Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

21 viewsFinal Tax

Final Tax

Uploaded by

Franz CampuedThis document outlines tax rates for different types of passive income received by individuals and corporations in the Philippines. It provides tax rates for dividend income, interest income from local and foreign currency deposits, winnings, royalties, share of net income, and prizes. The tax rates vary depending on whether the recipient is a citizen, resident alien, foreign corporation, or other entity. Certain types of passive income like inter-corporate dividends and dividends from exempt cooperatives are exempt from tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Chapter 05 Final Income Taxation1Document2 pagesChapter 05 Final Income Taxation1raven dayritNo ratings yet

- AppendicesDocument8 pagesAppendicescrackheads philippinesNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- Tax Rate SummaryDocument3 pagesTax Rate SummaryPamela Jean CuyaNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- H04.1 - Final Income Tax TableDocument2 pagesH04.1 - Final Income Tax Tablenona galidoNo ratings yet

- Final Taxes RatesDocument2 pagesFinal Taxes RatesPanda CocoNo ratings yet

- Income TaxDocument2 pagesIncome TaxEmy EspirituNo ratings yet

- Chapter 05 Final Income Taxation TableDocument4 pagesChapter 05 Final Income Taxation TablejannyNo ratings yet

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Individuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomeDocument1 pageIndividuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomePaul Winston Mansing Alcala100% (1)

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Other Winnings Except PCSO & LottoDocument5 pagesOther Winnings Except PCSO & LottoEzi AngelesNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Final Income Tax Rates RevisedDocument8 pagesFinal Income Tax Rates RevisedKhyle Ferrile EligioNo ratings yet

- PASSIVE INCOME Individual With CREATEDocument2 pagesPASSIVE INCOME Individual With CREATERacelle FlorentinNo ratings yet

- REO CPA Review: REO: Income Taxation - Final Withholding Tax TableDocument2 pagesREO CPA Review: REO: Income Taxation - Final Withholding Tax TableCamille SingianNo ratings yet

- C. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptDocument1 pageC. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptNajira HassanNo ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- Interest Income: Local Currency Bank DepositsDocument4 pagesInterest Income: Local Currency Bank Depositsroel rhodael samsonNo ratings yet

- Appendix A Final Withholding Tax TableDocument3 pagesAppendix A Final Withholding Tax TablemaureenNo ratings yet

- Passive Incomefor Both Individual and Corporation Individual CorporationDocument4 pagesPassive Incomefor Both Individual and Corporation Individual CorporationYrolle Lynart AldeNo ratings yet

- Income TaxDocument2 pagesIncome TaxRenalyn Ps MewagNo ratings yet

- Tax Notes Aug 10-11Document15 pagesTax Notes Aug 10-11Reiner NuludNo ratings yet

- Taxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDocument7 pagesTaxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDenny Kridex OmolonNo ratings yet

- Withholding TaxDocument20 pagesWithholding TaxAngela CanayaNo ratings yet

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- Sierra Leone Fiscal Guide 2020 PDFDocument10 pagesSierra Leone Fiscal Guide 2020 PDFMAlek AMARANo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableCristle ServentoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Tax NotesDocument2 pagesTax NotesHyeju SonNo ratings yet

- HO4Passive Income - Revision 1Document2 pagesHO4Passive Income - Revision 1Christopher SantosNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding Taxeskrisha milloNo ratings yet

- FWTX, CWTX and CGTX (Points To Remember and Tax Rates)Document2 pagesFWTX, CWTX and CGTX (Points To Remember and Tax Rates)Justz LimNo ratings yet

- Taxation Tax Rates For Individual Taxpayers, Estates and TrustsDocument5 pagesTaxation Tax Rates For Individual Taxpayers, Estates and TrustsSherri BonquinNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Tax On Individuals Part 2Document10 pagesTax On Individuals Part 2Tet AleraNo ratings yet

