Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

114 viewsCareer Paths Accounting SB-31

Career Paths Accounting SB-31

Uploaded by

YanetThis accounting firm provides concise tax services for both individuals and corporations, including:

1) Corporate tax accounting and preparation of individual tax returns.

2) Assistance with various taxes such as excise tax, sales tax, property tax, and inheritance tax.

3) Filing completed tax forms with the IRS at no additional charge.

Copyright:

© All Rights Reserved

You might also like

- CH 01Document4 pagesCH 01Rabie Haroun50% (2)

- 319 Question BankDocument142 pages319 Question BankElla67% (3)

- Qa Accounting Equation1Document49 pagesQa Accounting Equation1Basanta K SahuNo ratings yet

- Career Paths Accounting SB-28Document1 pageCareer Paths Accounting SB-28YanetNo ratings yet

- InglesDocument3 pagesInglesYanetNo ratings yet

- ERES ApplicationDocument4 pagesERES ApplicationSnovia MohsinNo ratings yet

- Darwin Route10 Pocket Maps/TimetableDocument2 pagesDarwin Route10 Pocket Maps/TimetableLachlanNo ratings yet

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- Income Taxes, Unusual Income Tax Items, and Investments in StocksDocument68 pagesIncome Taxes, Unusual Income Tax Items, and Investments in StockswarsimaNo ratings yet

- UntitledDocument14 pagesUntitledjawaharkumar MBANo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Accountingnincomenstatements 445f7ca6d561b83 PDFDocument2 pagesAccountingnincomenstatements 445f7ca6d561b83 PDFANDREA MELISSA PRADA LAGUADONo ratings yet

- Summer 2021 2Document8 pagesSummer 2021 2shashankNo ratings yet

- Types of Business Organization: Sole ProprietorshipDocument13 pagesTypes of Business Organization: Sole Proprietorshipmani_hashmiNo ratings yet

- IB1 CH 3.4 Final Accounts 2020 PDFDocument38 pagesIB1 CH 3.4 Final Accounts 2020 PDFamira zahari100% (1)

- Tax PlanningDocument2 pagesTax Planningscribed_12No ratings yet

- 2009 German Tax Organizer Siemens VersionDocument108 pages2009 German Tax Organizer Siemens VersionshaonaaNo ratings yet

- Chart of Accounts For PhotographersDocument4 pagesChart of Accounts For PhotographersCarl Rogers PascoNo ratings yet

- Product Markets and National Output Product Markets and National OutputDocument45 pagesProduct Markets and National Output Product Markets and National OutputNadhiNo ratings yet

- Ch16 Taxation 3Document1 pageCh16 Taxation 3Ahmed DanafNo ratings yet

- Lo 1.4 - Household and Personal TaxationDocument8 pagesLo 1.4 - Household and Personal Taxationkatefoskin2008No ratings yet

- What Is Accounting? What Is Accounting?Document22 pagesWhat Is Accounting? What Is Accounting?akg gNo ratings yet

- CH 02Document42 pagesCH 02Lê JerryNo ratings yet

- Taxation LawDocument94 pagesTaxation LawspandanaNo ratings yet

- Chapter 5 - Adjusting The AccountsDocument36 pagesChapter 5 - Adjusting The Accountsffpgy6c6cxNo ratings yet

- Assets Liobililies Owner's Equity: Balance SheetsDocument2 pagesAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANo ratings yet

- Slides Balance Sheet Non Current LiabilitiesDocument8 pagesSlides Balance Sheet Non Current LiabilitiesBISWAJIT DUSADHNo ratings yet

- Accounting-for-Management - QuestAnsDocument47 pagesAccounting-for-Management - QuestAnsUsaMa BhAttiNo ratings yet

- Lesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXDocument2 pagesLesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXRachelle Mae NagalesNo ratings yet

- Basic Accounting - MjdiDocument9 pagesBasic Accounting - MjdiRENz TUBALNo ratings yet

- Presentation On The "Enron Scandal": Presented byDocument26 pagesPresentation On The "Enron Scandal": Presented byarun100% (1)

- Tax 101 Reviewer For Business and Transfer TaxDocument34 pagesTax 101 Reviewer For Business and Transfer TaxVeronika BlairNo ratings yet

