Professional Documents

Culture Documents

Delhi - Pune - Hyderabad - Ahmedabad - Jaipur - Lucknow

Delhi - Pune - Hyderabad - Ahmedabad - Jaipur - Lucknow

Uploaded by

RAJESH KUMAROriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Delhi - Pune - Hyderabad - Ahmedabad - Jaipur - Lucknow

Delhi - Pune - Hyderabad - Ahmedabad - Jaipur - Lucknow

Uploaded by

RAJESH KUMARCopyright:

Available Formats

Why Accountability of RBI is important?

Democracy: In a democracy,

sovereignty lies with the people. And

government, not the central bank, is

answerable to the people. If the

Reserve Bank, for instance, fails to

keep inflation low, it is the

government that pays the price, not

RBI.

Answerable in failures: The flip side

of autonomy is accountability and the

RBI should be answerable if it fails to

achieve these goals. The progressive

widening and deepening of the

activities of the RBI in different

sectors of the economy affect the

lives of millions. Hence any type of

failure should be answerable by RBI.

More transparency: The central bank

can also make mistakes, and is

generally held publicly accountable

through parliamentary scrutiny and

transparency norms. This ensure

more transparency in the system with

clearly defined roles.

Accountable through Government:

The RBI is autonomous but within the

framework of the RBI Act. Hence

Central bank cannot claim absolute autonomy. It is autonomy within the limits set by the government

and its extent depends on the subject and the context.

Way forward

Balancing autonomy and accountability: Institutional autonomy of RBI has to be respected and all

institutions will have to work together to achieve the common goal.

o There has to be a forum within our democratic structure where the RBI is obligated to explain and

defend its position.

o There is a need to pay due regard to both autonomy and accountability. For example - we have an

inflation targeting model now and the central bank is accountable for its inflation targeting.

Similarly, there can be such autonomy and accountability for financial sector regulation by creating

some desirable objectives.

Implementing recommendations of Financial Sector Legislative Reforms Commission (FSLRC): FSLRC

sought to modernize governance and make regulators more independent as well as more accountable.

o For example, it proposed to do away with the government’s power to give directions, while it sought

to make boards of regulators more accountable and transparent with agenda and minutes of board

meetings to be public.

Separation of domains: Since the goals of the government and the RBI coincide, both have to respect

each other’s operational space. While economic growth is impossible without adequate credit, the RBI

needs to ensure that its policies do not hamper the growth of credit and investment.

Review of regulatory powers: If regulatory powers need a review, Parliament should make law

accordingly. There should be clarity on the regulatory powers of RBI as well as Government.

36

8468022022 DELHI | PUNE | HYDERABAD | AHMEDABAD | JAIPUR | LUCKNOW

You might also like

- Project Employment ContractDocument3 pagesProject Employment ContractCha Ancheta Cabigas100% (6)

- Role of RBI in Banking Sector in IndiaDocument17 pagesRole of RBI in Banking Sector in IndiaArunav Guha RoyNo ratings yet

- Secure Synopsis 07 November 2018Document3 pagesSecure Synopsis 07 November 2018Darshan KanganeNo ratings yet

- Commercial Banking System & Role of RBIDocument6 pagesCommercial Banking System & Role of RBIgauravNo ratings yet

- What Is Fiscal Dominance? Explain in Indian Context As Discussed in The ArticleDocument3 pagesWhat Is Fiscal Dominance? Explain in Indian Context As Discussed in The ArticleNimisha BhararaNo ratings yet

- Commercial Banking System Dec 2023Document10 pagesCommercial Banking System Dec 2023Rameshwar BhatiNo ratings yet

- Rift Between RBI and GovtDocument5 pagesRift Between RBI and GovtgaganNo ratings yet

- 9 1Document17 pages9 1VikasRoshanNo ratings yet

- Interview Supplement - 02Document34 pagesInterview Supplement - 02swati singhNo ratings yet

