Professional Documents

Culture Documents

China Everbright Water: China / Hong Kong Company Guide

China Everbright Water: China / Hong Kong Company Guide

Uploaded by

J. BangjakOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

China Everbright Water: China / Hong Kong Company Guide

China Everbright Water: China / Hong Kong Company Guide

Uploaded by

J. BangjakCopyright:

Available Formats

China / Hong Kong Company Guide

China Everbright Water

Version 8 | Bloomberg: CEWL SP Equity | Reuters: CEWL.SI

Refer to important disclosures at the end of this report

DBS Group Research . Equity 24 Feb 2017

BUY Exploring new business areas

Last Traded Price ( 24 Feb 2017):S$0.435 (STI : 3,117) Earnings rebound. We maintain our BUY rating on China Everbright

Price Target 12-mth: S$0.64 (47% upside) Water (CEW) despite its disappointing FY16 results. The company is

Potential Catalyst: New project wins progressing well in securing public–private partnership (PPP) projects

Where we differ: We use adjusted PE (stripping out construction and exploring new business areas. The stronger order backlog will also

revenue) to derive TP lead to a rebound in FY17 earnings.

Analyst

Patricia YEUNG +852 2863 8908 ; patricia_yeung@dbs.com

FY16 results below expectations. FY16 net profit drop of 15% to

What’s New

HK$349m was below our expectation by 13%, with discrepancies

FY16 net profit below our expectation by 13% due

stemming from the lower-than-expected construction revenue and

to lower revenue and higher expenses

higher-than-expected expenses (including interest expense and

Secured 12 new projects with total investment of administration cost). Effective interest rate climbed from 3.8% to 4.2%.

Rmb2.5bn On a positive note, trade receivable days shortened, implying an

improvement in settlement from customers. Volume of treated water

New business areas as new growth drivers

increased 28% to 1.14bn m³ which was higher than our estimate.

Maintain BUY with TP of S$0.64 Despite cash outflow for construction, CEW’s net debt-equity ratio

remained stable at 42%. A final dividend of S$0.0037 was declared, up

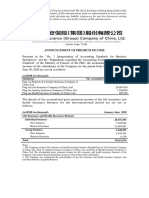

Price Relative from S$0.0035 in FY15, despite a drop in earnings.

S$ Relative Index

1.6

1.4

321 Strong order backlog for FY17. Apart from the traditional wastewater

1.2

271 treatment projects, CEW is exploring new business areas, including

1.0

221 integrated services, watershed management, sponge city, etc. Having

0.8 171

secured 12 new projects with a total investment of Rmb2.5bn, CEW

0.6 121

has a strong order backlog. In particular, most of the construction work

0.4

Feb-13 Feb-14 Feb-15 Feb-16

71

Feb-17 of Zhenjiang Sponge City (total investment of Rmb1.39bn) will be

China Everbright Water (LHS) Relative STI (RHS) completed within FY17, coupled with at least six waste treatment

plants (with total investment of c.Rmb600m) under construction, we

Forecasts and Valuation

FY Dec (HK$ m) 2015A 2016A 2017F 2018F expect construction revenue to jump by 25-35% in FY17/18. In

Turnover 1,815 2,494 2,994 3,522 addition, seven projects will commence operations in FY17 which

EBITDA 786 836 1,059 1,222 should bring a high single-digit growth in operation services. Coupled

Pre-tax Profit 596 537 706 832

Net Profit 406 349 473 558 with the absence of forex loss (HK$49m in FY16), we project

Net Pft (Pre Ex) (core profit) 406 349 473 558 35%/18% earnings growth in FY17/18.

Net Profit Gth (Pre-ex) (%) 38.7 (14.0) 35.3 18.0

EPS (HK$) 0.16 0.13 0.18 0.21 Valuation:

EPS (S$) 0.03 0.02 0.03 0.04

EPS Gth (%) 34.2 (15.2) 35.1 18.0

To reflect the disappointment in construction revenue in FY16 results,

Diluted EPS (S$) 0.03 0.02 0.03 0.04 we have revised down our FY17-18F earnings by 16-23%. However,

DPS (S$) 0.00 0.00 0.00 0.00 our TP remains unchanged at S$0.64 as it is based on 24x 12-month

BV Per Share (S$) 0.49 0.47 0.50 0.54 rolling adjusted PE which has stripped out construction revenue.

PE (X) 15.2 17.9 13.3 11.2

P/Cash Flow (X) 189.3 309.7 nm nm Key Risks to Our View:

P/Free CF (X) 275.5 753.7 nm nm We have assumed CEW will add at least 1m tons of capacity through

EV/EBITDA (X) 12.0 11.5 10.8 10.7

Net Div Yield (%) 0.1 0.2 0.2 0.2 acquisitions. Delay in M&A would result in slower-than-expected

P/Book Value (X) 0.9 0.9 0.9 0.8 earnings growth.

Net Debt/Equity (X) 0.4 0.4 0.6 0.8

ROAE (%) 5.8 5.0 6.7 7.4 At A Glance

Issued Capital (m shrs) 2,610

Earnings Rev (%): (23) (16)

Consensus EPS (HK$) 0.21 0.24 Mkt. Cap (S$m/US$m) 1,135 / 807

Other Broker Recs: B: 5 S: 0 H: 1 Major Shareholders

Source of all data on this page: Company, DBSV, Thomson Reuters, China Everbright International (%) 74.3

HKEX Free Float (%) 25.7

3m Avg. Daily Val. (US$m) 0.5

ICB Industry : Utilities / Gas, Water & Multiutilities

ASIAN INSIGHTS VICKERS SECURITIES

ed-TH / sa- AH

Company Guide

China Everbright Water

addition, CEW is also looking for opportunities in the

Strategies for FY17 overseas market.

