Professional Documents

Culture Documents

Support-Department Cost Allocation

Support-Department Cost Allocation

Uploaded by

NABILA SARI0 ratings0% found this document useful (0 votes)

40 views5 pages1. Support departments provide essential services like accounting, payroll, and maintenance that indirectly support producing departments like auditing, tax, and manufacturing.

2. There are several steps to allocate support department costs to producing departments including classifying departments, tracing costs, and calculating predetermined overhead rates.

3. Common cost drivers to allocate support department costs include the number of employees, transactions, change orders, and machine/maintenance hours used by other departments.

Original Description:

summary managerial accounting chapter 7

Original Title

assignment 10

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. Support departments provide essential services like accounting, payroll, and maintenance that indirectly support producing departments like auditing, tax, and manufacturing.

2. There are several steps to allocate support department costs to producing departments including classifying departments, tracing costs, and calculating predetermined overhead rates.

3. Common cost drivers to allocate support department costs include the number of employees, transactions, change orders, and machine/maintenance hours used by other departments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

40 views5 pagesSupport-Department Cost Allocation

Support-Department Cost Allocation

Uploaded by

NABILA SARI1. Support departments provide essential services like accounting, payroll, and maintenance that indirectly support producing departments like auditing, tax, and manufacturing.

2. There are several steps to allocate support department costs to producing departments including classifying departments, tracing costs, and calculating predetermined overhead rates.

3. Common cost drivers to allocate support department costs include the number of employees, transactions, change orders, and machine/maintenance hours used by other departments.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 5

Name : Nabila Ika Sari

ID Class : 008201900007

Summary Managerial Accounting

Support-Department Cost Allocation

An Overview of Cost Allocation

Mutually beneficial costs, which occur when the same resource is used in the output o

f two or more services or products, are common costs.

Types of Departments

Producing departments are directly responsible for creating the products or services sold

to customers. In the opening scenario’s public accounting firm, examples of producing d

epartments are auditing, tax, and management advisory services. In a manufacturing setti

ng, producing departments are those that work directly on the products being manufactur

ed .

Support departments provide essential support services for producing departments. These

departments are indirectly connected with an organization’s services or products. Note th

at this involves tracing costs to the departments, not allocating costs, because the costs ar

e directly associated with the individual department.

Step in Allocating Suport Department Costs to Producing Departments

1. Departmentalize the firm

2. Classify each department as a support department or a producing department.

3. Trace all overhead costs in the firm to a support department or producing department.

4. Allocate supports department costs to the producing departments.

5. Calculate predetermined overhead rates for the producing departments.

6. Allocate overhead costs to the units of individual products through the predetermined ov

erhead rates.

Example of Cost Drivers for Support Department

Support Department Possible Driver

Accounting Number of transaction

Cafeteria Number of employees

Engineering Number of change orders

Maintanance Machine hours, maintenance hours

Payroll Number of employees

Personnel Number of employees, firings, layoffs, new hires

Objectives of Allocation

A number of important objectives are associated with the allocation of support department co

sts to producing departments and ultimately to specific products. The following major objecti

ves have been identified by the IMA:

1. To obtain a mutually agreeable price.

2. To compute product-line profitability.

3. To predict the economic effects of planning and control.

4. To value inventory.

5. To motivate managers

Allocating One Department’s Costs to Another Department

Frequently, the costs of a support department are allocated to other departments through the u

se of a charging rate. In this case, we focus on the allocation of one department’s costs to othe

r departments. For example, a company’s Data-Processing Department may serve various oth

er departments. The cost of operating the Data Processing Department is then allocated to the

user departments.

A Single Charging Rate

Estimated usage (in pages) by the three producing departments is as follows:

Audit Department 94,500

Tax Department 67,500

MAS Department 108,000

Total 270,000

Variable costs of (270,000 $0.023) $6,210

Fixed costs of $26,190

Total costs for 270,000 pages $32,400

Average cost (32,400 ÷ 270,000) $0.12 per page

The total Photocopying Department charges

Number of Pages × Charge per page = Total Charges

Audit 92,000 $0.12 $ 11,040

Tax 65,000 0.12 7,800

MAS 115,000 0.12 13,800

Total 272,000 $32,640

Multiple Charging Rates

Peak Number Proportion Total Amount Allocated

of Pages of Peak Usage Fixed Costs to Each Department

Audit 7,875 0.20 $26,190 $5,238

Tax 22,500 0.57 26,190 14,928

MAS 9,000 0.23 26,190 6,024

Total 39,375 $26,190

Number of Fixed Cost

Pages × $0.023 + Allocation = Total Charges

Audit department $2,116 $5,238 $7,354

Tax department 1,495 14,928 16,423

MAS department 2,645 6,024 8,669

Total $6,256 $26,190 $32,446

Budgeted versus Actual Usage

A general principle of performance evaluation is that managers should not beheld responsible

for costs or activities over which they have no control.

