Professional Documents

Culture Documents

SEBI Puts New AIFs and Scheme Launch On Hold

SEBI Puts New AIFs and Scheme Launch On Hold

Uploaded by

ELP Law0 ratings0% found this document useful (0 votes)

25 views1 pageSEBI has introduced series of changes as follows:

1. Processing of applications for registration of Alternative Investment Fund (AIF) and launching of new schemes, where investment committee of an AIF consists of external members who may be resident Indian citizens or not resident Indian citizens;

2. Amendment to the Standard Operating Procedure issued for handling of SCORES complaints by stock exchanges and non redressal of grievances by listed companies.

Original Title

SEBI Puts New AIFs and Scheme Launch on Hold

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSEBI has introduced series of changes as follows:

1. Processing of applications for registration of Alternative Investment Fund (AIF) and launching of new schemes, where investment committee of an AIF consists of external members who may be resident Indian citizens or not resident Indian citizens;

2. Amendment to the Standard Operating Procedure issued for handling of SCORES complaints by stock exchanges and non redressal of grievances by listed companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

25 views1 pageSEBI Puts New AIFs and Scheme Launch On Hold

SEBI Puts New AIFs and Scheme Launch On Hold

Uploaded by

ELP LawSEBI has introduced series of changes as follows:

1. Processing of applications for registration of Alternative Investment Fund (AIF) and launching of new schemes, where investment committee of an AIF consists of external members who may be resident Indian citizens or not resident Indian citizens;

2. Amendment to the Standard Operating Procedure issued for handling of SCORES complaints by stock exchanges and non redressal of grievances by listed companies.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

SEBI put s ne w AI Fs and sche me l aunch on

hol d where IC s may have not re si de nt

I ndi an citi ze ns | SCORES - only pr omoter

shares t o be froze n | Re covery Ex pe nse October 23, 2020

Fund t o be cr eate d

SEBI has introduced series of changes as follows:

▪ Processing of applications for registration of Alternative Investment Fund (AIF) and launching of new schemes, where investment

committee of an AIF consists of external members who may be resident Indian citizens or not resident Indian citizens;

▪ Amendment to the Standard Operating Procedure issued for handling of SCORES complaints by stock exchanges and non-

redressal of grievances by listed companies to clarify that only promoters’ securities will be frozen and not the entire “promoter

and promoter group”

▪ Creation of ‘Recovery Expense Fund’ to deal with defaults in relation to listed debt securities.

Key changes are provided below:

▪ Processing of applications for registration of AIFs and launching of new schemes

In view of the recent amendments introduced vide SEBI (Alternative Investment Funds) (Amendment) Regulations, 2020 dated

October 19, 2020 (available here) providing that the fund manager may constitute an Investment Committee (IC) to approve

investment decisions of the AIF, SEBI has written to the Government and RBI seeking clarity on whether the investment made by an

AIF whose IC approves investment decisions and consists of external members who are not ‘resident Indian citizens’, would fall under

clause (4) of Schedule VIII under FEM (Non-debt Instruments) Rules, 2019 and accordingly be reckoned as indirect foreign investment.

Till clarification is received from Government/ RBI, SEBI has stated that the applications for registration of AIFs and launch of new

schemes will be dealt as under:

− The applications wherein IC proposed to be constituted to approve investment decisions of AIF includes external members who

are ‘resident Indian citizens’, shall be duly processed;

− The applications wherein IC proposed to be constituted to approve investment decisions of AIF includes external members who

are not ‘resident Indian citizens’, the same shall be considered only after receipt of clarification from the Government and RBI.

The aforesaid clarification has been provided vide SEBI Circular dated October 22, 2020 (available here).

