Professional Documents

Culture Documents

Neeraj Jawla & Associates: Chartered Accountants

Neeraj Jawla & Associates: Chartered Accountants

Uploaded by

Sandeep TyagiCopyright:

Available Formats

You might also like

- Management Theory and Practice PDFDocument533 pagesManagement Theory and Practice PDFMdms Payoe88% (51)

- CIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Document37 pagesCIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Dickson MusoniNo ratings yet

- Payment Receipt 0005743148Document1 pagePayment Receipt 0005743148Chitradeep FalguniyaNo ratings yet

- Introduction To GST RegistrationDocument18 pagesIntroduction To GST RegistrationgirirajNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- A Simple Guide To Resolve Your Rejected GST Registration ApplicationDocument6 pagesA Simple Guide To Resolve Your Rejected GST Registration ApplicationRam ADCANo ratings yet

- MB ComDocument2 pagesMB Comsatyanand guptaNo ratings yet

- Module IV - Income Tax and GSTDocument8 pagesModule IV - Income Tax and GSTsuhaibNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 4Document8 pagesINCOME TAX AND GST. JURAZ-Module 4TERZO IncNo ratings yet

- Renewal Notice-5hshsDocument2 pagesRenewal Notice-5hshsHshshsvd hdhdNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- In Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalDocument20 pagesIn Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalAshish AgarwalNo ratings yet

- LLB GST Notes Unit-4Document15 pagesLLB GST Notes Unit-4It's time to studyNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Goods and Services Tax, A/5, Rajya Kar Bhavan, Ashram Road, Ahmedabad - 380 009Document7 pagesGoods and Services Tax, A/5, Rajya Kar Bhavan, Ashram Road, Ahmedabad - 380 009Santosh KumarNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Health Insurance RecieptDocument2 pagesHealth Insurance RecieptRAWAN100% (1)

- Gogte Infrastructure Development Corporation Ltd. AAR KarnatakaDocument7 pagesGogte Infrastructure Development Corporation Ltd. AAR KarnatakaSWETCHCHA MISKANo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- WT Form 19Document2 pagesWT Form 19sukanyaNo ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- Notice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-GujratDocument7 pagesNotice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-Gujratashim1No ratings yet

- Distributor Registration PDFDocument2 pagesDistributor Registration PDFSharvan TomarNo ratings yet

- Gstr3a Za0710212084361Document1 pageGstr3a Za0710212084361Karan NishadNo ratings yet

- PDF - 28-09-23 07-02-29Document18 pagesPDF - 28-09-23 07-02-29jalodarahardik786No ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptRaghavendra KumarNo ratings yet

- Benefits of GST ImplementationDocument6 pagesBenefits of GST ImplementationMinhans SrivastavaNo ratings yet

- Registration in Continuation With Class NotesDocument5 pagesRegistration in Continuation With Class NotesRahul KumarNo ratings yet

- Distributor RegistrationDocument2 pagesDistributor RegistrationMadhu MohanNo ratings yet

- Distributor RegistrationDocument2 pagesDistributor RegistrationNith ishNo ratings yet

- Procedure For v. RegistrationDocument5 pagesProcedure For v. Registrationmanoj kumar SONWANENo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Format of Draft Reply On DRC-01Document3 pagesFormat of Draft Reply On DRC-01Awanish SrivastavaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSurinder PahwaNo ratings yet

- Refunds Under GST Q2 AssignmentDocument4 pagesRefunds Under GST Q2 Assignmentzm2pfgpcdtNo ratings yet

- Taxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTDocument6 pagesTaxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTmohd.samadNo ratings yet

- Basic GST - AmitDocument34 pagesBasic GST - AmitRohit MuleyNo ratings yet

- Aa240123134087p SCN03022023Document1 pageAa240123134087p SCN03022023ANISH SHAIKHNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- Areness Attorneys: AdvocatesDocument1 pageAreness Attorneys: AdvocatesParbhakar Kumar BharduwasNo ratings yet

- Aa1901230153000 SCN18012023Document1 pageAa1901230153000 SCN18012023ANISH SHAIKHNo ratings yet

- Issues of Compliance in GSTDocument8 pagesIssues of Compliance in GSTMahiya Ahmad100% (1)