Use of Budgeted Data for Product Costing

Number of Pages × Charge per page = Total Charges

Audit 94,500 $0.12 $ 11,340

Tax 67,500 0.12 8,100

MAS 108,000 0.12 12,960

Total 270,000 $32,400

Use of Actual Data for Performance Evaluation Purpose

Number of Pages × Charge per page = Total Charges

Audit 92,000 $0.12 $ 11,040

Tax 65,000 0.12 7,800

MAS 115,000 0.12 13,800

Total 272,000 $32,640

Choosing a Support-Department Cost Allocation Method

The three methods for allocating service department costs to producing departments are:

The Direct Method

The Sequential Method

The Reciprocal Method

Sequential Method of Allocation

Step 1—Calculate Allocation Ratios

Grinding Assembly

Power 600,000 0.75 -

(600,000+200,000)

200,000 - 0.25

(600,000+200,000)

Maintenanc 4,500 0.50 -

e (4,500+4,500)

4,500 - 0.50

(4,500+4,500)

Step 2—Allocate Support-Department Costs Using the Allocation Ratios

Support Department Producing Department

Power Maintenance Grinding Assembly

Direct cost $250,000 $160,000 $100,000 $60,000

Powera (250,000) 50,000 150,000 50,000

Maintenanceb - (210,000) 105,000 105,000

$ 0 $ 0 $335,000 $215,000

a

0.75 × $250,000 = $187,000 ; 0.25 × $250,000 = $62,500

b

0.50 × 160,000 = $80,000

Reciprocal Method of Allocation

Support Department Producing Department

Power Maintenance Grinding Assembly

Direct cost :

Normal Activity:

Kilowatt hours - 200,000 600,000 200,000

Maintenance hour 1,000 - 4,500 4,500

s

Propotion of Output Used by Department

Power Maintenance Grinding Assembly

Allocated ratio:

Power - 0.20 0.60 0.20

Maintenance 0.10 - 0.45 0.45

M = Direct costs + Share of Power’s costs P =Direct costs + Share of Maintenan

ce’s costs

= $160,000 + $50,000 + 0.02M = $250,000 + 0.1($214,286)

0.98M = $210,000 = $250,000 + $21,429

M = $214,286 P = $271,429

Comparison of the Three Methods

Departmental Overhead Rate

The overhead rate for the Grinding Department is computed as follows (assuming the normal

level of activity is 71,000 MH)

Overhead rate = $355,000/71,000 machine hours $5 per MH

The overhead rate for the Grinding Department is computed as follows (assuming the normal

level of activity is 107,500 DLH)

Overhead rate = $215,000/107,500 direct labor hours $2 per DLH

Product Unit Cost

A product requires two machine hours of grinding per unit and one hour of assembly.

Overhead cost assigned :

2×$5 $10 Total assigned $12

1×$2 $2

You might also like

- CO22001E IP01 SolutionDocument3 pagesCO22001E IP01 Solutionrui zhangNo ratings yet

- Integrated Logistics Support Handbook Mcgraw Hill Logistics Series Ebook PDF VersionDocument62 pagesIntegrated Logistics Support Handbook Mcgraw Hill Logistics Series Ebook PDF Versionteresa.vanhorn90798% (52)

- Quiz 2 - Job Costing - Printable, V (5.0)Document7 pagesQuiz 2 - Job Costing - Printable, V (5.0)Edward Prima KurniawanNo ratings yet

- Support Department Cost AllocationDocument44 pagesSupport Department Cost AllocationAwan Wibowo100% (1)

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- CH 7 Support Department Cost AllocationDocument45 pagesCH 7 Support Department Cost Allocationsalsa azzahraNo ratings yet

- Cost Allocation in The Service DepartmentDocument30 pagesCost Allocation in The Service DepartmentMa.Cristina JulatonNo ratings yet

- Acctg 6 CH 13Document11 pagesAcctg 6 CH 13Bea TiuNo ratings yet

- Bab 8 BOPDocument43 pagesBab 8 BOPMuhammad Zulhandi Aji PutraNo ratings yet

- CH 07Document43 pagesCH 07Dhani SardonoNo ratings yet

- Review Session 2024 SolutionsDocument3 pagesReview Session 2024 SolutionsHitesh MehtaNo ratings yet

- Chapter 15 - Questions To PracticeDocument15 pagesChapter 15 - Questions To Practiceraziabuhakmeh781No ratings yet

- Managerial Accounting Solutions Chapter 3 PDFDocument42 pagesManagerial Accounting Solutions Chapter 3 PDFadam_garcia_81No ratings yet

- CBA SampleDocument9 pagesCBA Samplemonderoclyde24No ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- Budget OperationDocument2 pagesBudget OperationHassanNo ratings yet

