Professional Documents

Culture Documents

Charleston Americas Alliance MarketBeat Industrial Q3 2020

Charleston Americas Alliance MarketBeat Industrial Q3 2020

Uploaded by

Kevin ParkerCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Charleston Americas Alliance MarketBeat Industrial Q3 2020

Charleston Americas Alliance MarketBeat Industrial Q3 2020

Uploaded by

Kevin ParkerCopyright:

Available Formats

M A R K E T B E AT

CHARLESTON, SC

Industrial Q3 2020

YoY 12-Mo. ECONOMY: Big News!

Chg Forecast

After months of speculation about the move, Boeing Co. confirmed it will consolidate production of its 787 Dreamliner jet in South

7.4% Carolina in mid-2021, marking a major shift for the company and the State’s aerospace sector. The changes will close the 787

production line in Everett, WA which has been splitting final assembly with Boeing’s plant in North Charleston. COVID caused

Vacancy Rate

significant disruption to global supply chain for the early part of the third quarter of 2020 but SC State ports saw an uptick in thru

traffic in September. Volumes posted the strongest year-over-year activity since the pandemic hit, showing a continued recovery

159K and strength in containers, vehicles and inland port moves, with the biggest gains are in furniture and electronics.

Net Absorption,SF

Upon the arrival of COVID-19 in the U.S., the economy entered a recession in March 2020, recording the worst decline in post-war

$5.68 history in Q2 2020. Mounting evidence indicates that the recovery began in May or June with Q3 2020 data likely reflecting that.

Asking Rent, PSF But, until there is a public health resolution to the pandemic, the recovery is likely to remain uncertain and gradual. Only then can

households and businesses become more confident. Access the most recent research on CRE and the state of economy here

Overall, Net Asking Rent

SUPPLY and DEMAND: Accelerated Demand

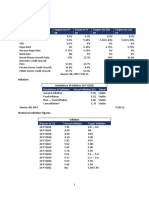

ECONOMIC INDICATORS Over 2.5 million square feet (msf) of new inventory has been delivered in 2020 and with just under 1.0 msf being absorbed.

Q3 2020 Construction levels have slowed, although there is still roughly 2.0 msf in the pipeline. Vacancy rates did increase to 7.4% with lease

rates hovering at $5.68 NNN an increase of 3.4% over the past year. Strong absorption, with ecommerce, 3Pls’s and taking large

YoY 12-Mo. blocks of space. Sales volume was tepid for the Quarter with CAP rates at 7.4%. The biggest deal to date is the 3,000,000-square

Chg Forecast

foot (sf) Walmart distribution center to be located in the SC State Ports owned / Ridgeville Industrial park. The facility is scheduled to

349.4K come online in Spring of 2022. Southern Current a solar panel company with as many 25+ solar fields in SC recently took 195,000 sf

Charleston in Charleston Logistics Park / Jedburg, SC.

Employment

PRICING:

7.8% The Charleston warehouse market is poised for continued expansion and positive activity into the next quarter and beyond. With

Charleston the new Leatherman Shipping Terminal coming online in March of 2021 adding an additional 700,000 TEUS of annual throughput

Unemployment Rate capacity, 2021 could shape up for a strong year. Asking rates are averaging in the $7.50/sf range which equate to almost $1.50/sf

below the national average. Current product under construction are in the $6.00 range with some asking more than $7.00/sf

8.8% SPACE DEMAND / DELIVERIES OVERALL VACANCY & ASKING RENT

U.S. $6.00 8%

10

Unemployment Rate $5.80

$5.60

Source: BLS 5 $5.40

$5.20 4%

Millions

2020Q3 data are based on latest available data.

