Professional Documents

Culture Documents

2006 Case Updates

2006 Case Updates

Uploaded by

Sitti Warna IsmaelOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2006 Case Updates

2006 Case Updates

Uploaded by

Sitti Warna IsmaelCopyright:

Available Formats

CASE UPDATES 2006

UNC College of Law

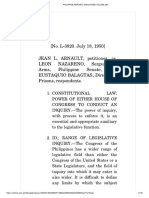

POLITICAL LAW Arnault involved a Senate investigation of the reportedly anomalous purchase of the Buenavista and

Tambobong Estates by the Rural Progress Administration. Arnault, who was considered a leading witness in

Senate of the Philippines v. Eduardo R. Ermita, G.R. No. 169777, April 20, 2006 the controversy, was called to testify thereon by the Senate. On account of his refusal to answer the questions

of the senators on an important point, he was, by resolution of the Senate, detained for contempt. Upholding

Respondents thus conclude that the petitions merely rest on an unfounded apprehension that the the Senate’s power to punish Arnault for contempt, this Court held:

President will abuse its power of preventing the appearance of officials before Congress, and that such

apprehension is not sufficient for challenging the validity of E.O. 464. Although there is no provision in the Constitution expressly investing either House

of Congress with power to make investigations and exact testimony to the end that it may

The Court finds respondents’ assertion that the President has not withheld her consent or prohibited exercise its legislative functions advisedly and effectively, such power is so far incidental to

the appearance of the officials concerned immaterial in determining the existence of an actual case or the legislative function as to be implied. In other words, the power of inquiry – with process

controversy insofar as E.O. 464 is concerned. For E.O. 464 does not require either a deliberate withholding of to enforce it – is an essential and appropriate auxiliary to the legislative function. A

consent or an express prohibition issuing from the President in order to bar officials from appearing before legislative body cannot legislate wisely or effectively in the absence of information

Congress. respecting the conditions which the legislation is intended to affect or change; and where

the legislative body does not itself possess the requisite information – which is not

As the implementation of the challenged order has already resulted in the absence of officials invited infrequently true – recourse must be had to others who do possess it. Experience has

to the hearings of petitioner Senate of the Philippines, it would make no sense to wait for any further event shown that mere requests for such information are often unavailing, and also that

before considering the present case ripe for adjudication. Indeed, it would be sheer abandonment of duty if this information which is volunteered is not always accurate or complete; so some means of

Court would now refrain from passing on the constitutionality of E.O. 464. compulsion is essential to obtain what is needed. . . (Emphasis and underscoring

supplied)

Xxxx

That this power of inquiry is broad enough to cover officials of the executive branch may be deduced

The power of inquiry from the same case. The power of inquiry, the Court therein ruled, is co-extensive with the power to legislate.

The matters which may be a proper subject of legislation and those which may be a proper subject of

The Congress power of inquiry is expressly recognized in Section 21 of Article VI of the Constitution investigation are one. It follows that the operation of government, being a legitimate subject for legislation, is a

which reads: proper subject for investigation.

SECTION 21. The Senate or the House of Representatives or any of its respective Thus, the Court found that the Senate investigation of the government transaction involved in Arnault

committees may conduct inquiries in aid of legislation in accordance with its duly published was a proper exercise of the power of inquiry. Besides being related to the expenditure of public funds of which

rules of procedure. The rights of persons appearing in or affected by such inquiries shall be Congress is the guardian, the transaction, the Court held, “also involved government agencies created by

respected. (Underscoring supplied) Congress and officers whose positions it is within the power of Congress to regulate or even abolish.”

This provision is worded exactly as Section 8 of Article VIII of the 1973 Constitution except that, in the latter, it Since Congress has authority to inquire into the operations of the executive branch, it would be

vests the power of inquiry in the unicameral legislature established therein – the Batasang Pambansa – and its incongruous to hold that the power of inquiry does not extend to executive officials who are the most familiar

committees. with and informed on executive operations.

The 1935 Constitution did not contain a similar provision. Nonetheless, in Arnault v. Nazareno, a case As discussed in Arnault, the power of inquiry, “with process to enforce it,” is grounded on the

decided in 1950 under that Constitution, the Court already recognized that the power of inquiry is inherent in the necessity of information in the legislative process. If the information possessed by executive officials on the

power to legislate. operation of their offices is necessary for wise legislation on that subject, by parity of reasoning, Congress has

the right to that information and the power to compel the disclosure thereof.

Xxxx

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

depends for its effectiveness solely upon information parceled out ex gratia by the

From the above discussion on the meaning and scope of executive privilege, both in the United States and in executive. (Emphasis and underscoring supplied)

this jurisdiction, a clear principle emerges. Executive privilege, whether asserted against Congress, the courts,

or the public, is recognized only in relation to certain types of information of a sensitive character. While Sections 21 and 22, therefore, while closely related and complementary to each other, should not be

executive privilege is a constitutional concept, a claim thereof may be valid or not depending on the ground considered as pertaining to the same power of Congress. One specifically relates to the power to conduct

invoked to justify it and the context in which it is made. Noticeably absent is any recognition that executive inquiries in aid of legislation, the aim of which is to elicit information that may be used for legislation, while the

officials are exempt from the duty to disclose information by the mere fact of being executive officials. Indeed, other pertains to the power to conduct a question hour, the objective of which is to obtain information in pursuit

the extraordinary character of the exemptions indicates that the presumption inclines heavily against executive of Congress’ oversight function.

secrecy and in favor of disclosure.

Xxxx When Congress merely seeks to be informed on how department heads are implementing the

statutes which it has issued, its right to such information is not as imperative as that of the President to whom,

A distinction was thus made between inquiries in aid of legislation and the question hour. While attendance was as Chief Executive, such department heads must give a report of their performance as a matter of duty. In

meant to be discretionary in the question hour, it was compulsory in inquiries in aid of legislation. The reference such instances, Section 22, in keeping with the separation of powers, states that Congress may only request

to Commissioner Suarez bears noting, he being one of the proponents of the amendment to make the their appearance. Nonetheless, when the inquiry in which Congress requires their appearance is “in aid of

appearance of department heads discretionary in the question hour. legislation” under Section 21, the appearance is mandatory for the same reasons stated in Arnault.

Xxxx In fine, the oversight function of Congress may be facilitated by compulsory process only to the extent

The framers of the 1987 Constitution removed the mandatory nature of such appearance during the question that it is performed in pursuit of legislation. This is consistent with the intent discerned from the deliberations of

hour in the present Constitution so as to conform more fully to a system of separation of powers. To that extent, the Constitutional Commission.

the question hour, as it is presently understood in this jurisdiction, departs from the question period of the

parliamentary system. That department heads may not be required to appear in a question hour does not, Ultimately, the power of Congress to compel the appearance of executive officials under Section 21

however, mean that the legislature is rendered powerless to elicit information from them in all circumstances. In and the lack of it under Section 22 find their basis in the principle of separation of powers. While the executive

fact, in light of the absence of a mandatory question period, the need to enforce Congress’ right to executive branch is a co-equal branch of the legislature, it cannot frustrate the power of Congress to legislate by refusing

information in the performance of its legislative function becomes more imperative. As Schwartz observes: to comply with its demands for information.