- Mock SFM Answer MarchDocument12 pagesMock SFM Answer MarchMenuka SiwaNo ratings yet

- Acc AssignmentDocument8 pagesAcc AssignmentKashémNo ratings yet

- Gross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsDocument85 pagesGross Profit/net Sales Gross Profit/revenue Net Income/Total AssetsMaria Dana BrillantesNo ratings yet

- CH 10 SolDocument7 pagesCH 10 SolNotty SingerNo ratings yet

- Problem Solving AssignmentDocument13 pagesProblem Solving AssignmentRajesh MongerNo ratings yet

- Actual Cost Vs Plan Projection: Your Company NameDocument25 pagesActual Cost Vs Plan Projection: Your Company NameShamsNo ratings yet

- Management AccountingDocument6 pagesManagement AccountingBornyNo ratings yet

- (Done) Activity-Chapter 2Document8 pages(Done) Activity-Chapter 2bbrightvc 一ไบร์ทNo ratings yet

- 23 Nov 2018 Mixed Questions With Solutions PDFDocument9 pages23 Nov 2018 Mixed Questions With Solutions PDFLaston MilanziNo ratings yet

- Cash Flow Brigham SolutionDocument14 pagesCash Flow Brigham SolutionShahid Mehmood100% (4)

- Measuring and Managing Process Performance: QuestionsDocument4 pagesMeasuring and Managing Process Performance: QuestionsAshik Uz ZamanNo ratings yet

- Service Department Cost Allocation: Solutions To Exercises and ProblemsDocument27 pagesService Department Cost Allocation: Solutions To Exercises and ProblemsMafi De LeonNo ratings yet

- JaletaDocument8 pagesJaletaአረጋዊ ሐይለማርያምNo ratings yet

- FM Assaignment Second SemisterDocument9 pagesFM Assaignment Second SemisterMotuma Abebe100% (1)

- Corporate Finance Canadian 7th Edition Jaffe Solutions ManualDocument16 pagesCorporate Finance Canadian 7th Edition Jaffe Solutions Manualtaylorhughesrfnaebgxyk100% (30)

- Job-Order Costing and Overhead ApplicationDocument18 pagesJob-Order Costing and Overhead ApplicationSuptoNo ratings yet

- Model - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisDocument23 pagesModel - Student Version: MODULE 13 CORAL BAY HOSPITAL: Traditional Project AnalysisHassanNo ratings yet

- SsDocument7 pagesSsyuval sharmaNo ratings yet

- Ch2 - Lesson3Document16 pagesCh2 - Lesson3mmh771984No ratings yet

- Charles AKMENDocument11 pagesCharles AKMENCharles GohNo ratings yet

- TAXN 1016 FE - Long ProblemsDocument11 pagesTAXN 1016 FE - Long ProblemsCrystel Kate MananganNo ratings yet

- Week 4Document9 pagesWeek 4kishorbombe.unofficialNo ratings yet

- Personal ProfileDocument13 pagesPersonal ProfileKristine Lei Del MundoNo ratings yet

- Chapter 6-19-36Document18 pagesChapter 6-19-36Idem Med0% (1)

- Chapter 5Document9 pagesChapter 5Dishantely SamboNo ratings yet

- Activity Based-WPS (Number 1 C)Document9 pagesActivity Based-WPS (Number 1 C)Takudzwa BenjaminNo ratings yet

- Title Student's Name: Course Code: Institutional Affiliation: DateDocument5 pagesTitle Student's Name: Course Code: Institutional Affiliation: DateChristopher KipsangNo ratings yet

- UntitledDocument13 pagesUntitledAbhinav SharmaNo ratings yet

- Support Department Cost AllocationDocument43 pagesSupport Department Cost AllocationWahyu Mayla RosaNo ratings yet

- Essay FIN202Document5 pagesEssay FIN202thaindnds180468No ratings yet

- FM11 CH 11 Mini CaseDocument16 pagesFM11 CH 11 Mini CaseDora VidevaNo ratings yet

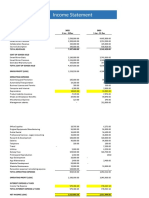

- Income Statement TemplateDocument4 pagesIncome Statement Templatesally ngNo ratings yet

- Case Study Accounting Oart2Document5 pagesCase Study Accounting Oart2Vero MinaNo ratings yet

- Tutorial 3 AnswersDocument7 pagesTutorial 3 AnswersFEI FEINo ratings yet

- B. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Document6 pagesB. (Basis of Findings Is The Missallocation of Payment From Zebra Computers)Kathlyn Joyce SumangNo ratings yet

- AC2105 Seminar 3 Group 3Document37 pagesAC2105 Seminar 3 Group 3Kwang Yi JuinNo ratings yet

