Professional Documents

Culture Documents

Mind Map Financing PDF

Mind Map Financing PDF

Uploaded by

Indira Setya DamayantiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mind Map Financing PDF

Mind Map Financing PDF

Uploaded by

Indira Setya DamayantiCopyright:

Available Formats

are financing obligations that require future payment of money, services, or other assets.

financing are all forms of credit financing (arise from financing activities) long-term notes/bonds, short-term borrowings, leases, current portion of long term liabilities, interest payable.

can be either financing or operating in nature

operating are obligations that arise from operations accounts/notes payable from trade creditors, unearned revenue, advanced payment, taxes payable, postretirement obligations, wages payable, other accruals/operating expenses.

obligations whose settlement requires the use of current assets

Liabilities current

In practice, current liabilities are recorded at their maturity value, and not their present value, due to the short time period until their settlement.

classified as, current and non current

are obligations that mature in more than one year

non current

noncurrent liabilities can take various forms, and their assessment and measurement requires disclosure of all restrictions and covenants (interest rates, maturity dates, conversion privileges, call features, and subordination provisions, pledged collateral, sinking fund requirements, and revolving credit provisions).

and are usually senior to those of equity holders

Terms of indebtedness (maturity, interest rate, payment pattern, and amount).

Restrictions on deploying resources and pursuing business activities.

Ability and flexibility in pursuing further financing

Analyzing Liabilities

Obligations for working capital, debt to equity, and other financial figures

Dilutive conversion features that liabilities are subject to.

Prohibitions on disbursements such as dividends

is a contractual agreement between a lessor (owner) and a lessee (user),

that gives a lessee the right to use an asset,

owned by the lessor, for the term of the lease, and in return, the lessee makes rental payments, called minimum lease payments

Lease contracts can be complex, and they vary in provisions relating to the lease term,

the transfer of ownership,

bargain purchase option,

bargain renewal option,

guaranteed / unguaranteed residual value,

problems early termination

Lease that transfers substantially all the benefits and risks of ownership is accounted for as an asset acquisition and a liability incurrence by the lessee

Capital Lessor treats such a lease as a sale (sales type lease) and financing (direct financing) transaction

The decision to account for a lease as a capital or operating lease can significantly impact F/S. Both the leased asset and the lease obligation are recognized on the balance sheet.

Lessee (lessor) accounts for the minimum lease payment as a rental expense (revenue), and no asset or liability is recognized on the balance sheet.

Operating

Business activities are financed with either liabilities or equity, or both. Lessee is engaging in off-balance-sheet financing

Sellers use leasing to promote sales by providing financing to buyers. Interest income from leasing is often a major source of revenue to those sellers.

leases In turn, leasing often is a convenient means for a buyer to finance its asset purchases

adv Leasing can be a source of off-balance-sheet financing

100% financing at fixed rates

More flexible than debt agreement, and Less costly financing

Current Issue

type of liabilities you should concern about

Liabilities + Equities

understate liabilities by keeping lease financing “off the balance sheet”, positively impacts solvency ratios (such as debt to equity) that are often used in credit analysis.

understate assets so can inflate both “return on investment” and “asset turnover ratios”.

“delay recognition of expenses” in comparison to capital leases

analyzing leases Operating leases

“understate current liabilities” by keeping the current portion of the principal payment off the balance sheet

understate both “operating income and interest expense”, as operating leases include interest with the lease rental (an operating expense)

therefore, an analyst must make adjustments to F/S prior to analysis (convert all operating leases to capital leases or selective to reclassifying leases will be used only when the lessee’s classification appears inconsistent with the economic characteristics of the lease

Contingencies are potential gains and losses whose resolution depends on one or more future events.

arise from litigation, threat of expropriation, collectibility of receivables, claims arising from product warranties or defects, guarantees of performance, tax assessments, self-insured risks, and catastrophic losses of property

it must be probable that a liability incurred (it must be probable that a future event will confirm the loss) (51-99%)

conservatism

the amount of loss must be reasonably estimable. Examples: losses from uncollectible receivables and the obligations related to product warranties

Accuracy of underlying “estimates” scrutinize management estimates

contingencies

Note “disclosures of all loss (and gain) contingencies” (description of the contingent liability, degree of risk, amount of risk, and how treated in assessing risk exposure, charges, if any, against income)

Recognize “a bias” to not record or underestimate contingent liabilities

Analyzing contingencies

Beware of big-baths, loss reserves are contingencies

“Review fillings from authority” for details of loss reserves

Analyze deferred tax notes for undisclosed provision for future losses

purchase agreements & through-put agreements (where a company agrees to purchase output from or run a specified amount of goods through a processing facility)

refers to the non-recording of certain financing obligations.

take-or-pay arrangements (where a company guarantees to pay for a specified quantity of goods whether needed or not).

