Professional Documents

Culture Documents

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

Uploaded by

arnab.for.ever9439Copyright:

Available Formats

You might also like

- Fundamentals of Corporate Finance 9th Edition by Brealey Myers Marcus ISBN Solution ManualDocument35 pagesFundamentals of Corporate Finance 9th Edition by Brealey Myers Marcus ISBN Solution Manualmatthew100% (29)

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Impacts of IFRS 17 Insurance Contracts Accounting Standard: Considerations For Data, Systems and ProcessesDocument23 pagesImpacts of IFRS 17 Insurance Contracts Accounting Standard: Considerations For Data, Systems and ProcessesjaxNo ratings yet

- US GAAP vs. IFRS - Key Differences in Accounting For Insurance ContractsDocument8 pagesUS GAAP vs. IFRS - Key Differences in Accounting For Insurance ContractsRicardo Laines LopezNo ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- ButlerDocument1 pageButlerarnab.for.ever9439100% (1)

- Variable IC Mock Exam - 02062020 PDFDocument30 pagesVariable IC Mock Exam - 02062020 PDFMikaella Sarmiento100% (1)

- 5 Stock To DoubleDocument25 pages5 Stock To DoubleLao ZhuNo ratings yet

- Investments BKM - 9e SolutionsDocument246 pagesInvestments BKM - 9e SolutionsMichael Ong100% (3)

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Document6 pagesIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesNo ratings yet

- IFRS17 Measurement and ApplicabilityDocument2 pagesIFRS17 Measurement and Applicabilityالخليفة دجوNo ratings yet

- Ifrs 17 Insurance ContractsDocument144 pagesIfrs 17 Insurance Contractsace zero100% (1)

- 1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCDocument156 pages1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCctprimaNo ratings yet

- IFRS 4 Insurance ContractsDocument27 pagesIFRS 4 Insurance ContractsAdam CuencaNo ratings yet

- Introduction To IFRS17Document37 pagesIntroduction To IFRS17baraalqasemNo ratings yet

- IFRS 17 Level of Aggregation - Background Briefing Paper FinalDocument19 pagesIFRS 17 Level of Aggregation - Background Briefing Paper FinalEmmanuelNo ratings yet

- HKFRS 17 - 2023Document309 pagesHKFRS 17 - 2023sashahe95No ratings yet

- EligibilityDocument20 pagesEligibilitynidasak12No ratings yet

- 2017 11 07 Ifrs 17 DeloitteDocument20 pages2017 11 07 Ifrs 17 Deloitteyousefjubran1997No ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- In The Spotlight: IFRS 17 Affects More Than Just Insurance CompaniesDocument14 pagesIn The Spotlight: IFRS 17 Affects More Than Just Insurance Companiesgir botNo ratings yet

- Contentdamifrsmeetings2014marchiasbinsurance Contractsap2d Use of Oci in Discount Rates PDFDocument28 pagesContentdamifrsmeetings2014marchiasbinsurance Contractsap2d Use of Oci in Discount Rates PDFmaria sol fernandezNo ratings yet

- IASB Issues Amendments To Ifrs 17: Insurance Accounting AlertDocument16 pagesIASB Issues Amendments To Ifrs 17: Insurance Accounting AlertYoanNo ratings yet

- Ap2b Amendments To Ifrs 17Document11 pagesAp2b Amendments To Ifrs 17Ioanna ZlatevaNo ratings yet

- Ey Good Insurance General Model Paa Nov 2020Document99 pagesEy Good Insurance General Model Paa Nov 2020Arlinda MartinajNo ratings yet

- IFRB 2023 06 Implications of IFRS 17 For Non InsurersDocument10 pagesIFRB 2023 06 Implications of IFRS 17 For Non InsurersSkymoonNo ratings yet

- IFRS17 Considerations Health InsurersDocument4 pagesIFRS17 Considerations Health Insurersjester lawNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- File 1 - Overview IFRS 17Document30 pagesFile 1 - Overview IFRS 17mcahya82No ratings yet

- PSC Introduction To Financial Derivatives and Hedging StrategiesDocument14 pagesPSC Introduction To Financial Derivatives and Hedging StrategiesAbdul Azim Zainal AbidinNo ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- A Deeper Dive - Full Slides IFRS17Document69 pagesA Deeper Dive - Full Slides IFRS17baraalqasemNo ratings yet

- Asc 2018-12Document193 pagesAsc 2018-12Babymetal LoNo ratings yet

- Contractual Terms and CDS PricingDocument12 pagesContractual Terms and CDS PricingSongHan123No ratings yet

- IFRS 17 Background Briefing Paper CSM AllocationDocument38 pagesIFRS 17 Background Briefing Paper CSM AllocationWubneh AlemuNo ratings yet

- 2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYDocument99 pages2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYctprimaNo ratings yet

- 1a. Insurance-Contracts-Accounting-Guide PWCDocument375 pages1a. Insurance-Contracts-Accounting-Guide PWCctprimaNo ratings yet

- Supervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryDocument3 pagesSupervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryЙоанна ЗNo ratings yet

- How To Standardize RE PPA With Fair Risk DistributionDocument12 pagesHow To Standardize RE PPA With Fair Risk DistributionAfian Dwi PrasetyoNo ratings yet

- PWC Revenue From Contracts With CustomersDocument16 pagesPWC Revenue From Contracts With CustomersJobelyn CasimNo ratings yet

- Q1 2022 iAFC iAIFS IFRS 17 PDF V2Document25 pagesQ1 2022 iAFC iAIFS IFRS 17 PDF V2Ioanna ZlatevaNo ratings yet

- 3blocks - IFRS 17 PDFDocument131 pages3blocks - IFRS 17 PDFDurgaprasad VelamalaNo ratings yet

- PWC Ifrs 17 Is Coming PDFDocument6 pagesPWC Ifrs 17 Is Coming PDFmarhadiNo ratings yet

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocument32 pagesIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulNo ratings yet

- Pfrs15 (No Appendix)Document15 pagesPfrs15 (No Appendix)AnDrea ChavEzNo ratings yet

- Revenue From Contracts With Customers: Indian Accounting Standard 115Document97 pagesRevenue From Contracts With Customers: Indian Accounting Standard 115Aarush GargNo ratings yet

- AP Newsletter Q4 2018 PDFDocument28 pagesAP Newsletter Q4 2018 PDFMuhammad SheikhNo ratings yet

- IFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALDocument80 pagesIFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALbaraalqasem100% (1)

- GX Ifrs17 What Does It Mean For YouDocument12 pagesGX Ifrs17 What Does It Mean For YouZaid KamalNo ratings yet

- Ifrs 4 Practical Guide PDFDocument5 pagesIfrs 4 Practical Guide PDFAdrianaNo ratings yet

- (Ic0210b14bobs) Variable and Unit-Linked Contracts - Separate AccountsDocument14 pages(Ic0210b14bobs) Variable and Unit-Linked Contracts - Separate AccountsElla ServantesNo ratings yet

