Professional Documents

Culture Documents

Revision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18

Revision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18

Uploaded by

dev4c-1Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Revision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18

Revision Notes: Book " Corporate Finance ", Chapter 1-18 Revision Notes: Book " Corporate Finance ", Chapter 1-18

Uploaded by

dev4c-1Copyright:

Available Formats

lOMoARcPSD|2985644

Revision Notes: Book " Corporate Finance ", Chapter 1-18

Corporate Finance (Griffith University)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

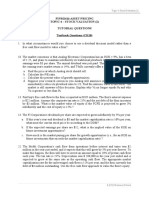

Fundamnntals of Corporatn Financn – Summary

Part 1: Ovnrvinw of Corporatn Financn

Chaptnr 1: Introduction to Corporatn Financn

1.1 Corporatn Financn and thn financial Managnr

Corporate Finance: the study of ways to answer these three questions:

(1) What long-term investments?

(2) Where will you get the long-term financing to pay for your investment?

(3) How will you manage your everyday financial activities such as collecting from customers + paying suppliers?

Financial Manager: the corporation employs managers to represent the owners’ interests and make decisions on their

behalf. In a large corporation, the financial manager would be in charge of answering the three questions above

(1) Capital budgeting: process of planning + managing a firm's long-term investments, in CB the financial manager tries to

identify investment opportunities, financial managers: Evaluating the size, timing, and risk of future cash flows

(2) Capital Structure: The mixture of debt and equity maintained by a firm, ways in which the firm obtains and manages the long-

term financing it needs to support its longterm investments, fm decides for financing mix

(3) Working capital/Dividend decision: A firm’s short-term assets and liabilities, ensures that the firm has sufficient resources to

continue its operations and avoid costly interruptions, involves decision of whether to pay dividends to shareholders or maintain the

funds for internal growth, factors to consider: growth opportunities, taxation, shareholders preference

1.2 Thn Goal of Financial Managnmnnt

possible financial goals: Survive, Avoid financial distress and bankruptcy, Beat the competition, Maximize sales or market

share, Minimize costs, Maximize profits, Maintain steady earnings growth → goals refering to profitability and a way of

controlling risk, but they are all very unprecise

Goal of Financial Management: maximize current value per share of the existing stock, maximize shareholders wealth

a more general goal: maximize the market value of the existing owners’ equity

1.3 Thn Agnncy Problnm and thn Control of thn Corporation

agency problem: The possibility of conflict of interest between the stockholders (principal) and management of a firm (agent).

Agency relationships: relationship between stockholders and management, the principal (stockholder) hires an agent to represent his

interests

Management roles: agency costs refers to the costs of conflict of interest between stockholders + management,

Direct agency costs – monitoring costs, the purchase of something for management that cannot be justified from the risk-return

standpoint (e.g. purchase of a company private jet)

Indirect agency costs – management’s tendency to forgo risky or expensive projects that could be justified from a risk-return

standpoint due to fear of failure and looking bad.

Managerial compensation: Management will frequently have a significant economic incentive to increase share value

Control of the firm: stakeholders control the firm → threat of takeover and proxy fight may result in better management

control from other stakeholder: government, employees, suppliers

stakeholder: Someone other than a stockholder or creditor who potentially has a claim on the cash flows of the firm.

1.4 Financial Marknts and thn Corporation

financial market: way of bringing buyers and sellers together.

Role of a Financial Market: To channel savings into investments, Enable sale and purchase of financial assets

primary market refers to the original sale of securities by governments and corporations, corporation is the seller, and the

transaction raises money for the corporation

secondary markets: involve the continual buying and selling of issued securities, ex: New York Stock Exchange (NYSE), Tokyo

Stock Exchange (TSE) and London Stock Exchange (LSE)

Money markets: involve the trading of short-term debt securities.

Capital markets: involve the trading of long-term debt securities and shares

Chaptnr 2: Financial Statnmnnts, Taxns, and Cash Flow

2.1 Thn yalancn Shnnt

balance sheet: Financial statement/snapshot showing a firm’s accounting value (assets and liabilites) on a particular date

assets: left-hand side (current assets (CL) vs. Fixed assets (FA), tangible (PC) and intangible (patent))

liabilites and owners' equity: liabilities (current (asset) or long-term (debt → bond)) right-hand side

balance sheet identity: Assets (A) = Liabilities (L) + Stockholders’ Equity (E)

Net Working capital (NWC): Current Assets (CL) – Current Liabilities (CL) Positive (NWC>0) when the cash that will be received

over the next 12 months exceeds the cash that will be paid out → 3sually positive in a healthy firm

Liquidity: refers to the speed and ease with which an asset can be converted to cash without a significant loss in value

The more liquid a business is, the less likely it is to experience financial distress, liquid assets are generally less profitable

→ trade-off between the advantages of liquidity and forgone potential profits, liquid and illiquid assets

debt vs. Equity: use of debt in a firm’s capital structure is called financiag geverage, it increases the potential reward to

shareholders, but it also increases the potential for financial distress and business failure

market value vs. Book value: The balance sheet provides the book value of the assets, liabilities and equity, price what the firm

paid for them, no matter what they are worth today

Market value is the price at which the assets, liabilities or equity can actually be bought or sold → it is more important

2.2 Thn Incomn Statnmnnt

Income statement: Financial statement summarizing a firm’s performance over a period of time

Revenues -Expenses = Income

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Earnings per share (EPS): net income / total shares outstanding

Dividends per share (DPS): total dividends / total shares outstanding

noncash items: Expenses charged against revenues that do not directly affect cash flow, such as depreciation, reason why accounting

income differs from cash flow, time and costs: variable costs vs. Fixed costs

2.3 Cash Flow

Cash flow: one of the most important pieces of info that a financial manager can derive from financial statements

cash flow: the difference between the number of dollars that came in and the number that went out

Earnings can be easily manipulated by managers by adjusting depreciation or other items. Cash flows are more difficult to manipulate

(Cash is king).

cash flow from assets (CFA): total of cash flow to creditors and cash flow to stockholders, consisting of the following: operating cash

flow, capital spending, and change in net working capital.

Cash generated from using our assets = Cash paid to those that finance the purchase of those assets (Creditors + S)

operating cash flow (OCF): Cash generated from a firm’s normal business activities.

Cash Flow Identity: Cash Flow from Assets (CFA) = Cash Flow to Creditors (CFC) + Cash Flow to Stockholders (CFS)

CFC = Interest Paid (Cash out) – Net New Borrowings (long-term debt ending – long-term debt beginning) (Cash in)

CFS = Dividends Paid (Cash out) – Net New Equity (common shares ending – common shares beginning) (Cash in)

CFA = OCF – NCS – ΔNWC

Cash Flow From Assets (CFA) = Operating Cash Flow (OCF) – Net Capital Spending (NCS) – Changes in Net Working Capital

(ΔNWC)

OCF = EBIT + depreciation – taxes

NCS = end net fix. assets – begin net fix. assets + depr.

∆ NWC = ending NWC (CA - CL) – beginning NWC (CA-CL)

Operating cash flow: EBIT

+ Depreciation

– Taxes

Less

Net capital spending: Ending net fixed assets

– Beginning net fixed assets

+ Depreciation

Less

Change in net working capital: Ending net working capital

– Beginning net working capital

= Cash flow from assets

Part 2: Financial Statnmnnts and Long-Tnrm Financial Planning

Chaptnr 3: Working with Financial Statnmnnts

3.1 Cash Flow and Financial Statnmnnt: A closnr Look

sources of cash: A firm’s activities that generate cash.

uses of cash: A firm’s activities in which cash is spent. Also called applications of cash.

Sources: - Cash inflow – occurs when we “sell” something

- Decrease in asset account (Accounts receivable, inventory, and net fixed assets)

- Increase in liability or equity account (Accounts payable, other current liabilities, and common stock)

3ses: - Cash outflow – occurs when we “buy” something

- Increase in asset account (Accounts receivable, and other current assets)

- Decrease in liability or equity account (Notes payable and long-term debt)

Statement of cash flow: firm’s financial statement that summarizes its sources and uses of cash over a specified period.