Exploring new business areas. Having achieved breakthrough

in new business areas, i.e. sponge city and ecological Technology advancement to enhance core competitiveness.

restoration work, CEW has now built up a track record to Through collaboration with academic institutions, CEW will

facilitate more deal flow. In fact, management expects strengthen its technology competitiveness with a focus on

increased demand for integrated services and environmental research of applied technologies. Key R&D areas include

services for rural areas. In particular, the issue of black and sponge city construction, river-basin restoration, industrial

stinky water bodies is very serious. Demand for integrated wastewater treatment, etc.

services, i.e. river water quality improvement, river dredging,

river outfall remediation, etc., will be strong. Thus, the recent New investment and financing models. While bank

win of Nanjing Municipal PPP project will be a showcase for borrowings remain the main financing method, CEW is also

CEW to secure similar deals. exploring other channels, such as issuing panda bonds and

setting up water industry funds. These new financing

Expansion of project portfolio. With a project portfolio of channels will be more suitable for large-scale projects. In fact,

>5m tons of daily treatment capacity, management aims to an industry fund is expected to be set up in 1HFY17. It has an

reach 10m tons by 2020. Apart from organic growth and investment amount of Rmb10bn which can finance projects

project extension, the above target can also be achieved with total investment of Rmb30bn.

through acquisitions. Its M&A candidate will not be limited to

private enterprises, but also assets from governments. In

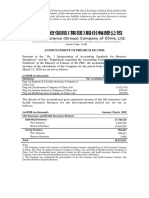

Income Statement (HK$ m)

FY Dec 2015A 2016A % chg yoy

Revenue 1,815 2,494 37.4

Cost of Goods Sold (1,001) (1,588) 58.7

Gross Profit 814 906 11.2

Other Opng (Exp)/Inc (100) (171) 70.6

Operating Profit 714 735 2.9

Other Non Opg (Exp)/Inc 0 0 nm

Associates & JV Inc 0 0 nm

Net Interest (Exp)/Inc (118) (198) (67.2)

Exceptional Gain/(Loss) 0 0 nm

Pre-tax Profit 596 537 (9.9)

Tax (172) (165) (4.4)

Minority Interest (17) (23) (33.1)

Net Profit 406 349 (14.0)

Net Profit before Except. 406 349 (14.0)

Margins & Ratio

Gross Margins (%) 44.9 36.3

Opg Profit Margin (%) 39.4 29.5

Net Profit Margin (%) 22.4 14.0

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 2

Company Guide

China Everbright Water

CRITICAL DATA POINTS TO WATCH Total operating capacity (m tons)

6

Earnings Drivers: 5.04

5

Tariff hikes. During FY16, a number of water plants enjoyed 4.34

4

tariff increases, ranging from 9% to 56%. The tariff hikes

were a result of upgrading, expansion and increase in 3

operating expenses. Currently, around 20% of CEW’s water 2

plants (excluding Dalian Dongda) are operating at Grade 1B 1

standard and will be required to be upgraded to Grade 1A.

0

Thus, water tariff uptrend will continue. 2017F 2018F

Improvement in utilisation. Average utilisation of water plants Volume of waste water treated (m tons)

at HanKore and Dalian Dongda are about 70% and 87% 1600

respectively, which are lower than 93% achieved by China 1400

1,427

1,297

Everbright International (CEI)’s water plants. Improvement in 1200

utilisation will be achieved by upgrading facilities and 1000

treatment standards, increasing sewage treatment volume, 800

improving pipeline connectivity, etc. 600

400

M&A strategy. With a current capacity of c.5m tons per day 200

and a capacity target of 10m tons per day by 2020, CEW 0

2017F 2018F

continues to look for M&A candidates which include private

enterprises and water plants from local governments. Project Treatment tariff (Rmb/ton)

extension, coupled with improving utilisation of the existing

2 1.49

plants, should grow treatment volume by 5-10% each year. 1.44

1

1

Expanding along the value chain. For the longer term, CEW 1

has to expand even further along the value chain in order to 1

provide a more comprehensive range of services. These 1

include not just water supply, but also recycled water, water 0

desalination, integrated watershed management, 0

construction of sponge cities, etc. 0

2017F 2018F

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 3

Company Guide

China Everbright Water

Leverage & Asset Turnover (x)

0.3

Balance Sheet: 0.90

Strong balance sheet. CEW’s net debt-equity ratio was 42% as 0.80

at end-2016. We expect the ratio to climb further to 62% by 0.70 0.3

0.60

end-FY17. While CEW is exploring new financing channels (such 0.50 0.2

as development funds for water equity), we should not rule out 0.40

the possibility of an equity fund-raising exercise. 0.30

0.2

0.20

0.10

0.00 0.1

Share Price Drivers: 2014A 2015A 2016A 2017F 2018F

M&A. Given that M&A is a major growth driver for CEW, a Gross Debt to Equity (LHS) Asset Turnover (RHS)

Capital Expenditure

successful acquisition of a sizeable water company will be a HK$m

strong share price catalyst. 350.0

300.0

Supportive government policy. The release of The Water Ten 250.0

Plan in April 2015 triggered the environmental services sector to 200.0

rally with a higher-than-expected investment amount. Additional 150.0

favourable government policy can stimulate the share price. 100.0

50.0

0.0

2014A 2015A 2016A 2017F 2018F

Key Risks: Capital Expenditure (-)

Keen competition. More new players have entered the market ROE

through acquisitions. 7.0%

6.0%

Project delay. Delays in project development will result in slower 5.0%

growth in earnings. 4.0%

3.0%

2.0%

Company Background:

China Everbright Water (CEW), previously named HanKore, was 1.0%

formed after China Everbright International (CEI) injected all of 0.0%

2014A 2015A 2016A 2017F 2018F

its water assets into HanKore, to become the largest shareholder.

Forward PE Band

CEW is now CEI's sole investment arm in water operations with (x)

5m tons of daily capacity under its project portfolio. 76.5

66.5

56.5 +2sd: 56.5x

46.5

+1sd: 44.2x

36.5

Avg: 31.9x

26.5

‐1sd: 19.6x

16.5

6.5 ‐2sd: 7.3x

Feb-13 Feb-14 Feb-15 Feb-16

PB Band

(x)

10.6

8.6

6.6 +2sd: 6.7x

4.6 +1sd: 4.61x

2.6 Avg: 2.52x

0.6 ‐1sd: 0.43x

Dec-13 Dec-14 Dec-15 Dec-16

-1.4

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 4

Company Guide

China Everbright Water

Key Assumptions

FY Dec 2017F 2018F

Total operating capacity

4.3 5.0

(m tons)

Volume of waste water

1,297.2 1,427.0

treated (m tons)

Treatment tariff

1.4 1.5

(Rmb/ton)

Source: Company, DBS Vickers

Segmental Breakdown (HK$ m)

FY Dec 2014A 2015A 2016A 2017F 2018F

Revenues (HK$ m)

Construction services 107 586 1,128 1,526 1,924

Operation services 625 753 818 888 962

Finance income 311 468 539 571 627

Others 9 8 8 9 9

Total 1,051 1,815 2,494 2,994 3,522

Source: Company, DBS Vickers

Income Statement (HK$ m)

