Operating Manual PDF

2017 Revised Anti-Money Laundering Operating Manual PDF

Uploaded by

mlnathalie4012Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 24

REVISED ANTI-MONEY LAUNDERING

OPERATING MANUAL

FOR COL FINANCIAL GROUP, INC.

Last updated on July 2017

um.

COL Financial Group, Inc

Anti-Money Laundering Operating Monval

‘TABLE OF CONTENTS

INTRODUCTION...

Section 1.1. Purpose.

Section 1.2. Policy Objective...

Section 1.3. Scope..

Section 1.4. Definition of Terms.

BRRAR

DESCRIPTION OF MONEY LAUNDERING ...

Section 2.1.Definition of Money Laundering,

Section 2.2. Stages of Money Laundering...

Section 2.3. Due Diligence Requirement.

BASIC PRINCIPLES AND POLICIES TO COMBAT MONEY LAUNDERING ..

Section 3.1. Principles.

‘CUSTOMER IDENTIFICATION.

Section 4.1. KYC Procedures. :

Section 4,2. Competent Evidence of Identity...

Section 4.3. Continuing Due Diligence...

Section 4.4 Acquisition of a Covered Institution.

Section 4.5. When Additional Verification Necessary.

Section 4.6. Rejection of Accounts.

Section 4.7. Notice to Clients.

Section 4.8. Third Party Reliance

Section 4.9, Outsourcing the Conduct of Customer Identification,

Section 4.10. Account Holder Name, urn :

Section 4.11. Reduced Due Diligence for Low Risk Customers...

Section 4.12. Minimum Information from individual Clients

Section 4.13. Original Documents,

Section 4.14, High Risk Customers..u.nm .

Section 4.15. Application to Subsidiaries and Branches.

Section 4.16. Verification of Juridical Entities...

Section 4.17. Minimum Documents for Juridical Entities...

Section 4.18, Shell Companies, Definition and Requirements.

Section 4.19. Accounts on Behalf of Another...

Section 4.20. Transactions on Behalf of Clients..

MI.

vil.

vill

ANNEX “A” Examples of Suspicious Transactions,

COL Financial Group, Inc

‘Anti-Money Loundering Operating Manual

RECORD KEEPING

Section 5.1. Required Record:

Section 5.2. Retention Periods...

Section 5.3. Manner of Retention..

COVERED AND SUSPICIOUS TRANSACTIONS

Section 6.1. Covered Transaction Report.

Section 6.2. Suspi

us Transaction Report.

REPORTORIAL REQUIREMENTS.

Section 7.1. System of Reporting...

Section 7.2. Compliance Officer.

Section 7.3. Confidentiality of Reports.

Section 7.4. Duty to Report.

Section 7.5. Register of Covered and Suspicious Transactions...

Section 7.6. Immunity from Criminal Prosecution.

‘COMPLIANCE. 5

Section 9.1. The Compliance Officer...

Section 9.2. Ultimate Responsibility.

TRAINING OF STAFF...

Section 10.1. Orientation and Continuing Training,

Section 10.2. Delegation of Audit and Training...

Section 10.3. Timing and Training Content.

COL Financial Group, Inc.

AntisMoney Laundering Operating Manual

1. INTRODUCTION

Section 1.1. Purpose.

This Anti-Money Laundering Operating Manual (“Manual”) is made pursuant to SEC Memorandum

Circular No. 2, series of 2010, as amended by the 2016 Revised Implementing Rules and Regulations of

Anti-Money Laundering Act.

Section 1.2, Policy Objective.

COL Financial Group, Inc. is committed to doing business with honesty and integrity in compliance with

all applicable laws and regulations and the highest ethical standards. This Manual is adopted to ensure

the prevention of money laundering and terrorist financing, taking into account the minimum

requirements set by applicable laws, rules and regulations, and international best practices.

Section 1.3. Scope.

This Manual shall apply to all directors, officers, employees (regardless of rank and status), agents,

salesmen, solicitors, consultants, and other personnel of COL (collectively, "COL personnel”)

Section 1.4. Definition of Terms.

For the purposes of this Manual, the following terms are defined as follows:

A. “Anti-Money Laundering Act” or the “Act” refers to Republic Act No. 9160, as amended by

Republic Act Nos. 9194, 10167, and 10365 and its Revised Implementing Rules and Regulations.

8. “Anti-Money Laundering Council” or the “Councit” refers to the financial intelligence unit of

the Republic of the Philippines which is the government agency tasked to implement the AMLA,

C. “Associated Person” refers to the person employed by the Broker Dealer whose responsibilities

include internal control supervision of other employees, agents, salesmen, officers, directors,

clerks, and stockholders of such Broker Dealer for compliance with the SRC and rules and

regulations adopted thereunder.