Changes divided into three major categories:

Operating Activity – includes net income and changes in most current accounts

Investment Activity – includes changes in fixed assets

Financing Activity – includes changes in notes payable, long-term debt and equity accounts as well as dividends

Cash Flow Statement:

Operating activities: + Net profit

+ Depreciation

+ Any decrease in current assets (except cash)

+ Increase in accounts payable

– Any increase in current assets (except cash)

– Decrease in accounts payable

Investment activities: + Ending non-current assets

– Beginning non-current assets

+ Depreciation

Financing activities: – Decrease in notes payable

+ Increase in notes payable

– Decrease in long-term debt

+ Increase in long-term debt

+ Increase in ordinary shares

– Dividends paid

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

CF = OCF– ΔNWC – NCS + financing

= (EBIT - tax + depr)– Δ(CA-CL) – (FA-depr) + financing

3.2 Ratio Analysis

Ratios also allow for better comparison through time or between companies, are used both internally and externally

Categories of financial rations:

- Short-term solvency or liquidity ratios

- Long-term solvency or financial leverage ratios: e.g. Total Debt Ratio, Debt/Equity Ratio, Equity Multiplier (EM) (A/E)

- Asset management or turnover ratios (Efficiency): e.g. Total Asset Turnover (TO) (Sales/A), NWC Turnover, Fixed Asset Turnover

- Profitability ratios: e.g. Profit Margin (PM) (NI/Sales), Return on Assets (ROA), Return on Equity (ROE)

- Market value ratios:

PE Ratio: Price per share / Earnings per share

Market value / Earnings

“Market-to-book” Ratio: Market price per share / Book value per share

Market value of equity / Book Value of equity

3.3 Thn Du Pont Idnntity

Du Pont identity: Popular expression breaking ROE into 3 parts: operating efficiency (as measured by profit margin PM), asset use

efficiency (as measured by total asset turnover TO), and financial leverage (as measured by the equity multiplier EM)

NI/E (ROE) = (NI/Sales) * (Sales/Asset) *(Asset/Equity)

ROE = PM * TO * EM

3.4 Using Financial Statnmnnt Information

Why evaluate financial statements?

Internal uses: Performance evaluation – compensation and comparison between divisions

Planning for the future – guide in estimating future cash flows

External uses: Creditors

Suppliers

Customers

Stockholders

Benchmarking: Ratios are not very helpful by themselves; they need to be compared to something.

Time-Trend Analysis: Used to see how the firm’s performance is changing through time

Peer Group Analysis: Compare to similar companies / industry, common way of identifying potential peers is based on

SIC codes

Standard Industrial Classification code: 3.S. government code to classify a firm by its type of business operations.

Potential Problems:

There is no underlying theory, so there is no way to know which ratios are most relevant

Benchmarking is difficult for diversified firms

Globalization + international competition makes comparison more difficult due to differences in accounting regulations

Varying accounting procedures, i.e. FIFO vs. LIFO

Different fiscal years

Extraordinary events

Part 3: Valuation of Futurn Cash Flows

Chaptnr 5: Introduction to Valuation: Thn Timn Valun of Monny

time value of money refers to the fact that a dollar in hand today is worth more than a dollar promised at some time in

the future

5.1 Futurn Valun and Compounding

future value (FV): The amount an investment is worth after one or more periods.

Compounding: The process of accumulating interest on an investment over time to earn more interest.

Simple interest: interest earned each period only on the principal

Ex. future value: you invest $1000 for one year at 5% per year future value in one year: 1000 (1+0.05) = 1050

future value in 2 years: 1000(1.05)2 = 1102.50

General Formula:FV = PV(1 + r)t , where FV = future value, PV = present value, r = pnriod interest rate, expressed as a decimal

t = number of pnriods

5.2 Prnsnnt Valun and Discounting

present value (PV): The current value of future cash flows discounted at the appropriate discount rate.

How much do I have to invest today to have some amount in the future?

FV = PV(1 + r)t → Rearrange to solve for PV = FV / (1 + r)t

discount: Calculate the present value of some future amount.

discount rate: The rate used to calculate the present value of future cash flows.

discounted cash flow (DCF) valuation: Calculating the present value of a future cash flow to determine its value today.

For a given interest rate – the longer the time period, the lower the present value

For a given time period – the higher the interest rate, the smaller the present value

To find r: rearrange to r = (FV/PV)1/t – 1

To find t: rearrange to t = LN(FV/PV)/LN(1 + r)

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Chaptnr 6: Discountnd Cash Flow Valuation

6.1 futurn and prnsnnt valuns of multipln cash flows

FV of multiple cash flows: draw a timeline at which time what sum of money is on your account and gets interest, compounding each

future value separately and adding up sum later, hoch...: Zahl der Lücken, umgekehrt Zeitstrahl

FV = C1(1+r)n-1 + C2(1+r)n-2 + …+Ct(1+r)n-t

PV of multiple cash flows: draw a timeline at which point of time you want to have how much money available, calculate the

present values individually and add them up, hoch...: Zahl am Zeitstrahl

PV = C1/(1+r) + C2/(1+r)2 + …+Ct/(1+r)t

Note: if there is an immediate cash flow (C ) at the start then begin sum with t = 0. Do not discount!!

0

6.2 valuing lnvnl cash flows: annuitins and pnrpntuitins

Annuity: finite series of equal payments that occur at regular intervals, e.g. comsumer loans → car, home mortgage

If the first payment occurs at the end of the period, it is called an ordinary annuity

If the first payment occurs at the beginning of the period, it is called an annuity due

PV=Cx {1-[1/(1+r)t]}/r

FV={[(1+r)t -1]/r}

If the monthly payments are unknown: C = PV/{[1-1/(1+r)t]/r}

to find the period it takes off to pay the amount,you need to rearrange the formula

Annuity: finding the rate → Trial and Error Process

Choose an interest rate and compute the PV of the payments based on this rate

Compare the computed PV with the actual given amount:

1.If the computed PV > given amount, then the interest rate is too low. Action: increase rate

2.If the computed PV < given amount, then the interest rate is too high. Action: lower rate

→ discount rate and present value move in opposite directions!

Adjust the rate and repeat the process until the computed PV and the given amount are equal

Suppose you begin saving for your retirement by depositing $2000 per year in an investment account. If the interest rate is 7.5%, how

much will you have in 40 years? FV = 2000(1.07540 – 1)/0.075 = 454,513.04

Perpetuity: infinite series of equal payments at regular intervals

Perpetuity: A company wants to sell preferred stock at $100 per share. Similar shares sell for $40 with $1 dividend per quarter. What

dividend will the new shares offer?

Perpetuity formula: PV = C / r, C = ?, C= P x r

Current required return: 40 = 1 / r, r = C/P,

r = 0.025 or 2.5% per quarter

6.3 comparing ratns: thn nffnct of compounding

If you want to compare two alternative investments with different compounding periods you need to compute the EAR (effective

annual rate) and use that for comparison, EAR: The interest rate expressed as if it were compounded once per year.

Nominal interest rates (NIR): This is the annual rate that is quoted by law

By definition NIR = period rate x number of periods per year

Period rate = NIR / number of periods per year

You should NEVER divide the EAR by the number of periods per year – it will NOT give you the period rate

What is the NIR if the monthly rate is 0.5%? → 0.005(12) = 6%

Formula:

m is the number of compounding periods per year

Example: Suppose you can earn 1% per month on $1 invested today.

What is the NIR ? 1% x (12) = 12%

FV = $1x(1.01)12 = $1.1268

EAR = ($1.1268 – $1) / $1 = .1268 = 12.68%

EAR = [1 + (Quoted rate/m)]m – 1 m = the number of times the interest is compounded during the year

→ If r=11% per month and is compounded, you have to divide it by 12 to get the EAR

Chaptnr 7: Intnrnst Ratns and yond Valuation

7.1 yonds and yond Valuation

What is a Bond? → Debt security

Par value (face value) = $100 → The principal that needs to be repaid

Coupon rate → Quoted rate as a percentage of face value

Coupon payment → The interest payment on a bond based on coupon rate

Maturity date → Date when principal is repaid.

