Professional Documents

Culture Documents

Marriot Corporation: The Cost of Capital: 1.598 Re-Levered B

Marriot Corporation: The Cost of Capital: 1.598 Re-Levered B

Uploaded by

Ahmad Ali0 ratings0% found this document useful (0 votes)

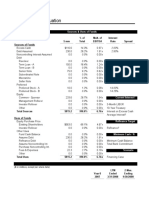

19 views1 pageThis document provides financial information for Marriot Corporation and its divisions to calculate their weighted average cost of capital (WACC). It lists the debt ratio, tax rate, levered and unlevered betas, and WACC for Marriot overall and its lodging, restaurant, and contract services divisions. It also shows the asset betas were weighted based on the proportion of identified assets for each division to calculate Marriot's overall asset beta of 0.666.

Original Description:

Original Title

Marriot ns.xlsx

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides financial information for Marriot Corporation and its divisions to calculate their weighted average cost of capital (WACC). It lists the debt ratio, tax rate, levered and unlevered betas, and WACC for Marriot overall and its lodging, restaurant, and contract services divisions. It also shows the asset betas were weighted based on the proportion of identified assets for each division to calculate Marriot's overall asset beta of 0.666.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

19 views1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered B

Marriot Corporation: The Cost of Capital: 1.598 Re-Levered B

Uploaded by

Ahmad AliThis document provides financial information for Marriot Corporation and its divisions to calculate their weighted average cost of capital (WACC). It lists the debt ratio, tax rate, levered and unlevered betas, and WACC for Marriot overall and its lodging, restaurant, and contract services divisions. It also shows the asset betas were weighted based on the proportion of identified assets for each division to calculate Marriot's overall asset beta of 0.666.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 1

Marriot Corporation: The Cost Of Capital

Equity Beta 1.11

Debt Ratio 60%

Equity Ratio 40%

Tax 34%

Asset Beta 0.666

Re-levered BL 1.598

Lodging Division Tax 0%

Hotels Levered (equity) Beta Market Leverage D/E Ratio Unlevered Beta

Hilton 0.76 14% 0.163 0.654

Holiday Corp 1.35 79% 3.762 0.284

La Quita Motor 0.89 69% 2.226 0.276

Ramada Inn 1.36 65% 1.857 0.476

Age. Un-levered (asset) Beta 0.422

Debt Ratio 74%

Equity Ratio 26%

Re-levered BL 1.624

Retaurant Division Tax 0%

Hotels Levered (equity) Beta Market Leverage D/E Ratio Unlevered Beta

Church Fried Chicken 1.45 4% 0.042 1.392

Collins Foods 1.45 10% 0.111 1.305

Frisch Restaurant 0.57 6% 0.064 0.536

Luby Cafeterias 0.76 1% 0.010 0.752

Mcdonalds 0.94 23% 0.299 0.724

Wendy's Int 1.32 21% 0.266 1.043

Avg. Un-levered (asset) Beta 0.959

Debt Ratio 42%

Equity Ratio 58%

Re-levered BL 1.653

Marriot Lodging Restaurant Contract Services

Risk free Rate 8.95% 8.95% 6.90% 6.90%

Spread 1.30% 1.10% 1.80% 1.40%

Pre Tax Kd 10.25% 10.05% 8.70% 8.30%

Tax 34% 34% 34% 34%

Post Tax Kd 6.77% 6.63% 5.74% 5.48%

Beta 1.598 1.624 1.653 1.553

Risk Premium 7.43% 7.43% 8.47% 8.47%

Ke 20.83% 21.02% 20.90% 20.06%

Debt Ratio 60% 74% 42% 40%

Equity Ratio 40% 26% 58% 60%

WACC 12.39% 10.37% 14.53% 14.23%

Divisions Identified Assets Ratio Un-levered Beta

Lodging 2777.4 0.61 0.422

Restaurant 567.6 0.12 0.959

Contract Services 1237.7 0.27 1.0788

4582.7 1 0.666

Equity Beta 1.0788

Debt Ratio 40%

Equity Ratio 60%

Tax 34%

Re-levered BL 1.553

You might also like

- Marriott Corporation - K - AbridgedDocument9 pagesMarriott Corporation - K - AbridgedDurgaprasad Velamala100% (5)

