Professional Documents

Culture Documents

Personal Banking SOC POSTER

Personal Banking SOC POSTER

Uploaded by

ashokj1984Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Personal Banking SOC POSTER

Personal Banking SOC POSTER

Uploaded by

ashokj1984Copyright:

Available Formats

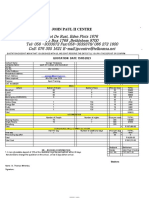

Schedule of Charges

Personal Banking Personal Banking Personal Banking

Plus/Youth Plus/Youth Plus/Youth

Package/Go4it/ Beyond/ Package/Go4it/ Beyond/ Package/Go4it/ Beyond/

Charges Classic Ladies Banking Executive/ UAE National Charges Classic Ladies Banking Executive/ UAE National Charges Classic Ladies Banking Executive/ UAE National

Man Utd Package Man Utd Package Man Utd Package

)Exclusive of VAT( (Homemaker)/ )Exclusive of VAT( (Homemaker)/ )Exclusive of VAT( (Homemaker)/

Plus Maximizer Plus Maximizer Plus Maximizer

Minimum monthly average relationship Services General

AED 3,000 N/A N/A N/A

balance (applicable for salary variant)

Special Clearing - Outward Free Free Free Free Payment due date (from the

Minimum monthly average relationship 25 days

AED 3,000 AED 3,000* AED 3,000* AED 100,000* statement date)

balance (applicable for savings variant) Special Clearing - Inward

Free Free Free Free Minimum payment due 5% or AED 100 (whichever is higher)

Minimum monthly salary transfer (proceeds by Manager's Cheque)

Not offered AED 5,000 AED 5,000* AED 15,000*

(applicable for salary variant) Special Clearing - Inward (proceeds Cash advance limit

Free Free Free Free

Fee for non-maintenance of balance AED 25 per through UAE Central Bank) - Business Card 75% / 50% of Credit Limit

Free Free Free

(applicable for salary variant) month Stop payment charge (per transaction) - Other Cards

Fee for non-maintenance of balance AED 25 per AED 25 per AED 25 per AED 25 per Please Note

One free per

(applicable for savings variant) month month month month For Cheque/Demand Draft/Manager's

N/A AED 50 AED 50 calendar quarter; 1. All fees and charges are exclusive of Value Added Tax (VAT) or similar sales tax. If VAT is applicable, it will be

Cheque

Non-receipt of salary** AED 25 AED 25 AED 25 AED 25 thereafter AED 50 chargeable and payable in addition to, and at the same time as, the above mentioned charges. These fees

Account opening fee Free Free Free Free Foreign currency and charges are subject to change, which will apply from the effective date specified by the Bank.

1.00% (min AED 2. Finance Charges are levied on all transaction types (Retail Purchases / Cash Advance), calculated from

8 10 10

6 transactions 20) for Select transaction date till repayment date (calculated based on average daily balance).

Teller Fees (Cash Deposit, Cash transactions**** transactions****

transactions****

per month free; 1.25% (min AED 1.25% (min AED package. 1.25% > No finance charges (except for Cash Advances) will be levied in case 100% payment is made on or

Withdrawals, Internal Fund Transfer, per month free; per month free;

per month free; Foreign Currency Cash Deposit* 1% (min AED 20)

thereafter AED 10 20)* 20)* (min AED 20) for before the payment due date.

Cheque Deposit) thereafter AED 10 thereafter AED 10

thereafter AED 10

per transaction Executive & Man > This is subject to increase by 0.5% p.m. in case the Card Account is past due at least twice in last

per transaction per transaction

per transaction

Utd packages* six months. An account is considered past due if Minimum Payment Due is not received before

One cheque book

First cheque book First cheque book 1.00% (min AED the Payment Due Date. Subsequently, these charges will revert to above published Finance Charges

Cheque book charge free every calendar

N/A (10 leaves) free; (10 leaves) free; 20) for Select if the card account is no longer past due more than once in the last six months.

(for 10 leaves cheque book) year; thereafter

thereafter AED 25 thereafter AED 20 1.25% (min AED 1.25% (min AED package. 1.25%

AED 20 Foreign Currency Cash Withdrawal* 1% (min AED 20) 3. Annual fee billed will not be reversed if the card is activated, used or cancelled.

