Professional Documents

Culture Documents

Fu Shou Yuan IPO

Fu Shou Yuan IPO

Uploaded by

J. BangjakCopyright:

Available Formats

You might also like

- International Physical DistributionDocument2 pagesInternational Physical DistributionJuliana GrNo ratings yet

- Golden Age of China's Education Industry: Seize The MomentumDocument42 pagesGolden Age of China's Education Industry: Seize The MomentumJ. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- Engineering Civilised Numbers: Yongnam HoldingsDocument5 pagesEngineering Civilised Numbers: Yongnam HoldingsTerence Seah Pei ChuanNo ratings yet

- IPO Outlook - BLS E-Services LTDDocument2 pagesIPO Outlook - BLS E-Services LTDalkeshkNo ratings yet

- Apollo Investor Presentation June 2013 PDFDocument21 pagesApollo Investor Presentation June 2013 PDFChit Moe ZawNo ratings yet

- Mukta Arts (MUKART) : Multiplex Screen Expansion To Drive Revenue..Document4 pagesMukta Arts (MUKART) : Multiplex Screen Expansion To Drive Revenue..Dinesh ChoudharyNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- Greatview Aseptic Packaging (468.HK) : IPO PreviewDocument3 pagesGreatview Aseptic Packaging (468.HK) : IPO Previewtkgoon6349No ratings yet

- Apollo Investor Presentation August 2013 PDFDocument21 pagesApollo Investor Presentation August 2013 PDFNitin SharmaNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- IDFC AnandRathi 050211Document2 pagesIDFC AnandRathi 050211SarweinNo ratings yet

- Real Estate Overweight: Set To Recover in 2H13Document4 pagesReal Estate Overweight: Set To Recover in 2H13bodaiNo ratings yet

- Profile - Aster DM HealthcareDocument2 pagesProfile - Aster DM HealthcareDr. Karan ShahNo ratings yet

- IPO Vijaya Diagnostic - 01092021 1630476491Document6 pagesIPO Vijaya Diagnostic - 01092021 1630476491Neil MannikarNo ratings yet

- HCL Technologies Ltd. - Q4FY11 Result UpdateDocument3 pagesHCL Technologies Ltd. - Q4FY11 Result UpdateSeema GusainNo ratings yet

- FY13: Spillover Boost To Weak Order Inflow: Enam DirectDocument5 pagesFY13: Spillover Boost To Weak Order Inflow: Enam DirectTanmay ChakrabortyNo ratings yet

- Tata Communications (VIDSAN) : Data Segment Highly Margin AccretiveDocument3 pagesTata Communications (VIDSAN) : Data Segment Highly Margin AccretivevikkediaNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Adaro Energy: Potential Short-Term WeaknessDocument6 pagesAdaro Energy: Potential Short-Term WeaknesserlanggaherpNo ratings yet

- Project On Compitative Anlyses On Depodsitery Service PraviderDocument59 pagesProject On Compitative Anlyses On Depodsitery Service PravidervivekbaroleNo ratings yet

- Inari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyDocument3 pagesInari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyFong Kah YanNo ratings yet

- Bse LTD Iponote Geplcapital 190117Document3 pagesBse LTD Iponote Geplcapital 190117SachinShingoteNo ratings yet

- A Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaDocument7 pagesA Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaCraft DealNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- Blackstone Embassy REITDocument4 pagesBlackstone Embassy REITNikhil Gupta100% (1)

- JSTREET Volume 351Document10 pagesJSTREET Volume 351JhaveritradeNo ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- MphasisDocument4 pagesMphasisAngel BrokingNo ratings yet

- Fortis Analyst Presentation FinalDocument28 pagesFortis Analyst Presentation FinalSonakshi KansalNo ratings yet

- Medplus IPO Note - VenturaDocument19 pagesMedplus IPO Note - Venturaaniket birariNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- Case Study Unit 1Document9 pagesCase Study Unit 1Dana E. AranasNo ratings yet

- TRIVENI140509 Wwwmon3yworldblogspotcomDocument3 pagesTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNo ratings yet

- Investment Banking (A) Group AssignmentDocument29 pagesInvestment Banking (A) Group AssignmentHarsh SudNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Adani EnterprisesDocument1 pageAdani EnterprisesDebjit SenguptaNo ratings yet

- Corporate Presentation Q4FY22Document46 pagesCorporate Presentation Q4FY22canmmathew2003No ratings yet

- A Project Report On Competitive AnalysisDocument115 pagesA Project Report On Competitive AnalysisMallesh ArjaNo ratings yet

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Document27 pagesDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinNo ratings yet

- Hindustan Unilever 100610 01Document2 pagesHindustan Unilever 100610 01Kumar AnuragNo ratings yet

- HCC Q1FY12 Result UpdateDocument3 pagesHCC Q1FY12 Result UpdateSeema GusainNo ratings yet

- Fitriyani 2022 Eps Der RoeDocument11 pagesFitriyani 2022 Eps Der RoeFitra Ramadhana AsfriantoNo ratings yet

- Management Meet Takeaways: Not RatedDocument8 pagesManagement Meet Takeaways: Not RatedAngel BrokingNo ratings yet

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- Crompton Greaves LTD - Q1FY12 Result UpdateDocument3 pagesCrompton Greaves LTD - Q1FY12 Result UpdateSeema GusainNo ratings yet

- PLDTDocument12 pagesPLDTJOHN MARK ESTREMERANo ratings yet

- HT Media LTD 1qfy12Document3 pagesHT Media LTD 1qfy12Seema GusainNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Intimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Document37 pagesIntimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Shyam SunderNo ratings yet