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- Hamid Apf DocumentsDocument18 pagesHamid Apf DocumentsShahaan ZulfiqarNo ratings yet

- Apl Annexure TemplateDocument3 pagesApl Annexure Templatemohd.samadNo ratings yet

- The Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreDocument6 pagesThe Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreRavi AgarwalNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- The Ultimate Guide To Online GST Registration - TaxGyataDocument7 pagesThe Ultimate Guide To Online GST Registration - TaxGyataNikita RaiNo ratings yet

- Subscriber Dispute FormDocument3 pagesSubscriber Dispute FormApril RNo ratings yet

- RCPL Notice 138 Rohit Balani 2Document2 pagesRCPL Notice 138 Rohit Balani 2Shreypratap SinghNo ratings yet

- GST Unit 2Document10 pagesGST Unit 2darshansah1990No ratings yet

- A Step-By-step Guide For Obtaining Your GSTIN - Business Standard NewsDocument4 pagesA Step-By-step Guide For Obtaining Your GSTIN - Business Standard Newsaditya0291No ratings yet

- MPDFDocument1 pageMPDFartika.ashuNo ratings yet

- Aa00189422 PDFDocument3 pagesAa00189422 PDFUday PawarNo ratings yet

- DeepakMedical HealthDocument3 pagesDeepakMedical HealthVipin SinghNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- As Level - Green ChemistryDocument26 pagesAs Level - Green Chemistrysazy5100% (2)

- Preparing - The - Pro - Forma - Real Estate PDFDocument63 pagesPreparing - The - Pro - Forma - Real Estate PDFhelgerson.mail4157100% (1)

- Hawaii HB1116 - Legislation To Release Birth Records of "Person of Civic Prominence" AKA Obama For $100.00 Fee - 2011Document9 pagesHawaii HB1116 - Legislation To Release Birth Records of "Person of Civic Prominence" AKA Obama For $100.00 Fee - 2011ObamaRelease YourRecordsNo ratings yet

- ISO 8813 1992 en PreviewDocument3 pagesISO 8813 1992 en Previewromvos8469No ratings yet

- Sunday Service - PST - ParkDocument7 pagesSunday Service - PST - ParkDennis ParkNo ratings yet

- 42 Items Q and ADocument2 pages42 Items Q and AJoy NavalesNo ratings yet

- People V MendozaDocument4 pagesPeople V MendozaKrys MartinezNo ratings yet

- SFP - Notes (Problem A-C)Document22 pagesSFP - Notes (Problem A-C)The Brain Dump PHNo ratings yet

- Raam Group Data - SVNITDocument22 pagesRaam Group Data - SVNITarjunsharma1530asdfNo ratings yet

- Ttheories On PerdevDocument26 pagesTtheories On Perdeveivenej aliugaNo ratings yet

- LS 101 Daylighting Controller Cut SheetDocument6 pagesLS 101 Daylighting Controller Cut SheetIgor NiculovicNo ratings yet

- AFC Vision Asia Club Licensing RegulationsDocument20 pagesAFC Vision Asia Club Licensing RegulationsPrateek ChawlaNo ratings yet

- Chapter 7 The SouthlandDocument6 pagesChapter 7 The SouthlandJose RodriguezNo ratings yet

- Hometask: Mi Ultimo Adios (My Last Farewell)Document3 pagesHometask: Mi Ultimo Adios (My Last Farewell)Jasmin BelarminoNo ratings yet

- Soal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Document21 pagesSoal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Muhammad AfifNo ratings yet

- Conditionals: Sentence With ConditionsDocument3 pagesConditionals: Sentence With ConditionsSobuz RahmanNo ratings yet

- 50 Cau Trac Nghiem Collocation On Thi THPT Quoc Gia 2021 Mon Anh Co Dap AnDocument6 pages50 Cau Trac Nghiem Collocation On Thi THPT Quoc Gia 2021 Mon Anh Co Dap AnSơn TrầnNo ratings yet

- Info Iec60376 (Ed3.0) enDocument6 pagesInfo Iec60376 (Ed3.0) enjycortes0% (1)