FY Dec 2014A 2015A 2016A 2017F 2018F

Revenue 1,051 1,815 2,494 2,994 3,522

Cost of Goods Sold (463) (1,001) (1,588) (1,926) (2,304)

Gross Profit 587 814 906 1,068 1,218

Other Opng (Exp)/Inc (64) (100) (171) (131) (140)

Operating Profit 523 714 735 936 1,078

Other Non Opg (Exp)/Inc 0 0 0 0 0

Associates & JV Inc 0 0 0 0 0

Net Interest (Exp)/Inc (90) (118) (198) (231) (246)

Dividend Income 0 0 0 0 0

Exceptional Gain/(Loss) 0 0 0 0 0

Pre-tax Profit 433 596 537 706 832

Tax (119) (172) (165) (208) (245)

Minority Interest (21) (17) (23) (25) (29)

Preference Dividend 0 0 0 0 0

Net Profit 293 406 349 473 558

Net Profit before Except. 293 406 349 473 558

EBITDA 547 786 836 1,059 1,222

Growth

Revenue Gth (%) (18.6) 72.7 37.4 20.0 17.6

EBITDA Gth (%) 11.5 43.6 6.4 26.6 15.4

Opg Profit Gth (%) 10.4 36.6 2.9 27.4 15.1

Net Profit Gth (%) 9.9 38.7 (14.0) 35.3 18.0

Margins & Ratio

Gross Margins (%) 55.9 44.9 36.3 35.7 34.6

Opg Profit Margin (%) 49.8 39.4 29.5 31.3 30.6

Net Profit Margin (%) 27.9 22.4 14.0 15.8 15.8

ROAE (%) 4.6 5.8 5.0 6.7 7.4

ROA (%) 2.9 2.9 2.5 3.2 3.3

ROCE (%) 4.0 3.8 3.8 4.8 4.9

Div Payout Ratio (%) 0.0 2.2 2.8 2.0 2.0

Net Interest Cover (x) 5.8 6.0 3.7 4.1 4.4

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 5

Company Guide

China Everbright Water

Interim Income Statement (HK$ m)

FY Dec 2H2014 1H2015 2H2015 1H2016 2H2016

Revenue 545 946 869 1,326 1,168

Cost of Goods Sold (258) (503) (488) (862) (727)

Gross Profit 287 443 381 464 442

Other Oper. (Exp)/Inc (46) (69) (41) (80) (90)

Operating Profit 241 374 340 384 351

Other Non Opg (Exp)/Inc 0 0 0 0 0

Associates & JV Inc 0 0 0 0 0

Net Interest (Exp)/Inc (56) (70) (48) (96) (102)

Exceptional Gain/(Loss) 0 0 0 0 0

Pre-tax Profit 186 304 292 288 250

Tax (50) (83) (89) (100) (65)

Minority Interest (9) (9) (8) (7) (16)

Net Profit 127 211 195 181 169

Net profit bef Except. 127 211 195 181 169

Growth

Revenue Gth (%) N/A 87.1 59.5 40.1 34.4

Opg Profit Gth (%) N/A 32.8 41.0 2.5 3.4

Net Profit Gth (%) N/A 27.3 53.7 (14.5) (13.5)

Margins

Gross Margins (%) 52.7 46.8 43.8 35.0 37.8

Opg Profit Margins (%) 44.3 39.6 39.1 28.9 30.1

Net Profit Margins (%) 23.3 22.3 22.4 13.6 14.4

Source: Company, DBS Vickers

Quarterly Income Statement (HK$ m)

FY Dec 4Q2015 1Q2016 2Q2016 3Q2016 4Q2016

Revenue 459 657 669 553 615

Cost of Goods Sold (269) (421) (441) (331) (396)

Gross Profit 190 236 228 223 219

Other Oper. (Exp)/Inc 1 (37) (43) (26) (64)

Operating Profit 191 199 185 197 154

Other Non Opg (Exp)/Inc 0 0 0 0 0

Associates & JV Inc 0 0 0 0 0

Net Interest (Exp)/Inc (33) (45) (50) (56) (46)

Exceptional Gain/(Loss) 0 0 0 0 0

Pre-tax Profit 157 154 134 141 109

Tax (46) (47) (53) (43) (22)

Minority Interest (5) (3) (4) (7) (9)

Net Profit 106 103 78 91 77

Net profit bef Except. 106 103 78 91 77

EBITDA 24 24 23 24 31

Growth (QoQ)

Revenue Gth (%) 11.9 43.2 1.7 (17.2) 11.1

EBITDA Gth (%) 0.0 55.2 (5.0) 4.3 30.9

Opg Profit Gth (%) 27.7 4.3 (7.2) 6.7 (21.6)

Net Profit Gth (%) 19.5 (2.9) (24.8) 17.5 (15.0)

Growth (YoY)

Revenue Gth (%) N/A 50.6 31.1 34.9 34.0

EBITDA Gth (%) N/A (88.0) 20.7 53.8 101.4

Opg Profit Gth (%) N/A 10.0 (4.5) 31.9 (19.0)

Net Profit Gth (%) N/A 2.2 (29.8) 2.6 (27.0)

Margins

Gross Margins (%) 41.4 36.0 34.1 40.2 35.6

Opg Profit Margins (%) 41.6 30.3 27.6 35.6 25.1

Net Profit Margins (%) 23.1 15.7 11.6 16.5 12.6

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 6

Company Guide

China Everbright Water

Balance Sheet (HK$ m)

FY Dec 2014A 2015A 2016A 2017F 2018F

Net Fixed Assets 174 163 148 431 661

Invts in Associates & JVs 0 0 1 2 2

Other LT Assets 8,229 10,462 10,635 12,428 14,189

Cash & ST Invts 681 1,769 1,903 1,048 880

Inventory 29 11 14 60 70

Debtors 998 1,535 1,380 1,596 1,905

Other Current Assets 0 0 0 90 106

Total Assets 10,112 13,939 14,081 15,654 17,813

ST Debt 763 2,395 1,521 1,571 1,605

Creditors 600 475 937 1,125 1,323

Other Current Liab 43 52 13 13 13

LT Debt 1,062 2,424 3,366 4,225 5,621

Other LT Liabilities 1,093 1,296 1,052 1,052 1,052

Shareholder’s Equity 6,325 7,061 6,798 7,250 7,751

Minority Interests 226 236 394 419 447

Total Cap. & Liab. 10,112 13,939 14,081 15,654 17,813

Non-Cash Wkg. Capital 385 1,018 444 607 745

Net Cash/(Debt) (1,143) (3,049) (2,985) (4,748) (6,346)