- Income Category: Summary of Final TaxesDocument3 pagesIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaNo ratings yet

- Adobe Scan Oct 27, 2023Document2 pagesAdobe Scan Oct 27, 2023Renalyn Ps MewagNo ratings yet

- Income Taxation RatesDocument2 pagesIncome Taxation RatesStephen ChuaNo ratings yet

- Undergrad Review in Income TaxationDocument17 pagesUndergrad Review in Income TaxationJamesNo ratings yet

- Tax Tables Latest Revisions 2022Document2 pagesTax Tables Latest Revisions 2022Novyh Angelique CabreraNo ratings yet

- RR 02-98 (Narrative Form)Document20 pagesRR 02-98 (Narrative Form)saintkarri100% (5)

- Regular Business/Corporate Tax: DC RFC NRFCDocument2 pagesRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- AFAR Mastery Part5 PDFDocument7 pagesAFAR Mastery Part5 PDFFranz CampuedNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Midterm Quiz 2 PDFDocument5 pagesMidterm Quiz 2 PDFFranz Campued100% (1)

- CVP Analysis and Marginal Costing and BEPDocument2 pagesCVP Analysis and Marginal Costing and BEPFranz CampuedNo ratings yet

- Finals Quiz 2Document6 pagesFinals Quiz 2Franz CampuedNo ratings yet

- AFAR Mastery Part4 PDFDocument3 pagesAFAR Mastery Part4 PDFFranz CampuedNo ratings yet

- Management Information System and The Systems EngagementDocument5 pagesManagement Information System and The Systems EngagementFranz CampuedNo ratings yet

- AFAR Mastery Part1 PDFDocument3 pagesAFAR Mastery Part1 PDFFranz CampuedNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- Cost Terms, Concepts and BehaviorDocument3 pagesCost Terms, Concepts and BehaviorFranz CampuedNo ratings yet

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- Operating and Financial BudgetingDocument4 pagesOperating and Financial BudgetingFranz CampuedNo ratings yet

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisFranz CampuedNo ratings yet

- Taxation - 1principles of TaxationDocument8 pagesTaxation - 1principles of TaxationFranz CampuedNo ratings yet

- Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitDocument2 pagesResponsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitFranz CampuedNo ratings yet

- 4introduction To AuditingDocument13 pages4introduction To AuditingFranz CampuedNo ratings yet

- 12the Auditors Report On FS (Samples)Document22 pages12the Auditors Report On FS (Samples)Franz CampuedNo ratings yet

- 2nature of System of Quality ControlDocument2 pages2nature of System of Quality ControlFranz CampuedNo ratings yet

- 8assertions, Audit Procedures and Audit EvidenceDocument10 pages8assertions, Audit Procedures and Audit EvidenceFranz CampuedNo ratings yet

- 13auditing in A CisDocument5 pages13auditing in A CisFranz CampuedNo ratings yet

- 1public Accounting ProfessionDocument6 pages1public Accounting ProfessionFranz CampuedNo ratings yet

- RAYANAIR CASE STUDY1 - CompressedDocument20 pagesRAYANAIR CASE STUDY1 - Compressedyasser massryNo ratings yet

- Aso Mega ListDocument7 pagesAso Mega ListcmlcbhtidNo ratings yet

- The Coffee Guy Franchise PackDocument9 pagesThe Coffee Guy Franchise PackLucien MANGANo ratings yet

- Techlogix Final SlidesDocument28 pagesTechlogix Final SlidesSohaib ArifNo ratings yet

- Manufacturing AnswersDocument9 pagesManufacturing AnswersGaurav YadavNo ratings yet

- Malware Analysis - WikipediaDocument4 pagesMalware Analysis - WikipediaihoneeNo ratings yet

- Project RAR IntegerationDocument25 pagesProject RAR IntegerationAl-Mahad International School100% (1)

- 1 Running Head: Grant Proposal Strategic PlanDocument6 pages1 Running Head: Grant Proposal Strategic PlanJoseph WainainaNo ratings yet