- TV Today Network LTD: EquitiesDocument3 pagesTV Today Network LTD: EquitiesAnonymous y3hYf50mTNo ratings yet

- Corporate Presentation Q2FY21Document44 pagesCorporate Presentation Q2FY21Rahul SharmaNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Markets Development in ChinaDocument11 pagesMarkets Development in ChinaÎrîsh LyzaNo ratings yet

- BHEL Q1FY12 Result UpdateDocument3 pagesBHEL Q1FY12 Result UpdateSeema GusainNo ratings yet

- Article IVol 12008Document9 pagesArticle IVol 12008Ziela AzilahNo ratings yet

- Vol 4 No. 21 August 05, 2013 - Trends in The Mutual Fund Industry in IndiaDocument1 pageVol 4 No. 21 August 05, 2013 - Trends in The Mutual Fund Industry in IndiavejayNo ratings yet

- Market Outlook 5th August 2011Document4 pagesMarket Outlook 5th August 2011Angel BrokingNo ratings yet

- ADB International Investment Agreement Tool Kit: A Comparative AnalysisFrom EverandADB International Investment Agreement Tool Kit: A Comparative AnalysisNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Boc Aviation Investor Update: November 2019Document27 pagesBoc Aviation Investor Update: November 2019J. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-May 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-May 2020J. BangjakNo ratings yet

- Special ShareDocument8 pagesSpecial ShareJ. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-June 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-June 2020J. BangjakNo ratings yet

- Overseas Regulatory AnnouncementDocument42 pagesOverseas Regulatory AnnouncementJ. BangjakNo ratings yet

- Ping An Insurance - DBS 20200228Document6 pagesPing An Insurance - DBS 20200228J. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-March 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-March 2020J. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- China Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineDocument6 pagesChina Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineJ. BangjakNo ratings yet

- Telemedecine in ChinaDocument9 pagesTelemedecine in ChinaJ. BangjakNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Fu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司Document1 pageFu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司J. BangjakNo ratings yet

- March Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialDocument17 pagesMarch Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialJ. BangjakNo ratings yet

- AIA Group: China / Hong Kong Company GuideDocument13 pagesAIA Group: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Inside Information Announcement - COVID19 Impacts - enDocument3 pagesInside Information Announcement - COVID19 Impacts - enJ. BangjakNo ratings yet

- March Quarter 2017 ResultsDocument14 pagesMarch Quarter 2017 ResultsJ. BangjakNo ratings yet

- p200522 PDFDocument50 pagesp200522 PDFJ. BangjakNo ratings yet

- Alibaba Group Announces December Quarter 2018 ResultsDocument30 pagesAlibaba Group Announces December Quarter 2018 ResultsJ. BangjakNo ratings yet

- en PDFDocument49 pagesen PDFJ. BangjakNo ratings yet

- China Utilities Sector: China / Hong Kong Industry FocusDocument7 pagesChina Utilities Sector: China / Hong Kong Industry FocusJ. BangjakNo ratings yet

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDocument13 pagesBeijing Capital Intl Airport: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Five Trends Shaping The Future of E-Commerce in China - World Economic ForumDocument5 pagesFive Trends Shaping The Future of E-Commerce in China - World Economic ForumJ. BangjakNo ratings yet

- With ROE of Over 20% For A Decade While The Stock Price Falling - BloombergDocument6 pagesWith ROE of Over 20% For A Decade While The Stock Price Falling - BloombergJ. BangjakNo ratings yet

- Table 1: Tencent Service Offerings: Monetization User Base Communications and SocialDocument11 pagesTable 1: Tencent Service Offerings: Monetization User Base Communications and SocialJ. BangjakNo ratings yet

- China Everbright Water: China / Hong Kong Company GuideDocument11 pagesChina Everbright Water: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Case Study 2Document10 pagesCase Study 2Mary Joy AquinoNo ratings yet

- Annex IDocument5 pagesAnnex Ifalosay704No ratings yet

- SMES Insolvency - A.G. Martinez 2022Document65 pagesSMES Insolvency - A.G. Martinez 2022Vilija MogenyteNo ratings yet

- UBERDocument6 pagesUBERtawfiqNo ratings yet

- Operations Management Co2 MaterialDocument49 pagesOperations Management Co2 MaterialvamsibuNo ratings yet

- Chapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved AutosavedDocument37 pagesChapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved Autosavedyametehhhh9No ratings yet

- (ECON2113) (2017) (F) Final 63uz5yz22zf 65641 PDFDocument2 pages(ECON2113) (2017) (F) Final 63uz5yz22zf 65641 PDFNamanNo ratings yet

- Lcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Document8 pagesLcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Musthari KhanNo ratings yet

- Determinants of Tax Administration Efficiency in Nigeria: Perception From Corporate Taxpayers Nuraddeen Usman Miko and Ismaila AbubakarDocument18 pagesDeterminants of Tax Administration Efficiency in Nigeria: Perception From Corporate Taxpayers Nuraddeen Usman Miko and Ismaila AbubakaraboNo ratings yet

- SPS. EDUARDO AND ELSA VERSOLA vs. CADocument2 pagesSPS. EDUARDO AND ELSA VERSOLA vs. CAArvy AgustinNo ratings yet

- PWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021Document6 pagesPWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021arifansari2299No ratings yet

