Professional Documents

Culture Documents

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

Uploaded by

MCCopyright:

Available Formats

You might also like

- Halifax Statement 2023 08 18Document4 pagesHalifax Statement 2023 08 18VALENTIN SHABLIKANo ratings yet

- MBA Finance ProjectDocument62 pagesMBA Finance Projectchotumotu13111190% (10)

- PAL v. NLRCDocument3 pagesPAL v. NLRCMCNo ratings yet

- General Concepts CasesDocument63 pagesGeneral Concepts CasesJanjan DumaualNo ratings yet

- CommRev CasesDocument30 pagesCommRev CasesanjisyNo ratings yet

- Philippine Health Care Providers Inc. Vs CirrDocument35 pagesPhilippine Health Care Providers Inc. Vs CirrTeacherEliNo ratings yet

- Philippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueDocument26 pagesPhilippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueTamara Bianca Chingcuangco Ernacio-TabiosNo ratings yet

- Cases 1-35Document308 pagesCases 1-35Vienie Ramirez BadangNo ratings yet

- G.R. No. 167330 INSURANCEDocument55 pagesG.R. No. 167330 INSURANCEcarpeNo ratings yet

- DIGEST CIR Vs Philippine Healthcare ProvidersDocument14 pagesDIGEST CIR Vs Philippine Healthcare ProvidersEthel Joi Manalac MendozaNo ratings yet

- PHILIPPINE HEALTH CARE PROVIDERS INC. vs. CIRDocument17 pagesPHILIPPINE HEALTH CARE PROVIDERS INC. vs. CIRDenee Vem MatorresNo ratings yet

- Digest of Philippine Health Care Providers vs. CIRDocument1 pageDigest of Philippine Health Care Providers vs. CIRDanya T. Reyes100% (2)

- Crac Method SampleDocument14 pagesCrac Method SampleAnonymous MikI28PkJcNo ratings yet

- Doctrines in TaxationDocument105 pagesDoctrines in TaxationRolando Mauring ReubalNo ratings yet

- G.R. No. 167330 September 18, 2009 Philippine Health Care Providers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentDocument67 pagesG.R. No. 167330 September 18, 2009 Philippine Health Care Providers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentJenny ButacanNo ratings yet

- Philippine Health Care Providers V CIRDocument2 pagesPhilippine Health Care Providers V CIRCassiopeiaNo ratings yet

- Philippine Health Care v. CIR, G.R. No. 167330, September 18, 2009Document15 pagesPhilippine Health Care v. CIR, G.R. No. 167330, September 18, 2009Elle MichNo ratings yet

- Philippine Health Care Providers Vs CIRDocument1 pagePhilippine Health Care Providers Vs CIRewnesssNo ratings yet

- #4 Philippine Health Care Providers Inc. v. Commissioner of Internal RevenueDocument11 pages#4 Philippine Health Care Providers Inc. v. Commissioner of Internal RevenueLean Gela MirandaNo ratings yet

- Philippine Health Providers Vs CIRDocument3 pagesPhilippine Health Providers Vs CIRana ortizNo ratings yet

- 2 PhilhealthDocument16 pages2 Philhealthbingkydoodle1012No ratings yet

- Digested (TAX 1) - Phil Health Care Providers Vs CIRDocument2 pagesDigested (TAX 1) - Phil Health Care Providers Vs CIRChugsNo ratings yet

- Commercial Law Cases 102212212Document66 pagesCommercial Law Cases 102212212tyansi lehetyNo ratings yet

- Tax Amnesty Doctrines in Taxation DigestDocument9 pagesTax Amnesty Doctrines in Taxation DigestJuralexNo ratings yet

- Digest - CIR v. PHIL. HEALTH CAREDocument2 pagesDigest - CIR v. PHIL. HEALTH CAREMyrahNo ratings yet

- Insurance Law Cases Full TextDocument295 pagesInsurance Law Cases Full TextAmir Nazri KaibingNo ratings yet

- PHCP Inc., Case G.R. No 167330Document23 pagesPHCP Inc., Case G.R. No 167330miscaccts incognitoNo ratings yet

- Philippine Health Care Providers, Inc. v. CIRDocument12 pagesPhilippine Health Care Providers, Inc. v. CIRPat EspinozaNo ratings yet

- 1st Batch CasesDocument82 pages1st Batch CasesMarshan GualbertoNo ratings yet

- Medicard vs. CirDocument5 pagesMedicard vs. CirTogz Mape100% (2)

- Philippine Health Care Providers, Inc. Vs CIR, 600 SCRA 413, September 18, 2009Document22 pagesPhilippine Health Care Providers, Inc. Vs CIR, 600 SCRA 413, September 18, 2009BREL GOSIMATNo ratings yet