- 7.3.1 Topic Test Questions AnswersDocument34 pages7.3.1 Topic Test Questions AnswersliamdrlnNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- Expenses and Allowances For The Self-Employed - What You Need To KnowDocument4 pagesExpenses and Allowances For The Self-Employed - What You Need To KnowsurfmadpigNo ratings yet

- Chapter4 Lao Bsacc 2yb 1Document4 pagesChapter4 Lao Bsacc 2yb 1Jessa LaoNo ratings yet

- Northern Cpa ReviewDocument11 pagesNorthern Cpa Reviewleyn sanburgNo ratings yet

- WEEK 3 Jobs in Accounting PDFDocument2 pagesWEEK 3 Jobs in Accounting PDFdaniNo ratings yet

- Normally Cash Book and Personal Accounts of Debtors & Creditors Are Maintained) - The Other Impersonal Accounts I.EDocument9 pagesNormally Cash Book and Personal Accounts of Debtors & Creditors Are Maintained) - The Other Impersonal Accounts I.EJinse ThomasNo ratings yet

- Dwnload Full Horngrens Accounting 11th Edition Miller Nobles Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Accounting 11th Edition Miller Nobles Solutions Manual PDFbrecciamoodgflo100% (14)

- Chapter 1 - Tax BasicsDocument24 pagesChapter 1 - Tax Basicsrogue.pve1No ratings yet

- LU 1 Slides - 2nd EditionDocument25 pagesLU 1 Slides - 2nd Editionsmxj4zxq5hNo ratings yet

- Unpaid ExpensesDocument2 pagesUnpaid ExpensesANDRE LIZARDO LOPEZ MASIASNo ratings yet

- 2 - Accounting Principles - Chapter (1) Accounting in ActionsDocument11 pages2 - Accounting Principles - Chapter (1) Accounting in ActionsMahmoud Mohamed BadwiNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- ch03 STUDocument41 pagesch03 STUl NguyenNo ratings yet

- Withholding Tax and Value Added TaxDocument11 pagesWithholding Tax and Value Added Taxadewumi mayowaNo ratings yet

- Accounting ProcessDocument36 pagesAccounting ProcessYnnej GemNo ratings yet

- Econ Jahsmen FinalDocument4 pagesEcon Jahsmen FinalJahsmen NavarroNo ratings yet

- Brown Vintage Scrapbook History Museum Report Project PresentationDocument38 pagesBrown Vintage Scrapbook History Museum Report Project PresentationHoward ValenciaNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- ACCOUNTING&FINANCESDocument4 pagesACCOUNTING&FINANCESAnival LopezNo ratings yet

- Script TK B IngDocument3 pagesScript TK B Ingdwioktavia.2023No ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- Chapter 2 NotesDocument7 pagesChapter 2 NoteskhwaishNo ratings yet

- Extra Material Units 1 and 2Document4 pagesExtra Material Units 1 and 2YanetNo ratings yet

- Principles of Accounting: Weygandt Kieso KimmelDocument38 pagesPrinciples of Accounting: Weygandt Kieso KimmelAfsar AhmedNo ratings yet

- 20221217195445D6181 Kimmel Accounting 8e PPT Ch04 Accrual-Accounting-Concepts WithNarrationDocument103 pages20221217195445D6181 Kimmel Accounting 8e PPT Ch04 Accrual-Accounting-Concepts WithNarrationpipityesni13No ratings yet

- Lecture 6 National AccountingDocument6 pagesLecture 6 National Accountinghossam369No ratings yet

- Data and Questions of MacroeconomicsDocument35 pagesData and Questions of MacroeconomicsSudip DhakalNo ratings yet

- Deloitte NL Tax Deloitte Vat Compliance CenterDocument9 pagesDeloitte NL Tax Deloitte Vat Compliance CenterBijiNo ratings yet

- Tax Interest and DepreciationDocument19 pagesTax Interest and Depreciationsohail janNo ratings yet

- The Balance SheetDocument39 pagesThe Balance SheetJUAN ANTONIO CERON CRUZNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Hear OrderDocument3 pagesHear OrderYanetNo ratings yet