$5.00

0 $4.80

$4.60

$4.40 0%

-5 2016 2017 2018 2019 2020

2016 2017 2018 2019 YTD 2020

Net Absorption, SF Construction Completions, SF Asking Rent, $ PSF Vacancy Rate

full service asking

M A R K E T B E AT

CHARLESTON

Industrial Q3 2020

MARKET STATISTICS

OVERALL CURRENT QTR UNDER CONSTR OVERALL OVERALL OVERALL

INVENTORY OVERALL YTD OVERALL NET

VACANCY OVERALL NET CNSTR COMPLETIONS WEIGHTED AVG WEIGHTED AVG WEIGHTED AVG

SUBMARKET (SF) VACANT (SF) ABSORPTION (SF)

RATE ABSORPTION (SF) (SF) (SF) NET RENT (MF) NET RENT (OS) NET RENT(W/D)

Daniel Island 5,108,615 690,122 13.5% -377,000 -405,089 0 21,600 - - $8.46

Dorchester County 8,782,186 523,452 6.0% 6,979 141,874 606,666 18,176 $5.16 - $6.08

Downtown Charleston 1,812,109 53,119 2.9% 0 -15,804 0 0 - - $10.87

E Charleston County 42,295 0 0.0% 0 0 0 0 - - -

East Islands/Mt Pleasant 1,065,001 43,345 4.1% -7,162 -7,211 0 0 - - $11.38

James Island/Folly Beach 480,678 123,100 25.6% -2,100 -16,100 0 0 - - $12.17

North Charleston 31,546,380 2,139,195 6.8% -23,161 -220,179 16,800 662,208 $6.99 $12.62 $11.12

Outlying Berkeley County 29,573,525 2,160,847 7.3% 569,624 1,455,056 1,422,929 557,815 $5.01 $10.00 $6.27

W Charleston County 203,074 0 0.0% 0 0 0 0 - - -

West Ashley 987,014 18,460 1.9% -7,919 -11,256 0 0 - $10.50 $15.22

West Islands 544,412 151,325 27.8% 102 -151,325 20,800 0 - - $12.86

CHARLESTON TOTALS 80,145,289 5,902,965 7.4% 159,363 759,966 2,067,195 1,259,799 $5.72 $11.04 $10.49

*Rental rates reflect weighted net asking $psf/year FX = Flex MF = Manufacturing OS = Office Service/Flex W/D = Warehouse/Distribution

KEY LEASE TRANSACTIONS Q3 2020 PHILIP OWENS

Vice President

PROPERTY SUBMARKET TENANT SF TYPE

+1 843 724 0100 /philip.owens@thalhimer.com

537 Omni Industrial Blvd Outlying Berkeley County Wanxiang America 316,140 New Lease

8060 Commerce Center Rd North Charleston RW Stoney Ladson Industrial 310,128 New Lease thalhimer.com

635 Omni Industrial Blvd Outlying Berkeley County WestRock Fulfillment Co 117,568 New Lease

9016 Palmetto Commerce Pky North Charleston Pattillo Construction Corp 78,330 New Lease

A CUSHMAN & WAKEFIELD RESEARCH PUBLICATION

*Renewals not included in leasing statistics Cushman & Wakefield (NYSE: CWK) is a leading global real

estate services firm that delivers exceptional value for real

KEY SALES TRANSACTIONS Q32 2020 estate occupiers and owners. Cushman & Wakefield is among

the largest real estate services firms with approximately

PROPERTY SUBMARKET SELLER / BUYER SF PRICE / $ PSF 53,000 employees in 400 offices and 60 countries. In 2019,

the firm had revenue of $8.8 billion across core services of

5 Alliance Dr Outlying Berkeley County TRU Simulation Training Inc./Textron 167,144 $5,385,250/$32.22

Systems Corp.

property, facilities and project management, leasing, capital

markets, valuation and other services.

5001 Lacross Rd - Coburg Dairy North Charleston Borden Dairy Co/New Dairy South 95,750 $4,940,789/$51.50

Carolina LLC

109 Old Depot Rd Outlying Berkeley County Santee River Facility LLC/Jet Pack 85,076 $1,280,000/$15.05 ©2020 Cushman & Wakefield. All rights reserved. The information

Warehousing LLC contained within this report is gathered from multiple sources believed

9516 Hamburg Rd North Charleston GBI Holdings LLC/BCP Hamburg LLC 36,000 $2,935,000/$81.53 to be reliable. The information may contain errors or omissions and is

presented without any warranty or representations as to its accuracy.