- G.R. No. 167330. September 18, 2009. Philippine Health Care Providers, Inc., Petitioner, vs. Commissioner of Internal Revenue, RespondentDocument19 pagesG.R. No. 167330. September 18, 2009. Philippine Health Care Providers, Inc., Petitioner, vs. Commissioner of Internal Revenue, RespondentJillen SuanNo ratings yet

- CIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007rizel_adlawanNo ratings yet

- Tax Digests MLQU CaneroDocument67 pagesTax Digests MLQU CaneroEric Tamayo0% (1)

- Philippine Health Care Provider Vs CirDocument21 pagesPhilippine Health Care Provider Vs CirYvon BaguioNo ratings yet

- Courage Vs CIRDocument8 pagesCourage Vs CIRAna GNo ratings yet

- Philippine Health Care Providers Inc. v. CIRDocument2 pagesPhilippine Health Care Providers Inc. v. CIRRukmini Dasi Rosemary GuevaraNo ratings yet

- 17 - CIR V Philippine Health Care ProvidersDocument2 pages17 - CIR V Philippine Health Care ProvidersCamille AngelicaNo ratings yet

- G.R. No. 167330 Phil. Health Care Providers Vs CIRDocument15 pagesG.R. No. 167330 Phil. Health Care Providers Vs CIRPamela Denise RufilaNo ratings yet

- Petitioner vs. vs. Respondent: Special First DivisionDocument19 pagesPetitioner vs. vs. Respondent: Special First Divisionjames lebronNo ratings yet

- Philippine Health Care Providers v. CIR, G.R. No. 167330 (2009)Document18 pagesPhilippine Health Care Providers v. CIR, G.R. No. 167330 (2009)Joena GeNo ratings yet

- PHIL. HEALTH CARE PROVIDERS, INC vs. COMMISSIONER OF INTERNAL REVENUE - The Law IsCoolDocument3 pagesPHIL. HEALTH CARE PROVIDERS, INC vs. COMMISSIONER OF INTERNAL REVENUE - The Law IsCoolJetJuárezNo ratings yet

- Phil Health Care Providers Vs Commissioner of Internal Revenue - GR 167330Document15 pagesPhil Health Care Providers Vs Commissioner of Internal Revenue - GR 167330VieNo ratings yet

- Phil Health vs. CIRDocument11 pagesPhil Health vs. CIRElsie CayetanoNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Philippine Health Care Provider VS CirDocument3 pagesPhilippine Health Care Provider VS CirbelleferiesebelsaNo ratings yet

- Case Digest LastDocument10 pagesCase Digest LastmichelleNo ratings yet

- CIR v. PhilHealthDocument5 pagesCIR v. PhilHealthlilblackieNo ratings yet

- Insurance PHCP Vs CIR 2008Document1 pageInsurance PHCP Vs CIR 2008Kaye de LeonNo ratings yet

- Commissioner of Internal Revenue V Philippine Health Care (Case)Document10 pagesCommissioner of Internal Revenue V Philippine Health Care (Case)Nurfaiza UllahNo ratings yet

- GR No. 168129 (CIR V Phil Health Care) (Nonretroactivity)Document12 pagesGR No. 168129 (CIR V Phil Health Care) (Nonretroactivity)Archie GuevarraNo ratings yet

- Courage VS Commissoner of Internal Revenue DigestDocument3 pagesCourage VS Commissoner of Internal Revenue DigestCharles Roger Raya100% (1)

- Philhealth Care vs. CIR, 554 SCRA 411Document22 pagesPhilhealth Care vs. CIR, 554 SCRA 411KidMonkey2299No ratings yet

- Draft Contract - Manpower PrivateDocument10 pagesDraft Contract - Manpower PrivateCristopher JavidoNo ratings yet

- 93 Courage, Et Al. Vs CIRDocument3 pages93 Courage, Et Al. Vs CIRZachary SiayngcoNo ratings yet

- CIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Gol LumNo ratings yet

- Cs GarmentDocument2 pagesCs GarmentTheodore0176No ratings yet

- Cir Vs Amex PhilsDocument2 pagesCir Vs Amex PhilsEllen Glae DaquipilNo ratings yet

- Tax Digest VatDocument7 pagesTax Digest Vatma.catherine merillenoNo ratings yet

- PH Health Care Provider V CIRDocument7 pagesPH Health Care Provider V CIRGio RuizNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- 02 A.C. Ransom Labor Union-CCLU v. National Labor Relations CommissionDocument6 pages02 A.C. Ransom Labor Union-CCLU v. National Labor Relations CommissionMCNo ratings yet

- 03 Halley v. Printwell, IncDocument13 pages03 Halley v. Printwell, IncMCNo ratings yet

- 01 Villa Rey Transit, Inc. v. FerrerDocument10 pages01 Villa Rey Transit, Inc. v. FerrerMCNo ratings yet

