Professional Documents

Culture Documents

Sub Sale SPA Procedure Without Encumbrance

Sub Sale SPA Procedure Without Encumbrance

Uploaded by

Hermione Leong Yen KheeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sub Sale SPA Procedure Without Encumbrance

Sub Sale SPA Procedure Without Encumbrance

Uploaded by

Hermione Leong Yen KheeCopyright:

Available Formats

lOMoARcPSD|3706016

Transfer by Contract of Sale

Conveyancing Law 1 (Universiti Teknologi MARA)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

Transfer by Contract of Sale

The second mode of transfer prescribed under the law of conveyancing and land

law in Malaysia is transfer by contract of sale. This type of transfer majorly governed

under the law of contract in ensuring whether all of the elements for valid contract have

been fulfilled. The process requires the transferee to pay specific amount of monetary

consideration in exchange for the transfer of indefeasibility upon the title of the land by

the transferor.

The concept of transfer by contract of sale can be divided into 3 stages, namely;

pre-contract, execution of contract and post contract. Firstly pre-contract. It is the duty of

transferor or vendor, and transferee or purchaser, to appoint their own solicitors acting

on their behalf. The modern approach has prohibited, per Legal Profession Act 1976,

single solicitor to act on behalf of both parties as conflict of interest may arose.

First Stage: Pre-Contract

Before execution of contract, it is the duty of the VS to ascertain several matters,

including the vendor’s ownership upon the land, for example if he is appointed as

trustee or holder of Power of Attorney. Secondly, VS must ascertain the material details

of the land. This includes both which can be visibly and legally interpreted. If the land is

subject to RII, mandatory consent must be obtained from State Authority if not the

transfer be rendered void. Transfer which is defective under Section 340(2) of NLC

shall also be rendered null. As for estate land, in pursuance of Section 214A of NLC,

consent from Estate Land Board must be obtained before any transfer is conducted, as

illustrated in the case of Rengamah a/p Rengasamy v Tai Yoke Lai & Anor, in which

the contract is subject to condition provided by Estate Land Board. Nonetheless, it is not

the duty of VS to apply for such consent as the duty lies of the vendor himself. VS only

bound to give credible advice in facilitating such transfer. Thirdly, terms of sale

agreement. VS must prepare the specific terms of such transaction in satisfaction of the

vendor and in accordance of law, including purchase price, deposit and duration of

payment. (DPD) Fourthly, if applicable, VS must prepare relevant document in relation

to transfer, including RPGT Form 1A or 3.

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

As for the purchaser’s solicitor, he is also subject to several duties which need to

be perfected before any contract of sale is executed. Firstly, making enquiries with

client. It is compulsory to make enquiries before initiating any transaction as this is the

basic step for a valid and safe purchase. In addition, enquiries shall be done as it is the

duty of the PS to prepare relevant documentation including Form 14A, RPGT 2A and

502, Form 19B for entry of private caveat and 19G for withdrawal of private caveat. As

for Sale and Purchase Agreement, the law in Malaysia does not specify which solicitor

shall prepare such but in practice, specifically in West Malaysia, it is the duty of PS as

he is also responsible in preparing relevant documentation on behalf of his client.

The first matter which needs to be ascertaining by PS is details of the purchaser.

Ensuring the necessary details of purchaser is important in order to ensure that the

purchaser is not prohibited from becoming registered proprietor of such land. It is crucial

that the purchaser falls under the language of Section 43 of NLC as a fit party to the

contract. In Anthony Ting Chio Pang v Wong Bing Seng, it was held that the solicitor

is negligent in determing the details of the purchaser, by only relying on report of lost of

the identity card. Besides that, in practice, PS must also consider where the money

which will be utilized in purchasing the land is obtained from, in order to prevent that the

money obtained from illegal sources.