20)* 20)* (min AED 20) for 4. This fee is charged to transactions done in any currency other than UAE Dirham and is in addition to standard

Cheque returned charges N/A AED 100 AED 100 AED 100 Executive & Man processing fee (approx. 1.15%) charged by Mastercard or Visa International or Diners Club. This is waived for

Maximum number of withdrawals per Utd packages* dnata World Cards.

1 1 1 1

month for Smart S@ver accounts*** *These are applicable with effect from November 16th, 2014. 5. The applicable interest rate, may vary in respect of each Credit Card Holder.

Statement Charges 6. For latest Terms and Conditions and Schedule of Charges, please visit our website emiratesnbd.com/cards.

Post-dated cheques

Request for copy of statement - Call

Free Free Free Free Extension of due date Free Free Free Free Personal Loans

Centre IVR, Online Banking

AED 25 per AED 25 per AED 25 per AED 25 per Substitution of cheque with cash Free Free Free Free Loan Processing Fee (New)* 1% of the loan amount (Min AED 500 and Max AED 2,500)

Request for copy of statement - Branch

statement statement statement statement

Post-dated cheques deposited for Loan Processing Fee (Top Up)* 1% of the incremental loan amount (Min AED 500 and Max AED 2,500)

Request for copy of statement - Call AED 10 per AED 10 per AED 10 per AED 10 per Free Free Free Free

collection Enhanced Credit Life Insurance

Centre agent***** statement statement statement statement 1.24% - 1.99% of loan amount (min AED 1,000)

Letters of Encashment Free Free Free Free (Double Cover)

Request for non-standard AED 25 per AED 25 per AED 25 per AED 25 per

e-statement frequency statement cycle statement cycle statement cycle statement cycle Rate (Reducing) per

Cheque Certification Free Free Free Free Overdraft (OD) Type Annual Set up Fee

*Minimum monthly average relationship balances have to be maintained to enjoy the respective package privileges, failing which month

the Bank has the right to downgrade the relationship. Fee for non-maintenance of balance will be charged if the monthly average Post-dated cheques for presentation on

relationship balance falls below AED 3,000. Customers with active Loans/Overdrafts or holding Youth package are exempt from the above Free Free Free Free Overdraft (OD) Overdraft (OD) against Salary AED 200 1.50%

due date

mentioned minimum balance requirements. For Beyond Customers fee for non-maintenance of balance will be waived for first 3 months Overdraft (OD) against Fixed

following which stated charges will apply. For Executive package, minimum monthly salary transfer to be AED 5,000 and minimum If PDC withdrawn before maturity, an AED 200 0.40%

monthly average relationship balance to be AED 100,000. For UAE National package customers, there is no minimum monthly average Free Free Free Free Deposit (FD)

additional charge will be levied

relationship balance or minimum monthly salary requirement.

**If salary is not credited for six months and minimum monthly average relationship balance is not maintained, the fee for non-maintenance of Outward Clean Collections Late Payment Charge AED 50

balance will be applicable.

***Transfers to own Smart S@ver accounts, utility bill payments through Online Banking or Bank induced charges will not be considered Standard collections Instalment Deferment Fee AED 100

as withdrawals. In case the number of monthly withdrawals are more than the above permissible limits, the interest applied for the month

will be at 0.25% p.a. Commission Free Free Free Free Rescheduling Fee AED 250

****6 transactions per month free for Essential and Executive packages.

*****Charges effective 1st September 2015. OCC Return Charges Free Free Free Free Early Settlement Fee 1% of outstanding amount (maximum AED 10,000)

Request for the copy of old cheques Cash letter items (non USD) Free Free Free Free Change in Due Date Free

Less than 1 year N/A AED 10 per copy AED 10 per copy AED 10 per copy Cheque collection (USD)* USD 160 USD 160 USD 160 USD 160 Advance EMI (up to 3 EMIs) Free

*Effective 26th March 2016, this service is offered only to approved customers. Additional charges of issuing bank if any will be collected Clearance Letter Free

Over 1 year N/A AED 20 per copy AED 20 per copy AED 20 per copy from the cheque value.