- 05 Gold Line Tours, Inc. v. Heirs of LacsaDocument8 pages05 Gold Line Tours, Inc. v. Heirs of LacsaMCNo ratings yet

- Estates and TrustsDocument2 pagesEstates and TrustsMCNo ratings yet

- 01 Torts in English and American Conflict of Laws - The Role of The FDocument65 pages01 Torts in English and American Conflict of Laws - The Role of The FMCNo ratings yet

- 07 M Gabriel Etc Vs N Bilon Et AlDocument12 pages07 M Gabriel Etc Vs N Bilon Et AlMCNo ratings yet

- 01 Gaspi Vs PacisDocument9 pages01 Gaspi Vs PacisMCNo ratings yet

- Ocampo v. EnriquezDocument550 pagesOcampo v. EnriquezMCNo ratings yet

- Un General Assembly Demands Russia Withdraw From UkraineDocument4 pagesUn General Assembly Demands Russia Withdraw From UkraineMCNo ratings yet

- Could International Criminal Court Bring Putin To Justice Over UkraineDocument6 pagesCould International Criminal Court Bring Putin To Justice Over UkraineMCNo ratings yet

- SANTUYO V REMERCO GARMENTS MANUFACTURINGDocument2 pagesSANTUYO V REMERCO GARMENTS MANUFACTURINGMCNo ratings yet

- Laguna Autoparts Manufacturing Corporation vs. Sec. of LaborDocument1 pageLaguna Autoparts Manufacturing Corporation vs. Sec. of LaborMCNo ratings yet

- 10 Wenphil Corporation Vs Abing and TuazonDocument10 pages10 Wenphil Corporation Vs Abing and TuazonMCNo ratings yet

- 10.5 Tanduay Distillery Labor Union Et Al Vs National Labor Relations Commission Et AlDocument6 pages10.5 Tanduay Distillery Labor Union Et Al Vs National Labor Relations Commission Et AlMCNo ratings yet

- 08 ESCORPIZO v. UNIVERSITY OF BAGUIODocument6 pages08 ESCORPIZO v. UNIVERSITY OF BAGUIOMCNo ratings yet

- PHILIPPINE JOURNALISTS, INC., Petitioner, vs. MICHAEL MOSQUEDA, RespondentDocument6 pagesPHILIPPINE JOURNALISTS, INC., Petitioner, vs. MICHAEL MOSQUEDA, RespondentMCNo ratings yet

- Soliman Security Services v. CADocument2 pagesSoliman Security Services v. CAMCNo ratings yet

- Mariano Siy v. NLRCDocument2 pagesMariano Siy v. NLRCMCNo ratings yet

- DIAZ Vs SECRETARY OF FINANCEDocument2 pagesDIAZ Vs SECRETARY OF FINANCEMCNo ratings yet

- SLECC V SECRETARY OF LABORDocument2 pagesSLECC V SECRETARY OF LABORMCNo ratings yet

- Genaro Bautista v. CADocument2 pagesGenaro Bautista v. CAMCNo ratings yet

- CIR vs. Pilipinas ShellDocument2 pagesCIR vs. Pilipinas ShellMCNo ratings yet

- Vat Ruling No 7-2006Document2 pagesVat Ruling No 7-2006MCNo ratings yet

- BRITISH AMERICAN TOBACCO Vs CAMACHODocument1 pageBRITISH AMERICAN TOBACCO Vs CAMACHOMCNo ratings yet

- 15 VGB RDS PP Licensing FINALDocument13 pages15 VGB RDS PP Licensing FINALPietroNo ratings yet

- Challan: Application No / Reg. No: 127508 Application No / Reg. No: 127508 Application No / Reg. No: 127508Document2 pagesChallan: Application No / Reg. No: 127508 Application No / Reg. No: 127508 Application No / Reg. No: 127508sanjay_dutta_5No ratings yet

- SPP Doc 201Document5 pagesSPP Doc 201Jellie Erika Abanador RodriguezNo ratings yet

- bnk601s120221 Tutorial 9 SolutionDocument3 pagesbnk601s120221 Tutorial 9 SolutionNatasha NadanNo ratings yet

- Dy - Supdt. AC - ST - 2023-24 (Final)Document5 pagesDy - Supdt. AC - ST - 2023-24 (Final)howaxep674No ratings yet

- ContractDocument9 pagesContractmasekoduduzile72No ratings yet

- Financial Services Unchained The Ongoing Rise of Open Financial DataDocument14 pagesFinancial Services Unchained The Ongoing Rise of Open Financial DataCarol LoNo ratings yet

- Privacy Policy Terms and Conditions FAQ: GeneralDocument4 pagesPrivacy Policy Terms and Conditions FAQ: GeneralPlum and Tangerine CompanyNo ratings yet