- Sent Catch: Order HearDocument3 pagesSent Catch: Order HearYanetNo ratings yet

- InventoryDocument2 pagesInventoryYanetNo ratings yet

- Wha 1'S Going On: 'Ntheback Offlce?Document2 pagesWha 1'S Going On: 'Ntheback Offlce?YanetNo ratings yet

- Extra Material Units 1 and 2Document4 pagesExtra Material Units 1 and 2YanetNo ratings yet

- Guiding Principles of Accounting: Get Ready!Document2 pagesGuiding Principles of Accounting: Get Ready!Yanet0% (1)

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- Cash Flow Statements: Get Ready!Document1 pageCash Flow Statements: Get Ready!YanetNo ratings yet

- Career Paths Accounting SB-20 PDFDocument1 pageCareer Paths Accounting SB-20 PDFYanetNo ratings yet

- Career Paths Accounting SB-30 PDFDocument1 pageCareer Paths Accounting SB-30 PDFYanetNo ratings yet

- Career Paths Accounting SB-26Document1 pageCareer Paths Accounting SB-26YanetNo ratings yet

- Career Paths Accounting SB-27Document1 pageCareer Paths Accounting SB-27YanetNo ratings yet

- Career Paths Accounting SB-22Document1 pageCareer Paths Accounting SB-22YanetNo ratings yet

- Gleaning Information From Financial Statements: ReadingDocument1 pageGleaning Information From Financial Statements: ReadingYanetNo ratings yet

- Career Paths Accounting SB-34 PDFDocument1 pageCareer Paths Accounting SB-34 PDFYanetNo ratings yet

- Career Paths Accounting SB-30Document1 pageCareer Paths Accounting SB-30YanetNo ratings yet

- Career Paths Accounting SB-32Document1 pageCareer Paths Accounting SB-32YanetNo ratings yet

- Office: MaterialsDocument1 pageOffice: MaterialsYanetNo ratings yet

- Speaking: Adjusted Trial BalanceDocument1 pageSpeaking: Adjusted Trial BalanceYanetNo ratings yet

- Speaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..Document1 pageSpeaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..YanetNo ratings yet

- Vocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorDocument2 pagesVocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorYanetNo ratings yet

- A Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteDocument4 pagesA Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteYanetNo ratings yet

- Bookkeeping Cycle: ReadingDocument1 pageBookkeeping Cycle: ReadingYanetNo ratings yet

- DDDDDocument1 pageDDDDYanetNo ratings yet

- PRR Edu11-2019Document14,118 pagesPRR Edu11-2019attaNo ratings yet

- Trade ReportDocument6 pagesTrade ReportIKEOKOLIE HOMEPCNo ratings yet

- Tiger - Gdynia PDFDocument3 pagesTiger - Gdynia PDFnarendraNo ratings yet

- BNK 601 - Tutorial 8 Solutions 2021Document5 pagesBNK 601 - Tutorial 8 Solutions 2021Natasha NadanNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument1 pageMobile Services: Your Account Summary This Month'S ChargesdmrajeshstvtNo ratings yet

- Saad Statement BobDocument3 pagesSaad Statement BobAmisha SinghNo ratings yet

- Exposicion InglesDocument2 pagesExposicion InglesalexNo ratings yet

- University of Kelaniya: Viva Voice Presentation On Business InternshipDocument14 pagesUniversity of Kelaniya: Viva Voice Presentation On Business InternshipAsiri KasunjithNo ratings yet

- Difference Between A Freight Forwarder and NVOCCDocument4 pagesDifference Between A Freight Forwarder and NVOCCGowri SekarNo ratings yet

- BHU Registration Form Con 2Document2 pagesBHU Registration Form Con 2kullsNo ratings yet

- Frequently Asked Questions On VatDocument9 pagesFrequently Asked Questions On VatSteve SantillanNo ratings yet

- 621213320531883RPOSDocument2 pages621213320531883RPOSSIVA KRISHNA PRASAD ARJANo ratings yet

- Kotak Indigo Ka-Ching Credit Card BrochureDocument12 pagesKotak Indigo Ka-Ching Credit Card BrochureSahal RizviNo ratings yet