- 13 Stat x-150Document179 pages13 Stat x-150ncwazzyNo ratings yet

- CCT Credit Agreement With VML For Hao CaiDocument6 pagesCCT Credit Agreement With VML For Hao CaiInvestigative Reporting ProgramNo ratings yet

- Routing Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenDocument20 pagesRouting Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenRycko PareiraNo ratings yet

- + 2 Eng - Tirunelveli - First Rev - Original Question & Answer Key - Jan 2023Document9 pages+ 2 Eng - Tirunelveli - First Rev - Original Question & Answer Key - Jan 2023ebeanandeNo ratings yet

- Tor Ic Adri - 2Document7 pagesTor Ic Adri - 2herri susantoNo ratings yet

- ATUL KUMAR PANDEY Aug. 2023Document4 pagesATUL KUMAR PANDEY Aug. 2023Amit SinhaNo ratings yet

- Jewish Standard, September 11, 2015Document76 pagesJewish Standard, September 11, 2015New Jersey Jewish StandardNo ratings yet

- Aspects of Culture5Document43 pagesAspects of Culture5Almira Bea Eramela Paguagan100% (1)

- Calif. Wildfire Surges To Nearly 200 Square Miles and Spreads Into Yosemite National ParkDocument3 pagesCalif. Wildfire Surges To Nearly 200 Square Miles and Spreads Into Yosemite National ParkCynthia TingNo ratings yet

Neeraj Jawla & Associates: Chartered Accountants

Neeraj Jawla & Associates: Chartered Accountants

Uploaded by

Sandeep TyagiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Neeraj Jawla & Associates: Chartered Accountants

Neeraj Jawla & Associates: Chartered Accountants

Uploaded by

Sandeep TyagiCopyright:

Available Formats

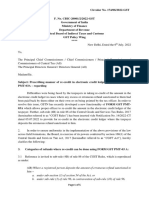

NEERAJ JAWLA & ASSOCIATES

CHARTERED ACCOUNTANTS

House No.191/5, Ward No.14, Samalkha-132101, Haryana

Email- caneerajjawla@gmail.com, Mobile-9017799990, 8708226338

Certificate No.21/2020-21

UDIN No.: 20542114AAAACH6906

Certificate under the State Goods and Services Tax Act, 2017 (in short “SGST Act”)

and the Central Goods and Services Tax Act, 2017 (in short “CGST Act”) in terms of

Section 54 of the said Acts

1. M/s SMBJ Pharmaceuticals Private Limited (hereinafter referred to as the “Applicant’)

is a registered person vide GSTIN 06AAYCS9071N1ZB and is having its principal place

of business at Plot No.330, Tehsil Ganaur, Village Bhari, Industrial Area, Sonipat-131101.

The Applicant has the following additional places of business duly registered in the State of

Nil:

a.____________________________________________

b. ____________________________________________

The principal place of business and the additional places of business in the State have been

duly registered with effect from 15 January 2018.

2. The Applicant has filed an application for refund u/s 54 of the CGST / SGST Act, 2017

under the following scenario:

refund of tax paid on zero-rated supplies of goods or services or both or on inputs

or input services used in making such zero-rated supplies; *

refund of unutilised input tax credit under sub-section (3); *

refund of tax paid on a supply which is not provided, either wholly or partially, and

for which invoice has not been issued, or where a refund voucher has been issued;

*

refund of tax in pursuance of section 77; *

the tax and interest, if any, or any other amount is paid by the applicant and he has

not passed on the incidence of such tax and interest to any other person; *

[*strike whichever is not applicable]

3. We have examined the books of accounts and other relevant documents / records of the

Applicant and on the basis of such examination & the information and explanation

furnished to us, we hereby certify that, in respect of the refund amounting to

Rs. 15,82,783/-, the incidence of such tax and interest or any other amount claimed as

refund has not been passed on by the Applicant to any other person.

4. This certificate has been issued in terms of Section 54 of the CGST / SGST Acts, 2017 read

with Rule 89 (2) of the CGST / SGST Rules, 2017.