▪ Amendment to the Standard Operating Procedure issued for handling of SCORES complaints by stock exchanges –

Only promoters’ securities to be frozen and not the entire “promoter and promoter group”

SEBI had recently provided the procedure for handling of complaints by the stock exchanges, as well as standard operating procedure

for actions to be taken against listed companies for failure to redress investor grievances through SCORES platform vide SEBI Circular

dated August 13, 2020 (available here). As per the circular, in case of non-compliance by listed entity and/ or failure to pay fine levied

within the stipulated period as per the notices, the designated stock exchange was empowered to issue intimation to depositories to

freeze the entire shareholding of the promoters and promoter group in the concerned listed entity as well as all other securities held

in the demat account of the promoter and promoter group.

SEBI has now revised the aforesaid provision to remove “promoter group” and accordingly, the securities of only the promoter(s) will

be frozen. The aforesaid amendment has been made vide SEBI Circular dated October 22, 2020 (available here).

▪ Creation of ‘Recovery Expense Fund’

Vide recent amendments, SEBI had directed that the issuer is obligated to create a recovery expense fund (REF) and the debenture

trustee is to ensure the implementation of recovery expense fund. Now, in order to enable the Debenture Trustee(s) to take prompt

action for enforcement of security in case of ‘default’ in listed debt securities, SEBI has provided the manner of creation, utilization

and refund of REF. The requirements will come into force w.e.f. January 01, 2021 and all the applications for listing of debt securities

made on or after January 01, 2021 will be required to comply with the condition of creation of REF. The existing issuers whose debt

securities are already listed on Stock Exchange(s) shall be given additional time period of 90 days to comply with the requirements

for creation of REF.

SEBI Circular dated October 22, 2020 (available here) lays further detail in relation to the aforementioned.

Disclaimer: The information provided in this update is intended for informational purposes only and does not constitute legal opinion or advice. Readers are

requested to seek formal legal advice prior to acting upon any of the information provided herein.

You might also like

- Solved For A Given Soil, The Following Are Known Gs 2.74, M...Document1 pageSolved For A Given Soil, The Following Are Known Gs 2.74, M...Cristian A. GarridoNo ratings yet

- PR - SEBI Board MeetingDocument4 pagesPR - SEBI Board MeetingShyam SunderNo ratings yet

- ELP Corporate Update SEBI Issues The Modalities For Implementation of Accredited InvestorsDocument4 pagesELP Corporate Update SEBI Issues The Modalities For Implementation of Accredited InvestorsELP LawNo ratings yet

- SEBI Outlines Procedures For AIF RegistrationDocument6 pagesSEBI Outlines Procedures For AIF RegistrationHashir KhanNo ratings yet

- Investment Law MarketingDocument6 pagesInvestment Law MarketingJust RandomNo ratings yet

- Notification No. FEMA 120/RB-2004 Dated July 7, 2004Document4 pagesNotification No. FEMA 120/RB-2004 Dated July 7, 2004Shivam DhamijaNo ratings yet

- Foreign Currency Exchangeable BondsDocument7 pagesForeign Currency Exchangeable BondsDheeraj VijayNo ratings yet

- Click Here 122Document34 pagesClick Here 122Akanksha BohraNo ratings yet

- Supplement Professional Programme: For December, 2022 ExaminationDocument28 pagesSupplement Professional Programme: For December, 2022 ExaminationsukritiNo ratings yet

- Corporate Cue - March 2010Document20 pagesCorporate Cue - March 2010Ankith RaoNo ratings yet

- UFCE RBI REGULATION Jan 23Document12 pagesUFCE RBI REGULATION Jan 23renu.balaNo ratings yet

- Declaration of Dividend by CooperativesDocument5 pagesDeclaration of Dividend by CooperativesManuel MoralesNo ratings yet

- Investment Law 2Document36 pagesInvestment Law 2Utkarsha MovvaNo ratings yet

- FCEBDocument3 pagesFCEBRedefining Success KashishNo ratings yet

- PIB 2-14 MarchDocument122 pagesPIB 2-14 MarchgaganNo ratings yet

- B BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateDocument20 pagesB BB Bbanking Anking Anking Anking Anking: U Uu Uupdate Pdate Pdate Pdate PdateGuruswami PrakashNo ratings yet

