Professional Documents

Culture Documents

Name: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Multiple Question 2-19

Name: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Multiple Question 2-19

Uploaded by

Muhammad AreebOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Name: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Multiple Question 2-19

Name: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Multiple Question 2-19

Uploaded by

Muhammad AreebCopyright:

Available Formats

Name: Muhammad Areeb

ID: 19P01954

Section: C1

Managerial Accounting Assignment 3

Multiple Question 2-19

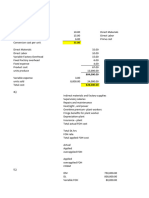

Cost of Goods Sold = $850,000 + $1,700,000 + $400,000 + $750,000

= $3,700,000

D option is correct ($3,700,000)

Multiple Question 2-20

Total cost of goods manufactured = Direct materials used + Direct manufacturing labor costs +

Indirect manufacturing labor costs + Other plant expenses

=76,000 +10,000 + 12,000 +22,000

=$120,000

2 is the correct option

Exercise 2-21

1.

in the million

Supreme Deluxe Regular Total

Direct material cost $ 89.00 $ 57.00 $60.00 $206.00

Direct manuf. labor costs 16.00 26.00 8.00 50.00

Manufacturing overhead costs 48.00 78.00 24.00 150.00

Total manuf. costs 153.00 161.00 92.00 406.00

Fixed costs 4.80 7.80 2.40 15.00

Variable costs $148.20 $153.20 $89.60 $391.00

Units produced (millions) 125 150 140

Manuf. cost per unit $1.2240 $1.0733 $0.6571

Variable manuf. cost per unit $1.1856 $1.0213 $0.6400

2. (In millions)

Supreme Deluxe Regular Total

Based on total manuf. cost

Per unit $183.60 $203.93 $144.56 $532.09

Variable costs $177.84 $194.05 $140.80 $512.69

Fixed costs 15.00

Total costs $527.69

Exercise 2-33

1. Manufacturing companies purchase raw materials input and process them into outputs.

Merchandising companies keep inventories and sale goods. Service companies provide

intangible services.

2. Inventoriable or product cost is the cost that directly involved in manufacturing while period

cost is time based and non-manufacturing cost.

3. (a) inventoriable cost

(b) inventoriable cost

(c) period cost

(d) period cost

(e) inventoriable cost

(f) period cost

(g) period cost

(h) period cost

(i) period cost

You might also like

- Pantene Case StudyDocument21 pagesPantene Case StudyMuhammad AreebNo ratings yet

- THE SIGNIFICANT ROLE OF THE MON LANGUAGE AND CULTURE by Dr. Nai Pan HlaDocument111 pagesTHE SIGNIFICANT ROLE OF THE MON LANGUAGE AND CULTURE by Dr. Nai Pan HlaMin Justin100% (7)

- AML-Excercise Week 4 (Reviandi Ramadhan)Document21 pagesAML-Excercise Week 4 (Reviandi Ramadhan)reviandiramadhanNo ratings yet

- HW2Document16 pagesHW2Nevan NovaNo ratings yet

- Practice Questions - SolDocument8 pagesPractice Questions - SolNicholas LeeNo ratings yet

- Vicenzo Bernard Leandro Tioriman - 01011182025009Document6 pagesVicenzo Bernard Leandro Tioriman - 01011182025009ImVicNo ratings yet

- Chapter 2 Homework Manufacturing Economics and Computation Exercise With SolutionDocument9 pagesChapter 2 Homework Manufacturing Economics and Computation Exercise With SolutionPhương NguyễnNo ratings yet

- Activity Based Costing and Activity Based Management - ProblemDocument3 pagesActivity Based Costing and Activity Based Management - Problemkiara kiesh FosterNo ratings yet

- Lucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiDocument21 pagesLucky Cement Limited: Managerial Accounting Submitted To: Dr. Nayyer ZaidiMuhammad AreebNo ratings yet

- Pak Studies Paper 2020Document36 pagesPak Studies Paper 2020Shan Ali Shah100% (1)

- Marxist CriminologyDocument15 pagesMarxist CriminologyPerry Mag100% (1)

- Lecture 4 Day 3 Stochastic Frontier AnalysisDocument45 pagesLecture 4 Day 3 Stochastic Frontier AnalysisSp Ina100% (4)

- Name: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Exercises: Horngren Multiple Question 2-19Document3 pagesName: Muhammad Areeb ID: 19P01954 Section: C1 Managerial Accounting Assignment 3 Exercises: Horngren Multiple Question 2-19Muhammad AreebNo ratings yet

