Professional Documents

Culture Documents

Corporate America and Sarbanes

Corporate America and Sarbanes

Uploaded by

Mohammad Nowaiser MaruhomCopyright:

Available Formats

You might also like

- Chap 012Document20 pagesChap 012Hemali MehtaNo ratings yet

- Module in Criminal Law Book 2 (Criminal Jurisprudence)Document11 pagesModule in Criminal Law Book 2 (Criminal Jurisprudence)felixreyes100% (3)

- Queen NogukDocument1 pageQueen NogukEllen LabradorNo ratings yet

- Securities and Exchange Commission: Sarbanes-Oxley ActDocument10 pagesSecurities and Exchange Commission: Sarbanes-Oxley ActLedayl MaralitNo ratings yet

- Sox 2002Document2 pagesSox 2002commoNo ratings yet

- Ethics For A Post-Enron America: John R. BoatrightDocument2 pagesEthics For A Post-Enron America: John R. Boatrightayoub dangerNo ratings yet

- Sarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014Document12 pagesSarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014jadeen serviceNo ratings yet

- Operation Audit Case AnalysisDocument3 pagesOperation Audit Case AnalysisEu RiNo ratings yet

- Value Creation Through Corporate GovernanceDocument11 pagesValue Creation Through Corporate GovernanceAbdel AyourNo ratings yet

- Ans:-The Determinants of Structure of Financial Markets AreDocument3 pagesAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNo ratings yet

- Basic Facts of Sox LawDocument2 pagesBasic Facts of Sox LawnamuNo ratings yet

- Cato Handbook Congress: Washington, D.CDocument9 pagesCato Handbook Congress: Washington, D.CDiscoverupNo ratings yet

- Enron Case StudyDocument6 pagesEnron Case Studyali goharNo ratings yet

- Case StudyDocument17 pagesCase StudyAmit RajoriaNo ratings yet

- Acct 201 - Chapter 4Document24 pagesAcct 201 - Chapter 4Huy TranNo ratings yet

- Internal ControlsDocument40 pagesInternal ControlsARIEL FRITZ CACERESNo ratings yet

- Oxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesDocument21 pagesOxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesposttoamitNo ratings yet

- Assignment On Sarbanes Oaxley Act 2Document4 pagesAssignment On Sarbanes Oaxley Act 2Haris MunirNo ratings yet

- Corporate Governance: The Worldcom Scandal: Ugba107 Week 11Document16 pagesCorporate Governance: The Worldcom Scandal: Ugba107 Week 11Clarence FernandoNo ratings yet

- Congress Disclosures Enron Corporation Worldcom Financial StatementsDocument4 pagesCongress Disclosures Enron Corporation Worldcom Financial StatementsMichael Olmedo NeneNo ratings yet

- The Sarbanes-Oxley Act: costs, benefits and business impactsFrom EverandThe Sarbanes-Oxley Act: costs, benefits and business impactsNo ratings yet

- The Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceDocument4 pagesThe Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceShiney BenjaminNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Sob 2022 Assignment 1-1Document8 pagesSob 2022 Assignment 1-1mwenifumbocheluNo ratings yet

- Sec Compliance, Disclosure and Enforcement Challenges in The New EraDocument31 pagesSec Compliance, Disclosure and Enforcement Challenges in The New EraKok MengNo ratings yet

- Discussion Computer AccountingDocument4 pagesDiscussion Computer AccountingArceeNo ratings yet

- The Goals and Promise of The Sarbanes-Oxley Act: John C. Coates IVDocument26 pagesThe Goals and Promise of The Sarbanes-Oxley Act: John C. Coates IVbm08smmNo ratings yet

- Sarbanes Oxley ActDocument17 pagesSarbanes Oxley Actglenndso100% (2)

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- Enron Case History and Major Issues SummaryDocument6 pagesEnron Case History and Major Issues Summaryshanker23scribd100% (1)

- Sarbanes Oxley Act DissertationDocument7 pagesSarbanes Oxley Act DissertationWhatShouldIWriteMyPaperAboutCanada100% (1)

- Trust Markets GovDocument10 pagesTrust Markets GovwhitestoneoeilNo ratings yet

- 1st Asignment of Financial ManagDocument2 pages1st Asignment of Financial ManagHamza AbbasNo ratings yet

- 10 - SoxDocument2 pages10 - Soxreina maica terradoNo ratings yet

- Enron Scandal: Managing Finance and Financial DecisionsDocument10 pagesEnron Scandal: Managing Finance and Financial Decisions'Sabur-akin AkinadeNo ratings yet

