Professional Documents

Culture Documents

The Report Should Be Submitted Via Canvas by Midnight On Sunday 19

The Report Should Be Submitted Via Canvas by Midnight On Sunday 19

Uploaded by

ZainImranOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

The Report Should Be Submitted Via Canvas by Midnight On Sunday 19

The Report Should Be Submitted Via Canvas by Midnight On Sunday 19

Uploaded by

ZainImranCopyright:

Available Formats

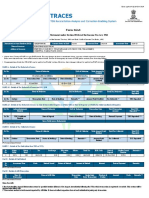

4104LBSBW

The Report should be submitted via Canvas by Midnight on Sunday 19th

April 2020

Warrior Ltd

You are the recently appointed accountant at Warrior Ltd is a new company, which will be

incorporated on 1st April 2020. Initially the company will manufacture and sell a single

electronic product used in the production of drones. The following details relate to the

company’s first financial year:

Selling price £275 per unit.

Direct materials cost £75 per unit

Direct labour is 5 hours per unit for the first 2 months, reducing to 4 hours per

unit thereafter.

Direct labour cost £12 per hour

Sales targets for the forthcoming financial year are as follows:

Units

April 2020 1,200

May 1,400

June 1,500

July 1,900

August 2,000

September 2,000

October 2,100

November 2,200

December 2,000

January 2021 1,800

February 1,800

March 1,900

90% of sales will be on credit terms, with customers paying two months later. The remaining

sales are paid for immediately. Closing inventory is planned to be 10% of the following

month’s sales target. Sales for April 2021 are expected to be 1,700 units.

Direct materials will be purchased during the month they are required for production and

paid for during the following month. An overhead absorption rate of £12 per direct labour

hour has been calculated for the variable production overheads. Variable distribution costs of

£8 per unit sold will also be incurred.

Total fixed production overheads of £115,000 and total fixed administration and distribution

overheads of £73,000 for the year will be incurred on an even basis throughout the year. All

overheads and the direct labour costs will be paid for in the month in which they are

incurred.

All production machinery will be leased; the costs of leasing the machinery are included in

the above figures. Warrior Ltd will also buy equipment that will be used mainly in the I.T.

department. They will purchase and pay for the equipment in June 2020. The equipment will

cost £22,000 and will be depreciated by 25% per annum. Depreciation is not included in the

overhead details given above.

Warrior Ltd will issue 140,000 ordinary shares of £1 at par for cash on 1st April 2020 and the

company is unwilling to issue any further shares at this stage.

The Board of Directors have little financial knowledge and currently does not

include a Finance Director. In order to assist you have been asked to produce

the following:

A report (created in Word) to the Board of Directors of Warrior Ltd which includes

1. An explanation as to why it is important to prepare budgets 10 marks

2. Comments on the budgeted cash position 10 marks

3. Suggestions of ways the monthly budgeted cash balances could be improved 10

marks

4. An explanation for the Directors as to the reasons why the forecast profit for the year

is not the same as the cash movement for the year (with reference to underlying

accounting assumptions and accounting concepts) 5 marks

5. The Directors are keen to compare their forecast results with their competitors.

Explain how ratios could be used to compare the company’s liquidity with its’

competitors results (Calculations are not required) 5 marks

6. An appendix (created as an Excel workbook) which shows :

The following budgets (on a single worksheet) on a monthly basis for the 12

months ended 31st March 2021 in as much detail as the information given

allows (you should also include a total column for the year):

i. The Production Budget (in units)

ii. The Sales Budgets (in £)

iii. The Materials Purchases Budget (in £)

iv. The Direct Labour Budgets (in £)

v. The Overheads Budgets (in £) 20 marks

Cash Budget for the company on a monthly basis for the 12 months ended

31st March 2020 in as much detail as the information given allows (you should

also include a total column for the year) 20 marks

A single forecast Income Statement (Profit and Loss Account) for the whole of

the year 15 marks

Layout of report 5 marks

You might also like

- Assessment 1 - Assignment 1 Part BDocument3 pagesAssessment 1 - Assignment 1 Part BTen Nine100% (1)

- Rights of Kuwaiti Women Married To Non-Kuwaiti MenDocument18 pagesRights of Kuwaiti Women Married To Non-Kuwaiti MenZainImranNo ratings yet

- Statement of Management Responsibility (Not Personally Owned)Document1 pageStatement of Management Responsibility (Not Personally Owned)Mabz Buan0% (2)

- AccDocument4 pagesAcclopbaodong2No ratings yet

- Referral Deferral Assessement 2 2020 21Document2 pagesReferral Deferral Assessement 2 2020 21KakaNo ratings yet