- st32 Call For Scholarship Applications Uganda Must MaDocument10 pagesst32 Call For Scholarship Applications Uganda Must MaSaturnin YandjiNo ratings yet

- Tek'S Member Benefits and Services: Membership Fees 2019Document2 pagesTek'S Member Benefits and Services: Membership Fees 2019Le Dang Dai DuongNo ratings yet

- FINAL BILL. Vangaon FarmhouseDocument2 pagesFINAL BILL. Vangaon Farmhousevirendra mhatreNo ratings yet

- Chapter 6 Value of Supply NOV 19 1565841637382Document9 pagesChapter 6 Value of Supply NOV 19 1565841637382Manoj BothraNo ratings yet

- Government AccountingDocument22 pagesGovernment Accountingkris4aleya4domingo4sNo ratings yet

- 1 BizLink Onboarding Consent Form v2Document1 page1 BizLink Onboarding Consent Form v2joseph oribeNo ratings yet

- HOSPA Finance Community USALI PDFDocument56 pagesHOSPA Finance Community USALI PDFVanjB.Payno100% (1)

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- SMKN 2 Dumai (Dumai-Balikpapan)Document3 pagesSMKN 2 Dumai (Dumai-Balikpapan)Muhammad Arief FadillahNo ratings yet

- CTFAIA Hari Ke 5 Materi 2 - Waheed KhanDocument31 pagesCTFAIA Hari Ke 5 Materi 2 - Waheed Khanoyonglisa12No ratings yet

- PG Prospectus 19-20Document37 pagesPG Prospectus 19-20manmohansai bacheNo ratings yet

- Coldwell Banker Home Buyer's GuidebookDocument25 pagesColdwell Banker Home Buyer's GuidebookLani Rosales100% (2)

- Fabm2 q2 Module 3 Bank ReconDocument13 pagesFabm2 q2 Module 3 Bank ReconLady Hara100% (1)

- Heal ThyselfDocument33 pagesHeal Thyselfpeter tichiNo ratings yet

- Cuee-2018 LasyaDocument2 pagesCuee-2018 Lasyaagoyal5145No ratings yet

- Consultation Paper On Park Home Commission RateDocument25 pagesConsultation Paper On Park Home Commission Rateapi-25373714No ratings yet

- National Teachers College: Student Registration FormDocument1 pageNational Teachers College: Student Registration FormMaurice TanoteNo ratings yet

- ASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKDocument33 pagesASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKFaustina del Rosario100% (1)

- The Selection of The Civil Engineer, Salary and Project CostDocument7 pagesThe Selection of The Civil Engineer, Salary and Project CostLevien Jan Dela RosaNo ratings yet

- Tokia WhitepaperDocument37 pagesTokia WhitepaperICO ListNo ratings yet

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

Uploaded by

MCOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

PHILIPPINE HEALTH CARE PROVIDERS vs. CIRdocx

Uploaded by

MCCopyright:

Available Formats

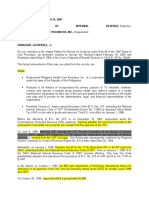

PHILIPPINE HEALTH CARE PROVIDERS., INC. v.

CIR

G.R. NO 167330 | September 18, 2009

FACTS:

Philippine Health Care Providers, Inc. is a domestic corporation whose primary purpose is "[t]o

establish, maintain, conduct and operate a prepaid group practice health care delivery system

or a health maintenance organization to take care of the sick and disabled persons enrolled in

the health care plan and to provide for the administrative, legal, and financial responsibilities of

the organization". Individuals enrolled in its health care programs pay an annual membership

fee and are entitled to various preventive, diagnostic and curative medical services provided by

its duly licensed physicians, specialists and other professional technical staff participating in the

group practice health delivery system at a hospital or clinic owned, operated or accredited by it.

Respondent Commissioner of Internal Revenue [CIR] sent petitioner a formal demand letter and

the corresponding assessment notices demanding the payment of deficiency taxes, including

surcharges and interest, for the taxable years 1996 and 1997 in the total amount of

P224,702,641.18. The deficiency [documentary stamp tax (DST)] assessment was imposed on

petitioner's health care agreement with the members of its health care program pursuant to

Section 185 of the 1997 Tax Code.

Petitioner filed a petition for review in the Court of Tax Appeals.

The CTA cancelled and set aside the 1996 and 1997 deficiency DST.

Respondent appealed to the CA and claimed that petitioner's health care agreement was a

contract of insurance subject to DST under Section 185 of the 1997 Tax Code.

The CA held that petitioner's health care agreement was in the nature of a non-life insurance

contract subject to DST.