Indeed, if the separation of powers has anything to tell us on the subject under When Congress exercises its power of inquiry, the only way for department heads to exempt

discussion, it is that the Congress has the right to obtain information from any source – even themselves therefrom is by a valid claim of privilege. They are not exempt by the mere fact that they are

from officials of departments and agencies in the executive branch. In the United States department heads. Only one executive official may be exempted from this power — the President on whom

there is, unlike the situation which prevails in a parliamentary system such as that in Britain, executive power is vested, hence, beyond the reach of Congress except through the power of impeachment. It

a clear separation between the legislative and executive branches. It is this very separation is based on her being the highest official of the executive branch, and the due respect accorded to a co-equal

that makes the congressional right to obtain information from the executive so essential, if branch of government which is sanctioned by a long-standing custom.

the functions of the Congress as the elected representatives of the people are adequately to

be carried out. The absence of close rapport between the legislative and executive Xxxx

branches in this country, comparable to those which exist under a parliamentary system, By the same token, members of the Supreme Court are also exempt from this power of inquiry. Unlike the

and the nonexistence in the Congress of an institution such as the British question period Presidency, judicial power is vested in a collegial body; hence, each member thereof is exempt on the basis not

have perforce made reliance by the Congress upon its right to obtain information from the only of separation of powers but also on the fiscal autonomy and the constitutional independence of the

executive essential, if it is intelligently to perform its legislative tasks. Unless the Congress judiciary. This point is not in dispute, as even counsel for the Senate, Sen. Joker Arroyo, admitted it during the

possesses the right to obtain executive information, its power of oversight of administration oral argument upon interpellation of the Chief Justice.

in a system such as ours becomes a power devoid of most of its practical content, since it

Xxx

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

In view thereof, whenever an official invokes E.O. 464 to justify his failure to be present, such

Having established the proper interpretation of Section 22, Article VI of the Constitution, the Court now invocation must be construed as a declaration to Congress that the President, or a head of office authorized by

proceeds to pass on the constitutionality of Section 1 of E.O. 464. the President, has determined that the requested information is privileged, and that the President has not

reversed such determination. Such declaration, however, even without mentioning the term “executive

Section 1, in view of its specific reference to Section 22 of Article VI of the Constitution and the privilege,” amounts to an implied claim that the information is being withheld by the executive branch, by

absence of any reference to inquiries in aid of legislation, must be construed as limited in its application to authority of the President, on the basis of executive privilege. Verily, there is an implied claim of privilege.

appearances of department heads in the question hour contemplated in the provision of said Section 22 of

Article VI. The reading is dictated by the basic rule of construction that issuances must be interpreted, as much Xxx

as possible, in a way that will render it constitutional.

While there is no Philippine case that directly addresses the issue of whether executive privilege may be

The requirement then to secure presidential consent under Section 1, limited as it is only to invoked against Congress, it is gathered from Chavez v. PEA that certain information in the possession of the

appearances in the question hour, is valid on its face. For under Section 22, Article VI of the Constitution, the executive may validly be claimed as privileged even against Congress. Thus, the case holds:

appearance of department heads in the question hour is discretionary on their part.

There is no claim by PEA that the information demanded by petitioner is privileged

Section 1 cannot, however, be applied to appearances of department heads in inquiries in aid of information rooted in the separation of powers. The information does not cover Presidential

legislation. Congress is not bound in such instances to respect the refusal of the department head to appear in conversations, correspondences, or discussions during closed-door Cabinet meetings

such inquiry, unless a valid claim of privilege is subsequently made, either by the President herself or by the which, like internal-deliberations of the Supreme Court and other collegiate courts, or

Executive Secretary. executive sessions of either house of Congress, are recognized as confidential. This kind of

information cannot be pried open by a co-equal branch of government. A frank exchange of

Xxxx exploratory ideas and assessments, free from the glare of publicity and pressure by

interested parties, is essential to protect the independence of decision-making of those

In light, however, of Sec 2(a) of E.O. 464 which deals with the nature, scope and coverage of tasked to exercise Presidential, Legislative and Judicial power. This is not the situation in

executive privilege, the reference to persons being “covered by the executive privilege” may be read as an the instant case. (Emphasis and underscoring supplied)

abbreviated way of saying that the person is in possession of information which is, in the judgment of the head

of office concerned, privileged as defined in Section 2(a). The Court shall thus proceed on the assumption that Section 3 of E.O. 464, therefore, cannot be dismissed outright as invalid by the mere fact that it

this is the intention of the challenged order. sanctions claims of executive privilege. This Court must look further and assess the claim of privilege

authorized by the Order to determine whether it is valid.

Upon a determination by the designated head of office or by the President that an official is “covered

by the executive privilege,” such official is subjected to the requirement that he first secure the consent of the While the validity of claims of privilege must be assessed on a case to case basis, examining the

President prior to appearing before Congress. This requirement effectively bars the appearance of the official ground invoked therefor and the particular circumstances surrounding it, there is, in an implied claim of privilege,

concerned unless the same is permitted by the President. The proviso allowing the President to give its consent a defect that renders it invalid per se. By its very nature, and as demonstrated by the letter of respondent

means nothing more than that the President may reverse a prohibition which already exists by virtue of E.O. Executive Secretary quoted above, the implied claim authorized by Section 3 of E.O. 464 is not accompanied by

464. any specific allegation of the basis thereof (e.g., whether the information demanded involves military or

diplomatic secrets, closed-door Cabinet meetings, etc.). While Section 2(a) enumerates the types of information

Thus, underlying this requirement of prior consent is the determination by a head of office, authorized that are covered by the privilege under the challenged order, Congress is left to speculate as to which among

by the President under E.O. 464, or by the President herself, that such official is in possession of information them is being referred to by the executive. The enumeration is not even intended to be comprehensive, but a

that is covered by executive privilege. This determination then becomes the basis for the official’s not showing mere statement of what is included in the phrase “confidential or classified information between the President

up in the legislative investigation. and the public officers covered by this executive order.”

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

Certainly, Congress has the right to know why the executive considers the requested information responsibilities. The doctrine of executive privilege is thus premised on the fact that certain informations must,

privileged. It does not suffice to merely declare that the President, or an authorized head of office, has as a matter of necessity, be kept confidential in pursuit of the public interest. The privilege being, by definition,

determined that it is so, and that the President has not overturned that determination. Such declaration leaves an exemption from the obligation to disclose information, in this case to Congress, the necessity must be of

Congress in the dark on how the requested information could be classified as privileged. That the message is such high degree as to outweigh the public interest in enforcing that obligation in a particular case.

couched in terms that, on first impression, do not seem like a claim of privilege only makes it more pernicious. It

threatens to make Congress doubly blind to the question of why the executive branch is not providing it with the In light of this highly exceptional nature of the privilege, the Court finds it essential to limit to the

information that it has requested. President the power to invoke the privilege. She may of course authorize the Executive Secretary to invoke the

privilege on her behalf, in which case the Executive Secretary must state that the authority is “By order of the

Xxx President,” which means that he personally consulted with her. The privilege being an extraordinary power, it

Upon the other hand, Congress must not require the executive to state the reasons for the claim with such must be wielded only by the highest official in the executive hierarchy. In other words, the President may not

particularity as to compel disclosure of the information which the privilege is meant to protect. authorize her subordinates to exercise such power. There is even less reason to uphold such authorization in

the instant case where the authorization is not explicit but by mere silence. Section 3, in relation to Section 2(b),

Xxx is further invalid on this score.