- Drafting Service Level Agreements: Best Practices For Corporate and Technology CounselDocument64 pagesDrafting Service Level Agreements: Best Practices For Corporate and Technology CounselstcastemerNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- Why Renting Is Better Than BuyingDocument4 pagesWhy Renting Is Better Than BuyingMonali MathurNo ratings yet

- Case Study LogitechDocument2 pagesCase Study LogitechAryanNo ratings yet

- Trading Journal TemplateDocument20 pagesTrading Journal TemplateAdah AuduNo ratings yet

- Advanced Transport ManagementDocument5 pagesAdvanced Transport ManagementCOT Management Training InsituteNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- Project On "Associate Recruitment Test Paper Revision": Rahulji SinghDocument94 pagesProject On "Associate Recruitment Test Paper Revision": Rahulji SinghDeepak SinghalNo ratings yet

- THEVIDEOGAMINGINDUSTRYDocument10 pagesTHEVIDEOGAMINGINDUSTRYlacrosivanNo ratings yet

- Organic LeadsDocument14 pagesOrganic Leadsnarutoxsasuke3363No ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- Final Technical Report. Group 2Document13 pagesFinal Technical Report. Group 2Chamel Jamora RuperezNo ratings yet

- Chapters 1-3 Oct.-5Document37 pagesChapters 1-3 Oct.-5Erica FlorentinoNo ratings yet

- BSBPMG540 Task 2 Knowledge Questions V1.1121-SV049116-MarianaVargasGarciaDocument5 pagesBSBPMG540 Task 2 Knowledge Questions V1.1121-SV049116-MarianaVargasGarciaRahmi Can ÖzmenNo ratings yet

- B315F962 - ไกด์สัม BBA TUDocument55 pagesB315F962 - ไกด์สัม BBA TUJaruwat somsriNo ratings yet

- How To Become A More Effective LeaderDocument36 pagesHow To Become A More Effective LeaderSerpilNo ratings yet

- JSA Scaffolding (Green) - OSBLDocument20 pagesJSA Scaffolding (Green) - OSBLSiti AminahNo ratings yet

- Draft Minutes of Progress Meeting No. 5 - Ruaha Rev 01cmDocument15 pagesDraft Minutes of Progress Meeting No. 5 - Ruaha Rev 01cmzewdiegizachew10No ratings yet

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- Elastomers Presentation BrochureDocument20 pagesElastomers Presentation BrochureFrench CorvetteNo ratings yet

- History of The Consumer Protection Act in India: Any Person WhoDocument11 pagesHistory of The Consumer Protection Act in India: Any Person WhoankitNo ratings yet

- Mid-Essay IE 124109Document6 pagesMid-Essay IE 124109Alexandra BragaNo ratings yet

Final Tax

Final Tax

Uploaded by

Franz Campued0 ratings0% found this document useful (0 votes)

21 views1 pageThis document outlines tax rates for different types of passive income received by individuals and corporations in the Philippines. It provides tax rates for dividend income, interest income from local and foreign currency deposits, winnings, royalties, share of net income, and prizes. The tax rates vary depending on whether the recipient is a citizen, resident alien, foreign corporation, or other entity. Certain types of passive income like inter-corporate dividends and dividends from exempt cooperatives are exempt from tax.