- Bridging The GAAP - IFRS 17 and LDTIDocument5 pagesBridging The GAAP - IFRS 17 and LDTImikfrancisNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- IFRS 17 Simplified Case Study PDFDocument18 pagesIFRS 17 Simplified Case Study PDFAnonymous H1l0FwNYPS0% (1)

- Yardimci Ufrs Rehberi PDFDocument39 pagesYardimci Ufrs Rehberi PDFEhli HibreNo ratings yet

- IFRS 4 Vs IFRS 17Document3 pagesIFRS 4 Vs IFRS 17Cristel TannaganNo ratings yet

- PWC Revenue From Contracts With Customers Industry SupplementDocument25 pagesPWC Revenue From Contracts With Customers Industry SupplementAmy SpencerNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- Commentary ISDA Master Agreements PDFDocument24 pagesCommentary ISDA Master Agreements PDFJahanzeb DurraniNo ratings yet

- Five-Golden Principles of FIDICDocument4 pagesFive-Golden Principles of FIDICMintesnot BogaleNo ratings yet

- International Financial Reporting Standard IFRS 17 - Insurance ContractsDocument14 pagesInternational Financial Reporting Standard IFRS 17 - Insurance ContractsLiz NguyenNo ratings yet

- IFRS 4 Implementation GuidanceDocument50 pagesIFRS 4 Implementation GuidanceMariana MirelaNo ratings yet

- 4 Insurance ContractDocument40 pages4 Insurance ContractChelsea Anne VidalloNo ratings yet

- Demystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidDocument43 pagesDemystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidWubneh AlemuNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- 7 Trends Transforming The Insurance Industry 062513 - v2b PDFDocument17 pages7 Trends Transforming The Insurance Industry 062513 - v2b PDFarnab.for.ever9439No ratings yet

- Home Insurance Laws Etc. Regulations: RegulationDocument4 pagesHome Insurance Laws Etc. Regulations: Regulationarnab.for.ever9439No ratings yet

- Key US Regulatory Reforms and Opportunities For Actuaries in IndiaDocument11 pagesKey US Regulatory Reforms and Opportunities For Actuaries in Indiaarnab.for.ever9439No ratings yet

- Job Description Data Scientist AkzoNobelDocument3 pagesJob Description Data Scientist AkzoNobelarnab.for.ever9439No ratings yet

- Up Up Up: Wake To Ldti Keep With Innovation Step Actuarial PerformanceDocument15 pagesUp Up Up: Wake To Ldti Keep With Innovation Step Actuarial Performancearnab.for.ever9439No ratings yet

- List of Approved Insurance Web Aggregators As 31 01 2017Document2 pagesList of Approved Insurance Web Aggregators As 31 01 2017arnab.for.ever9439No ratings yet

- Right For InformationDocument4 pagesRight For Informationarnab.for.ever9439No ratings yet

- 174-White Paper Insurance Aggregator 13022014 WEBDocument15 pages174-White Paper Insurance Aggregator 13022014 WEBarnab.for.ever9439No ratings yet

- Coming To Terms With Insurance Aggregators:: Global Lessons For CarriersDocument12 pagesComing To Terms With Insurance Aggregators:: Global Lessons For Carriersarnab.for.ever9439No ratings yet

- Internet of Things ReportDocument108 pagesInternet of Things Reportarnab.for.ever9439No ratings yet

- 7 Trends Transforming The Insurance Industry 062513 - v2b PDFDocument17 pages7 Trends Transforming The Insurance Industry 062513 - v2b PDFarnab.for.ever9439No ratings yet

- AGEAS DistributionDocument13 pagesAGEAS Distributionarnab.for.ever9439No ratings yet

- Accenture Coming To Terms With AggregatorsDocument12 pagesAccenture Coming To Terms With Aggregatorsarnab.for.ever9439No ratings yet

- Invest EcDocument4 pagesInvest Ecarnab.for.ever9439No ratings yet

- 2001 Prentice Hall, Inc. All Rights ReservedDocument12 pages2001 Prentice Hall, Inc. All Rights Reservedarnab.for.ever9439No ratings yet

- ERP NTPC-FinalDocument41 pagesERP NTPC-Finalarnab.for.ever9439100% (1)

- Total Quality Management Session by MukherjeeDocument2 pagesTotal Quality Management Session by Mukherjeearnab.for.ever9439No ratings yet

- Madonna CaseDocument3 pagesMadonna Casearnab.for.ever9439100% (1)

- Academic CalendarDocument1 pageAcademic Calendararnab.for.ever9439No ratings yet

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- FIN 201 Chapter 02 TheoryDocument24 pagesFIN 201 Chapter 02 TheoryAhmed ShantoNo ratings yet

- Divis Laboratories Initiating Coverage 15062020Document7 pagesDivis Laboratories Initiating Coverage 15062020vigneshnv77No ratings yet

- The Effect of Capital Structure Choice On Banking Performance: Empirical Evidence From GhanaDocument52 pagesThe Effect of Capital Structure Choice On Banking Performance: Empirical Evidence From GhanaErnest GabluiNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- 2016 AFR PaperDocument6 pages2016 AFR Paperrwl s.r.lNo ratings yet

- Indian Stock MarketDocument71 pagesIndian Stock MarketNeha Thakur100% (1)

- High Dividend YieldDocument6 pagesHigh Dividend YieldErnie DaysNo ratings yet

- PDF Chapter 2 Cash and Cash Equivalents Problems - CompressDocument2 pagesPDF Chapter 2 Cash and Cash Equivalents Problems - CompresspehikNo ratings yet

- CBS Selection - GartnerDocument6 pagesCBS Selection - GartnerSIYONA CHAMOLANo ratings yet

- Introduction To Financial InstrumentsDocument21 pagesIntroduction To Financial InstrumentsSky SoronoiNo ratings yet

- محمد مجدي كيز جروبDocument6 pagesمحمد مجدي كيز جروبAlaa HassaninNo ratings yet

- PSO FinanceDocument18 pagesPSO FinancesabaNo ratings yet

- Chapter 05 Test Bank - StaticDocument14 pagesChapter 05 Test Bank - StaticCaioGamaNo ratings yet

- Bem102 7Document22 pagesBem102 7Mellisa AndileNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- Managerial Accounting Tools For Business Canadian 3Rd Edition Weygandt Test Bank Full Chapter PDFDocument67 pagesManagerial Accounting Tools For Business Canadian 3Rd Edition Weygandt Test Bank Full Chapter PDFcomplinofficialjasms100% (14)

- Chapter 6 - Accounting For MerchandiseDocument30 pagesChapter 6 - Accounting For MerchandiseTrần Anh TuấnNo ratings yet

- Technical Analysis On Banks Dissertation PDFDocument18 pagesTechnical Analysis On Banks Dissertation PDFWaibhav KrishnaNo ratings yet

- Formula Sheet: Part I: Financial StatementDocument2 pagesFormula Sheet: Part I: Financial StatementSachin Kumar GoyelNo ratings yet

- Casper Investor Presentation 2Q'21 August UpdateDocument20 pagesCasper Investor Presentation 2Q'21 August UpdatepaoscagNo ratings yet

- Series 86 87 Content Outline RevisedDocument9 pagesSeries 86 87 Content Outline RevisedRaghdaNo ratings yet

- Business ValuationDocument9 pagesBusiness ValuationMohsin AijazNo ratings yet

- NFO Tata Growing Economies Infrastructure FundDocument12 pagesNFO Tata Growing Economies Infrastructure FundDrashti Investments100% (1)

- Financial MathDocument50 pagesFinancial Mathfabricioace1978No ratings yet

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

Uploaded by

arnab.for.ever9439Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

05-03 Comparison IFRS 17 and US GAAP - Issues Paper 18-07-05

Uploaded by

arnab.for.ever9439Copyright:

Available Formats

EFRAG TEG meeting

5 July 2018

Paper 05-03

EFRAG Secretariat: Insurance team

This paper has been prepared by the EFRAG Secretariat for discussion at a public meeting of EFRAG TEG.