- Breakout With A Buildup: Sniper Trading EntriesDocument3 pagesBreakout With A Buildup: Sniper Trading EntriesJoy CheungNo ratings yet

- Comparative Balance Sheet of BSNL LTDDocument19 pagesComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- 04 Task Performance 1Document6 pages04 Task Performance 1Hanna LyNo ratings yet

- Introduction To Production and Operation Management: Chapter OutlineDocument12 pagesIntroduction To Production and Operation Management: Chapter Outlineyza gunidaNo ratings yet

- Cara Menghitung Biaya K3Document53 pagesCara Menghitung Biaya K3H. Muhammad Temter GandaNo ratings yet

- MBA FPX5008 - Assessment2 1Document11 pagesMBA FPX5008 - Assessment2 1AA TsolScholarNo ratings yet

- How To Open An LC' by Buyer-"Procedures To Open An Letter of Credit"Document2 pagesHow To Open An LC' by Buyer-"Procedures To Open An Letter of Credit"amity mbaNo ratings yet

- Final Book WorkDocument229 pagesFinal Book WorkAron Yohannes Gimisso100% (1)

- GL Owners - JTDocument50 pagesGL Owners - JTSuneet GaggarNo ratings yet

- BCG MatrixDocument4 pagesBCG MatrixAzwad ChowdhuryNo ratings yet

- Your College NameDocument22 pagesYour College NamegihanNo ratings yet

- d457 NoteDocument25 pagesd457 NoteAtul KapurNo ratings yet

- How Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009Document18 pagesHow Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009jazzskyblueNo ratings yet

- Q1 2023 US VC Valuations ReportDocument25 pagesQ1 2023 US VC Valuations ReportToni WilliamNo ratings yet

- VAT Refund Directive 24-2008 (English)Document5 pagesVAT Refund Directive 24-2008 (English)YoNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- Flipkart Invoice CompressDocument1 pageFlipkart Invoice CompressGurnek SinghNo ratings yet

Fu Shou Yuan IPO

Fu Shou Yuan IPO

Uploaded by

J. BangjakOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fu Shou Yuan IPO

Fu Shou Yuan IPO

Uploaded by

J. BangjakCopyright:

Available Formats

Hong Kong

Initial Public Offering 9 December 2013

IPO write-up Fu Shou Yuan

Company background

Fu Shou Yuan (“FSY”) was the largest provider of death care services

in the PRC in terms of revenue and geographical coverage in the years

Ivan LI, CFA ended December 31, 2010, 2011 and 2012. FSY was one of the first

ivanli@kimeng.com.hk private company entrants into the PRC death care services industry

(852) 2268 0641

when it began operating a cemetery in Shanghai in 1994. Through

almost 20 years of growth in operations and enhancement of the

quality of services, FSY have expanded operations to provide premium

death care services in major cities in eight provinces of the PRC. The

company believes it has become a leader in the death care services

industry and that its emphasis on the quality of death care services

has made FSY a benchmark of the industry that others seek to

Stock Information emulate. This is exemplified by FSY’s cooperation with certain PRC

governmental entities to be the provider of training to other industry

Stock code: 1448 HK

participants.

Issue size: 500m shares (all new

shares)

Selling points and strength

Green shoe option: 15%

Public/Placement 10%/90% 1) Leader in the death care services industry in the PRC.

tranche:

Share issue price: HKD2.88-3.33 2) Successful consolidator in a rapidly growing industry in the PRC.

Market cap after HKD5,760-6,660m

listing: 3) Ability to satisfy customers’ needs through provision of

Use of proceeds (net): HKD1,460m, 52% develop professional and customized services.

new cemeteries, 15% set up

new funeral facilities, 3% 4) Presence in strategic locations within certain major cities in the

expand coverage of sales PRC.

network, 20% potential

M&A, 10% general working

capital

Some points of concern

Application list open 9th– 12th Dec 2013 1) FSY may not be able to sustain premium pricing for its death care

Expected listing date: 19th Dec 2013 service offerings, which may adversely affect its profit margins.

Book runners: Citi, UBS, CIMB

Profit forecast: N/A 2) Business operations are subject to regulatory controls.

Dividend policy: No less than 25% payout

ratio starting FY14

(indicative only)

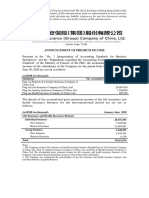

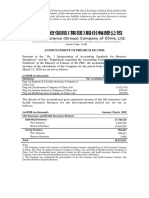

Financial Summary (Year ended Dec 31)

PER: 23-27x 1H13A annualized CNY’000 FY2010 FY2011 FY2012 1H13

PER

Revenue 350,470 421,420 479,977 306,656

Post IPO shareholders Tan Tize Shune (26.25%), Cost of sales and services (67,783) (77,628) (93,659) (60,217)

Chief Union (24.15%), Ge Gross profit 282,687 343,792 386,318 246,439

Qiansong(5.97%) Net profit 113,668 141,575 138,201 118,137

Cornerstone investors Carlyle Asia, Cinda Attributable profit 104,253 130,692 124,270 99,595

International, China Cinda Gross profit margin (%) 80.7 81.6 80.5 80.4

(HK) (111 HK) and Farallon. Net profit margin (%) 32.4 33.6 28.8 38.5

Total investment USD45m, Source: Company data, Maybank Kim Eng

5.6% of post-IPO share

capital, 22.5% of offer

shares.