Original Description:

Original Title

FINAL TAX

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document outlines tax rates for different types of passive income received by individuals and corporations in the Philippines. It provides tax rates for dividend income, interest income from local and foreign currency deposits, winnings, royalties, share of net income, and prizes. The tax rates vary depending on whether the recipient is a citizen, resident alien, foreign corporation, or other entity. Certain types of passive income like inter-corporate dividends and dividends from exempt cooperatives are exempt from tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

21 views1 pageFinal Tax

Final Tax

Uploaded by

Franz CampuedThis document outlines tax rates for different types of passive income received by individuals and corporations in the Philippines. It provides tax rates for dividend income, interest income from local and foreign currency deposits, winnings, royalties, share of net income, and prizes. The tax rates vary depending on whether the recipient is a citizen, resident alien, foreign corporation, or other entity. Certain types of passive income like inter-corporate dividends and dividends from exempt cooperatives are exempt from tax.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

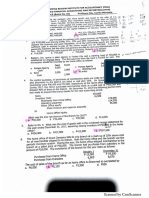

INDIVIDUAL CORPORATION

PASSIVE INCOME ALIEN

FOREIGN

(DITWRISP) CITIZEN RESIDENT NON-RESIDENT

RC NRC RA ETB NETB DC RFC NRFC

DIVIDEND INCOME

*All kinds of dividends except STOCK DIVIDENDS and LIQUIDATING DIVIDENDS (except : SUBSEQUENT CANCELLATION AND

REDEMPTION AND STOCK DIVIDENDS IN LIEU OF CASH)

**Inter-corporate dividends (received by DC and RFC from DC) and Dividends from exempt cooperatives are EXEMPT

***Note: DC includes Business partnerships and NOT EXEMPT Ventures and Co-Ownership

FROM DOMESTIC CORPORATION

Jan 1, 2000 earnings and thereafter 10% 10% 10% 20% 25% E-DT E-DT 15%*

Jan 1, 1999 earnings 8% 8% 8% 20% 25% E-DT E-DT 15%*

Jan 1, 1998 earnings 6% 6% 6% 20% 25% E-DT E-DT 15%*

FROM FOREIGN CORPORATION (RESIDENT and NON-RESIDENT) RIT

INTEREST INCOME

ON LOCAL CURRENCY DEPOSITS *savings or time deposits with cooperatives are not subject to final tax

SHORT TERM YIELD (less than 5 years) *Bank deposits, Deposit substitute, money market placement and trust funds (CTF, UIFT, IMA) 20% 20% 20% 20% 25% 20% 20% 30%

LONG TERM YIELD (5 years and above) *Deposits, Investment in the form of savings, Common or Individual Trust Funds, Investment EXEMPT 25% 20% 20% 30%

Management Accounts, Deposit substitute and Other Investments evidenced by certificate prescribed by the BSP

PRE-TERMINATION OF LONGTERM DEPOSITS OR INVESTMENT OF INDIVIDUALS *Individual ceases to be exempt from long-term yield

by pre-termination before 5 years

Less than 3 years held 20% 20% 20% 20%

3 years to less than 4 years 12% 12% 12% 12% 25% 20% 20% 30%

4 years to less than 5 years 5% 5% 5% 5%

ON FOREIGN CURRENCY DEPOSIT *NO LONGTERM OR SHORT TERM CLASSIFICATION

FROM FOREIGN CURRENCY DEPOSITARY UNITS DEPOSITARY BANKS (BANKS WITHIN PH) *NIRC (7.5%) *** JOINT ACCOUNTS ON FOREIGN

CURRENCY DEPOSITS OF NON-RESIDENT AND RESIDENT TAX PAYER IS 50% EXEMPT AND 50% SUBJECT TO FINAL TAX

15% E 15% E E 15% 15% E

OF FOREIGN CURRENCY UNIT DESPOSITARY BANKS * BANKS ARE CORPORATIONS N/A 10% 20% N/A

ON FOREIGN LOANS *MOSTLY GIVEN TO CORPORATIONS N/A 20%

TAX-FREE CORPORATE COVENANT BONDS-INTEREST INCOME *WITHHOLD BY OBLIGOR *FINANCIAL LIABILITIES OF DC AND RFC WITH TAX FREE PROVISION 30% RIT

WINNINGS

IN GENERAL *earned within 20% 25% RIT 30%

PSCO AND LOTTO WINNING (10,000 AND BELOW = EXEMPT) *NIRC NO CLASSIFICATION AS TO EXCEEDING 10,000 ALL ARE EXEMPT 20% 25% 20% 30%