- Credit ControlDocument5 pagesCredit ControlHimanshu GargNo ratings yet

- Assignment - Commercial Banking System and Role of RBIDocument6 pagesAssignment - Commercial Banking System and Role of RBIShivam GoelNo ratings yet

- Monetary Policy Is of Two KindsDocument16 pagesMonetary Policy Is of Two KindsSainath SindheNo ratings yet

- ResearchDocument53 pagesResearchsanhitaNo ratings yet

- Ever NoteDocument22 pagesEver NoteAyush RaiNo ratings yet

- Commercial Banking SystemDocument8 pagesCommercial Banking SystemMohan KottuNo ratings yet

- RBI Credit Control in IndiaDocument11 pagesRBI Credit Control in IndiaDeepjyotiNo ratings yet

- Debt Management in IndiaDocument3 pagesDebt Management in IndiaSarbartho MukherjeeNo ratings yet

- Suggestions Based On IndexDocument21 pagesSuggestions Based On IndexTasviha Taher TrishilaNo ratings yet

- Notes On Last Topic - CH6Document4 pagesNotes On Last Topic - CH6Taran DeepNo ratings yet

- Intervention of RBI in Money MarketDocument1 pageIntervention of RBI in Money MarketSahil AcharyaNo ratings yet

- Raghuraman Rajan's Opening SpeechDocument5 pagesRaghuraman Rajan's Opening SpeechRahul ShakyaNo ratings yet

- KP IifsDocument15 pagesKP IifsKalyani PranjalNo ratings yet

- Credit Control in India - WikipediaDocument20 pagesCredit Control in India - WikipediapranjaliNo ratings yet

- Banking AssignmentDocument7 pagesBanking AssignmentAlikaNo ratings yet

- Banking Terms: Banking Terminology 1. What Is A Repo Rate?Document9 pagesBanking Terms: Banking Terminology 1. What Is A Repo Rate?Ravi AgarwalNo ratings yet

- Rbi V/S Indian Government: Presented byDocument22 pagesRbi V/S Indian Government: Presented byVyshnav PcNo ratings yet

- Financial Sector Reforms in India: An Assessment Montek S. AhluwaliaDocument28 pagesFinancial Sector Reforms in India: An Assessment Montek S. AhluwaliaBhavana AdvaniNo ratings yet

- IEPR493SRR0913Document7 pagesIEPR493SRR0913Harshit MasterNo ratings yet

- RBIDocument5 pagesRBIrichahcpatnaNo ratings yet

- Commercial BankingDocument10 pagesCommercial BankingVikkuNo ratings yet

- PSB and Governance ChallengeDocument16 pagesPSB and Governance ChallengePratiksha GosaliaNo ratings yet

- EditedDocument7 pagesEditedtejasvgahlot05No ratings yet

- Bank PODocument10 pagesBank POtgvnayagamNo ratings yet

- Monetary Policy of IndiaDocument6 pagesMonetary Policy of IndiaKushal PatilNo ratings yet

- P3 Task3B MBATHM02 Kartik TitirmareDocument1 pageP3 Task3B MBATHM02 Kartik TitirmareKartik TitirmareNo ratings yet

- Central BankDocument17 pagesCentral BankSania ZaheerNo ratings yet

- Monetary Policy Monetary Policy DefinedDocument9 pagesMonetary Policy Monetary Policy DefinedXyz YxzNo ratings yet

- Bank GKDocument51 pagesBank GKTarun JakharNo ratings yet

- Roles & Function: Manya Sinha Shreeyansh Swarnkar Shaik Tanveer Hussain Himanshu MauryaDocument12 pagesRoles & Function: Manya Sinha Shreeyansh Swarnkar Shaik Tanveer Hussain Himanshu MauryaAryan YadavNo ratings yet

- Financial Management Report: On "Repo Rate and Impact On GDP"Document10 pagesFinancial Management Report: On "Repo Rate and Impact On GDP"Anjali BhatiaNo ratings yet