The claim of privilege under Section 3 of E.O. 464 in relation to Section 2(b) is thus invalid per se. It is

not asserted. It is merely implied. Instead of providing precise and certain reasons for the claim, it merely It follows, therefore, that when an official is being summoned by Congress on a matter which, in his

invokes E.O. 464, coupled with an announcement that the President has not given her consent. It is woefully own judgment, might be covered by executive privilege, he must be afforded reasonable time to inform the

insufficient for Congress to determine whether the withholding of information is justified under the circumstances President or the Executive Secretary of the possible need for invoking the privilege. This is necessary in order

of each case. It severely frustrates the power of inquiry of Congress. to provide the President or the Executive Secretary with fair opportunity to consider whether the matter indeed

calls for a claim of executive privilege. If, after the lapse of that reasonable time, neither the President nor the

Xxx Executive Secretary invokes the privilege, Congress is no longer bound to respect the failure of the official to

No infirmity, however, can be imputed to Section 2(a) as it merely provides guidelines, binding only on appear before Congress and may then opt to avail of the necessary legal means to compel his appearance.

the heads of office mentioned in Section 2(b), on what is covered by executive privilege. It does not purport to

be conclusive on the other branches of government. It may thus be construed as a mere expression of opinion The Court notes that one of the expressed purposes for requiring officials to secure the consent of the

by the President regarding the nature and scope of executive privilege. President under Section 3 of E.O. 464 is to ensure “respect for the rights of public officials appearing in inquiries

in aid of legislation.” That such rights must indeed be respected by Congress is an echo from Article VI Section

Petitioners, however, assert as another ground for invalidating the challenged order the alleged 21 of the Constitution mandating that “[t]he rights of persons appearing in or affected by such inquiries shall be

unlawful delegation of authority to the heads of offices in Section 2(b). Petitioner Senate of the Philippines, in respected.”

particular, cites the case of the United States where, so it claims, only the President can assert executive Xxxx

privilege to withhold information from Congress.

There are, it bears noting, clear distinctions between the right of Congress to information which

Section 2(b) in relation to Section 3 virtually provides that, once the head of office determines that a underlies the power of inquiry and the right of the people to information on matters of public concern. For one,

certain information is privileged, such determination is presumed to bear the President’s authority and has the the demand of a citizen for the production of documents pursuant to his right to information does not have the

effect of prohibiting the official from appearing before Congress, subject only to the express pronouncement of same obligatory force as a subpoena duces tecum issued by Congress. Neither does the right to information

the President that it is allowing the appearance of such official. These provisions thus allow the President to grant a citizen the power to exact testimony from government officials. These powers belong only to Congress

authorize claims of privilege by mere silence. and not to an individual citizen.

Such presumptive authorization, however, is contrary to the exceptional nature of the privilege. Thus, while Congress is composed of representatives elected by the people, it does not follow, except

Executive privilege, as already discussed, is recognized with respect to information the confidential nature of in a highly qualified sense, that in every exercise of its power of inquiry, the people are exercising their right to

which is crucial to the fulfillment of the unique role and responsibilities of the executive branch, or in those information.

instances where exemption from disclosure is necessary to the discharge of highly important executive

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

To the extent that investigations in aid of legislation are generally conducted in public, however, any executive Section 4 of Article III of the Constitution provides:

issuance tending to unduly limit disclosures of information in such investigations necessarily deprives the people

of information which, being presumed to be in aid of legislation, is presumed to be a matter of public concern. SEC. 4. No law shall be passed abridging the freedom of speech, of expression, or of the press, or

The citizens are thereby denied access to information which they can use in formulating their own opinions on the right of the people peaceably to assemble and petition the government for redress of grievances.

the matter before Congress — opinions which they can then communicate to their representatives and other

government officials through the various legal means allowed by their freedom of expression. The first point to mark is that the right to peaceably assemble and petition for redress of grievances is, together

with freedom of speech, of expression, and of the press, a right that enjoys primacy in the realm of constitutional

Xxxx protection. For these rights constitute the very basis of a functional democratic polity, without which all the other

rights would be meaningless and unprotected. As stated in Jacinto v. CA,

Implementation of E.O. 464 prior to its publication

While E.O. 464 applies only to officials of the executive branch, it does not follow that the same is XXXX

exempt from the need for publication. On the need for publishing even those statutes that do not directly apply

to people in general, Tañada v. Tuvera states: It is very clear, therefore, that B.P. No. 880 is not an absolute ban of public assemblies but a restriction that

simply regulates the time, place and manner of the assemblies. This was adverted to in Osmeña v.

The term “laws” should refer to all laws and not only to those of general Comelec ,where the Court referred to it as a “content-neutral” regulation of the time, place, and manner of

application, for strictly speaking all laws relate to the people in general albeit there are some holding public assemblies.

that do not apply to them directly. An example is a law granting citizenship to a particular

individual, like a relative of President Marcos who was decreed instant naturalization. It A fair and impartial reading of B.P. No. 880 thus readily shows that it refers to all kinds of public

surely cannot be said that such a law does not affect the public although it unquestionably assemblies that would use public places. The reference to “lawful cause” does not make it content-based

does not apply directly to all the people. The subject of such law is a matter of public because assemblies really have to be for lawful causes, otherwise they would not be “peaceable” and entitled to

interest which any member of the body politic may question in the political forums or, if he is protection. Neither are the words “opinion,” “protesting” and “influencing” in the definition of public assembly

a proper party, even in courts of justice. (Emphasis and underscoring supplied) content based, since they can refer to any subject. The words “petitioning the government for redress of

grievances” come from the wording of the Constitution, so its use cannot be avoided. Finally, maximum

Although the above statement was made in reference to statutes, logic dictates that the challenged tolerance is for the protection and benefit of all rallyists and is independent of the content of the expressions in

order must be covered by the publication requirement. As explained above, E.O. 464 has a direct effect on the the rally.

right of the people to information on matters of public concern. It is, therefore, a matter of public interest which

members of the body politic may question before this Court. Due process thus requires that the people should Furthermore, the permit can only be denied on the ground of clear and present danger to public order,

have been apprised of this issuance before it was implemented. public safety, public convenience, public morals or public health. This is a recognized exception to the exercise

of the right even under the Universal Declaration of Human Rights and the International Covenant on Civil and

Political Rights…

BAYAN, et al v. EDUARDO ERMITA, in his capacity as Executive Secretary, et al, G.R. No. 169838, April 25,

2006 XXXX

Petitioners’ standing cannot be seriously challenged. Their right as citizens to engage in peaceful Not every expression of opinion is a public assembly. The law refers to “rally, demonstration, march, parade,

assembly and exercise the right of petition, as guaranteed by the Constitution, is directly affected by B.P. No. procession or any other form of mass or concerted action held in a public place.” So it does not cover any and

880 which requires a permit for all who would publicly assemble in the nation’s streets and parks. They have, in all kinds of gatherings.

fact, purposely engaged in public assemblies without the required permits to press their claim that no such

permit can be validly required without violating the Constitutional guarantee. Respondents, on the other hand, Neither is the law overbroad. It regulates the exercise of the right to peaceful assembly and petition

have challenged such action as contrary to law and dispersed the public assemblies held without the permit. only to the extent needed to avoid a clear and present danger of the substantive evils Congress has the right to

prevent.