Debtors Turn (avg days) 346.8 308.6 213.3 181.4 181.4

Creditors Turn (avg days) 498.5 186.8 173.4 208.6 206.9

Inventory Turn (avg days) 24.0 4.2 3.1 7.5 11.0

Asset Turnover (x) 0.1 0.1 0.2 0.2 0.2

Current Ratio (x) 1.2 1.1 1.3 1.0 1.0

Quick Ratio (x) 1.2 1.1 1.3 1.0 0.9

Net Debt/Equity (X) 0.2 0.4 0.4 0.6 0.8

Net Debt/Equity ex MI (X) 0.2 0.4 0.4 0.7 0.8

Capex to Debt (%) 0.2 0.2 0.2 5.2 3.5

Z-Score (X) NA NA NA NA NA

Source: Company, DBS Vickers

Cash Flow Statement (HK$ m)

FY Dec 2014A 2015A 2016A 2017F 2018F

Pre-Tax Profit 433 596 537 706 832

Dep. & Amort. 24 72 101 123 144

Tax Paid (65) (95) (134) (208) (245)

Assoc. & JV Inc/(loss) 0 0 0 0 0

(Pft)/ Loss on disposal of FAs 0 0 0 0 0

Chg in Wkg.Cap. (173) (635) (642) (1,493) (1,456)

Other Operating CF 98 95 157 231 246

Net Operating CF 317 33 20 (642) (480)

Capital Exp.(net) (3) (10) (12) (300) (250)

Other Invts.(net) 431 (2,163) (1) 0 0

Invts in Assoc. & JV 1 0 0 0 0

Div from Assoc & JV 0 0 0 0 0

Other Investing CF 2 (4) 7 (570) (565)

Net Investing CF 430 (2,177) (6) (870) (815)

Div Paid 0 0 0 (21) (56)

Chg in Gross Debt 33 3,389 310 1,452 1,430

Capital Issues 0 659 (23) 0 0

Other Financing CF (521) (1,094) (145) (231) (246)

Net Financing CF (488) 2,954 142 1,200 1,128

Currency Adjustments (6) (20) (85) 0 0

Chg in Cash 252 789 71 (311) (167)

Opg CFPS (HK$) 0.20 0.26 0.25 0.33 0.37

Free CFPS (HK$) 0.13 0.01 0.00 (0.36) (0.28)

Source: Company, DBS Vickers

ASIAN INSIGHTS VICKERS SECURITIES

Page 7

Company Guide

China Everbright Water

Target Price & Ratings History

S.No . Da te Cl o s i n g Ta rg e t R a ti n g

S$

Pri c e Pri c e

0.80 10

2 5 67 9 11 12 13 1: 16-Feb-16 S$0.425 S$0.58 Buy

0.70 8 2: 17-Feb-16 S$0.44 S$0.58 Buy

3&4

3: 22-Feb-16 S$0.475 S$0.64 Buy

0.60

4: 22-Feb-16 S$0.475 S$0.64 Buy

0.50 1 5: 3-Mar-16 S$0.50 S$0.64 Buy

0.40 6: 12-Apr-16 S$0.545 S$0.64 Buy

7: 19-Apr-16 S$0.63 S$0.69 Buy

0.30 8: 20-Apr-16 S$0.63 S$0.69 Buy

0.20 9: 16-May-16 S$0.67 S$0.69 Buy

10: 18-May-16 S$0.675 S$0.69 Buy

0.10

11: 10-Jun-16 S$0.66 S$0.69 Buy

Mar-16

Apr-16

Sep-16

Jan-17

Jun-16

Aug-16

Dec-16

Jul-16

May-16

Feb-16

Oct-16

Nov-16

Feb-17

12: 9-Aug-16 S$0.60 S$0.66 Buy

13: 3-Nov-16 S$0.545 S$0.64 Buy

Source: DBS Vickers

Analyst: Patricia YEUNG

ASIAN INSIGHTS VICKERS SECURITIES

Page 8

Company Guide

China Everbright Water

DBSVHK recommendations are based an Absolute Total Return* Rating system, defined as follows:

STRONG BUY (>20% total return over the next 3 months, with identifiable share price catalysts within this time frame)

BUY (>15% total return over the next 12 months for small caps, >10% for large caps)

HOLD (-10% to +15% total return over the next 12 months for small caps, -10% to +10% for large caps)

FULLY VALUED (negative total return i.e. > -10% over the next 12 months)

SELL (negative total return of > -20% over the next 3 months, with identifiable catalysts within this time frame)

Share price appreciation + dividends

Completed Date: 24 Feb 2017 18:51:44 (HKT)

Dissemination Date: 24 Feb 2017 19:03:24 (HKT)

GENERAL DISCLOSURE/DISCLAIMER

This report is prepared by DBS Vickers (Hong Kong) Limited (“DBSVHK”). This report is solely intended for the clients of DBS Bank Ltd., DBS Vickers

Securities (Singapore) Pte Ltd. (“DBSVS”) and DBSVHK, its respective connected and associated corporations and affiliates only and no part of this

document may be (i) copied, photocopied or duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBSVHK.

The research set out in this report is based on information obtained from sources believed to be reliable, but we (which collectively refers to DBS Bank Ltd.,

DBSVS and DBSVHK, its respective connected and associated corporations, affiliates and their respective directors, officers, employees and agents

(collectively, the “DBS Group”)) do not make any representation or warranty as to its accuracy, completeness or correctness. Opinions expressed are

subject to change without notice. This document is prepared for general circulation. Any recommendation contained in this document does not have

regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of

addressees only and is not to be taken in substitution for the exercise of judgement by addressees, who should obtain separate independent legal or

financial advice. The DBS Group accepts no liability whatsoever for any direct, indirect and/or consequential loss (including any claims for loss of profit)

arising from any use of and/or reliance upon this document and/or further communication given in relation to this document. This document is not to be

construed as an offer or a solicitation of an offer to buy or sell any securities. The DBS Group, along with its affiliates and/or persons associated with any

of them may from time to time have interests in the securities mentioned in this document. The DBS Group may have positions in, and may effect

transactions in securities mentioned herein and may also perform or seek to perform broking, investment banking and other banking services for these

companies.

