Professional Documents

Culture Documents

Annex A - Certificate of Availment

Annex A - Certificate of Availment

Uploaded by

Joel SyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annex A - Certificate of Availment

Annex A - Certificate of Availment

Uploaded by

Joel SyCopyright:

Available Formats

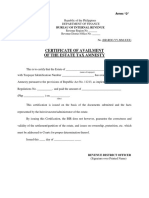

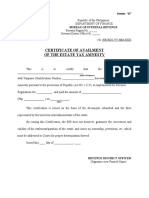

Annex A

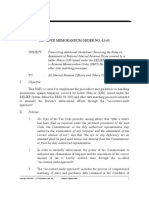

Republic of the Philippines

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

Large Taxpayers Service/Revenue Region No. ___

LT Audit Division ___ / LT Division ___ /Revenue District Office No. ___

No.: (CA-RDO No.-MM-XXXXX)

CERTIFICATE OF AVAILMENT

[VOLUNTARY ASSESSMENT AND PAYMENT PROGRAM (VAPP)]

This is to certify that ____________________________________________________

(name of taxpayer)

with Taxpayer Identification Number ______________________ availed of the Voluntary

Assessment and Payment Program pursuant to Revenue Regulations (RR) No. 21-2020 for the

following tax type(s) and taxable year/period:

Tax Type Taxable Period

By issuing this Certification, the BIR grants the privilege of “no audit” for the covered

aforestated tax type(s) and taxable year/period.

This certification is issued on the basis of the documents submitted by the taxpayer or

his/its duly authorized representative. However, if upon verification, the data will be found out to

be different or the availment is not qualified based on Section 10 of RR No. 21-2020, then this

certification shall be null and void.

Issued this ____ day of _____________, ____.

________________________________________

Chief LT Office/Revenue District Officer

(Signature over Printed Name)

You might also like

- REMINDER LETTER Late Filing of Vat ReturnDocument2 pagesREMINDER LETTER Late Filing of Vat ReturnHanabishi Rekka100% (1)

- Additional Withholding Agents - Non-IndividualsDocument14 pagesAdditional Withholding Agents - Non-IndividualsJoel SyNo ratings yet

- Sample Protest LetterDocument2 pagesSample Protest LetterConsciousness Vivid100% (1)

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- Tax Amnesty CertificateDocument1 pageTax Amnesty CertificateJewelyn C. Espares-CioconNo ratings yet

- Annex A-RR22-2020NOD V03Document2 pagesAnnex A-RR22-2020NOD V03Fo LetNo ratings yet

- Report of No Late Returns Filed/Received Under Revenue Regulations No.Document1 pageReport of No Late Returns Filed/Received Under Revenue Regulations No.EupraxiaNo ratings yet

- Annex B - RMC 103-2019Document2 pagesAnnex B - RMC 103-2019Ra JeNo ratings yet

- Annex B - RMC 103-2019Document2 pagesAnnex B - RMC 103-2019Isaac Dominic MacaranasNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentJason YangaNo ratings yet

- Certificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2Document1 pageCertificate of Availment of The Estate Tax Amnesty: Annex "B" Ver. 2PaulNo ratings yet

- Annex A - Format of Notice of Discrepancy - RMC 102-2020 1Document2 pagesAnnex A - Format of Notice of Discrepancy - RMC 102-2020 1Joanna AbañoNo ratings yet

- RMC No. 102-2020 Annex ADocument2 pagesRMC No. 102-2020 Annex AHerzl Hali V. HermosaNo ratings yet

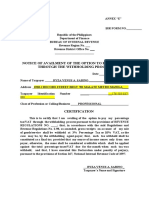

- Notice of Availment of The Option To Pay The Tax Through The Withholding ProcessDocument2 pagesNotice of Availment of The Option To Pay The Tax Through The Withholding ProcessArgielJedTabalBorrasNo ratings yet

- Annex "C": Republic of The Philippines Department of Finance Quezon CityDocument2 pagesAnnex "C": Republic of The Philippines Department of Finance Quezon CityYna YnaNo ratings yet

- Notice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnDocument1 pageNotice of Cancellation of Availment of The Substituted Filing of Percentage Tax/Vat ReturnWarlie Zambales DiazNo ratings yet