Partial Payment 1% of payment made (maximum AED 10,000)

Inward Clean Collection

Account closure (within 1 year) AED 100 AED 100 AED 100 AED 100 Liability / No Liability letter AED 50

Commission Free Free Free Free

Loan Cancellation Fee AED 50

Dormant account charges Free Free Free Free Proceeds by DD/MC Free Free Free Free

*This charge will be applicable only to individual account holders. Proceeds by TT Free Free Free Free Auto Loans

Cheque returned charges Free Free Free Free Loan Processing Fee 1% of the loan amount (Min AED 500 and Max AED 2,500)

Remittances

One free per Certification & letters Early Settlement Fee 1% of outstanding amount

Demand draft/Manager’s cheque

AED 30 AED 30 AED 25 month; thereafter Auto Protect 1% of total loan amount (minimum AED 1,000)

(for account holders) Account balance letter/Account reference

AED 25 AED 50 per cert. AED 50 per cert. AED 40 per cert. AED 40 per cert.

charges Late Payment Fee AED 50

Cancellation of demand draft FREE FREE FREE FREE

Telegraphic transfer for account holders Liability letter AED 50 AED 50 AED 50 AED 50 Change in Mode of Payment Free

One free per No Liability letter AED 50 AED 50 AED 50 AED 50 Deferment AED 100

Local currency within UAE (SHA)

AED 5 AED 5 AED 5 month; thereafter

(through branches) Attestation of signature Free Free Free Free Temporary Release of Mortgage Free

AED 5

One free per Bulk cash deposit & withdrawal at teller Change of Registration Free

Local currency within UAE (BEN) Free Free Free Free

AED 5 AED 5 AED 5 month; thereafter counter

(through branches) Pre-payment of EMIs (only valid for 3

AED 5 Issue of IPO/rights issues by order Free Free Free Free 1% of payment made

and above instalments)

One free

Local currency within UAE (OURS) Safe Deposit Lockers Rescheduling Fee AED 250

AED 5 AED 5 AED 5 per month*;

(through branches)

thereafter AED 5 Rentals per annum Change of due date on

One free per Free

Foreign currency remittance (through Small AED 750 AED 750 AED 750 AED 750 Standing Instructions

AED 75 AED 75 AED 70 month; thereafter

branch) NOC to Traffic Department Free

AED 70 Medium AED 1,000 AED 1,000 AED 1,000 AED 1,000

Foreign currency remittance (through Cheque Returned Charges AED 100

Online Banking, Mobile Banking & Free Free Free Free Large AED 1,500 AED 1,500 AED 1,500 AED 1,500

ATM)** Extra-large AED 2,000 AED 2,000 AED 2,000 AED 2,000 Liability / No Liability Letter AED 50

Direct transfer to Bank of Beirut AED 20 AED 20 AED 20 AED 20 Over-size AED 2,500 AED 2,500 AED 2,500 AED 2,500 Clearance Letter Free

Local currency remittance (through Replacement of lock/key Actual Actual Actual Actual Home Loans

Online Banking, Mobile Banking & Free Free Free Free

ATM)** Locker Deposit will be required based on the size of the locker.

Loan Processing Fee 1% of the Loan Amount

DirectRemit transfers (through Online Other services

Free Free Free Free Application fee / Pre-approval Fee AED 3,000 (Non Refundable)

Banking, Mobile Banking & ATM)

Hold mail Free Free Free Free

Revalidation Fee Up to AED 1,000

Additional Telex (e.g. tracer) sent at Investigations Free Free Free Free

Free Free Free Free AED 3,000 (Completed Property)

request of customer - UAE Valuation Charge

T.C. purchase AED 20 AED 20 AED 20 AED 20 AED 20,000 (For Self-Construction)

Additional Telex (e.g. tracer) sent at Postage Early Settlement Charges AED 10,000 or 1% of Loan Outstanding whichever is lower

Free Free Free Free

request of customer - others

UAE Free Free Free Free Relationship Breakage Fee 2% of Loan Outstanding

Cancellation of remittance instruction/ Other Free Free Free Free Partial Pre-payment Fee 1% over and above free allowance

Free Free Free Free

recalling of funds remitted Life Insurance (single applicant)* 0.05% p.m. on Loan Outstanding

Faxes

Swift message copy AED 15 AED 15 AED 15 AED 15 UAE Free Free Free Free Life Insurance (Joint applicant or Joint

0.09% p.m. on Loan Outstanding

Borrower)*

*For Charge Code “OURS”, only AED 4 will be refunded (as AED 1 is paid towards beneficiary bank charges). Other Free Free Free Free