SEE APPENDIX I FOR IMPORTANT DISCLOSURES AND ANALYST CERTIFICATIONS

APPENDIX I: TERMS FOR PROVISION OF REPORT, DISCLAIMERS AND DISCLOSURES

DISCLAIMERS

This research report is prepared for general circulation and for information purposes only and under no circumstances should it be considered or intended

as an offer to sell or a solicitation of an offer to buy the securities referred to herein. Investors should note that values of such securities, if any, may

fluctuate and that each security’s price or value may rise or fall. Opinions or recommendations contained herein are in form of technical ratings and

fundamental ratings. Technical ratings may differ from fundamental ratings as technical valuations apply different methodologies and are purely based on

price and volume-related information extracted from the relevant jurisdiction’s stock exchange in the equity analysis. Accordingly, investors’ returns may

be less than the original sum invested. Past performance is not necessarily a guide to future performance. This report is not intended to provide personal

investment advice and does not take into account the specific investment objectives, the financial situation and the particular needs of persons who may

receive or read this report. Investors should therefore seek financial, legal and other advice regarding the appropriateness of investing in any securities or

the investment strategies discussed or recommended in this report.

The information contained herein has been obtained from sources believed to be reliable but such sources have not been independently verified by

Maybank Investment Bank Berhad, its subsidiary and affiliates (collectively, “MKE”) and consequently no representation is made as to the accuracy or

completeness of this report by MKE and it should not be relied upon as such. Accordingly, MKE and its officers, directors, associates, connected parties

and/or employees (collectively, “Representatives”) shall not be liable for any direct, indirect or consequential losses or damages that may arise from the

use or reliance of this report. Any information, opinions or recommendations contained herein are subject to change at any time, without prior notice.

This report may contain forward looking statements which are often but not always identified by the use of words such as “anticipate”, “believe”,

“estimate”, “intend”, “plan”, “expect”, “forecast”, “predict” and “project” and statements that an event or result “may”, “will”, “can”, “should”,

“could” or “might” occur or be achieved and other similar expressions. Such forward looking statements are based on assumptions made and information

currently available to us and are subject to certain risks and uncertainties that could cause the actual results to differ materially from those expressed in

any forward looking statements. Readers are cautioned not to place undue relevance on these forward-looking statements. MKE expressly disclaims any

obligation to update or revise any such forward looking statements to reflect new information, events or circumstances after the date of this publication

or to reflect the occurrence of unanticipated events.

MKE and its officers, directors and employees, including persons involved in the preparation or issuance of this report, may, to the extent permitted by

law, from time to time participate or invest in financing transactions with the issuer(s) of the securities mentioned in this report, perform services for or

solicit business from such issuers, and/or have a position or holding, or other material interest, or effect transactions, in such securities or options

thereon, or other investments related thereto. In addition, it may make markets in the securities mentioned in the material presented in this report. MKE

may, to the extent permitted by law, act upon or use the information presented herein, or the research or analysis on which they are based, before the

material is published. One or more directors, officers and/or employees of MKE may be a director of the issuers of the securities mentioned in this report.

This report is prepared for the use of MKE’s clients and may not be reproduced, altered in any way, transmitted to, copied or distributed to any other

party in whole or in part in any form or manner without the prior express written consent of MKE and MKE and its Representatives accepts no liability

whatsoever for the actions of third parties in this respect.

This report is not directed to or intended for distribution to or use by any person or entity who is a citizen or resident of or located in any locality, state,

country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation. This report is for distribution

only under such circumstances as may be permitted by applicable law. The securities described herein may not be eligible for sale in all jurisdictions or to

certain categories of investors. Without prejudice to the foregoing, the reader is to note that additional disclaimers, warnings or qualifications may apply

based on geographical location of the person or entity receiving this report.

Malaysia

Opinions or recommendations contained herein are in the form of technical ratings and fundamental ratings. Technical ratings may differ from

fundamental ratings as technical valuations apply different methodologies and are purely based on price and volume-related information extracted from

Bursa Malaysia Securities Berhad in the equity analysis.

Singapore

This report has been produced as of the date hereof and the information herein may be subject to change. Maybank Kim Eng Research Pte. Ltd. (“Maybank

KERPL”) in Singapore has no obligation to update such information for any recipient. For distribution in Singapore, recipients of this report are to contact

Maybank KERPL in Singapore in respect of any matters arising from, or in connection with, this report. If the recipient of this report is not an accredited

investor, expert investor or institutional investor (as defined under Section 4A of the Singapore Securities and Futures Act), Maybank KERPL shall be legally

liable for the contents of this report, with such liability being limited to the extent (if any) as permitted by law.

Thailand

The disclosure of the survey result of the Thai Institute of Directors Association (“IOD”) regarding corporate governance is made pursuant to the policy of

the Office of the Securities and Exchange Commission. The survey of the IOD is based on the information of a company listed on the Stock Exchange of

Thailand and the market for Alternative Investment disclosed to the public and able to be accessed by a general public investor. The result, therefore, is

from the perspective of a third party. It is not an evaluation of operation and is not based on inside information. The survey result is as of the date

appearing in the Corporate Governance Report of Thai Listed Companies. As a result, the survey may be changed after that date. Maybank Kim Eng

Securities (Thailand) Public Company Limited (“MBKET”) does not confirm nor certify the accuracy of such survey result.

Except as specifically permitted, no part of this presentation may be reproduced or distributed in any manner without the prior written permission of

MBKET. MBKET accepts no liability whatsoever for the actions of third parties in this respect.