Scrutinize management communications and press releases

Off Balance Sheet Financing

Analyze notes about financing arrangements

Analysis

Recognize a bias to not disclose financing obligations

Review authority filings for details of financing arrangements

refers to claims of owners on the net assets of a company.

claims of owners are junior to creditors, meaning they are “residual claims” to all assets

although equity holders are exposed to max company risk, they are also have “opportunity to all residual returns” of a company

some form securities has hybird characteristic, such as convertible bonds

refers to owner (shareholder) financing of a company (viewed as reflecting the claims of owners on the net assets of the company).

treasury stock

capital stock preferred stock

common stock

Equities type

Cash dividend

R/E Stock dividend

Shareholders Equity

Property dividend

“Classifying and distinguishing” among major sources of equity financing.

Examining “rights for classes” of shareholders and their “priorities” in liquidation.

Analysis Evaluating “legal restrictions” for distribution of equity.

Reviewing contractual, legal, and other restrictions on “distribution of retained earnings”.

Assessing “terms and provisions” of convertible securities, stock options, and other arrangements involving potential issuance of shares.

You might also like

- Chapter 03Document40 pagesChapter 03faidhkp11No ratings yet

- LLS 7e Global Edition Ch09Document7 pagesLLS 7e Global Edition Ch09thanh subNo ratings yet

- FM 4B Debt Financing Activity CMMDocument12 pagesFM 4B Debt Financing Activity CMMKim EspinaNo ratings yet

- Gerunda Kristine Lesson 2 Ia2Document11 pagesGerunda Kristine Lesson 2 Ia2KRISTINE JEAN BUNA GERUNDANo ratings yet

- LiabilitiesDocument16 pagesLiabilitiesEdielyn VillarandaNo ratings yet

- IFRS 16 MindmapDocument2 pagesIFRS 16 MindmapNurin NadhirahNo ratings yet

- Chapter 1 CONCEPT MAPDocument1 pageChapter 1 CONCEPT MAPClyde SaladagaNo ratings yet

- BAB 3 Analyzing Financing Activities 071016Document64 pagesBAB 3 Analyzing Financing Activities 071016Haniedar NadifaNo ratings yet

- Chapter 03Document62 pagesChapter 03Mutiara RamadhaniNo ratings yet

- (Chap4) PAS 7Document1 page(Chap4) PAS 7liza marie basiaNo ratings yet

- 7 - LiabilitiesDocument79 pages7 - LiabilitiesFavian Maraville YadisaputraNo ratings yet

- Chapter 03Document29 pagesChapter 03Irfan AdhityoNo ratings yet

- Analysing Financial ActivitiesDocument49 pagesAnalysing Financial ActivitiesharshNo ratings yet

- Forms of Financing Comparative TableDocument5 pagesForms of Financing Comparative TableScribdTranslationsNo ratings yet

- Current Liabilities and Contingencies: HapterDocument58 pagesCurrent Liabilities and Contingencies: Haptergellie mare floresNo ratings yet

- Intacc NotesDocument10 pagesIntacc NotesIris FenelleNo ratings yet

- IAChap 014 PPTDocument9 pagesIAChap 014 PPTcamhang1509No ratings yet

- Chapter 1Document3 pagesChapter 1clarizaNo ratings yet

- Intacc 2 NotesDocument25 pagesIntacc 2 Notescoco credoNo ratings yet

- Accounting For Management: UniversityDocument14 pagesAccounting For Management: UniversityMehak SharmaNo ratings yet

- Debt RestructuringDocument4 pagesDebt RestructuringPushTheStart GamingNo ratings yet

- FAR14 Financial Liabilities - With AnsDocument9 pagesFAR14 Financial Liabilities - With AnsAJ CresmundoNo ratings yet

- Ebs CohostDocument17 pagesEbs CohostSue-Allen MardenboroughNo ratings yet

- 8 - Cash Flow Analysis - Indirect MethodDocument25 pages8 - Cash Flow Analysis - Indirect MethodBagas KaraNo ratings yet

- Scholarship Application FormDocument6 pagesScholarship Application FormJeromyNo ratings yet

- Chapter 3 - Sources of CapitalDocument7 pagesChapter 3 - Sources of CapitalAnthony BalandoNo ratings yet

- ULOa. Liabilities - 1Document47 pagesULOa. Liabilities - 1pam pamNo ratings yet

- Leasing and Factoring : Fin 435: Banking Products and ServicesDocument11 pagesLeasing and Factoring : Fin 435: Banking Products and ServicesPuteri NinaNo ratings yet