The paper forms part of an early stage of the development of a potential EFRAG position. Consequently, the

paper does not represent the official views of EFRAG or any individual member of the EFRAG Board or

EFRAG TEG. The paper is made available to enable the public to follow the discussions in the meeting.

Tentative decisions are made in public and reported in the EFRAG Update. EFRAG positions, as approved

by the EFRAG Board, are published as comment letters, discussion or position papers, or in any other form

considered appropriate in the circumstances.

Summary of US GAAP requirements for insurance (including

proposed changes to the Accounting for Long-Duration

Insurance Contracts) and comparison with IFRS 17

Issues Paper

Introduction

1 In comparing US GAAP requirements with IFRS 17, this paper considers US GAAP

ASC Topic 944 Financial Services—Insurance in addition to IFRS 17. The proposed

changes for Long-duration Contracts have also been considered. The paper is

designed to provide the technical basis for the assessment in the draft endorsement

advice of the impact on competition, if any, of the technical differences between

insurers applying US GAAP and insurers applying IFRS 17.

2 This paper has been reviewed by the EFRAG IAWG at its meeting on 24 May 2018.

Comments from EFRAG IAWG members will be addressed in updating the paper.

Question to EFRAG TEG

3 Do EFRAG TEG members have comments on the comparison between US GAAP

requirements for insurance and IFRS 17?

Summary of proposed changes for Long-duration Contracts

4 In September 2016, the FASB issued a proposed Accounting Standards Update,

Financial Services—Insurance (Topic 944): Targeted Improvements to the

Accounting for Long-duration Contracts. These targeted improvements are intended

to:

(a) Improve the timeliness of recognising changes in the liability for future policy

benefits by requiring that updated assumptions be used to measure the

liability for future policy benefits (i.e. assumptions would be unlocked) and

modify the rate used to discount future cash flows;

(b) Simplify and improve the accounting for certain options or guarantees

embedded in deposit (or account balance) contracts;

(c) Simplify the amortisation of deferred acquisition costs (DAC); and

(d) Improve the effectiveness of required disclosures.

Comparing the requirements

5 The US GAAP requirements for insurance contracts differ from the requirements of

IFRS 17. The main differences between the two frameworks are related to the

following areas:

(a) Scope;

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 1 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

(b) Different types of insurance contracts – overall view;

(c) Measurement of insurance contracts;

(d) Level of aggregation;

(e) Risk sharing;

(f) Recognition of onerous contracts;

(g) Reinsurance;

(h) Deferred acquisition costs;

(i) Revenue recognition;

(j) Accounting treatment of income on day one;

(k) Measurement of options and guarantees;

(l) Separation of embedded derivatives within insurance contracts; and

(m) Presentation and disclosure.

Scope

6 Unlike IFRS 17, US GAAP establishes industry-specific accounting and reporting

guidance for insurance companies, as opposed to accounting for insurance

contracts. For entities other than insurance companies, any contract issued that

would meet the definition of an insurance contract under IFRS Standards is

accounted for in accordance with other applicable US GAAP literature because the

specific contract has not been issued by insurance, reinsurance, or certain financial

guarantor companies.

Different types of insurance contracts - overall view

IFRS 17 US GAAP

General model, simplified or Short- Long-duration Reinsurance Financial

modified for duration Guarantees

Traditional

Premium Allocation Approach

Universal Life

Variable Fee Approach

Participating

Investment contracts with Contracts

discretionary participation

features Guarantee

benefits

Reinsurance contracts embedded in

certain

contracts

7 Both IFRS 17 (through the Premium Allocation Approach) and US GAAP distinguish

between short-term and long-term insurance contracts. Also, both IFRS 17 and US

GAAP use modified requirements for particular subcategories of long-term

insurance contracts. However, the subcategories used in both frameworks are

different as shown in the table below.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 2 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

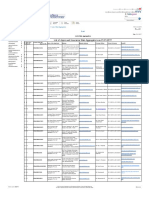

Measurement of insurance contracts

IFRS 17 US GAAP

Short-duration Long-duration Long-duration

(Traditional life) (Universal life)

Cash flows Required to Same as IFRS Same as IFRS Same as IFRS

fulfil the

contracts

Assumptions Updated Updated Historical (proposed Updated

to change to:

Updated)

Discount To reflect the Typically not Expected Contract rate or

rates characteristics discounted investment yield expected

of the cash (except for some (proposed to investment yield

flows arising contracts for change to: an (proposed to

from the which the upper-medium change to: an

insurance settlement of grade (low credit upper-medium

contracts claims may take risk) fixed-income grade (low credit

many years) instrument yield risk) fixed-income

that maximises the instrument yield)

use of current

market observable

inputs). This is also

valid for Limited-

Payment Long-

Duration Contracts

Risk margin Explicit risk Risk margin is not Provision for risk of Risk margin is not

margin applicable adverse deviation applicable (implicit)

(implicit) for certain long-

duration contracts

(proposed change

to eliminate the

provision for risk of

adverse deviation)

Cash flows

8 For insurance contracts that do not include complex features such as options and

guarantees, both frameworks use expected cash flows required to fulfil the

insurance contracts in the liability measurement. For insurance contracts that

include complex features such as options and guarantees, please refer to

paragraph 51.

Assumptions

9 In accordance with IFRS 17, assumptions used in measuring the insurance liability

are updated. In contrast, for traditional life long-duration contracts under US GAAP,

the original assumptions used to measure the liability for future policy benefits are

locked at contract inception and held constant over the term of the contract. As part

of the proposed changes to the requirements for long-duration contracts, this

requirement would be changed to require an insurance entity to review and if

necessary update the assumptions used to measure future cash flows at least

annually. Further, as part of the proposed changes to the requirements for long-

duration contracts, the FASB tentatively decided, for non-participating traditional

and limited payment contracts, that measurement assumptions should be updated.

However, an insurance entity may make an entity-wide election to not update the

expense assumption for cash flow changes.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 3 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

Discount rates

10 IFRS 17 requires discount rates used to reflect the characteristics of the cash flows

arising from the insurance contracts.

11 Under IFRS 17, investment returns are not included in the cash flows used in

measuring the insurance liability. Investments are recognised, measured and

presented separately. Consequently, in order to avoid double counting or omissions,

cash flows that do not vary based on the returns on any underlying items shall be

discounted at rates that do not reflect any such variability. Cash flows that vary

based on the returns on any underlying items are discounted using rates that reflect

that variability or are adjusted for the effect of that variability and discounted at a

rate that reflects the adjustment.