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

unconstitutional; it does not curtail or unduly restrict freedoms; it merely regulates the use of public places as to

There is, likewise, no prior restraint, since the content of the speech is not relevant to the regulation. the time, place and manner of assemblies. Far from being insidious, “maximum tolerance” is for the benefit of

rallyists, not the government. The delegation to the mayors of the power to issue rally “permits” is valid because

XXX it is subject to the constitutionally-sound “clear and present danger” standard.

As to the delegation of powers to the mayor, the law provides a precise and sufficient standard – the clear and XXX

present danger test stated in Sec. 6(a). The reference to “imminent and grave danger of a substantive evil” in

Sec. 6(c) substantially means the same thing and is not an inconsistent standard. As to whether respondent In this Decision, the Court goes even one step further in safeguarding liberty by giving local

Mayor has the same power independently under Republic Act No. 7160 is thus not necessary to resolve in governments a deadline of 30 days within which to designate specific freedom parks as provided under B.P. No.

these proceedings, and was not pursued by the parties in their arguments. 880. If, after that period, no such parks are so identified in accordance with Section 15 of the law, all public

parks and plazas of the municipality or city concerned shall in effect be deemed freedom parks; no prior permit

XXXX of whatever kind shall be required to hold an assembly therein. The only requirement will be written notices to

Considering that the existence of such freedom parks is an essential part of the law’s system of the police and the mayor’s office to allow proper coordination and orderly activities.

regulation of the people’s exercise of their right to peacefully assemble and petition, the Court is constrained to

rule that after thirty (30) days from the finality of this Decision, no prior permit may be required for the exercise

of such right in any public park or plaza of a city or municipality until that city or municipality shall have complied Abakada Guro Party List, et al v. The Honorable Executive Secretary Eduardo Ermita, et al, G.R. No. 168056,

with Section 15 of the law. For without such alternative forum, to deny the permit would in effect be to deny the September 1, 2005

right. Advance notices should, however, be given to the authorities to ensure proper coordination and orderly

proceedings. Under the “enrolled bill doctrine,” the signing of a bill by the Speaker of the House and the Senate President and

the certification of the Secretaries of both Houses of Congress that it was passed are conclusive of its due

XXX enactment. A review of cases reveals the Court’s consistent adherence to the rule. The Court finds no reason

Furthermore, there is need to address the situation adverted to by petitioners where mayors do not act to deviate from the salutary rule in this case where the irregularities alleged by the petitioners mostly involved

on applications for a permit and when the police demand a permit and the rallyists could not produce one, the the internal rules of Congress, e.g., creation of the 2nd or 3rd Bicameral Conference Committee by the House.

rally is immediately dispersed. In such a situation, as a necessary consequence and part of maximum This Court is not the proper forum for the enforcement of these internal rules of Congress, whether House or

tolerance, rallyists who can show the police an application duly filed on a given date can, after two days from Senate. Parliamentary rules are merely procedural and with their observance the courts have no concern.

said date, rally in accordance with their application without the need to show a permit, the grant of the permit Whatever doubts there may be as to the formal validity of Rep. Act No. 9006 must be resolved in its favor. The

being then presumed under the law, and it will be the burden of the authorities to show that there has been a Court reiterates its ruling in Arroyo vs. De Venecia, viz.:

denial of the application, in which case the rally may be peacefully dispersed following the procedure of

maximum tolerance prescribed by the law. But the cases, both here and abroad, in varying forms of expression, all deny to the courts the power to inquire

In sum, this Court reiterates its basic policy of upholding the fundamental rights of our people, into allegations that, in enacting a law, a House of Congress failed to comply with its own rules, in the absence

especially freedom of expression and freedom of assembly. In several policy addresses, Chief Justice Artemio of showing that there was a violation of a constitutional provision or the rights of private individuals. In Osmeña

V. Panganiban has repeatedly vowed to uphold the liberty of our people and to nurture their prosperity. He said v. Pendatun, it was held: “At any rate, courts have declared that ‘the rules adopted by deliberative bodies are

that “in cases involving liberty, the scales of justice should weigh heavily against the government and in favor of subject to revocation, modification or waiver at the pleasure of the body adopting them.’ And it has been said

the poor, the oppressed, the marginalized, the dispossessed and the weak. Indeed, laws and actions that that “Parliamentary rules are merely procedural, and with their observance, the courts have no concern. They

restrict fundamental rights come to the courts with a heavy presumption against their validity. These laws and may be waived or disregarded by the legislative body.” Consequently, “mere failure to conform to parliamentary

actions are subjected to heightened scrutiny.” usage will not invalidate the action (taken by a deliberative body) when the requisite number of members have

agreed to a particular measure.”[21] (Emphasis supplied)

For this reason, the so-called calibrated preemptive response policy has no place in our legal

firmament and must be struck down as a darkness that shrouds freedom. It merely confuses our people and is xxxxxxxx

used by some police agents to justify abuses. On the other hand, B.P. No. 880 cannot be condemned as

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

R.A. No. 9337 Does Not Violate Article VI, Section 26(2) of the Constitution on the “No-Amendment Rule” In the present cases, petitioners admit that it was indeed House Bill Nos. 3555 and 3705 that initiated the move

for amending provisions of the NIRC dealing mainly with the value-added tax. Upon transmittal of said House

Article VI, Sec. 26 (2) of the Constitution, states: bills to the Senate, the Senate came out with Senate Bill No. 1950 proposing amendments not only to NIRC

provisions on the value-added tax but also amendments to NIRC provisions on other kinds of taxes. Is the

No bill passed by either House shall become a law unless it has passed three readings on separate introduction by the Senate of provisions not dealing directly with the value- added tax, which is the only kind of

days, and printed copies thereof in its final form have been distributed to its Members three days tax being amended in the House bills, still within the purview of the constitutional provision authorizing the

before its passage, except when the President certifies to the necessity of its immediate enactment to Senate to propose or concur with amendments to a revenue bill that originated from the House?

meet a public calamity or emergency. Upon the last reading of a bill, no amendment thereto shall be

allowed, and the vote thereon shall be taken immediately thereafter, and the yeas and nays entered in The foregoing question had been squarely answered in the Tolentino case, wherein the Court held, thus:

the Journal.

. . . To begin with, it is not the law – but the revenue bill – which is required by the Constitution to “originate

exclusively” in the House of Representatives. It is important to emphasize this, because a bill originating in the

Petitioners’ argument that the practice where a bicameral conference committee is allowed to add or delete House may undergo such extensive changes in the Senate that the result may be a rewriting of the whole. . . .

provisions in the House bill and the Senate bill after these had passed three readings is in effect a At this point, what is important to note is that, as a result of the Senate action, a distinct bill may be produced.

circumvention of the “no amendment rule” (Sec. 26 (2), Art. VI of the 1987 Constitution), fails to convince the To insist that a revenue statute – and not only the bill which initiated the legislative process culminating in the

Court to deviate from its ruling in the Tolentino case that: enactment of the law – must substantially be the same as the House bill would be to deny the Senate’s power

not only to “concur with amendments” but also to “propose amendments.” It would be to violate the coequality

Nor is there any reason for requiring that the Committee’s Report in these cases must have of legislative power of the two houses of Congress and in fact make the House superior to the Senate.

undergone three readings in each of the two houses. If that be the case, there would be no end to …

negotiation since each house may seek modification of the compromise bill. . . .