Yield or Yield to maturity (YTM) → Required market rate

yond Valuation: Bond Value = Present Value of Cash Flows

Bond Value = PV of coupons + PV of par

Bond Value = PV annuity + PV single sum

Remember, as interest rates increase present values decrease → So, as interest rates increase, bond prices decrease and vice versa

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Bond value C x [1 - 1/(1 + r)t]/r + F/(1 r)t

→ bond prices and interest rates always move in opposite directions. When interest rates rise, a bond’s value, like any

other present value, will decline.

If : YTM > coupon rate then bond price < par value → Selling at a discount, called a discount bond

If: YTM < coupon rate then bond price > par value → Selling at a prnmium, called a premium bond

If: YTM = coupon rate then par value = bond price → Selling at par

Intnrnst ratn risk: possible change in bond value due to change in interest risk

1. All other things being equal, the longer the time to maturity, the greater the interest rate risk.

2. All other things being equal, the lower the coupon rate, the greater the interest rate risk.

7.2 Somn diffnrnnt typns of bonds

Difference between debt and equity:

debt: - Not an ownership interest

- Creditors do not have voting rights

- Interest is considered a cost of doing business and is tax deductible

- Creditors have legal recourse if interest or principal payments are missed

- Excess debt can lead to financial distress and bankruptcy

Equity: - Ownership interest

- Common stockholders vote for the board of directors and other issues

- Dividends are not considered a cost of doing business and are not tax deductible

- Dividends are not a liability of the firm and stockholders have no legal recourse if dividends are not paid

- An all equity firm can not go bankrupt

Types of debt in A3:

Government Securities: Treasury bonds, Treasury notes

Other Debt Securities: Bank bills, commercial bills, promissory notes, Corporate Bonds, Debentures, 3nsecured notes, Floating-rate

notes, Convertible notes, Hybrid debt securities, Collateralised Debt Obligations - CDOs

7.3 Inflation and Intnrnst Ratns

Real rate of interest – adjusted for inflation

Nominal rate of interest – quoted rate that has not been adjusted for inflation

Fisher Effect – relationship between real, nominal and inflation rate.

(1 + R) = (1 + r)(1 + h), where R = nominal rate, r = real rate, h = expected inflation rate

Approximation: R = r + h

Chaptnr 8: Stock Valuation

Issuns in sharn valuation:

If you buy a share of stock, you can receive cash in two ways: The company pays dividends, You sell your shares

As with bonds, the price of the stock is the PV of these expected cash flows, PV of all expected future dividends + PV of selling price

3ncertainty of cash flows

Indefinite life

Dividend Growth Model: A model that determines the current price of a stock as its dividend next period divided by the discount rate

less the dividend growth rate.

3 Spncial casns:Constant dividend: The firm will pay a constant dividend forever

Constant dividend growth: The firm will increase the dividend by a constant percent every period

Supernormal growth: Dividend growth is not consistent initially, but settles down to constant growth eventually

Constant (zero growth): D1 = D2 = D3.…= Dt constant dividend or zero growth

P0 = D1 / R

Ex: Suppose a stock is expected to pay the same $0.50 dividend every quarter indefinitely and the required return is 10% with

quarterly compounding. What is the price? P0 = 0.50 / (0.025) = $20

Dividend Growth Model: Dividends are expected to grow at a constant percent per period (g%)

D0 < D1 < D2 …Dt-1< Dt P0 = D1/(r-g) = Do(1+g)/(r-g), Pt=Dt(1+g)/r-g = Dt+1/r-g

Beispiel: P4=D5(1+g)/r-g, D5=D1(1+g)4

dividend's yield: A stock’s expected cash dividend divided by its current price.

Chaptnr 9: Nnt Prnsnnt Valun and othnr invnstmnnt critnria

Good Dncision Critnria:

We need to ask ourselves the following questions when evaluating capital budgeting decision rules

- Does the decision rule adjust for the time value of money?

- Does the decision rule adjust for risk?

- Does the decision rule provide information on whether we are creating value for the firm?

Nnt prnsnnt valun (NPV)

Difference between market value and cost

Take the project if the NPV is positive, if not reject it

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Has no serious problems

Preferred decision criterion

Intnrnal ratn of rnturn (IRR)

Discount rate that makes NPV of an investment = 0, calculation with NPV formula and trial and error process

Take the project if the IRR is greater than the required return

most important alternative after NPV, often used in practice

Same decision as NPV with conventional cash flows, but:

IRR is unreliable with non-conventional cash flows or mutually exclusive projects (you can only choose one project)

Prnsnnt Valun Indnx (PVI)

Benefit-cost ratio, Measures the benefit per unit of cost, based on the time value of money

Calculation: PVI = PV of CF/Cost

Take investment if PI > 1

Cons: Cannot be used to rank mutually exclusive projects

Pros: closely related to NPV and leading to same decision, easy to understand, useful if investment funds are limited

Discountnd payback pnriod

Length of time until initial investment is recovered on a discounted basis

calculation: Compute PV of each cash flow, Subtract the discounted cash flows from initial cost, Compare to specified required period

Take the project if it pays back in some specified period

Cons: arbitrary cutoff period, may reject positive NPV projects, ignores cash flows beyond cutoff date, biased against longterm

projects

Pros: includes time value of money, easy to understand, biased towards liquidity, does not accept negative estimated NPVs

Payback pnriod

Length of time until initial investment is recovered

Computation: Estimate cash flows, Subtract the future cash flows from the initial cost until the initial investment has been recovered

calculate last postive cashflow : number which is still to cover to receive exact time

Take the project if it pays back in some specified period

Cons: Doesn’t account for time value of money, arbitrary cutoff period, ignores cash flows beyond cutoff date, biased against

longterm projects

Pros: easy to understand, biased towards liquidity

Chaptnr 12: Somn Lnssons from Capital Marknt History

the greater the risk, the greater the required return → there is a reward for bearing risk, the greater the potential reward is, the

greater

is the risk

Rnturns

Dollar Return: the sum of the cash received and the change in value of the asset in dollars

Return on investment: 1) income component (e.g. dividends) 2) change of value of the asset (capital gain or loss)

Total dollar return: Dividend income + Capital gain (or loss)

Total cash if stock is sold: Initial investment + Total return

Percentage Returns: the cash received and the change in value

of the asset divided by the original investment.

Dividend yield Dt +1/Pt

Capitag gains yiegd (P t +1 - Pt)/Pt

Holding Period Returns:

the return that an investor would get when holding an investment

over a period of n years

Avnragn Rnturns

Gnomntric Avnragn = annual average compound return per period over multiple periods, is overly pessimistic for short horizons - use

over long term GM =Rg = π[1+R]1/t -1 → Rg =[(1+R1)x(1+R2)x(1+R3)x(1+R4)]1/t -1

Arithmntic Avnragn = return in an average year per period over multiple periods,

is overly optimistic for long horizons - use over short term AM= Ra

Risk Mnasurnmnnts:

Main Measures:

- Variance (VAR): = the average of the squared differences between the actual return and the average return.

- Standard Deviation (SD): = square root of Variance

Lnssons from Capital Marknt History

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

- Data reflects two features often observed in financial markets: - There is a reward for bearing risk.

- The larger the potential reward, the larger the risk.

- This is called the risk-return trade-off

- There is a positive relationship between risk and return

Risk Prnmium

- The “extra” return earned for taking on risk

- The risk premium is the return over and above the risk-free rate

- Average Return – Risk-free Rate = Risk Premium

- What is a risk free rate? Treasury bills are considered to be risk-free. Can use Government bonds as well, Considered risk free in

terms of ability of pay interest obligations

Capital Marknt Efficinncy

Efficient Capital Markets: A market in which security prices reflect available information → based on available information, there

is no reason to believe that the current price is too low or too high.

efficient markets hypothesis (EMH): The hypothesis that actual capital markets, such as the NYSE, are efficient.