ROYALTIES

PASSIVE ROYALTIES *earned within

IN GENERAL 20% 25% 20% 20% 30%

FROM books, literary works and musical compositions 10% 25% 20% 20% 30%

Active Royalties *earned within RIT 25% RIT 30%

INFORMER’S TAX REWARD 10%

SHARE IN NET INCOME

OF TAXABLE PARTNERSHIP, JOINT VENTURE AND CO-OWNERSHIP *not a dividends *If bonus, salaries and interest of partners are expensed = RIT 10% 20% 25% 10% 10% 30%

FROM REAL ESTATE INVESTMENT TRUST OR REIT (IN FORM OF DIVIDENDS) 10% E 10% 10% 10% E E 10%

PRIZES (TAXABLE)

10,000 and Below RIT (Progressive) RIT

Above 10,000 20% 25% RIT

You might also like

- Chapter 05 Final Income Taxation1Document2 pagesChapter 05 Final Income Taxation1raven dayritNo ratings yet

- AppendicesDocument8 pagesAppendicescrackheads philippinesNo ratings yet

- Summary of Passive Income and Capital Gains Taxes - MaupoDocument4 pagesSummary of Passive Income and Capital Gains Taxes - MaupoMae MaupoNo ratings yet

- Fit - Tax Table 2Document4 pagesFit - Tax Table 2zipaganermy15No ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Final Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldDocument4 pagesFinal Income Tax Rates: Short-Term Interest or Yield Long-Term Interest or YieldJulie Mae Caling MalitNo ratings yet

- Summary of FWT ThresholdDocument4 pagesSummary of FWT ThresholdAngel Chane OstrazNo ratings yet

- Tax Rate SummaryDocument3 pagesTax Rate SummaryPamela Jean CuyaNo ratings yet

- EX EX EX EX: Regular Income TaxDocument7 pagesEX EX EX EX: Regular Income TaxMary Leigh TenezaNo ratings yet

- H04.1 - Final Income Tax TableDocument2 pagesH04.1 - Final Income Tax Tablenona galidoNo ratings yet

- Final Taxes RatesDocument2 pagesFinal Taxes RatesPanda CocoNo ratings yet

- Income TaxDocument2 pagesIncome TaxEmy EspirituNo ratings yet

- Chapter 05 Final Income Taxation TableDocument4 pagesChapter 05 Final Income Taxation TablejannyNo ratings yet

- Final Tax LectureDocument7 pagesFinal Tax LectureJefrey Jismen Ballesteros100% (1)

- Individuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomeDocument1 pageIndividuals Corporations RC NRC RA Nraetb Nranetb DC RFC NRFC 1. Interest IncomePaul Winston Mansing Alcala100% (1)

- Final Income TaxDocument6 pagesFinal Income TaxJñelle Faith Herrera SaludaresNo ratings yet

- Lesson 4 Final Income Taxation PDFDocument4 pagesLesson 4 Final Income Taxation PDFErika ApitaNo ratings yet

- Midterm Assignment No. 3Document3 pagesMidterm Assignment No. 3XaxxyNo ratings yet

- Final Tax Lecture PDFDocument7 pagesFinal Tax Lecture PDFMarlo Caluya ManuelNo ratings yet

- Other Winnings Except PCSO & LottoDocument5 pagesOther Winnings Except PCSO & LottoEzi AngelesNo ratings yet

- FT and CGTDocument12 pagesFT and CGTLiyana ChuaNo ratings yet

- Final Withholding Tax On Passive IncomeDocument1 pageFinal Withholding Tax On Passive IncomeChelsea Anne VidalloNo ratings yet

- TAX of PinalizeDocument19 pagesTAX of PinalizeDennis IsananNo ratings yet

- Final Income Tax Rates RevisedDocument8 pagesFinal Income Tax Rates RevisedKhyle Ferrile EligioNo ratings yet