- Sworn Application For Tax Clearance For General Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For General Purposes Individual Taxpayersjdsindustrial23No ratings yet

- RMO No 9-06 TCVD Tax Mapping Annex N-QDocument5 pagesRMO No 9-06 TCVD Tax Mapping Annex N-QGil PinoNo ratings yet

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezNo ratings yet

- Financial InformationDocument2 pagesFinancial Informationeprints cebuNo ratings yet

- REVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherDocument15 pagesREVENUE MEMORANDUM ORDER NO. 1-2015 Issued On January 7, 2015 FurtherGoogleNo ratings yet

- Annex D - Certificate of AvailmentDocument1 pageAnnex D - Certificate of AvailmentMELLICENT LIANZANo ratings yet

- RMC No. 10-2020Document2 pagesRMC No. 10-2020Volt LozadaNo ratings yet

- Annex E RR14 - 2003Document1 pageAnnex E RR14 - 2003Jomar Teneza100% (1)

- Application Form For Tax Compliance Verification Certificate (Individual Taxpayers)Document1 pageApplication Form For Tax Compliance Verification Certificate (Individual Taxpayers)abmbookkeepingofficeNo ratings yet

- RR 22-2020 (Notice of Discrepancy) PDFDocument3 pagesRR 22-2020 (Notice of Discrepancy) PDFilovelawschoolNo ratings yet

- ANNEX eDocument2 pagesANNEX eChristian Sadia0% (1)

- Tax FormDocument1 pageTax FormChriestal SorianoNo ratings yet

- Republic of The Philippines: Quezon CityDocument1 pageRepublic of The Philippines: Quezon CityCharina Marie CaduaNo ratings yet

- Tax Declaration Form 2021Document1 pageTax Declaration Form 2021Jessica SantosNo ratings yet

- RMC No 68-2017 PDFDocument2 pagesRMC No 68-2017 PDFPatrick John Castro BonaguaNo ratings yet

- RR No. 33-2020Document2 pagesRR No. 33-2020JejomarNo ratings yet

- Rmo No 9-06 TCVD Tax Mapping Annex A-C, FDocument5 pagesRmo No 9-06 TCVD Tax Mapping Annex A-C, FGil PinoNo ratings yet

- Annex J.5 - TCGP - IndividualDocument1 pageAnnex J.5 - TCGP - Individualmaureen.lumbao95No ratings yet

- Tra Confirmation Page 1601eq DecemberDocument1 pageTra Confirmation Page 1601eq Decembernaim indahiNo ratings yet

- Bureau of Internal Revenue: Republic of The Philippines Department of FinanceDocument4 pagesBureau of Internal Revenue: Republic of The Philippines Department of FinanceHanabishi RekkaNo ratings yet

- Tax Clearance FormDocument1 pageTax Clearance FormJhen FigueroaNo ratings yet

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezNo ratings yet

- How To File Indian Income Tax Updated ReturnDocument6 pagesHow To File Indian Income Tax Updated ReturnpragativistaarNo ratings yet

- Business Permit License Office Renewal FormDocument1 pageBusiness Permit License Office Renewal FormAdrian Joseph GarciaNo ratings yet

- Application For Tax Compliance Verification Certificate Individual TaxpayersDocument1 pageApplication For Tax Compliance Verification Certificate Individual TaxpayerslynmarieloverNo ratings yet

- And Prescribed by The National Office." (Italics and Emphasis Supplied)Document2 pagesAnd Prescribed by The National Office." (Italics and Emphasis Supplied)Ckey ArNo ratings yet

- Tax ExamDocument2 pagesTax ExamCzarina Joy PenaNo ratings yet

- Bureau of Internal Revenue: Republic of The PhilippinesDocument1 pageBureau of Internal Revenue: Republic of The PhilippinesLeizza Ni Gui DulaNo ratings yet

- Notice of Availment of The Substituted Filing of Percentage Tax ReturnDocument1 pageNotice of Availment of The Substituted Filing of Percentage Tax ReturnArgielJedTabalBorras100% (1)