- Background: Direct Investment by Indian Resident in JV/WOS Outside India - Direct Investments byDocument19 pagesBackground: Direct Investment by Indian Resident in JV/WOS Outside India - Direct Investments byrenu.balaNo ratings yet

- CA Jan 09Document8 pagesCA Jan 09ElvisPresliiNo ratings yet

- Recent Developments On Participatory Notes: IndiaDocument3 pagesRecent Developments On Participatory Notes: IndiapulkitaquarianNo ratings yet

- SEBI Board Meeting: PR No.24/2021Document6 pagesSEBI Board Meeting: PR No.24/2021Avinash SNo ratings yet

- NBFC Audit ProgramDocument8 pagesNBFC Audit ProgramPankaj AmbreNo ratings yet

- Business Trusts in IndiaDocument7 pagesBusiness Trusts in IndiaKunwarbir Singh lohatNo ratings yet

- Click Here 137Document23 pagesClick Here 137Nanda GroupNo ratings yet

- Commercial PapersDocument10 pagesCommercial PapersShreya AgarwalNo ratings yet

- Audit of NBFCDocument17 pagesAudit of NBFCSriramNo ratings yet

- Sebi Updates NovDocument7 pagesSebi Updates NovParidhi JainNo ratings yet

- Ca Final New Case Laws Notification CircularsDocument9 pagesCa Final New Case Laws Notification Circularsbedidanish900No ratings yet

- WA0004. - RemovedDocument76 pagesWA0004. - Removedsushil.saliyan1003No ratings yet

- Module V Recent Trends & DevelopmentsDocument18 pagesModule V Recent Trends & DevelopmentsItisha SinghNo ratings yet

- Npa Management ToolsDocument11 pagesNpa Management ToolsSK MishraNo ratings yet

- Wbhidco Kolkata TenderDocument24 pagesWbhidco Kolkata Tendershafaquesameen2001No ratings yet

- Mahindra & Mahindra Financial Services Limited Dividend Distribution PolicyDocument6 pagesMahindra & Mahindra Financial Services Limited Dividend Distribution PolicyJuan Carlos CalderonNo ratings yet

- External Commercial BorrowingDocument10 pagesExternal Commercial BorrowingKunal TapreNo ratings yet

- Convertible Notes Open Doors To Foreign Investments For StartupsDocument4 pagesConvertible Notes Open Doors To Foreign Investments For StartupsFelix AdvisoryNo ratings yet

- CFL - Amendments - June 2023Document12 pagesCFL - Amendments - June 2023Ranjana YadavNo ratings yet

- 3 The Bnak Companies Act, 1991 (AMENDEDUP TO 2003)Document20 pages3 The Bnak Companies Act, 1991 (AMENDEDUP TO 2003)IQBALNo ratings yet

- Suggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsDocument16 pagesSuggested Answer - Syl12 - Jun2014 - Paper - 13 Final Examination: Suggested Answers To QuestionsMdAnjum1991No ratings yet

- Alternative Investment Fund RegistrationDocument6 pagesAlternative Investment Fund RegistrationParas MittalNo ratings yet

- Recent Amendments in FemaDocument14 pagesRecent Amendments in FemaSarath Kumar Vijaya KumarNo ratings yet

- Regulatory Provisions Under EcbDocument6 pagesRegulatory Provisions Under EcbAllwyn FlowNo ratings yet

- Master Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)Document10 pagesMaster Circular - Bank Finance To Non-Banking Financial Companies (NBFCS)yogendrachat4057No ratings yet

- ODI May2011Document4 pagesODI May2011Parul ShahNo ratings yet

- SEBI Board Meeting: I. Reduction of Fees Payable by Brokers by 25% and Calibration of Other FeesDocument4 pagesSEBI Board Meeting: I. Reduction of Fees Payable by Brokers by 25% and Calibration of Other FeesNewsBharatiNo ratings yet