- Trade - SOC - 01.12.2017 - ICICI PDFDocument4 pagesTrade - SOC - 01.12.2017 - ICICI PDFSanjay GuptaNo ratings yet

- Philhealth Eregistration System: Noreply@Philhealth - Gov.PhDocument4 pagesPhilhealth Eregistration System: Noreply@Philhealth - Gov.PhRhea BernalesNo ratings yet

- Amadeus Quick Reference Help PageDocument14 pagesAmadeus Quick Reference Help PageEric SGN100% (2)

- Top50 Logistics OperatorDocument20 pagesTop50 Logistics Operatoralfredo.caputa4644No ratings yet

- ROHM Apollo Semiconductor Philippines vs. CIRDocument8 pagesROHM Apollo Semiconductor Philippines vs. CIRred gynNo ratings yet

- UGC Pay CalculatorDocument13 pagesUGC Pay CalculatorRajeshje83% (12)

- Allard, Sebastien: SubscriberDocument3 pagesAllard, Sebastien: SubscriberDanielle YoderNo ratings yet

- Financial Accounting ACC500Document48 pagesFinancial Accounting ACC500Jabnon NonjabNo ratings yet

- 8% Tax RuleDocument24 pages8% Tax Rulemarjorie blancoNo ratings yet

- Virtual Construction LTD: Purchases Order Form (POF)Document31 pagesVirtual Construction LTD: Purchases Order Form (POF)Shoyeeb AhmedNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Fare ChartDocument17 pagesFare ChartNagesh SharmaNo ratings yet

- CamDocument511 pagesCamgetrandhir100% (1)

- Start Here: Click ConsultingDocument10 pagesStart Here: Click ConsultingNyasha MakoreNo ratings yet

- Statement Bank March J o Fleet Services LLC D375ad5b17Document10 pagesStatement Bank March J o Fleet Services LLC D375ad5b17Madelyn VasquezNo ratings yet

Career Paths Accounting SB-31

Career Paths Accounting SB-31

Uploaded by

Yanet0 ratings0% found this document useful (0 votes)

114 views1 pageThis accounting firm provides concise tax services for both individuals and corporations, including:

1) Corporate tax accounting and preparation of individual tax returns.

2) Assistance with various taxes such as excise tax, sales tax, property tax, and inheritance tax.

3) Filing completed tax forms with the IRS at no additional charge.

Original Description:

Original Title

Career_Paths_Accounting_SB-31

Copyright

© © All Rights Reserved

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis accounting firm provides concise tax services for both individuals and corporations, including:

1) Corporate tax accounting and preparation of individual tax returns.

2) Assistance with various taxes such as excise tax, sales tax, property tax, and inheritance tax.

3) Filing completed tax forms with the IRS at no additional charge.

Copyright:

© All Rights Reserved

0 ratings0% found this document useful (0 votes)

114 views1 pageCareer Paths Accounting SB-31

Career Paths Accounting SB-31

Uploaded by

YanetThis accounting firm provides concise tax services for both individuals and corporations, including:

1) Corporate tax accounting and preparation of individual tax returns.

2) Assistance with various taxes such as excise tax, sales tax, property tax, and inheritance tax.

3) Filing completed tax forms with the IRS at no additional charge.

Copyright:

© All Rights Reserved

You are on page 1of 1

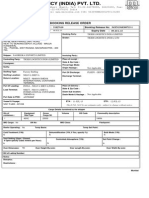

1 . 0 an and Associates.

That's the prorn~se of Ca v1n nti~ Our experienced

We specialize in ta\~cc1f~our ~~x accounting needs:

accountants help you w1 a

•Excise tax

• corporate tax

• Inheritance tax

•Sales tax

• Value-added tax

• Property tax

Get Ready! . d rporate accounting,

0 Before you read the passage, In addition to in~iv1dual ~~x ~r~paration services.

talk about these questions. we also offer inc?rn~. t our tax forms.

We assist you in.f1lhnhg ~~Syat no additional charge.

1 What are some different types of taxes?

2 How do accountants help with taxes?

k:

Then we will file thdern tw1trnh at an appointment.

Call to ay o

Reading 0 Fill in the blanks with the

correct words and phrases

f) Read the advertisement from an accounting firm. Then, from the word bank.

mark the following statements as true (T) or false (F).

