Professional Documents

Culture Documents

Academic Version: Pheonix

Academic Version: Pheonix

Uploaded by

krukruch1602Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Academic Version: Pheonix

Academic Version: Pheonix

Uploaded by

krukruch1602Copyright:

Available Formats

Pheonix

Table: Start-up

Start-up

Requirements

Start-up Expenses

Legal $2,000

Stationery etc. $500

Insurance $2,500

Other $5,000

Total Start-up Expenses $10,000

Start-up Assets

Cash Required $200,000

Other Current Assets $0

Long-term Assets $275,000

Total Assets $475,000

Total Requirements $485,000

Table: Sales Forecast

Sales Forecast

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Sales

Financial Services $708,000 $1,600,000 $3,000,000 $5,000,000 $10,000,000

$0 $0 $0 $0 $0

Total Sales $708,000 $1,600,000 $3,000,000 $5,000,000 $10,000,000

Direct Cost of Sales FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Personnel Expense $0 $0 $0 $0 $0

$0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0 $0 $0

Academic Version Page 1

Pheonix

Table: Personnel

Personnel Plan

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Personnel Expenses Personnel

Personnel $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

$0 $0 $0 $0 $0

Subtotal $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

Personnel

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0

Personnel

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0

Personnel

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0

Total Payroll $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

Academic Version Page 2

Pheonix

Table: Start-up Funding

Start-up Funding

Start-up Expenses to Fund $10,000

Start-up Assets to Fund $475,000

Total Funding Required $485,000

Assets

Non-cash Assets from Start-up $275,000

Cash Requirements from Start-up $200,000

Additional Cash Raised $15,000

Cash Balance on Starting Date $215,000

Total Assets $490,000

Liabilities and Capital

Liabilities

Current Borrowing $0

Long-term Liabilities $350,000

Accounts Payable (Outstanding Bills) $0

Other Current Liabilities (interest-free) $0

Total Liabilities $350,000

Capital

Planned Investment

Promoters $50,000

Investor $100,000

Additional Investment Requirement $0

Total Planned Investment $150,000

Loss at Start-up (Start-up Expenses) ($10,000)

Total Capital $140,000

Total Capital and Liabilities $490,000

Total Funding $500,000

Table: Break-even Analysis

Break-even Analysis

Monthly Revenue Break-even $7,542

Assumptions:

Average Percent Variable Cost 0%

Estimated Monthly Fixed Cost $7,542

Academic Version Page 3

Pheonix

Academic Version Page 4

Pheonix

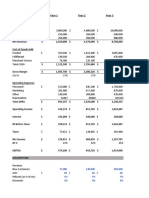

Table: Profit and Loss

Pro Forma Profit and Loss

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Sales $708,000 $1,600,000 $3,000,000 $5,000,000 $10,000,000

Direct Cost of Sales $0 $0 $0 $0 $0

Personnel Expenses Payroll $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

Other Costs of Sales $0 $0 $0 $0 $0

------------ ------------ ------------ ------------ ------------

Total Cost of Sales $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

Gross Margin ($72,900) $214,900 $780,000 $2,128,700 $5,686,000

Gross Margin % -10.30% 13.43% 26.00% 42.57% 56.86%

Operating Expenses

Expenses

Payroll $0 $0 $0 $0 $0

Advertising $30,000 $30,000 $80,000 $100,000 $120,000

Travelling $20,000 $20,000 $41,000 $51,000 $61,000

------------ ------------ ------------ ------------ ------------

Total Expenses $50,000 $50,000 $121,000 $151,000 $181,000

% 7.06% 3.13% 4.03% 3.02% 1.81%

Expenses

Payroll $0 $0 $0 $0 $0

Marketing/Promotion $0 $0 $0 $0 $0

Depreciation $30,000 $30,000 $30,000 $30,000 $30,000

Utilities $5,000 $5,500 $6,000 $6,500 $7,000

Insurance $2,500 $2,500 $2,500 $2,500 $2,500

Other $3,000 $3,000 $3,000 $3,000 $3,000

------------ ------------ ------------ ------------ ------------

Total Expenses $40,500 $41,000 $41,500 $42,000 $42,500

% 5.72% 2.56% 1.38% 0.84% 0.43%

Expenses:

Payroll $0 $0 $0 $0 $0

$0 $0 $0 $0 $0

$0 $0 $0 $0 $0

------------ ------------ ------------ ------------ ------------

Total Expenses $0 $0 $0 $0 $0

% 0.00% 0.00% 0.00% 0.00% 0.00%

------------ ------------ ------------ ------------ ------------

Total Operating Expenses $90,500 $91,000 $162,500 $193,000 $223,500

Profit Before Interest and Taxes ($163,400) $123,900 $617,500 $1,935,700 $5,462,500

EBITDA ($133,400) $153,900 $647,500 $1,965,700 $5,492,500

Interest Expense $29,750 $30,750 $29,263 $25,288 $22,313

Taxes Incurred $0 $18,630 $117,648 $382,083 $1,088,038

Net Profit ($193,150) $74,520 $470,590 $1,528,330 $4,352,150

Net Profit/Sales -27.28% 4.66% 15.69% 30.57% 43.52%

Academic Version Page 5

Pheonix

Academic Version Page 6

Pheonix

Table: Cash Flow

Pro Forma Cash Flow

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Cash Received

Cash from Operations

Cash Sales $177,000 $400,000 $750,000 $1,250,000 $2,500,000

Cash from Receivables $488,225 $1,146,108 $2,165,417 $3,629,167 $7,197,917

Subtotal Cash from Operations $665,225 $1,546,108 $2,915,417 $4,879,167 $9,697,917

Additional Cash Received

Sales Tax, VAT, HST/GST

$0 $0 $0 $0 $0

Received

New Current Borrowing $0 $20,000 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $50,000

New Investment Received $0 $0 $0 $0 $0

Subtotal Cash Received $665,225 $1,566,108 $2,915,417 $4,879,167 $9,747,917

Expenditures FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Expenditures from Operations

Cash Spending $780,900 $1,385,100 $2,220,000 $2,871,300 $4,314,000

Bill Payments $82,980 $108,578 $265,517 $546,455 $1,243,564

Subtotal Spent on Operations $863,880 $1,493,678 $2,485,517 $3,417,755 $5,557,564

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0

Principal Repayment of Current

$0 $0 $20,000 $0 $0

Borrowing

Other Liabilities Principal

$0 $0 $0 $0 $0

Repayment

Long-term Liabilities Principal

$0 $0 $35,000 $35,000 $35,000

Repayment

Purchase Other Current Assets $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $75,000 $80,000 $100,000 $300,000

Dividends $0 $0 $0 $0 $0

Subtotal Cash Spent $863,880 $1,568,678 $2,620,517 $3,552,755 $5,892,564

Net Cash Flow ($198,655) ($2,569) $294,900 $1,326,411 $3,855,353

Cash Balance $16,345 $13,776 $308,675 $1,635,086 $5,490,439

Academic Version Page 7

Pheonix

Table: Balance Sheet

Pro Forma Balance Sheet

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Assets

Current Assets

Cash $16,345 $13,776 $308,675 $1,635,086 $5,490,439

Accounts Receivable $42,775 $96,667 $181,250 $302,083 $604,167

Other Current Assets $0 $0 $0 $0 $0

Total Current Assets $59,120 $110,442 $489,925 $1,937,170 $6,094,606

Long-term Assets

Long-term Assets $275,000 $350,000 $430,000 $530,000 $780,000

Accumulated Depreciation $30,000 $60,000 $90,000 $120,000 $150,000

Total Long-term Assets $245,000 $290,000 $340,000 $410,000 $630,000

Total Assets $304,120 $400,442 $829,925 $2,347,170 $6,724,606

Liabilities and Capital FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Current Liabilities

Accounts Payable $7,270 $9,072 $22,965 $46,880 $107,166

Current Borrowing $0 $20,000 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0