Hence, this petition. One of the issues raised by the petitioner is that petitioner availed of the tax

amnesty benefits under RA 9480 for the taxable year 2005 and all prior years. Therefore, the

questioned assessments on the DST are now rendered moot and academic. [‘di na ako nag-

dwell sa ibang issues kasi under ito ng “No legal compensation between taxes and debts”]

Petitioner asserted that, regardless of the arguments, the DST assessment for taxable years

1996 and 1997 became moot and academic when it availed of the tax amnesty under RA 9480

on December 10, 2007. It paid P5,127,149.08 representing 5% of its net worth as of the year

ended December 31, 2005 and complied with all requirements of the tax amnesty. Under

Section 6 (a) of RA 9480, it is entitled to immunity from payment of taxes as well as additions

thereto, and the appurtenant civil, criminal or administrative penalties under the 1997 NIRC, as

amended, arising from the failure to pay any and all internal revenue taxes for taxable year 2005

and prior years.

ISSUE: Whether or not petitioner’s liability is extinguished on the ground that it availed of the tax

amnesty benefits under RA 9480

HELD: YES. The Court held in a recent case that DST is one of the taxes covered by the tax

amnesty program under RA 9480. There is no other conclusion to draw than that petitioner's

liability for DST for the taxable years 1996 and 1997 was totally extinguished by its availment of

the tax amnesty under RA 9480.

You might also like

- Halifax Statement 2023 08 18Document4 pagesHalifax Statement 2023 08 18VALENTIN SHABLIKANo ratings yet

- MBA Finance ProjectDocument62 pagesMBA Finance Projectchotumotu13111190% (10)

- PAL v. NLRCDocument3 pagesPAL v. NLRCMCNo ratings yet

- General Concepts CasesDocument63 pagesGeneral Concepts CasesJanjan DumaualNo ratings yet

- CommRev CasesDocument30 pagesCommRev CasesanjisyNo ratings yet

- Philippine Health Care Providers Inc. Vs CirrDocument35 pagesPhilippine Health Care Providers Inc. Vs CirrTeacherEliNo ratings yet

- Philippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueDocument26 pagesPhilippine Health Care Providers, Inc., Petitioner, V.commissioner of Internal RevenueTamara Bianca Chingcuangco Ernacio-TabiosNo ratings yet

- Cases 1-35Document308 pagesCases 1-35Vienie Ramirez BadangNo ratings yet

- G.R. No. 167330 INSURANCEDocument55 pagesG.R. No. 167330 INSURANCEcarpeNo ratings yet

- DIGEST CIR Vs Philippine Healthcare ProvidersDocument14 pagesDIGEST CIR Vs Philippine Healthcare ProvidersEthel Joi Manalac MendozaNo ratings yet

- PHILIPPINE HEALTH CARE PROVIDERS INC. vs. CIRDocument17 pagesPHILIPPINE HEALTH CARE PROVIDERS INC. vs. CIRDenee Vem MatorresNo ratings yet

- Digest of Philippine Health Care Providers vs. CIRDocument1 pageDigest of Philippine Health Care Providers vs. CIRDanya T. Reyes100% (2)

- Crac Method SampleDocument14 pagesCrac Method SampleAnonymous MikI28PkJcNo ratings yet

- Doctrines in TaxationDocument105 pagesDoctrines in TaxationRolando Mauring ReubalNo ratings yet

- G.R. No. 167330 September 18, 2009 Philippine Health Care Providers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentDocument67 pagesG.R. No. 167330 September 18, 2009 Philippine Health Care Providers, Inc., Petitioner, Commissioner of Internal Revenue, RespondentJenny ButacanNo ratings yet

- Philippine Health Care Providers V CIRDocument2 pagesPhilippine Health Care Providers V CIRCassiopeiaNo ratings yet

- Philippine Health Care v. CIR, G.R. No. 167330, September 18, 2009Document15 pagesPhilippine Health Care v. CIR, G.R. No. 167330, September 18, 2009Elle MichNo ratings yet

- Philippine Health Care Providers Vs CIRDocument1 pagePhilippine Health Care Providers Vs CIRewnesssNo ratings yet

- #4 Philippine Health Care Providers Inc. v. Commissioner of Internal RevenueDocument11 pages#4 Philippine Health Care Providers Inc. v. Commissioner of Internal RevenueLean Gela MirandaNo ratings yet

- Philippine Health Providers Vs CIRDocument3 pagesPhilippine Health Providers Vs CIRana ortizNo ratings yet

- 2 PhilhealthDocument16 pages2 Philhealthbingkydoodle1012No ratings yet

- Digested (TAX 1) - Phil Health Care Providers Vs CIRDocument2 pagesDigested (TAX 1) - Phil Health Care Providers Vs CIRChugsNo ratings yet

- Commercial Law Cases 102212212Document66 pagesCommercial Law Cases 102212212tyansi lehetyNo ratings yet