US

This research report prepared by MKE is distributed in the United States (“US”) to Major US Institutional Investors (as defined in Rule 15a-6 under the

Securities Exchange Act of 1934, as amended) only by Maybank Kim Eng Securities USA Inc (“Maybank KESUSA”), a broker-dealer registered in the US

(registered under Section 15 of the Securities Exchange Act of 1934, as amended). All responsibility for the distribution of this report by Maybank KESUSA

in the US shall be borne by Maybank KESUSA. All resulting transactions by a US person or entity should be effected through a registered broker-dealer in

the US. This report is not directed at you if MKE is prohibited or restricted by any legislation or regulation in any jurisdiction from making it available to

you. You should satisfy yourself before reading it that Maybank KESUSA is permitted to provide research material concerning investments to you under

relevant legislation and regulations.

UK

This document is being distributed by Maybank Kim Eng Securities (London) Ltd (“Maybank KESL”) which is authorized and regulated, by the Financial

Services Authority and is for Informational Purposes only. This document is not intended for distribution to anyone defined as a Retail Client under the

Financial Services and Markets Act 2000 within the UK. Any inclusion of a third party link is for the recipients convenience only, and that the firm does not

take any responsibility for its comments or accuracy, and that access to such links is at the individuals own risk. Nothing in this report should be

considered as constituting legal, accounting or tax advice, and that for accurate guidance recipients should consult with their own independent tax

advisers.

9 December 2013 Page 2 of 3

DISCLOSURES

Legal Entities Disclosures

Malaysia: This report is issued and distributed in Malaysia by Maybank Investment Bank Berhad (15938-H) which is a Participating Organization of Bursa

Malaysia Berhad and a holder of Capital Markets and Services License issued by the Securities Commission in Malaysia. Singapore: This material is issued

and distributed in Singapore by Maybank KERPL (Co. Reg No 197201256N) which is regulated by the Monetary Authority of Singapore. Indonesia: PT Kim

Eng Securities (“PTKES”) (Reg. No. KEP-251/PM/1992) is a member of the Indonesia Stock Exchange and is regulated by the BAPEPAM LK. Thailand: MBKET

(Reg. No.0107545000314) is a member of the Stock Exchange of Thailand and is regulated by the Ministry of Finance and the Securities and Exchange

Commission. Philippines: Maybank ATRKES (Reg. No.01-2004-00019) is a member of the Philippines Stock Exchange and is regulated by the Securities and

Exchange Commission. Vietnam: Maybank Kim Eng Securities JSC (License Number: 71/UBCK-GP) is licensed under the State Securities Commission of

Vietnam. Hong Kong: KESHK (Central Entity No AAD284) is regulated by the Securities and Futures Commission. India: Kim Eng Securities India Private

Limited (“KESI”) is a participant of the National Stock Exchange of India Limited (Reg No: INF/INB 231452435) and the Bombay Stock Exchange (Reg. No.

INF/INB 011452431) and is regulated by Securities and Exchange Board of India. KESI is also registered with SEBI as Category 1 Merchant Banker (Reg. No.

INM 000011708) US: Maybank KESUSA is a member of/ and is authorized and regulated by the FINRA – Broker ID 27861. UK: Maybank KESL (Reg No 2377538)

is authorized and regulated by the Financial Services Authority.

Disclosure of Interest

Malaysia: MKE and its Representatives may from time to time have positions or be materially interested in the securities referred to herein and may

further act as market maker or may have assumed an underwriting commitment or deal with such securities and may also perform or seek to perform

investment banking services, advisory and other services for or relating to those companies.

Singapore: As of 9 December 2013, Maybank KERPL and the covering analyst do not have any interest in any companies recommended in this research

report.

Thailand: MBKET may have a business relationship with or may possibly be an issuer of derivative warrants on the securities /companies mentioned in the

research report. Therefore, Investors should exercise their own judgment before making any investment decisions. MBKET, its associates, directors,

connected parties and/or employees may from time to time have interests and/or underwriting commitments in the securities mentioned in this report.

Hong Kong: KESHK may have financial interests in relation to an issuer or a new listing applicant referred to as defined by the requirements under

Paragraph 16.5(a) of the Hong Kong Code of Conduct for Persons Licensed by or Registered with the Securities and Futures Commission.

As of 9 December 2013, KESHK and the authoring analyst do not have any interest in any companies recommended in this research report.

MKE may have, within the last three years, served as manager or co-manager of a public offering of securities for, or currently may make a primary market

in issues of, any or all of the entities mentioned in this report or may be providing, or have provided within the previous 12 months, significant advice or

investment services in relation to the investment concerned or a related investment and may receive compensation for the services provided from the

companies covered in this report.

OTHERS

Analyst Certification of Independence

The views expressed in this research report accurately reflect the analyst’s personal views about any and all of the subject securities or issuers; and no

part of the research analyst’s compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in the

report.

Reminder

Structured securities are complex instruments, typically involve a high degree of risk and are intended for sale only to sophisticated investors who are

capable of understanding and assuming the risks involved. The market value of any structured security may be affected by changes in economic, financial

and political factors (including, but not limited to, spot and forward interest and exchange rates), time to maturity, market conditions and volatility and

the credit quality of any issuer or reference issuer. Any investor interested in purchasing a structured product should conduct its own analysis of the

product and consult with its own professional advisers as to the risks involved in making such a purchase.

No part of this material may be copied, photocopied or duplicated in any form by any means or redistributed without the prior consent of MKE.