- Sarbanes Oxley ActDocument3 pagesSarbanes Oxley ActRomnick PascuaNo ratings yet

- EnronDocument30 pagesEnronrakshitgupta17No ratings yet

- 3 A Brief History of CGDocument27 pages3 A Brief History of CGM YounasNo ratings yet

- Financial Reporting and The Securities and Exchange CommissionDocument18 pagesFinancial Reporting and The Securities and Exchange CommissionJordan YoungNo ratings yet

- Challenges of Audit ProfessionDocument8 pagesChallenges of Audit ProfessionEershad Muhammad GunessNo ratings yet

- Research Paper On Sarbanes Oxley ActDocument7 pagesResearch Paper On Sarbanes Oxley Actegw0a18w100% (1)

- Aj Ibañez - Assignment 2Document19 pagesAj Ibañez - Assignment 2AJ Louise IbanezNo ratings yet

- Case Study Session 1 Group 7Document4 pagesCase Study Session 1 Group 7rifqi salmanNo ratings yet

- Aj Ibañez - Assignment 2Document19 pagesAj Ibañez - Assignment 2AJ Louise IbanezNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyatz24No ratings yet

- Corporate Governance & Insurance Industry.Document42 pagesCorporate Governance & Insurance Industry.Parag MoreNo ratings yet

- Managerial FinanceDocument4 pagesManagerial Financeinnies duncanNo ratings yet

- Good GovernanceDocument73 pagesGood GovernanceJhoan Gestoso De Sosa100% (1)

- Lesson 1 Governance Additional NotesDocument6 pagesLesson 1 Governance Additional NotesCarmela Tuquib RebundasNo ratings yet

- The Worldcom Scandal: How Worldcom Shuffled Its BooksDocument2 pagesThe Worldcom Scandal: How Worldcom Shuffled Its BooksAaditya ManojNo ratings yet

- Freddie Mac Scandal Report PDFDocument4 pagesFreddie Mac Scandal Report PDFaditikhasnisNo ratings yet

- Sarbanes - Oxley Act: United States Federal LawDocument8 pagesSarbanes - Oxley Act: United States Federal LawJayanta ChowdhuryNo ratings yet

- Sarbanes-Oxley (SOX) Act of 2002: Presented by GroupDocument11 pagesSarbanes-Oxley (SOX) Act of 2002: Presented by GroupMathew Joshy 18099No ratings yet

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyNo ratings yet

- Sarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingDocument4 pagesSarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingRavi MarwahNo ratings yet

- Akshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleDocument27 pagesAkshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleBhavya KapoorNo ratings yet

- Computer AssociatesDocument18 pagesComputer AssociatesRosel RicafortNo ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- Audit CaseDocument15 pagesAudit CaseSyad Shahidah100% (1)

- ZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionFrom EverandZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionNo ratings yet

- Case AnalysisDocument3 pagesCase AnalysisMohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expenxe Tracking - February 2021Document6 pagesMaruhom - Expenxe Tracking - February 2021Mohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expenxe Tracking - January 2021Document5 pagesMaruhom - Expenxe Tracking - January 2021Mohammad Nowaiser MaruhomNo ratings yet

- Name of Student Dec-18 Jan-08 Jan-15 Jan-22 Jan-29 IN OUT IN OUTDocument2 pagesName of Student Dec-18 Jan-08 Jan-15 Jan-22 Jan-29 IN OUT IN OUTMohammad Nowaiser MaruhomNo ratings yet

- Whole Foods Market - Me Case StudyDocument3 pagesWhole Foods Market - Me Case StudyMohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expense Tracking - Jan 2021Document5 pagesMaruhom - Expense Tracking - Jan 2021Mohammad Nowaiser MaruhomNo ratings yet

- Maruhom-Concept MapDocument1 pageMaruhom-Concept MapMohammad Nowaiser MaruhomNo ratings yet

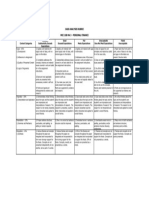

- Case Analysis Rubric Mec 108 Ma 3 - Personal FinanceDocument1 pageCase Analysis Rubric Mec 108 Ma 3 - Personal FinanceMohammad Nowaiser MaruhomNo ratings yet

- Maec-1 UpdatedDocument1 pageMaec-1 UpdatedMohammad Nowaiser MaruhomNo ratings yet

- Graduated Income Tax Rates Under Section 24 (A) (2) of The Tax Code of 1997, As Amended by RepublicDocument10 pagesGraduated Income Tax Rates Under Section 24 (A) (2) of The Tax Code of 1997, As Amended by RepublicMohammad Nowaiser MaruhomNo ratings yet