D. “Beneficial Owner” refers to any natural person who ultimately owns or controls the customer

and/or on whose behalf a transaction or activity is being conducted or has ultimate effective

control over a legal person or arrangement.

E. “Broker” refers to a person engaged in the business of buying and selling securities for the

account of others.

F. “Client” or “Customer” refers to any person who hasan account with the Company.

G. “COL” or the “Company” refers to COL Financial Group, Inc.

Ot Financial Group, Inc

Anti-Money Loundering Operating Manual

H. “COL Personnel” refers to all directors, officers, employees (regardless of rank and status),

agents, salesmen, solicitors, consultants, and other personnel of COL

“Covered Institutions” refers to the following:

1

Persons supervised or regulated by Bangko Sentral ng Pilipinas ("BSP"), such as banks,

non-banks, quasi-banks, trust entities, pawnshops, non-stock savings and loan

associations, electronic money issuers, and all other persons and their subsidiaries and

affiliates supervised or regulated by the BSP. For purposes of this Manual, foreign

exchange dealers, money changers, and remittance and transfer companies are covered

persons under the supervision of the BSP.

Persons supervised or regulated by Insurance Commission ("IC"), such as insurance

companies, pre-need companies, insurance agents, insurance brokers, professional

reinsurers, reinsurance brokers, holding companies, holding company systems, mutual

benefit associations, and all other persons and their subsidiaries and affiliates

supervised or regulated by the IC.

Persons supervised or regulated by the Commission, such as securities dealers, brokers,

salesmen, investment houses, and other similar persons managing securities or

rendering services, such as investment agents, advisors, or consultants, mutual funds or

open-end investment companies, close-end investment companies or issuers, and other

similar entities, and other entities, administering or otherwise dealing in commodities,

or financial derivatives based thereon, valuable objects, cash substitutes, and other

similar monetary instruments or properties, supervised or regulated by the SEC.

Designated Non-Financial Businesses and Professions ("DNFBPS”) as defined under the

Act

J. “Covered Transaction” refers to a transaction exceeding Five Hundred Thousand Pesos

(Php500,000.00) within one (1) banking day.

K. “Dealer” refers to any person who buys and sells securities for his own account in the ordinary

course of business.

“Salesman” refers to is a natural person hired to buy and sell securities properly endorsed to

the Commission by the Company.

M. “SEC” or the “Commission” refers to the Securities and Exchange Commission,

N. “Solicitor” refers to a natural person hired to buy and sell mutual fund shares properly endorsed

to the Commission by the Company.

0. “SRC” refers to Republic Act No. 8799, otherwise known as the Securities Regulation Code and

its Implementing Rules and Regulations, as may be amended from time to time.

COL Financial Group, in.

Anti-Money Laundering Operating Manual

P. “Suspicious Transaction” refers to a transaction, regardless of amount, where any of the

following circumstances exists:

1

7

There is no underlying legal or trade obligation, purpose or economic justification;

The client is not properly identified;

The amount involved is not commensurate with the business or financial capacity of the

client;

Taking into account all known circumstances, it may be perceived that the client's

transaction is structured in order to avoid being the subject of reporting requirements

under the Act;

Any circumstance relating to the transaction which is observed to deviate from the

profile of the client and/or the client's past transactions with the covered person;

The transaction is in any way related to an unlawful activity or any money laundering

activity or offense that is about to be committed, is being or has been committed; or

imilar, analogous or identical to any of the foregoing.

Except as otherwise defined herein, all terms used shall have the same meaning as provided in the

Anti-Money Laundering Act.

Ot Financial Group, Inc

Anti-doney Loundering Operating Manual

Il. DESCRIPTION OF MONEY LAUNDERING

Section 2.1. Definition of Money Laundering.

Money Laundering is the processing of the proceeds of a crime to disguise their origin. It is a process

intended to mask the benefits derived from serious offenses or criminal conduct as described under the

‘Act, so that they appear to have originated from a legitimate source.

Section 2.2. Stages of Money Laundering.

The process of money laundering generally comprises of three (3) stages, during which there may be

numerous transactions that could alert the Company to the money laundering activity:

‘A. Placement, or the physical disposal of cash proceeds derived from illegal activity

B. Layering, or the separation of the illicit proceeds from their source by creating complex layers of

financial transactions designed to disguise the audit trail and provide anonymity or to obscure

the source of the funds.

. Integration, or the process which provides appearance of legitimacy to criminally derived

wealth. If the layering process has succeeded, integration schemes place the laundered

proceeds back into the economy in such a way that they re-enter the financial system appearing

to be normal business funds.