Subtotal Current Liabilities $7,270 $29,072 $22,965 $46,880 $107,166

Long-term Liabilities $350,000 $350,000 $315,000 $280,000 $245,000

Total Liabilities $357,270 $379,072 $337,965 $326,880 $352,166

Paid-in Capital $150,000 $150,000 $150,000 $150,000 $150,000

Retained Earnings ($10,000) ($203,150) ($128,630) $341,960 $1,870,290

Earnings ($193,150) $74,520 $470,590 $1,528,330 $4,352,150

Total Capital ($53,150) $21,370 $491,960 $2,020,290 $6,372,440

Total Liabilities and Capital $304,120 $400,442 $829,925 $2,347,170 $6,724,606

Net Worth ($53,150) $21,370 $491,960 $2,020,290 $6,372,440

Academic Version Page 8

Pheonix

Table: Ratios

Ratio Analysis

Industry

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Profile

Sales Growth 0.00% 125.99% 87.50% 66.67% 100.00% 6.99%

Percent of Total Assets

Accounts Receivable 14.07% 24.14% 21.84% 12.87% 8.98% 18.01%

Other Current Assets 0.00% 0.00% 0.00% 0.00% 0.00% 52.28%

Total Current Assets 19.44% 27.58% 59.03% 82.53% 90.63% 74.45%

Long-term Assets 80.56% 72.42% 40.97% 17.47% 9.37% 25.55%

Total Assets 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Current Liabilities 2.39% 7.26% 2.77% 2.00% 1.59% 32.67%

Long-term Liabilities 115.09% 87.40% 37.96% 11.93% 3.64% 17.17%

Total Liabilities 117.48% 94.66% 40.72% 13.93% 5.24% 49.84%

Net Worth -17.48% 5.34% 59.28% 86.07% 94.76% 50.16%

Percent of Sales

Sales 100.00% 100.00% 100.00% 100.00% 100.00% 100.00%

Gross Margin -10.30% 13.43% 26.00% 42.57% 56.86% 100.00%

Selling, General & Administrative

16.98% 8.77% 10.31% 12.01% 13.34% 78.70%

Expenses

Advertising Expenses 4.24% 1.88% 2.67% 2.00% 1.20% 1.17%

Profit Before Interest and Taxes -23.08% 7.74% 20.58% 38.71% 54.63% 3.28%

Main Ratios

Current 8.13 3.80 21.33 41.32 56.87 1.68

Quick 8.13 3.80 21.33 41.32 56.87 1.36

Total Debt to Total Assets 117.48% 94.66% 40.72% 13.93% 5.24% 59.49%

Pre-tax Return on Net Worth 363.41% 435.89% 119.57% 94.56% 85.37% 7.66%

Pre-tax Return on Assets -63.51% 23.26% 70.88% 81.39% 80.90% 18.91%

Additional Ratios FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Net Profit Margin -27.28% 4.66% 15.69% 30.57% 43.52% n.a

Return on Equity 0.00% 348.71% 95.66% 75.65% 68.30% n.a

Activity Ratios

Accounts Receivable Turnover 12.41 12.41 12.41 12.41 12.41 n.a

Collection Days 29 21 23 24 22 n.a

Accounts Payable Turnover 12.41 12.17 12.17 12.17 12.17 n.a

Payment Days 27 27 21 22 22 n.a

Total Asset Turnover 2.33 4.00 3.61 2.13 1.49 n.a

Debt Ratios

Debt to Net Worth 0.00 17.74 0.69 0.16 0.06 n.a

Current Liab. to Liab. 0.02 0.08 0.07 0.14 0.30 n.a

Liquidity Ratios

Net Working Capital $51,850 $81,370 $466,960 $1,890,290 $5,987,440 n.a

Interest Coverage -5.49 4.03 21.10 76.55 244.82 n.a

Additional Ratios

Assets to Sales 0.43 0.25 0.28 0.47 0.67 n.a

Current Debt/Total Assets 2% 7% 3% 2% 2% n.a

Acid Test 2.25 0.47 13.44 34.88 51.23 n.a

Sales/Net Worth 0.00 74.87 6.10 2.47 1.57 n.a

Dividend Payout 0.00 0.00 0.00 0.00 0.00 n.a

Academic Version Page 9

Pheonix

Table: General Assumptions

General Assumptions

FY 2012 FY 2013 FY 2014 FY 2015 FY 2016

Plan Month 1 2 3 4 5

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 8.50% 8.50% 8.50% 8.50% 8.50%

Tax Rate 20.00% 20.00% 20.00% 20.00% 20.00%

Other 0 0 0 0 0

Academic Version Page 10

Appendix

Table: Sales Forecast

Sales Forecast

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Sales

Financial Services 0% $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000

0% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Sales $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000

Direct Cost of Sales Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Personnel Expense $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Academic Version Page 11