- Submitted By: Maruhom, Macapodi, Camama, Guiling, Pandapatan, Neri, Macaayan, Mangurun, Mira-Ato, Villaroya, Mila, UmparaDocument3 pagesSubmitted By: Maruhom, Macapodi, Camama, Guiling, Pandapatan, Neri, Macaayan, Mangurun, Mira-Ato, Villaroya, Mila, UmparaMohammad Nowaiser MaruhomNo ratings yet

- R.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsDocument6 pagesR.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsMohammad Nowaiser MaruhomNo ratings yet

- AIS - Written ReportDocument10 pagesAIS - Written ReportMohammad Nowaiser MaruhomNo ratings yet

- Cream and Brown Illustration Social Science Class Education Presentation PDFDocument7 pagesCream and Brown Illustration Social Science Class Education Presentation PDFMohammad Nowaiser MaruhomNo ratings yet

- Physical Disability: Perspectives in Appreciating Diversities in SocietyDocument12 pagesPhysical Disability: Perspectives in Appreciating Diversities in SocietyMohammad Nowaiser MaruhomNo ratings yet

- FWT, CWT, Gross Income, DividendsDocument10 pagesFWT, CWT, Gross Income, DividendsMohammad Nowaiser MaruhomNo ratings yet

- Template - Parent Consent FormDocument1 pageTemplate - Parent Consent FormMohammad Nowaiser MaruhomNo ratings yet

- Mutual Funds Price ListDocument6 pagesMutual Funds Price ListMohammad Nowaiser MaruhomNo ratings yet

- GimDocument165 pagesGimmdgemrNo ratings yet

- 1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessDocument5 pages1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessdhaiwatNo ratings yet

- Gene Keys: Hologenetic ProfileDocument3 pagesGene Keys: Hologenetic ProfileContactNo ratings yet

- Bang! Card Breakdown - Character CardsDocument3 pagesBang! Card Breakdown - Character Cardsxosajo7647No ratings yet

- Hover-1 I-200 Hoverboard With Built-In Bluetooth Speaker, LED Headlights, LED Wheel Lights, 7 MPH Max Speed - Black - Walmart - CoDocument1 pageHover-1 I-200 Hoverboard With Built-In Bluetooth Speaker, LED Headlights, LED Wheel Lights, 7 MPH Max Speed - Black - Walmart - CoAhmad GadsonNo ratings yet

- hsk3 Exam h31327Document18 pageshsk3 Exam h31327Elizabeth FernandezNo ratings yet

- THEO530 Book Critique 1 Heikkinen "Two Views On Women in MinistryDocument10 pagesTHEO530 Book Critique 1 Heikkinen "Two Views On Women in MinistryCrystal HeikkinenNo ratings yet

- tb10 1Document14 pagestb10 1PeterNo ratings yet

- John Duda - Cybernetics, Anarchism and Self-OrganisationDocument21 pagesJohn Duda - Cybernetics, Anarchism and Self-OrganisationBloomNo ratings yet

- Group Assignment SM.Document6 pagesGroup Assignment SM.Waheed LangahNo ratings yet

- Notification AAICLAS Security Screener Posts PDFDocument15 pagesNotification AAICLAS Security Screener Posts PDFPraveen laxkarNo ratings yet

- ResumeDocument4 pagesResumeJulie RaftiNo ratings yet

- Franchisee Advisory Network (Partner) - Fan (P) Information PaperDocument5 pagesFranchisee Advisory Network (Partner) - Fan (P) Information PaperAditi SinghNo ratings yet

- What The Meaning of LifeDocument2 pagesWhat The Meaning of Life星が輝く夜AdamNo ratings yet

- How To Write A DigestDocument1 pageHow To Write A DigestClark Lim100% (1)

- EO-GA-21 Expanding Open Texas COVID-19Document8 pagesEO-GA-21 Expanding Open Texas COVID-19Amber NicoleNo ratings yet

- Debate TCCNDocument29 pagesDebate TCCNViệt Phương NguyễnNo ratings yet

- Cosh TermsDocument8 pagesCosh TermsMike Vanjoe SeraNo ratings yet

- Communication Past Exam 22 - 23 Answers - Done by Lugy-2Document8 pagesCommunication Past Exam 22 - 23 Answers - Done by Lugy-2Lugy AnanNo ratings yet