- Investments by Co-Op SocietiesDocument16 pagesInvestments by Co-Op SocietiesRajendra JoshiNo ratings yet

- Edelvise ProjectDocument21 pagesEdelvise ProjectsunitaNo ratings yet

- PWC ODI Reg. AnalysisDocument5 pagesPWC ODI Reg. AnalysisVishwas SharmaNo ratings yet

- RBI (Unhedged Foreign Currency Exposure) Directions, 2022 - Taxguru - inDocument10 pagesRBI (Unhedged Foreign Currency Exposure) Directions, 2022 - Taxguru - invijayjoshitempNo ratings yet

- Newsletter December 2022Document9 pagesNewsletter December 2022Dsp VarmaNo ratings yet

- RBI Issues Regulations Under The Amended Factoring Regulation Act, 2011Document1 pageRBI Issues Regulations Under The Amended Factoring Regulation Act, 2011Aayush GuptaNo ratings yet

- Supplement Executive Programme: For June, 2021 ExaminationDocument51 pagesSupplement Executive Programme: For June, 2021 ExaminationNiel JangirNo ratings yet

- New Microsoft Office Word DocumentDocument30 pagesNew Microsoft Office Word Documentawais_hussain7998No ratings yet

- Definition of Round TrippingDocument6 pagesDefinition of Round Trippingjdx sanNo ratings yet

- QIPsDocument19 pagesQIPsJyothsna RanganathNo ratings yet

- SEBI-Framework For The Process of Accreditation of Investors For The Purpose of Innovators Growth PlatformDocument6 pagesSEBI-Framework For The Process of Accreditation of Investors For The Purpose of Innovators Growth PlatformAyushi MittalNo ratings yet

- Non Banking Financial Company1Document7 pagesNon Banking Financial Company1Prakansha PandeyNo ratings yet

- 13 - Amendment To AIFDocument4 pages13 - Amendment To AIFPooja dhamorNo ratings yet

- External Commercial Borrowing 1Document6 pagesExternal Commercial Borrowing 1Esha GuptaNo ratings yet

- Draft Guidelines For Issue of Commercial Paper (CP)Document9 pagesDraft Guidelines For Issue of Commercial Paper (CP)extraterrestrial2024No ratings yet

- 2022 138 Taxmann Com 459 ArticleDocument19 pages2022 138 Taxmann Com 459 ArticleraghavbediNo ratings yet

- RBI FAQ of FDI in IndiaDocument53 pagesRBI FAQ of FDI in Indiaaironderon1No ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- FSR Book FinalDocument21 pagesFSR Book FinalELP LawNo ratings yet

- SC Rules On Interpretation of Tax Treaty - NotificationDocument2 pagesSC Rules On Interpretation of Tax Treaty - NotificationELP LawNo ratings yet

- Corporate Solutions: Economic Laws Practice - Your Trusted Corporate Law Firms in MumbaiDocument33 pagesCorporate Solutions: Economic Laws Practice - Your Trusted Corporate Law Firms in MumbaiELP LawNo ratings yet

- ELP Quarterly Update Competition Law Policy Newsletter Q1 of 2023Document9 pagesELP Quarterly Update Competition Law Policy Newsletter Q1 of 2023ELP LawNo ratings yet

- BIS Newsletter - September EditionDocument14 pagesBIS Newsletter - September EditionELP LawNo ratings yet

- Indirect Tax Newsletter - September 2023Document11 pagesIndirect Tax Newsletter - September 2023ELP LawNo ratings yet

- E-Invoicing-Whether The Relevant Provisions of GST Law Require PatchworkDocument3 pagesE-Invoicing-Whether The Relevant Provisions of GST Law Require PatchworkELP LawNo ratings yet