For NEERAJ JAWLA & ASSOCIATES

Chartered Accountants

FRN: 031528N

CA NEERAJ JAWLA

Partner

Membership No.542114

Place: Samalkha

Date: 17-10-2020

You might also like

- Management Theory and Practice PDFDocument533 pagesManagement Theory and Practice PDFMdms Payoe88% (51)

- CIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Document37 pagesCIPS Level 4 Diploma in Procurement and Supply: Module Title: Ethical and Responsible Sourcing (L4M4)Dickson MusoniNo ratings yet

- Payment Receipt 0005743148Document1 pagePayment Receipt 0005743148Chitradeep FalguniyaNo ratings yet

- Introduction To GST RegistrationDocument18 pagesIntroduction To GST RegistrationgirirajNo ratings yet

- REGISTRATION On GST NotesDocument6 pagesREGISTRATION On GST NotesRohan SinhaNo ratings yet

- A Simple Guide To Resolve Your Rejected GST Registration ApplicationDocument6 pagesA Simple Guide To Resolve Your Rejected GST Registration ApplicationRam ADCANo ratings yet

- MB ComDocument2 pagesMB Comsatyanand guptaNo ratings yet

- Module IV - Income Tax and GSTDocument8 pagesModule IV - Income Tax and GSTsuhaibNo ratings yet

- INCOME TAX AND GST. JURAZ-Module 4Document8 pagesINCOME TAX AND GST. JURAZ-Module 4TERZO IncNo ratings yet

- Renewal Notice-5hshsDocument2 pagesRenewal Notice-5hshsHshshsvd hdhdNo ratings yet

- Reply Letter - Lawyer NoticeDocument3 pagesReply Letter - Lawyer Noticemeghan googlyNo ratings yet

- In Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalDocument20 pagesIn Re Rajesh Kumar Gupta of Mahveer Prasad MohanlalAshish AgarwalNo ratings yet

- LLB GST Notes Unit-4Document15 pagesLLB GST Notes Unit-4It's time to studyNo ratings yet

- Cir 174 06 2022 CGSTDocument5 pagesCir 174 06 2022 CGSTNM JHANWAR & ASSOCIATESNo ratings yet

- Asmt 10 1920Document69 pagesAsmt 10 1920Prashant ZawareNo ratings yet

- Goods and Services Tax, A/5, Rajya Kar Bhavan, Ashram Road, Ahmedabad - 380 009Document7 pagesGoods and Services Tax, A/5, Rajya Kar Bhavan, Ashram Road, Ahmedabad - 380 009Santosh KumarNo ratings yet

- GST and It Ppt. GRP.6Document32 pagesGST and It Ppt. GRP.6BANANI DASNo ratings yet

- Field Training Report 127411Document7 pagesField Training Report 127411deepak mauryaNo ratings yet

- Health Insurance RecieptDocument2 pagesHealth Insurance RecieptRAWAN100% (1)

- Gogte Infrastructure Development Corporation Ltd. AAR KarnatakaDocument7 pagesGogte Infrastructure Development Corporation Ltd. AAR KarnatakaSWETCHCHA MISKANo ratings yet

- JudgementbyjdateDocument27 pagesJudgementbyjdateBasanta Kumar SahooNo ratings yet

- WT Form 19Document2 pagesWT Form 19sukanyaNo ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- Z. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofDocument9 pagesZ. Aarno.R:/Ap/Gs'F/Zozo: (+) of ofACCTLVO 35No ratings yet

- Notice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-GujratDocument7 pagesNotice Pay - Amneal-Pharmaceuticals-Pvt.-Ltd.-GST-AAR-Gujratashim1No ratings yet

- Distributor Registration PDFDocument2 pagesDistributor Registration PDFSharvan TomarNo ratings yet

- Gstr3a Za0710212084361Document1 pageGstr3a Za0710212084361Karan NishadNo ratings yet

- PDF - 28-09-23 07-02-29Document18 pagesPDF - 28-09-23 07-02-29jalodarahardik786No ratings yet

- Payment ReceiptDocument1 pagePayment ReceiptRaghavendra KumarNo ratings yet

- Benefits of GST ImplementationDocument6 pagesBenefits of GST ImplementationMinhans SrivastavaNo ratings yet

- Registration in Continuation With Class NotesDocument5 pagesRegistration in Continuation With Class NotesRahul KumarNo ratings yet