12 Under US GAAP, for short-duration contracts, liabilities for unpaid claims and claim

adjustment expenses can be discounted at the same rate used to report the same

claims liabilities to State regulatory authorities or discounting liabilities with respect

to settled claims under the following circumstances: (i) if the payment pattern and

ultimate cost are fixed and determinable on an individual claim basis, and (ii) the

discount rate used is reasonable on the facts and circumstances applicable to the

registrant at the time the claims are settled. For traditional long-duration contracts,

US GAAP currently relies on the expected investment yield to discount the

insurance contract cash flows.

13 Under US GAAP, for long-duration contracts, at present the interest assumptions

used in estimating the liability for future policy benefits are based on estimates of

investment yields (net of related investment expenses) expected at the time

insurance contracts are issued. For non-participating traditional and limited-

payment contracts, the FASB has tentatively decided to change and require the use

of a current upper-medium grade (low credit risk) fixed-income instrument yield for

those contracts. The effect of updating the discount rate assumption is to be

recognised immediately in other comprehensive income.

Risk margin

14 The general requirements in IFRS 17 prescribe the recognition of a risk adjustment

in order to address uncertainty in non-financial risk. The risk adjustment is also

applied to investment contracts1 but has a zero value as these contracts have no

significant insurance risk.

15 US GAAP contains a similar concept, provision for risk of adverse deviation, but is

only applied to traditional life long-duration contracts. As part of the proposed

changes to the requirements for long-duration contracts, the FASB tentatively

decided, for non-participating traditional and limited-payment contracts, to eliminate

the provision for risk of adverse deviation.

Level of aggregation

16 IFRS 17 subdivides each portfolio into groups of (i) contracts onerous at initial

recognition, if any, (ii) contracts at initial recognition having no significant possibility

of becoming onerous subsequently, if any and (iii) remaining contracts in the

portfolio, if any. Contracts issued more than one year apart shall not be included in

the same group.

17 US GAAP indicates that insurance contracts shall be grouped consistent with the

entity's manner of acquiring, servicing, and measuring the profitability of its

1This refers to investment contracts with discretionary participation features that are within the

scope of IFRS 17.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 4 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

insurance contracts to determine if a premium deficiency exists. As part of the

proposed changes to the requirements for long-duration contracts (more particularly

for non-participating traditional and limited-payment contracts), the FASB tentatively

decided that contracts from different issue years should not be grouped, but

contracts issued within a single issue year may be grouped when determining the

level of aggregation for measuring the liability for future policy benefits.2

Risk sharing

18 Under IFRS 17, entities should consider whether the cash flows of insurance

contracts in one group affect the cash flows to policyholders of contracts in another

group. This is to determine whether they result in policyholders subordinating their

claims or cash flows to those of other policyholders, thereby reducing the direct

exposure of the entity to a collective risk. This factor, sometimes referred to as

‘mutualisation between contracts’, is considered in the measurement of the

fulfilment cash flows.

19 US GAAP does not include the concept of risk sharing amongst groups for cash

flows that affect the cash flows to policyholders in another group.

Recognition of onerous contracts

20 US GAAP does not prohibit (and, in fact, requires) accrual of a net loss (that is, a

loss in excess of deferred premiums) that probably will be incurred on insurance

policies that are in force, provided that the loss can be reasonably estimated. A

probable loss on insurance contracts exists if there is a premium deficiency relating

to short-duration or long-duration contracts.

Short-duration contracts

21 A premium deficiency is recognised if the sum of expected claim costs and claim

adjustment expenses, expected dividends to policyholders, unamortised acquisition

costs, and maintenance costs exceeds related unearned premiums. A premium

deficiency shall first be recognised by expensing any unamortised acquisition costs

to the extent required to eliminate the deficiency. If the premium deficiency is greater

than unamortised acquisition costs, a liability is accrued for the excess deficiency.

Long-duration contracts

22 Original policy benefit assumptions for long-duration contracts ordinarily continue to

be used during the periods in which the liability for future policy benefits is accrued.

However, actual experience with respect to investment yields, mortality, morbidity,

terminations, or expenses may indicate that existing contract liabilities, together with

the present value of future gross premiums, will not be sufficient to both:

(a) Cover the present value of future benefits to be paid to or on behalf of

policyholders and settlement and maintenance costs relating to a block of

long-duration contracts; and

(b) Recover unamortised acquisition costs (the FASB has tentatively decided to

eliminate the impairment test for deferred acquisition costs, which is done

through a premium deficiency test).

23 The premium deficiency is recognised by a charge to income and either of the

following:

2 Source: FASB tentative decision of 2 August 2017.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 5 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

(a) A reduction of unamortised acquisition costs (the FASB has tentatively

decided to eliminate the impairment test for deferred acquisition costs, which

is done through a premium deficiency test).

(b) An increase in the liability for future policy benefits.

24 A premium deficiency, at a minimum, shall be recognised if the aggregate liability

on an entire line of business is deficient. In some instances, the liability on a

particular line of business may not be deficient in the aggregate, but circumstances

may be such that profits would be recognised in early years and losses in later years.

In those situations, the liability shall be increased by an amount necessary to offset

losses that would be recognised in later years.

25 For non-participating traditional and limited-payment contracts, the FASB has

tentatively decided to eliminate premium deficiency testing, but loss recognition

testing should be retained for universal life-type contracts.

26 Under IFRS 17, an entity shall recognise onerous contracts:

(a) At initial recognition: an entity shall recognise a loss in profit or loss if the

fulfilment cash flows allocated to the contract, any previously recognised

acquisition cash flows and any cash flows arising from the contract are a net

outflow; and

(b) On subsequent measurement: insurance contracts can become onerous

when adjustments to the contractual service margin exceed the amount of the

contractual service margin (‘CSM’). Such excess is recognised immediately in

profit or loss. The losses are allocated to a loss component of the liability for

remaining coverage for an onerous group.

27 Another key difference between US GAAP and IFRS Standards lies in the definition

of "probable" which is used to determine whether a contingent loss or provision

should be recognised. Paragraph 23 of IAS 37 Provisions, Contingent Liabilities and

Contingent Assets defines probable as "more likely than not to occur" (i.e., "the

probability that the event will occur is greater than the probability that it will not").

ASC 450 Contingencies subsection 450-20-20 defines "probable" as "likely to

occur."

Reinsurance

28 Under US GAAP, reinsurance contracts do not result in immediate recognition of

gains unless the reinsurance contract is a legal replacement of one insurer by

another and thereby extinguishes the ceding entity’s liability to the policyholder.

Reinsurance recoverables shall be recognised in a manner consistent with the

liabilities relating to the underlying reinsured contracts. Assumptions used in

estimating reinsurance recoverables shall be consistent with those used in

estimating the related liabilities.

Short-duration contracts

29 Under US GAAP, amounts paid for prospective reinsurance shall be reported as

prepaid reinsurance premiums and amortised over the remaining contract period in

proportion to the amount of insurance protection provided.