…Given, then, the power of the Senate to propose amendments, the Senate can propose its own version even

Art. VI. § 26 (2) must, therefore, be construed as referring only to bills introduced for the first time in either with respect to bills which are required by the Constitution to originate in the House.

house of Congress, not to the conference committee report.[32] (Emphasis supplied) ...

The Court reiterates here that the “no-amendment rule” refers only to the procedure to be followed by each Indeed, what the Constitution simply means is that the initiative for filing revenue, tariff or tax bills, bills

house of Congress with regard to bills initiated in each of said respective houses, before said bill is transmitted authorizing an increase of the public debt, private bills and bills of local application must come from the House

to the other house for its concurrence or amendment. Verily, to construe said provision in a way as to proscribe of Representatives on the theory that, elected as they are from the districts, the members of the House can be

any further changes to a bill after one house has voted on it would lead to absurdity as this would mean that the expected to be more sensitive to the local needs and problems. On the other hand, the senators, who are

other house of Congress would be deprived of its constitutional power to amend or introduce changes to said elected at large, are expected to approach the same problems from the national perspective. Both views are

bill. Thus, Art. VI, Sec. 26 (2) of the Constitution cannot be taken to mean that the introduction by the Bicameral thereby made to bear on the enactment of such laws.[33] (Emphasis supplied)

Conference Committee of amendments and modifications to disagreeing provisions in bills that have been acted

upon by both houses of Congress is prohibited. Since there is no question that the revenue bill exclusively originated in the House of Representatives, the

Senate was acting within its constitutional power to introduce amendments to the House bill when it included

XXX provisions in Senate Bill No. 1950 amending corporate income taxes, percentage, excise and franchise taxes.

Verily, Article VI, Section 24 of the Constitution does not contain any prohibition or limitation on the extent of the

Article VI, Section 24 of the Constitution reads: amendments that may be introduced by the Senate to the House revenue bill.

Sec. 24. All appropriation, revenue or tariff bills, bills authorizing increase of the public debt, bills of Furthermore, the amendments introduced by the Senate to the NIRC provisions that had not been touched in

local application, and private bills shall originate exclusively in the House of Representatives but the the House bills are still in furtherance of the intent of the House in initiating the subject revenue bills. The

Senate may propose or concur with amendments.

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

Explanatory Note of House Bill No. 1468, the very first House bill introduced on the floor, which was later

substituted by House Bill No. 3555, stated: In every case of permissible delegation, there must be a showing that the delegation itself is valid. It is valid only

if the law (a) is complete in itself, setting forth therein the policy to be executed, carried out, or implemented by

One of the challenges faced by the present administration is the urgent and daunting task of solving the the delegate;[41] and (b) fixes a standard — the limits of which are sufficiently determinate and determinable —

country’s serious financial problems. To do this, government expenditures must be strictly monitored and to which the delegate must conform in the performance of his functions.[42] A sufficient standard is one which

controlled and revenues must be significantly increased. This may be easier said than done, but our fiscal defines legislative policy, marks its limits, maps out its boundaries and specifies the public agency to apply it. It

authorities are still optimistic the government will be operating on a balanced budget by the year 2009. In fact, indicates the circumstances under which the legislative command is to be effected.[43] Both tests are intended

several measures that will result to significant expenditure savings have been identified by the administration. It to prevent a total transference of legislative authority to the delegate, who is not allowed to step into the shoes

is supported with a credible package of revenue measures that include measures to improve tax administration of the legislature and exercise a power essentially legislative.[44]

and control the leakages in revenues from income taxes and the value-added tax (VAT). (Emphasis supplied)

XXX

XXXX

Clearly, the legislature may delegate to executive officers or bodies the power to determine certain facts or

The principle of separation of powers ordains that each of the three great branches of government has exclusive conditions, or the happening of contingencies, on which the operation of a statute is, by its terms, made to

cognizance of and is supreme in matters falling within its own constitutionally allocated sphere.[37] A logical depend, but the legislature must prescribe sufficient standards, policies or limitations on their authority.[49]

corollary to the doctrine of separation of powers is the principle of non-delegation of powers, as expressed in the While the power to tax cannot be delegated to executive agencies, details as to the enforcement and

Latin maxim: potestas delegata non delegari potest which means “what has been delegated, cannot be administration of an exercise of such power may be left to them, including the power to determine the existence

delegated.”[38] This doctrine is based on the ethical principle that such as delegated power constitutes not only of facts on which its operation depends.[50]

a right but a duty to be performed by the delegate through the instrumentality of his own judgment and not

through the intervening mind of another.[39] The rationale for this is that the preliminary ascertainment of facts as basis for the enactment of legislation is not

of itself a legislative function, but is simply ancillary to legislation. Thus, the duty of correlating information and

With respect to the Legislature, Section 1 of Article VI of the Constitution provides that “the Legislative power making recommendations is the kind of subsidiary activity which the legislature may perform through its

shall be vested in the Congress of the Philippines which shall consist of a Senate and a House of members, or which it may delegate to others to perform. Intelligent legislation on the complicated problems of

Representatives.” The powers which Congress is prohibited from delegating are those which are strictly, or modern society is impossible in the absence of accurate information on the part of the legislators, and any

inherently and exclusively, legislative. Purely legislative power, which can never be delegated, has been reasonable method of securing such information is proper.[51] The Constitution as a continuously operative

described as the authority to make a complete law – complete as to the time when it shall take effect and as to charter of government does not require that Congress find for itself every fact upon which it desires to base

whom it shall be applicable – and to determine the expediency of its enactment.[40] Thus, the rule is that in legislative action or that it make for itself detailed determinations which it has declared to be prerequisite to

order that a court may be justified in holding a statute unconstitutional as a delegation of legislative power, it application of legislative policy to particular facts and circumstances impossible for Congress itself properly to

must appear that the power involved is purely legislative in nature – that is, one appertaining exclusively to the investigate.[52]

legislative department. It is the nature of the power, and not the liability of its use or the manner of its exercise, XXXX

which determines the validity of its delegation.

The case before the Court is not a delegation of legislative power. It is simply a delegation of ascertainment of

Nonetheless, the general rule barring delegation of legislative powers is subject to the following recognized facts upon which enforcement and administration of the increase rate under the law is contingent. The

limitations or exceptions: legislature has made the operation of the 12% rate effective January 1, 2006, contingent upon a specified fact

or condition. It leaves the entire operation or non-operation of the 12% rate upon factual matters outside of the

(1) Delegation of tariff powers to the President under Section 28 (2) of Article VI of the Constitution; control of the executive.