Any valuations, opinions, estimates, forecasts, ratings or risk assessments herein constitutes a judgment as of the date of this report, and there can be no

assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments. The

information in this document is subject to change without notice, its accuracy is not guaranteed, it may be incomplete or condensed, it may not contain

all material information concerning the company (or companies) referred to in this report and the DBS Group is under no obligation to update the

information in this report.

This publication has not been reviewed or authorized by any regulatory authority in Singapore, Hong Kong or elsewhere. There is no planned

schedule or frequency for updating research publication relating to any issuer.

The valuations, opinions, estimates, forecasts, ratings or risk assessments described in this report were based upon a number of estimates and

assumptions and are inherently subject to significant uncertainties and contingencies. It can be expected that one or more of the estimates on which the

valuations, opinions, estimates, forecasts, ratings or risk assessments were based will not materialize or will vary significantly from actual results. Therefore,

the inclusion of the valuations, opinions, estimates, forecasts, ratings or risk assessments described herein IS NOT TO BE RELIED UPON as a representation

and/or warranty by the DBS Group (and/or any persons associated with the aforesaid entities), that:

(a) such valuations, opinions, estimates, forecasts, ratings or risk assessments or their underlying assumptions will be achieved, and

(b)there is any assurance that future results or events will be consistent with any such valuations, opinions, estimates, forecasts, ratings or risk assessments

stated therein.

Please contact the primary analyst for valuation methodologies and assumptions associated with the covered companies or price targets.

Any assumptions made in this report that refers to commodities, are for the purposes of making forecasts for the company (or companies) mentioned

herein. They are not to be construed as recommendations to trade in the physical commodity or in the futures contract relating to the commodity

referred to in this report.

DBS Vickers Securities (USA) Inc ("DBSVUSA"), a U.S.-registered broker-dealer, does not have its own investment banking or research department, has

not participated in any public offering of securities as a manager or co-manager or in any other investment banking transaction in the past twelve months

and does not engage in market-making.

ASIAN INSIGHTS VICKERS SECURITIES

Page 9

Company Guide

China Everbright Water

ANALYST CERTIFICATION

The research analyst(s) primarily responsible for the content of this research report, in part or in whole, certifies that the views about the companies and

their securities expressed in this report accurately reflect his/her personal views. The analyst(s) also certifies that no part of his/her compensation was, is, or

will be, directly or indirectly, related to specific recommendations or views expressed in the report. The DBS Group has procedures in place to eliminate,

avoid and manage any potential conflicts of interests that may arise in connection with the production of research reports. As of 24 February 2017, the

analyst(s) and his/her spouse and/or relatives who are financially dependent on the analyst(s), do not hold interests in the securities recommended in this

report (“interest” includes direct or indirect ownership of securities). The research analyst(s) responsible for this report operates as part of a separate and

independent team to the investment banking function of the DBS Group and procedures are in place to ensure that confidential information held by

either the research or investment banking function is handled appropriately.

COMPANY-SPECIFIC / REGULATORY DISCLOSURES

1. DBSVHK and its subsidiaries do not have a proprietary position in the securities recommended/mentioned in this report as of 23 Feb

2017.

2. Compensation for investment banking services:

DBSVUSA does not have its own investment banking or research department, nor has it participated in any public offering of securities

as a manager or co-manager or in any other investment banking transaction in the past twelve months. Any US persons wishing to

obtain further information, including any clarification on disclosures in this disclaimer, or to effect a transaction in any security

discussed in this document should contact DBSVUSA exclusively.

3. Disclosure of previous investment recommendation produced:

DBS Bank Ltd, DBSVS, DBSVHK, their subsidiaries and/or other affiliates of DBSVUSA may have published other investment

recommendations in respect of the same securities / instruments recommended in this research report during the preceding 12

months. Please contact the primary analyst listed in the first page of this report to view previous investment recommendations

published by DBS Bank Ltd, DBSVHK, their subsidiaries and/or other affiliates of DBSVUSA in the preceding 12 months.

RESTRICTIONS ON DISTRIBUTION

General This report is not directed to, or intended for distribution to or use by, any person or entity who is a citizen or resident

of or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use

would be contrary to law or regulation.

Australia This report is being distributed in Australia by DBS Bank Ltd. (“DBS”) or DBS Vickers Securities (Singapore) Pte Ltd

(“DBSVS”) or DBS Vickers (Hong Kong) Limited (“DBSVHK”), which are exempted from the requirement to hold an

Australian Financial Services Licence under the Corporation Act 2001 (“CA”) in respect of financial services provided

to the recipients. Both DBS and DBSVS are regulated by the Monetary Authority of Singapore under the laws of

Singapore, and DBSVHK is regulated by the Securities and Futures Commission of Hong Kong under the laws of Hong

Kong, which differ from Australian laws. Distribution of this report is intended only for “wholesale investors” within

the meaning of the CA.

Hong Kong This report is being distributed in Hong Kong by DBSVHK which is licensed and regulated by the Hong Kong

Securities and Futures Commission.

Indonesia This report is being distributed in Indonesia by PT DBS Vickers Sekuritas Indonesia.

Malaysia This report is distributed in Malaysia by AllianceDBS Research Sdn Bhd ("ADBSR"). Recipients of this report, received

from ADBSR are to contact the undersigned at 603-2604 3333 in respect of any matters arising from or in connection

with this report. In addition to the General Disclosure/Disclaimer found at the preceding page, recipients of this report

are advised that ADBSR (the preparer of this report), its holding company Alliance Investment Bank Berhad, their

respective connected and associated corporations, affiliates, their directors, officers, employees, agents and parties

related or associated with any of them may have positions in, and may effect transactions in the securities mentioned

herein and may also perform or seek to perform broking, investment banking/corporate advisory and other services

for the subject companies. They may also have received compensation and/or seek to obtain compensation for

broking, investment banking/corporate advisory and other services from the subject companies.

Wong Ming Tek, Executive Director, ADBSR

Singapore This report is distributed in Singapore by DBS Bank Ltd (Company Regn. No. 196800306E) or DBSVS (Company Regn

No. 198600294G), both of which are Exempt Financial Advisers as defined in the Financial Advisers Act and regulated

by the Monetary Authority of Singapore. DBS Bank Ltd and/or DBSVS, may distribute reports produced by its

respective foreign entities, affiliates or other foreign research houses pursuant to an arrangement under Regulation

32C of the Financial Advisers Regulations. Where the report is distributed in Singapore to a person who is not an

Accredited Investor, Expert Investor or an Institutional Investor, DBS Bank Ltd accepts legal responsibility for the

contents of the report to such persons only to the extent required by law. Singapore recipients should contact DBS

Bank Ltd at 6327 2288 for matters arising from, or in connection with the report.