- Tax Amnesty Doctrines in Taxation DigestDocument9 pagesTax Amnesty Doctrines in Taxation DigestJuralexNo ratings yet

- Digest - CIR v. PHIL. HEALTH CAREDocument2 pagesDigest - CIR v. PHIL. HEALTH CAREMyrahNo ratings yet

- Insurance Law Cases Full TextDocument295 pagesInsurance Law Cases Full TextAmir Nazri KaibingNo ratings yet

- PHCP Inc., Case G.R. No 167330Document23 pagesPHCP Inc., Case G.R. No 167330miscaccts incognitoNo ratings yet

- Philippine Health Care Providers, Inc. v. CIRDocument12 pagesPhilippine Health Care Providers, Inc. v. CIRPat EspinozaNo ratings yet

- 1st Batch CasesDocument82 pages1st Batch CasesMarshan GualbertoNo ratings yet

- Medicard vs. CirDocument5 pagesMedicard vs. CirTogz Mape100% (2)

- Philippine Health Care Providers, Inc. Vs CIR, 600 SCRA 413, September 18, 2009Document22 pagesPhilippine Health Care Providers, Inc. Vs CIR, 600 SCRA 413, September 18, 2009BREL GOSIMATNo ratings yet

- G.R. No. 167330. September 18, 2009. Philippine Health Care Providers, Inc., Petitioner, vs. Commissioner of Internal Revenue, RespondentDocument19 pagesG.R. No. 167330. September 18, 2009. Philippine Health Care Providers, Inc., Petitioner, vs. Commissioner of Internal Revenue, RespondentJillen SuanNo ratings yet

- CIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR v. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007rizel_adlawanNo ratings yet

- Tax Digests MLQU CaneroDocument67 pagesTax Digests MLQU CaneroEric Tamayo0% (1)

- Philippine Health Care Provider Vs CirDocument21 pagesPhilippine Health Care Provider Vs CirYvon BaguioNo ratings yet

- Courage Vs CIRDocument8 pagesCourage Vs CIRAna GNo ratings yet

- Philippine Health Care Providers Inc. v. CIRDocument2 pagesPhilippine Health Care Providers Inc. v. CIRRukmini Dasi Rosemary GuevaraNo ratings yet

- 17 - CIR V Philippine Health Care ProvidersDocument2 pages17 - CIR V Philippine Health Care ProvidersCamille AngelicaNo ratings yet

- G.R. No. 167330 Phil. Health Care Providers Vs CIRDocument15 pagesG.R. No. 167330 Phil. Health Care Providers Vs CIRPamela Denise RufilaNo ratings yet

- Petitioner vs. vs. Respondent: Special First DivisionDocument19 pagesPetitioner vs. vs. Respondent: Special First Divisionjames lebronNo ratings yet

- Philippine Health Care Providers v. CIR, G.R. No. 167330 (2009)Document18 pagesPhilippine Health Care Providers v. CIR, G.R. No. 167330 (2009)Joena GeNo ratings yet

- PHIL. HEALTH CARE PROVIDERS, INC vs. COMMISSIONER OF INTERNAL REVENUE - The Law IsCoolDocument3 pagesPHIL. HEALTH CARE PROVIDERS, INC vs. COMMISSIONER OF INTERNAL REVENUE - The Law IsCoolJetJuárezNo ratings yet

- Phil Health Care Providers Vs Commissioner of Internal Revenue - GR 167330Document15 pagesPhil Health Care Providers Vs Commissioner of Internal Revenue - GR 167330VieNo ratings yet

- Phil Health vs. CIRDocument11 pagesPhil Health vs. CIRElsie CayetanoNo ratings yet

- Case DigestsDocument158 pagesCase DigestsJustin Imadhay100% (4)

- Philippine Health Care Provider VS CirDocument3 pagesPhilippine Health Care Provider VS CirbelleferiesebelsaNo ratings yet

- Case Digest LastDocument10 pagesCase Digest LastmichelleNo ratings yet

- CIR v. PhilHealthDocument5 pagesCIR v. PhilHealthlilblackieNo ratings yet

- Insurance PHCP Vs CIR 2008Document1 pageInsurance PHCP Vs CIR 2008Kaye de LeonNo ratings yet

- Commissioner of Internal Revenue V Philippine Health Care (Case)Document10 pagesCommissioner of Internal Revenue V Philippine Health Care (Case)Nurfaiza UllahNo ratings yet

- GR No. 168129 (CIR V Phil Health Care) (Nonretroactivity)Document12 pagesGR No. 168129 (CIR V Phil Health Care) (Nonretroactivity)Archie GuevarraNo ratings yet

- Courage VS Commissoner of Internal Revenue DigestDocument3 pagesCourage VS Commissoner of Internal Revenue DigestCharles Roger Raya100% (1)