1 _ The firm works with both individuals and corporations.

2 _ The company does not fill out tax forms. value-added tax specialize

IRS excise tax tax forms

3 _ There is an additional fee for filing with the IRS.

1 In addition to paying taxes, people

Vocabulary also have to file _ _ __

f) Match the words (1-5) with the definitions (A-E). 2 The is the U.S.

agency in charge of taxation.

1 _ corporate tax 4 _sales tax

3 Accountants sometimes

2 _ property tax 5 _ inheritance tax _ _ _ _ in a certain type of

3 _file accounting.

4 is a fee for

A money that businesses pay to a government

producing products like fuel and

B money that is paid to a government after a person dies tobacco.

C a fee that local governments charge owners of real estate 5 is charged at each

D a fee that governments charge when goods are sold step in the manufacturing

E to submit documents to a government agency process.

30

You might also like

- CH 01Document4 pagesCH 01Rabie Haroun50% (2)

- 319 Question BankDocument142 pages319 Question BankElla67% (3)

- Qa Accounting Equation1Document49 pagesQa Accounting Equation1Basanta K SahuNo ratings yet

- Career Paths Accounting SB-28Document1 pageCareer Paths Accounting SB-28YanetNo ratings yet

- InglesDocument3 pagesInglesYanetNo ratings yet

- ERES ApplicationDocument4 pagesERES ApplicationSnovia MohsinNo ratings yet

- Darwin Route10 Pocket Maps/TimetableDocument2 pagesDarwin Route10 Pocket Maps/TimetableLachlanNo ratings yet

- 01 Accounting StatementsDocument4 pages01 Accounting StatementsTijana DoberšekNo ratings yet

- Income Taxes, Unusual Income Tax Items, and Investments in StocksDocument68 pagesIncome Taxes, Unusual Income Tax Items, and Investments in StockswarsimaNo ratings yet

- UntitledDocument14 pagesUntitledjawaharkumar MBANo ratings yet

- Acct615 NjitDocument24 pagesAcct615 NjithjnNo ratings yet

- Accountingnincomenstatements 445f7ca6d561b83 PDFDocument2 pagesAccountingnincomenstatements 445f7ca6d561b83 PDFANDREA MELISSA PRADA LAGUADONo ratings yet

- Summer 2021 2Document8 pagesSummer 2021 2shashankNo ratings yet

- Types of Business Organization: Sole ProprietorshipDocument13 pagesTypes of Business Organization: Sole Proprietorshipmani_hashmiNo ratings yet

- IB1 CH 3.4 Final Accounts 2020 PDFDocument38 pagesIB1 CH 3.4 Final Accounts 2020 PDFamira zahari100% (1)

- Tax PlanningDocument2 pagesTax Planningscribed_12No ratings yet

- 2009 German Tax Organizer Siemens VersionDocument108 pages2009 German Tax Organizer Siemens VersionshaonaaNo ratings yet

- Chart of Accounts For PhotographersDocument4 pagesChart of Accounts For PhotographersCarl Rogers PascoNo ratings yet

- Product Markets and National Output Product Markets and National OutputDocument45 pagesProduct Markets and National Output Product Markets and National OutputNadhiNo ratings yet

- Ch16 Taxation 3Document1 pageCh16 Taxation 3Ahmed DanafNo ratings yet

- Lo 1.4 - Household and Personal TaxationDocument8 pagesLo 1.4 - Household and Personal Taxationkatefoskin2008No ratings yet

- What Is Accounting? What Is Accounting?Document22 pagesWhat Is Accounting? What Is Accounting?akg gNo ratings yet

- CH 02Document42 pagesCH 02Lê JerryNo ratings yet

- Taxation LawDocument94 pagesTaxation LawspandanaNo ratings yet

- Chapter 5 - Adjusting The AccountsDocument36 pagesChapter 5 - Adjusting The Accountsffpgy6c6cxNo ratings yet

- Assets Liobililies Owner's Equity: Balance SheetsDocument2 pagesAssets Liobililies Owner's Equity: Balance SheetsVARGAS PALOMINO KIARA PAMELANo ratings yet