Section 2.3. Due Diligence Requirement.

Due diligence must be exercised to prevent the use of the Company as instrument for money

laundering. Salesmen and Solicitors should take all reasonable steps and exercise due diligence to

enable them to establish, to their satisfaction, the true and full identity of each client, and of each

dlient’s source of funds, investment objectives and other related information concerning his financial

situation and needs.

COL Financial Group, in.

Anti-Money Laundering Operating Manual

Ill, BASIC PRINCIPLES AND POLICIES TO COMBAT MONEY LAUNDERING

Section 3.1. Principles.

‘The Company adopts the following principles to combat money laundering:

‘A. Know Your Customer. Before opening an account, the Company shall obtain satisfactory and

competent evidence on the identity of the Client and apply effective procedures to verify their

bona fide identity. The Company shall keep a Customer Account Information Form (“CAIF") of

each of its customers. The Company reserves to change the CAIF from time to time.

B. Compliance with Laws. The Company shall ensure that business is conducted in adherence with

the high ethical standards, that laws and regulations are complied with, and that service is not

provided to any Client if there is good reason to believe that his transactions are associated with

‘money laundering activities,

C. Cooperation with Law Enforcement Agencies. Should there be reasonable grounds to suspect

money laundering, the Company shall fully cooperate with proper law enforcement agencies

within the legal constraints relating to customer confidentiality. For purposes of the Anti-Money

Laundering Act, disclosure of information regarding suspicious transactions and covered

transactions shall be made to the Council,

D. Policies, Procedures, and Training. COL shall ensure that these policies and procedures are

properly disseminated to all COL Personnel and that they are adequately trained on all matters

related to money laundering.

COL Financial Group, Inc.

Anti-Money Laundering Operating Manual

IV, CUSTOMER IDENTIFICATION

In General

Section 4.1. KYC Procedures.

Know your customer measures of the Company includes conducting continuing due diligence on the

business relationship to ensure that the transactions being conducted are consistent with the

Company's knowledge of the customer and/or beneficial owner and their business profile, including,

where necessary, the source of its funds.

Section 4.2. Competent Evidence of Identity.

‘The Company shall obtain and record competent evidence of the true and full identity, representative

capacity, domicile, legal capacity, occupation, or business purposes of clients, as well as other identifying

information, through the use of documents such as, but not limited to:

‘A. Identity documents, such as passports, birth certificates, driver's licenses, and other similar

identity documents, which are verifiable from the institution issuing the same. These identifying

documents should provide evidence of complete name or names used, residential address, date

of birth, nationality, office address, and contact details. They should include at least one (1)

identifying document bearing the photograph and signature of the client. The identifying

documents which are considered most reliable are official identity cards and passports. While

identification documents that are easily obtained in any name e.g. medical cards, credit cards

and student identification cards, may be used, they should not be accepted as the sole means of

identification.

Clients shall present one (1) original official identity card with photo and signature. For this

purpose, the term “official identity card” shall refer to those issued by the National Government

of the Republic of the Philippines, its political subdivisions or instrumentalities, or government

owned and controlled corporations.

Passports issued by foreign governments shall be considered as prima facie identification

documents of foreign clients.

B. Incorporation and partnership papers, for corporate and partnership accounts.

€. Special authorizations for representatives, which must be duly notarized.

The Company shall inform its prospective clients of its explicit policy that business transactions will not

be conducted with those who fail to provide competent evidence of their identity. The above

notwithstanding, the Company reiterates its commitment to report suspicious transactions.

COL Financial Group, Inc.

Anti-Money Laundering Operating Manual,

Section 4.3. Continuing Due Diligence.

‘The Company shall ensure that it knows its customers well, and accordingly, shall keep current and

accurate all material information with respect to their customers by regularly conducting verification

and an update thereof. Information on existing clients should be updated at least once every two (2)

years.

‘The Company shall pay special attention to all unusually large transactions or unusual patterns of

transactions. This applies both to the establishment of a business relationship and to ongoing due

diligence. The background and purpose of such transactions should, as far as possible, be examined, the

findings established in writing, and be available to help competent authorities.

Section 4.4 Acquisition of a Covered Institution.

If the Company acquires the business of another covered institution, either in whole or as a product

portfolio, it is not necessary for the identity of all existing customers to be re-identified, provided that:

‘A. All customer account records are acquired with the business; and

B. Due diligence inquiries do not raise any doubt as to whether the anti-money laundering

procedures previously adopted by the acquired business have satisfied Philippine requirements,

Section 4.5. When Additional Verification Necessary.