It means that, on average, you will earn a return that is appropriate for the risk undertaken and there is not a bias in prices that can be

exploited to earn excess returns

3 forms:

- weak form efficiency: - Prices reflect all past market information such as price and volume

- investors cannot earn abnormal returns by trading on market information

- Implies that technical analysis will not lead to abnormal returns

- Empirical evidence indicates that markets are generally weak form efficient

- semistrong form efficiency: - Prices reflect all publicly available information including trading information, annual reports,

press releases, etc.

- investors cannot earn abnormal returns by trading on public information

- Implies that fundamental analysis will not lead to abnormal returns

- strong form efficiency: - Prices reflect all information, including public and private

- investors could not earn abnormal returns regardless of the information they possessed

- Empirical evidence indicates that markets are NOT strong form efficient and that insiders could earn

abnormal returns

Chaptnr 13: Rnturn, Risk and Sncurity Marknt Linn

Expnctnd Rnturns

Average or Expected returns is based on the average of all possible future returns weighted by their probabilities,

Suppose there are T possible returns, and that R1 has probability p1 of occurring, R2 has probability p2 , …, and RT has probability

pT . Then: Expected returns = Sum of returns x possibility

Variancn and Standard Dnviation

measure the volatility of returns

3sing unequal probabilities for the entire range of possibilities

Weighted average of squared deviations from the expected returns

Portfolio = a collection of assets

An asset’s risk and return are important in how they affect the risk and return of the portfolio

The risk-return trade-off for a portfolio is measured by the portfolio expected return and standard deviation, like individual assets

portfolio weight: A percentage of a portfolio’s total value that is in a particular asset.

Portfolio expected returns:

Method 1: weighted average of the expected returns for each asset in the portfolio

Step 1: calculate expected return of the individual assets

Step2: calculate expected return based on weights of assets

Method 2: finding the portfolio return in each possible state and computing the expected value as we did with individual securities

Step 1: calculate expected return in each state, e,g, boom or recession

Step 2: add the state returns weighted by each probability

Portfolio Variance with probabilities: careful! not generally a simple combination of the variances of the assets in the

portfolio!!

combining assets into portfolios can substantially alter the risks faced by the investor!!

1) Compute the portfolio return for each state, boom, bust.. etc. (step 1): E(RPstate) = w1R1 + w2R2

2) Compute the E(Rpstate) using probabilities as for a single asset: E(RP) = p1 x E(Rstate1) + p2 x E(Rstate2) + p3 x E(Rstate3)

3) This E(RP) becomes the mean

4) Compute the deviations of each state from the mean, then square the deviation: [E(RPstate)-E(RP)]2

5) Multiply the squared deviation with probability of each state, then sum: ∑ (pstate x [E(RPstate)-E(RP)]2)

Total return = expected return + unexpected return, on average the expected return equals the actual return

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Risk and Portfolio Theory: Risk Averse Investors: require a higher average return to take on a higher risk

Portfolio Theory Assumption: Investors prefer the portfolio with the highest expected return for a given variance, or, the lowest

variance for a given expected return

Expected returns and Variances of Portfolios derived from historical returns, variances, and covariances of individual assets in

portfolio

Covariancn and Corrnlation Confficinnt

Covariance is an absolute measure of the degree to which two variables move together over time relative to their individual mean.

Correlation Coefficient, ρ, is a standardised measure of the relationship between the two variables, ranging between -1.00 to +1.00

In order to reduce the overall risk, it is best to have assets with low positive or negative correlation (covariance)

The smaller the covariance between the assets, the smaller will be the portfolio’s variance

Systnmatic or unsystnmatic Risk

Systematic or Non-Diversifiable Risk, market risk: That portion of an asset’s risk attributed to the market factors that affect all firms

and cannot be eliminated through the process of diversification.

3nsystematic or Diversifiable Risk asset-specific risk: That portion of an asset’s risk which is firm specific and can be eliminated

through the process of diversification

Total risk = systematic risk + unsystematic risk

The standard deviation of returns is a measure of total risk

For well-diversified portfolios, unsystematic risk is very small → essentially equivalent to the systematic risk

Thn Principln of Divnrsification:

states that spreading an investment across many assets will eliminate some but not all of the risk.

Diversification can substantially reduce the variability of returns without an equivalent reduction in expected returns

Size of risk reduction depends on covariances between assets in the portfolio

However, there is a minimum level of risk that cannot be diversified away and that is the systematic portion

3nsystematic risk is essentially eliminated by diversification, but systematic risk cannot be reduced by a portfolio

Systnmatic Risk and ynta

Systematic Risk Principle: There is a reward for bearing risk

There is not a reward for bearing risk unnecessarily

The expected return on a risky asset depends only on that asset’s systematic risk since unsystematic risk can be diversified away

risk premium only depends on systematic risk

Mnsuring systnmatic risk = ß:

We use the beta coefficient to measure systematic risk

Beta measures the responsiveness of a security to movements in the market.

beta coefficient: The amount of systematic risk present in a particular risky asset relative to that in an average risky asset.

Market beta βm = 1

Therefore if: βA= 1, the asset has the same systematic risk as the overall market

βA < 1 implies the asset has less systematic risk than the overall market

βA > 1 implies the asset has more systematic risk than the overall market

Because assets with larger betas have greater systematic risks, they will have greater expected returns → risk premium

A portfolio beta can be calculated, just like a portfolio expected return

Thn capital assnt pricing modnl (CAPM)

- defines the relationship between risk and return

- If we know an asset’s systematic risk, we can use the CAPM

to determine its expected return

- This is true whether we are talking about financial assets or

physical assets

shows that expected return of a particular asset depends on 3 things:

- time value of money

- reward for bearing systematic risk

- amount of systematic risk

Thn Sncurity Marknt Linn

= is the graphical representation of CAPM

Shows the relationship between systematic

risk and expected return

Positive slope

The higher the risk, the higher the return

According to the CAPM, all stocks must

lie on the SML, otherwise they would be

under or over-priced.

Reward to risk Ratio:

SML slope = Reward to Risk Ratio of Market

= Market Risk Premium

In equilibrium, all assets and portfolios must

have the same reward-to-risk ratio and they

all must equal the reward-to risk ratio for the

market, If not, assets are undervalued or

overvalued

Chaptnr 15: Thn Cost of Capital

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Our cost of capital provides us with an indication of how the market views the risk of our assets

Rnquirnd rnturn = cost of capital

- The Required Rate of Return = Discount Rate = Hurdle Rate = Cost of Capital

- Need to know the required return for an investment so we can compute the NPV and decide whether or not to take the investment

- Need to earn at least the required return to compensate investors for their financing

- Required return – from the investor’s point of view

- Cost of capital – from the firm’s point of view

Cost of Capital

- Cost of Capital is a mix of Cost of Equity and Cost of Debt

- These costs are determined by the market

- The firm determines the mix, Debt/Equity (D/E) reflecting it’s target capital structure.

- To calculate cost of capital: Calculate cost of equity → Calculate cost of debt → Combine them

Cost of Equity

- The cost of equity is the return required by equity investors, the shareholders on their investment in the firm

- Since this cost is not directly observable, it must be estimated

- There are two main methods for determining the cost of equity: - Dividend Growth Model

- CAPM

DGM Approach

Start with the dividend growth model formula where g is constant:

Where: RE is the required return for shareholders, P0 is the current price, D0 is the current/last dividend, D1 is the next dividend.