You might also like

- The Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersFrom EverandThe Basics of Public Budgeting and Financial Management: A Handbook for Academics and PractitionersNo ratings yet

- Global Case Study ABC Audio Company Profile For PartnersDocument11 pagesGlobal Case Study ABC Audio Company Profile For PartnersGabriela_vm678No ratings yet

- Manual Scalping Cumulative DeltaDocument6 pagesManual Scalping Cumulative DeltaMuhamad Andri100% (2)

- Microsoft Word - Costa CoffeeDocument33 pagesMicrosoft Word - Costa Coffeerajeshdhomane50% (2)

- Case Problem 1Document8 pagesCase Problem 1Fanny MainNo ratings yet

- US Industrial MarketBeat Q1 2023Document7 pagesUS Industrial MarketBeat Q1 2023ANUSUA DASNo ratings yet

- Logistics Operations of VinamilkDocument19 pagesLogistics Operations of VinamilkĐức Thạch NguyễnNo ratings yet

- Charleston Americas Alliance MarketBeat Industrial Q2 2020Document2 pagesCharleston Americas Alliance MarketBeat Industrial Q2 2020Kevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q12020 PDFDocument2 pagesFredericksburg Americas Alliance MarketBeat Retail Q12020 PDFKevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q22020 PDFDocument2 pagesGreenville Americas Alliance MarketBeat Industrial Q22020 PDFKevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Retail Q32021 FINALDocument2 pagesFredericksburg Americas Alliance MarketBeat Retail Q32021 FINALKevin ParkerNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Industrial Q2 2020Document2 pagesHampton Roads Americas Alliance MarketBeat Industrial Q2 2020Kevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Roanoke Americas Alliance MarketBeat Industrial Q1 2021Document1 pageRoanoke Americas Alliance MarketBeat Industrial Q1 2021Kevin ParkerNo ratings yet

- Greenville Americas Alliance MarketBeat Industrial Q42020Document2 pagesGreenville Americas Alliance MarketBeat Industrial Q42020Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Industrial Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Industrial Q1 2024Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Industrial Q22021 (Final)Document2 pagesRichmond Americas Alliance MarketBeat Industrial Q22021 (Final)Kevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q32021Document2 pagesRichmond Americas Alliance MarketBeat Office Q32021Kevin ParkerNo ratings yet

- Dallas/Fort Worth: Office Q4 2020Document4 pagesDallas/Fort Worth: Office Q4 2020David ThomasNo ratings yet

- 4Q21 Greater Philadelphia Industrial MarketDocument5 pages4Q21 Greater Philadelphia Industrial MarketKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q12022Document2 pagesRichmond Americas Alliance MarketBeat Office Q12022Kevin ParkerNo ratings yet

- Roanoke Americas Alliance MarketBeat Retail Q32020 PDFDocument1 pageRoanoke Americas Alliance MarketBeat Retail Q32020 PDFKevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Industrial Q12020 PDFDocument2 pagesFredericksburg Americas Alliance MarketBeat Industrial Q12020 PDFKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Office Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Office Q1 2024Kevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- US Industrial MarketBeat Q2 2020 PDFDocument7 pagesUS Industrial MarketBeat Q2 2020 PDFRN7 BackupNo ratings yet

- Hampton Roads 2024 Q1 Industrial Market ReportDocument3 pagesHampton Roads 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Netra Early Signals Through Charts Sep 2023Document19 pagesNetra Early Signals Through Charts Sep 2023Apurva ShethNo ratings yet

- Phoenix Americas MarketBeat Multifamily Q2 2023Document4 pagesPhoenix Americas MarketBeat Multifamily Q2 2023redcorolla95573No ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Mexico City: Industrial Q4 2019Document2 pagesMexico City: Industrial Q4 2019PepitofanNo ratings yet