- Philhealth Care vs. CIR, 554 SCRA 411Document22 pagesPhilhealth Care vs. CIR, 554 SCRA 411KidMonkey2299No ratings yet

- Draft Contract - Manpower PrivateDocument10 pagesDraft Contract - Manpower PrivateCristopher JavidoNo ratings yet

- 93 Courage, Et Al. Vs CIRDocument3 pages93 Courage, Et Al. Vs CIRZachary SiayngcoNo ratings yet

- CIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Document8 pagesCIR vs. Philippine Health Care Providers, Inc., G.R. No. 168129, April 24, 2007Gol LumNo ratings yet

- Cs GarmentDocument2 pagesCs GarmentTheodore0176No ratings yet

- Cir Vs Amex PhilsDocument2 pagesCir Vs Amex PhilsEllen Glae DaquipilNo ratings yet

- Tax Digest VatDocument7 pagesTax Digest Vatma.catherine merillenoNo ratings yet

- PH Health Care Provider V CIRDocument7 pagesPH Health Care Provider V CIRGio RuizNo ratings yet

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- Health Care Reform Act: Critical Tax and Insurance RamificationsFrom EverandHealth Care Reform Act: Critical Tax and Insurance RamificationsNo ratings yet

- 02 A.C. Ransom Labor Union-CCLU v. National Labor Relations CommissionDocument6 pages02 A.C. Ransom Labor Union-CCLU v. National Labor Relations CommissionMCNo ratings yet

- 03 Halley v. Printwell, IncDocument13 pages03 Halley v. Printwell, IncMCNo ratings yet

- 01 Villa Rey Transit, Inc. v. FerrerDocument10 pages01 Villa Rey Transit, Inc. v. FerrerMCNo ratings yet

- 05 Gold Line Tours, Inc. v. Heirs of LacsaDocument8 pages05 Gold Line Tours, Inc. v. Heirs of LacsaMCNo ratings yet

- Estates and TrustsDocument2 pagesEstates and TrustsMCNo ratings yet

- 01 Torts in English and American Conflict of Laws - The Role of The FDocument65 pages01 Torts in English and American Conflict of Laws - The Role of The FMCNo ratings yet

- 07 M Gabriel Etc Vs N Bilon Et AlDocument12 pages07 M Gabriel Etc Vs N Bilon Et AlMCNo ratings yet

- 01 Gaspi Vs PacisDocument9 pages01 Gaspi Vs PacisMCNo ratings yet

- Ocampo v. EnriquezDocument550 pagesOcampo v. EnriquezMCNo ratings yet

- Un General Assembly Demands Russia Withdraw From UkraineDocument4 pagesUn General Assembly Demands Russia Withdraw From UkraineMCNo ratings yet

- Could International Criminal Court Bring Putin To Justice Over UkraineDocument6 pagesCould International Criminal Court Bring Putin To Justice Over UkraineMCNo ratings yet

- SANTUYO V REMERCO GARMENTS MANUFACTURINGDocument2 pagesSANTUYO V REMERCO GARMENTS MANUFACTURINGMCNo ratings yet

- Laguna Autoparts Manufacturing Corporation vs. Sec. of LaborDocument1 pageLaguna Autoparts Manufacturing Corporation vs. Sec. of LaborMCNo ratings yet

- 10 Wenphil Corporation Vs Abing and TuazonDocument10 pages10 Wenphil Corporation Vs Abing and TuazonMCNo ratings yet

- 10.5 Tanduay Distillery Labor Union Et Al Vs National Labor Relations Commission Et AlDocument6 pages10.5 Tanduay Distillery Labor Union Et Al Vs National Labor Relations Commission Et AlMCNo ratings yet

- 08 ESCORPIZO v. UNIVERSITY OF BAGUIODocument6 pages08 ESCORPIZO v. UNIVERSITY OF BAGUIOMCNo ratings yet

- PHILIPPINE JOURNALISTS, INC., Petitioner, vs. MICHAEL MOSQUEDA, RespondentDocument6 pagesPHILIPPINE JOURNALISTS, INC., Petitioner, vs. MICHAEL MOSQUEDA, RespondentMCNo ratings yet

- Soliman Security Services v. CADocument2 pagesSoliman Security Services v. CAMCNo ratings yet

- Mariano Siy v. NLRCDocument2 pagesMariano Siy v. NLRCMCNo ratings yet

- DIAZ Vs SECRETARY OF FINANCEDocument2 pagesDIAZ Vs SECRETARY OF FINANCEMCNo ratings yet

- SLECC V SECRETARY OF LABORDocument2 pagesSLECC V SECRETARY OF LABORMCNo ratings yet