Rearranging to solve for RE:

Where D1/P0 is the dividend yield, and g is the growth rate of dividends

Problem: estimate the dividend growth rate: e.g. through historical average or using analysts forecast

Advantages and Disadvantages of DGM:

- Advantage: Easy to understand and use

- Disadvantages: Only applicable to companies currently paying dividends, Assumes dividend growth is constant, Cost of equity is

sensitive to growth estimate, Does not explicitly consider risk

CAPM Approach

using the SML approach, the expected return of the asset i is: , rearranging for return expected we

get:

Advantages and disadvantages of CAPM:

- Advantages: Explicitly adjusts for risk, Applicable to all companies

- Disadvantages: Have to estimate the expected market risk premium, which does vary over time, Have to estimate beta, which also

varies over time, We are using the past to predict the future, which is not always reliable

Cost of Prnfnrrnd Stock

- Preferred stock pays a constant dividend

- Dividends are expected to be paid forever

- Preferred stock return = Perpetuity RP P0 = D/Rp → RP = D / P0

Cost of Dnbt

The cost of debt is the required return on our company’s debt

We usually focus on the cost of long-term debt or bonds

The required return is best estimated by computing the yield-to-maturity or YTM

The cost of debt is NOT the coupon rate

For publicly listed debt use YTM

If the firm has no publicly traded debt, use YTM on similar debt that is traded

→ solve after RD with a trial and error process

Wnightnd avnragn cost of capital

We can use the individual costs of capital that we have computed to get our “average” cost of capital for the firm.

WACC is the required return on our assets, based on the market’s perception of the risk of those assets

The weights are determined by how much of each type of financing we use: WACC = wE*RE + wP*RP + wD*RD

E = market value of equity = nr. of outstanding shares times price per share

P = market value of preference shares = nr. of outstanding preference shares times price per share

D = market value of debt = nr. of outstanding bonds times bond price

V = market value of the firm = E + P + D

Weights: wE = E/V = percent financed with equity

wP = P/V = percent financed with preference stock

wD = D/V = percent financed with debt

wE + wP + wD = 1

WACC adjustnd

The company gets a tax deduction for interest on debt, reducing the effective cost of debt.

If TC is the corporate tax rate then the after tax cost of debt is RD*(1 TC), and the WACC adjusted for taxation effects is given by:

WACC = wE*RE + wP*RPS + wD*RD*(1 TC) or WACC = (E/V)*RE + (P/V)*RPS +(D/V)*RD*(1 TC)

WACC interpretation: it is the overall return the firm must earn on its existing assets to maintain the value of its stock.

To calculate the WACC:

Step 1: Calculate cost of equity and cost of debt

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

Step 2: Calculate the market value of each source of financing and the weights

Step 3: Calculate the WACC adjusting for tax

to find the numbers of an D/E taio = 0.33 just assign one number (e.g. 1) to E, afterwards calculate D=0.33v and V=1.33, afterwards

you can calculate the E/v and D/V for the WACC

WACC can be taken into account to see if a firm should take on a porject or rather not or as a performance evaluation

Divisional and Projnct Costs of Capital

- 3sing the WACC as our discount rate is only appropriate for projects that have the same risk as the firm’s current operations

- If we are looking at a project that does NOT have the same risk as the firm, then we need to determine the appropriate discount rate

for that project

- Divisions also often require separate discount rates

danger: a firm that uses its WACC to evaluate all projects will have a tendency to both accept unprofitable investments and

become increasingly risky.

Othnr approachns to estimating a discount rate:

- divisional cost of capital—used if a company has more than one division with different levels of risk;

- pure play approach —a discount rate that is unique to a particular project is used;

Look at companies in the same line of business as the new project

Calculate an average WACC for all the companies and use this rate as the discount rate of the new project

- subjective approach —projects are allocated to specific risk classes which, in turn, have specified discount rates

Consider the project’s risk relative to the firm overall risk

If the project risk > firm risk, use a discount rate > WACC

If the project risk < firm risk, use a discount rate < WACC

Flotation Costs

The required return depends on the risk, not how the money is raised

However, the cost of issuing new securities should not just be ignored either

Basic Approach: Compute the weighted average flotation cost, 3se the target weights because the firm will issue securities in these

percentages over the long term fA = (E/V)*fE + (D/V)* fD, where fA is the weighted average flotation cost, fE is the equity flotation

cost proportion, and fD is debt flotation cost proportion.

True cost of project = Cost/(1-fA)

Chaptnr 17: Financial Lnvnragn and Capital Structurn Policy

Choosing the capital structure: What is the primary goal of financial managers?

Maximize stockholder wealth → Choose the optimal capital structure → Maximize the value of the firm → Minimize the WACC

Thn Effnct of Financial Lnvnragn

Capital Rnstucturing: - Financial leverage = the extent to which a firm relies on debt financing

- Capital restructuring involves changing the amount of leverage a firm has without changing the firm’s assets

- The firm can increase leverage by issuing debt and repurchasing outstanding shares

- The firm can decrease leverage by issuing new shares and retiring outstanding debt

Thn Effnct of Lnvnrage: How does leverage affect the EPS and ROE of a firm?

- More debt financing, means more fixed interest expense

- In expansion, we have more income after we pay interest, have more left over for stockholders

- In recession, we still have to pay our costs therefore we have less left over for stockholders

- Leverage amplifies the variation in both EPS and ROE

- If EBIT is above break-even-point, leverage is beneficial;

Break-even-EBIT: Break-Even EBIT where: EPS debt = EPS no debt

If expected EBIT > break-even EBIT, then leverage is beneficial to our stockholders

If expected EBIT < break-even EBIT, then leverage is detrimental to our stockholders

Capital Strucutre Theory

Modigliani and Miller Theory of Capital Structure

Proposition I – firm value

Proposition II – cost of equity & WACC

The value of the firm is determined by the cash flows to the firm and the risk of the assets

Changing firm value: Change the risk of the cash flows, Change the cash flows

3 special cases: (1) Case I – Assumptions: No taxes, No bankruptcy costs

(2) Case II – Assumptions: With taxes, No bankruptcy costs

(3) Case III – Assumptions: With taxes, With bankruptcy costs

Casn 1: Proposition I: The value of the firm is NOT affected by changes in the capital structure

The cash flows of the firm do not change; therefore, value doesn’t change

Proposition II: Cost of Equity increases as Debt increases

The WACC of the firm is NOT affected by capital structure

WACC = RA = (E/V)RE + (D/V)RD

RE = RA + (RA – RD)(D/E)

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

RA is the “cost” of the firm’s business risk, i.e., the risk of the firm’s assets

(RA – RD)(D/E) is the “cost” of the firm’s financial risk, i.e., the additional return required by stockholders to compensate for the risk

of leverage

CAPM, yusinnss Risk, Financial Risk and Proposition II

How does financial leverage affect systematic risk?

CAPM: RE = Rf + E(RM – Rf) for equity CAPM: RA = Rf + A(RM – Rf) for assets

Where A is the firm’s asset beta and measures the systematic risk of the firm’s assets, also called unleverred beta – the risk of the

assets if the firm would have no debt ( in essence E = A if no debt)

RE = RA + (RA – RD)(D/E)

RE = RA + (RA – Rf)(D/E) assume RD = Rf

Proposition II

As we introduce debt in the firm:

RE = Rf + A(1+D/E)(RM – Rf)

E = A(1 + D/E)

Therefore, the systematic risk of the stock depends on: Systematic risk of the assets, A, (Business risk)

Level of leverage, D/E, (Financial risk)

→ as the firm raises its debt-equity ratio, the increase in leverage raises the risk of the equity and therefore the required

return or cost of equity

→ The total systematic risk of the firm’s equity thus has two parts: business risk (not affected by capital strucutre) and

financial risk (affected by capital strucutre)

Pizza Analogy and Capital Strucutre Theory

Assuming pereect capital markets, M&M found, without taxes, the total value of a firm is unaffected by its capital structure

Whether or not an investment makes sense does not depend on how we are going to raise the money to pay for it

→ A firm's cash flow is like a pizza: to change the firm's capital structure is to change the size of individual pizza slices

This dons not changn thn ovnrall sizn of thn pizza, nor does it change the overall value of the firm

Casn 2: Introducing Taxns

What happens to the firm’s cash flows? Interest is tax deductible → when a firm adds debt, it reduces taxes, all else equal

The reduction in taxes increases the cash flow of the firm

How should an increase in cash flows affect the value of the firm?