- ACC705 Tutorial 1 SCDocument2 pagesACC705 Tutorial 1 SCLyle BulehiteNo ratings yet

- MN20501 Lecture 7 Review Exercise - Updated 19 DecDocument4 pagesMN20501 Lecture 7 Review Exercise - Updated 19 Decsamvrab1919No ratings yet

- Operating Budget DiscussionDocument3 pagesOperating Budget DiscussionDavin DavinNo ratings yet

- WCM NotesDocument2 pagesWCM NotesTharunNo ratings yet

- Management Accounting and Finance: Level Iii Examination - January 2021Document9 pagesManagement Accounting and Finance: Level Iii Examination - January 2021Rajendran KajananthanNo ratings yet

- Basic Operating BudgetDocument6 pagesBasic Operating BudgetalyNo ratings yet

- Requirements. All Raw Materials Are Purchased On Account. 50% of A Quarter'sDocument4 pagesRequirements. All Raw Materials Are Purchased On Account. 50% of A Quarter'sairis nyanganoNo ratings yet

- Unithibs LTDDocument4 pagesUnithibs LTDRobert Daniel AquinoNo ratings yet

- Assume THDocument1 pageAssume THeyniyaaabdiNo ratings yet

- Postgraduate Diploma in Management (PGDM) : 2020-22 Term 2 - End-Term Examination (February, 2021) Cost & Management Accounting (CMA)Document3 pagesPostgraduate Diploma in Management (PGDM) : 2020-22 Term 2 - End-Term Examination (February, 2021) Cost & Management Accounting (CMA)Ankita JoshiNo ratings yet

- Ae 191 F-Test 1Document3 pagesAe 191 F-Test 1Venus PalmencoNo ratings yet

- MACP.L II Question April 2019Document5 pagesMACP.L II Question April 2019Taslima AktarNo ratings yet

- ACC 222 PREPARATION OF A MASTER BUDGET COMPREHENSIVE v2Document2 pagesACC 222 PREPARATION OF A MASTER BUDGET COMPREHENSIVE v2Angel Nhova Pepito OmalayNo ratings yet

- AE 221 Unit 3 Problems PDFDocument5 pagesAE 221 Unit 3 Problems PDFMae-shane SagayoNo ratings yet

- Quiz 2 MAC PDFDocument2 pagesQuiz 2 MAC PDFPaul De PedroNo ratings yet

- Operational Budget Assignment IIIDocument7 pagesOperational Budget Assignment IIIzeritu tilahunNo ratings yet

- WCM EstimationDocument3 pagesWCM Estimationtanya.p23No ratings yet

- Financial AccountingDocument2 pagesFinancial AccountingKartik GurmuleNo ratings yet

- ACC 303, ExaminationDocument4 pagesACC 303, Examinationdavidoshioke45No ratings yet

- Master BudgetDocument4 pagesMaster BudgetNigussie BerhanuNo ratings yet

- Master Budget .. Feb 2020Document9 pagesMaster Budget .. Feb 2020신두No ratings yet

- Master BudgetDocument10 pagesMaster BudgetFareha Riaz0% (1)

- Workshop-8-Qs Warwick Assignments AndvsolutionsvDocument3 pagesWorkshop-8-Qs Warwick Assignments AndvsolutionsvNaresh SehdevNo ratings yet

- Problem 1: It Is Required To PrepareDocument7 pagesProblem 1: It Is Required To PrepareGaurav ChauhanNo ratings yet

- Assignment No. 5 Hoba Franchising Joint ArrangementsDocument4 pagesAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNo ratings yet

- MOJAKOE UTS AM Genap 2010-2011Document11 pagesMOJAKOE UTS AM Genap 2010-2011Fildzah Dessyana MannanNo ratings yet

- San Pedro College: Accounting & Financial ManagementDocument4 pagesSan Pedro College: Accounting & Financial ManagementJuan Frivaldo100% (1)

- Illustration: Preparation of Master Budget (Manufacturing Company)Document4 pagesIllustration: Preparation of Master Budget (Manufacturing Company)shimelis100% (1)

- Budget Practice QuestionsDocument8 pagesBudget Practice Questionsmohammad bilalNo ratings yet

- Drills - Comprehensive BudgetingDocument11 pagesDrills - Comprehensive BudgetingDan RyanNo ratings yet

- 4 Financial Planning and BudgetsDocument3 pages4 Financial Planning and BudgetsPercy Joy CruzNo ratings yet

- Budget Problems Jan23 CWDocument7 pagesBudget Problems Jan23 CWMedhaNo ratings yet

- Accountancy and Auditing-2017Document5 pagesAccountancy and Auditing-2017Jassmine RoseNo ratings yet