** Charges are waived only when “SHARED” option is selected; correspondent / beneficiary banks charges, if any, shall be applicable. For loan amount more than

Courier Insurance fees may differ

Inward Remittances AED 5 million

UAE Free Free Free Free Property Insurance 0.01% p.m. on the Property Value

If deposited in beneficiary's account Free Free Free Free

Other Free Free Free Free Late Payment Fee AED 400

Standing Instructions

First 3 set-up free; Telex/cable/SWIFT messages Nonstandard statement /

Set-up charges AED 50 AED 50 AED 40 Free

thereafter AED 40 UAE Free Free Free Free

Copy of original docs

Periodic Payments (per transaction) Free Free Free Free Other Free Free Free Free Rescheduling Fee AED 250

Amendment charges Free Free Free Free Safe Custody Charges Free Free Free Free Change in Property (SWAP) AED 1,320

Failed Standing Instruction and DDS AED 25 AED 25 AED 25 AED 25 Credit card service and price guide Change in Ownership Details

AED 1,320

Balance order Free Free Free Free Annual Fee3 Finance Charges2 (per month (Co-borrower)

Primary card

Debit Card Charges (AED) Liability / No Liability Letter AED 85

U by Emaar Infinite / Signature / Family 1500 / 250 / Free 3.25% / 3.25% / 3.09% Request of other letter Free

Annual Fee Free Free Free Free

Skywards Infinite / Signature 1500 / 700 3.25% / 3.09% Clearance Letter Free

Debit Card Replacement Fee AED 25 AED 25 AED 25 AED 25

Marriott Bonvoy™ World Mastercard® 1500 3.09% All fees and charges are effective from 15th February 2019.

Copy of sales voucher AED 25 AED 25 AED 25 AED 25 *Life Insurance Premiums are collected on monthly and rate may differ for Loan amount more than AED 5 million.

Infinite 1500 2.99%

One time Service Fee*** - AED 50 - -

LuLu 247 Platinum / Titanium 250 / Free 3.25% Retail Wealth Management

International Delivery Charges AED 150 AED 150 AED 150 AED 150 dnata World / Platinum 999 / 500 3.25% / 3.09% Fees and Charges on Portfolio Accounts Valid as of July 2018

Foreign Currency Transaction Fee Duo / Flexi / Platinum 800 / 700 / 700 3.25% Under 100,000 to 250,000 to 500,000 to 1,000,000 and

Traded Value USD

For Purchase in Non-AED* 1.99% 1.99% 1.99% 1.99% Titanium / Diners Club 400 3.25% 100,000 249,999 499,999 999,999 above

For Purchase in AED** 1.99% 1.99% 1.99% 1.99% Manchester United Titanium 250 3.25% Fixed Income/Sukuk 3.00% 2.50% 2.50% 2.25% 2.00%

Usage fee in UAE at Emirates NBD ATMs Go4it Gold / Platinum 99 / 199 3.09% Direct Equity 1.50% 1.25% 1.00% 0.75% 0.50%

Cash Withdrawal/Deposit Free Free Free Free Business Card / Business Rewards 750 / 1000 3.25% Mutual Funds 3.00% 2.50% 2.00% 1.75% 1.50%

Other fees and charges Structured Products Please refer to respective term sheets

Balance Enquiry Free Free Free Free

Insurance: Protect Plus / Lifestyle

Mini-statement Free Free Free Free 0.99% per month of the Credit Card Outstanding (First 2 months Free) 2.00% 2.00% 1.50% 1.25% 1.00%

Protector / Business Protector

Emirates NBD Gold Saving Minimum Fee equivalent to USD 200.

Utility payment Free Free Free Free Installment Payment Plan / Balance Certificate

0.29% - 1.99% flat monthly interest rate A flat fee of AED50 will be applied as Certificate Issuance Charges.

Conversion / Loan on Card /

Usage fee on Non Emirates NBD (UAE Switch) ATMs (0.53% - 3.46% reducing monthly interest rate) A flat fee of 15fils per gram will be charged at time of subscription.

Balance Transfer / ALOC 5

Cash Withdrawal AED 2 AED 2 AED 2 AED 2

A custody fee of 0.25% will be charged on per annum calculated daily,

0% Installment Plan AED 49 per transaction Safe Custody* based on total portfolio value and charged on quarterly basis to the customer

Balance Enquiry AED 1 AED 1 AED 1 AED 1 Cancellation Fee: Installment Plan / account.