- Hampton Roads Americas Alliance MarketBeat Retail Q12022Document2 pagesHampton Roads Americas Alliance MarketBeat Retail Q12022Kevin ParkerNo ratings yet

- Charlotte Americas MarketBeat Office Q12023Document4 pagesCharlotte Americas MarketBeat Office Q12023Stefan StrongNo ratings yet

- State and Federal SpendingDocument25 pagesState and Federal SpendingNational Press FoundationNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Roanoke Americas Alliance MarketBeat Office Q32020 PDFDocument1 pageRoanoke Americas Alliance MarketBeat Office Q32020 PDFKevin ParkerNo ratings yet

- Estimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Document10 pagesEstimating The Cost of The Proposed Reston VPAC: Construction and Operating Costs, December 8, 2022Terry MaynardNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q22021 FINALDocument2 pagesRichmond Americas Alliance MarketBeat Retail Q22021 FINALKevin ParkerNo ratings yet

- Fredericksburg Americas Alliance MarketBeat Office Q1 2022 FINALDocument2 pagesFredericksburg Americas Alliance MarketBeat Office Q1 2022 FINALKevin ParkerNo ratings yet

- 2023 Multifamily OutlookDocument18 pages2023 Multifamily OutlookAminul IslamNo ratings yet

- National Multifamily: MIDYEAR 2020Document12 pagesNational Multifamily: MIDYEAR 2020Kevin ParkerNo ratings yet

- Weekly Economic & Financial Commentary 18novDocument12 pagesWeekly Economic & Financial Commentary 18novErick Abraham MarlissaNo ratings yet

- Weekly Economic & Financial Commentary 28octDocument12 pagesWeekly Economic & Financial Commentary 28octErick Abraham MarlissaNo ratings yet

- Richmond Americas Alliance MarketBeat Multifamily Q1 2021Document2 pagesRichmond Americas Alliance MarketBeat Multifamily Q1 2021Kevin ParkerNo ratings yet

- Macroeconomic Analysis Key Economic VariablesDocument6 pagesMacroeconomic Analysis Key Economic VariablesShaikh Saifullah KhalidNo ratings yet

- LMT July 2019 Conf Call Webcharts FinalDocument18 pagesLMT July 2019 Conf Call Webcharts FinalTNo ratings yet

- 2010 Annual OutlookDocument28 pages2010 Annual OutlookTRIFMAKNo ratings yet

- Third Point Q3 2019 Letter TPOIDocument13 pagesThird Point Q3 2019 Letter TPOImarketfolly.com100% (1)

- Dallas Fort Worth Americas Marketbeat Industrial Q3 2023Document4 pagesDallas Fort Worth Americas Marketbeat Industrial Q3 2023ANUSUA DASNo ratings yet

- TMV Template - 2021806Document1 pageTMV Template - 2021806acasushi ginzagaNo ratings yet

- 4th Quarter 2019 Earnings Conference Call: March 13, 2020Document35 pages4th Quarter 2019 Earnings Conference Call: March 13, 2020bachirodriguezNo ratings yet

- Richmond Americas Alliance MarketBeat Multifamily Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Multifamily Q1 2024Kevin ParkerNo ratings yet

- Online Annex 1.1. Fragilities in Us Dollar Short-Term Funding MarketsDocument4 pagesOnline Annex 1.1. Fragilities in Us Dollar Short-Term Funding MarketsAswin AswinNo ratings yet

- Indonesia Jakarta Retail 2Q23Document2 pagesIndonesia Jakarta Retail 2Q23Allison Almathea WijayaNo ratings yet

- Sinking Deeper: Lockdowns and Restrictions Have Hit Harder Than ExpectedDocument6 pagesSinking Deeper: Lockdowns and Restrictions Have Hit Harder Than Expectedabhinavsingh4uNo ratings yet

- FactSet Bank Tracker 31-JulDocument8 pagesFactSet Bank Tracker 31-JulBrianNo ratings yet