- Acct 2020 Excel Budget Problem Description Master Version BDocument7 pagesAcct 2020 Excel Budget Problem Description Master Version Bapi-237087046No ratings yet

- Ch1 - Master BudgetDocument38 pagesCh1 - Master BudgetProf. Nisaif JasimNo ratings yet

- Kuis UTS Genap 21-22 ACCDocument3 pagesKuis UTS Genap 21-22 ACCNatasya FlorenciaNo ratings yet

- httpswww.icagh.orgwp-contentuploads202401FINANCIAL-ACCOUNTING-PAPER-1.1Nov-2023.pdfDocument23 pageshttpswww.icagh.orgwp-contentuploads202401FINANCIAL-ACCOUNTING-PAPER-1.1Nov-2023.pdfProsperity Thēë BwøyNo ratings yet

- Required: Prepare A Variable-Costing Income Statement For The Same PeriodDocument2 pagesRequired: Prepare A Variable-Costing Income Statement For The Same PeriodFarjana AkterNo ratings yet

- CAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityDocument7 pagesCAE 10 Strategic Cost Management: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Assignment Brief - Assignment 02 - Accounting Principles - April-July2022Document12 pagesAssignment Brief - Assignment 02 - Accounting Principles - April-July2022manojNo ratings yet

- Cost AssignmentDocument4 pagesCost AssignmentSYED MUHAMMAD MOOSA RAZANo ratings yet

- ALl Questions According To TopicsDocument11 pagesALl Questions According To TopicsHassan KhanNo ratings yet

- ACT 202 AssignmentDocument3 pagesACT 202 AssignmentFahim AnjumNo ratings yet

- PA - Group Assignment T1.2022Document3 pagesPA - Group Assignment T1.2022Phan Phúc NguyênNo ratings yet

- Working Capital NumericalsDocument3 pagesWorking Capital NumericalsShriya SajeevNo ratings yet

- Tutorial Budget2Document6 pagesTutorial Budget2Prashant KumarNo ratings yet

- Mid Term Exam Paper 4Document2 pagesMid Term Exam Paper 4Rohansh AroraNo ratings yet

- Actg 26A - Strategic Cost Management Take Home Quiz: RequirementsDocument2 pagesActg 26A - Strategic Cost Management Take Home Quiz: RequirementsseviNo ratings yet

- CH 9 - Class Notes - Mos 3370 - Kings - Fall 2023-2Document24 pagesCH 9 - Class Notes - Mos 3370 - Kings - Fall 2023-2niweisheng28No ratings yet

- Ex06 - Comprehensive BudgetingDocument14 pagesEx06 - Comprehensive BudgetingANa Cruz100% (2)

- AUD02 - A - 04 Misstatement in The Financial StatementsDocument2 pagesAUD02 - A - 04 Misstatement in The Financial StatementsMark BajacanNo ratings yet

- Chap07 Rev. FI5 Ex PR 1Document10 pagesChap07 Rev. FI5 Ex PR 1Beyond ThatNo ratings yet

- Budget (Master Planning)Document20 pagesBudget (Master Planning)krisha milloNo ratings yet

- Management AccountingDocument5 pagesManagement AccountingHamdan SheikhNo ratings yet

- 106 1648004706 PDFDocument15 pages106 1648004706 PDFMohd AmanullahNo ratings yet

- Quiz Budgeting and Standard CostingDocument2 pagesQuiz Budgeting and Standard CostingAli SwizzleNo ratings yet

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryFrom EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Name ID Title Dated: Single Use PlasticsDocument6 pagesName ID Title Dated: Single Use PlasticsZainImranNo ratings yet

- Law 5000wordsDocument25 pagesLaw 5000wordsZainImranNo ratings yet

- Speaker NoteDocument10 pagesSpeaker NoteZainImranNo ratings yet

- Boston, Massachusetts, USA Motels: Motels in The Boston Area/cheap Motels in The Boston AreaDocument6 pagesBoston, Massachusetts, USA Motels: Motels in The Boston Area/cheap Motels in The Boston AreaZainImranNo ratings yet

- MIA Assignment AZDocument30 pagesMIA Assignment AZZainImranNo ratings yet

- MIA International Security AssignmentDocument6 pagesMIA International Security AssignmentZainImranNo ratings yet

- Assessment Cover Sheet: Student DeclarationDocument7 pagesAssessment Cover Sheet: Student DeclarationZainImranNo ratings yet

- Proposal C5Document5 pagesProposal C5ZainImranNo ratings yet

- By Zain ImranDocument14 pagesBy Zain ImranZainImranNo ratings yet

- HPM B309F Theme Park Management PDFDocument5 pagesHPM B309F Theme Park Management PDFZainImranNo ratings yet