Tax savings = TC + RD * D

Casn 2 with taxns, Proposition I

The value of the firm increases by the present value of the annual interest tax shield

Value of a levered firm = value of an unlevered firm + PV of interest tax shield

Assuming perpetual cash flows: VU = EyIT(1-T) / RU with no debt R3 = RA= RE and V3 = E

VL = VU + D*TC E = VL – D

Casn 2 with taxns, Propostition II

When taxes are introduced in Case II:

RE increases as Debt increases: RE = RU + (RU – RD)(D/E)(1-TC)

WACC decreases as D/E increases: RL = WACC = (E/V)RE + (D/V)(RD)(1-TC)

Casn 3: with yankruptcy costs

As the D/E ratio increases, the probability of bankruptcy increases

This increased probability will increase the expected bankruptcy costs

At some point, the additional value of the interest tax shield will be offset by the increase in expected bankruptcy cost

At this point, the value of the firm will start to decrease and the WACC will start to increase as more debt is added

Bankruptcy Costs:

– Direct costs: Legal and administrative costs

– Indirect costs: Larger than direct costs & more difficult to measure and estimate

– Financial distress costs: All costs associated with going bankrupt and/or avoiding bankruptcy (direct + indirect costs)

Optimal Capital strucutrn

A firm will borrow because the interest tax shield is valuable. At relatively low debt levels, the probability of bankruptcy and

financial distress is low, and the benefit from debt outweighs the cost. At very high debt levels, the possibility of financial

distress is a chronic, ongoing problem for the firm, so the benefit from debt financing may be more than offset by the

financial distress costs → an optimal capital structure exists somewhere in between these extremes.

Conclusions:

- Case I – no taxes or bankruptcy

costs: No optimal capital structure

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

- Case II – corporate taxes but no

bankruptcy costs, Optimal capital

structure is almost 100% debt, Each

additional dollar of debt increases

the cash flow of the firm

- Case III – corporate taxes and

bankruptcy costs, Optimal capital

structure is part debt and part equity,

Occurs where the benefit from an

additional dollar of debt just offsets

the increase in expected bankruptcy

costs

Managnrial Rncommnndations

- The tax benefit is only important if the firm has a large tax

liability

- Risk of financial distress:

The greater the risk of financial distress, the less debt will

be optimal for the firm

The cost of financial distress varies across firms and

industries and as a manager you need to understand the cost

for your industry

Chaptnr 18: Dividnnds and Dividnnd Policy

Cash Dividnnds

- Regular cash dividend: cash payments made directly to stockholders, usually each quarter

- Extra cash dividend: indication that the “extra” amount may not be repeated in the future

- Special cash dividend: similar to extra dividend, but definitely won’t be repeated

- Liquidating dividend: some or all of the business has been sold

Dividnnd Paymnnt Chronology

- Declaration Date : Board declares the dividend and it becomes a liability of the firm

- Ex-dividend Date: 7 business days before date of record, Stock bought on or after this date, will not receive the dividend, Stock

price generally drops by about the amount of the dividend

- Date of Record : Holders of record are determined

- Date of Payment : Cheques are mailed

Dons Dividnnd Policy mattnr?

- Dividends matter!!!!!

the value of the stock is based on the present value of expected future dividends

- Dividend policy may not matter

Pay larger dividends and reinvest less vs

Pay smaller dividends and retain funds to reinvest more in the firm

In theory, if the firm reinvests capital now, it will grow and can pay higher dividends in the future

Irrnlnvancn Thnory

Modigliani and Miller’s (1961) irrelevance theory makes use of home-made dividends and relies on a number of assumptions:

– No company taxes, no transaction costs or market imperfections.

– No personal taxes

– A fixed capital budgeting program

The value of a firm:

– is determined by the earning power of the firm’s assets

– is not affected how the income is split between dividends and retained earnings.

Homnmadn Dividnnd Policy

Investors will not pay higher prices for firms with higher dividend payouts.

In other words, dividend policy will have no impact on the value of the firm because investors can create whatever income stream

they prefer by using homemade dividends.

Homemade Dividend Policy = Tailored dividend policy created by individual investors to undo corporate dividend policy

Rnlnvancy of dividnnd policy: 2 contradictory vinws:

- Dividend Policy is irrelevant → Since investors do not need dividends to convert shares to cash, dividend policy will have no impact

on the value of the firm

– Dividend policy is relevant → investors prefer high dividend policy because dividends are cash, and so are less risky than

capital gains that depend on future market sentiment., Differential tax treatment for dividends and capital gains can either favour or

penalise a dividend policy

Rnal-World Factors Favoring a Low Payout

Why might a low payout be desirable?

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

- Taxes: Individuals in upper income tax brackets might prefer lower dividend payouts, given the immediate tax liability, in favor of

higher capital gains with the deferred tax liability. All other things being the same, when personal tax rates are higher than

corporate tax rates, a firm will have an incentive to reduce dividend payouts. However, if personal tax rates are lower than

corporate tax rates, a

firm will have an incentive to pay out any excess cash in dividends.

- Flotation costs (for selling stock) – low payouts can decrease the amount of capital that needs to be raised, thereby lowering flotation

costs

- Dividend restrictions – debt contracts might limit the percentage of income that can be paid out as dividends

Thn imputation Systnm

The imputation system results in shareholders receiving a tax credit with their dividend for the tax actually paid by the company.

Imputation credits can be offset against income tax on the income of shareholders.

Franked dividends are dividends that are paid out of company profits on which tax has been levied.

Dividends are declared as: - eully eranked

- partially eranked

- uneranked

Rnal-World Factors Favoring a High Payout

Why might a high payout be desirable?

- Desire for current income: Individuals that need current income, i.e. Retirees, Groups that are prohibited from spending principal

(trusts and endowments)

- 3ncertainty resolution – no guarantee that the higher future dividends will materialize

- Taxes: Dividend income taxed less for corporation shareholders, Tax-exempt investors don’t have to worry about differential

treatment between dividends and capital gains

A Rnsolution of Rnal-World Factors?

Dividnnds and Signals

Asymmetric information – managers have more information about the health of the company than investors

Information Content Effect > Changes in dividends convey information > Cause market reaction

- Dividend increases: Management believes it can be sustained, Expectation of higher future dividends, increasing present value,

Signal of a healthy, growing firm

– Dividend decreases: Management believes it can no longer sustain the current level of dividends, Expectation of lower

dividends indefinitely; decreasing present value, Signal of a firm that is having financial difficulties

Clinntnln Effnct

Some investors prefer low dividend payouts and will buy stock in those companies that offer low dividend payouts

Some investors prefer high dividend payouts and will buy stock in those companies that offer high dividend payouts

→ If a firms changes the dividend policy from low to high or vice versa, it doesn’t matter!!

Establishing a Dividnnd Policy

Rnsidual dividnnd policy

Determine capital budget

Determine target capital structure

Finance investments with a combination of debt and equity in line with the target capital structure: Remember that retained earnings

are equity, If additional equity is needed, issue new shares

If there are excess earnings, then pay the remainder out in dividends

Constant growth dividnnd policy – dividends increased at a constant rate each year

Strict Residual Policy may lead to very unstable dividend payout : Depends on profitable investment opportunities

When earnings are seasonal, quarterly dividends can vary: Eg. Department stores before/after Christmas

Stable dividend policy is in the interest of the firm and its shareholders: Decrease uncertainty of future dividends

Constant payout ratio – pay a constant pnrcnnt of narnings nach ynar

Compromisn dividnnd policy

- Goals, ranked in order of importance:

Avoid cutting back on positive NPV projects to pay a dividend

Avoid dividend cuts

Avoid the need to sell equity

Maintain a target debt/equity ratio

Maintain a target dividend payout ratio

- Companies want to accept positive NPV projects, while avoiding negative signals

Dividnnd Rninvnstmnnt Plans – DRPs

Cash dividends are used to buy additional newly issued shares in the company

Advantages to the Company: - cheap and effective means of raising capital and conserving cash

- promotes good shareholder relations

Disadvantages to the company: - administration costs

- promotion of the plan

- may lead to excessive capital raising

Benefits to Investors - taxation benefits

- flexibility

- savings program

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

lOMoARcPSD|2985644

- no transaction costs involved

- sometimes offered at a discount

Disadvantages to investors - non-participants get diluted when participants get new shares at a discount.