- BRF Revised - xlsx201919 19315Document1 pageBRF Revised - xlsx201919 19315Jane CMNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Individual TaxpayersdiopenesjoelNo ratings yet

- Sample Protest LetterDocument2 pagesSample Protest LetterLyceum WebinarNo ratings yet

- Philippine Economic Zone Authority: Republic of The PhilippinesDocument2 pagesPhilippine Economic Zone Authority: Republic of The PhilippinesPaul GeorgeNo ratings yet

- BLGF MC No. 009.2022 Change Request Forms For The FY 2022 SGLG AssessmentDocument5 pagesBLGF MC No. 009.2022 Change Request Forms For The FY 2022 SGLG AssessmentmtolgujavierNo ratings yet

- Notice of Availment of Substituted Filing of Percentage Tax ReturnsDocument1 pageNotice of Availment of Substituted Filing of Percentage Tax ReturnsJomar TenezaNo ratings yet

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocument12 pagesRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArNo ratings yet

- Tax Remittance Advice: Bureau of Internal RevenueDocument1 pageTax Remittance Advice: Bureau of Internal RevenueJi Aub TakNo ratings yet

- 1601EQDocument1 page1601EQJi Aub TakNo ratings yet

- Annex F - Cancelled LAs-TVNsDocument2 pagesAnnex F - Cancelled LAs-TVNsJoel SyNo ratings yet

- OLD Income Tax Performa-2021-22Document13 pagesOLD Income Tax Performa-2021-22Research AccountNo ratings yet

- EFG Chapter 4Document13 pagesEFG Chapter 4Kal KalNo ratings yet

- Sworn Application For Tax Clearance For Bidding Purposes Non-Individual Taxpayers - CopyDocument1 pageSworn Application For Tax Clearance For Bidding Purposes Non-Individual Taxpayers - CopyCecille GenerosoNo ratings yet

- RMC No 23-2012 - Withholding of TaxesDocument7 pagesRMC No 23-2012 - Withholding of TaxesJOHAYNIENo ratings yet

- RMC No. 46-2021Document1 pageRMC No. 46-2021Joel SyNo ratings yet

- RMC No. 16-2022Document2 pagesRMC No. 16-2022Joel SyNo ratings yet

- Revenue Memorandum Circular No.Document5 pagesRevenue Memorandum Circular No.Joel SyNo ratings yet

- BB No. 2020-14Document1 pageBB No. 2020-14Joel SyNo ratings yet

- RMO No. 34-2020Document1 pageRMO No. 34-2020Joel SyNo ratings yet

- RMC No. 108-2020 Annex BDocument2 pagesRMC No. 108-2020 Annex BJoel SyNo ratings yet

- Bir Form No. 0622Document2 pagesBir Form No. 0622Joel SyNo ratings yet

- RMC No. 108-2020 Annex ADocument3 pagesRMC No. 108-2020 Annex AJoel SyNo ratings yet

- RMO No. 34-2020 - DigestDocument1 pageRMO No. 34-2020 - DigestJoel SyNo ratings yet

- Annex CDocument1 pageAnnex CJoel SyNo ratings yet

- Annex F - Cancelled LAs-TVNsDocument2 pagesAnnex F - Cancelled LAs-TVNsJoel SyNo ratings yet

- RR No. 21-2020Document10 pagesRR No. 21-2020Joel SyNo ratings yet

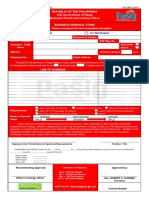

- Payment Form: Voluntary Assessment and Payment Program (VAPP)Document2 pagesPayment Form: Voluntary Assessment and Payment Program (VAPP)Joel SyNo ratings yet

- RR 21-2020 (Digest)Document4 pagesRR 21-2020 (Digest)Joel SyNo ratings yet

- RR No. 11-2020 April 29, 2020Document15 pagesRR No. 11-2020 April 29, 2020Joel SyNo ratings yet

- BIR Updates Issue No. 15Document1 pageBIR Updates Issue No. 15Joel SyNo ratings yet

- Delisted Top Withholding Agents - Non-IndividualDocument20 pagesDelisted Top Withholding Agents - Non-IndividualJoel SyNo ratings yet