- PASSIVE INCOME Individual With CREATEDocument2 pagesPASSIVE INCOME Individual With CREATERacelle FlorentinNo ratings yet

- REO CPA Review: REO: Income Taxation - Final Withholding Tax TableDocument2 pagesREO CPA Review: REO: Income Taxation - Final Withholding Tax TableCamille SingianNo ratings yet

- C. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptDocument1 pageC. Summary of Final Tax Rates On Different Taxpayers: From PCSO and Lotto Amounting To P10,000 or Less-ExemptNajira HassanNo ratings yet

- FT TableDocument4 pagesFT TableChantie BorlonganNo ratings yet

- Interest Income: Local Currency Bank DepositsDocument4 pagesInterest Income: Local Currency Bank Depositsroel rhodael samsonNo ratings yet

- Appendix A Final Withholding Tax TableDocument3 pagesAppendix A Final Withholding Tax TablemaureenNo ratings yet

- Passive Incomefor Both Individual and Corporation Individual CorporationDocument4 pagesPassive Incomefor Both Individual and Corporation Individual CorporationYrolle Lynart AldeNo ratings yet

- Income TaxDocument2 pagesIncome TaxRenalyn Ps MewagNo ratings yet

- Tax Notes Aug 10-11Document15 pagesTax Notes Aug 10-11Reiner NuludNo ratings yet

- Taxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDocument7 pagesTaxation 1 (Income Taxation) Passive Income Subject To FINAL TAXDenny Kridex OmolonNo ratings yet

- Withholding TaxDocument20 pagesWithholding TaxAngela CanayaNo ratings yet

- Ast TX 502 Tax Rates For Individuals (Batch 22)Document5 pagesAst TX 502 Tax Rates For Individuals (Batch 22)CelestiaNo ratings yet

- Sierra Leone Fiscal Guide 2020 PDFDocument10 pagesSierra Leone Fiscal Guide 2020 PDFMAlek AMARANo ratings yet

- Income Tax TableDocument6 pagesIncome Tax TableCristle ServentoNo ratings yet

- Manila Cavite Laguna Cebu Cagayan de Oro DavaoDocument3 pagesManila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaNo ratings yet

- Tax NotesDocument2 pagesTax NotesHyeju SonNo ratings yet

- HO4Passive Income - Revision 1Document2 pagesHO4Passive Income - Revision 1Christopher SantosNo ratings yet

- Module 4 .1 - Schedule of Withholding TaxesDocument2 pagesModule 4 .1 - Schedule of Withholding Taxeskrisha milloNo ratings yet

- FWTX, CWTX and CGTX (Points To Remember and Tax Rates)Document2 pagesFWTX, CWTX and CGTX (Points To Remember and Tax Rates)Justz LimNo ratings yet

- Taxation Tax Rates For Individual Taxpayers, Estates and TrustsDocument5 pagesTaxation Tax Rates For Individual Taxpayers, Estates and TrustsSherri BonquinNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Final Tax Rates Notes: General CoverageDocument3 pagesFinal Tax Rates Notes: General CoverageDarius DelacruzNo ratings yet

- Tax On Individuals Part 2Document10 pagesTax On Individuals Part 2Tet AleraNo ratings yet

- Income Category: Summary of Final TaxesDocument3 pagesIncome Category: Summary of Final TaxesKathleen Mae Salenga FontalbaNo ratings yet

- Adobe Scan Oct 27, 2023Document2 pagesAdobe Scan Oct 27, 2023Renalyn Ps MewagNo ratings yet

- Income Taxation RatesDocument2 pagesIncome Taxation RatesStephen ChuaNo ratings yet

- Undergrad Review in Income TaxationDocument17 pagesUndergrad Review in Income TaxationJamesNo ratings yet

- Tax Tables Latest Revisions 2022Document2 pagesTax Tables Latest Revisions 2022Novyh Angelique CabreraNo ratings yet