- comprehensive records to be maintained

- no control over the reinvestment price

Stock Rnpurchasn

- Company buys back its own shares of stock: Equal access purchase, On-market purchase, Employee share purchase, Selective

purchase, Odd-lot purchase

- Similar to a cash dividend in that it returns cash from the firm to the stockholders

- Supports the argument for dividend policy irrelevance in the absence of taxes or other imperfections

- In a world with taxes, repurchases may be more desirable due to the options provided to stockholders

Stock Dividnnds

- Pay additional shares of stock instead of cash

- Increases the number of outstanding shares

- Small stock dividend – less than 20 to 25%

- Large stock dividend – more than 20 to 25%

Stock Splits

Stock splits – essentially the same as a stock dividend except expressed as a ratio

Stock price is reduced when the stock splits

If have 100 shares @ $30 each

A 2 for 1 stock split is the same as a 100% stock div.

New nr of shares = old nr. x (new nr./old nr.) = 200

New price = old $ x (old/ new) = $15

Common explanation for split is to return price to a “more desirable trading range”

Reverse split – number of share is reduced

If same data and have a 1 for 2 reverse split:

New nr of shares = old nr. x (new nr./old nr) = 50

New price = old $ x (old/ new) = $60

Downloaded by DAN HOWARD (DAN118DH@HOTMAIL.COM)

You might also like

- Day 1Document11 pagesDay 1Abdullah EjazNo ratings yet

- Chapter 7 BVDocument2 pagesChapter 7 BVprasoonNo ratings yet

- CH 04Document56 pagesCH 04Hiền AnhNo ratings yet

- Geopolitical Risk and InvestmentDocument18 pagesGeopolitical Risk and InvestmentGia Hân100% (1)

- Tutorial 4 QuestionsDocument4 pagesTutorial 4 Questionsguan junyan0% (1)

- Escanear 0003Document8 pagesEscanear 0003JanetCruces0% (4)

- AFM Notes by - Taha Popatia - Volume 1Document68 pagesAFM Notes by - Taha Popatia - Volume 1Ashfaq Ul Haq OniNo ratings yet

- Tutorial 1: Textbook Question 1Document33 pagesTutorial 1: Textbook Question 1Nurfairuz Diyanah RahzaliNo ratings yet

- Peirson12e SM CH12Document17 pagesPeirson12e SM CH12Corry CarltonNo ratings yet

- ACCT212 WorkingPapers E2-16ADocument2 pagesACCT212 WorkingPapers E2-16AlowluderNo ratings yet

- Hull Fund 8 e CH 12 Problem SolutionsDocument14 pagesHull Fund 8 e CH 12 Problem SolutionsVandrexz ChungNo ratings yet

- CH - 15 Financial Management: Core ConceptsDocument35 pagesCH - 15 Financial Management: Core ConceptsLolaNo ratings yet

- Revision Notes Book Corporate Finance Chapter 1 18Document15 pagesRevision Notes Book Corporate Finance Chapter 1 18Yashrajsing LuckkanaNo ratings yet

- Delwarca Software Remote Support UnitDocument13 pagesDelwarca Software Remote Support Unitdev4c-1100% (1)

- EarthWear Annual Report 2018Document16 pagesEarthWear Annual Report 2018Joy LeeNo ratings yet

- Capital Structure Decisions: Part I: Answers To End-Of-Chapter QuestionsDocument8 pagesCapital Structure Decisions: Part I: Answers To End-Of-Chapter Questionssalehin1969No ratings yet

- Time Value of Money Notes Loan ArmotisationDocument12 pagesTime Value of Money Notes Loan ArmotisationVimbai ChituraNo ratings yet

- Aicpa 040212far SimDocument118 pagesAicpa 040212far SimHanabusa Kawaii IdouNo ratings yet

- CH01SMDocument43 pagesCH01SMHuyenDaoNo ratings yet

- CH 17Document8 pagesCH 17cddaniel910411No ratings yet

- Working Capital Management: Answers To End-Of-Chapter QuestionsDocument27 pagesWorking Capital Management: Answers To End-Of-Chapter QuestionsMiftahul FirdausNo ratings yet

- McLeavey, Dennis W. - Solnik, Bruno H - Global Investments (2013 - 2014, Pearson) - Libgen - LiDocument591 pagesMcLeavey, Dennis W. - Solnik, Bruno H - Global Investments (2013 - 2014, Pearson) - Libgen - Liphoebe8soh100% (1)

- CH 02 Review and Discussion Problems SolutionsDocument16 pagesCH 02 Review and Discussion Problems SolutionsArman Beirami100% (2)

- Excercises MA 2023 1Document4 pagesExcercises MA 2023 1fin.minhtringuyenNo ratings yet

- Charles P. Jones, Investments: Principles and Concepts, Eleventh Edition, John Wiley & SonsDocument18 pagesCharles P. Jones, Investments: Principles and Concepts, Eleventh Edition, John Wiley & SonsJOYS RIOCARDO (00000032178)No ratings yet

- Required Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate FinanceDocument2 pagesRequired Texts:: Hanoi Foreign Trade University Faculty of Banking and Finance TCHE321 Corporate Financegenius_2No ratings yet

- Bibitor LLC Inventory Analysis Case Study Phase 3Document21 pagesBibitor LLC Inventory Analysis Case Study Phase 3Phạm Duy ĐạtNo ratings yet

- Chapter 9Document18 pagesChapter 9Rubén ZúñigaNo ratings yet

- Fm14e SM Ch13Document7 pagesFm14e SM Ch13Syed Atiq TurabiNo ratings yet

- Acst252 - Week 3 - Ross - 7e - PPT - ch03 - V3Document41 pagesAcst252 - Week 3 - Ross - 7e - PPT - ch03 - V3nathanNo ratings yet

- CF Week11 12 STDocument57 pagesCF Week11 12 STPol 馬魄 MattostarNo ratings yet

- Wiley - Chapter 11: Depreciation, Impairments, and DepletionDocument39 pagesWiley - Chapter 11: Depreciation, Impairments, and DepletionIvan BliminseNo ratings yet

- Foundations of Finance: An Introduction To The Foundations of Financial Management - The Ties That BindDocument35 pagesFoundations of Finance: An Introduction To The Foundations of Financial Management - The Ties That BindManish MahajanNo ratings yet

- Assignment 3Document4 pagesAssignment 3will.li.shuaiNo ratings yet

- Asset Recognition and Operating Assets: Fourth EditionDocument55 pagesAsset Recognition and Operating Assets: Fourth EditionAyush JainNo ratings yet

- Chapter 6Document26 pagesChapter 6dshilkarNo ratings yet

- Acountancy 10Document129 pagesAcountancy 10Erfan Bhat0% (1)

- Free Cash Flow Valuation: Wacc FCFF VDocument6 pagesFree Cash Flow Valuation: Wacc FCFF VRam IyerNo ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument14 pagesChapter 02 - How To Calculate Present Valuesdev4c-1No ratings yet

- Nanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)Document3 pagesNanyang Business School AB1201 Financial Management Tutorial 5: Risk and Rates of Return (Common Questions)asdsadsaNo ratings yet

- Introduction To Accounting and BusinessDocument42 pagesIntroduction To Accounting and BusinessCris LuNo ratings yet

- Lecture 7 Adjusted Present ValueDocument19 pagesLecture 7 Adjusted Present ValuePraneet Singavarapu100% (1)

- Chap-17-Lending Policies and ProceduresDocument30 pagesChap-17-Lending Policies and ProceduresNazmul H. PalashNo ratings yet

- Ratio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)Document19 pagesRatio Analysis of Eastern Bank LTD.: Bus 635 (Managerial Finance)shadmanNo ratings yet