- Cost - Concepts and ClassificationsDocument23 pagesCost - Concepts and ClassificationsYehetNo ratings yet

- Cost of Goods ManufacturedDocument26 pagesCost of Goods ManufacturedAb.Rahman AfghanNo ratings yet

- Traditional Vs ABC Costing CaseDocument1 pageTraditional Vs ABC Costing Casesul239No ratings yet

- 2020-10-12 - ACCT Test Practice ExercisesDocument146 pages2020-10-12 - ACCT Test Practice ExercisesAlenne FelizardoNo ratings yet

- Tugas Akuntansi BiayaDocument3 pagesTugas Akuntansi BiayapurnamiNo ratings yet

- Solutions To Exercises: 2-1. (1) Beginning Direct Materials - 8/1Document8 pagesSolutions To Exercises: 2-1. (1) Beginning Direct Materials - 8/1EfrenNo ratings yet

- Soultions - Chapter 3Document8 pagesSoultions - Chapter 3Naudia L. TurnbullNo ratings yet

- Class Problems: HDR Chapter 2: Supreme Deluxe Regular TotalDocument6 pagesClass Problems: HDR Chapter 2: Supreme Deluxe Regular TotalNguyễn Thị Thanh ThúyNo ratings yet

- Cordova, Alexander JR - Individual TaskDocument6 pagesCordova, Alexander JR - Individual TaskAlexander CordovaNo ratings yet

- ACC60181H619 Managerial AccountingDocument9 pagesACC60181H619 Managerial AccountingaksNo ratings yet

- BBA211 Vol5 Marginal&AbsortptionCostingDocument15 pagesBBA211 Vol5 Marginal&AbsortptionCostingAnisha SarahNo ratings yet

- Pma Test 1 2022Document6 pagesPma Test 1 2022Janielle LambertNo ratings yet

- 78Document1 page78laale dijaanNo ratings yet

- Kerjakan 4-12 Dan 4 - 17: 1. "Plantwide"Document4 pagesKerjakan 4-12 Dan 4 - 17: 1. "Plantwide"natan. lieNo ratings yet

- 102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Document4 pages102,000.00 Prime Cost 102,000.00 147,000.00 Conversion Cost 147,000.00 197,000.00Darasin, Mhirasol B.No ratings yet

- ABC CostingDocument7 pagesABC CostingNafiz RahmanNo ratings yet

- University of Finance and MarketingDocument8 pagesUniversity of Finance and MarketingQuế Phương NguyễnNo ratings yet

- Jawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasDocument9 pagesJawaban Soal Kasus 4.2 Bab 17 Akmen LJT Dari Laptop AnasMaksi angkatan35No ratings yet

- HBS SolutionDocument6 pagesHBS Solutionabdulazeem_cfeNo ratings yet

- Process Costing Excel ExampleDocument3 pagesProcess Costing Excel Examplehub sportxNo ratings yet

- Module 2 Case AssignmentDocument2 pagesModule 2 Case AssignmentMadison HeffronNo ratings yet

- Cost AccountingDocument5 pagesCost Accountingrumelrashid_seuNo ratings yet

- Molding Fabrication: 1a) Departmental Predetermined Overhead Rates Y A+ BXDocument34 pagesMolding Fabrication: 1a) Departmental Predetermined Overhead Rates Y A+ BXZyra BaltazarNo ratings yet

- Example-2 With SolutionDocument4 pagesExample-2 With SolutionDeepNo ratings yet

- 05 Wilkerson Company Solution - StudentsDocument9 pages05 Wilkerson Company Solution - StudentsVinyabhooshan Bajpai PGP 2022-24 Batch100% (1)

- Problem - ABC Vs Traditional - AnsDocument3 pagesProblem - ABC Vs Traditional - AnsAbhijit AshNo ratings yet

- Managerial Accounting: Case Study 1 Cost Concepts, Behaviors & MeasurementsDocument5 pagesManagerial Accounting: Case Study 1 Cost Concepts, Behaviors & MeasurementsTricia Marie TumandaNo ratings yet

- Case 1 AnswerDocument5 pagesCase 1 AnswerTricia Marie TumandaNo ratings yet

- Jawaban Soal UAS AkmenDocument3 pagesJawaban Soal UAS AkmenElyana IrmaNo ratings yet

- Tugas Kasus Akuntansi Manajemen ABCDocument3 pagesTugas Kasus Akuntansi Manajemen ABCutari yani dewiNo ratings yet