- Motion To Compel Stephen RobesonDocument9 pagesMotion To Compel Stephen RobesonWXYZ-TV Channel 7 DetroitNo ratings yet

- Makina 2Document7 pagesMakina 2Keneth Brayle LorenzoNo ratings yet

- Accounting EquationDocument14 pagesAccounting EquationDindin Oromedlav LoricaNo ratings yet

- 2024 Calendar WebDocument20 pages2024 Calendar WebgreenietorbesNo ratings yet

- Cameral AccountingDocument4 pagesCameral Accountingchin_lord8943No ratings yet

- Restoration Ecology - 2023 - Rother - Historical Trajectory of Restoration Practice and Science Across The BrazilianDocument11 pagesRestoration Ecology - 2023 - Rother - Historical Trajectory of Restoration Practice and Science Across The Brazilianstella.mdlrNo ratings yet

- DIG - Vir Jen Shipping and Marine Services Vs NLRC 1983 Case DigestDocument4 pagesDIG - Vir Jen Shipping and Marine Services Vs NLRC 1983 Case DigestKris OrenseNo ratings yet

- Natres Finals ReviewerDocument32 pagesNatres Finals ReviewerAavhNo ratings yet

- Sample DIARY - CASDocument5 pagesSample DIARY - CASDAN DNANo ratings yet

Corporate America and Sarbanes

Corporate America and Sarbanes

Uploaded by

Mohammad Nowaiser MaruhomOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Corporate America and Sarbanes

Corporate America and Sarbanes

Uploaded by

Mohammad Nowaiser MaruhomCopyright:

Available Formats

Corporate America and Sarbanes-Oxley Act: The Costs vs

Benefits

Abstract: In response to the wave of scandals that damaged the reputation of corporate

America, in 2002, the Securities Exchange Commission (SEC) formulated the Sarbanes-Oxley

Act. The Sarbanes-Oxley Act intended to improve transparency, management accountability

and bring in accuracy in corporate disclosures and help restore investors' confidence. Analysts

believed that the benefits of the law would be realised in the long run and would help

corporate America improve its tarnished image. However, companies had to bear huge

compliance-related costs of the act. To bypass the act and avoid these huge costs they began to

de-list from the New York Stock Exchange (NYSE) and other US stock exchanges. The case

details the accounting irregularities and frauds that have gradually come to light since 2001

Pedagogical Objectives:

To understand the conflict of interest between accounting and consulting professions,

considered to be one of the reasons for such failures in corporate governance

To discuss the ability of Sarbanes-Oxley Act in checking frauds and preventing the top

executives from siphoning off huge amounts at the cost of shareholders and employees'

interest.

Keywords :Corporate Governance Case Study, Sarbanes-Oxley act, Accounting scandals, Enron

debacle, Corporate governance problems, Image of corporate America, Corporate disclosures,

Compliance-related costs, Delisting from stock exchanges, Chief Executive Officer pay, Retaining

investor confidence, Benefits to shareholders

Contents :

» Corporate America and the Auditing Industry

» Sarbanes-Oxley Act

» Costs vs. Benefits

» Public Company Accounting Oversight Board

Introduction: In 2002, SEC formulated the Sarbanes-Oxley Act in response to the wave of

scandals thatmarred the reputation of corporateAmerica, costing nearly $40 billion on GDP of

the country, in terms of its effect on stock prices.Accounting and governance related frauds of

Enron, Tyco,Aldelphia andWorldComled to loss of shareholders and employees’ trust in top

management.TheSarbanes-OxleyAct intended to improve transparency,management

accountability and bring in accuracy in corporate disclosures and help restore investors’

confidence.

The federal legislationmandated disclosure of company’s state-of-affairs by all public

companies to its shareholders. In addition, the CEOwas to certify the details revealed to the

shareholders, by signing and certifying the financial statements. TheAct required due diligence

in the disclosure of the required information to the investorswhile holding the topmanagement

liable for irregularities. Also, public companies were to regularly change their auditors. All these

stipulations and their compliance raised the cost of auditing for the companies, in terms of the

auditing fees and the cost of personnel involved. Further,more costs came to light for the

country’s economy as public companieswere delisting fromNYSE and other stock exchanges of

the country to escape theUS corporate governance regulation.On the other hand, analysts

believed that the benefits the law aimed atwould be realized only in the long-term.Meanwhile,

the scandals continued to erupt even after the Act came into effect, as some believed

fraudsters would always find unscrupulous ways to escape.