Where initial know-your-client verification during account opening falls to identify the applicant, or gives

rise to suspicion/s that the information provided is false, additional verification measures should be

undertaken to determine whether to proceed with the business and/or make a suspicious transaction

report. Details of any additional verification are to be recorded in writing and be made available for

inspection by the Commission or appropriate authorities.

Further, additional measures to verify the identity of the customer or the beneficial owner, as

applicable, shall be taken if during the business relationship, the Company has reason to doubt the

accuracy of the information relating to the customer's identity, that the customer is the beneficial

owner, or the customer’s declaration of beneficial ownership.

Section 4.6. Rejection of Accounts.

‘The Company shall not open accounts or commence business if it cannot form a reasonable belief that it

knows the true identity of a customer or when the customer is unable to comply with the Company's

know-your-client procedures,

Section 4.7. Notice to Clients.

‘The Company shall provide customers with adequate notice that it is requesting information to verify

their identities.

10

Ot Financial Group nc

‘Anti-Money Loundering Operating Manual

Section 4.8. Third Party Reliance.

‘The Company may rely on a third party to perform customer identification, including face-to-face

contact. The third party shall be:

‘A. ACovered Institution; or

B. A financial institution or DNFBP operating outside the Philippines that is covered by equivalent

customer identification and face-to-face requirements.

Notwithstanding the foregoing, the ultimate responsibility for identifying the customer remains with the

Company; Provided, that in cases of high risk customers, the Company shall also conduct enhanced due

diligence procedure.

Section 4.9, Outsourcing the Conduct of Customer Identification.

The Company may outsource the conduct of customer identification, including face-to-face contact, to a

counter-party, intermediary, or agent. The outsource, counter-party, or intermediary shall be regarded

as agent of the Company. The ultimate responsibility for identifying the customer and keeping the

identification documents remains with the Company.

‘The Company shall ensure that the employees or representatives of the counter-party, intermediary, or

agent undergo equivalent training program as that of the Company's own employees undertaking

similar activity.

Section 4.10. Account Holder Name.

Accounts should be maintained only in the name of the account holder. Anonymous accounts, fictitious

accounts, accounts under incorrect names, numbered accounts, and similar accounts are not allowed.

Section 4.11. Reduced Due Diligence for Low Risk Customers.

In general, the full range of customer due diligence measures should be applied. However, if the risk of

money laundering or the financing of terrorism is lower based on the Company's assessment, and if,

information on the identity of the customer and the beneficial owner is publicly available, or adequate

checks and controls exist elsewhere in national systems, it could be reasonable for covered institutions

to apply simplified or reduced customer due diligence measures when identifying and verifying the

identity of the customer, the beneficial owner and other parties to the business relationship. Simplified

or reduced customer due diligence measures could apply to the following customers:

‘A. Financial institutions where they are subject to requirements to combat money laundering and

the financing of terrorism consistent with the Financial Action Task Force ("FATF")

Recommendations, and are supervised for compliance with those controls;

B. Public companies that are subject to regulatory disclosure requirements; and

C. Government institutions and its instrumentalities.

rT

COL Financial Group, Inc

Anti-Money Loundering Operating Manual

Personal Accounts

Section 4.12. Minimum Information from individual Clients.

The Company shall obtain from all individual clients the following informatior

Customer name;

Date and place of birth;

Nationality;

Contact details;

Email address;

Present and Permanent address;

Employment status;

Tax identification number, social security number, or government service and insurance system

number;

Name of employer or business, office contact details, and office address;

Whether the customer is an officer or director of a company listed on the Exchange;

Whether the customer is associated with another broker dealer;

Financial information such as assets, net worth, and annual income;

Sources of fund

Investment experience and investment objectives; and

Specimen signatures.

Zommonep

ozerase

Pursuant to SRC Rule 34.4, the Company cannot open accounts for stockholders, directors, officers,

associated persons, salesmen, and other employees of another broker dealer unless they obtain

permission from their employer and provided that the Company agrees to provide a duplicate account

statement to the affiliated member broker.

Section 4.13, Original Documents.

Individual clients who present only photocopies of identification card and other documents shall be

required to produce the original documents thereof for verification purposes.

High Risk Customers

Section 4.14, High Risk Customers.

The Company shall give special attention to business relationships and transactions with persons,

including companies and financial institutions, from countries which do not or insufficiently apply the

FATF Recommendations. Whenever these transactions have no apparent economic or visible lawful

purpose, their background and purpose should, as far as possible, be examined, the findings established

in writing, and be available to help competent authorities,

Customers from countries that do not have or insufficiently apply anti-money laundering measures are

considered high risk customers. In addition to the minimum requirements applicable to all customers,

2

COL Financial Group, In.