- Slides Balance Sheet Non Current LiabilitiesDocument8 pagesSlides Balance Sheet Non Current LiabilitiesBISWAJIT DUSADHNo ratings yet

- Accounting-for-Management - QuestAnsDocument47 pagesAccounting-for-Management - QuestAnsUsaMa BhAttiNo ratings yet

- Lesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXDocument2 pagesLesson 1 Theories On Business Tax, Percentage Tax, and Excise TAXRachelle Mae NagalesNo ratings yet

- Basic Accounting - MjdiDocument9 pagesBasic Accounting - MjdiRENz TUBALNo ratings yet

- Presentation On The "Enron Scandal": Presented byDocument26 pagesPresentation On The "Enron Scandal": Presented byarun100% (1)

- Tax 101 Reviewer For Business and Transfer TaxDocument34 pagesTax 101 Reviewer For Business and Transfer TaxVeronika BlairNo ratings yet

- 7.3.1 Topic Test Questions AnswersDocument34 pages7.3.1 Topic Test Questions AnswersliamdrlnNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- Expenses and Allowances For The Self-Employed - What You Need To KnowDocument4 pagesExpenses and Allowances For The Self-Employed - What You Need To KnowsurfmadpigNo ratings yet

- Chapter4 Lao Bsacc 2yb 1Document4 pagesChapter4 Lao Bsacc 2yb 1Jessa LaoNo ratings yet

- Northern Cpa ReviewDocument11 pagesNorthern Cpa Reviewleyn sanburgNo ratings yet

- WEEK 3 Jobs in Accounting PDFDocument2 pagesWEEK 3 Jobs in Accounting PDFdaniNo ratings yet

- Normally Cash Book and Personal Accounts of Debtors & Creditors Are Maintained) - The Other Impersonal Accounts I.EDocument9 pagesNormally Cash Book and Personal Accounts of Debtors & Creditors Are Maintained) - The Other Impersonal Accounts I.EJinse ThomasNo ratings yet

- Dwnload Full Horngrens Accounting 11th Edition Miller Nobles Solutions Manual PDFDocument36 pagesDwnload Full Horngrens Accounting 11th Edition Miller Nobles Solutions Manual PDFbrecciamoodgflo100% (14)

- Chapter 1 - Tax BasicsDocument24 pagesChapter 1 - Tax Basicsrogue.pve1No ratings yet

- LU 1 Slides - 2nd EditionDocument25 pagesLU 1 Slides - 2nd Editionsmxj4zxq5hNo ratings yet

- Unpaid ExpensesDocument2 pagesUnpaid ExpensesANDRE LIZARDO LOPEZ MASIASNo ratings yet

- 2 - Accounting Principles - Chapter (1) Accounting in ActionsDocument11 pages2 - Accounting Principles - Chapter (1) Accounting in ActionsMahmoud Mohamed BadwiNo ratings yet

- Final IBF (Numerical) Chapter 2, 5 & 15Document13 pagesFinal IBF (Numerical) Chapter 2, 5 & 15Imtiaz SultanNo ratings yet

- ch03 STUDocument41 pagesch03 STUl NguyenNo ratings yet

- Withholding Tax and Value Added TaxDocument11 pagesWithholding Tax and Value Added Taxadewumi mayowaNo ratings yet

- Accounting ProcessDocument36 pagesAccounting ProcessYnnej GemNo ratings yet

- Econ Jahsmen FinalDocument4 pagesEcon Jahsmen FinalJahsmen NavarroNo ratings yet

- Brown Vintage Scrapbook History Museum Report Project PresentationDocument38 pagesBrown Vintage Scrapbook History Museum Report Project PresentationHoward ValenciaNo ratings yet

- AFM CH 2Document58 pagesAFM CH 2Birhanu MengisteNo ratings yet

- ACCOUNTING&FINANCESDocument4 pagesACCOUNTING&FINANCESAnival LopezNo ratings yet

- Script TK B IngDocument3 pagesScript TK B Ingdwioktavia.2023No ratings yet

- Introduction To Accounting and FinanceDocument39 pagesIntroduction To Accounting and FinanceEngr Muhammad RohanNo ratings yet