- Raghuram Rajans Statement After Taking Charge As RBI Governor - Full Text - NDTVProfitDocument4 pagesRaghuram Rajans Statement After Taking Charge As RBI Governor - Full Text - NDTVProfitVishnu GopalNo ratings yet

- Principles and Practices of BankingDocument63 pagesPrinciples and Practices of BankingPaavni SharmaNo ratings yet

- Meaning: Function of RBIDocument5 pagesMeaning: Function of RBIAnu GuptaNo ratings yet

- Y V Reddy: Public Sector Banks and The Governance Challenge - The Indian ExperienceDocument12 pagesY V Reddy: Public Sector Banks and The Governance Challenge - The Indian ExperiencePsubbu RajNo ratings yet

- Strategic Aspirations of The Reserve Bank of India: Presented By: Gauri Mathur MBA (F&C) - Sem. IIIDocument19 pagesStrategic Aspirations of The Reserve Bank of India: Presented By: Gauri Mathur MBA (F&C) - Sem. IIIAnkita SehgalNo ratings yet

- Banking TermsDocument36 pagesBanking TermslenovojiNo ratings yet

- Ali Afzal - Economy of Pakistan PaperDocument4 pagesAli Afzal - Economy of Pakistan PaperAli Afzal WassanNo ratings yet

- RBI and Banking Sector Reform: Y.V. ReddyDocument10 pagesRBI and Banking Sector Reform: Y.V. ReddyAman KhanNo ratings yet

- Indian Economy Part-II in EnglishDocument116 pagesIndian Economy Part-II in EnglishWTF NewsNo ratings yet

- Reserve Bank of IndiaDocument4 pagesReserve Bank of IndiaashwiniurshgNo ratings yet

- Is RBI An Effective RegulatorDocument73 pagesIs RBI An Effective RegulatorAvinash KandoiNo ratings yet

- Role of Banks in Development of EconomyDocument13 pagesRole of Banks in Development of EconomyAjay SharmaNo ratings yet

- Literature ReviewDocument4 pagesLiterature ReviewJimmy JonesNo ratings yet

- Monetary Policy - Eco ProjectDocument8 pagesMonetary Policy - Eco Projectnandanaa06No ratings yet

- Ibe - Unit-3Document37 pagesIbe - Unit-3Pranav YeleswarapuNo ratings yet

- Role of Urban Cooperative Bank in Banking SectorDocument60 pagesRole of Urban Cooperative Bank in Banking SectorbluechelseanNo ratings yet

- Rbi Monetary PolicyDocument5 pagesRbi Monetary PolicyRohit GuptaNo ratings yet

- Assignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryDocument9 pagesAssignment of Buisness Enviroment MGT 511: TOPIC: Changes in Monetary Policy On Banking Sector or IndustryRohit VermaNo ratings yet

- Monetary Policy - Managerial EconomicsDocument2 pagesMonetary Policy - Managerial EconomicsPrincess Ela Mae CatibogNo ratings yet

- The Handbook for Integrity in the Government Accountability OfficeFrom EverandThe Handbook for Integrity in the Government Accountability OfficeNo ratings yet

- January 2007 NSA PowerPoint On Bulk Collection of Telephony Metadata For AnalystsDocument18 pagesJanuary 2007 NSA PowerPoint On Bulk Collection of Telephony Metadata For AnalystsMatthew KeysNo ratings yet

- San Nicolas, PangasinanDocument2 pagesSan Nicolas, PangasinanSunStar Philippine NewsNo ratings yet

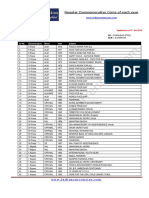

- Yearwise Regular Commemorative Coins of Republic IndiaDocument4 pagesYearwise Regular Commemorative Coins of Republic IndiashambhavNo ratings yet

- E0363 PDFDocument29 pagesE0363 PDFAnjali KilledarNo ratings yet

- Encryption Policy and Its International Impacts: A Framework For Understanding Extraterritorial Ripple EffectsDocument28 pagesEncryption Policy and Its International Impacts: A Framework For Understanding Extraterritorial Ripple EffectsHoover InstitutionNo ratings yet