30 Amounts paid for retroactive reinsurance that meets the conditions for reinsurance

accounting shall be reported as reinsurance receivables to the extent those amounts

do not exceed the recorded liabilities relating to the underlying reinsured contracts.

If the recorded liabilities exceed the amounts paid, reinsurance receivables shall be

increased to reflect the difference and the resulting gain deferred. The deferred gain

shall be amortised over the estimated remaining settlement period.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 6 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

Long-duration contracts

31 Under US GAAP, the amortisation of the estimated cost of reinsurance of long-

duration contracts that meets the conditions for reinsurance accounting depends on

whether the reinsurance contract is long-duration or short-duration. The cost shall

be amortised over the remaining life of the underlying reinsured contracts if the

reinsurance contract is a long-duration contract, or over the contract period of the

reinsurance if the reinsurance contract is a short-duration contract. The

assumptions used in accounting for reinsurance costs shall be consistent with those

used for the reinsured contracts.

32 The difference, if any, between amounts paid for a reinsurance contract and the

amount of the liabilities for policy benefits relating to the underlying reinsured

contracts is part of the estimated cost to be amortised.

33 Similar to US GAAP, IFRS 17 utilises consistent assumptions as the underlying

insurance contracts for measuring the estimates of the present value of future cash

flows for a group of reinsurance contracts held. However, under IFRS 17, the effect

of any risk of non-performance by the reinsurer, including the effects of collateral

and losses from disputes, is considered when determining such estimates.

34 The difference between the amount paid for the reinsurance cover and the expected

risk-adjusted present value of the cash flows generated by the reinsurance contracts

held, represents the contractual service margin which is recognised over the

reinsurance coverage period.

Deferred acquisition costs

35 Differences may occur between deferred acquisition costs as defined under

IFRS°17 and in accordance with US GAAP.

36 IFRS 17 defines insurance acquisition cash flows as cash flows arising from the

costs of selling, underwriting and starting a group of insurance contracts that are

directly attributable to the portfolio of insurance contracts to which the group

belongs. Such cash flows include cash flows that are not directly attributable to

individual contracts or groups of insurance contracts within the portfolio.

37 US GAAP defines acquisition costs as those that are related directly to the

successful acquisition of new or renewal insurance contracts. In addition, US GAAP

provides detailed guidance about how to identify costs that directly relate to the

successful acquisition of new or renewal insurance contracts.

38 Under IFRS 17, insurance acquisition costs form part of the fulfilment cash flows

and are reflected as an immediate cash outflow at the start of the contract boundary.

Under US GAAP, such costs are deferred and amortised based on different

amortisation methods, one of these methods being present value of estimated gross

profits. However, if estimated gross profits are expected to be negative, alternative

amortisation techniques are to be used.

39 As part of the proposed changes to the requirements for long-duration contracts,

deferred acquisition costs would be amortised on a constant basis over the expected

life of the related contracts. Deferred acquisition costs would be written off for

unexpected contract terminations, but would not be subject to impairment testing.

Revenue recognition

40 Under IFRS 17, entities are required to report as insurance revenue the

consideration for services on an earned basis. As a result, when applying IFRS 17,

insurance revenue will exclude deposit components which represent policyholders’

investments that are not consideration for services. The said revenue is then

recognised as described in paragraph 46 below.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 7 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

41 US GAAP has different methods of premium revenue recognition: short-duration

contracts, three methods of long-duration contract accounting: traditional, universal

life and participating contracts, reinsurance contracts and financial guarantee

insurance contracts.

42 For short-duration contracts, premiums are recognised over the period of the

contract in proportion to the amount of insurance protection provided. For few types

of contracts where the period of risk differs significantly from the contract period,

premiums are recognised as revenue over the period of risk in proportion to the

amount of insurance protection provided.

43 For long-duration contracts, premiums are recognised as revenue over the

premium-paying periods of the contracts when due from policyholders.

(a) Traditional long-duration contracts: Premiums are recognised as revenue over

the premium-paying periods of the contracts when due from policyholders;

(b) Limited-payment contracts: Any gross premium received in excess of the

premium is deferred and recognised in income in a constant relationship with

insurance in force (life insurance) or with the amount of expected future benefit

payments (annuities);

(c) Universal life type and Participating contracts: Premiums collected are not

reported as revenue. Revenue from those contracts represents amounts

assessed against policyholders and is reported in the period that the amounts

are assessed unless evidence indicates that the amounts are designed to

compensate the insurer for services to be provided over more than one period.

Amounts assessed that represent compensation to the insurance entity for

services to be provided in future periods are not earned in the period

assessed. Such amounts are recognised as unearned revenue and

recognised in income over the period benefited using the same assumptions

and factors used to amortise capitalised acquisition costs.

44 For foreign property and liability reinsurance contracts: depending on the

circumstances, either the periodic method or the open year method are to be used.

(a) Under the periodic method, premiums are recognised as revenue over the

policy term, and claims, including an estimate of claims incurred but not

reported are recognised as they occur.

(b) Under the open year method, premiums, claims, commissions and related

direct taxes are not reported as income, instead they are reported in the open

underwriting balances to which they pertain. The underwriting balances are

aggregated and kept open until sufficient information becomes available to

record a reasonable estimate of earned premiums.

45 Financial guarantee insurance contracts: At inception a liability for the unearned

premium revenue is recognised. The premiums from a financial guarantee

insurance contracts are recognised as revenue over the period of the contract in

proportion to the amount of insurance protection provided with a corresponding

adjustment (decrease) in the unearned premium revenue. The premium revenue for

each reporting period is determined by multiplying the insured principal amount for

that period by the ratio of the following components:

(a) The total present value of the premium due or expected to be collected over

the period of the contract; and

(b) The sum of all insured principal amounts outstanding during each reporting

period over the period of the contract (either contract period or expected

period).

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 8 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

Accounting treatment of income on day one

46 The accounting treatment under IFRS 17 for the unearned profit or contractual

service margin (CSM) as determined on day one depends on whether the CSM

arising from a primary insurance contract is in a gain or loss position or whether the

entity incurred a cost or gain resulting from purchasing reinsurance coverage. This

can be illustrated as such:

IFRS 17: Recognition at Gain position Loss making position

inception

Primary insurance CSM is deferred and The net loss position is

contract recognised in profit or recognised immediately

loss over the period as in profit or loss at

services are provided. inception and if it arises

subsequently for a group.

Reinsurance contract The net gain is not The net loss is not

held recognised immediately recognised immediately

in profit or loss but is in profit or loss but is

deferred. deferred.

47 For traditional life insurance, limited-payment, and participating life insurance

contracts under US GAAP, the net premium model is used to measure the liability

for future policyholder benefits. The liability for future policy benefits for traditional

life insurance, limited-payment, and participating life insurance contracts is

calculated as the present value of estimated future policy benefits to be paid to or

on behalf of policyholders less the present value of estimated future net premiums

to be collected from policyholders and shall be accrued as premium revenue is

recognised.