- Planilha de Gerenciamento de Risco e RentabilidadeDocument6 pagesPlanilha de Gerenciamento de Risco e RentabilidadeBEACH SCUBA DETECTINGNo ratings yet

- 4Q21 Philadelphia Office Market ReportDocument6 pages4Q21 Philadelphia Office Market ReportKevin ParkerNo ratings yet

- NMF 2018 Kansas City MF ReportDocument7 pagesNMF 2018 Kansas City MF ReportPhilip Maxwell AftuckNo ratings yet

- 2020 Budget OverviewDocument17 pages2020 Budget OverviewJohn TuringNo ratings yet

- Agritech PsebDocument20 pagesAgritech PsebJilani HussainNo ratings yet

- Manhattan Americas MarketBeat Office Q42019Document4 pagesManhattan Americas MarketBeat Office Q42019Zara SabriNo ratings yet

- Food Production Distribution Newsletter Q2 24Document22 pagesFood Production Distribution Newsletter Q2 24Kevin ParkerNo ratings yet

- New ProjectDocument3 pagesNew ProjectKevin ParkerNo ratings yet

- Analysis of House WRDA24 BillDocument5 pagesAnalysis of House WRDA24 BillKevin ParkerNo ratings yet

- Roanoke 2024 Q1 Office Market ReportDocument1 pageRoanoke 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- 2023 Healthy Harbor Report CardDocument9 pages2023 Healthy Harbor Report CardKevin ParkerNo ratings yet

- Food Drink The Baltimore BannerDocument1 pageFood Drink The Baltimore BannerKevin ParkerNo ratings yet

- ADM WhitepaperDocument6 pagesADM WhitepaperKevin ParkerNo ratings yet

- Global Fraud Report 2024 AmericasDocument16 pagesGlobal Fraud Report 2024 AmericasKevin ParkerNo ratings yet

- Erdc-Chl MP-24-3Document20 pagesErdc-Chl MP-24-3Kevin ParkerNo ratings yet

- Due Madri - Catering MenuDocument1 pageDue Madri - Catering MenuKevin ParkerNo ratings yet

- Cpu June 2024Document31 pagesCpu June 2024Kevin ParkerNo ratings yet

- Roanoke 2024 Q1 Industrial Market ReportDocument1 pageRoanoke 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Beach Management Analysis 2024Document29 pagesBeach Management Analysis 2024Kevin ParkerNo ratings yet

- Consumer Products Update - April 2024Document31 pagesConsumer Products Update - April 2024Kevin ParkerNo ratings yet

- Due Madri MenuDocument1 pageDue Madri MenuKevin ParkerNo ratings yet

- P2024 SBB 20240506 Eng - 0Document2 pagesP2024 SBB 20240506 Eng - 0Kevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 RichmondDocument1 pageFive Fast Facts Q1 2024 RichmondKevin ParkerNo ratings yet

- Richmond Americas Alliance MarketBeat Retail Q1 2024Document3 pagesRichmond Americas Alliance MarketBeat Retail Q1 2024Kevin ParkerNo ratings yet

- Roanoke 2024 Q1 Retail Market ReportDocument1 pageRoanoke 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Industrial Market ReportDocument3 pagesFredericksburg 2024 Q1 Industrial Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 CharlottesvilleDocument1 pageFive Fast Facts Q1 2024 CharlottesvilleKevin ParkerNo ratings yet

- Hampton Roads 2024 Q1 Office Market ReportDocument3 pagesHampton Roads 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Office Market ReportDocument3 pagesFredericksburg 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- Fredericksburg 2024 Q1 Retail Market ReportDocument3 pagesFredericksburg 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- Five Fast Facts Q1 2024 FredericksburgDocument1 pageFive Fast Facts Q1 2024 FredericksburgKevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Office Market ReportDocument1 pageCharlottesville 2024 Q1 Office Market ReportKevin ParkerNo ratings yet