- Distributor RegistrationDocument2 pagesDistributor RegistrationMadhu MohanNo ratings yet

- Distributor RegistrationDocument2 pagesDistributor RegistrationNith ishNo ratings yet

- Procedure For v. RegistrationDocument5 pagesProcedure For v. Registrationmanoj kumar SONWANENo ratings yet

- C320284551-Renewal Premium ReceiptDocument1 pageC320284551-Renewal Premium ReceiptThelu RajuNo ratings yet

- Format of Draft Reply On DRC-01Document3 pagesFormat of Draft Reply On DRC-01Awanish SrivastavaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeJerry LamaNo ratings yet

- Renewal NoticeDocument2 pagesRenewal NoticeSurinder PahwaNo ratings yet

- Refunds Under GST Q2 AssignmentDocument4 pagesRefunds Under GST Q2 Assignmentzm2pfgpcdtNo ratings yet

- Taxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTDocument6 pagesTaxguru - In-Draft Sample Appeal For DRC-01 DRC-07 of FY 2017-18 GSTmohd.samadNo ratings yet

- Basic GST - AmitDocument34 pagesBasic GST - AmitRohit MuleyNo ratings yet

- Aa240123134087p SCN03022023Document1 pageAa240123134087p SCN03022023ANISH SHAIKHNo ratings yet

- POLICY SERVICING REQUEST 2 - With StandardDocument3 pagesPOLICY SERVICING REQUEST 2 - With Standardsarwar shamsNo ratings yet

- Draft Reply For DRC 01Document5 pagesDraft Reply For DRC 01Rahul GoelNo ratings yet

- Areness Attorneys: AdvocatesDocument1 pageAreness Attorneys: AdvocatesParbhakar Kumar BharduwasNo ratings yet

- Aa1901230153000 SCN18012023Document1 pageAa1901230153000 SCN18012023ANISH SHAIKHNo ratings yet

- Issues of Compliance in GSTDocument8 pagesIssues of Compliance in GSTMahiya Ahmad100% (1)

- Input Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtDocument9 pagesInput Tax Credit Cannot Be Denied To Purchaser Merely Because Seller Didnt Record Transaction in GSTR-2A Form - Kerala High CourtdeepakasopaNo ratings yet

- Hamid Apf DocumentsDocument18 pagesHamid Apf DocumentsShahaan ZulfiqarNo ratings yet

- Apl Annexure TemplateDocument3 pagesApl Annexure Templatemohd.samadNo ratings yet

- The Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreDocument6 pagesThe Deputy Commissioner of Income Tax Vs Bharath Fritz Werner Ltd. ITAT BangaloreRavi AgarwalNo ratings yet

- DRC 03 Letters-1Document2 pagesDRC 03 Letters-1anjani deviNo ratings yet

- The Ultimate Guide To Online GST Registration - TaxGyataDocument7 pagesThe Ultimate Guide To Online GST Registration - TaxGyataNikita RaiNo ratings yet

- Subscriber Dispute FormDocument3 pagesSubscriber Dispute FormApril RNo ratings yet

- RCPL Notice 138 Rohit Balani 2Document2 pagesRCPL Notice 138 Rohit Balani 2Shreypratap SinghNo ratings yet

- GST Unit 2Document10 pagesGST Unit 2darshansah1990No ratings yet

- A Step-By-step Guide For Obtaining Your GSTIN - Business Standard NewsDocument4 pagesA Step-By-step Guide For Obtaining Your GSTIN - Business Standard Newsaditya0291No ratings yet

- MPDFDocument1 pageMPDFartika.ashuNo ratings yet

- Aa00189422 PDFDocument3 pagesAa00189422 PDFUday PawarNo ratings yet

- DeepakMedical HealthDocument3 pagesDeepakMedical HealthVipin SinghNo ratings yet

- 21St Century Computer Solutions: A Manual Accounting SimulationFrom Everand21St Century Computer Solutions: A Manual Accounting SimulationNo ratings yet

- As Level - Green ChemistryDocument26 pagesAs Level - Green Chemistrysazy5100% (2)