(2) Delegation of emergency powers to the President under Section 23 (2) of Article VI of the Constitution;

(3) Delegation to the people at large; No discretion would be exercised by the President. Highlighting the absence of discretion is the fact that the

(4) Delegation to local governments; and word shall is used in the common proviso. The use of the word shall connotes a mandatory order. Its use in a

(5) Delegation to administrative bodies. statute denotes an imperative obligation and is inconsistent with the idea of discretion.[53] Where the law is

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

clear and unambiguous, it must be taken to mean exactly what it says, and courts have no choice but to see to it undue delegation of legislative power but only of the discretion as to the execution of a law. This is

that the mandate is obeyed.[54] constitutionally permissible.[57] Congress does not abdicate its functions or unduly delegate power when it

describes what job must be done, who must do it, and what is the scope of his authority; in our complex

Thus, it is the ministerial duty of the President to immediately impose the 12% rate upon the existence of any of economy that is frequently the only way in which the legislative process can go forward.[58]

the conditions specified by Congress. This is a duty which cannot be evaded by the President. Inasmuch as the

law specifically uses the word shall, the exercise of discretion by the President does not come into play. It is a XXXX

clear directive to impose the 12% VAT rate when the specified conditions are present. The time of taking into

effect of the 12% VAT rate is based on the happening of a certain specified contingency, or upon the As earlier stated, the input tax is the tax paid by a person, passed on to him by the seller, when he buys goods.

ascertainment of certain facts or conditions by a person or body other than the legislature itself. Output tax meanwhile is the tax due to the person when he sells goods. In computing the VAT payable, three

possible scenarios may arise:

XXXX

First, if at the end of a taxable quarter the output taxes charged by the seller are equal to the input taxes that he

When one speaks of the Secretary of Finance as the alter ego of the President, it simply means that as head of paid and passed on by the suppliers, then no payment is required;

the Department of Finance he is the assistant and agent of the Chief Executive. The multifarious executive and

administrative functions of the Chief Executive are performed by and through the executive departments, and Second, when the output taxes exceed the input taxes, the person shall be liable for the excess, which has to

the acts of the secretaries of such departments, such as the Department of Finance, performed and be paid to the Bureau of Internal Revenue (BIR);and

promulgated in the regular course of business, are, unless disapproved or reprobated by the Chief Executive,

presumptively the acts of the Chief Executive. The Secretary of Finance, as such, occupies a political position Third, if the input taxes exceed the output taxes, the excess shall be carried over to the succeeding quarter or

and holds office in an advisory capacity, and, in the language of Thomas Jefferson, "should be of the quarters. Should the input taxes result from zero-rated or effectively zero-rated transactions, any excess over

President's bosom confidence" and, in the language of Attorney-General Cushing, is “subject to the direction of the output taxes shall instead be refunded to the taxpayer or credited against other internal revenue taxes, at

the President."[55] the taxpayer’s option.

In the present case, in making his recommendation to the President on the existence of either of the two Section 8 of R.A. No. 9337 however, imposed a 70% limitation on the input tax. Thus, a person can credit his

conditions, the Secretary of Finance is not acting as the alter ego of the President or even her subordinate. In input tax only up to the extent of 70% of the output tax. In layman’s term, the value-added taxes that a

such instance, he is not subject to the power of control and direction of the President. He is acting as the agent person/taxpayer paid and passed on to him by a seller can only be credited up to 70% of the value-added taxes

of the legislative department, to determine and declare the event upon which its expressed will is to take effect. that is due to him on a taxable transaction. There is no retention of any tax collection because the

[56] The Secretary of Finance becomes the means or tool by which legislative policy is determined and person/taxpayer has already previously paid the input tax to a seller, and the seller will subsequently remit such

implemented, considering that he possesses all the facilities to gather data and information and has a much input tax to the BIR. The party directly liable for the payment of the tax is the seller.[71] What only needs to be

broader perspective to properly evaluate them. His function is to gather and collate statistical data and other done is for the person/taxpayer to apply or credit these input taxes, as evidenced by receipts, against his output

pertinent information and verify if any of the two conditions laid out by Congress is present. His personality in taxes.

such instance is in reality but a projection of that of Congress. Thus, being the agent of Congress and not of the

President, the President cannot alter or modify or nullify, or set aside the findings of the Secretary of Finance XXXX

and to substitute the judgment of the former for that of the latter.

The input tax is not a property or a property right within the constitutional purview of the due process clause. A

Congress simply granted the Secretary of Finance the authority to ascertain the existence of a fact, namely, VAT-registered person’s entitlement to the creditable input tax is a mere statutory privilege.

whether by December 31, 2005, the value-added tax collection as a percentage of Gross Domestic Product

(GDP) of the previous year exceeds two and four-fifth percent (24/5%) or the national government deficit as a The distinction between statutory privileges and vested rights must be borne in mind for persons have no vested

percentage of GDP of the previous year exceeds one and one-half percent (1½%). If either of these two rights in statutory privileges. The state may change or take away rights, which were created by the law of the

instances has occurred, the Secretary of Finance, by legislative mandate, must submit such information to the state, although it may not take away property, which was vested by virtue of such rights.

President. Then the 12% VAT rate must be imposed by the President effective January 1, 2006. There is no

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

XXXX

Article VI, Section 28(1) of the Constitution reads: Moreover, Congress provided mitigating measures to cushion the impact of the imposition of the tax on those

previously exempt. Excise taxes on petroleum products[91] and natural gas[92] were reduced. Percentage tax

The rule of taxation shall be uniform and equitable. The Congress shall evolve a progressive system on domestic carriers was removed.[93] Power producers are now exempt from paying franchise tax.[94]

of taxation.

Aside from these, Congress also increased the income tax rates of corporations, in order to distribute the

Uniformity in taxation means that all taxable articles or kinds of property of the same class shall be taxed at the burden of taxation. Domestic, foreign, and non-resident corporations are now subject to a 35% income tax

same rate. Different articles may be taxed at different amounts provided that the rate is uniform on the same rate, from a previous 32%.[95] Intercorporate dividends of non-resident foreign corporations are still subject to

class everywhere with all people at all times.[86] 15% final withholding tax but the tax credit allowed on the corporation’s domicile was increased to 20%.[96]

The Philippine Amusement and Gaming Corporation (PAGCOR) is not exempt from income taxes anymore.[97]

In this case, the tax law is uniform as it provides a standard rate of 0% or 10% (or 12%) on all goods and Even the sale by an artist of his works or services performed for the production of such works was not spared.

services. Sections 4, 5 and 6 of R.A. No. 9337, amending Sections 106, 107 and 108, respectively, of the

NIRC, provide for a rate of 10% (or 12%) on sale of goods and properties, importation of goods, and sale of All these were designed to ease, as well as spread out, the burden of taxation, which would otherwise rest

services and use or lease of properties. These same sections also provide for a 0% rate on certain sales and largely on the consumers. It cannot therefore be gainsaid that R.A. No. 9337 is equitable.

transaction.

XXXX

Neither does the law make any distinction as to the type of industry or trade that will bear the 70% limitation on

the creditable input tax, 5-year amortization of input tax paid on purchase of capital goods or the 5% final Progressive taxation is built on the principle of the taxpayer’s ability to pay. This principle was also lifted from

withholding tax by the government. It must be stressed that the rule of uniform taxation does not deprive Adam Smith’s Canons of Taxation, and it states:

Congress of the power to classify subjects of taxation, and only demands uniformity within the particular class.

[87] I. The subjects of every state ought to contribute towards the support of the government, as nearly

as possible, in proportion to their respective abilities; that is, in proportion to the revenue which

R.A. No. 9337 is also equitable. The law is equipped with a threshold margin. The VAT rate of 0% or 10% (or they respectively enjoy under the protection of the state.

12%) does not apply to sales of goods or services with gross annual sales or receipts not exceeding II. Taxation is progressive when its rate goes up depending on the resources of the person affected.