‘Anti-Money Laundering Operating Manual

the Company must also establish the source of wealth of such high risk customers. Decisions on business

relations with high risk customers must be taken by its senior management.

Section 4.15. Application to Subsidiaries and Branches.

‘The Company shall ensure that the principles applicable to the parent company are also applied to

branches and majority owned subsidiaries located abroad, especially in countries which do not or

insufficiently apply the anti-money laundering measures implemented in the Philippines, to the extent

that local applicable laws and regulations permit. When local applicable laws and regulations of the

foreign branch or subsidiary prohibit such implementation, the Commission should be informed by the

covered institutions that they cannot apply the anti-money laundering measures of the Philippines.

Juridical Entities

Section 4.16. Verification of Juridical Entities.

Before establishing a business relationship, the Company shall conduct a company search and/or other

commercial inquiry to ensure that the corporate/other business applicant has not been, or is not in the

process of being dissolved, struck off, wound-up, or terminated. In case of doubt as to the veracity of

the corporation or identity of its directors and/or officers, or of the business or its partners, a search or

inquiry with the Commission or the relevant Supervising Authority/Regulatory Agency shall be made.

Section 4.17. Minimum Documents for Juridical Entities.

The Company shall request for the following relevant documents from juridical entities regulated in the

Philippines:

A. Copies of the Certificate of Registration issued by the Department of Trade and Industry, for

single proprietors, or by the Commission, for corporations and partnerships, including the

Articles of Incorporation or Certificate of Partnership, as appropriate; copies of the By-Laws of

the corporation; the latest General Information Sheet, which lists the names of

irectors/trustees/partners and principal stockholders; and secondary licenses, if any; and other

documents such as but not limited to clearance/certification from the Commission that the

company is active and compliant with the reportorial requirements.

The original or certified true copies of any or all the foregoing documents, where required,

should be produced for comparison and verification.

n forms or account opening authority

B. Appropriate board resolutions and signed appl

containing specimen signatures.

C. Where necessary and reasonable, the Company may also require additional information about,

the nature of the business of clients, copies of identification documents of shareholders,

directors, officers and all authorized signatories,

D. Sworn statement as to the existence or non-existence of beneficial owners.

3

COL Financial Group, In.

‘Anti-Money Laundering Operating Manual

The type of measures that would normally be needed to satisfactorily perform identification of

beneficial owners would require identifying the natural persons with a controlling interest and

identifying the natural persons who comprise the management of the legal person or arrangement.

Where the customer or owner of the controlling interest is a public company that is subject to

regulatory disclosure requirements, it is not necessary to seek to identify and verify the identity of

any shareholder of that company.

For companies, businesses or partnerships registered outside the Philippines, comparable

documents are to be obtained, duly authenticated by the Philippine Consulate where said entities

are located.

If significant changes to the company structure or ownership occur subsequently, or suspicions arise

a @ result of a change in the payment profile as reflected in a company account, further checks are

to be made on the identities of the new owners.

‘Shell Companies

Section 4.18. Shell Companies, Definition and Requirements.

Shell companies are legal entities without business substance in their own right but through which

financial transactions may be conducted. Shell companies may be abused by money launderers and

therefore be cautious in their dealings with them.

In addition to the requirement for all juridical persons, the Company shall also obtain a certification

from the Board of Directors as to the purposes of the owners/stockholders in acquiring the shell

company. There must likewise be satisfactory evidence of the identities of the beneficial owners,

bearing in mind the “know-Your-Customer” principle.

‘Trust, Nominee, and Fiduciary Accounts

Section 4.19. Accounts on Behalf of Another.

The Company shall establish whether the client is acting on behalf of another person as a trustee,

nominee, or agent. In such a case, the Company shall obtain competent evidence of the identity of such

agents and authorized signatories, and the nature of their trustee or nominee capacity and duties.

Where the Company has reason to suspect that the trustee, nominee, or agent is being used as a

dummy in circumvention of existing laws, it shall immediately make further inquiries to verify the status

of the business relationship between the parties. If satisfactory evidence of the beneficial owners cannot,

be obtained, the Company shall consider whether to proceed with the business, bearing in mind the

“know-Your-Customer” principle. If the Company decides to proceed, it shall record any misgivings and

give extra attention to monitoring the account in question.

1

COL Financial Group, In.

Anti-Money Laundering Operating Manual

Where the account is opened by a firm of lawyers or accountants, the Company shall make reasonable

inquiries about transactions passing through the subject accounts that give cause for concern, or from

reporting those transactions if any suspicion is aroused. if @ money laundering Suspicious Transaction

Report is made to the Council in respect of such client’s account/s, the Council will seek information

directly from the lawyers or accountants as to the identity of its client and the nature of the relevant

transaction, in accordance with the powers granted to it under the AMLA, as amended, and other

pertinent laws.