- Preparing - The - Pro - Forma - Real Estate PDFDocument63 pagesPreparing - The - Pro - Forma - Real Estate PDFhelgerson.mail4157100% (1)

- Hawaii HB1116 - Legislation To Release Birth Records of "Person of Civic Prominence" AKA Obama For $100.00 Fee - 2011Document9 pagesHawaii HB1116 - Legislation To Release Birth Records of "Person of Civic Prominence" AKA Obama For $100.00 Fee - 2011ObamaRelease YourRecordsNo ratings yet

- ISO 8813 1992 en PreviewDocument3 pagesISO 8813 1992 en Previewromvos8469No ratings yet

- Sunday Service - PST - ParkDocument7 pagesSunday Service - PST - ParkDennis ParkNo ratings yet

- 42 Items Q and ADocument2 pages42 Items Q and AJoy NavalesNo ratings yet

- People V MendozaDocument4 pagesPeople V MendozaKrys MartinezNo ratings yet

- SFP - Notes (Problem A-C)Document22 pagesSFP - Notes (Problem A-C)The Brain Dump PHNo ratings yet

- Raam Group Data - SVNITDocument22 pagesRaam Group Data - SVNITarjunsharma1530asdfNo ratings yet

- Ttheories On PerdevDocument26 pagesTtheories On Perdeveivenej aliugaNo ratings yet

- LS 101 Daylighting Controller Cut SheetDocument6 pagesLS 101 Daylighting Controller Cut SheetIgor NiculovicNo ratings yet

- AFC Vision Asia Club Licensing RegulationsDocument20 pagesAFC Vision Asia Club Licensing RegulationsPrateek ChawlaNo ratings yet

- Chapter 7 The SouthlandDocument6 pagesChapter 7 The SouthlandJose RodriguezNo ratings yet

- Hometask: Mi Ultimo Adios (My Last Farewell)Document3 pagesHometask: Mi Ultimo Adios (My Last Farewell)Jasmin BelarminoNo ratings yet

- Soal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Document21 pagesSoal Tes Penjajakan Hasil Belajar Sma/Ma TAHUN PELAJARAN 2020/2021Muhammad AfifNo ratings yet

- Conditionals: Sentence With ConditionsDocument3 pagesConditionals: Sentence With ConditionsSobuz RahmanNo ratings yet

- 50 Cau Trac Nghiem Collocation On Thi THPT Quoc Gia 2021 Mon Anh Co Dap AnDocument6 pages50 Cau Trac Nghiem Collocation On Thi THPT Quoc Gia 2021 Mon Anh Co Dap AnSơn TrầnNo ratings yet

- Info Iec60376 (Ed3.0) enDocument6 pagesInfo Iec60376 (Ed3.0) enjycortes0% (1)

- 13 Stat x-150Document179 pages13 Stat x-150ncwazzyNo ratings yet

- CCT Credit Agreement With VML For Hao CaiDocument6 pagesCCT Credit Agreement With VML For Hao CaiInvestigative Reporting ProgramNo ratings yet

- Routing Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenDocument20 pagesRouting Protocols in Ad-Hoc Networks, Olsr: Jørn Andre BerntzenRycko PareiraNo ratings yet

- + 2 Eng - Tirunelveli - First Rev - Original Question & Answer Key - Jan 2023Document9 pages+ 2 Eng - Tirunelveli - First Rev - Original Question & Answer Key - Jan 2023ebeanandeNo ratings yet

- Tor Ic Adri - 2Document7 pagesTor Ic Adri - 2herri susantoNo ratings yet

- ATUL KUMAR PANDEY Aug. 2023Document4 pagesATUL KUMAR PANDEY Aug. 2023Amit SinhaNo ratings yet

- Jewish Standard, September 11, 2015Document76 pagesJewish Standard, September 11, 2015New Jersey Jewish StandardNo ratings yet

- Aspects of Culture5Document43 pagesAspects of Culture5Almira Bea Eramela Paguagan100% (1)

- Calif. Wildfire Surges To Nearly 200 Square Miles and Spreads Into Yosemite National ParkDocument3 pagesCalif. Wildfire Surges To Nearly 200 Square Miles and Spreads Into Yosemite National ParkCynthia TingNo ratings yet