- Chapter 9 Divisional Transfer Pricing Nov2020 1Document90 pagesChapter 9 Divisional Transfer Pricing Nov2020 1Priyanka LunavatNo ratings yet

- Akmen Tugas 1Document2 pagesAkmen Tugas 1riskidian166No ratings yet

- Case1 Cost Concepts Behaviors MeasurementsDocument9 pagesCase1 Cost Concepts Behaviors MeasurementsTricia Marie TumandaNo ratings yet

- Answer: As To Total Per UnitDocument9 pagesAnswer: As To Total Per UnitTricia Marie TumandaNo ratings yet

- 1perhitungan Soal SPM 2Document37 pages1perhitungan Soal SPM 2RamaNo ratings yet

- Tugas-Kasus - 4.12Document3 pagesTugas-Kasus - 4.12niti dsNo ratings yet

- Chapter 2 Homework Manufacturing Economics and Computation Exercise With Solution CompressDocument8 pagesChapter 2 Homework Manufacturing Economics and Computation Exercise With Solution Compressngxbao0211suyaNo ratings yet

- Analisis Biaya: Semester Genap TA 2019 - 2020 Activity-Based CostingDocument25 pagesAnalisis Biaya: Semester Genap TA 2019 - 2020 Activity-Based CostingMochamad PutraNo ratings yet

- 4 51Document3 pages4 51Achmad Faizal AzmiNo ratings yet

- Solutions-Chapter 6Document4 pagesSolutions-Chapter 6Saurabh SinghNo ratings yet

- Tugasan 3Document2 pagesTugasan 3nur shahibah nusaibahNo ratings yet

- ABC and ABMDocument64 pagesABC and ABMBrian GiriNo ratings yet

- Sba AssignmentDocument8 pagesSba AssignmentjuniordelossantospenasNo ratings yet

- 7114afe WK5 (WS3) AnsDocument8 pages7114afe WK5 (WS3) AnsFrasat IqbalNo ratings yet

- CCCAC Chapter 3Document10 pagesCCCAC Chapter 3rochelle lagmayNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- XLSXDocument12 pagesXLSXashibhallau100% (1)

- Akmen Soal Review Uas PDFDocument8 pagesAkmen Soal Review Uas PDFvionaNo ratings yet

- Finance - Danshui Plant No. 2Document18 pagesFinance - Danshui Plant No. 2Anamika ChauhanNo ratings yet

- Exam 1 Review SessionDocument8 pagesExam 1 Review SessionNémesis FiguereoNo ratings yet

- Tugas Chapter 8Document8 pagesTugas Chapter 8wiwit_karyantiNo ratings yet

- Problem CH 7 Hansen Mowen Cornerstone of Managerial AccountingDocument8 pagesProblem CH 7 Hansen Mowen Cornerstone of Managerial Accountingwiwit_karyantiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Quiz #3 Q1) Q2) : Qandeel Wahid Sec BDocument60 pagesQuiz #3 Q1) Q2) : Qandeel Wahid Sec BMuhammad AreebNo ratings yet

- Pakistan Tourism IndustryDocument9 pagesPakistan Tourism IndustryMuhammad AreebNo ratings yet

- Pantene M.hashim B2Document1 pagePantene M.hashim B2Muhammad AreebNo ratings yet

- Pantene Assignment - Zohaib Khan - 19P01951 - Section ADocument2 pagesPantene Assignment - Zohaib Khan - 19P01951 - Section AMuhammad AreebNo ratings yet

- Defining The Marketing Research Problem and Developing An ApproachDocument24 pagesDefining The Marketing Research Problem and Developing An ApproachMuhammad AreebNo ratings yet

- Muhammad Areeb (19p01954) C1 Lt2Document4 pagesMuhammad Areeb (19p01954) C1 Lt2Muhammad AreebNo ratings yet

- Exploratory Research Design: Secondary DataDocument36 pagesExploratory Research Design: Secondary DataMuhammad AreebNo ratings yet

- Check: by Muhammad Ali AslamDocument29 pagesCheck: by Muhammad Ali AslamMuhammad AreebNo ratings yet

- Chapter Five: Exploratory Research Design: Qualitative ResearchDocument49 pagesChapter Five: Exploratory Research Design: Qualitative ResearchMuhammad AreebNo ratings yet

- Lahore School of Economics: Branding and Advertisement ManagementDocument63 pagesLahore School of Economics: Branding and Advertisement ManagementMuhammad AreebNo ratings yet