- Overview of The Digital Personal Data Protection DPDP Bill 2023Document5 pagesOverview of The Digital Personal Data Protection DPDP Bill 2023ELP LawNo ratings yet

- TradeWatch Weekly Bulletin May 22 2023Document3 pagesTradeWatch Weekly Bulletin May 22 2023ELP LawNo ratings yet

- ELP Tax Update - Recent Clarifications To Settle Certain Issues Under GSTDocument4 pagesELP Tax Update - Recent Clarifications To Settle Certain Issues Under GSTELP LawNo ratings yet

- Here.: BackgroundDocument1 pageHere.: BackgroundELP LawNo ratings yet

- List of Quality Control Orders Notified in Gazette of India To Make The Standards Mandatory - Ministry of Chemicals and FertilizersDocument14 pagesList of Quality Control Orders Notified in Gazette of India To Make The Standards Mandatory - Ministry of Chemicals and FertilizersELP LawNo ratings yet

- The India Growth StoryDocument13 pagesThe India Growth StoryELP LawNo ratings yet

- Interplay of Some of The Recent Judgments Under IbcDocument24 pagesInterplay of Some of The Recent Judgments Under IbcELP LawNo ratings yet

- Taxsutra ELP Newsletter 15RDocument36 pagesTaxsutra ELP Newsletter 15RELP LawNo ratings yet

- ELP Update VCC Structure Recommended For Funds in GIFT CityDocument10 pagesELP Update VCC Structure Recommended For Funds in GIFT CityELP LawNo ratings yet

- Social Media Companies Bulk Up Legal Teams Amid Increase in Compliance RequirementsDocument1 pageSocial Media Companies Bulk Up Legal Teams Amid Increase in Compliance RequirementsELP LawNo ratings yet

- Administrative Mechanism in India For Valuation of Related Party Imports - Perspective & ChallengesDocument7 pagesAdministrative Mechanism in India For Valuation of Related Party Imports - Perspective & ChallengesELP LawNo ratings yet

- Redevelopment of Co-Operative Housing Societies - GST ImplicationsDocument13 pagesRedevelopment of Co-Operative Housing Societies - GST ImplicationsELP LawNo ratings yet

- Guidelines On Misleading Advertisements in IndiaDocument5 pagesGuidelines On Misleading Advertisements in IndiaELP LawNo ratings yet

- ELP Indirect Tax Newsletter November 2022Document6 pagesELP Indirect Tax Newsletter November 2022ELP LawNo ratings yet

- Aifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerDocument4 pagesAifs To Segregate and Ring-Fence Assets and Liabilities of Each Scheme Parameters Provided For First Close, Tenure and Change of Sponsor/ManagerELP LawNo ratings yet

- The WTO's MC-12 Key Outcomes and HighlightsDocument4 pagesThe WTO's MC-12 Key Outcomes and HighlightsELP LawNo ratings yet

- ELP Arbitration Update - Ravi Ranjan Developers Pvt. Ltd. v. Aditya Kumar Chatterjee - ELPLAWDocument6 pagesELP Arbitration Update - Ravi Ranjan Developers Pvt. Ltd. v. Aditya Kumar Chatterjee - ELPLAWELP LawNo ratings yet

- Navigating GST 2.0 - Tax MantraDocument34 pagesNavigating GST 2.0 - Tax MantraELP LawNo ratings yet

- AVE On Azure: Julio Dominguez Sr. SE DPDDocument8 pagesAVE On Azure: Julio Dominguez Sr. SE DPDIsrael Mayen NavaNo ratings yet

- China Limits Exports of Rare Earth MaterialsDocument1 pageChina Limits Exports of Rare Earth Materialscr7 bestNo ratings yet

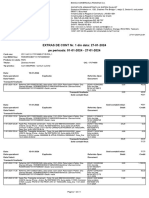

- Pe Perioada: 01-01-2024 - 27-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 27-01-2024Document4 pagesPe Perioada: 01-01-2024 - 27-01-2024 EXTRAS DE CONT Nr. 1 Din Data: 27-01-2024andrei.zbercea04No ratings yet