Declined transaction AED 1 AED 1 AED 1 AED 1 Balance Conversion / Loan on Card / 3% of Principal Outstanding or AED 250, whichever is higher Any additional costs charged by our custodian for the receipt or delivery of

Balance Transfer / ALOC / 0% IPP Administration Services

securities will be debited to the customer account.

GCC Net ATMs (in Gulf Co-operation Countries)

Cash Advance Fee 3% or AED 99, whichever is higher

Exit Fees

Cash Withdrawal AED 6 AED 6 AED 6 AED 6**** Over Limit Fee AED 279 per month

Fixed Income/Sukuk 0.5%

Balance Enquiry AED 3 AED 3 AED 3 AED 3 Late Payment Fee AED 230 per month

Foreign Currency Transaction Fee Equity 0.5%

International ATMs (outside Gulf Co-operation Countries)

(Purchases in Non-AED4 / AED 1.99% Mutual Funds As per fund structure

Cash Withdrawal AED 20 AED 20 AED 20 AED 20**** Currency)

Structured Products As per term sheet

Balance Enquiry Free (If available) Free (If available) Free (If available) Free (If available) Card Replacement Fee: Go4it / Others AED 50 / AED 20

An exit fee of 0.5% will be applied upon redemption.

*This fee is charged in addition to the standard processing fee charged by Visa International. Applicable for all foreign transactions ENBD Gold Saving Certificate

International Delivery Charge A custody & insurance fee of 0.30% will be charged at time of redemption.

paid in any currency other than UAE Dirhams. This fee will be effective from 1st March 2019. AED 150

**This fee will be effective from 1st March 2019. Applicable for all foreign transactions paid in UAE Dirhams. This is in addition to per Credit Card *Structured products, Emirates NBD issued medium term notes and GCC equities are exempted from Custody Fees.

the mark up fee charged by the acquirer.

August 2020

The above fees apply to securities that are held with the Bank and include all charges and fees paid for the execution of the transaction through recognized

***Applicable only for Go4it Package. Fee waived for a limited period. Cheque / Direct Debit Return Fee AED 100

counterparties of the Bank. Where applicable, taxes, bourse levies and other third party fees will be charged separately.

****Maximum of 5 free transactions per calendar year subject to a minimum of USD 300 per transaction.

All charges, commissions and fees are exclusive of Value Added Tax or any other similar sales tax (VAT). If VAT is applicable, it will be chargeable and payable in

addition to, and at the same time as, the above mentioned charges.

*Effective from June 2018 “Beyond” Charges for savings variant customers are applicable to “KSA Beyond” Customers.

PERSONAL BANKING

You might also like

- MCQ On Letter of CreditDocument25 pagesMCQ On Letter of CreditLakshman Singh78% (9)

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozal100% (1)

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFCarl SoriaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKakz KarthikNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementGejehNo ratings yet

- Sandia Homes Pricelist As of 09.25.20 Local OnlyDocument1 pageSandia Homes Pricelist As of 09.25.20 Local OnlyvicNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementKNNo ratings yet

- Lif Co Books PDFDocument8 pagesLif Co Books PDFashokj1984100% (1)

- Investment Notes (Lecture 2)Document35 pagesInvestment Notes (Lecture 2)JoelNo ratings yet

- Delpher Trades Corporation V Iac Case DigestDocument2 pagesDelpher Trades Corporation V Iac Case Digestrobby100% (1)

- Personal Banking SOC POSTERDocument1 pagePersonal Banking SOC POSTERDeep BariaNo ratings yet

- Personal Banking SOC POSTERDocument1 pagePersonal Banking SOC POSTERmrv462No ratings yet

- Personal Banking Soc PosterDocument1 pagePersonal Banking Soc PosterfabsassticNo ratings yet

- ENBDDocument1 pageENBDpvr2k1No ratings yet

- Schedule of Charges: Personal BankingDocument1 pageSchedule of Charges: Personal BankingJismin JosephNo ratings yet

- Personal Banking Soc PosterDocument1 pagePersonal Banking Soc PosterAli RazaNo ratings yet

- Personal Banking SOC POSTERDocument1 pagePersonal Banking SOC POSTERHassan AliNo ratings yet

- Work Program - 230 PpeDocument6 pagesWork Program - 230 PpeHarris DarpingNo ratings yet