Secondly, details of the property. This includes conducting land search upon the

land which is intended to be purchased. Conducting land search is crucial in order to

obtain necessary information of the land which then be used in preparing relevant

documentation of the transfer. PS usually conduct private search per Section 384 of

NLC as result can be obtained quickly in order to settle the contract within stipulated

time, as compared to official search under Section 385 of NLC. Among the importance

are (DESCA). Failure to conduct land search will amount to professional negligence on

behalf of the PS, as seen in the case of Ngeoh Soo Oh v G Rethinasamy, in which

purchaser had suffered severe monetary loss due to PS failure to conduct competent

land search which clarify that the land is under acquisition. On behalf of purchaser, it is

their right to insist that land search is conducted before purchase price is paid, stated in

the case of Chow Yoong Hong v Tai Chet Siang. Nonetheless, even though it is less

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

time consuming, conducting private search has its own risk, as it is not bound by

compensation under Section 386 of NLC if there is any form of errors, as seen in the

case of Tiara Kristal Sdn Bhd v Pengarah Tanah dan Galian Wilayah Persekutuan.

Thirdly, making extra enquiries. Besides enquiries with the purchaser, PS also

have the duty to make enquiries with regards to the vendor and the land itself. This

includes making enquiries with relevant authority such as Tenaga Nasional Berhad to

determine if there is any sort of arrears in payment upon the land. For the vendor, PS

has the duty to determine the basic requirement which need to be satisfied by the PS,

including falls under the language of Section 43 of NLC, and is not bound by any

bankruptcy proceedings per Insolvency Act 1967.

Fourthly, site inspection. PS shall advise or preferably, inspect the land together

with the purchaser before entering into contract to purchase the land. This is to

determine the physicality of the land itself, including the existence of any buildings on

such land, or if there is any tenant, lessee or occupier on the land.

Second Stage: Execution of Contract

After all the pre-contract necessities have been complied with, the next stage is

execution of contract. Under this stage, the primary purpose is to enforce a valid sale

and purchase agreement between the vendor and purchaser. In establishing a valid

SPA, there are four components which need to be determined. Firstly, date of the

agreement. This is to determine when is the exact and precise moment the contract is

to be enforced.

Secondly, recital. Under this component, it mainly involves the basic details of

the agreement involving both parties. The details of parties and property must be

precisely prepared. Besides that, side factor of the parties must also be taken into

consideration, for example if the vendor is a trustee, the transaction shall be governed

under Trustees Act, and if he is executor, he may only sell or charge the land subject to

restriction of will under Section 60(a) of Probate and Administration Act. On behalf of

the court, when application for recital approval is obtained, several factors must be

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

taken into consideration, including reasonableness of price, age of beneficiaries of the

vendor and consent from adult beneficiaries of the purchaser. (RAC)

Thirdly, terms and conditions of the sale. This is the most fundamental

component of any sale and purchase agreement. All relevant terms shall be specifically

stated in clarifying both vendor and purchaser of the contract. Terms and conditions can

be divided into 4 major parts, namely; rights and obligations of the vendor, rights and

obligations of the purchaser, common obligation and miscellaneous.

Rights and obligations of the vendor: Ensure the transfer free from

encumbrances/problem. To accept

purchase price as agreed.

Rights and obligations of the purchaser: Payment of deposit, ascertaining mode

of payment, pay purchase price

within time, mode of payment of BPP,

agree on terms if default in payment.

Miscellaneous terms: Back up plan and to determine status of SPA if anything

happened (vendor refused to proceed, purchaser

failed to pay, State Authority refused consent, land

suddenly subject to Land Acquisition Act, act of

God, supervening impossibility)

Common obligation: Performance of contract, duration of payment, mode of

payment, time of execution.

In addition, SPA shall also be prepared by considering conditional terms as well

as preparing general clause of the agreements. Remedies shall also be clarified in the

SPA, in the event of frustration or breach of contract. Failure to do so will render the

injured party to receive remedies per discretion of the court. In the case of Palmerston

Holdings Sdn Bhd, it was held that as the SPA does not provide relief of specific

performance, injured party may only be entitled to liquidated damages.