48 The net premiums are the portion of the gross premiums required the provide for all

benefits and expenses, excluding acquisition costs or costs that are required to be

charged to expense as incurred. The net premium ratio is calculated at contract

inception by dividing the present value of the total policyholder benefits and

expenses, excluding acquisition costs or costs that are required to be charged to

expense as incurred, by the present value of total gross premiums. Therefore, the

net premium ratio remains a constant percentage of the gross premium for the

duration of the contract. The model results in profits being recognised as a level

percentage of premiums over the entire life of the contracts.

49 As part of the targeted improvements project, the Board has tentatively decided to

require the unlocking of net premiums, by applying the retrospective catch-up

approach. Under this approach, when an entity updates their cash flow

assumptions, the entity would do so by updating net premiums as of contract

inception (while including actual cash flows) and rolling revised net premiums

forward to calculate an updated liability for future policy benefits.

50 For reinsurance contracts under US GAAP, refer to paragraphs 30 and 32.

Measurement of options and guarantees

51 Certain contracts may be sold with contract features that provide for benefits in

addition to the account balance. IFRS 17 requires an entity to include all financial

options and guarantees embedded in insurance contracts in the measurement of

the fulfilment cash flows, in a way that is consistent with observable market prices

for such options and guarantees. However under US GAAP, some of those features

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 9 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

are accounted for as embedded derivatives at fair value under ASC Topic 815

Derivatives and Hedging (ASC 815) or as insurance liabilities under ASC 944.

52 As part of the proposed changes to the requirements for long-duration contracts,

market risk benefits (such as guarantees embedded in variable contracts) are to be

measured at fair value.

Separation of embedded derivatives within insurance contracts

53 Insurance contracts typically create a number of rights and obligations that together

generate a package of cash inflows and cash outflows. They can include features

in addition to the transfer of significant insurance risk, such as derivatives. IFRS 17

paragraph 11(a) requires an entity to apply IFRS 9 Financial Instruments to

determine whether an embedded derivative should be accounted for separately

from an insurance host contract.

54 Similar to IFRS, US GAAP also requires entities to first assess whether benefit

features embedded in an insurance host contract should be accounted for as an

embedded derivative under ASC 815. All other benefit features are assessed to

determine whether they should be accounted for as insurance liabilities using the

benefit ratio model under ASC 944. As part of the proposed changes to the

requirements for the accounting of long-duration contracts, entities will first evaluate

whether such benefits should be accounted for as a market risk benefit. For benefits

that are not determined to be market risk benefits, an insurance entity should then

determine whether such benefits should be accounted for under Derivate and

Embedded Derivative guidance in ASC Topic 815. All other benefits should be

accounted for under the provisions of ASC Topic 944.

Presentation and disclosure

55 In accordance with IFRS 17, the carrying amount of insurance contracts that are an

asset and those that are liabilities are to be presented separately in the statement

of financial position. The same is valid for reinsurance contracts held.

56 In the statement of financial performance, a disaggregation is to be made between

the insurance service result and the insurance finance income and expenses.

57 Further, IFRS 17 requires disclosure of qualitative and quantitative information

about:

(a) the amounts recognised in its financial statements from insurance contracts;

(b) the significant judgements, and changes in those judgements, made when

applying IFRS 17;

(c) detailed reconciliations of opening and closing balances; and

(d) the nature and extent of the risks from contracts within the scope of IFRS 17.

58 US GAAP requires various disclosures of qualitative and quantitative information

that are applicable to the different types of products. In some cases, the disclosure

requirements request similar information across contract types; however, in many

instances disclosure requirements are not consistent across products or benefit

features. For these reasons, the FASB tentatively decided to improve the

consistency of information being provided by requiring the following type of

information across products be disclosed (however, there will be some instances

that, due to the nature of the product or benefit feature, only certain disclosures will

be applicable):

(a) Insurance entities would be required to provide disaggregated rollforwards of

the beginning to ending balances of the liability for future policy benefits,

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 10 of 11

Summary of US GAAP requirements for insurance (including proposed changes to the

Accounting for Long-Duration Insurance Contracts) and comparison with IFRS 17 -

Issues Paper

policyholder account balances, market risk benefits, separate account

liabilities, and deferred acquisition costs

(b) Insurance entities would be required to disclose information about significant

inputs, judgments, assumptions, and methods used in measurement,

including changes in those inputs, judgments, assumptions, and methods, and

the effect of those changes on the measurement.

59 As part of the proposed changes to the requirements for long-duration contracts

under US GAAP, the presentation and disclosure requirements are being changed.

60 As for presentation, insurers would be required to separately present the carrying

amount of market risk benefit liabilities in the statement of financial position. Also,

the changes in the fair value related to the market risk benefits would be presented

separately in the statement of operations, except for changes in instrument-specific

credit risk, which would be presented separately in other comprehensive income.

Additionally, the adjustment relating to updating the liability for future policy benefits

measurement assumptions would be presented separately in the statement of

operations.

EFRAG TEG meeting 5 July 2018 Paper 05-03, Page 11 of 11

You might also like

- Fundamentals of Corporate Finance 9th Edition by Brealey Myers Marcus ISBN Solution ManualDocument35 pagesFundamentals of Corporate Finance 9th Edition by Brealey Myers Marcus ISBN Solution Manualmatthew100% (29)

- Advanced Accounting Chapter 1Document11 pagesAdvanced Accounting Chapter 1Nellie Panedy80% (15)

- Impacts of IFRS 17 Insurance Contracts Accounting Standard: Considerations For Data, Systems and ProcessesDocument23 pagesImpacts of IFRS 17 Insurance Contracts Accounting Standard: Considerations For Data, Systems and ProcessesjaxNo ratings yet

- US GAAP vs. IFRS - Key Differences in Accounting For Insurance ContractsDocument8 pagesUS GAAP vs. IFRS - Key Differences in Accounting For Insurance ContractsRicardo Laines LopezNo ratings yet

- SAP Collateral Management System (CMS): Configuration Guide & User ManualFrom EverandSAP Collateral Management System (CMS): Configuration Guide & User ManualRating: 4 out of 5 stars4/5 (1)

- ButlerDocument1 pageButlerarnab.for.ever9439100% (1)

- Variable IC Mock Exam - 02062020 PDFDocument30 pagesVariable IC Mock Exam - 02062020 PDFMikaella Sarmiento100% (1)

- 5 Stock To DoubleDocument25 pages5 Stock To DoubleLao ZhuNo ratings yet

- Investments BKM - 9e SolutionsDocument246 pagesInvestments BKM - 9e SolutionsMichael Ong100% (3)

- IFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Document6 pagesIFRS 17 Insurance Contracts Why Annual Cohorts 1588124015Grace MoraesNo ratings yet

- IFRS17 Measurement and ApplicabilityDocument2 pagesIFRS17 Measurement and Applicabilityالخليفة دجوNo ratings yet

- Ifrs 17 Insurance ContractsDocument144 pagesIfrs 17 Insurance Contractsace zero100% (1)

- 1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCDocument156 pages1b. IFRS 17 - Insurance - Contracts - As - Amended - in - June - 2020 - An - Illustration - PWCctprimaNo ratings yet

- IFRS 4 Insurance ContractsDocument27 pagesIFRS 4 Insurance ContractsAdam CuencaNo ratings yet