- RR 02-98 (Narrative Form)Document20 pagesRR 02-98 (Narrative Form)saintkarri100% (5)

- Regular Business/Corporate Tax: DC RFC NRFCDocument2 pagesRegular Business/Corporate Tax: DC RFC NRFCGrace Angelie C. Asio-SalihNo ratings yet

- Tax - Simplified Table of RatesDocument5 pagesTax - Simplified Table of RatesLouNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2020: Volume II: COVID-19 Impact on Micro, Small, and Medium-Sized Enterprises in Developing AsiaNo ratings yet

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesFrom EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Securities Brokerage Revenues World Summary: Market Values & Financials by CountryFrom EverandSecurities Brokerage Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- AFAR Mastery Part5 PDFDocument7 pagesAFAR Mastery Part5 PDFFranz CampuedNo ratings yet

- Midterms Quiz 2 Answers PDFDocument7 pagesMidterms Quiz 2 Answers PDFFranz Campued100% (1)

- Midterm Quiz 2 PDFDocument5 pagesMidterm Quiz 2 PDFFranz Campued100% (1)

- CVP Analysis and Marginal Costing and BEPDocument2 pagesCVP Analysis and Marginal Costing and BEPFranz CampuedNo ratings yet

- Finals Quiz 2Document6 pagesFinals Quiz 2Franz CampuedNo ratings yet

- AFAR Mastery Part4 PDFDocument3 pagesAFAR Mastery Part4 PDFFranz CampuedNo ratings yet

- Management Information System and The Systems EngagementDocument5 pagesManagement Information System and The Systems EngagementFranz CampuedNo ratings yet

- AFAR Mastery Part1 PDFDocument3 pagesAFAR Mastery Part1 PDFFranz CampuedNo ratings yet

- Financial Statements AnalysisDocument8 pagesFinancial Statements AnalysisFranz CampuedNo ratings yet

- Cost Terms, Concepts and BehaviorDocument3 pagesCost Terms, Concepts and BehaviorFranz CampuedNo ratings yet

- Variable and Absorption CostingDocument4 pagesVariable and Absorption CostingFranz CampuedNo ratings yet

- Operating and Financial BudgetingDocument4 pagesOperating and Financial BudgetingFranz CampuedNo ratings yet

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisFranz CampuedNo ratings yet

- Taxation - 1principles of TaxationDocument8 pagesTaxation - 1principles of TaxationFranz CampuedNo ratings yet

- Responsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitDocument2 pagesResponsibility Accounting: Segment Margin Is The Same As Segment Income or Segment ProfitFranz CampuedNo ratings yet

- 4introduction To AuditingDocument13 pages4introduction To AuditingFranz CampuedNo ratings yet

- 12the Auditors Report On FS (Samples)Document22 pages12the Auditors Report On FS (Samples)Franz CampuedNo ratings yet

- 2nature of System of Quality ControlDocument2 pages2nature of System of Quality ControlFranz CampuedNo ratings yet

- 8assertions, Audit Procedures and Audit EvidenceDocument10 pages8assertions, Audit Procedures and Audit EvidenceFranz CampuedNo ratings yet

- 13auditing in A CisDocument5 pages13auditing in A CisFranz CampuedNo ratings yet

- 1public Accounting ProfessionDocument6 pages1public Accounting ProfessionFranz CampuedNo ratings yet

- RAYANAIR CASE STUDY1 - CompressedDocument20 pagesRAYANAIR CASE STUDY1 - Compressedyasser massryNo ratings yet

- Aso Mega ListDocument7 pagesAso Mega ListcmlcbhtidNo ratings yet

- The Coffee Guy Franchise PackDocument9 pagesThe Coffee Guy Franchise PackLucien MANGANo ratings yet

- Techlogix Final SlidesDocument28 pagesTechlogix Final SlidesSohaib ArifNo ratings yet