- Debt Financing vs. Equity Financing Bonds PayableDocument5 pagesDebt Financing vs. Equity Financing Bonds PayableAmbeleigh Venice Delos SantosNo ratings yet

- Current LiabilityDocument5 pagesCurrent LiabilityMaria AngelicaNo ratings yet

- Afm - 21421134Document13 pagesAfm - 21421134Mehak SharmaNo ratings yet

- ICA Comments Responses 06112020Document13 pagesICA Comments Responses 06112020Rohit Anand DasNo ratings yet

- ACCO 20083 Module 5 ActivitiesDocument3 pagesACCO 20083 Module 5 ActivitiesVincent Luigil AlceraNo ratings yet

- Pas 7 Statement of Cash FlowsDocument3 pagesPas 7 Statement of Cash FlowsJESSIE GIL DUMONo ratings yet

- Bond ValuationDocument31 pagesBond ValuationVeena DixitNo ratings yet

- Indas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDocument15 pagesIndas-116: Name - Dipeeka Banka ROLL NO. - 859 Guide - Prof. Sonali SahaDipeeka BankaNo ratings yet

- White Illustrative Creative Literature Project PresentationDocument16 pagesWhite Illustrative Creative Literature Project PresentationMilenka GutierrezNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument79 pagesFinancial Statement Analysis: K.R. SubramanyamFitri SafiraNo ratings yet

- Financial Statement Analysis: K.R. SubramanyamDocument37 pagesFinancial Statement Analysis: K.R. SubramanyamFitri SafiraNo ratings yet

- Lesson 1.4: SCFDocument3 pagesLesson 1.4: SCFIshi MaxineNo ratings yet

- o Credit LineDocument4 pageso Credit LineNichloe Lauren TanNo ratings yet

- 5HM04 Module 5.evaluating Healthcare Institution Financial PerformanceDocument21 pages5HM04 Module 5.evaluating Healthcare Institution Financial PerformanceJoseph De JoyaNo ratings yet

- Glossary of Financial Banking TermsDocument3 pagesGlossary of Financial Banking TermsbitocasNo ratings yet

- Intacc Chapter 1Document2 pagesIntacc Chapter 1Niño Albert EugenioNo ratings yet

- Credit and CollectionDocument3 pagesCredit and CollectionArnold BelangoyNo ratings yet

- Project Finance V General Debt Finance 1682186009Document14 pagesProject Finance V General Debt Finance 1682186009bq6bj9crmxNo ratings yet

- LiabilitiesDocument4 pagesLiabilitiessafe.skies00No ratings yet

- IAChap003PPT VNDocument12 pagesIAChap003PPT VNDUONG PHAM NGOC THUYNo ratings yet

- Group 4 Debt ManagementDocument31 pagesGroup 4 Debt ManagementVellaNo ratings yet

- Lecture 5 - Notes On LeasingDocument1 pageLecture 5 - Notes On LeasingCalvin MaNo ratings yet

- Long-Term Financing: Debts: Financial Management Part IIDocument11 pagesLong-Term Financing: Debts: Financial Management Part IIKisha QuirozNo ratings yet

- Conceptual Framework and Accounting Standards: Loans ReceivableDocument2 pagesConceptual Framework and Accounting Standards: Loans ReceivableKaryl FailmaNo ratings yet

- Security Analysis and Portfolio Management: Valuation of BondsDocument28 pagesSecurity Analysis and Portfolio Management: Valuation of BondsFranklin ArnoldNo ratings yet

- Audit of LiabilitiesDocument13 pagesAudit of LiabilitiesJoshua Catalla MabilinNo ratings yet

- 2BS 9 Chapter9 Financial ManagementDocument15 pages2BS 9 Chapter9 Financial ManagementArchanaa PadmavathiNo ratings yet

- JLL - RE DictionaryDocument34 pagesJLL - RE DictionaryHarsh Shah100% (1)

- Asifkhokhar - 2152 - 3435 - 1 - LECTURE Liabilities Both Current and Non Current LiabilitiesDocument23 pagesAsifkhokhar - 2152 - 3435 - 1 - LECTURE Liabilities Both Current and Non Current LiabilitiesShahzad C7No ratings yet

- Cepm 1701 LM 4Document10 pagesCepm 1701 LM 4Vishnu BalajiNo ratings yet

- Statement of Cash FlowsDocument2 pagesStatement of Cash FlowsjunjunNo ratings yet

- Unlocking Capital: The Power of Bonds in Project FinanceFrom EverandUnlocking Capital: The Power of Bonds in Project FinanceNo ratings yet

- Ratio Analysis of Hindalco Industries LimitedDocument13 pagesRatio Analysis of Hindalco Industries LimitedSmall Town BandaNo ratings yet