Fourthly, signing and attestation clause. After all the necessary procedures of

execution contract stage has been complied with, the final step is to execute the

contract by way of signing of the agreement. Both parties must sign the agreement in

front of their solicitor, and further attested by qualified individuals such as notary public.

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

Deposit

Under the concept of transfer by contract of sale, monetary consideration is one

of the vital elements which act as the key in receiving indefeasibility of title from the

vendor towards the purchaser. Deposit is part of monetary consideration from the

purchaser. Literally, deposit can be defined as part payment of purchase price from the

purchaser towards the vendor upon the signing of sale and purchase agreement. In the

case of Sun Properties Sdn Bhd v Happy Shopping Plaza Sdn Bhd, deposit was

expressed as part payment, which is advanced payment by purchaser in favour of

vendor. However, it does not act as security, as illustrated in the case of Warren v Tay

Say Geok, as purchaser may lose the deposit if he repudiated the contract.

In terms of amount, the law in Malaysia does not provide specific amount which

need to be paid in order to be considered as deposit. Nonetheless, the court accepted

that the amount shall be around 10% to 20% of the purchase price agreed. In the case

of Linggi Plantations v Jegatheesan, the court held that payment more than 10% of

purchase price may also be considered as deposit, which similarly seen in Lee Yew Hin

v Kow Lup Ping.

Functions (Complete/Serious/Payment/Caveat/Breach)(CSPCB)

In the event of default on behalf of purchaser, the vendor may forfeit the deposit

obtained as part payment of the agreed purchase price. It may act as an award, in

which the vendor receives money without the need to surrender his proprietorship over

the land. However, right to forfeit deposit is not provided under any written statute and

cannot be impliedly induced by vendor. Thus, vendor with the assist from vendor’s

solicitor shall include forfeiture clause within the sale and purchase agreement. Once

the clause is incorporated within the agreement, vendor need not prove any loss

suffered due to default on behalf of the purchaser, as seen in the case of Morello Sdn

Bhd v Jacques (International) Sdn Bhd. In Master Strike Sdn Bhd v Sterling Height

Sdn Bhd, the court highlighted that payment of purchase price is a fundamental

obligation and breach of such goes to the root of the agreement, allowing vendor to

forfeit the deposit.

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

The amount paid which to be forfeit; even though seems to be part of court’s

consideration by applying reasonable man test; is immaterial. So long that the forfeiture

clause is incorporated in the agreement, it is lawful for the vendor to forfeit the deposit,

as seen in the case of Happy Shopping Plaza Sdn Bhd v Sun Property Sdn Bhd, in

which it was upheld that the forfeiture of RM 1,000,000 as deposit by the vendor is

lawful per the forfeiture clause, regardless of huge amount of money.

Stakeholder

In general, stakeholder can be defined as an independent party who holds the

money and documents in relation to transaction conducted, pending the completion of

certain tasks. For transfer by contract of sale, stakeholder is appointed in order to

resolve the situation of deadlock; situation whereby the vendor will not surrender his

proprietorship over land until he receives the monetary consideration and the purchaser

will not surrender his money unless he is guaranteed to possessed the proprietorship

after the consideration on his behalf is satisfied. Stakeholder plays an important role in

preventing conflict of interest between both vendor and purchaser.

In the case of Tan Suan Sim v Chang Fook Shen, it was held that stakeholder

undertakes to release purchase price only once the transfer is duly registered, and in

the event of default, the money will be refunded and title deed will be returned to

appropriate party. Solicitors usually appointed as stakeholder, and any sort of breach of

undertaking will amount to disciplinary offence per Section 92(b) of Legal Profession

Act.

Stakeholder bears status as independent party regardless of his appointment.

Traditional approach in the case of Kuldip Singh v Lembaga Letrik Negara illustrates

that although the money has been transferred by the purchaser to the stakeholder; in

which she absconded, the money was deemed to have yet been paid towards the

vendor thus rendering loss to the purchaser. To distinguish, slightly modern practice

provides a contrast view, as in the case of OCBC v Lee Lee Fah, in which although the

stakeholder absconded with the money, the purchaser deemed to have paid to the

vendor thus rendering proprietorship to be transferred to the purchaser.