- Chapter 2 NotesDocument7 pagesChapter 2 NoteskhwaishNo ratings yet

- Extra Material Units 1 and 2Document4 pagesExtra Material Units 1 and 2YanetNo ratings yet

- Principles of Accounting: Weygandt Kieso KimmelDocument38 pagesPrinciples of Accounting: Weygandt Kieso KimmelAfsar AhmedNo ratings yet

- 20221217195445D6181 Kimmel Accounting 8e PPT Ch04 Accrual-Accounting-Concepts WithNarrationDocument103 pages20221217195445D6181 Kimmel Accounting 8e PPT Ch04 Accrual-Accounting-Concepts WithNarrationpipityesni13No ratings yet

- Lecture 6 National AccountingDocument6 pagesLecture 6 National Accountinghossam369No ratings yet

- Data and Questions of MacroeconomicsDocument35 pagesData and Questions of MacroeconomicsSudip DhakalNo ratings yet

- Deloitte NL Tax Deloitte Vat Compliance CenterDocument9 pagesDeloitte NL Tax Deloitte Vat Compliance CenterBijiNo ratings yet

- Tax Interest and DepreciationDocument19 pagesTax Interest and Depreciationsohail janNo ratings yet

- The Balance SheetDocument39 pagesThe Balance SheetJUAN ANTONIO CERON CRUZNo ratings yet

- Homeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransFrom EverandHomeowner's Simple Guide to Property Tax Protest: Whats key: Exemptions & Deductions Blind. Disabled. Over 65. Property Rehabilitation. VeteransNo ratings yet

- Hear OrderDocument3 pagesHear OrderYanetNo ratings yet

- Sent Catch: Order HearDocument3 pagesSent Catch: Order HearYanetNo ratings yet

- InventoryDocument2 pagesInventoryYanetNo ratings yet

- Wha 1'S Going On: 'Ntheback Offlce?Document2 pagesWha 1'S Going On: 'Ntheback Offlce?YanetNo ratings yet

- Extra Material Units 1 and 2Document4 pagesExtra Material Units 1 and 2YanetNo ratings yet

- Guiding Principles of Accounting: Get Ready!Document2 pagesGuiding Principles of Accounting: Get Ready!Yanet0% (1)

- Career Paths Accounting SB-33Document1 pageCareer Paths Accounting SB-33YanetNo ratings yet

- Career Paths Accounting SB-17Document1 pageCareer Paths Accounting SB-17YanetNo ratings yet

- Cash Flow Statements: Get Ready!Document1 pageCash Flow Statements: Get Ready!YanetNo ratings yet

- Career Paths Accounting SB-20 PDFDocument1 pageCareer Paths Accounting SB-20 PDFYanetNo ratings yet

- Career Paths Accounting SB-30 PDFDocument1 pageCareer Paths Accounting SB-30 PDFYanetNo ratings yet

- Career Paths Accounting SB-26Document1 pageCareer Paths Accounting SB-26YanetNo ratings yet

- Career Paths Accounting SB-27Document1 pageCareer Paths Accounting SB-27YanetNo ratings yet

- Career Paths Accounting SB-22Document1 pageCareer Paths Accounting SB-22YanetNo ratings yet

- Gleaning Information From Financial Statements: ReadingDocument1 pageGleaning Information From Financial Statements: ReadingYanetNo ratings yet

- Career Paths Accounting SB-34 PDFDocument1 pageCareer Paths Accounting SB-34 PDFYanetNo ratings yet

- Career Paths Accounting SB-30Document1 pageCareer Paths Accounting SB-30YanetNo ratings yet

- Career Paths Accounting SB-32Document1 pageCareer Paths Accounting SB-32YanetNo ratings yet

- Office: MaterialsDocument1 pageOffice: MaterialsYanetNo ratings yet

- Speaking: Adjusted Trial BalanceDocument1 pageSpeaking: Adjusted Trial BalanceYanetNo ratings yet

- Speaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..Document1 pageSpeaking: There S A Problem With You Sent .. But We Ordered I Apologize For The Error We LL ..YanetNo ratings yet

- Vocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorDocument2 pagesVocabulary Pay Attention Naughty Lovely Parents Feed Fight All The Time Do The Bed Candy (Ies) Share Toys As Advices BehaviorYanetNo ratings yet