- Phase 2Document29 pagesPhase 2Muhammad AreebNo ratings yet

- NewspaperDocument4 pagesNewspaperMuhammad AreebNo ratings yet

- Final Social Media CalendarDocument74 pagesFinal Social Media CalendarMuhammad AreebNo ratings yet

- Ciné TranseDocument11 pagesCiné TransePROFESSOR VISITANTE 2023No ratings yet

- Prevention and Management of Postpartum Haemorrhage: Green-Top Guideline No. 52Document24 pagesPrevention and Management of Postpartum Haemorrhage: Green-Top Guideline No. 52naeem19860% (1)

- Put in 'Mustn't' or 'Don't / Doesn't Have To':: 1) We Have A Lot of Work Tomorrow. You Be LateDocument8 pagesPut in 'Mustn't' or 'Don't / Doesn't Have To':: 1) We Have A Lot of Work Tomorrow. You Be LateEmir XHNo ratings yet

- Week 10 Chandra Talpade Mohanty 2Document3 pagesWeek 10 Chandra Talpade Mohanty 2jenhenNo ratings yet

- Historical ReviewDocument2 pagesHistorical ReviewKimber Lee BaldozNo ratings yet

- Ee5121 Tutorial 1Document2 pagesEe5121 Tutorial 1ananNo ratings yet

- Malcolm X Papers SchomburgDocument49 pagesMalcolm X Papers Schomburgdrferg50% (2)

- Daniel James - English A SbaDocument13 pagesDaniel James - English A Sbadanieltjames5092No ratings yet

- BBC Knowledge 201506Document98 pagesBBC Knowledge 201506Victor CameronNo ratings yet

- Section 1.3 - Evaluating Limits AnalyticallyDocument20 pagesSection 1.3 - Evaluating Limits Analyticallyseetha_thundena301No ratings yet

- Northern MountainsDocument35 pagesNorthern MountainsReha BhatiaNo ratings yet

- Tulpa's DIY Guide To Tulpamancy v4Document193 pagesTulpa's DIY Guide To Tulpamancy v4wylder100% (1)

- Development CommunicationDocument11 pagesDevelopment CommunicationNishantNo ratings yet

- NYC Criminal LawyerDocument49 pagesNYC Criminal LawyerThomas LaScolaNo ratings yet

- Prepositions and The Haunted HouseDocument6 pagesPrepositions and The Haunted HouseHanna MykhalskaNo ratings yet

- Lecture Notes On Polya's Problem Solving StrategyDocument20 pagesLecture Notes On Polya's Problem Solving StrategyJohn Asher Josh AguinilloNo ratings yet

- People V AranzadoDocument17 pagesPeople V AranzadoClement del RosarioNo ratings yet

- Arroyo vs. de Venecia G.R. No. 127255, August 14, 1997Document2 pagesArroyo vs. de Venecia G.R. No. 127255, August 14, 1997Enyong LumanlanNo ratings yet

- CHAPTER III Research MethodologyDocument3 pagesCHAPTER III Research MethodologyKrisk TadeoNo ratings yet

- Application of PaymentDocument13 pagesApplication of Paymentulticon0% (2)

- ALBARRACÍN, Mauricio. Movilización Legal para El Reconocimiento de La Igualdad de Las Parejas Del Mismo Sexo".Document100 pagesALBARRACÍN, Mauricio. Movilización Legal para El Reconocimiento de La Igualdad de Las Parejas Del Mismo Sexo".malbarracin100% (2)

- WTC18 - Rangga Amalul Akhli - Indonesia Defense University PDFDocument6 pagesWTC18 - Rangga Amalul Akhli - Indonesia Defense University PDFHary Weilding FransNo ratings yet

- STAT 310 SyllabusDocument5 pagesSTAT 310 SyllabusAaron BraunsteinNo ratings yet

- Rethinking American Grand Strategy Elizabeth Borgwardt All ChapterDocument67 pagesRethinking American Grand Strategy Elizabeth Borgwardt All Chaptertodd.schrader522100% (19)

- Social Innovation Project: Science, Technology and SocietyDocument3 pagesSocial Innovation Project: Science, Technology and SocietyRobert GarlandNo ratings yet

- Organoboranes in Organic Syntheses Including Suzuki Coupling ReactionDocument29 pagesOrganoboranes in Organic Syntheses Including Suzuki Coupling Reactionratul mahataNo ratings yet