Corporate America and the Auditing Industry Traditionally, auditing industry inAmerica has

been solely responsible for auditing of company accounts to be perused by shareholders for

assessing the financial state of their investments. Till the late 1930s, auditing was

voluntary.After the SecuritiesAct of 1934, auditingwasmademandatory, as companies were

required to disclose information to the public. The jobwas entrusted to third parties,who were

appointed to audit the accounts of public companies. In the late 1980s, the laws that restricted

advertising and competitive bidding for accounts by the auditorswere lifted. Subsequently,

consolidations in the industry left fewdominant players in the industry (Exhibit I). Since then,

auditing industry in US has been dominated by the big five firms namelyAndersen, Deloitte

Touche, PriceWaterhouse Coopers, Ernst & Young and KPMG...

Sarbanes-Oxley Act On July 30th 2002,GeorgeW.Bush signedSarbanes-OxleyAct of 2002,

reinforcing the need for accountability and due diligence in corporate disclosures. Bush

announced, “Nomore easymoney for corporate criminals, just hard time. The era of

lowstandards and false profits is over”13 , and added, that the long-standing corporate scandals

that have resulted in loss of trust on US business systemwould be addressed.14 The law

intended to bring in checks and balances in the financial disclosures and corporate governance.

Costs vs. Benefits The corporate scandals at Enron andWorldCom, had above all, questioned

the premise of corporate governance, which defines the roles of the executives working

towards enrichment of shareholder’s wealth. The wave of scandals depicted the incidents of

betrayal by the top executives who pocketed huge amounts while leaving the shareholders at

losses. American capitalism built on the shareholders’ capital, was losing the trust of the

investors. This would in future determine the access to investments in the country, wheremore

than half of allAmericans own stock.

Public Company Accounting Oversight Board Public Company Accounting Oversight

Board.Moving to a different private sector regulatory structure, a new Public Company

Accounting Oversight Board (the Board) will be appointed and overseen by the SEC. The

Board,made up of fivefull-timemembers,will oversee and investigate the audits and auditorsof

public companies, andsanctionboth firms and individuals for violations of laws, regulations and

rules...

You might also like

- Chap 012Document20 pagesChap 012Hemali MehtaNo ratings yet

- Module in Criminal Law Book 2 (Criminal Jurisprudence)Document11 pagesModule in Criminal Law Book 2 (Criminal Jurisprudence)felixreyes100% (3)

- Queen NogukDocument1 pageQueen NogukEllen LabradorNo ratings yet

- Securities and Exchange Commission: Sarbanes-Oxley ActDocument10 pagesSecurities and Exchange Commission: Sarbanes-Oxley ActLedayl MaralitNo ratings yet

- Sox 2002Document2 pagesSox 2002commoNo ratings yet

- Ethics For A Post-Enron America: John R. BoatrightDocument2 pagesEthics For A Post-Enron America: John R. Boatrightayoub dangerNo ratings yet

- Sarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014Document12 pagesSarbanes-Oxley Act of 2002 Jadeen Service Hampton University 2014 MBA 315 3/5/2014jadeen serviceNo ratings yet

- Operation Audit Case AnalysisDocument3 pagesOperation Audit Case AnalysisEu RiNo ratings yet

- Value Creation Through Corporate GovernanceDocument11 pagesValue Creation Through Corporate GovernanceAbdel AyourNo ratings yet

- Ans:-The Determinants of Structure of Financial Markets AreDocument3 pagesAns:-The Determinants of Structure of Financial Markets Aresajeev georgeNo ratings yet

- Basic Facts of Sox LawDocument2 pagesBasic Facts of Sox LawnamuNo ratings yet

- Cato Handbook Congress: Washington, D.CDocument9 pagesCato Handbook Congress: Washington, D.CDiscoverupNo ratings yet

- Enron Case StudyDocument6 pagesEnron Case Studyali goharNo ratings yet

- Case StudyDocument17 pagesCase StudyAmit RajoriaNo ratings yet

- Acct 201 - Chapter 4Document24 pagesAcct 201 - Chapter 4Huy TranNo ratings yet

- Internal ControlsDocument40 pagesInternal ControlsARIEL FRITZ CACERESNo ratings yet

- Oxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesDocument21 pagesOxley Act of 2002 (Pub.L. 107-204, 116 Stat. 745, Enacted July 30, 2002), Also Known As The 'Public - Oxley, Sarbox or SOX, Is A United StatesposttoamitNo ratings yet

- Assignment On Sarbanes Oaxley Act 2Document4 pagesAssignment On Sarbanes Oaxley Act 2Haris MunirNo ratings yet