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

Third Stage: Post-Contract

Although all the necessary procedures in executing the agreement have been

satisfied, the transfer is yet to be completed and enforceable under the law. Firstly,

purchaser’s solicitor must ensure that all relevant documents; including SPA and Form

14A have been completed, duly executed and attested in accordance of Section 211 of

NLC, witnessed by qualified person under 5th Schedule of NLC.

Secondly, lodgment of private caveat. This step is mandatory in order to; not only

protect the purchaser’s interest, but also to ensure that the vendor performed as what is

agreed in the sale and purchase agreement. Private caveat need to be lodge as

registration of transfer may take certain period of time, thus ensuring purchaser’s

interest is protected before the transfer is completed and documented on the RDT. Per

Section 323(1)(a) of NLC, the burden of proving lies on the purchaser to prove that he

is indeed possess caveatable interest over the said land, further approved in the case of

Million Group Credit. In Ong Chat Phang, a purchaser is said to have caveatable

interest once the SPA has been signed and deposit has been paid towards the vendor.

That being said; stated in the case of Macon Engineering, valid SPA is the ultimate

proof to show that the purchaser indeed possess caveatable interest via signing of the

agreement.

In lodging private caveat, several procedures need to be followed by the

caveator. First, per Section 323(2) of NLC, application to lodge private caveat must be

made in Form 19B and be attested per Section 211 and 5th Schedule of NLC. In

addition, per Section 323(3) of NLC, application shall be accompanied with prescribed

fee, grounds of application which is verified by Statutory Declaration, and description of

land or undivided share of the land. Statutory Declaration, on the other hand, must be

prepared in accordance of Statutory Declaration Act, signifying the name applicant or

the firm acting on behalf of the applicant, amount of deposit, details of property and the

caveatable interest, further signed before the Commissioner of Oath.

(Name/Money/Property/Interest)(NMPI).

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

Once the application is approved, the Registrar will lodge the caveat via

endorsement on RDT under his hand and seal. It is worth noting that caveat is not

subject to any stamp duty and last for 6 years per Section 328 of NLC. Form 19A will

also be served to the proprietor as a notice that he will no longer be able to deal with his

land until the caveator withdraw his caveat upon the land.

Thirdly, preparation and payment of RPGT. Besides lodgment of caveat, RPGT

Form must also be prepared by both vendor’s and purchaser’s solicitor. On behalf of

purchaser, Form RPGT 2A must be file before the Inland Revenue and payment of

RPGT must be made within 60 days of the conclusion of SPA, stated under Section

13(2) of RPGT Act. The purpose of Form RPGT 2A is to notify the specific date of

purchase in order to be counted by the Inland Revenue for future dealings. In addition,

Form 502 must be submitted together with retention sum of 3% from purchase price to

the Inland Revenue, within 60 days from the date of sale and purchase agreement per

Section 21B of RPGT Act. Penalty will be imposed for failure to do so.

On behalf of vendor, if the sale is made after 5 years after acquiring the property,

RPGT need not be paid and done in Form RPGT 3. Whereas if the sale is made within

5 years, payment of RPGT is compulsory and be done in Form 1A. Calculation is as

follow;

First Step: Untung kasar: Harga jual - Harga beli

Second Step: Untung bersih: Untung Kasar – Expenses (Legal fees,

renovation etc)

Third Step: RPGT: Percentage RPGT x (Untung bersih – Exemption (if

applicable))

Any application for exemption shall be done in Form RPGT 3 per Section 9 of

RPGT Act 1976. If the vendor is exempted from RPGT, the purchaser also need not

pay 3% retention sum.

If the caveator wishes to withdraw private caveat, application shall be done in

Form 19G by notifying the Registrar per Section 325(1)(a) of NLC. Then, Registrar

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

lOMoARcPSD|3706016

shall cancel the caveat and stating his reason on the RDT per Section 325(2)(a) of

NLC, and notification will be given per Section 325(2)(b) of NLC.