- Willem Hoek: This Notes Relates To SAP ECC (ERP Central Component) 5.0Document11 pagesWillem Hoek: This Notes Relates To SAP ECC (ERP Central Component) 5.0m abbasiNo ratings yet

- Contract of Lease FormDocument3 pagesContract of Lease FormHal JordanNo ratings yet

- UPMPL - BPD - MM3A - Material Reservation - V1 0Document7 pagesUPMPL - BPD - MM3A - Material Reservation - V1 0Sujith PNo ratings yet

- Manufacturing AnswersDocument9 pagesManufacturing AnswersGaurav YadavNo ratings yet

- M.C. Mehta and Anr Vs Union of India & Ors On 20 December, 1986 Equivalent Citations: 1987 AIR 1086, 1987 SCR (1) 819 Bench: Bhagwati, P.N. (CJ)Document3 pagesM.C. Mehta and Anr Vs Union of India & Ors On 20 December, 1986 Equivalent Citations: 1987 AIR 1086, 1987 SCR (1) 819 Bench: Bhagwati, P.N. (CJ)Prakher ShuklaNo ratings yet

- Avon Products, Inc.: A Case Narrative in Company Relations With Customers and SuppliersDocument13 pagesAvon Products, Inc.: A Case Narrative in Company Relations With Customers and SuppliersAndreea IoanaNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Deeksha SinghNo ratings yet

- Eldama Ravine Technical: and Vocational CollegeDocument2 pagesEldama Ravine Technical: and Vocational CollegeBen ChelagatNo ratings yet

- TDP Template FinalDocument9 pagesTDP Template Finaldeepak1007No ratings yet

- Neja 1Document8 pagesNeja 1Fathan NugrahaNo ratings yet

- Agricultural Extension in Asia Constraints and Options For ImprovementDocument15 pagesAgricultural Extension in Asia Constraints and Options For ImprovementMarejen Almedilla VillaremoNo ratings yet

- Aso Mega ListDocument7 pagesAso Mega ListcmlcbhtidNo ratings yet

- Principal of MarketingDocument121 pagesPrincipal of MarketingBindu Devender MahajanNo ratings yet

- Tourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDocument12 pagesTourism in Africa:: Harnessing Tourism For Growth and Improved LivelihoodsDIPIN PNo ratings yet

- OD427980832162006100Document1 pageOD427980832162006100nikhbiradarNo ratings yet

- Taco 230803PF00985414 2Document1 pageTaco 230803PF00985414 2roy.somnath.wkNo ratings yet

- BuxlyDocument13 pagesBuxlyAimen KhatanaNo ratings yet

- Jib Service Crane For RTG-Terminal 2Document7 pagesJib Service Crane For RTG-Terminal 2YasirNo ratings yet

- BCG MatrixDocument28 pagesBCG MatrixsatishNo ratings yet

- Case Study LogitechDocument2 pagesCase Study LogitechAryanNo ratings yet

- 978940180663C SMPLDocument22 pages978940180663C SMPLVi PhươngNo ratings yet

- E-Banking Act.1Document2 pagesE-Banking Act.1Christian Lorenz EdulanNo ratings yet

- Baf2206 Ahmed PDFDocument8 pagesBaf2206 Ahmed PDFODUNDO JOEL OKWIRINo ratings yet

- Managerial AccountingDocument21 pagesManagerial AccountingRam KnowlesNo ratings yet

- Template IPO Affidavit of Consent FormDocument2 pagesTemplate IPO Affidavit of Consent Formcathy cenonNo ratings yet

- HTG - Distribution Equipment - OfficialRelease - V1.0Document59 pagesHTG - Distribution Equipment - OfficialRelease - V1.0Altamir Nunes JuniorNo ratings yet