- Corporate Governance: The Worldcom Scandal: Ugba107 Week 11Document16 pagesCorporate Governance: The Worldcom Scandal: Ugba107 Week 11Clarence FernandoNo ratings yet

- Congress Disclosures Enron Corporation Worldcom Financial StatementsDocument4 pagesCongress Disclosures Enron Corporation Worldcom Financial StatementsMichael Olmedo NeneNo ratings yet

- The Sarbanes-Oxley Act: costs, benefits and business impactsFrom EverandThe Sarbanes-Oxley Act: costs, benefits and business impactsNo ratings yet

- The Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceDocument4 pagesThe Enron Scandal - A Case Study in Business Ethics and Corporate GovernanceShiney BenjaminNo ratings yet

- Assignment - 5: International Finance and Forex ManagementDocument8 pagesAssignment - 5: International Finance and Forex ManagementAnika VarkeyNo ratings yet

- Sob 2022 Assignment 1-1Document8 pagesSob 2022 Assignment 1-1mwenifumbocheluNo ratings yet

- Sec Compliance, Disclosure and Enforcement Challenges in The New EraDocument31 pagesSec Compliance, Disclosure and Enforcement Challenges in The New EraKok MengNo ratings yet

- Discussion Computer AccountingDocument4 pagesDiscussion Computer AccountingArceeNo ratings yet

- The Goals and Promise of The Sarbanes-Oxley Act: John C. Coates IVDocument26 pagesThe Goals and Promise of The Sarbanes-Oxley Act: John C. Coates IVbm08smmNo ratings yet

- Sarbanes Oxley ActDocument17 pagesSarbanes Oxley Actglenndso100% (2)

- Examples of Agency ProblemsDocument3 pagesExamples of Agency ProblemsdaleNo ratings yet

- Enron Case History and Major Issues SummaryDocument6 pagesEnron Case History and Major Issues Summaryshanker23scribd100% (1)

- Sarbanes Oxley Act DissertationDocument7 pagesSarbanes Oxley Act DissertationWhatShouldIWriteMyPaperAboutCanada100% (1)

- Trust Markets GovDocument10 pagesTrust Markets GovwhitestoneoeilNo ratings yet

- 1st Asignment of Financial ManagDocument2 pages1st Asignment of Financial ManagHamza AbbasNo ratings yet

- 10 - SoxDocument2 pages10 - Soxreina maica terradoNo ratings yet

- Enron Scandal: Managing Finance and Financial DecisionsDocument10 pagesEnron Scandal: Managing Finance and Financial Decisions'Sabur-akin AkinadeNo ratings yet

- Sarbanes Oxley ActDocument3 pagesSarbanes Oxley ActRomnick PascuaNo ratings yet

- EnronDocument30 pagesEnronrakshitgupta17No ratings yet

- 3 A Brief History of CGDocument27 pages3 A Brief History of CGM YounasNo ratings yet

- Financial Reporting and The Securities and Exchange CommissionDocument18 pagesFinancial Reporting and The Securities and Exchange CommissionJordan YoungNo ratings yet

- Challenges of Audit ProfessionDocument8 pagesChallenges of Audit ProfessionEershad Muhammad GunessNo ratings yet

- Research Paper On Sarbanes Oxley ActDocument7 pagesResearch Paper On Sarbanes Oxley Actegw0a18w100% (1)

- Aj Ibañez - Assignment 2Document19 pagesAj Ibañez - Assignment 2AJ Louise IbanezNo ratings yet

- Case Study Session 1 Group 7Document4 pagesCase Study Session 1 Group 7rifqi salmanNo ratings yet

- Aj Ibañez - Assignment 2Document19 pagesAj Ibañez - Assignment 2AJ Louise IbanezNo ratings yet

- Accounting ScandalsDocument4 pagesAccounting Scandalsyatz24No ratings yet

- Corporate Governance & Insurance Industry.Document42 pagesCorporate Governance & Insurance Industry.Parag MoreNo ratings yet

- Managerial FinanceDocument4 pagesManagerial Financeinnies duncanNo ratings yet

- Good GovernanceDocument73 pagesGood GovernanceJhoan Gestoso De Sosa100% (1)

- Lesson 1 Governance Additional NotesDocument6 pagesLesson 1 Governance Additional NotesCarmela Tuquib RebundasNo ratings yet

- The Worldcom Scandal: How Worldcom Shuffled Its BooksDocument2 pagesThe Worldcom Scandal: How Worldcom Shuffled Its BooksAaditya ManojNo ratings yet

- Freddie Mac Scandal Report PDFDocument4 pagesFreddie Mac Scandal Report PDFaditikhasnisNo ratings yet