- Role of Planning in A Project: Prepared byDocument9 pagesRole of Planning in A Project: Prepared byZainImranNo ratings yet

- Canadian Regulaotor IRB GuidelinesDocument360 pagesCanadian Regulaotor IRB GuidelinesAshley CherianNo ratings yet

- AFM Cash Flow StatementDocument13 pagesAFM Cash Flow StatementSusheel KumarNo ratings yet

- Báo Cáo Thư NG Niên 7-Eleven 2011Document103 pagesBáo Cáo Thư NG Niên 7-Eleven 2011dreamworks1606No ratings yet

- Mount Vernon City School District AuditDocument47 pagesMount Vernon City School District AuditSamuel L. RiversNo ratings yet

- Sales: Chapter 1 - Nature and Form of The ContractDocument28 pagesSales: Chapter 1 - Nature and Form of The ContractCharmaine Chua100% (1)

- Brochure One Year PG Diploma in Financial Economics 2022 23 NDocument21 pagesBrochure One Year PG Diploma in Financial Economics 2022 23 NAbhishek KaleNo ratings yet

- Cary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunDocument3 pagesCary Conger Debunks Adam Ledford's Sac City Street Improvement Project Explanation Letter in The January 8, 2013 Sac SunthesacnewsNo ratings yet

- Final LoA 130 MW WIND AWEKFLDocument22 pagesFinal LoA 130 MW WIND AWEKFLYash GuptaNo ratings yet

- Adjudication Order in respect of Mr. Madhur Somani, Mr. Rangnath Somani, Ms. Kanak Somani, Master Tanay Somani, Ms. Sarla Somani and Mr. Rangnath Somani HUF in the matter of M/s Kidderpore Holdings LimitedDocument28 pagesAdjudication Order in respect of Mr. Madhur Somani, Mr. Rangnath Somani, Ms. Kanak Somani, Master Tanay Somani, Ms. Sarla Somani and Mr. Rangnath Somani HUF in the matter of M/s Kidderpore Holdings LimitedShyam SunderNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument65 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancePardeep KumarNo ratings yet

- Bernardo vs. CADocument5 pagesBernardo vs. CALaura MangantulaoNo ratings yet

- Barclays PDD Pinduoduo Inc. - Shedding Some Light On The Black BoxDocument11 pagesBarclays PDD Pinduoduo Inc. - Shedding Some Light On The Black Boxoldman lokNo ratings yet

- OTS Indonesia Application Form 2018-2019Document3 pagesOTS Indonesia Application Form 2018-2019Kajian Remaja BaiturrahmahNo ratings yet

- Hotel Security Service AgreementDocument2 pagesHotel Security Service AgreementmaolewiNo ratings yet

- Acctg 311 Prelim ExamDocument8 pagesAcctg 311 Prelim ExamJaycie EscuadroNo ratings yet

- Chapter 8 Computation of Total Income and Tax PayableDocument8 pagesChapter 8 Computation of Total Income and Tax PayablePrabhjot KaurNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document3 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Vikas VidhurNo ratings yet

- Uap Document 301Document4 pagesUap Document 301Lariza LopegaNo ratings yet

- Company Meetings: Meaning and Definition of CompanyDocument14 pagesCompany Meetings: Meaning and Definition of CompanyMohsin AliNo ratings yet

- Financial ManagementDocument8 pagesFinancial Managementoptimistic070% (1)

- Axis CTF FillableDocument1 pageAxis CTF FillablemayankNo ratings yet

- A History of Venture Capital - LebretDocument66 pagesA History of Venture Capital - LebretHerve LebretNo ratings yet

- Research Report On Sun Pharma Advanced Research Company Ltd.Document5 pagesResearch Report On Sun Pharma Advanced Research Company Ltd.moneybee100% (3)

- Itr-1 Sahaj Individual Income Tax ReturnDocument5 pagesItr-1 Sahaj Individual Income Tax Returnchinna rajaNo ratings yet

- 6207 Present Scenario and Future Potential of Takaful1Document15 pages6207 Present Scenario and Future Potential of Takaful1Biplab KarNo ratings yet

- HydrocarbonsDocument137 pagesHydrocarbonsCiise Cali HaybeNo ratings yet

- June 2014 JbpaDocument12 pagesJune 2014 JbpajsergiomcostaNo ratings yet

- Adobe Scan FebDocument1 pageAdobe Scan FebpranayjadhavNo ratings yet

- Using The Envelope Budgeting Method in Today's Cashless SocietyDocument5 pagesUsing The Envelope Budgeting Method in Today's Cashless SocietyJean Marc LouisNo ratings yet