- Introduction To IFRS17Document37 pagesIntroduction To IFRS17baraalqasemNo ratings yet

- IFRS 17 Level of Aggregation - Background Briefing Paper FinalDocument19 pagesIFRS 17 Level of Aggregation - Background Briefing Paper FinalEmmanuelNo ratings yet

- HKFRS 17 - 2023Document309 pagesHKFRS 17 - 2023sashahe95No ratings yet

- EligibilityDocument20 pagesEligibilitynidasak12No ratings yet

- 2017 11 07 Ifrs 17 DeloitteDocument20 pages2017 11 07 Ifrs 17 Deloitteyousefjubran1997No ratings yet

- Ifrs 17 Project SummaryDocument16 pagesIfrs 17 Project Summarymarhadi100% (1)

- In The Spotlight: IFRS 17 Affects More Than Just Insurance CompaniesDocument14 pagesIn The Spotlight: IFRS 17 Affects More Than Just Insurance Companiesgir botNo ratings yet

- Contentdamifrsmeetings2014marchiasbinsurance Contractsap2d Use of Oci in Discount Rates PDFDocument28 pagesContentdamifrsmeetings2014marchiasbinsurance Contractsap2d Use of Oci in Discount Rates PDFmaria sol fernandezNo ratings yet

- IASB Issues Amendments To Ifrs 17: Insurance Accounting AlertDocument16 pagesIASB Issues Amendments To Ifrs 17: Insurance Accounting AlertYoanNo ratings yet

- Ap2b Amendments To Ifrs 17Document11 pagesAp2b Amendments To Ifrs 17Ioanna ZlatevaNo ratings yet

- Ey Good Insurance General Model Paa Nov 2020Document99 pagesEy Good Insurance General Model Paa Nov 2020Arlinda MartinajNo ratings yet

- IFRB 2023 06 Implications of IFRS 17 For Non InsurersDocument10 pagesIFRB 2023 06 Implications of IFRS 17 For Non InsurersSkymoonNo ratings yet

- IFRS17 Considerations Health InsurersDocument4 pagesIFRS17 Considerations Health Insurersjester lawNo ratings yet

- Ifrs at A GlanceDocument8 pagesIfrs at A GlanceRafael Renz DayaoNo ratings yet

- File 1 - Overview IFRS 17Document30 pagesFile 1 - Overview IFRS 17mcahya82No ratings yet

- PSC Introduction To Financial Derivatives and Hedging StrategiesDocument14 pagesPSC Introduction To Financial Derivatives and Hedging StrategiesAbdul Azim Zainal AbidinNo ratings yet

- Knowledge Base Care Ifrs 17 (LRC)Document33 pagesKnowledge Base Care Ifrs 17 (LRC)grace sijabatNo ratings yet

- A Deeper Dive - Full Slides IFRS17Document69 pagesA Deeper Dive - Full Slides IFRS17baraalqasemNo ratings yet

- Asc 2018-12Document193 pagesAsc 2018-12Babymetal LoNo ratings yet

- Contractual Terms and CDS PricingDocument12 pagesContractual Terms and CDS PricingSongHan123No ratings yet

- IFRS 17 Background Briefing Paper CSM AllocationDocument38 pagesIFRS 17 Background Briefing Paper CSM AllocationWubneh AlemuNo ratings yet

- 2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYDocument99 pages2b. Ey-Good-Life-Insurance-Pd-Oct-2018 - EYctprimaNo ratings yet

- 1a. Insurance-Contracts-Accounting-Guide PWCDocument375 pages1a. Insurance-Contracts-Accounting-Guide PWCctprimaNo ratings yet

- Supervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryDocument3 pagesSupervisory Implications of IFRS 17 Insurance Contracts - Executive SummaryЙоанна ЗNo ratings yet

- How To Standardize RE PPA With Fair Risk DistributionDocument12 pagesHow To Standardize RE PPA With Fair Risk DistributionAfian Dwi PrasetyoNo ratings yet

- PWC Revenue From Contracts With CustomersDocument16 pagesPWC Revenue From Contracts With CustomersJobelyn CasimNo ratings yet

- Q1 2022 iAFC iAIFS IFRS 17 PDF V2Document25 pagesQ1 2022 iAFC iAIFS IFRS 17 PDF V2Ioanna ZlatevaNo ratings yet

- 3blocks - IFRS 17 PDFDocument131 pages3blocks - IFRS 17 PDFDurgaprasad VelamalaNo ratings yet

- PWC Ifrs 17 Is Coming PDFDocument6 pagesPWC Ifrs 17 Is Coming PDFmarhadiNo ratings yet

- IFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASADocument32 pagesIFRS 17 - Understanding The Requirements For Life Insurers: Abdul Moid Ahmed Khan, ASAkamrangulNo ratings yet

- Pfrs15 (No Appendix)Document15 pagesPfrs15 (No Appendix)AnDrea ChavEzNo ratings yet

- Revenue From Contracts With Customers: Indian Accounting Standard 115Document97 pagesRevenue From Contracts With Customers: Indian Accounting Standard 115Aarush GargNo ratings yet

- AP Newsletter Q4 2018 PDFDocument28 pagesAP Newsletter Q4 2018 PDFMuhammad SheikhNo ratings yet

- IFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALDocument80 pagesIFRS17 - Deep Dive - VFA and PAA 2019-11-15 FINALbaraalqasem100% (1)

- GX Ifrs17 What Does It Mean For YouDocument12 pagesGX Ifrs17 What Does It Mean For YouZaid KamalNo ratings yet

- Ifrs 4 Practical Guide PDFDocument5 pagesIfrs 4 Practical Guide PDFAdrianaNo ratings yet

- (Ic0210b14bobs) Variable and Unit-Linked Contracts - Separate AccountsDocument14 pages(Ic0210b14bobs) Variable and Unit-Linked Contracts - Separate AccountsElla ServantesNo ratings yet

- Bridging The GAAP - IFRS 17 and LDTIDocument5 pagesBridging The GAAP - IFRS 17 and LDTImikfrancisNo ratings yet

- AC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Document41 pagesAC3102 Jan2018 Seminar 18 19 Hedge Accounting LKW 20march2018Shawn TayNo ratings yet

- IFRS 17 Simplified Case Study PDFDocument18 pagesIFRS 17 Simplified Case Study PDFAnonymous H1l0FwNYPS0% (1)

- Yardimci Ufrs Rehberi PDFDocument39 pagesYardimci Ufrs Rehberi PDFEhli HibreNo ratings yet

- IFRS 4 Vs IFRS 17Document3 pagesIFRS 4 Vs IFRS 17Cristel TannaganNo ratings yet

- PWC Revenue From Contracts With Customers Industry SupplementDocument25 pagesPWC Revenue From Contracts With Customers Industry SupplementAmy SpencerNo ratings yet

- SummaryDocument3 pagesSummaryMaitet CarandangNo ratings yet

- Commentary ISDA Master Agreements PDFDocument24 pagesCommentary ISDA Master Agreements PDFJahanzeb DurraniNo ratings yet