- Spouses Galang v. Spouses ReyesDocument9 pagesSpouses Galang v. Spouses ReyesRostum AgapitoNo ratings yet

- 3 AMIN Party-List Group v. Executive SecretaryDocument2 pages3 AMIN Party-List Group v. Executive SecretaryJoshua BorresNo ratings yet

- Saldivar Vs CabanesDocument1 pageSaldivar Vs CabanesTrem GallenteNo ratings yet

- Rowan v. ADESA Cincinnati Dayton - Document No. 3Document5 pagesRowan v. ADESA Cincinnati Dayton - Document No. 3Justia.comNo ratings yet

- Dwnload Full Cornerstones of Cost Accounting Canadian 1st Edition Hansen Solutions Manual PDFDocument36 pagesDwnload Full Cornerstones of Cost Accounting Canadian 1st Edition Hansen Solutions Manual PDFthivesbalaom4100% (21)

- Handwashing and ToothbrushingDocument5 pagesHandwashing and ToothbrushingLea RemorozaNo ratings yet

- BarkatDocument2 pagesBarkatjunaid ahmedNo ratings yet

- Elizabeth Lebeau v. Thomas Spirito, Etc., 703 F.2d 639, 1st Cir. (1983)Document8 pagesElizabeth Lebeau v. Thomas Spirito, Etc., 703 F.2d 639, 1st Cir. (1983)Scribd Government DocsNo ratings yet

- History Assignment 2.0Document8 pagesHistory Assignment 2.0Michael WorkinehNo ratings yet

- Tamil Nadu Government Gazette: Part VI-Section 4Document79 pagesTamil Nadu Government Gazette: Part VI-Section 4ebenesarbNo ratings yet

- Ahiara DeclarationDocument28 pagesAhiara DeclarationChukwunonso ArinzeNo ratings yet

- Information For SwissStudent VisaDocument1 pageInformation For SwissStudent VisaAnonymous ErgGsdNo ratings yet

- GIMC: Semi-Finalists - RespondentsDocument45 pagesGIMC: Semi-Finalists - RespondentsAmol Mehta75% (4)

- Antigua and BarbudaDocument15 pagesAntigua and BarbudaclovaliciousNo ratings yet

- Autographics v. PALDocument4 pagesAutographics v. PALCristelle Elaine Collera100% (1)

- Datuk Seri Anwar Ibrahim V Government of Malaysia & AnorDocument80 pagesDatuk Seri Anwar Ibrahim V Government of Malaysia & AnorikmalhmtNo ratings yet

- Job Search LogDocument2 pagesJob Search LogMichael CurtisNo ratings yet

- Case DR Ti Teoh SeowDocument6 pagesCase DR Ti Teoh SeowIqram Meon100% (2)

- League of NationsDocument7 pagesLeague of NationsAbdul HaseebNo ratings yet

- Jonathan Soberanis December 2018 Probable Cause StatementDocument2 pagesJonathan Soberanis December 2018 Probable Cause StatementAdam ForgieNo ratings yet

- Verification, Certification Against Forum Shopping, Memorandum of Appeal, Memorandum, Reply, Motions and Other Necessary Pleadings inDocument2 pagesVerification, Certification Against Forum Shopping, Memorandum of Appeal, Memorandum, Reply, Motions and Other Necessary Pleadings inRbms Soriano100% (1)

- New Microsoft Word DocumentDocument16 pagesNew Microsoft Word DocumentSwastikaRaushniNo ratings yet

- Results - DV - Jr. Steno (Eng.), Jr. Translator (Hindi) - CEN-03-2014 & SSEs & JEs - CEN-01 - 2015)Document1 pageResults - DV - Jr. Steno (Eng.), Jr. Translator (Hindi) - CEN-03-2014 & SSEs & JEs - CEN-01 - 2015)jayeshrane2107No ratings yet