Appendix

Table: Personnel

Personnel Plan

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Personnel Expenses Personnel

Personnel $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

Personnel

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Personnel

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Personnel

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Name or Title or Group $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Payroll $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

Academic Version Page 12

Appendix

Table: Profit and Loss

Pro Forma Profit and Loss

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Sales $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000

Direct Cost of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Personnel Expenses Payroll $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

Other Costs of Sales $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total Cost of Sales $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

Gross Margin ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075) ($6,075)

Gross Margin % -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30% -10.30%

Operating Expenses

Expenses

Payroll $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Advertising $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Travelling $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667 $1,667

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total Expenses $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167 $4,167

% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06% 7.06%

Expenses

Payroll $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Marketing/Promotion $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Depreciation $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500 $2,500

Utilities $417 $417 $417 $417 $417 $417 $417 $417 $417 $417 $417 $417

Insurance $208 $208 $208 $208 $208 $208 $208 $208 $208 $208 $208 $208

Other $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250 $250

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total Expenses $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375 $3,375

% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72% 5.72%

Expenses:

Payroll $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

$0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total Expenses $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%

------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------ ------------

Total Operating Expenses $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542 $7,542

Profit Before Interest and Taxes ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617) ($13,617)

EBITDA ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117) ($11,117)

Interest Expense $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479 $2,479

Taxes Incurred $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Net Profit ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096) ($16,096)

Net Profit/Sales -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28% -27.28%

Academic Version Page 13

Appendix

Table: Cash Flow

Pro Forma Cash Flow

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Cash Received

Cash from Operations

Cash Sales $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750 $14,750

Cash from Receivables $1,475 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250 $44,250

Subtotal Cash from Operations $16,225 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000

Additional Cash Received

Sales Tax, VAT, HST/GST Received 0.00% $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Other Liabilities (interest-free) $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Long-term Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Sales of Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

New Investment Received $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Received $16,225 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000 $59,000

Expenditures Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Expenditures from Operations

Cash Spending $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075 $65,075

Bill Payments $251 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521 $7,521

Subtotal Spent on Operations $65,326 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596

Additional Cash Spent

Sales Tax, VAT, HST/GST Paid Out $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Principal Repayment of Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other Liabilities Principal Repayment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Long-term Liabilities Principal Repayment $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Purchase Long-term Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Dividends $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Cash Spent $65,326 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596 $72,596

Net Cash Flow ($49,101) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596) ($13,596)

Cash Balance $165,899 $152,303 $138,708 $125,112 $111,516 $97,920 $84,324 $70,728 $57,133 $43,537 $29,941 $16,345

Academic Version Page 14

Appendix

Table: Balance Sheet

Pro Forma Balance Sheet

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Assets Starting Balances

Current Assets

Cash $215,000 $165,899 $152,303 $138,708 $125,112 $111,516 $97,920 $84,324 $70,728 $57,133 $43,537 $29,941 $16,345

Accounts Receivable $0 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775 $42,775

Other Current Assets $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Total Current Assets $215,000 $208,674 $195,078 $181,483 $167,887 $154,291 $140,695 $127,099 $113,503 $99,908 $86,312 $72,716 $59,120

Long-term Assets

Long-term Assets $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000 $275,000

Accumulated Depreciation $0 $2,500 $5,000 $7,500 $10,000 $12,500 $15,000 $17,500 $20,000 $22,500 $25,000 $27,500 $30,000

Total Long-term Assets $275,000 $272,500 $270,000 $267,500 $265,000 $262,500 $260,000 $257,500 $255,000 $252,500 $250,000 $247,500 $245,000

Total Assets $490,000 $481,174 $465,078 $448,983 $432,887 $416,791 $400,695 $384,599 $368,503 $352,408 $336,312 $320,216 $304,120

Liabilities and Capital Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Current Liabilities

Accounts Payable $0 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270

Current Borrowing $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Other Current Liabilities $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0

Subtotal Current Liabilities $0 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270 $7,270

Long-term Liabilities $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000 $350,000

Total Liabilities $350,000 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270 $357,270

Paid-in Capital $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000 $150,000

Retained Earnings ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000) ($10,000)

Earnings $0 ($16,096) ($32,192) ($48,288) ($64,383) ($80,479) ($96,575) ($112,671) ($128,767) ($144,863) ($160,958) ($177,054) ($193,150)