ASIAN INSIGHTS VICKERS SECURITIES

Page 10

Company Guide

China Everbright Water

Thailand This report is being distributed in Thailand by DBS Vickers Securities (Thailand) Co Ltd. Research reports distributed are

only intended for institutional clients only and no other person may act upon it.

United This report is produced by DBSVHK which is regulated by the Securities and Futures Commission of Hong Kong.

Kingdom

This report is disseminated in the United Kingdom by DBS Vickers Securities (UK) Ltd (“DBSVUK”). DBSVUK is

authorised and regulated by the Financial Conduct Authority in the United Kingdom.

In respect of the United Kingdom, this report is solely intended for the clients of DBSVUK, its respective connected

and associated corporations and affiliates only and no part of this document may be (i) copied, photocopied or

duplicated in any form or by any means or (ii) redistributed without the prior written consent of DBSVUK. This

communication is directed at persons having professional experience in matters relating to investments. Any

investment activity following from this communication will only be engaged in with such persons. Persons who do not

have professional experience in matters relating to investments should not rely on this communication.

Dubai This research report is being distributed in The Dubai International Financial Centre (“DIFC”) by DBS Bank Ltd., (DIFC

rd

Branch) having its office at PO Box 506538, 3 Floor, Building 3, East Wing, Gate Precinct, Dubai International

Financial Centre (DIFC), Dubai, United Arab Emirates. DBS Bank Ltd., (DIFC Branch) is regulated by The Dubai Financial

Services Authority. This research report is intended only for professional clients (as defined in the DFSA rulebook) and

no other person may act upon it.

United States This report was prepared by DBSVHK. DBSVUSA did not participate in its preparation. The research analyst(s) named

on this report are not registered as research analysts with FINRA and are not associated persons of DBSVUSA. The

research analyst(s) are not subject to FINRA Rule 2241 restrictions on analyst compensation, communications with a

subject company, public appearances and trading securities held by a research analyst. This report is being distributed

in the United States by DBSVUSA, which accepts responsibility for its contents. This report may only be distributed to

Major U.S. Institutional Investors (as defined in SEC Rule 15a-6) and to such other institutional investors and qualified

persons as DBSVUSA may authorize. Any U.S. person receiving this report who wishes to effect transactions in any

securities referred to herein should contact DBSVUSA directly and not its affiliate.

Other In any other jurisdictions, except if otherwise restricted by laws or regulations, this report is intended only for

jurisdictions qualified, professional, institutional or sophisticated investors as defined in the laws and regulations of such

jurisdictions.

DBS Vickers (Hong Kong) Limited

th

18 Floor Man Yee building, 68 Des Voeux Road Central, Central, Hong Kong

Tel: (852) 2820-4888, Fax: (852) 2868-1523

Company Regn. No. 31758

ASIAN INSIGHTS VICKERS SECURITIES

Page 11

You might also like

- Whitepaper Roic Rs InvestmentsDocument12 pagesWhitepaper Roic Rs InvestmentsmdorneanuNo ratings yet

- NISM XV Research Analyst Short NotesDocument40 pagesNISM XV Research Analyst Short Notesjack75% (4)

- Student Transcript Corporate Finance Institute®: Student No.: Student Name: Date of BirthDocument9 pagesStudent Transcript Corporate Finance Institute®: Student No.: Student Name: Date of BirthHarshit100% (2)

- Golden Age of China's Education Industry: Seize The MomentumDocument42 pagesGolden Age of China's Education Industry: Seize The MomentumJ. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- 2016 Free Mind Maps CFA Level 2Document22 pages2016 Free Mind Maps CFA Level 2Pho680% (5)

- Kpil 9 2 24 PLDocument8 pagesKpil 9 2 24 PLrmishraNo ratings yet

- IHH (4Q2019) - 02mar2020Document15 pagesIHH (4Q2019) - 02mar2020surananamita99No ratings yet

- Sadbhav Engineering: Execution-Driven GrowthDocument11 pagesSadbhav Engineering: Execution-Driven GrowthDinesh ChoudharyNo ratings yet

- Firstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDocument12 pagesFirstsource Solutions (FIRSOU) : H2FY17E Expected To Be BetterDeep Run WatersNo ratings yet

- Hong Leong Bank BHD Market Perform : 2QFY21 Within ExpectationsDocument4 pagesHong Leong Bank BHD Market Perform : 2QFY21 Within Expectationsit4728No ratings yet

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDocument10 pagesBeijing Capital Intl Airport: China / Hong Kong Company GuideajayNo ratings yet

- Jaiprakash Associates: Growth Across VerticalsDocument16 pagesJaiprakash Associates: Growth Across VerticalssachitanandaNo ratings yet

- CMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingDocument10 pagesCMP: INR141 TP: INR175 (+24%) Biggest Beneficiary of Improved PricingPratik PatilNo ratings yet

- Sadbhav Engineering (SADE IN) : Q4FY20 Result UpdateDocument8 pagesSadbhav Engineering (SADE IN) : Q4FY20 Result UpdatewhitenagarNo ratings yet

- Banks - HBL - Earnings Revision - BMADocument3 pagesBanks - HBL - Earnings Revision - BMAmuddasir1980No ratings yet

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDocument13 pagesBeijing Capital Intl Airport: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Slowing Growth: Results Review 3qfy17 13 FEB 2017Document10 pagesSlowing Growth: Results Review 3qfy17 13 FEB 2017arun_algoNo ratings yet

- Bumi Serpong Damai: Indonesia Company GuideDocument10 pagesBumi Serpong Damai: Indonesia Company GuidetimphamNo ratings yet

- Xinyi SolarDocument25 pagesXinyi Solarwilliam zengNo ratings yet

- GRUH-Finance-Limited 204 QuarterUpdateDocument10 pagesGRUH-Finance-Limited 204 QuarterUpdatevikasaggarwal01No ratings yet

- Larsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYDocument10 pagesLarsen & Toubro: Bottoming Out Order Pick-Up Awaited BUYVikas AggarwalNo ratings yet

- Daily Wealth Take: A Product of Wealth Securities IncDocument3 pagesDaily Wealth Take: A Product of Wealth Securities IncJun GomezNo ratings yet