- No Selling. No Jargon.: Just The Facts About Credit UnionsDocument10 pagesNo Selling. No Jargon.: Just The Facts About Credit UnionsSia MwamoloNo ratings yet

- Pricing 20240301 ENDocument29 pagesPricing 20240301 ENerinNo ratings yet

- ICICI Prudential Bharat Consumption Fund - Series 5 (DistributorDocument26 pagesICICI Prudential Bharat Consumption Fund - Series 5 (DistributorRajat GuptaNo ratings yet

- Cuadro 029Document2 pagesCuadro 029Jimmy LlerenaNo ratings yet

- Personal Banking Conventional SOC English Version - Feb 2023Document1 pagePersonal Banking Conventional SOC English Version - Feb 2023Mohamed EssamNo ratings yet

- Department: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsDocument3 pagesDepartment: State Universities and Colleges (Sucs) Agency: Davao Del Sur State College Operating Unit: Authorization: New General AppropriationsCharlesNo ratings yet

- Division of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportDocument1 pageDivision of Pampanga: Brigada Eskwela 2020 District/Cluster Consolidated ReportIan BondocNo ratings yet

- Schedule of Benefits Charges Paid DCDocument1 pageSchedule of Benefits Charges Paid DCallu.monuNo ratings yet

- Your Quick Guide To Our Products and Services Prices: Revised - 18 - Effective - 18Document1 pageYour Quick Guide To Our Products and Services Prices: Revised - 18 - Effective - 18Vasco JosephNo ratings yet

- SoC Non ComfortDocument4 pagesSoC Non ComfortBirendra PadhiNo ratings yet

- Financial CrisesDocument21 pagesFinancial CrisesShan KhanNo ratings yet

- Special Events Contract & Rental Agreement: How Did You Hear About The Sunset View Resort?Document8 pagesSpecial Events Contract & Rental Agreement: How Did You Hear About The Sunset View Resort?Dherick RaleighNo ratings yet

- I 1166265Document1 pageI 1166265MohaMed KalifaNo ratings yet

- Online Media Outlets ListDocument1 pageOnline Media Outlets ListpradeepkgjNo ratings yet

- Cuadro 029Document2 pagesCuadro 029Anonymous Zl8SQhNo ratings yet

- CDRD Revised Tariff Guide 2020Document11 pagesCDRD Revised Tariff Guide 2020Atlas Microfinance LtdNo ratings yet

- MTBsDocument26 pagesMTBsrestiaresa10No ratings yet

- PremiumDocument1 pagePremiumosamaNo ratings yet

- Income Tax Calculation 2022 2023Document9 pagesIncome Tax Calculation 2022 2023GungamerNo ratings yet

- Caso Mano de Obra CocadasDocument3 pagesCaso Mano de Obra CocadasNatalia Jauregui GumucioNo ratings yet

- Work Program Format NEWDocument2 pagesWork Program Format NEWmarjgumate1214No ratings yet

- At Least 30% Are Women Involved in The M & EDocument10 pagesAt Least 30% Are Women Involved in The M & EleahtabsNo ratings yet

- Sample Only: November 2015Document19 pagesSample Only: November 2015Fahad KhanNo ratings yet

- Cuadro 029Document2 pagesCuadro 029dgmamanigomezNo ratings yet

- Indicative Card Scheme Fee Rates: RomaniaDocument1 pageIndicative Card Scheme Fee Rates: RomaniaVáclav NěmecNo ratings yet

- Total Cash Flow To Date:: Savings Summary Income Summary Expenses Summary Discretionary SummaryDocument1 pageTotal Cash Flow To Date:: Savings Summary Income Summary Expenses Summary Discretionary SummaryjoytoriolsantiagoNo ratings yet

- Claims Process: It Pays To Be Well PreparedDocument2 pagesClaims Process: It Pays To Be Well PreparedJolly ImmigrationNo ratings yet

- 6.2 Renault - Price List - 3rd Jan 2023Document3 pages6.2 Renault - Price List - 3rd Jan 2023Vishal SheteNo ratings yet

- NMB Tariff Guide - 2022Document2 pagesNMB Tariff Guide - 2022doplapesa dpNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFfpenalozalNo ratings yet

- CASHFLOW JuegoDocument1 pageCASHFLOW JuegoRebeca Valverde DelgadoNo ratings yet