- Ch11 Tool KitDocument368 pagesCh11 Tool KitRoy HemenwayNo ratings yet

- Solutions To ProblemsDocument42 pagesSolutions To ProblemsJane TuazonNo ratings yet

- FFMA Jan 23 AnsDocument7 pagesFFMA Jan 23 AnsMiftah Nur HudaNo ratings yet

- CA CHP 12 MC Questions ShareDocument15 pagesCA CHP 12 MC Questions ShareTrần Lê Phương ThảoNo ratings yet

- Lecture 27Document34 pagesLecture 27Riaz Baloch NotezaiNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- SOP Receiving of Incoming Materials (Re)Document2 pagesSOP Receiving of Incoming Materials (Re)colinvelascoNo ratings yet

- Table of ContenDocument3 pagesTable of ContenAlene Amsalu100% (1)

- ecovadis-ratings-methodology-overview-and-principlesDocument20 pagesecovadis-ratings-methodology-overview-and-principlesAymen BEN HSANNo ratings yet

- Llaves de Diales MecanicosDocument9 pagesLlaves de Diales MecanicosHo MeGaNo ratings yet

- Annex C - Barangay BaRCO MonthlyDocument1 pageAnnex C - Barangay BaRCO MonthlyEt WatNo ratings yet

- Good Documentation PracticesDocument28 pagesGood Documentation PracticesGanesh V Gaonkar100% (1)

- HELP Bachelor of Business Finance - AUGUST 2022 DAMANSARA SUBANG CAMPUSDocument20 pagesHELP Bachelor of Business Finance - AUGUST 2022 DAMANSARA SUBANG CAMPUSjingen0203No ratings yet

- Selling On Amazon Quick Start Style Guide PDFDocument2 pagesSelling On Amazon Quick Start Style Guide PDFJose Castillo100% (1)

- 1 - ExercisesDocument6 pages1 - ExercisesTrang Nguyễn QuỳnhNo ratings yet

- QIM Integration With Audit Management & Quality ManagementDocument7 pagesQIM Integration With Audit Management & Quality ManagementAbhijeet MhatreNo ratings yet

- THAILAND v2Document12 pagesTHAILAND v2Artasena SatyaresiNo ratings yet

- Chapter 4 AnswerDocument23 pagesChapter 4 AnswerMethly Moreno100% (1)

- Imparting Value To Luxury and Luxury To Value: A Case StudyDocument11 pagesImparting Value To Luxury and Luxury To Value: A Case StudyAritra DasNo ratings yet

- How They Keep You POOR! (Watch This To Become A MILLIONAIRE in 2023) - Alex HormoziDocument101 pagesHow They Keep You POOR! (Watch This To Become A MILLIONAIRE in 2023) - Alex HormoziGlen SaktiNo ratings yet

- Final Exam: Assoumou Kouame Jose Auditing DR BoguiDocument2 pagesFinal Exam: Assoumou Kouame Jose Auditing DR BoguiEudes Salvy AssoumouNo ratings yet

- Global Business Services: Performance ImprovementDocument139 pagesGlobal Business Services: Performance ImprovementBea Cassandra EdnilaoNo ratings yet

- Job Description Die Maintainance SupervisiorDocument2 pagesJob Description Die Maintainance SupervisiorSarah ChaudharyNo ratings yet

- Nestle P and LDocument2 pagesNestle P and Lashmit gumberNo ratings yet

- Internal Audit NC ReportDocument2 pagesInternal Audit NC ReportCQMS 5S DivisionNo ratings yet

- Cost ClassificationDocument17 pagesCost Classificationsyed mohdNo ratings yet

- Lecture 1: Introduction To Strategic ManagementDocument42 pagesLecture 1: Introduction To Strategic ManagementGaurav VermaNo ratings yet

- Chapter 4: Main Factors Affecting Project Success: March 2017Document37 pagesChapter 4: Main Factors Affecting Project Success: March 2017Getasew AzezeNo ratings yet

- Chapter 8 - Controlling Notes PDFDocument7 pagesChapter 8 - Controlling Notes PDFabhishekNo ratings yet

- SOPDocument2 pagesSOPShaikh Saifullah KhalidNo ratings yet

- All SA 700 SeriesDocument29 pagesAll SA 700 Seriesrsai naniNo ratings yet

- Quality and Reliability Management: Summarized ArticleDocument12 pagesQuality and Reliability Management: Summarized ArticleazmatullahNo ratings yet

- Nidhi Resume 1Document5 pagesNidhi Resume 1Harshit VermaNo ratings yet

- TACCP Doc 5.4.2ii Threat and Vulnerability AssessmentDocument3 pagesTACCP Doc 5.4.2ii Threat and Vulnerability AssessmentBryan MooreNo ratings yet