- Sarbanes - Oxley Act: United States Federal LawDocument8 pagesSarbanes - Oxley Act: United States Federal LawJayanta ChowdhuryNo ratings yet

- Sarbanes-Oxley (SOX) Act of 2002: Presented by GroupDocument11 pagesSarbanes-Oxley (SOX) Act of 2002: Presented by GroupMathew Joshy 18099No ratings yet

- Chapter 12 IMSMDocument19 pagesChapter 12 IMSMZachary Thomas CarneyNo ratings yet

- Sarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingDocument4 pagesSarbanes Oxley Act: - Oxley Act of 2002, Also Known As The 'Public Company AccountingRavi MarwahNo ratings yet

- Akshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleDocument27 pagesAkshay Jain Aditi Chauhan Aditya Mishra Priya Swami Sagar Sundik Prasen BhosaleBhavya KapoorNo ratings yet

- Computer AssociatesDocument18 pagesComputer AssociatesRosel RicafortNo ratings yet

- Three Models of Financial RegulationDocument16 pagesThree Models of Financial RegulationRamjunum RandhirsinghNo ratings yet

- Audit CaseDocument15 pagesAudit CaseSyad Shahidah100% (1)

- ZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionFrom EverandZERO TO MASTERY IN CORPORATE GOVERNANCE: Become Zero To Hero In Corporate Governance, This Book Covers A-Z Corporate Governance Concepts, 2022 Latest EditionNo ratings yet

- Case AnalysisDocument3 pagesCase AnalysisMohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expenxe Tracking - February 2021Document6 pagesMaruhom - Expenxe Tracking - February 2021Mohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expenxe Tracking - January 2021Document5 pagesMaruhom - Expenxe Tracking - January 2021Mohammad Nowaiser MaruhomNo ratings yet

- Name of Student Dec-18 Jan-08 Jan-15 Jan-22 Jan-29 IN OUT IN OUTDocument2 pagesName of Student Dec-18 Jan-08 Jan-15 Jan-22 Jan-29 IN OUT IN OUTMohammad Nowaiser MaruhomNo ratings yet

- Whole Foods Market - Me Case StudyDocument3 pagesWhole Foods Market - Me Case StudyMohammad Nowaiser MaruhomNo ratings yet

- Maruhom - Expense Tracking - Jan 2021Document5 pagesMaruhom - Expense Tracking - Jan 2021Mohammad Nowaiser MaruhomNo ratings yet

- Maruhom-Concept MapDocument1 pageMaruhom-Concept MapMohammad Nowaiser MaruhomNo ratings yet

- Case Analysis Rubric Mec 108 Ma 3 - Personal FinanceDocument1 pageCase Analysis Rubric Mec 108 Ma 3 - Personal FinanceMohammad Nowaiser MaruhomNo ratings yet

- Maec-1 UpdatedDocument1 pageMaec-1 UpdatedMohammad Nowaiser MaruhomNo ratings yet

- Graduated Income Tax Rates Under Section 24 (A) (2) of The Tax Code of 1997, As Amended by RepublicDocument10 pagesGraduated Income Tax Rates Under Section 24 (A) (2) of The Tax Code of 1997, As Amended by RepublicMohammad Nowaiser MaruhomNo ratings yet

- Submitted By: Maruhom, Macapodi, Camama, Guiling, Pandapatan, Neri, Macaayan, Mangurun, Mira-Ato, Villaroya, Mila, UmparaDocument3 pagesSubmitted By: Maruhom, Macapodi, Camama, Guiling, Pandapatan, Neri, Macaayan, Mangurun, Mira-Ato, Villaroya, Mila, UmparaMohammad Nowaiser MaruhomNo ratings yet

- R.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsDocument6 pagesR.A. # 11232: Revised Corporation Code of The Philippines Transactions Vote Percentage For Stock CorporationsMohammad Nowaiser MaruhomNo ratings yet

- AIS - Written ReportDocument10 pagesAIS - Written ReportMohammad Nowaiser MaruhomNo ratings yet

- Cream and Brown Illustration Social Science Class Education Presentation PDFDocument7 pagesCream and Brown Illustration Social Science Class Education Presentation PDFMohammad Nowaiser MaruhomNo ratings yet

- Physical Disability: Perspectives in Appreciating Diversities in SocietyDocument12 pagesPhysical Disability: Perspectives in Appreciating Diversities in SocietyMohammad Nowaiser MaruhomNo ratings yet