Payment of Balance Purchase Price

For settlement of balance purchase price, there are two modes which can be

utilized by the purchaser, namely; payment by case or by bank loan. Nonetheless,

payment of balance purchase price depends on the status of the property itself, whether

it is free from encumbrance or subject to existing charge.

For property which is free from encumbrance, as stakeholder of the purchaser,

purchaser’s solicitor must ensure that he receives the balance purchase price from the

purchaser before relevant documents can be adjudicated. Once the balance had been

received, purchaser’s solicitor may proceed for adjudication of Memorandum of

Transfer, PDS 15, copy of SPA and title deed, by way of stamping at the Stamp Duty

Office. The primary purpose is to enable the Stamp Office authority to evaluate the

property and determine the amount of stamp duty payable by the purchaser. Once the

property has been evaluated, notification or “Notis Taksiran” will be issued and

purchaser’s solicitor needs to pay the amount within 30 days of its execution per

Section 47 of Stamp Act 1949. Failure to do so is subject to penalty under Section

47A of Stamp Act 1949. Next, presentation of document shall be made per Section

292(1) of NLC and subject to payment of fees under Section 293(1) of NLC.

Considering all the steps have been complied, the date of presentation is

deemed to be the date of registration although the presentation of MOT may be rejected

and endorsement of RDT has yet been carried out. That being said, the balance

purchase price can be forwarded to the vendor’s solicitor whereas title deed shall be

forwarded to the purchaser’s solicitors.

(Duit-Adju-Evaluate-Notice-Present-Registration-Forward-Deed)(DAENPRFD)

Downloaded by Hermione Leong (yenkheeleong@gmail.com)

You might also like

- Birth Certificate English Translation (Oaxaca)Document2 pagesBirth Certificate English Translation (Oaxaca)Brian100% (3)

- Amity Law School: Topic-Drafting of Sale DeedDocument11 pagesAmity Law School: Topic-Drafting of Sale DeedAishwarya SinghalNo ratings yet

- Hire Purchase - DBFDocument12 pagesHire Purchase - DBFMuna Farhana88% (17)

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintFrom EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintRating: 4 out of 5 stars4/5 (1)

- Bates V Post Office: Steve Parker Witness Statement 1Document79 pagesBates V Post Office: Steve Parker Witness Statement 1Nick Wallis100% (2)

- Sale and Purchase Land in Malaysia: Real Estate Agency PracticeDocument26 pagesSale and Purchase Land in Malaysia: Real Estate Agency PracticeTe KellyNo ratings yet

- Credit Cases - Rem, CHM, AchDocument18 pagesCredit Cases - Rem, CHM, AchJose MasarateNo ratings yet

- Convey Presentation Sub SaleDocument72 pagesConvey Presentation Sub SalehaziqahNo ratings yet

- What Is A Lease DeedDocument3 pagesWhat Is A Lease DeedAdan HoodaNo ratings yet

- ChargesDocument24 pagesChargesHishvar RameshNo ratings yet

- PD 957Document7 pagesPD 957gwenNo ratings yet

- Law On Hire PurchaseDocument25 pagesLaw On Hire Purchase2022461016No ratings yet

- Act 1508Document7 pagesAct 1508Alyssa Fabella ReyesNo ratings yet

- Tutorial Convey 1Document5 pagesTutorial Convey 1Anis AqilahNo ratings yet

- Lesson 12 - Conducting Property SalesDocument64 pagesLesson 12 - Conducting Property SalesmariesharmilaravindranNo ratings yet

- Registration of ChargeDocument5 pagesRegistration of ChargekinNo ratings yet

- HK Endsems CTDocument27 pagesHK Endsems CTHardik KhattarNo ratings yet

- Drafting, Pleading and Conveyancing, Mod 2Document50 pagesDrafting, Pleading and Conveyancing, Mod 2kinkini1007No ratings yet