- Genaro Bautista v. CADocument2 pagesGenaro Bautista v. CAMCNo ratings yet

- CIR vs. Pilipinas ShellDocument2 pagesCIR vs. Pilipinas ShellMCNo ratings yet

- Vat Ruling No 7-2006Document2 pagesVat Ruling No 7-2006MCNo ratings yet

- BRITISH AMERICAN TOBACCO Vs CAMACHODocument1 pageBRITISH AMERICAN TOBACCO Vs CAMACHOMCNo ratings yet

- 15 VGB RDS PP Licensing FINALDocument13 pages15 VGB RDS PP Licensing FINALPietroNo ratings yet

- Challan: Application No / Reg. No: 127508 Application No / Reg. No: 127508 Application No / Reg. No: 127508Document2 pagesChallan: Application No / Reg. No: 127508 Application No / Reg. No: 127508 Application No / Reg. No: 127508sanjay_dutta_5No ratings yet

- SPP Doc 201Document5 pagesSPP Doc 201Jellie Erika Abanador RodriguezNo ratings yet

- bnk601s120221 Tutorial 9 SolutionDocument3 pagesbnk601s120221 Tutorial 9 SolutionNatasha NadanNo ratings yet

- Dy - Supdt. AC - ST - 2023-24 (Final)Document5 pagesDy - Supdt. AC - ST - 2023-24 (Final)howaxep674No ratings yet

- ContractDocument9 pagesContractmasekoduduzile72No ratings yet

- Financial Services Unchained The Ongoing Rise of Open Financial DataDocument14 pagesFinancial Services Unchained The Ongoing Rise of Open Financial DataCarol LoNo ratings yet

- Privacy Policy Terms and Conditions FAQ: GeneralDocument4 pagesPrivacy Policy Terms and Conditions FAQ: GeneralPlum and Tangerine CompanyNo ratings yet

- st32 Call For Scholarship Applications Uganda Must MaDocument10 pagesst32 Call For Scholarship Applications Uganda Must MaSaturnin YandjiNo ratings yet

- Tek'S Member Benefits and Services: Membership Fees 2019Document2 pagesTek'S Member Benefits and Services: Membership Fees 2019Le Dang Dai DuongNo ratings yet

- FINAL BILL. Vangaon FarmhouseDocument2 pagesFINAL BILL. Vangaon Farmhousevirendra mhatreNo ratings yet

- Chapter 6 Value of Supply NOV 19 1565841637382Document9 pagesChapter 6 Value of Supply NOV 19 1565841637382Manoj BothraNo ratings yet

- Government AccountingDocument22 pagesGovernment Accountingkris4aleya4domingo4sNo ratings yet

- 1 BizLink Onboarding Consent Form v2Document1 page1 BizLink Onboarding Consent Form v2joseph oribeNo ratings yet

- HOSPA Finance Community USALI PDFDocument56 pagesHOSPA Finance Community USALI PDFVanjB.Payno100% (1)

- TDS, TCS & Advance Payment of TaxDocument54 pagesTDS, TCS & Advance Payment of TaxFalak GoyalNo ratings yet

- SMKN 2 Dumai (Dumai-Balikpapan)Document3 pagesSMKN 2 Dumai (Dumai-Balikpapan)Muhammad Arief FadillahNo ratings yet

- CTFAIA Hari Ke 5 Materi 2 - Waheed KhanDocument31 pagesCTFAIA Hari Ke 5 Materi 2 - Waheed Khanoyonglisa12No ratings yet

- PG Prospectus 19-20Document37 pagesPG Prospectus 19-20manmohansai bacheNo ratings yet

- Coldwell Banker Home Buyer's GuidebookDocument25 pagesColdwell Banker Home Buyer's GuidebookLani Rosales100% (2)

- Fabm2 q2 Module 3 Bank ReconDocument13 pagesFabm2 q2 Module 3 Bank ReconLady Hara100% (1)

- Heal ThyselfDocument33 pagesHeal Thyselfpeter tichiNo ratings yet

- Cuee-2018 LasyaDocument2 pagesCuee-2018 Lasyaagoyal5145No ratings yet

- Consultation Paper On Park Home Commission RateDocument25 pagesConsultation Paper On Park Home Commission Rateapi-25373714No ratings yet

- National Teachers College: Student Registration FormDocument1 pageNational Teachers College: Student Registration FormMaurice TanoteNo ratings yet

- ASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKDocument33 pagesASTRID A. VAN DE BRUG v. PHILIPPINE NATIONAL BANKFaustina del Rosario100% (1)

- The Selection of The Civil Engineer, Salary and Project CostDocument7 pagesThe Selection of The Civil Engineer, Salary and Project CostLevien Jan Dela RosaNo ratings yet

- Tokia WhitepaperDocument37 pagesTokia WhitepaperICO ListNo ratings yet