Total Capital $140,000 $123,904 $107,808 $91,713 $75,617 $59,521 $43,425 $27,329 $11,233 ($4,863) ($20,958) ($37,054) ($53,150)

Total Liabilities and Capital $490,000 $481,174 $465,078 $448,983 $432,887 $416,791 $400,695 $384,599 $368,503 $352,408 $336,312 $320,216 $304,120

Net Worth $140,000 $123,904 $107,808 $91,713 $75,617 $59,521 $43,425 $27,329 $11,233 ($4,863) ($20,958) ($37,054) ($53,150)

Academic Version Page 15

Appendix

Table: General Assumptions

General Assumptions

Feb-11 Mar-11 Apr-11 May-11 Jun-11 Jul-11 Aug-11 Sep-11 Oct-11 Nov-11 Dec-11 Jan-12

Plan Month 1 2 3 4 5 6 7 8 9 10 11 12

Current Interest Rate 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00% 10.00%

Long-term Interest Rate 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50% 8.50%

Tax Rate 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00% 20.00%

Other 0 0 0 0 0 0 0 0 0 0 0 0

Academic Version Page 16

You might also like

- CFI - FMVA Practice Exam Case Study ADocument18 pagesCFI - FMVA Practice Exam Case Study AWerfelli MaramNo ratings yet

- Sneakers 2013Document5 pagesSneakers 2013priyaa0367% (12)

- CFI FMVA Final Assessment Case Study 1ADocument12 pagesCFI FMVA Final Assessment Case Study 1Apadre pio kone100% (1)

- Accounting Microsoft CaseDocument6 pagesAccounting Microsoft CaseChi100% (1)

- UntitledDocument131 pagesUntitledMark EstevesNo ratings yet

- FDDGDocument7 pagesFDDGlistenkidNo ratings yet

- Larrys Bicycle Shop - Annual Financial Statements - Original HardcodedDocument4 pagesLarrys Bicycle Shop - Annual Financial Statements - Original HardcodedLarry MaiNo ratings yet

- Bookkeeping ActivityDocument11 pagesBookkeeping ActivityIest HinigaranNo ratings yet

- Capital Trainers Full PPT On TDSDocument78 pagesCapital Trainers Full PPT On TDSYamuna GNo ratings yet

- Financial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free GroceriesDocument6 pagesFinancial Plan For Meet Green: Locally Grown Produce, Chemical-And Preservative-Free Groceriesramsha nishatNo ratings yet

- 4 TiposDocument4 pages4 TiposCarlos BernadacNo ratings yet

- Jaxworks PaybackAnalysis1Document1 pageJaxworks PaybackAnalysis1Jo Ann RangelNo ratings yet

- Task 7Document14 pagesTask 7Damaris MoralesNo ratings yet

- SCM Topic 1 Blades Solution 2022Document3 pagesSCM Topic 1 Blades Solution 2022Adi KurniawanNo ratings yet

- Medical Office Startup Expenses 1Document8 pagesMedical Office Startup Expenses 1cplNo ratings yet

- Dust Busters SpreadsheetsDocument1 pageDust Busters Spreadsheetsapi-223613030No ratings yet

- Account Excess FV Over BV $ 200,000 Allocations: TotalDocument6 pagesAccount Excess FV Over BV $ 200,000 Allocations: TotalMcKenzie WNo ratings yet

- jz0424 01Document9 pagesjz0424 01ianduncan355No ratings yet

- HR Department BudgetDocument3 pagesHR Department Budgetrainesiusdohling.iitrNo ratings yet

- HR Annual Budget Template A4Document2 pagesHR Annual Budget Template A4rainesiusdohling.iitrNo ratings yet

- Running Head: Budget AnalysisDocument5 pagesRunning Head: Budget AnalysisCarlos AlphonceNo ratings yet

- Guillermo UpdateddataDocument6 pagesGuillermo UpdateddataGabiNo ratings yet

- #NAME?: Income Statement TemplateDocument8 pages#NAME?: Income Statement TemplateNurul Shahira Ahmad MaswahNo ratings yet