- CASHFLOW The Board Game Personal Financial Statement PDFDocument1 pageCASHFLOW The Board Game Personal Financial Statement PDFArifNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementUtiyyalaNo ratings yet

- CASHFLOW The Board Game Personal Financial StatementDocument1 pageCASHFLOW The Board Game Personal Financial StatementCarl SoriaNo ratings yet

- Innova Hycross Pricelist-3Document1 pageInnova Hycross Pricelist-3Kiran ThakkarNo ratings yet

- Debtermined Budget Worksheet 1Document17 pagesDebtermined Budget Worksheet 1Nhoj Cire ZevodrocNo ratings yet

- Mots en Francais Traduits en ArabeDocument2 pagesMots en Francais Traduits en ArabeAhmed Khalid RasheedNo ratings yet

- Medgulf Nextcare Rn2 QuoteDocument1 pageMedgulf Nextcare Rn2 Quotekcatolico00No ratings yet

- Business Owners Super Suite Education BrochureDocument2 pagesBusiness Owners Super Suite Education BrochureHihiNo ratings yet

- For Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMDocument1 pageFor Local Sales Only: The Peak Antipolo City, Rizal February 04, 2022 12:38 AMGEN888 IGNo ratings yet

- Fund Reward 2020Document1 pageFund Reward 2020yogaNo ratings yet

- Raw Material Feedstock 23 May 2023Document1 pageRaw Material Feedstock 23 May 2023hasantwinNo ratings yet

- AXASmartTraveller 212 PDFDocument11 pagesAXASmartTraveller 212 PDFDavid PalashNo ratings yet

- NMB Tariff Guide 2023Document2 pagesNMB Tariff Guide 2023MabulaNo ratings yet

- Incometax Calculation 2022 23 For MobileDocument10 pagesIncometax Calculation 2022 23 For Mobileanuj palNo ratings yet

- Mohamed Bajrudeen R: Mobile Number: E-Mail IdDocument3 pagesMohamed Bajrudeen R: Mobile Number: E-Mail Idashokj1984No ratings yet

- Chitti Labs Brochure - Grade 1-4Document12 pagesChitti Labs Brochure - Grade 1-4ashokj1984No ratings yet

- Home Services: Application FormDocument3 pagesHome Services: Application Formashokj1984No ratings yet

- Venkatam Muthal Kumari Varai-2Document290 pagesVenkatam Muthal Kumari Varai-2ashokj1984No ratings yet

- 11 Basic Mechanical Engineering EM PDFDocument256 pages11 Basic Mechanical Engineering EM PDFashokj1984No ratings yet

- 5694 - Business Device Bundles - App - EngDocument8 pages5694 - Business Device Bundles - App - Engashokj1984No ratings yet

- 11 Basic Civil Engg Theo EM PDFDocument232 pages11 Basic Civil Engg Theo EM PDFashokj1984No ratings yet

- 12th Physics Vol 1 EM WWW - Tntextbooks.inDocument352 pages12th Physics Vol 1 EM WWW - Tntextbooks.inRekha100% (2)

- Battery Slice: About Warnings and CautionsDocument32 pagesBattery Slice: About Warnings and Cautionsashokj1984No ratings yet

- 2018 ks2 Mathematics Paper3 Reasoning PDFDocument24 pages2018 ks2 Mathematics Paper3 Reasoning PDFashokj1984No ratings yet

- Application For Schengen Visa: This Application Is FreeDocument3 pagesApplication For Schengen Visa: This Application Is Freeashokj1984No ratings yet

- Aero Quickstart: Important Icons Find More InformationDocument24 pagesAero Quickstart: Important Icons Find More Informationashokj1984No ratings yet

- Phyto 0571 Miyawaki wm-1Document10 pagesPhyto 0571 Miyawaki wm-1ashokj1984No ratings yet

- Dell Active Pen User's Guide: 5000 SeriesDocument24 pagesDell Active Pen User's Guide: 5000 Seriesashokj1984No ratings yet

- Chanting - Daily Schedule PDFDocument1 pageChanting - Daily Schedule PDFashokj1984No ratings yet

- User's Guide: Dell™ Combination Power AdapterDocument278 pagesUser's Guide: Dell™ Combination Power Adapterashokj1984No ratings yet

- Next-Gen 11ac Wave 2 Indoor Access PointsDocument8 pagesNext-Gen 11ac Wave 2 Indoor Access Pointsashokj1984No ratings yet