- Annual Report 1998 PDFDocument171 pagesAnnual Report 1998 PDFHa LinhNo ratings yet

- Od 329808896732339100Document5 pagesOd 329808896732339100Rachna GuptaNo ratings yet

- CH 02 Plant DesignDocument61 pagesCH 02 Plant DesignJoseph KinfeNo ratings yet

- General Rules in Income TaxationDocument6 pagesGeneral Rules in Income TaxationLee SuarezNo ratings yet

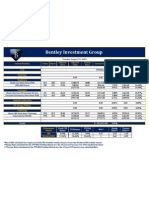

- Bentley Investment Group: Tuesday August 25, 2009Document1 pageBentley Investment Group: Tuesday August 25, 2009bentleyinvestmentgroupNo ratings yet

- Quiz 5Document5 pagesQuiz 5Lê Thanh ThủyNo ratings yet

- Dissertation Hotel ManagementDocument8 pagesDissertation Hotel ManagementPaperWriterServicesUK100% (1)

- Vrio Framework of GilleteDocument2 pagesVrio Framework of GilleteHenry NelsonNo ratings yet

- Urbanization and Economic Growth: The Arguments and Evidence For Africa and AsiaDocument19 pagesUrbanization and Economic Growth: The Arguments and Evidence For Africa and AsiamaizansofiaNo ratings yet

- Group Interview With An EntrepreneurDocument2 pagesGroup Interview With An EntrepreneurDoom RefugeNo ratings yet

- Network Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososDocument36 pagesNetwork Planning Na Vale: Planejamento Integrado Da Malha Produtiva de FerrososEduardo MoreiraNo ratings yet

- Introduction of FinanceDocument2 pagesIntroduction of FinanceWilsonNo ratings yet

- Human Resource Management: Course Code: MGT350Document17 pagesHuman Resource Management: Course Code: MGT350Noor DeenNo ratings yet

- International and Dutch Standards On Business and Human RightsDocument3 pagesInternational and Dutch Standards On Business and Human RightsjosienkapmaNo ratings yet

- Session 4 (Global Marketing)Document30 pagesSession 4 (Global Marketing)Hassan ShafiqNo ratings yet

- Support Resistance For Day TradingDocument1,103 pagesSupport Resistance For Day Tradingnbhnbhnnb nhbbnh50% (2)

- A Feasibility Study: Effectiveness of Using Coupon To Increase The Sales of Boodle Meals Offered by Hub-Eat Boardgame CaféDocument19 pagesA Feasibility Study: Effectiveness of Using Coupon To Increase The Sales of Boodle Meals Offered by Hub-Eat Boardgame CaféJanine GalangNo ratings yet

- When A New Manager Stumbles, Who's at Fault?Document11 pagesWhen A New Manager Stumbles, Who's at Fault?Shivam Khandelwal100% (1)

- Regional Economic IntegrationDocument11 pagesRegional Economic IntegrationAyush GargNo ratings yet

- Advantages of AdvertisingDocument4 pagesAdvantages of Advertisingali khanNo ratings yet

- Production Planning and Control (MEFB 433) : Ts. Zubaidi Faiesal Email: Zubaidi@uniten - Edu.my Room No. BN-1-010Document20 pagesProduction Planning and Control (MEFB 433) : Ts. Zubaidi Faiesal Email: Zubaidi@uniten - Edu.my Room No. BN-1-010Sritaran BalakrishnanNo ratings yet

- Ecological Degradation and Environmental Pollution: Lecture 37: Population and Sustainable DevelopmentDocument8 pagesEcological Degradation and Environmental Pollution: Lecture 37: Population and Sustainable DevelopmentJaf ShahNo ratings yet

- Securities and Regulations CodeDocument57 pagesSecurities and Regulations CodeBeth Diaz Laurente100% (2)

- Purchase Requisition (PR) Document in SAP MM. Purchase Requisition (PR) Is An Internal Purchasing Document in SAPDocument5 pagesPurchase Requisition (PR) Document in SAP MM. Purchase Requisition (PR) Is An Internal Purchasing Document in SAPashwiniNo ratings yet

- Executive SummaryDocument2 pagesExecutive SummaryAshlindah KisakuraNo ratings yet

- Japanese ImperialismDocument10 pagesJapanese ImperialismDevin ValladeNo ratings yet

- Management Accounting and Control For Sustainability: July 2020Document18 pagesManagement Accounting and Control For Sustainability: July 2020Bhanuka GamageNo ratings yet

- Baby BoomerDocument18 pagesBaby BoomerBethany CrusantNo ratings yet

- Fin542 Individual AssDocument8 pagesFin542 Individual AssImran AziziNo ratings yet