- Marriot CaseStudyDocument17 pagesMarriot CaseStudySambhav SamNo ratings yet

- Balance Sheet: Larry's Landscaping & Garden SupplyDocument2 pagesBalance Sheet: Larry's Landscaping & Garden SupplyBelle B.No ratings yet

- 2014 03 22 Caso Frozen Food Costo de CapitalDocument6 pages2014 03 22 Caso Frozen Food Costo de CapitalAbdul wahabNo ratings yet

- SNGPL Performance Appraisal System Case AnalysisDocument14 pagesSNGPL Performance Appraisal System Case AnalysisAhmad Ali100% (3)

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- 1.524 (Assumption) Relevered BDocument3 pages1.524 (Assumption) Relevered BAhmad AliNo ratings yet

- 1.524 (Assumption) Relevered BDocument4 pages1.524 (Assumption) Relevered BAhmad AliNo ratings yet

- Marriott Cost of CapitalDocument3 pagesMarriott Cost of Capitalanmolsaini01No ratings yet

- Marriot Corporation Lodging Restaurant Contract ServicesDocument2 pagesMarriot Corporation Lodging Restaurant Contract ServicesFurqanTariqNo ratings yet

- Question 1: Overall WACCDocument15 pagesQuestion 1: Overall WACCSaadatNo ratings yet

- Marriott Corp BDocument15 pagesMarriott Corp BEshesh GuptaNo ratings yet

- PNL Ustt2022Document2 pagesPNL Ustt2022nerdvanacolNo ratings yet

- WACC Calculations (With Solution)Document4 pagesWACC Calculations (With Solution)hukaNo ratings yet

- Marriott Corp Cost of Capital: Finance 319Document7 pagesMarriott Corp Cost of Capital: Finance 319ilyakostNo ratings yet

- Feuille de CalculDocument25 pagesFeuille de Calculyves_amaniNo ratings yet

- Wacc ProjectDocument8 pagesWacc ProjectSubhash PandeyNo ratings yet

- FA Balance SheetDocument15 pagesFA Balance SheetPrakash BhanushaliNo ratings yet

- Discount Rate SulamapuaDocument19 pagesDiscount Rate SulamapuaAndriansyah RasyidNo ratings yet

- SAPM SheetDocument5 pagesSAPM SheetMridav GoelNo ratings yet

- AnswersDocument7 pagesAnswersClarisse AlimotNo ratings yet

- BetasDocument7 pagesBetasWendy FernándezNo ratings yet

- Cost of Debt Calculation Mariott LodgingDocument4 pagesCost of Debt Calculation Mariott LodgingsmokieremoNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered Betahassan1993No ratings yet

- Assignment 3Document18 pagesAssignment 3Annas AmanNo ratings yet

- BetasDocument7 pagesBetasJulio Cesar ChavezNo ratings yet

- CFP Class 4Document5 pagesCFP Class 4moneshivangi29No ratings yet

- MahindraDocument13 pagesMahindrashrikant.colonelNo ratings yet

- Corporate Valuation DeonDocument9 pagesCorporate Valuation Deondeonlopes057No ratings yet

- HW 5 - SolutionDocument2 pagesHW 5 - SolutionRohan SinghNo ratings yet

- Form PrintDocument3 pagesForm PrintSakura2709No ratings yet

- Jan 24Document2 pagesJan 24eria rachmawatyNo ratings yet

- SaraZafar Marriot Corporation Cost of CapitalDocument3 pagesSaraZafar Marriot Corporation Cost of CapitalSaraNo ratings yet

- RatioDocument11 pagesRatioAnant BothraNo ratings yet

- Jenis Saldo Akhir Bulan Bobot Saldo Tertimbang: Pendapatan Yang Di DistribusikanDocument6 pagesJenis Saldo Akhir Bulan Bobot Saldo Tertimbang: Pendapatan Yang Di DistribusikanIkhwannurrahman AnwarNo ratings yet