- Task 1Document20 pagesTask 1RaimundoNo ratings yet

- It App - WorkbookDocument8 pagesIt App - WorkbookAsi Cas JavNo ratings yet

- FS MODEL (KSP)Document106 pagesFS MODEL (KSP)Oh Oh OhNo ratings yet

- Financial PlanDocument5 pagesFinancial PlanVivian CorpuzNo ratings yet

- 3 Statement Financial Model: How To Build From Start To FinishDocument9 pages3 Statement Financial Model: How To Build From Start To FinishMiks EnriquezNo ratings yet

- Economic Analysis: Summary TableDocument79 pagesEconomic Analysis: Summary TableGeorgios PalaiologosNo ratings yet

- Business Plan Templates - Income Statement, Balance Sheet, Cash-Flow StatementDocument7 pagesBusiness Plan Templates - Income Statement, Balance Sheet, Cash-Flow StatementJakob GrayNo ratings yet

- Financial Analysis of Ebay IncDocument8 pagesFinancial Analysis of Ebay Incshepherd junior masasiNo ratings yet

- Financial ManagementDocument12 pagesFinancial ManagementValeria MartinezNo ratings yet

- Managerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020Document10 pagesManagerial Accounting Assignment-1: Submitted by Harpreet Singh 2010PGP020happiest1No ratings yet

- Financial Plan: 7.1 Important AssumptionsDocument21 pagesFinancial Plan: 7.1 Important Assumptionsaira eau claire orbeNo ratings yet

- Financial Plan: 7.1 Break-Even AnalysisDocument41 pagesFinancial Plan: 7.1 Break-Even AnalysisnahidasumbalsundasNo ratings yet

- Documento 3Document2 pagesDocumento 3aimarylorenzoizquierdoNo ratings yet

- Advance2 HW - P6-9Document4 pagesAdvance2 HW - P6-9Fernando HermawanNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument3 pagesCapital Investment Model - NPV IRR Payback: Strictly ConfidentialKrishna YagnamurthyNo ratings yet

- Tarea Final Principles of AccountingDocument8 pagesTarea Final Principles of AccountingCarlos RiveraNo ratings yet

- Peanut FinancialsDocument4 pagesPeanut FinancialsTertius Du ToitNo ratings yet

- Alekaya StatementDocument4 pagesAlekaya Statementapi-527776626No ratings yet

- Operating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00Document3 pagesOperating Cash Flows (A) $ 6,895,625.00 $ 8,824,750.00 $ 12,248,375.00 $ 13,087,125.00MohitNo ratings yet

- Bab-2 MK2018Document15 pagesBab-2 MK2018CalistaNo ratings yet

- Financial Planning and Forecasting: AsssumptionsDocument4 pagesFinancial Planning and Forecasting: AsssumptionssubhenduNo ratings yet

- Profit and Loss StatementDocument3 pagesProfit and Loss StatementAli TekinNo ratings yet

- Sample Financial ModelDocument69 pagesSample Financial ModelfoosaaNo ratings yet

- Tagpuno, Riki Jonas - Capital BudgetingDocument9 pagesTagpuno, Riki Jonas - Capital BudgetingrikitagpunoNo ratings yet

- Michael Hermawan Yuwono MGMT6346 Ba10 UtpDocument36 pagesMichael Hermawan Yuwono MGMT6346 Ba10 UtpchristianNo ratings yet

- SC BladesDocument3 pagesSC Bladesxiaotuling117No ratings yet

- Financial PlanDocument12 pagesFinancial PlanNico BoialterNo ratings yet

- InstructionsDocument3 pagesInstructionsmohitgaba19No ratings yet

- Assignment 2Document5 pagesAssignment 2Ahmad SaleemNo ratings yet

- SALOMON-CASE - STUDY (Repaired)Document8 pagesSALOMON-CASE - STUDY (Repaired)kylaasio8No ratings yet

- Cash Flow Forecasting TemplateDocument41 pagesCash Flow Forecasting TemplateAdil Javed CHNo ratings yet

- Capital Investment Model - NPV IRR Payback: Strictly ConfidentialDocument4 pagesCapital Investment Model - NPV IRR Payback: Strictly Confidentialsh munnaNo ratings yet

- HolaKola HW Model ProvideDocument4 pagesHolaKola HW Model ProvideslmedcalfeNo ratings yet