9 December 2013 Page 3 of 3

You might also like

- International Physical DistributionDocument2 pagesInternational Physical DistributionJuliana GrNo ratings yet

- Golden Age of China's Education Industry: Seize The MomentumDocument42 pagesGolden Age of China's Education Industry: Seize The MomentumJ. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- Engineering Civilised Numbers: Yongnam HoldingsDocument5 pagesEngineering Civilised Numbers: Yongnam HoldingsTerence Seah Pei ChuanNo ratings yet

- IPO Outlook - BLS E-Services LTDDocument2 pagesIPO Outlook - BLS E-Services LTDalkeshkNo ratings yet

- Apollo Investor Presentation June 2013 PDFDocument21 pagesApollo Investor Presentation June 2013 PDFChit Moe ZawNo ratings yet

- Mukta Arts (MUKART) : Multiplex Screen Expansion To Drive Revenue..Document4 pagesMukta Arts (MUKART) : Multiplex Screen Expansion To Drive Revenue..Dinesh ChoudharyNo ratings yet

- Infosys Ltd-Q2 FY12Document4 pagesInfosys Ltd-Q2 FY12Seema GusainNo ratings yet

- Greatview Aseptic Packaging (468.HK) : IPO PreviewDocument3 pagesGreatview Aseptic Packaging (468.HK) : IPO Previewtkgoon6349No ratings yet

- Apollo Investor Presentation August 2013 PDFDocument21 pagesApollo Investor Presentation August 2013 PDFNitin SharmaNo ratings yet

- Hinduja Global Solutions: Healthcare Spending To Drive Growth Margins To ExpandDocument4 pagesHinduja Global Solutions: Healthcare Spending To Drive Growth Margins To Expandapi-234474152No ratings yet

- IDFC AnandRathi 050211Document2 pagesIDFC AnandRathi 050211SarweinNo ratings yet

- Real Estate Overweight: Set To Recover in 2H13Document4 pagesReal Estate Overweight: Set To Recover in 2H13bodaiNo ratings yet

- Profile - Aster DM HealthcareDocument2 pagesProfile - Aster DM HealthcareDr. Karan ShahNo ratings yet

- IPO Vijaya Diagnostic - 01092021 1630476491Document6 pagesIPO Vijaya Diagnostic - 01092021 1630476491Neil MannikarNo ratings yet

- HCL Technologies Ltd. - Q4FY11 Result UpdateDocument3 pagesHCL Technologies Ltd. - Q4FY11 Result UpdateSeema GusainNo ratings yet

- FY13: Spillover Boost To Weak Order Inflow: Enam DirectDocument5 pagesFY13: Spillover Boost To Weak Order Inflow: Enam DirectTanmay ChakrabortyNo ratings yet

- Tata Communications (VIDSAN) : Data Segment Highly Margin AccretiveDocument3 pagesTata Communications (VIDSAN) : Data Segment Highly Margin AccretivevikkediaNo ratings yet

- Market Outlook 25th August 2011Document3 pagesMarket Outlook 25th August 2011Angel BrokingNo ratings yet

- Adaro Energy: Potential Short-Term WeaknessDocument6 pagesAdaro Energy: Potential Short-Term WeaknesserlanggaherpNo ratings yet

- Project On Compitative Anlyses On Depodsitery Service PraviderDocument59 pagesProject On Compitative Anlyses On Depodsitery Service PravidervivekbaroleNo ratings yet

- Inari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyDocument3 pagesInari Amertron (INRI MK/HOLD/RM1.44/Target: RM1.50) : Malaysia DailyFong Kah YanNo ratings yet

- Bse LTD Iponote Geplcapital 190117Document3 pagesBse LTD Iponote Geplcapital 190117SachinShingoteNo ratings yet

- A Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaDocument7 pagesA Study of The Dividend Pattern of Nifty Companies: Dr. Anil Soni, Dr. Madhu GabaCraft DealNo ratings yet

- Cordlife Group Limited: Results ReviewDocument10 pagesCordlife Group Limited: Results ReviewKelvin FuNo ratings yet

- Blackstone Embassy REITDocument4 pagesBlackstone Embassy REITNikhil Gupta100% (1)

- JSTREET Volume 351Document10 pagesJSTREET Volume 351JhaveritradeNo ratings yet

- Tatva Chintan Pharma Chem LTD IPODocument1 pageTatva Chintan Pharma Chem LTD IPOparmodNo ratings yet

- MphasisDocument4 pagesMphasisAngel BrokingNo ratings yet

- Fortis Analyst Presentation FinalDocument28 pagesFortis Analyst Presentation FinalSonakshi KansalNo ratings yet

- Medplus IPO Note - VenturaDocument19 pagesMedplus IPO Note - Venturaaniket birariNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- India - Diagnostics: Leaders Need To Keep The InitiativeDocument4 pagesIndia - Diagnostics: Leaders Need To Keep The Initiativeashok yadavNo ratings yet

- Case Study Unit 1Document9 pagesCase Study Unit 1Dana E. AranasNo ratings yet

- TRIVENI140509 Wwwmon3yworldblogspotcomDocument3 pagesTRIVENI140509 Wwwmon3yworldblogspotcomAbhishek Kr. MishraNo ratings yet

- Investment Banking (A) Group AssignmentDocument29 pagesInvestment Banking (A) Group AssignmentHarsh SudNo ratings yet

- CRISIL Research Ier Report Sterlite Technologies 2012Document28 pagesCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopNo ratings yet