Section 4,20, Transactions on Behalf of Clients.

Where transactions are undertaken on behalf of account holders, the Company shall take particular care

to ensure that the person giving instructions is authorized to do so by the account holder.

The Company shall not undertake transactions for non-account holders.

8

OL Financial Group Inc.

‘Anti-Money Loundering Operating Manual

V. RECORD KEEPING

Section 5.1. Required Records.

The Company shall prepare and maintain documentation on their customer relationships and

transactions such that:

A. Requirements of the Act are fully met;

B. Any transaction effected through the Company can be reconstructed and from which the

Council will be able to compile an audit trail for suspected money laundering, when such a

report is made to it; and

The Company can satisfy within a reasonable time any inquiry or order from the AMILC as to

disclosure of information, including without limitation whether a particular person is the

customer or beneficial owner of transactions conducted through the Company.

Section 5.2. Retention Periods.

The following document retention periods shall be followed:

‘A. All records if all transactions, especially customer identification records, shall be maintained and

safely stored for five (5) years from the dates of transactions.

B. With respect to closed accounts, the records on customer identification, account files and

business correspondence, shall be preserved and safely stored for at least five (5) years from the

dates when they were closed.

€. The necessary records in compliance with the Books and Records Rule and Records Retention

Rule of the SRC.

Provided, that if the records relate to on-going investigations or transactions that have been the subject

of a disclosure, they shall be retained beyond the stipulated retention period until it is confirmed that

the case has been closed and terminated.

Section 5.3. Manner of Retention.

Transaction documents may be retained as originals or copies, on microfilm, or in electronic form,

provided that such forms are admissible in court, pursuant to the Revised Rules of Court and the E-

Commerce Act and its Implementing Rules and Regulations.

16

Ot Financial Group, nc.

‘Anti-Money Loundering Operating Monval

VI. COVERED AND SUSPICIOUS TRANSACTIONS

Section 6.1. Covered Transaction Report.

‘The Company shall file Covered Transaction Report within ten (10) working days from occurrence

thereof before the Council for covered transactions.

Section 6.2. Suspicious Transaction Report.

The Company shall file a Suspicious Transaction Report before the Coun

the transaction where any of the following circumstances exists:

|, regardless of the amount of

‘A. There is no underlying legal or trade obligation, purpose, or economic justification

8. The client is not properly identified;

C. The amount involved is not commensurate with the business or financial capacity of the client;

D. Taking into account all known circumstances, it may be perceived that the client's transaction is

structured in order to avoid being the subject of reporting requirements under the Act;

E. Any circumstance relating to the transaction which is observed to deviate from the profile of the

client and/or the client’s past transactions with the covered institution;

F, The transaction is in any way related to an unlawful activity or offense under this Act that is

about to be, is being or has been committed; or

G. Any transaction that is similar or analogous to any of the foregoing.

A suspicious transaction, as a general principle, relates to any transaction involving a number of factors

which together raise a suspicion in the mind that the transaction may be connected with an unlawful

A list of examples of suspicious transactions is attached in Annex “A” hereof. This list is not

exhaustive and only provides examples of the most basic ways in which money may be laundered.

Identification of any of the transactions listed should prompt initial enquiries and, if necessary, further

investigations on the source of funds.

v7

COL Financial Group, Inc

Anti:Money Laundering Operating Manual

VI. REPORTORIAL REQUIREMENTS

Section 7.1. System of Reporting.

‘The Company shall institute a system for the mandatory reporting of covered transactions and

suspicious transactions.

Section 7.2. Compliance Officer.

The Company shall designate a Compliance Officer at management level who will be in charge of the

implementation of this Operating Manual and the application of the internal programs and procedures,

including customer identification policies and procedures, proper maintenance of records, reporting of

covered and suspicious transactions to the Council, internal audits, and training of employees.

Section 7.3. Confidentiality of Reports.

COL Personnel shall not warn their customers that information relating to them has been reported or is

in the process of being reported to the Council, or communicate, directly or indirectly, such information

to any person other than the Council. Any violation of this confidentiality provision shall render them

liable for criminal, civil and administrative sanctions under the Act.

Section 7.4. Duty to Report.

All COL Personnel shall report any knowledge or suspicion of money laundering activity to the

Compliance Officer. It shall be the duty of such reporting officer to evaluate any report in light of all the

relevant information available to determine whether there is a reasonable ground to suspect money

laundering,

After a thorough evaluation and reasonable belief that there is a basis to suspect the intent to or that

money laundering has taken place, the Compliance Officer shall file the necessary reports with the

Council.