- FWT, CWT, Gross Income, DividendsDocument10 pagesFWT, CWT, Gross Income, DividendsMohammad Nowaiser MaruhomNo ratings yet

- Template - Parent Consent FormDocument1 pageTemplate - Parent Consent FormMohammad Nowaiser MaruhomNo ratings yet

- Mutual Funds Price ListDocument6 pagesMutual Funds Price ListMohammad Nowaiser MaruhomNo ratings yet

- GimDocument165 pagesGimmdgemrNo ratings yet

- 1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessDocument5 pages1.5 Monopolistic Competition, Oligopoly, and Monopoly - Exploring BusinessdhaiwatNo ratings yet

- Gene Keys: Hologenetic ProfileDocument3 pagesGene Keys: Hologenetic ProfileContactNo ratings yet

- Bang! Card Breakdown - Character CardsDocument3 pagesBang! Card Breakdown - Character Cardsxosajo7647No ratings yet

- Hover-1 I-200 Hoverboard With Built-In Bluetooth Speaker, LED Headlights, LED Wheel Lights, 7 MPH Max Speed - Black - Walmart - CoDocument1 pageHover-1 I-200 Hoverboard With Built-In Bluetooth Speaker, LED Headlights, LED Wheel Lights, 7 MPH Max Speed - Black - Walmart - CoAhmad GadsonNo ratings yet

- hsk3 Exam h31327Document18 pageshsk3 Exam h31327Elizabeth FernandezNo ratings yet

- THEO530 Book Critique 1 Heikkinen "Two Views On Women in MinistryDocument10 pagesTHEO530 Book Critique 1 Heikkinen "Two Views On Women in MinistryCrystal HeikkinenNo ratings yet

- tb10 1Document14 pagestb10 1PeterNo ratings yet

- John Duda - Cybernetics, Anarchism and Self-OrganisationDocument21 pagesJohn Duda - Cybernetics, Anarchism and Self-OrganisationBloomNo ratings yet

- Group Assignment SM.Document6 pagesGroup Assignment SM.Waheed LangahNo ratings yet

- Notification AAICLAS Security Screener Posts PDFDocument15 pagesNotification AAICLAS Security Screener Posts PDFPraveen laxkarNo ratings yet

- ResumeDocument4 pagesResumeJulie RaftiNo ratings yet

- Franchisee Advisory Network (Partner) - Fan (P) Information PaperDocument5 pagesFranchisee Advisory Network (Partner) - Fan (P) Information PaperAditi SinghNo ratings yet

- What The Meaning of LifeDocument2 pagesWhat The Meaning of Life星が輝く夜AdamNo ratings yet

- How To Write A DigestDocument1 pageHow To Write A DigestClark Lim100% (1)

- EO-GA-21 Expanding Open Texas COVID-19Document8 pagesEO-GA-21 Expanding Open Texas COVID-19Amber NicoleNo ratings yet

- Debate TCCNDocument29 pagesDebate TCCNViệt Phương NguyễnNo ratings yet

- Cosh TermsDocument8 pagesCosh TermsMike Vanjoe SeraNo ratings yet

- Communication Past Exam 22 - 23 Answers - Done by Lugy-2Document8 pagesCommunication Past Exam 22 - 23 Answers - Done by Lugy-2Lugy AnanNo ratings yet

- Motion To Compel Stephen RobesonDocument9 pagesMotion To Compel Stephen RobesonWXYZ-TV Channel 7 DetroitNo ratings yet

- Makina 2Document7 pagesMakina 2Keneth Brayle LorenzoNo ratings yet

- Accounting EquationDocument14 pagesAccounting EquationDindin Oromedlav LoricaNo ratings yet

- 2024 Calendar WebDocument20 pages2024 Calendar WebgreenietorbesNo ratings yet

- Cameral AccountingDocument4 pagesCameral Accountingchin_lord8943No ratings yet

- Restoration Ecology - 2023 - Rother - Historical Trajectory of Restoration Practice and Science Across The BrazilianDocument11 pagesRestoration Ecology - 2023 - Rother - Historical Trajectory of Restoration Practice and Science Across The Brazilianstella.mdlrNo ratings yet

- DIG - Vir Jen Shipping and Marine Services Vs NLRC 1983 Case DigestDocument4 pagesDIG - Vir Jen Shipping and Marine Services Vs NLRC 1983 Case DigestKris OrenseNo ratings yet

- Natres Finals ReviewerDocument32 pagesNatres Finals ReviewerAavhNo ratings yet

- Sample DIARY - CASDocument5 pagesSample DIARY - CASDAN DNANo ratings yet