- WACC Calculator: WACC Calculation Comparable Companies Unlevered BetaDocument1 pageWACC Calculator: WACC Calculation Comparable Companies Unlevered BetajeganathanNo ratings yet

- Weighted Average Cost of Capital (WACC) : Ultra TechDocument6 pagesWeighted Average Cost of Capital (WACC) : Ultra TechNipsi DasNo ratings yet

- AFM WorkingDocument7 pagesAFM Workingsairad1999No ratings yet

- Balance GeneralDocument9 pagesBalance GeneralPool Lido Chaupis EnriquezNo ratings yet

- Marriott Cost of Capital DataDocument18 pagesMarriott Cost of Capital DataSaadatNo ratings yet

- Case2 MarriottDocument10 pagesCase2 Marriott石曉儒No ratings yet

- Foodtree LBO Deleverage: FinancialsDocument12 pagesFoodtree LBO Deleverage: FinancialsmartinsiklNo ratings yet

- DCF ModelingDocument8 pagesDCF Modelingramanshekhawat719No ratings yet

- AnswersDocument15 pagesAnswerslika rukhadzeNo ratings yet

- Case 1 MarriottDocument14 pagesCase 1 Marriotthimanshu sagar100% (1)

- ACF - Capital StructureDocument8 pagesACF - Capital StructureAmit JainNo ratings yet

- Des 23Document2 pagesDes 23eria rachmawatyNo ratings yet

- Marriot Corporation - Cost of CapitalDocument3 pagesMarriot Corporation - Cost of CapitalInderpreet Singh Saini100% (17)

- Weighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnDocument4 pagesWeighted Average Cost of Capital (WACC) - 2017 Value Weight Required Rate of ReturnravinyseNo ratings yet

- Factsheet 1704957862487Document2 pagesFactsheet 1704957862487umanarayanvaishnavNo ratings yet

- Projections 2023Document8 pagesProjections 2023DHANAMNo ratings yet

- Defaultable Fixed Coupon Bond: PricingDocument10 pagesDefaultable Fixed Coupon Bond: PricinggiulioNo ratings yet

- Water UtilitiesDocument2 pagesWater Utilitiesapi-3773892No ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Sample DCF Valuation TemplateDocument2 pagesSample DCF Valuation TemplateTharun RaoNo ratings yet

- Beginning Balance ReceiptsDocument1 pageBeginning Balance ReceiptspeejayNo ratings yet

- PSB Ame 05-19Document203 pagesPSB Ame 05-19Ryan DizonNo ratings yet

- Genting Malaysia Berhad 110220Document51 pagesGenting Malaysia Berhad 110220BT GOHNo ratings yet

- 1.524 (Assumption) Relevered BDocument4 pages1.524 (Assumption) Relevered BAhmad AliNo ratings yet

- Marriot Corporation: The Cost of Capital: 1.598 Re-Levered BDocument1 pageMarriot Corporation: The Cost of Capital: 1.598 Re-Levered BAhmad AliNo ratings yet

- 1.524 (Assumption) Relevered BDocument3 pages1.524 (Assumption) Relevered BAhmad AliNo ratings yet

- Logitech Case SolutionDocument4 pagesLogitech Case SolutionAhmad AliNo ratings yet

- The Unintended Environmental Effect of A Climate Change Adaptation Strategy - Evidence From The Colombian Coffee SectorDocument46 pagesThe Unintended Environmental Effect of A Climate Change Adaptation Strategy - Evidence From The Colombian Coffee SectorrafardzvNo ratings yet

- 2D46D407Document1 page2D46D407Dhyan MothukuriNo ratings yet

- IRR and PaybackDocument10 pagesIRR and Paybackkfir goldburdNo ratings yet

- WEO DataDocument14 pagesWEO DataPrypiat 0No ratings yet

- 5 Business and Consumer LoansDocument34 pages5 Business and Consumer LoansLukas AlexanderNo ratings yet