- Adani EnterprisesDocument1 pageAdani EnterprisesDebjit SenguptaNo ratings yet

- Corporate Presentation Q4FY22Document46 pagesCorporate Presentation Q4FY22canmmathew2003No ratings yet

- A Project Report On Competitive AnalysisDocument115 pagesA Project Report On Competitive AnalysisMallesh ArjaNo ratings yet

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Document27 pagesDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinNo ratings yet

- Hindustan Unilever 100610 01Document2 pagesHindustan Unilever 100610 01Kumar AnuragNo ratings yet

- HCC Q1FY12 Result UpdateDocument3 pagesHCC Q1FY12 Result UpdateSeema GusainNo ratings yet

- Fitriyani 2022 Eps Der RoeDocument11 pagesFitriyani 2022 Eps Der RoeFitra Ramadhana AsfriantoNo ratings yet

- Management Meet Takeaways: Not RatedDocument8 pagesManagement Meet Takeaways: Not RatedAngel BrokingNo ratings yet

- Research Report On LKP SecDocument9 pagesResearch Report On LKP SecVipin PatilNo ratings yet

- Crompton Greaves LTD - Q1FY12 Result UpdateDocument3 pagesCrompton Greaves LTD - Q1FY12 Result UpdateSeema GusainNo ratings yet

- PLDTDocument12 pagesPLDTJOHN MARK ESTREMERANo ratings yet

- HT Media LTD 1qfy12Document3 pagesHT Media LTD 1qfy12Seema GusainNo ratings yet

- Financial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranDocument8 pagesFinancial Key Performance Indicators of Jio Infocomm: K P Ezhil MaranShreyansh JainNo ratings yet

- Intimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Document37 pagesIntimation Regarding Investors Meetings of The Company and Submission of Presentation To Be Made To The Investors (Company Update)Shyam SunderNo ratings yet

- TV Today Network LTD: EquitiesDocument3 pagesTV Today Network LTD: EquitiesAnonymous y3hYf50mTNo ratings yet

- Corporate Presentation Q2FY21Document44 pagesCorporate Presentation Q2FY21Rahul SharmaNo ratings yet

- Market Outlook 14th September 2011Document4 pagesMarket Outlook 14th September 2011Angel BrokingNo ratings yet

- Markets Development in ChinaDocument11 pagesMarkets Development in ChinaÎrîsh LyzaNo ratings yet

- BHEL Q1FY12 Result UpdateDocument3 pagesBHEL Q1FY12 Result UpdateSeema GusainNo ratings yet

- Article IVol 12008Document9 pagesArticle IVol 12008Ziela AzilahNo ratings yet

- Vol 4 No. 21 August 05, 2013 - Trends in The Mutual Fund Industry in IndiaDocument1 pageVol 4 No. 21 August 05, 2013 - Trends in The Mutual Fund Industry in IndiavejayNo ratings yet

- Market Outlook 5th August 2011Document4 pagesMarket Outlook 5th August 2011Angel BrokingNo ratings yet

- ADB International Investment Agreement Tool Kit: A Comparative AnalysisFrom EverandADB International Investment Agreement Tool Kit: A Comparative AnalysisNo ratings yet

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveFrom EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveNo ratings yet

- Reforms, Opportunities, and Challenges for State-Owned EnterprisesFrom EverandReforms, Opportunities, and Challenges for State-Owned EnterprisesNo ratings yet

- Boc Aviation Investor Update: November 2019Document27 pagesBoc Aviation Investor Update: November 2019J. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-May 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-May 2020J. BangjakNo ratings yet

- Special ShareDocument8 pagesSpecial ShareJ. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-June 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-June 2020J. BangjakNo ratings yet

- Overseas Regulatory AnnouncementDocument42 pagesOverseas Regulatory AnnouncementJ. BangjakNo ratings yet

- Ping An Insurance - DBS 20200228Document6 pagesPing An Insurance - DBS 20200228J. BangjakNo ratings yet

- Announcement of Premium Income: (In RMB Ten Thousand) January-March 2020Document2 pagesAnnouncement of Premium Income: (In RMB Ten Thousand) January-March 2020J. BangjakNo ratings yet

- IDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesDocument7 pagesIDC - China's Public Cloud Service Market Tops US$5.4 Billion in 1H 2019 As Competition IntensifiesJ. BangjakNo ratings yet

- China Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineDocument6 pagesChina Medical System (867.HK) : Drug Tender Leading To ASP Drop and New Acquisition To Enrich PipelineJ. BangjakNo ratings yet

- Telemedecine in ChinaDocument9 pagesTelemedecine in ChinaJ. BangjakNo ratings yet

- 2019FY Anual ResultDocument48 pages2019FY Anual ResultJ. BangjakNo ratings yet

- Fu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司Document1 pageFu Shou Yuan International Group Limited 福 壽 園 國 際 集 團 有 限 公 司J. BangjakNo ratings yet

- March Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialDocument17 pagesMarch Quarter 2019 and Full Fiscal Year 2019 Results: ConfidentialJ. BangjakNo ratings yet

- AIA Group: China / Hong Kong Company GuideDocument13 pagesAIA Group: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Inside Information Announcement - COVID19 Impacts - enDocument3 pagesInside Information Announcement - COVID19 Impacts - enJ. BangjakNo ratings yet

- March Quarter 2017 ResultsDocument14 pagesMarch Quarter 2017 ResultsJ. BangjakNo ratings yet