- Q: What Is The Recto Law?Document9 pagesQ: What Is The Recto Law?threeNo ratings yet

- BANKING LAWS Additional Supreme Court Doctrines On Real Estate Mortgage 01Document18 pagesBANKING LAWS Additional Supreme Court Doctrines On Real Estate Mortgage 01RaineNo ratings yet

- ConveyancingDocument4 pagesConveyancinghibaNo ratings yet

- Conveyancing Rough Draft 2Document23 pagesConveyancing Rough Draft 2Sylvia G.No ratings yet

- Assignment 22 OvesDocument8 pagesAssignment 22 OvesfaarehaNo ratings yet

- Exclusive Right To Sell: 5. Quiroga V ParsonsDocument4 pagesExclusive Right To Sell: 5. Quiroga V ParsonsAlexis Dominic San ValentinNo ratings yet

- PD 957 Effect of Absence of Certificate of Registration or License To Sell by The HLURBDocument7 pagesPD 957 Effect of Absence of Certificate of Registration or License To Sell by The HLURBKaren GaliciaNo ratings yet

- Serra Vs CA - DigestDocument2 pagesSerra Vs CA - Digestbibemergal100% (2)

- What Information You Need To Transfer A Land Title in MalaysiaDocument7 pagesWhat Information You Need To Transfer A Land Title in MalaysiaAimi AzemiNo ratings yet

- 1 6 ConveyanceDocument16 pages1 6 ConveyanceKavya mNo ratings yet

- Case Digest-Contracts-General ProvisionDocument3 pagesCase Digest-Contracts-General ProvisionKê MilanNo ratings yet

- Class C Firm 14 - Complex AgreementDocument5 pagesClass C Firm 14 - Complex AgreementTerry CheyneNo ratings yet

- Secured TransactionsDocument3 pagesSecured TransactionsMoon MoonNo ratings yet

- Suit For The Specific Performance of Contract: Prashanti UpadhyayDocument7 pagesSuit For The Specific Performance of Contract: Prashanti UpadhyayPallavi AgrawallaNo ratings yet

- A Transaction Is Deemed To Be An Equitable MortgageDocument3 pagesA Transaction Is Deemed To Be An Equitable MortgageShan KhingNo ratings yet

- Concept of Crim Law To TerritorialityDocument46 pagesConcept of Crim Law To TerritorialityJanela LanaNo ratings yet

- Brief Hire Purchase Law NotesDocument3 pagesBrief Hire Purchase Law NotesMiriam WanjiruNo ratings yet

- Commercial Transactions Endterm Answer SheetDocument21 pagesCommercial Transactions Endterm Answer Sheetaarushi190604No ratings yet

- Bortikey vs. AFP Retirement and Separation BenefitsDocument3 pagesBortikey vs. AFP Retirement and Separation BenefitsRon Acopiado100% (1)

- Rosello-Bentir v. Leanda PDFDocument9 pagesRosello-Bentir v. Leanda PDFLucio GeorgioNo ratings yet

- How To Be Good Delay AnaDocument7 pagesHow To Be Good Delay AnaAnonymous JIHJTWw4ThNo ratings yet

- 2000 Rosello Bentir - v. - Leanda20210605 13 18jki35Document10 pages2000 Rosello Bentir - v. - Leanda20210605 13 18jki3519105259No ratings yet

- Property Law II Life Saver!Document8 pagesProperty Law II Life Saver!Hadi Onimisi TijaniNo ratings yet

- DPC 2 - Roll No. 202 - Div DDocument35 pagesDPC 2 - Roll No. 202 - Div DShubham PatelNo ratings yet

- Suit For Specific Performance of ContractDocument21 pagesSuit For Specific Performance of ContractT K Ramanathan100% (1)

- D) Whether Martha Can Object The Application For An Order of Sale by The Bank (With Citation)Document5 pagesD) Whether Martha Can Object The Application For An Order of Sale by The Bank (With Citation)Shahrul IzhamNo ratings yet