- MA Newsletter Q1 2024Document12 pagesMA Newsletter Q1 2024Kevin ParkerNo ratings yet

- Charlottesville 2024 Q1 Retail Market ReportDocument1 pageCharlottesville 2024 Q1 Retail Market ReportKevin ParkerNo ratings yet

- 2024 Q1 Industrial Houston Report ColliersDocument7 pages2024 Q1 Industrial Houston Report ColliersKevin ParkerNo ratings yet

- Canals 2024 UpdateDocument57 pagesCanals 2024 UpdateKevin ParkerNo ratings yet

- Executive SummaryDocument18 pagesExecutive SummaryariaNo ratings yet

- Ganga FailureDocument10 pagesGanga FailureSwasti IBSARNo ratings yet

- Distribution Requirements PlanningDocument2 pagesDistribution Requirements Planningjai_mspNo ratings yet

- Bus 620 Assignment 2Document3 pagesBus 620 Assignment 2Md. Arman Islam Sun 2125155660No ratings yet

- Inventory InclusionsDocument3 pagesInventory InclusionsjangjangNo ratings yet

- Forecasting and Demand MeasurementDocument30 pagesForecasting and Demand Measurementsneha khuranaNo ratings yet

- What Is A Variable Cost?Document4 pagesWhat Is A Variable Cost?Niño Rey LopezNo ratings yet

- PowerbankDocument1 pagePowerbankMynameis lakhanNo ratings yet

- Motivation of Channel MemberDocument34 pagesMotivation of Channel MemberArnold CliftonNo ratings yet

- Viva CVDocument2 pagesViva CVujjwalsinghthakuriNo ratings yet

- Lesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessDocument8 pagesLesson 3d Preparation of Statement of Comprehensive Income - Manufacturing BusinessBenedict CladoNo ratings yet

- Hafsa Bookstore Business Plan 1Document3 pagesHafsa Bookstore Business Plan 1Abdi100% (1)

- Learning Activity 2. Jupiter Drug CorporationDocument2 pagesLearning Activity 2. Jupiter Drug CorporationRenz BrionesNo ratings yet

- The XXX Eyewear Collection: Business PlanDocument6 pagesThe XXX Eyewear Collection: Business PlanAjinkya BhagatNo ratings yet

- Content: Analysis and Interpretation of Financial Statements Mabhel B. Catle ShstiiDocument25 pagesContent: Analysis and Interpretation of Financial Statements Mabhel B. Catle Shstiiachlys lunaNo ratings yet

- 10 - 11 - 12 - Data Cruncher Plus InstructionDocument6 pages10 - 11 - 12 - Data Cruncher Plus InstructionatikasaNo ratings yet

- Incentive Travel Buyers HandbookDocument37 pagesIncentive Travel Buyers Handbookgraphicman1060No ratings yet

- Instructions:: (1) All Questions Are Compulsory. Q1 - 10 Marks Q2-10 MarksDocument1 pageInstructions:: (1) All Questions Are Compulsory. Q1 - 10 Marks Q2-10 MarksYogesh WaghNo ratings yet

- 3 Steps To An Irresistible Business Model PDFDocument3 pages3 Steps To An Irresistible Business Model PDFjaimequintoNo ratings yet

- Altex Proiect DoneDocument12 pagesAltex Proiect DonePop RobertNo ratings yet

- Internet and E-CommerceDocument7 pagesInternet and E-Commercezakirno19248No ratings yet

- Sumit Namdev: Institute / OrganizationDocument3 pagesSumit Namdev: Institute / OrganizationSumit NamdevNo ratings yet

- International Marketing Research NotesDocument5 pagesInternational Marketing Research NotesKiranUmaraniNo ratings yet

- APPENDIX Checklists For Developing Competitive StrategiesDocument12 pagesAPPENDIX Checklists For Developing Competitive StrategiesSAHR SAIF100% (1)

- CHAPTERISATIONDocument2 pagesCHAPTERISATIONAbhinav Goyal100% (1)