- Final ExamDocument7 pagesFinal ExamRuthchell CiriacoNo ratings yet

- Edited Copy Christian Youth Const.Document26 pagesEdited Copy Christian Youth Const.IGGA ELIANo ratings yet

- SVM141 Ch3.1Document3 pagesSVM141 Ch3.1Loren SalanguitNo ratings yet

- 09 The Philippine Guaranty Co Vs CirDocument2 pages09 The Philippine Guaranty Co Vs CirJoshua Erik MadriaNo ratings yet

- Final MCom Dissertation Lloyd Uta 482059Document126 pagesFinal MCom Dissertation Lloyd Uta 482059Phi BaiNo ratings yet

- Form Reimbursement Boy (Bali 14-20 May)Document10 pagesForm Reimbursement Boy (Bali 14-20 May)David ValentinoNo ratings yet

- Business English-FinalDocument37 pagesBusiness English-FinalLee's WorldNo ratings yet

- Company Valuation: Navana CNG Limited: Analysis of Financial Investment Course Code: F-307Document20 pagesCompany Valuation: Navana CNG Limited: Analysis of Financial Investment Course Code: F-307Farzana Fariha LimaNo ratings yet

- PO 160 Heresite Coating UnpriceDocument1 pagePO 160 Heresite Coating UnpricedennisjuntakNo ratings yet

- Vul QuestionnaireDocument14 pagesVul QuestionnaireKyla Bianca Cuenco TadeoNo ratings yet

- Market Studies: Using Information To Guide Your StrategyDocument12 pagesMarket Studies: Using Information To Guide Your StrategyNicolás Galavis VelandiaNo ratings yet

- Accountant TPIA Analysis Muhammad Reza HandyansyahDocument4 pagesAccountant TPIA Analysis Muhammad Reza HandyansyahMuhammad Reza HandyansyahNo ratings yet

- 05 Mar 2023 To 03 Jun 2023 FCMB StatementDocument2 pages05 Mar 2023 To 03 Jun 2023 FCMB StatementOlamilekan QuadriNo ratings yet

- Chapter 6 & 7 Business Cntrol and EthicsDocument26 pagesChapter 6 & 7 Business Cntrol and EthicsAddiNo ratings yet

- Assignment 7Document6 pagesAssignment 7eric stevanusNo ratings yet

- Ultimate Guide Toforex Trading EbookDocument24 pagesUltimate Guide Toforex Trading Ebookief zzieNo ratings yet

- InvoiceDocument4 pagesInvoicePhương Thanh TrịnhNo ratings yet

- PR - No.11 To 17 QuestionsDocument5 pagesPR - No.11 To 17 QuestionsSiva SankariNo ratings yet

- Ma 2019..Document6 pagesMa 2019..Ꮢ.Gᴀɴᴇsн ٭ʏт᭄No ratings yet

- Mock Scenario - Manufacturing - ERP - UATDocument1 pageMock Scenario - Manufacturing - ERP - UATHtun LinNo ratings yet

- Smart Design For Performance: A New Approach To Organization DesignDocument23 pagesSmart Design For Performance: A New Approach To Organization DesignVEDNo ratings yet

- Balance Sheet - The Coca-Cola Company (KO)Document1 pageBalance Sheet - The Coca-Cola Company (KO)vijayNo ratings yet

- SBI PO Prelims Memory Based Paper (Held On 17th December 2022 Shift 1) (English)Document26 pagesSBI PO Prelims Memory Based Paper (Held On 17th December 2022 Shift 1) (English)mushahidNo ratings yet

- Acharya Institute of Technology: Submitted ToDocument56 pagesAcharya Institute of Technology: Submitted ToNikitha Alpet100% (1)

- Role of e Service Quality Brand Commitment and e WOM Trust On e WOM Intentions of MillennialsDocument22 pagesRole of e Service Quality Brand Commitment and e WOM Trust On e WOM Intentions of MillennialsCaptain SkyNo ratings yet