P1,500,000.00.[88] Also, basic marine and agricultural food products in their original state are still not subject

to the tax,[89] thus ensuring that prices at the grassroots level will remain accessible. As was stated in The VAT is an antithesis of progressive taxation. By its very nature, it is regressive. The principle of

Kapatiran ng mga Naglilingkod sa Pamahalaan ng Pilipinas, Inc. vs. Tan:[90] progressive taxation has no relation with the VAT system inasmuch as the VAT paid by the consumer or

business for every goods bought or services enjoyed is the same regardless of income. In other words, the

The disputed sales tax is also equitable. It is imposed only on sales of goods or services by persons engaged in VAT paid eats the same portion of an income, whether big or small. The disparity lies in the income earned by

business with an aggregate gross annual sales exceeding P200,000.00. Small corner sari-sari stores are a person or profit margin marked by a business, such that the higher the income or profit margin, the smaller the

consequently exempt from its application. Likewise exempt from the tax are sales of farm and marine products, portion of the income or profit that is eaten by VAT. A converso, the lower the income or profit margin, the

so that the costs of basic food and other necessities, spared as they are from the incidence of the VAT, are bigger the part that the VAT eats away. At the end of the day, it is really the lower income group or businesses

expected to be relatively lower and within the reach of the general public. with low-profit margins that is always hardest hit.

It is admitted that R.A. No. 9337 puts a premium on businesses with low profit margins, and unduly favors those Nevertheless, the Constitution does not really prohibit the imposition of indirect taxes, like the VAT. What it

with high profit margins. Congress was not oblivious to this. Thus, to equalize the weighty burden the law simply provides is that Congress shall "evolve a progressive system of taxation." The Court stated in the

entails, the law, under Section 116, imposed a 3% percentage tax on VAT-exempt persons under Section Tolentino case, thus:

109(v), i.e., transactions with gross annual sales and/or receipts not exceeding P1.5 Million. This acts as a

equalizer because in effect, bigger businesses that qualify for VAT coverage and VAT-exempt taxpayers stand The Constitution does not really prohibit the imposition of indirect taxes which, like the VAT, are regressive.

on equal-footing. What it simply provides is that Congress shall ‘evolve a progressive system of taxation.’ The constitutional

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

provision has been interpreted to mean simply that ‘direct taxes are . . . to be preferred [and] as much as This brings us to the second self-evident point. Water is life, and must be saved at all costs. In Collado v. Court

possible, indirect taxes should be minimized.’ (E. FERNANDO, THE CONSTITUTION OF THE PHILIPPINES of Appeals,[36] we had occasion to reaffirm our previous discussion in Sta. Rosa Realty Development

221 (Second ed. 1977)) Indeed, the mandate to Congress is not to prescribe, but to evolve, a progressive tax Corporation v. Court of Appeals,[37] on the primordial importance of watershed areas, thus: “The most

system. Otherwise, sales taxes, which perhaps are the oldest form of indirect taxes, would have been prohibited important product of a watershed is water, which is one of the most important human necessities. The

with the proclamation of Art. VIII, §17 (1) of the 1973 Constitution from which the present Art. VI, §28 (1) was protection of watersheds ensures an adequate supply of water for future generations and the control of

taken. Sales taxes are also regressive. flashfloods that not only damage property but also cause loss of lives. Protection of watersheds is an

“intergenerational” responsibility that needs to be answered now.[38]

Resort to indirect taxes should be minimized but not avoided entirely because it is difficult, if not impossible, to

avoid them by imposing such taxes according to the taxpayers' ability to pay. In the case of the VAT, the law Three short months before Proclamation No. 635 was passed to avert the garbage crisis, Congress had

minimizes the regressive effects of this imposition by providing for zero rating of certain transactions (R.A. No. enacted the National Water Crisis Act[39] to “adopt urgent and effective measures to address the nationwide

7716, §3, amending §102 (b) of the NIRC), while granting exemptions to other transactions. (R.A. No. 7716, §4 water crisis which adversely affects the health and well-being of the population, food production, and

amending §103 of the NIRC)[99] industrialization process. One of the issues the law sought to address was the “protection and conservation of

watersheds.”[40]

Province of Rizal v. Executive Secretary et al and The Honorable Court Of Appeals, G.R. NO. 129546, In other words, while respondents were blandly declaring that “the reason for the creation of the Marikina

December 13, 2005 Watershed Reservation, i.e., to protect Marikina River as the source of water supply of the City of Manila, no

longer exists,” the rest of the country was gripped by a shortage of potable water so serious, it necessitated its

Were it not for the TRO, then President Estrada’s instructions would have been lawfully carried out, for as we own legislation.

observed in Oposa v. Factoran, the freedom of contract is not absolute. Thus:

Respondents’ actions in the face of such grave environmental consequences defy all logic. The petitioners

….. In Abe vs. Foster Wheeler Corp., this Court stated: "The freedom of contract, under our system of rightly noted that instead of providing solutions, they have, with unmitigated callousness, worsened the problem.

government, is not meant to be absolute. The same is understood to be subject to reasonable legislative It is this readiness to wreak irrevocable damage on our natural heritage in pursuit of what is expedient that has

regulation aimed at the promotion of public health, moral, safety and welfare. In other words, the constitutional compelled us to rule at length on this issue. We ignore the unrelenting depletion of our natural heritage at our

guaranty of non-impairment of obligations of contract is limited by the exercise of the police power of the State, peril.

in the interest of public health, safety, moral and general welfare." The reason for this is emphatically set forth in

Nebia vs. New York, quoted in Philippine American Life Insurance Co. vs. Auditor General, to wit: "'Under our XXXXXXX

form of government the use of property and the making of contracts are normally matters of private and not of

public concern. The general rule is that both shall be free of governmental interference. But neither property In Cruz v. Secretary of Environment and Natural Resources,[41] we had occasion to observe that “(o)ne of the

rights nor contract rights are absolute; for government cannot exist if the citizen may at will use his property to fixed and dominating objectives of the 1935 Constitutional Convention was the nationalization and conservation

the detriment of his fellows, or exercise his freedom of contract to work them harm. Equally fundamental with of the natural resources of the country. There was an overwhelming sentiment in the convention in favor of the

the private right is that of the public to regulate it in the common interest.'" In short, the non-impairment clause principle of state ownership of natural resources and the adoption of the Regalian doctrine. State ownership of

must yield to the police power of the state. (Citations omitted, emphasis supplied) natural resources was seen as a necessary starting point to secure recognition of the state’s power to control

their disposition, exploitation, development, or utilization.”[42]

We thus feel there is also the added need to reassure the residents of the Province of Rizal that this is indeed a

final resolution of this controversy, for a brief review of the records of this case indicates two self-evident facts. The Regalian doctrine was embodied in the 1935 Constitution, in Section 1 of Article XIII on “Conservation and

First, the San Mateo site has adversely affected its environs, and second, sources of water should always be Utilization of Natural Resources.” This was reiterated in the 1973 Constitution under Article XIV on the “National

protected. Economy and the Patrimony of the Nation,” and reaffirmed in the 1987 Constitution in Section 2 of Article XII on

“National Economy and Patrimony,” to wit:

XXXXXXXX

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

Sec. 2. All lands of the public domain, waters, minerals, coal, petroleum, and other mineral oils, all The municipal mayors acted within the scope of their powers, and were in fact fulfilling their mandate, when they

forces of potential energy, fisheries, forests or timber, wildlife, flora and fauna, and other natural did this. Section 16 allows every local government unit to “exercise the powers expressly granted, those

resources are owned by the State. With the exception of agricultural lands, all other natural resources necessarily implied therefrom, as well as powers necessary, appropriate, or incidental for its efficient and

shall not be alienated. The exploration, development and utilization of natural resources shall be effective governance, and those which are essential to the promotion of the general welfare,” which involve,

under the full control and supervision of the State. The State may directly undertake such activities or among other things, “promot(ing) health and safety, enhance(ing) the right of the people to a balanced ecology,

it may enter into co-production, joint venture, or production-sharing agreements with Filipino citizens, and preserv(ing) the comfort and convenience of their inhabitants.”

or corporations or associations at least sixty per centum of whose capital is owned by such citizens.