- Vishnu Sahasranamam Sanskrit NewDocument14 pagesVishnu Sahasranamam Sanskrit Newashokj1984No ratings yet

- Fjkfkspaf DM: Agathiyar PusaiDocument254 pagesFjkfkspaf DM: Agathiyar Pusaiashokj1984No ratings yet

- Internal Assignment No:-1 Paper Title: - Human Resurece Management MBA: - 204Document14 pagesInternal Assignment No:-1 Paper Title: - Human Resurece Management MBA: - 204ashokj1984No ratings yet

- Modern Medicine Practioners - 1 PDFDocument2,761 pagesModern Medicine Practioners - 1 PDFashokj1984100% (1)

- Mba 205 PDFDocument96 pagesMba 205 PDFashokj1984No ratings yet

- 2008 Digest-Sc Taxation CasesDocument19 pages2008 Digest-Sc Taxation Caseschiclets777100% (2)

- MFDocument49 pagesMFDeep SekhonNo ratings yet

- Integrated Realty Corp Vs PNBDocument2 pagesIntegrated Realty Corp Vs PNBMarielle MercadoNo ratings yet

- Deed of Absolute Sale of Real Property: TAX DECLARATION NO. 01017-00093Document3 pagesDeed of Absolute Sale of Real Property: TAX DECLARATION NO. 01017-00093Elaiza LaudeNo ratings yet

- Operating and Financial Leverage Slides PDFDocument27 pagesOperating and Financial Leverage Slides PDFBradNo ratings yet

- Module - 4 National IncomeDocument64 pagesModule - 4 National Incomelakshmi dileepNo ratings yet

- JP Quotation Mr. George Tshabalala From 8th-15th June 2023 4Document2 pagesJP Quotation Mr. George Tshabalala From 8th-15th June 2023 4George TshabalalaNo ratings yet

- BHAVESHDocument1 pageBHAVESHbhaveshvats194No ratings yet

- FAFSA Checklist FY23Document2 pagesFAFSA Checklist FY23Lyon HuynhNo ratings yet

- Cost 1 PDFDocument13 pagesCost 1 PDFShubham jindalNo ratings yet

- Irr Ra 11057 RRD PDFDocument49 pagesIrr Ra 11057 RRD PDFYya LadignonNo ratings yet

- Classification of ContractsDocument33 pagesClassification of ContractsWest Gomez JucoNo ratings yet

- NR NORDIC RUSSIA Prospectus 17 December 2007 ENDocument200 pagesNR NORDIC RUSSIA Prospectus 17 December 2007 ENAli SaifyNo ratings yet

- DCM For LSEDocument14 pagesDCM For LSEAlbert TsouNo ratings yet

- BBA 4th 2012 Financial Management-204Document2 pagesBBA 4th 2012 Financial Management-204Ríshãbh JåíñNo ratings yet

- Historical Background of RHB Bank PDFDocument5 pagesHistorical Background of RHB Bank PDFtuan nasiruddinNo ratings yet

- Topic I Introduction To CreditDocument4 pagesTopic I Introduction To CreditLemon OwNo ratings yet

- Royal Cargo. ContradictDocument4 pagesRoyal Cargo. ContradictRiffy OisinoidNo ratings yet

- TRANSACTIONCYCLESDocument26 pagesTRANSACTIONCYCLESKelly CardejonNo ratings yet

- Philippine Iron Construction & Marine Works, Inc.: Employment Application FormDocument4 pagesPhilippine Iron Construction & Marine Works, Inc.: Employment Application FormHarvey PagaranNo ratings yet

- Old Republic - New Rates ManualDocument9 pagesOld Republic - New Rates ManualLinda MujicaNo ratings yet

- Escort FinalDocument77 pagesEscort FinalHaridas GoyalNo ratings yet

- Income From SalaryDocument30 pagesIncome From SalaryNicholas OwensNo ratings yet

- Accounting Sample 1Document6 pagesAccounting Sample 1AmnaNo ratings yet

- DS82 CompleteDocument6 pagesDS82 CompleteBambang WijanarkoNo ratings yet

- DRAFT First Semester 2023 2024 Examination Timetable NewDocument16 pagesDRAFT First Semester 2023 2024 Examination Timetable NewpalngnenchikaNo ratings yet