- A Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteDocument4 pagesA Continuación, Encontrarás El Texto Visto en Clase. El Texto Tiene Algunos Errores Que Tú Debes Corregir. Revisa Muy CuidadosamenteYanetNo ratings yet

- Bookkeeping Cycle: ReadingDocument1 pageBookkeeping Cycle: ReadingYanetNo ratings yet

- DDDDDocument1 pageDDDDYanetNo ratings yet

- PRR Edu11-2019Document14,118 pagesPRR Edu11-2019attaNo ratings yet

- Trade ReportDocument6 pagesTrade ReportIKEOKOLIE HOMEPCNo ratings yet

- Tiger - Gdynia PDFDocument3 pagesTiger - Gdynia PDFnarendraNo ratings yet

- BNK 601 - Tutorial 8 Solutions 2021Document5 pagesBNK 601 - Tutorial 8 Solutions 2021Natasha NadanNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument1 pageMobile Services: Your Account Summary This Month'S ChargesdmrajeshstvtNo ratings yet

- Saad Statement BobDocument3 pagesSaad Statement BobAmisha SinghNo ratings yet

- Exposicion InglesDocument2 pagesExposicion InglesalexNo ratings yet

- University of Kelaniya: Viva Voice Presentation On Business InternshipDocument14 pagesUniversity of Kelaniya: Viva Voice Presentation On Business InternshipAsiri KasunjithNo ratings yet

- Difference Between A Freight Forwarder and NVOCCDocument4 pagesDifference Between A Freight Forwarder and NVOCCGowri SekarNo ratings yet

- BHU Registration Form Con 2Document2 pagesBHU Registration Form Con 2kullsNo ratings yet

- Frequently Asked Questions On VatDocument9 pagesFrequently Asked Questions On VatSteve SantillanNo ratings yet

- 621213320531883RPOSDocument2 pages621213320531883RPOSSIVA KRISHNA PRASAD ARJANo ratings yet

- Kotak Indigo Ka-Ching Credit Card BrochureDocument12 pagesKotak Indigo Ka-Ching Credit Card BrochureSahal RizviNo ratings yet

- Trade - SOC - 01.12.2017 - ICICI PDFDocument4 pagesTrade - SOC - 01.12.2017 - ICICI PDFSanjay GuptaNo ratings yet

- Philhealth Eregistration System: Noreply@Philhealth - Gov.PhDocument4 pagesPhilhealth Eregistration System: Noreply@Philhealth - Gov.PhRhea BernalesNo ratings yet

- Amadeus Quick Reference Help PageDocument14 pagesAmadeus Quick Reference Help PageEric SGN100% (2)

- Top50 Logistics OperatorDocument20 pagesTop50 Logistics Operatoralfredo.caputa4644No ratings yet

- ROHM Apollo Semiconductor Philippines vs. CIRDocument8 pagesROHM Apollo Semiconductor Philippines vs. CIRred gynNo ratings yet

- UGC Pay CalculatorDocument13 pagesUGC Pay CalculatorRajeshje83% (12)

- Allard, Sebastien: SubscriberDocument3 pagesAllard, Sebastien: SubscriberDanielle YoderNo ratings yet

- Financial Accounting ACC500Document48 pagesFinancial Accounting ACC500Jabnon NonjabNo ratings yet

- 8% Tax RuleDocument24 pages8% Tax Rulemarjorie blancoNo ratings yet

- Virtual Construction LTD: Purchases Order Form (POF)Document31 pagesVirtual Construction LTD: Purchases Order Form (POF)Shoyeeb AhmedNo ratings yet

- Servlet ControllerDocument1 pageServlet Controllermukesh sahuNo ratings yet

- Fare ChartDocument17 pagesFare ChartNagesh SharmaNo ratings yet

- CamDocument511 pagesCamgetrandhir100% (1)

- Start Here: Click ConsultingDocument10 pagesStart Here: Click ConsultingNyasha MakoreNo ratings yet

- Statement Bank March J o Fleet Services LLC D375ad5b17Document10 pagesStatement Bank March J o Fleet Services LLC D375ad5b17Madelyn VasquezNo ratings yet