- Manufacturing AnswersDocument9 pagesManufacturing AnswersGaurav YadavNo ratings yet

- Malware Analysis - WikipediaDocument4 pagesMalware Analysis - WikipediaihoneeNo ratings yet

- Project RAR IntegerationDocument25 pagesProject RAR IntegerationAl-Mahad International School100% (1)

- 1 Running Head: Grant Proposal Strategic PlanDocument6 pages1 Running Head: Grant Proposal Strategic PlanJoseph WainainaNo ratings yet

- Drafting Service Level Agreements: Best Practices For Corporate and Technology CounselDocument64 pagesDrafting Service Level Agreements: Best Practices For Corporate and Technology CounselstcastemerNo ratings yet

- Audit Financier by Falloul Moulay El MehdiDocument1 pageAudit Financier by Falloul Moulay El MehdiDriss AitbourigueNo ratings yet

- Why Renting Is Better Than BuyingDocument4 pagesWhy Renting Is Better Than BuyingMonali MathurNo ratings yet

- Case Study LogitechDocument2 pagesCase Study LogitechAryanNo ratings yet

- Trading Journal TemplateDocument20 pagesTrading Journal TemplateAdah AuduNo ratings yet

- Advanced Transport ManagementDocument5 pagesAdvanced Transport ManagementCOT Management Training InsituteNo ratings yet

- Stellar One: GH-09, Sector-1, Greater Noida WestDocument7 pagesStellar One: GH-09, Sector-1, Greater Noida WestRavi BhattacharyaNo ratings yet

- Project On "Associate Recruitment Test Paper Revision": Rahulji SinghDocument94 pagesProject On "Associate Recruitment Test Paper Revision": Rahulji SinghDeepak SinghalNo ratings yet

- THEVIDEOGAMINGINDUSTRYDocument10 pagesTHEVIDEOGAMINGINDUSTRYlacrosivanNo ratings yet

- Organic LeadsDocument14 pagesOrganic Leadsnarutoxsasuke3363No ratings yet

- Group3 PizzanadaDocument36 pagesGroup3 Pizzanadatwiceitzyskz100% (1)

- Final Technical Report. Group 2Document13 pagesFinal Technical Report. Group 2Chamel Jamora RuperezNo ratings yet

- Chapters 1-3 Oct.-5Document37 pagesChapters 1-3 Oct.-5Erica FlorentinoNo ratings yet

- BSBPMG540 Task 2 Knowledge Questions V1.1121-SV049116-MarianaVargasGarciaDocument5 pagesBSBPMG540 Task 2 Knowledge Questions V1.1121-SV049116-MarianaVargasGarciaRahmi Can ÖzmenNo ratings yet

- B315F962 - ไกด์สัม BBA TUDocument55 pagesB315F962 - ไกด์สัม BBA TUJaruwat somsriNo ratings yet

- How To Become A More Effective LeaderDocument36 pagesHow To Become A More Effective LeaderSerpilNo ratings yet

- JSA Scaffolding (Green) - OSBLDocument20 pagesJSA Scaffolding (Green) - OSBLSiti AminahNo ratings yet

- Draft Minutes of Progress Meeting No. 5 - Ruaha Rev 01cmDocument15 pagesDraft Minutes of Progress Meeting No. 5 - Ruaha Rev 01cmzewdiegizachew10No ratings yet

- Guide To The Markets Q3 2023 1688397991Document100 pagesGuide To The Markets Q3 2023 1688397991nicholasNo ratings yet

- Elastomers Presentation BrochureDocument20 pagesElastomers Presentation BrochureFrench CorvetteNo ratings yet

- History of The Consumer Protection Act in India: Any Person WhoDocument11 pagesHistory of The Consumer Protection Act in India: Any Person WhoankitNo ratings yet

- Mid-Essay IE 124109Document6 pagesMid-Essay IE 124109Alexandra BragaNo ratings yet