- Mercantile LawDocument11 pagesMercantile LawNitesh Matta100% (1)

- Christian General AssemblyDocument3 pagesChristian General AssemblyOwen BuenaventuraNo ratings yet

- Author: Loice Erambo: Why Need An Advocate For Land Transfer?Document36 pagesAuthor: Loice Erambo: Why Need An Advocate For Land Transfer?Emeka NkemNo ratings yet

- Consolidated CasesDocument41 pagesConsolidated CasesChi OdanraNo ratings yet

- Case No. 19-Odyssey Park vs. CA and Union BankDocument1 pageCase No. 19-Odyssey Park vs. CA and Union BankSam Leaño100% (1)

- Legal AspectsDocument9 pagesLegal Aspectsaryanboxer786No ratings yet

- Atp Cases Digest 1001Document65 pagesAtp Cases Digest 1001Radel LlagasNo ratings yet

- Cavite Development Bank v. Spouses LimDocument19 pagesCavite Development Bank v. Spouses LimGabriel UyNo ratings yet

- Assign 4 Mahinay, Beya AmmahryDocument21 pagesAssign 4 Mahinay, Beya AmmahryAmmahry BeyNo ratings yet

- Assign 4Document20 pagesAssign 4Ammahry BeyNo ratings yet

- Atp 108 - DDocument17 pagesAtp 108 - Dcfirm23No ratings yet

- Magno v. Court of Appeals, G.R. No. 96132 June 26, 1992Document6 pagesMagno v. Court of Appeals, G.R. No. 96132 June 26, 1992Adeptus Xiao TherNo ratings yet

- CGA V IgnacioDocument2 pagesCGA V IgnacioboyetverzosaNo ratings yet

- Contracts ChecklistDocument7 pagesContracts ChecklistBree Savage100% (1)

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsFrom EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Soccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2From EverandSoccer (Football) Contracts: An Introduction to Player Contracts (Clubs & Agents) and Contract Law: Volume 2No ratings yet

- Drafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsFrom EverandDrafting Legal Notices in India: A Guide to Understanding the Importance of Legal Notices, along with DraftsRating: 1 out of 5 stars1/5 (2)

- Topic 3 Cases Admin LawDocument5 pagesTopic 3 Cases Admin LawHermione Leong Yen KheeNo ratings yet

- Human Rights CommissionDocument3 pagesHuman Rights CommissionHermione Leong Yen KheeNo ratings yet

- Dream Property SDN BHD V Atlas Housing SDN BHDDocument49 pagesDream Property SDN BHD V Atlas Housing SDN BHDHermione Leong Yen KheeNo ratings yet

- Dream Property SDN BHD V Atlas Housing SDN BHDDocument49 pagesDream Property SDN BHD V Atlas Housing SDN BHDHermione Leong Yen KheeNo ratings yet

- 1 Court Jurisdiction 1 Court JurisdictionDocument19 pages1 Court Jurisdiction 1 Court JurisdictionHermione Leong Yen KheeNo ratings yet

- Sub Sale SPA Procedure Without EncumbranceDocument10 pagesSub Sale SPA Procedure Without EncumbranceHermione Leong Yen KheeNo ratings yet

- 2.procedure For Adducing Evidence in CourtDocument17 pages2.procedure For Adducing Evidence in CourtHermione Leong Yen KheeNo ratings yet

- Baviera Sales OutlineDocument12 pagesBaviera Sales OutlineRom100% (1)

- Bara Lidasan vs. Comelec - Case DigestDocument2 pagesBara Lidasan vs. Comelec - Case DigestChevrolie Maglasang-Isoto100% (1)

- Minitab SPCDocument11 pagesMinitab SPCCoCon GaloenkNo ratings yet

- SINAMICS G Speed Control of A G120 (Startdrive) With S7-1500Document48 pagesSINAMICS G Speed Control of A G120 (Startdrive) With S7-1500Juan Carlos AlconNo ratings yet