- Test Bank For Corporate Finance The Core, 4e Jonathan BerkDocument13 pagesTest Bank For Corporate Finance The Core, 4e Jonathan Berksobiakhan52292No ratings yet

- 032431986X 104971Document5 pages032431986X 104971Nitin JainNo ratings yet

- Jan 2018Document34 pagesJan 2018alekhya manneNo ratings yet

- Ans. Corporate Finance Part 2Document17 pagesAns. Corporate Finance Part 2HashimRazaNo ratings yet

- MBA711 - Answers To Book - Chapter 4Document16 pagesMBA711 - Answers To Book - Chapter 4Hạng VũNo ratings yet

- Chap 012Document15 pagesChap 012van tinh khuc100% (2)

- Tutorial 2 QuestionsDocument4 pagesTutorial 2 QuestionswarishaaNo ratings yet

- CH 16Document43 pagesCH 16Angely May JordanNo ratings yet

- Deegan5e SM Ch28Document20 pagesDeegan5e SM Ch28Rachel Tanner100% (2)

- Ch.10 - The Statement of Cash Flows - MHDocument59 pagesCh.10 - The Statement of Cash Flows - MHSamZhao100% (1)

- Week 1 Conceptual Framework For Financial ReportingDocument17 pagesWeek 1 Conceptual Framework For Financial ReportingSHANE NAVARRONo ratings yet

- Dokumen - Tips Chapter 3 Fundamentals of Corporate Finance 9th Edition Test BankDocument24 pagesDokumen - Tips Chapter 3 Fundamentals of Corporate Finance 9th Edition Test BankHà NguyễnNo ratings yet

- Pak Electron Limited (PEL) : Financial PositionDocument5 pagesPak Electron Limited (PEL) : Financial PositionAbdul RehmanNo ratings yet

- Bank Management Assignment 2: Name: Dinesh M Section: A Roll No: 19PGP051Document11 pagesBank Management Assignment 2: Name: Dinesh M Section: A Roll No: 19PGP051DinNo ratings yet

- Solution Manual For Financial Accounting Global Edition 8th Edition by Libby and Short DownloadDocument32 pagesSolution Manual For Financial Accounting Global Edition 8th Edition by Libby and Short DownloadrahimNo ratings yet

- Analyzing Financing Activities: ReviewDocument64 pagesAnalyzing Financing Activities: ReviewNisaNo ratings yet

- Cash Flow Statement-2015Document43 pagesCash Flow Statement-2015Sudipta Chatterjee100% (1)

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- OMS413 Review Questions (Chapters 1,2,3,4 and 5) Part I. ConceptDocument2 pagesOMS413 Review Questions (Chapters 1,2,3,4 and 5) Part I. Conceptdev4c-1No ratings yet

- ch07 Jiambalvo 5e Test BankDocument46 pagesch07 Jiambalvo 5e Test Bankdev4c-1No ratings yet

- Chap018 Waiting-LinesDocument21 pagesChap018 Waiting-Linesdev4c-1No ratings yet

- Accounting For Managers: Professor ZHOU NingDocument38 pagesAccounting For Managers: Professor ZHOU Ningdev4c-1No ratings yet

- DelwarcaDocument6 pagesDelwarcadev4c-1No ratings yet

- Global Sourcing in Fast Fashion Retailers: Sourcing Locations and Sustainability ConsiderationsDocument22 pagesGlobal Sourcing in Fast Fashion Retailers: Sourcing Locations and Sustainability Considerationsdev4c-1No ratings yet

- Session 1 Slides From AWDocument25 pagesSession 1 Slides From AWdev4c-1No ratings yet

- CH 06 StuDocument42 pagesCH 06 Studev4c-1No ratings yet

- CheatSheet Interest Calculation PDFDocument4 pagesCheatSheet Interest Calculation PDFdev4c-1No ratings yet

- Chapter 02 - How To Calculate Present ValuesDocument14 pagesChapter 02 - How To Calculate Present Valuesdev4c-1No ratings yet

- Ridgely Manufacturing Company Production Report Jul-92 Quantity of ProductionDocument3 pagesRidgely Manufacturing Company Production Report Jul-92 Quantity of ProductionJessa BasadreNo ratings yet

- Sample Question Paper 2022-23 Subject Accountancy 055 Class XiiDocument21 pagesSample Question Paper 2022-23 Subject Accountancy 055 Class XiiTûshar ThakúrNo ratings yet

- A Post Factor Analysis of Financial RatiosDocument13 pagesA Post Factor Analysis of Financial Ratiosbanhi.guhaNo ratings yet

- ANS #3 Ritik SehgalDocument10 pagesANS #3 Ritik Sehgaljasbir singhNo ratings yet

- Learning Objectives-Auditing LiabDocument3 pagesLearning Objectives-Auditing Liabadrian eboraNo ratings yet

- Statement of Cash Flows Quiz Set ADocument5 pagesStatement of Cash Flows Quiz Set AImelda lee0% (1)

- Test Bank For Fundamentals of Corporate Finance 2nd Edition ParrinoDocument36 pagesTest Bank For Fundamentals of Corporate Finance 2nd Edition Parrinotractory.callowsl6io100% (40)

- TheoryDocument15 pagesTheoryrogealynNo ratings yet

- MFS International Equity Segregated FundDocument1 pageMFS International Equity Segregated Fundarrow1714445dongxinNo ratings yet

- Mas Preweek Hndouts Batch 92Document26 pagesMas Preweek Hndouts Batch 92Mark Anthony CasupangNo ratings yet

- Feasibility Study of Belitung Hotel Project (Case Study PT Xyz)Document11 pagesFeasibility Study of Belitung Hotel Project (Case Study PT Xyz)rikasusanNo ratings yet

- Chapter 10 in Class Problems DAY 2 SolutionsDocument2 pagesChapter 10 in Class Problems DAY 2 SolutionsAbdullah alhamaadNo ratings yet

- Institute of Chartered Accountants of PakistanDocument4 pagesInstitute of Chartered Accountants of PakistanAqib SheikhNo ratings yet

- Aivazian, Ge and Qiu - 2005Document15 pagesAivazian, Ge and Qiu - 2005bildyNo ratings yet

- Quiz 1-EIB10403 - Oct 2023 ComfirmDocument6 pagesQuiz 1-EIB10403 - Oct 2023 ComfirmprfznvtczdNo ratings yet

- Buss CombiDocument2 pagesBuss CombiErika LanezNo ratings yet

- Questions With SolutionsDocument4 pagesQuestions With SolutionsArshad UllahNo ratings yet

- IFRS - First-Time AdoptersDocument272 pagesIFRS - First-Time AdoptersMarvin Montero100% (1)

- Executive SummaryDocument24 pagesExecutive SummaryeshwarNo ratings yet

- Weebly ResumeDocument1 pageWeebly Resumeapi-313922701No ratings yet

- Chapter 04Document4 pagesChapter 04Nouman BaigNo ratings yet

- 905pm - 10.EPRA JOURNALS 13145Document3 pages905pm - 10.EPRA JOURNALS 13145Mohammed YASEENNo ratings yet

- Fin 004Document4 pagesFin 004adorakim1000No ratings yet

- 2024 Tutorial 2 - Question and SolutionDocument9 pages2024 Tutorial 2 - Question and SolutionNdondoNo ratings yet

- UITF Practice TestDocument24 pagesUITF Practice TestJohnfreNo ratings yet

- Edelweiss Internship ProjectDocument17 pagesEdelweiss Internship ProjectHenal PanchmatiyaNo ratings yet

- Working Capital Management andDocument15 pagesWorking Capital Management and155- Salsabila GadingNo ratings yet

- Solutions To B Exercises: Kieso, (For Instructor Use Only)Document7 pagesSolutions To B Exercises: Kieso, (For Instructor Use Only)Jogja AntiqNo ratings yet

- Seven Patterns of Inefficiency in Pricing of Quality Businesses - Fundoo ProfessorDocument1 pageSeven Patterns of Inefficiency in Pricing of Quality Businesses - Fundoo ProfessorSubham JainNo ratings yet