- p200522 PDFDocument50 pagesp200522 PDFJ. BangjakNo ratings yet

- Alibaba Group Announces December Quarter 2018 ResultsDocument30 pagesAlibaba Group Announces December Quarter 2018 ResultsJ. BangjakNo ratings yet

- en PDFDocument49 pagesen PDFJ. BangjakNo ratings yet

- China Utilities Sector: China / Hong Kong Industry FocusDocument7 pagesChina Utilities Sector: China / Hong Kong Industry FocusJ. BangjakNo ratings yet

- Beijing Capital Intl Airport: China / Hong Kong Company GuideDocument13 pagesBeijing Capital Intl Airport: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Five Trends Shaping The Future of E-Commerce in China - World Economic ForumDocument5 pagesFive Trends Shaping The Future of E-Commerce in China - World Economic ForumJ. BangjakNo ratings yet

- With ROE of Over 20% For A Decade While The Stock Price Falling - BloombergDocument6 pagesWith ROE of Over 20% For A Decade While The Stock Price Falling - BloombergJ. BangjakNo ratings yet

- Table 1: Tencent Service Offerings: Monetization User Base Communications and SocialDocument11 pagesTable 1: Tencent Service Offerings: Monetization User Base Communications and SocialJ. BangjakNo ratings yet

- China Everbright Water: China / Hong Kong Company GuideDocument11 pagesChina Everbright Water: China / Hong Kong Company GuideJ. BangjakNo ratings yet

- Dhan Vriddhi English Sales BrochureDocument16 pagesDhan Vriddhi English Sales BrochureNimesh PrakashNo ratings yet

- Case Study 2Document10 pagesCase Study 2Mary Joy AquinoNo ratings yet

- Annex IDocument5 pagesAnnex Ifalosay704No ratings yet

- SMES Insolvency - A.G. Martinez 2022Document65 pagesSMES Insolvency - A.G. Martinez 2022Vilija MogenyteNo ratings yet

- UBERDocument6 pagesUBERtawfiqNo ratings yet

- Operations Management Co2 MaterialDocument49 pagesOperations Management Co2 MaterialvamsibuNo ratings yet

- Chapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved AutosavedDocument37 pagesChapter 3 Recognizing Assessing and Exploiting Opportunities Autosaved Autosavedyametehhhh9No ratings yet

- (ECON2113) (2017) (F) Final 63uz5yz22zf 65641 PDFDocument2 pages(ECON2113) (2017) (F) Final 63uz5yz22zf 65641 PDFNamanNo ratings yet

- Lcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Document8 pagesLcci Level 4 Certificate in Financial Accounting ASE20101 Resource Booklet Nov 2019Musthari KhanNo ratings yet

- Determinants of Tax Administration Efficiency in Nigeria: Perception From Corporate Taxpayers Nuraddeen Usman Miko and Ismaila AbubakarDocument18 pagesDeterminants of Tax Administration Efficiency in Nigeria: Perception From Corporate Taxpayers Nuraddeen Usman Miko and Ismaila AbubakaraboNo ratings yet

- SPS. EDUARDO AND ELSA VERSOLA vs. CADocument2 pagesSPS. EDUARDO AND ELSA VERSOLA vs. CAArvy AgustinNo ratings yet

- PWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021Document6 pagesPWC Virtual Case Experience Corporate Tax - Model Work Task 1 - Tax Provision Calculation 2021arifansari2299No ratings yet

- Breakout With A Buildup: Sniper Trading EntriesDocument3 pagesBreakout With A Buildup: Sniper Trading EntriesJoy CheungNo ratings yet

- Comparative Balance Sheet of BSNL LTDDocument19 pagesComparative Balance Sheet of BSNL LTDsmarty19b100% (2)

- 04 Task Performance 1Document6 pages04 Task Performance 1Hanna LyNo ratings yet

- Introduction To Production and Operation Management: Chapter OutlineDocument12 pagesIntroduction To Production and Operation Management: Chapter Outlineyza gunidaNo ratings yet

- Cara Menghitung Biaya K3Document53 pagesCara Menghitung Biaya K3H. Muhammad Temter GandaNo ratings yet

- MBA FPX5008 - Assessment2 1Document11 pagesMBA FPX5008 - Assessment2 1AA TsolScholarNo ratings yet

- How To Open An LC' by Buyer-"Procedures To Open An Letter of Credit"Document2 pagesHow To Open An LC' by Buyer-"Procedures To Open An Letter of Credit"amity mbaNo ratings yet

- Final Book WorkDocument229 pagesFinal Book WorkAron Yohannes Gimisso100% (1)

- GL Owners - JTDocument50 pagesGL Owners - JTSuneet GaggarNo ratings yet

- BCG MatrixDocument4 pagesBCG MatrixAzwad ChowdhuryNo ratings yet

- Your College NameDocument22 pagesYour College NamegihanNo ratings yet

- d457 NoteDocument25 pagesd457 NoteAtul KapurNo ratings yet

- How Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009Document18 pagesHow Did Economists Get It So Wrong?: by Paul Krugman Published: September 2, 2009jazzskyblueNo ratings yet

- Q1 2023 US VC Valuations ReportDocument25 pagesQ1 2023 US VC Valuations ReportToni WilliamNo ratings yet

- VAT Refund Directive 24-2008 (English)Document5 pagesVAT Refund Directive 24-2008 (English)YoNo ratings yet

- Dissolution QuizDocument2 pagesDissolution QuizveriNo ratings yet

- Flipkart Invoice CompressDocument1 pageFlipkart Invoice CompressGurnek SinghNo ratings yet