- Central Surety and Insurance CompanyDocument2 pagesCentral Surety and Insurance CompanyxyrakrezelNo ratings yet

- Result PRCJune 2023Document56 pagesResult PRCJune 2023Iqramunir IqramunirNo ratings yet

- Cabanatuan City: Coach ChaperonDocument38 pagesCabanatuan City: Coach ChaperonJayjay RonielNo ratings yet

- THY - HW5 - Human Dignity As Inviolable and InalienableDocument1 pageTHY - HW5 - Human Dignity As Inviolable and InalienableOri SeinNo ratings yet

- Pilots LawsuitDocument33 pagesPilots LawsuitAnonymous 6f8RIS6No ratings yet

- Digested Banking CasesDocument11 pagesDigested Banking CasesJunivenReyUmadhayNo ratings yet

- Test Bank For Microeconomics Fifth EditionDocument99 pagesTest Bank For Microeconomics Fifth Editionmichaelmckayksacoxebfi100% (29)

- Five Minute Plank WorkoutDocument4 pagesFive Minute Plank WorkoutMIIIBNo ratings yet

- Housing Rehabilitation ProjectDocument147 pagesHousing Rehabilitation ProjectTanya LokwaniNo ratings yet

- S.R. Bommai v. Union of India: CritiqueDocument4 pagesS.R. Bommai v. Union of India: Critiqueanon_913299743No ratings yet

- SonicWALL VPN With Red Hat LinuxDocument4 pagesSonicWALL VPN With Red Hat Linuxjpereira100% (2)

- 77d8135f PDFDocument12 pages77d8135f PDFKhgdueve BuatsaihaNo ratings yet

- Install Smartplant Reference Data: Setup - Exe in The Main FolderDocument2 pagesInstall Smartplant Reference Data: Setup - Exe in The Main FolderMayur MandrekarNo ratings yet

- Risk and Opportunities Register Bulacan State UniversityDocument58 pagesRisk and Opportunities Register Bulacan State UniversityNiezel Sabrido100% (1)

- DISTAT ENIM QVAE SYDERA TE EXCIPIANT Rodolfo SignoriniDocument2 pagesDISTAT ENIM QVAE SYDERA TE EXCIPIANT Rodolfo Signoriniberix100% (1)

- Action Plan (Neap PDP)Document2 pagesAction Plan (Neap PDP)RACHEL ABE100% (1)

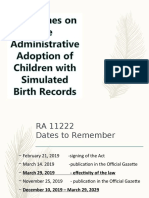

- Guidelines of RA 11222 LatestDocument52 pagesGuidelines of RA 11222 LatestAna Shiella SaavedraNo ratings yet

- Commanding Amazon's Army of Workers With Software: Christopher MimsDocument2 pagesCommanding Amazon's Army of Workers With Software: Christopher MimsJulinar RodriguezNo ratings yet

- The Impact of Ethics and Professionalism in Banking IndustryDocument20 pagesThe Impact of Ethics and Professionalism in Banking Industrytrinath ojhaNo ratings yet

- Advanced Ledger Entry Service in Microsoft Dynamics AX 2012 For Public SectorDocument15 pagesAdvanced Ledger Entry Service in Microsoft Dynamics AX 2012 For Public SectorIbrahim Khaleel0% (1)

- Kidnapping of School Pupils and Myth of Security in Northern Nigeria Causes and SolutionsDocument7 pagesKidnapping of School Pupils and Myth of Security in Northern Nigeria Causes and SolutionsEditor IJTSRDNo ratings yet

- Qdoc - Tips Principles of Managerial Finance 14th Edition GitmDocument12 pagesQdoc - Tips Principles of Managerial Finance 14th Edition GitmClarisa NataliaNo ratings yet

- List of Statutory Instruments 2016 Up To 2016-11-04Document6 pagesList of Statutory Instruments 2016 Up To 2016-11-04miti victorNo ratings yet

- Basic Features of BondsDocument1 pageBasic Features of Bondspmaina100% (1)