- Gym BudgetDocument3 pagesGym BudgetJOHN MANTHINo ratings yet

- Schoolwide BudgetDocument6 pagesSchoolwide Budgetapi-572446928No ratings yet

- Financial Plan:: The Following Sections Will Outline Important Financial InformationDocument17 pagesFinancial Plan:: The Following Sections Will Outline Important Financial InformationpalwashaNo ratings yet

- Personal Financial PlanDocument10 pagesPersonal Financial Planclossbu2310No ratings yet

- 23-NURFC 2002 Projections vs. ActualDocument4 pages23-NURFC 2002 Projections vs. ActualCOASTNo ratings yet

- 49 5year 1Document3 pages49 5year 1ravuri.monisha4No ratings yet

- Feed. LerhetDocument35 pagesFeed. LerhetfuadzeyniNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- DMMR CVP MathDocument2 pagesDMMR CVP MathSabbir ZamanNo ratings yet

- This Study Resource Was: Research Report - Relaxo FootwearsDocument7 pagesThis Study Resource Was: Research Report - Relaxo FootwearskaranNo ratings yet

- Indian Bond MarketDocument4 pagesIndian Bond MarketAmritangshu BanerjeeNo ratings yet

- 23si0055 - Ace WaterDocument1 page23si0055 - Ace WaterDeshan SingNo ratings yet

- 100 Percent Financial Inclusion - Gulbarga District InitiativeDocument7 pages100 Percent Financial Inclusion - Gulbarga District InitiativeBasavaraj MtNo ratings yet

- Far160 Pyq July2023Document8 pagesFar160 Pyq July2023nazzyusoffNo ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- Cash DepartmentDocument2 pagesCash DepartmentTaimur ZiaNo ratings yet

- Agricultural EconomicsDocument14 pagesAgricultural EconomicsIzuka ChibuzorNo ratings yet

- Report of Investigation: Burns Philp and Co LTDDocument41 pagesReport of Investigation: Burns Philp and Co LTDa_bleem_userNo ratings yet

- Specimen Paper - Maths A&I SL - Answers: November 23, 2021Document2 pagesSpecimen Paper - Maths A&I SL - Answers: November 23, 2021Jaime Molano Moreno0% (1)

- Global Recession and Its Impact On Indian ECONOMY (2008) : By:-Sarwadaman Singh R.No:-17 BBA010 COURSE: - B. B. A (2017)Document22 pagesGlobal Recession and Its Impact On Indian ECONOMY (2008) : By:-Sarwadaman Singh R.No:-17 BBA010 COURSE: - B. B. A (2017)varun rajNo ratings yet

- 1Document60 pages1alicewilliams83nNo ratings yet

- Income Tax For Ind - and Corp - 1Document11 pagesIncome Tax For Ind - and Corp - 1bobo kaNo ratings yet

- Accountancy Paper III Advance Financial Management Final BookDocument395 pagesAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- Reserve Bank of India 3Document2 pagesReserve Bank of India 3john_muellorNo ratings yet

- Netowrth CertificateDocument3 pagesNetowrth CertificateSai Charan GvNo ratings yet

- Chola MsDocument98 pagesChola MsDhaval224No ratings yet

- Savings and Investments Pricing Guide 2023Document21 pagesSavings and Investments Pricing Guide 2023Thanduxolo MlamuliNo ratings yet

- Altisource IIM A JDDocument2 pagesAltisource IIM A JDBipin Bansal AgarwalNo ratings yet

- Your Recent Charges Your Last Bill Summary: Tax InvoiceDocument10 pagesYour Recent Charges Your Last Bill Summary: Tax InvoiceDibyendu Karmakar100% (1)

- Chap 3 Bonds and Their ValuationDocument42 pagesChap 3 Bonds and Their ValuationShahzad C7No ratings yet

- The Cooperative Societies Act, 1925Document25 pagesThe Cooperative Societies Act, 1925Asghar Ali RanaNo ratings yet

- Credit MonitoringDocument15 pagesCredit MonitoringSyam Sandeep67% (3)

- Chapter 9 Home Office, Branch and Agency Accounting-PROFE01Document5 pagesChapter 9 Home Office, Branch and Agency Accounting-PROFE01Steffany RoqueNo ratings yet

- COOKIEDocument15 pagesCOOKIEBecca AlmencionNo ratings yet