Such agreements may be for a period not exceeding twenty-five years, renewable for not more than In Lina , Jr. v. Paño, we held that Section 2 (c), requiring consultations with the appropriate local government

twenty-five years, and under such terms and conditions as may be provided by law. In cases of water units, should apply to national government projects affecting the environmental or ecological balance of the

rights for irrigation, water supply, fisheries, or industrial uses other than the development of water particular community implementing the project. Rejecting the petitioners’ contention that Sections 2(c) and 27 of

power, beneficial use may be the measure and limit of the grant.[43] the Local Government Code applied mandatorily in the setting up of lotto outlets around the country, we held

that:

Clearly, the state is, and always has been, zealous in preserving as much of our natural and national heritage

as it can, enshrining as it did the obligation to preserve and protect the same within the text of our fundamental From a careful reading of said provisions, we find that these apply only to national programs and/or projects

law. which are to be implemented in a particular local community. Lotto is neither a program nor a project of the

national government, but of a charitable institution, the PCSO. Though sanctioned by the national government, it

XXX is far fetched to say that lotto falls within the contemplation of Sections 2 (c) and 27 of the Local Government

Code.

In sum, the Administrative Code of 1987 and Executive Order No. 192 entrust the DENR with the guardianship

and safekeeping of the Marikina Watershed Reservation and our other natural treasures. However, although XXXX

the DENR, an agency of the government, owns the Marikina Reserve and has jurisdiction over the same, this

power is not absolute, but is defined by the declared policies of the state, and is subject to the law and higher Thus, the projects and programs mentioned in Section 27 should be interpreted to mean projects and programs

authority. Section 2, Title XIV, Book IV of the Administrative Code of 1987, while specifically referring to the whose effects are among those enumerated in Section 26 and 27, to wit, those that: (1) may cause pollution; (2)

mandate of the DENR, makes particular reference to the agency’s being subject to law and higher authority, may bring about climatic change; (3) may cause the depletion of non-renewable resources; (4) may result in

thus: loss of crop land, range-land, or forest cover; (5) may eradicate certain animal or plant species from the face of

the planet; and (6) other projects or programs that may call for the eviction of a particular group of people

SEC. 2. Mandate. - (1) The Department of Environment and Natural Resources shall be primarily residing in the locality where these will be implemented. Obviously, none of these effects will be produced by

responsible for the implementation of the foregoing policy. the introduction of lotto in the province of Laguna. (emphasis supplied)

(2) It shall, subject to law and higher authority, be in charge of carrying out the State's constitutional We reiterated this doctrine in the recent case of Bangus Fry Fisherfolk v. Lanzanas,[50] where we held that

mandate to control and supervise the exploration, development, utilization, and conservation of the there was no statutory requirement for the sangguniang bayan of Puerto Galera to approve the construction of a

country's natural resources. mooring facility, as Sections 26 and 27 are inapplicable to projects which are not environmentally critical.

XXX

With great power comes great responsibility. It is the height of irony that the public respondents have vigorously

arrogated to themselves the power to control the San Mateo site, but have deftly ignored their corresponding Under the Local Government Code, therefore, two requisites must be met before a national project that affects

responsibility as guardians and protectors of this tormented piece of land. the environmental and ecological balance of local communities can be implemented: prior consultation with the

affected local communities, and prior approval of the project by the appropriate sanggunian. Absent either of

XXXX these mandatory requirements, the project’s implementation is illegal.

XXXX

Compiled by FCR, UNC College of Law Batch 2005

CASE UPDATES 2006

UNC College of Law

applied to one set of facts and invalid in its application to another.

Central Bank (now Bangko Sentral ng Pilipinas) Employees Association, INC., v. BSP and the Executive

Secretary, G.R. No. 148208, December 15, 2004 A statute valid at one time may become void at another time because of altered circumstances. Thus, if a

statute in its practical operation becomes arbitrary or confiscatory, its validity, even though affirmed by a former

Congress is allowed a wide leeway in providing for a valid classification. The equal protection clause is not adjudication, is open to inquiry and investigation in the light of changed conditions.

infringed by legislation which applies only to those persons falling within a specified class. If the groupings are

characterized by substantial distinctions that make real differences, one class may be treated and regulated XXXX

differently from another. The classification must also be germane to the purpose of the law and must apply to all

those belonging to the same class. Masikip v. The City of Pasig et al, G.R. No. 136349, January 23, 2006

In the case at bar, it is clear in the legislative deliberations that the exemption of officers (SG 20 and The power of eminent domain is lodged in the legislative branch of the government. It delegates the

above) from the SSL was intended to address the BSP’s lack of competitiveness in terms of attracting exercise thereof to local government units, other public entities and public utility corporations, subject only to

competent officers and executives. It was not intended to discriminate against the rank-and-file. If the end-result Constitutional limitations. Local governments have no inherent power of eminent domain and may exercise it

did in fact lead to a disparity of treatment between the officers and the rank-and-file in terms of salaries and only when expressly authorized by statute. Section 19 of the Local Government Code of 1991 (Republic Act No.

benefits, the discrimination or distinction has a rational basis and is not palpably, purely, and entirely arbitrary in 7160) prescribes the delegation by Congress of the power of eminent domain to local government units and lays

the legislative sense. down the parameters for its exercise, thus:

That the provision was a product of amendments introduced during the deliberation of the Senate Bill does not “SEC. 19. Eminent Domain. – A local government unit may, through its chief executive and

detract from its validity. As early as 1947 and reiterated in subsequent cases, this Court has subscribed to the acting pursuant to an ordinance, exercise the power of eminent domain for public use, purpose or

conclusiveness of an enrolled bill to refuse invalidating a provision of law, on the ground that the bill from which welfare for the benefit of the poor and the landless, upon payment of just compensation, pursuant to

it originated contained no such provision and was merely inserted by the bicameral conference committee of the provisions of the Constitution and pertinent laws: Provided, however, That, the power of eminent

both Houses. domain may not be exercised unless a valid and definite offer has been previously made to the owner

and such offer was not accepted: Provided, further, That, the local government unit may immediately

Moreover, it is a fundamental and familiar teaching that all reasonable doubts should be resolved in favor take possession of the property upon the filing of expropriation proceedings and upon making a

of the constitutionality of a statute. An act of the legislature, approved by the executive, is presumed to be within deposit with the proper court of at least fifteen percent (15%) of the fair market value of the property