- Five-Golden Principles of FIDICDocument4 pagesFive-Golden Principles of FIDICMintesnot BogaleNo ratings yet

- International Financial Reporting Standard IFRS 17 - Insurance ContractsDocument14 pagesInternational Financial Reporting Standard IFRS 17 - Insurance ContractsLiz NguyenNo ratings yet

- IFRS 4 Implementation GuidanceDocument50 pagesIFRS 4 Implementation GuidanceMariana MirelaNo ratings yet

- 4 Insurance ContractDocument40 pages4 Insurance ContractChelsea Anne VidalloNo ratings yet

- Demystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidDocument43 pagesDemystifying IFRS 17 Mahasen Kunapuli & ShrenikBaidWubneh AlemuNo ratings yet

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyFrom EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNo ratings yet

- 7 Trends Transforming The Insurance Industry 062513 - v2b PDFDocument17 pages7 Trends Transforming The Insurance Industry 062513 - v2b PDFarnab.for.ever9439No ratings yet

- Home Insurance Laws Etc. Regulations: RegulationDocument4 pagesHome Insurance Laws Etc. Regulations: Regulationarnab.for.ever9439No ratings yet

- Key US Regulatory Reforms and Opportunities For Actuaries in IndiaDocument11 pagesKey US Regulatory Reforms and Opportunities For Actuaries in Indiaarnab.for.ever9439No ratings yet

- Job Description Data Scientist AkzoNobelDocument3 pagesJob Description Data Scientist AkzoNobelarnab.for.ever9439No ratings yet

- Up Up Up: Wake To Ldti Keep With Innovation Step Actuarial PerformanceDocument15 pagesUp Up Up: Wake To Ldti Keep With Innovation Step Actuarial Performancearnab.for.ever9439No ratings yet

- List of Approved Insurance Web Aggregators As 31 01 2017Document2 pagesList of Approved Insurance Web Aggregators As 31 01 2017arnab.for.ever9439No ratings yet

- Right For InformationDocument4 pagesRight For Informationarnab.for.ever9439No ratings yet

- 174-White Paper Insurance Aggregator 13022014 WEBDocument15 pages174-White Paper Insurance Aggregator 13022014 WEBarnab.for.ever9439No ratings yet

- Coming To Terms With Insurance Aggregators:: Global Lessons For CarriersDocument12 pagesComing To Terms With Insurance Aggregators:: Global Lessons For Carriersarnab.for.ever9439No ratings yet

- Internet of Things ReportDocument108 pagesInternet of Things Reportarnab.for.ever9439No ratings yet

- 7 Trends Transforming The Insurance Industry 062513 - v2b PDFDocument17 pages7 Trends Transforming The Insurance Industry 062513 - v2b PDFarnab.for.ever9439No ratings yet

- AGEAS DistributionDocument13 pagesAGEAS Distributionarnab.for.ever9439No ratings yet

- Accenture Coming To Terms With AggregatorsDocument12 pagesAccenture Coming To Terms With Aggregatorsarnab.for.ever9439No ratings yet

- Invest EcDocument4 pagesInvest Ecarnab.for.ever9439No ratings yet

- 2001 Prentice Hall, Inc. All Rights ReservedDocument12 pages2001 Prentice Hall, Inc. All Rights Reservedarnab.for.ever9439No ratings yet

- ERP NTPC-FinalDocument41 pagesERP NTPC-Finalarnab.for.ever9439100% (1)

- Total Quality Management Session by MukherjeeDocument2 pagesTotal Quality Management Session by Mukherjeearnab.for.ever9439No ratings yet

- Madonna CaseDocument3 pagesMadonna Casearnab.for.ever9439100% (1)

- Academic CalendarDocument1 pageAcademic Calendararnab.for.ever9439No ratings yet

- Arbitrage Pricing TheoryDocument16 pagesArbitrage Pricing Theorya_karimNo ratings yet

- FIN 201 Chapter 02 TheoryDocument24 pagesFIN 201 Chapter 02 TheoryAhmed ShantoNo ratings yet

- Divis Laboratories Initiating Coverage 15062020Document7 pagesDivis Laboratories Initiating Coverage 15062020vigneshnv77No ratings yet

- The Effect of Capital Structure Choice On Banking Performance: Empirical Evidence From GhanaDocument52 pagesThe Effect of Capital Structure Choice On Banking Performance: Empirical Evidence From GhanaErnest GabluiNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- 2016 AFR PaperDocument6 pages2016 AFR Paperrwl s.r.lNo ratings yet

- Indian Stock MarketDocument71 pagesIndian Stock MarketNeha Thakur100% (1)

- High Dividend YieldDocument6 pagesHigh Dividend YieldErnie DaysNo ratings yet

- PDF Chapter 2 Cash and Cash Equivalents Problems - CompressDocument2 pagesPDF Chapter 2 Cash and Cash Equivalents Problems - CompresspehikNo ratings yet

- CBS Selection - GartnerDocument6 pagesCBS Selection - GartnerSIYONA CHAMOLANo ratings yet

- Introduction To Financial InstrumentsDocument21 pagesIntroduction To Financial InstrumentsSky SoronoiNo ratings yet

- محمد مجدي كيز جروبDocument6 pagesمحمد مجدي كيز جروبAlaa HassaninNo ratings yet

- PSO FinanceDocument18 pagesPSO FinancesabaNo ratings yet

- Chapter 05 Test Bank - StaticDocument14 pagesChapter 05 Test Bank - StaticCaioGamaNo ratings yet

- Bem102 7Document22 pagesBem102 7Mellisa AndileNo ratings yet

- Presentation On BSEC (Debt Securities) Rules, 2021Document39 pagesPresentation On BSEC (Debt Securities) Rules, 2021Asif Abdullah KhanNo ratings yet

- Managerial Accounting Tools For Business Canadian 3Rd Edition Weygandt Test Bank Full Chapter PDFDocument67 pagesManagerial Accounting Tools For Business Canadian 3Rd Edition Weygandt Test Bank Full Chapter PDFcomplinofficialjasms100% (14)

- Chapter 6 - Accounting For MerchandiseDocument30 pagesChapter 6 - Accounting For MerchandiseTrần Anh TuấnNo ratings yet

- Technical Analysis On Banks Dissertation PDFDocument18 pagesTechnical Analysis On Banks Dissertation PDFWaibhav KrishnaNo ratings yet

- Formula Sheet: Part I: Financial StatementDocument2 pagesFormula Sheet: Part I: Financial StatementSachin Kumar GoyelNo ratings yet

- Casper Investor Presentation 2Q'21 August UpdateDocument20 pagesCasper Investor Presentation 2Q'21 August UpdatepaoscagNo ratings yet

- Series 86 87 Content Outline RevisedDocument9 pagesSeries 86 87 Content Outline RevisedRaghdaNo ratings yet

- Business ValuationDocument9 pagesBusiness ValuationMohsin AijazNo ratings yet

- NFO Tata Growing Economies Infrastructure FundDocument12 pagesNFO Tata Growing Economies Infrastructure FundDrashti Investments100% (1)

- Financial MathDocument50 pagesFinancial Mathfabricioace1978No ratings yet