Section 7.5. Register of Covered and Suspicious Transactions.

The Company shall maintain a register of all suspicious transactions that have been brought to the

attention of its Compliance Officer, including transactions that are not reported to the Council

It shall likewise maintain a register of all covered transactions which are not reported to the Council, if

any.

The registers shall contain details of the date on which the report is made, the person who made the

report to its Compliance Officer, and information sufficient to identify the relevant papers related to

said reports.

18

COL Financial Group, Ine.

“Anti-Money Laundering Operating Manual

Section 7.6. Immunity from Criminal Prosecution.

No administrative, criminal, or civil proceedings shall lie against any person for having made a suspicious

or covered transaction report in the regular performance of his duties and in good faith, whether or not

such reporting results in any criminal prosecution under the Act or any other Philippine law. The

Company and COL Personnel shall likewise not be liable for any loss arising out of such disclosure, or any

act or omission, in relation to the fund, property or investment in consequence of the disclosure, where

such is made in good faith and in the regular performance of their duties under the Act.

~

COL Financial Group, Inc

‘Anti-Money Laundering Operating Manual

vill, COMPLIANCE

Section 9.1. The Compliance Officer.

The Company shall designate a Compliance Officer who shall advise its management and staff on the

issuance and enforcement of in-house instructions to promote adherence to the Act, its implementing

rules and regulations, this Manual, including personnel training, reporting of covered and suspicious

transactions, and generally, all matters relating to the prevention of money laundering.

The Compliance Officer shall be:

A. Duly registered as an Associated Person with the Commission;

B. Asenior officer with relevant qualifications and experience to enable him to respond sufficiently

‘well to inquiries relating to the relevant person and the conduct of its business;

C._ Responsible for establishing and maintaining a manual of compliance procedures in relation to

the business of the Company;

. Responsible for ensuring compliance by the staff with the provisions of the Act, its implementing

rules and regulations, and this Manual;

E. Responsible for disseminating to COL Personnel memorandum circulars, resolutions,

instructions, and policies issued by the Council and by the Commission in all matters relating to

the prevention of money laundering;

F. The liaison between the Company and the Council in matters relating to compliance with the

provisions of the Act and its implementing rules and regulations; and

G. Responsible for the preparation and submission to the Council of written reports on the

Company's compliance with the Act and its implementing rules and regulations.

The above notwithstanding, the Company reiterates its policy that the reporting of covered and

suspicious transactions must start from every COL Personnel. Said COL Personnel, after assessing any

transaction as either a covered or suspicious transaction, shall report the same to the Compliance

Officer, who, after a review of the circumstances, may report the same to the Council

Section 9.2. Ultimate Responsibility.

Notwithstanding the duties of the Compliance Officer, the ultimate responsibility for proper supervision,

reporting and compliance under the Act and its implementing rules and regulations shall rest with the

Company and its Board of Directors.

20

COL Financial Group, ine

“Anti:Money Laundering Operating Manual

1X. TRAINING OF STAFF

Section 10.1. Orientation and Continuing Training.

The Company shall provide education and continuing training for all its staff and personnel, including

directors and officers, to ensure that they are fully aware of their personal obligations and

responsibilities in combating money laundering and to be familiar with its system for reporting and

investigating suspicious matters.

Section 10.2. Delegation of Audit and Training.

‘The Company may assign the internal audit or training functions to another person (e.g. professional

association, parent company or external auditors). In case of such delegation, due diligence must be

exercised to ensure that the persons appointed are able to perform these functions effectively and the

fact of such appointment must be relayed in writing to the Commission or to the Council

Section 10.3, Timing and Training Content.

on of the COL Personnel according to

The Company shall determine the extent of training and

its own needs.

‘The Company shall, at least once a year, make arrangements for refresher training to remind key staff of

their responsibilities and to make them aware of any changes in the laws and rules relating to money

laundering, as well as the internal procedures of the Company.

CHairman of the Board

2

COL Financial Group, nc.

“Anti-Money Laundering Operating Manual

ANNEX “A” -EXAMPLES OF SUSPICIOUS TRANSACTIONS:

General Comments

This list is intended mainly to highlight the basic ways in which money may be laundered. While each

individual situation may not be sufficient to suggest that money laundering is taking place,

combination of such situations may be indicative of such a transaction. Further, the list is by no means

complete or exhaustive and will require constant updating and adaptation to changing circumstance and

new methods of laundering money. The list is intended solely as an aid, and must not be applied as a

routine instrument in place of common sense.

Examples of Suspicious Transactions

‘A. Transactions Which do not Make Economic Sense

1. Transactions not in keeping with the customer's normal activity, the financial markets in

which the customer is active, and the business which the customer operates.