- Glenmark - MacquarieDocument11 pagesGlenmark - MacquarieSomendraNo ratings yet

- Serba Dinamik Holdings Under Review: Another Results DisappointmentDocument4 pagesSerba Dinamik Holdings Under Review: Another Results DisappointmentZhi_Ming_Cheah_8136No ratings yet

- Oppenheimer RUN RUN Growth Continues With Strong DemandDocument10 pagesOppenheimer RUN RUN Growth Continues With Strong DemandBrian AhuatziNo ratings yet

- China Water Affairs Group: Improvements at Kangda InternationalDocument5 pagesChina Water Affairs Group: Improvements at Kangda InternationalJ. BangjakNo ratings yet

- Research - Note - 2017 12 27 - 10 48 05 000000 PDFDocument14 pagesResearch - Note - 2017 12 27 - 10 48 05 000000 PDFMOHAMEDNo ratings yet

- NBCC-IPO Emkay 220312Document8 pagesNBCC-IPO Emkay 220312profd3No ratings yet

- 141342112021251larsen Toubro Limited - 20210129Document5 pages141342112021251larsen Toubro Limited - 20210129Michelle CastelinoNo ratings yet

- Voltamp Transformers (VAMP IN) : Q4FY21 Result UpdateDocument6 pagesVoltamp Transformers (VAMP IN) : Q4FY21 Result UpdateDarwish MammiNo ratings yet

- BIMB Holdings: Malaysia Company GuideDocument11 pagesBIMB Holdings: Malaysia Company GuideEugene TeoNo ratings yet

- SobhaDocument21 pagesSobhadigthreeNo ratings yet

- 2022Q1 PR EN FinalDocument13 pages2022Q1 PR EN FinalMATHU MOHANNo ratings yet

- Dilip Buildcon: Strong ComebackDocument11 pagesDilip Buildcon: Strong ComebackPawan AsraniNo ratings yet

- FinolexIndustries Q3FY22ResultReview27Jan22 ResearchDocument10 pagesFinolexIndustries Q3FY22ResultReview27Jan22 ResearchBISWAJIT DUSADHNo ratings yet

- Enbridge Inc: Investment BriefDocument5 pagesEnbridge Inc: Investment BriefrickescherNo ratings yet

- Suzlon Energy: Momentum Building UpDocument9 pagesSuzlon Energy: Momentum Building Uparun_algoNo ratings yet

- Idirect Sail Q4fy16Document9 pagesIdirect Sail Q4fy16Binod Kumar PadhiNo ratings yet

- Emlak Konut REIC: Price Target RevisionDocument6 pagesEmlak Konut REIC: Price Target RevisionCbpNo ratings yet

- State Bank of India: CMP: INR407 TP: INR600 (+47%)Document12 pagesState Bank of India: CMP: INR407 TP: INR600 (+47%)satyendragupta0078810No ratings yet

- STX OSV Holdings LimitedDocument34 pagesSTX OSV Holdings LimitedKyithNo ratings yet

- Indian Institute of Management, Calcutta: Company Analysis: Tata SteelDocument13 pagesIndian Institute of Management, Calcutta: Company Analysis: Tata SteelAyush ChamariaNo ratings yet

- Vaibhav Global Research ReportDocument4 pagesVaibhav Global Research ReportVikrant SadanaNo ratings yet

- Wipro (WPRO IN) : Q1FY22 Result UpdateDocument13 pagesWipro (WPRO IN) : Q1FY22 Result UpdatePrahladNo ratings yet

- ITMGDocument5 pagesITMGjovalNo ratings yet

- BBNI Backed by Infrastructure Loan Disbursement - 20170718 - NHKS - Company Update 2Q17 (English)Document5 pagesBBNI Backed by Infrastructure Loan Disbursement - 20170718 - NHKS - Company Update 2Q17 (English)Anonymous XoUqrqyuNo ratings yet

- ICICI - Piramal PharmaDocument4 pagesICICI - Piramal PharmasehgalgauravNo ratings yet

- Breadtalk Group LTD: Singapore Company GuideDocument11 pagesBreadtalk Group LTD: Singapore Company GuideBrandon TanNo ratings yet

- Ramco Cement Q2FY24 ResultsDocument8 pagesRamco Cement Q2FY24 ResultseknathNo ratings yet

- PSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10Document8 pagesPSP Projects LTD - Q1FY24 Result Update - 28072023 - 28-07-2023 - 10samraatjadhavNo ratings yet

- 1 BHEL 13nov23 Kotak InstDocument10 pages1 BHEL 13nov23 Kotak InstRajesh SinghNo ratings yet

- JM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)Document9 pagesJM Financial - L&T Technology Services Ltd. - An Imbalanced Equation (4QFY17 RU) (HOLD)darshanmadeNo ratings yet

- Indofood CBP Sukses Makmur: Assessing The New Potential Sales DriverDocument9 pagesIndofood CBP Sukses Makmur: Assessing The New Potential Sales DriverRizqi HarryNo ratings yet

- Residential Recovery Awaited: Highlights of The QuarterDocument16 pagesResidential Recovery Awaited: Highlights of The QuartergbNo ratings yet

- Apcotex Industries 230817 PDFDocument7 pagesApcotex Industries 230817 PDFADNo ratings yet

- BLS International - 2QFY18 - HDFC Sec-201711112030262626379Document11 pagesBLS International - 2QFY18 - HDFC Sec-201711112030262626379Anonymous y3hYf50mTNo ratings yet

- SChand Analyst CoverageDocument7 pagesSChand Analyst CoverageMohan KNo ratings yet

- InvestmentIdea - Larsen Toubro300821Document5 pagesInvestmentIdea - Larsen Toubro300821vikalp123123No ratings yet

- AngelBrokingResearch CochinShipyard IC 310717Document12 pagesAngelBrokingResearch CochinShipyard IC 310717durgasainathNo ratings yet

- Intellect Design Arena LTD: Stock Price & Q4 Results of Intellect Design Arena Limited - HDFC SecuritiesDocument11 pagesIntellect Design Arena LTD: Stock Price & Q4 Results of Intellect Design Arena Limited - HDFC SecuritiesHDFC SecuritiesNo ratings yet

- Blue Star (BLSTR In) 2QFY20 Result Update - RsecDocument9 pagesBlue Star (BLSTR In) 2QFY20 Result Update - RsecHardik ShahNo ratings yet

- ABL ResultUpdate Feb21Document8 pagesABL ResultUpdate Feb21yoursaaryaNo ratings yet