2. Buying and selling of securities with no discernible purpose in circumstances which

appear unusual

3, Transactions not in keeping with normal practice in the market in which they relate, e.g.,

with reference to market size and frequency, or at off-market prices, early termination

of products at a loss due to front end loading or early cancellation, especially where

cash had been tendered and/or the refund check is to a third party.

4, Other transactions linked to the transaction in question which could be designed to

disguise money and divert it to other forms or to other destinations or beneficiaries.

5. The entry of matching buys and sells in particular securities, wash sales, creating an

illusion of trading. Such wash trading does not result in a bona fide market position and

might provide “cover” for a money launderer.

6. Wash trading through multiple accounts of the same customer with the same or

different broker(s) might be used to transfer accounts by generating offsetting losses

and profits in different accounts.

7. Unusual transfers of positions between accounts, whether or not commonly owned.

8 Abnormal settlement instructions, including payment to apparently unconnected

parties, and/or where such instructions for settlement are not in accordance with the

Usual practice of the market or the Regulated Intermediary.

2

COL Financial Group, In.

{Anti-Money Laundering Operating Manual

B. Transactions Involving Overseas Jurisdiction,

2

‘A customer introduced by an overseas bank, affiliate, Regulated Intermediary or other

investor, all of which are based in countries where production of drugs, drug trafficking

or graft and corruption may be prevalent.

A large number of security transactions across a number of jurisdictions.

C. Transactions Involving Unidentified Parties

1

‘Apersonal customer for whom verification of identity proves unusually difficult and who

is reluctant to provide details.

‘Acorporate/trust customer where there are difficulties and delays in obtaining copies of

the accounts or other documents of incorporation.

Any transaction in which the counterparty to the transaction is unknown.

Settlement either by registration or delivery of securities to be made to an unverified

third party.

Customers who wish to maintain a number of trustee or customers’ accounts that do

not appear consistent with their type of business, including transactions that involve

nominee names.

‘A number of transactions by the same counterparty in small amounts relating to the

same security, each purchased for cash, then sold in one transaction, the proceeds

being credited to an account different from the original account, the owner of whict

unverified.

D. Miscellaneous

1

Large or unusual transactions in cash or bearer forms, remittances and transfers of

funds.

‘The use of a customer of an intermediary to holds funds that are not being used to trade

in securities.

‘Acustomer who deals with an intermediary only in cash or cash equivalents rather than

through banking channels.

‘A customer who opens several accounts, in his own name or that of a nominee/s,

trustee/s, agent/s, or dummy/ies, that do not appear to be consistent with their type of,

business.

2

COL Financial Group, inc

Anti-Money Laundering Operating Manual

The known background of the person conducting the transaction is not consistent with

the transaction, and/or any unusual behavior in conducting the transaction;

The production of seemingly false identification in connection with any transaction, the

use of aliases and a variety of different addresses;

A client with no discernible purpose for using the covered institution's service, where

such service can easily be provided elsewhere with more convenience to client.

Py

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Memorandum - 2023-013Document1 pageMemorandum - 2023-013mlnathalie4012No ratings yet

- Faith That WaversDocument24 pagesFaith That Waversmlnathalie4012No ratings yet

- Memo 2009-0202 PDFDocument3 pagesMemo 2009-0202 PDFmlnathalie4012No ratings yet

- Memo 2009-0047Document1 pageMemo 2009-0047mlnathalie4012No ratings yet

- TPA - No. 2019-0002: TO: Trading Participants Subject: Trading of Pse Shares Date: January 4, 2019Document5 pagesTPA - No. 2019-0002: TO: Trading Participants Subject: Trading of Pse Shares Date: January 4, 2019mlnathalie4012No ratings yet

- TO: Trading Participants Date: January 15, 2018 Subject: PSE Front-End Trading Sytem EnhancementsDocument5 pagesTO: Trading Participants Date: January 15, 2018 Subject: PSE Front-End Trading Sytem Enhancementsmlnathalie4012No ratings yet

- Memo For Brokers: Secunrrres Clenntno Conpomrron of The Pxrr-RpprnesDocument2 pagesMemo For Brokers: Secunrrres Clenntno Conpomrron of The Pxrr-Rpprnesmlnathalie4012No ratings yet

- Keith Martin - Because of YouDocument3 pagesKeith Martin - Because of Youmlnathalie4012100% (1)

- Tpa 2018-0071Document2 pagesTpa 2018-0071mlnathalie4012No ratings yet

- GV Directors Certificate-Amendent To Articles of Incorporation DEFAULTDocument2 pagesGV Directors Certificate-Amendent To Articles of Incorporation DEFAULTmlnathalie4012No ratings yet