- Udita Wadhwa - 2019BB10060Document14 pagesUdita Wadhwa - 2019BB10060Khushii NaamdeoNo ratings yet

- Fiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesFrom EverandFiscal Decentralization Reform in Cambodia: Progress over the Past Decade and OpportunitiesNo ratings yet

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?From EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?No ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-June 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-June 2020J. BangjakNo ratings yet

- Boc Aviation Investor Update: November 2019Document27 pagesBoc Aviation Investor Update: November 2019J. BangjakNo ratings yet

- Overseas Regulatory AnnouncementDocument42 pagesOverseas Regulatory AnnouncementJ. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-May 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-May 2020J. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- Ping An Insurance - DBS 20200228Document6 pagesPing An Insurance - DBS 20200228J. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-March 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-March 2020J. BangjakNo ratings yet

- Telemedecine in ChinaDocument9 pagesTelemedecine in ChinaJ. BangjakNo ratings yet

- China Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineDocument6 pagesChina Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineJ. BangjakNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Special ShareDocument8 pagesSpecial ShareJ. BangjakNo ratings yet

- Fu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司Document1 pageFu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司J. BangjakNo ratings yet

- Fu Shou Yuan IPODocument3 pagesFu Shou Yuan IPOJ. BangjakNo ratings yet

- Table 1: Tencent Service Offerings: Monetization User Base Communications and SocialDocument11 pagesTable 1: Tencent Service Offerings: Monetization User Base Communications and SocialJ. BangjakNo ratings yet

- March Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialDocument17 pagesMarch Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialJ. BangjakNo ratings yet

- AIA Group: China / Hong Kong Company GuideDocument13 pagesAIA Group: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Five Trends Shaping The Future of E-Commerce in China - World Economic ForumDocument5 pagesFive Trends Shaping The Future of E-Commerce in China - World Economic ForumJ. BangjakNo ratings yet

- March Quarter 2017 ResultsDocument14 pagesMarch Quarter 2017 ResultsJ. BangjakNo ratings yet

- p200522 PDFDocument50 pagesp200522 PDFJ. BangjakNo ratings yet

- en PDFDocument49 pagesen PDFJ. BangjakNo ratings yet

- With ROE of Over 20% For A Decade While The Stock Price Falling - BloombergDocument6 pagesWith ROE of Over 20% For A Decade While The Stock Price Falling - BloombergJ. BangjakNo ratings yet

- Alibaba Group Announces December Quarter 2018 ResultsDocument30 pagesAlibaba Group Announces December Quarter 2018 ResultsJ. BangjakNo ratings yet

- Inside Information Announcement - COVID19 Impacts - enDocument3 pagesInside Information Announcement - COVID19 Impacts - enJ. BangjakNo ratings yet

- China Utilities Sector: China / Hong Kong Industry FocusDocument7 pagesChina Utilities Sector: China / Hong Kong Industry FocusJ. BangjakNo ratings yet

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDocument13 pagesBeijing Capital Intl Airport: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Sahand CVDocument1 pageSahand CVSahand LaliNo ratings yet

- Jobstore Survey Report Post GE14Document25 pagesJobstore Survey Report Post GE14Farmaz SomuNo ratings yet

- Resume 8Document1 pageResume 8Shashank SauravNo ratings yet

- 2007 Resume BookDocument14 pages2007 Resume BooknachiketaaaNo ratings yet

- Total Addressable Market - Learn How To Calculate The TAMDocument10 pagesTotal Addressable Market - Learn How To Calculate The TAMkgs m mullah ibadurrahmanNo ratings yet

- Fundamental of ValuationDocument39 pagesFundamental of Valuationkristeen1211No ratings yet

- R02.1 Standards I (A) and I (B) - AnswersDocument27 pagesR02.1 Standards I (A) and I (B) - AnswersShashwat DesaiNo ratings yet

- Unit Three: 3. Financial Statement Analysis and InterpretationDocument76 pagesUnit Three: 3. Financial Statement Analysis and InterpretationSintayehu MeseleNo ratings yet

- Pavan ProjectDocument44 pagesPavan Project084 UjwalaNo ratings yet

- Finance - English Track - Fall - ParisDocument3 pagesFinance - English Track - Fall - ParisAbys AbysNo ratings yet

- JPM Asia Pacific Equity 2011-07-07 624664Document22 pagesJPM Asia Pacific Equity 2011-07-07 624664tommyphyuNo ratings yet

- Format For AlertsDocument423 pagesFormat For AlertsAnkit UtrejaNo ratings yet

- Company Detailed Report - Pakistan International Bulk Terminal LimitedDocument13 pagesCompany Detailed Report - Pakistan International Bulk Terminal LimitedAbdullah UmerNo ratings yet

- Financial ManagementDocument171 pagesFinancial ManagementNasr MohammedNo ratings yet

- Report On EBL & NICDocument34 pagesReport On EBL & NICDevKumar MahatoNo ratings yet

- The Market Share in IPOsDocument4 pagesThe Market Share in IPOsSamin SakibNo ratings yet

- Separata Unit 1 Ses 1 2 3 4Document13 pagesSeparata Unit 1 Ses 1 2 3 4Blanca Rebaza MateoNo ratings yet

- Perceived Importance of Systems AnalystsDocument20 pagesPerceived Importance of Systems AnalystsKevin GovenderNo ratings yet

- Part 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Document66 pagesPart 2 - Liquidity and Profitability Ratios (Exercises) - Sol 11 Sept 2021Alyssa PilapilNo ratings yet

- MGT 635 Syllabus 2010-11 PDFDocument11 pagesMGT 635 Syllabus 2010-11 PDFRajivManochaNo ratings yet

- Security Analysis and Portfolio Management Project by TanveerDocument77 pagesSecurity Analysis and Portfolio Management Project by TanveeradeenNo ratings yet

- Vakrangee LimitedDocument3 pagesVakrangee LimitedSubham MazumdarNo ratings yet

- KSDL 1 Repaired)Document76 pagesKSDL 1 Repaired)Arshad Ali100% (1)

- Campus Brochure ADYPU-290523Document16 pagesCampus Brochure ADYPU-290523Yogesh Madhav jahirNo ratings yet

- Nawrez Senior Associate ResumeDocument1 pageNawrez Senior Associate ResumeNawrezNo ratings yet

- Jacob François: Financial Analyst and PlannerDocument3 pagesJacob François: Financial Analyst and Plannerminjacob_601721240No ratings yet