Professional Documents

Culture Documents

Norms: Standards

Norms: Standards

Uploaded by

Aswin NandaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Norms: Standards

Norms: Standards

Uploaded by

Aswin NandaCopyright:

Available Formats

Resource support on NGO Governance, Accounting and Regulations

Standards & NORMS

An initiative of FMSF

Vol. III Issue 6, July 2010 For private circulation only

AMENDMENT OF

TRUST DEED

CONTENTS

Overview 01

Amendment of the Trust Deed by Trustees 01

The Settlor or Founder has no power to revoke 02

Limited Power of Rectification by Civil Court 02

Section 26 of Specific Relief Act is the Remedy and

not Section 34 of Trust Act 03

Section 92 of Civil Procedure Code 03

Revenue Need not be a Party to Rectification 03

The Effect of Rectification is not Retrospective 04

Supplementary Trust Deeds 04

Sum up Points 04

OVERVIEW Therefore, only such amendments should

be made which are in line with the original

1.01 It is extremely difficult to amend a intent of the settlor. It may further be

trust deed since a trust by its inherent noted that even the settlor does not have

nature is irrevocable. Therefore, it is powers to amend the trust deed.

important to provide the amendment

clauses in the trust deed itself. However,

if the amendment clauses provided in the

trust deed are too wide, then the trust

may not be treated as irrevocable. In the

trust deed where there is no mention AMENDMENT OF THE TRUST

about amendment, the amendment has to DEED BY TRUSTEES

be done with the permission of a civil

court. Even the Civil Courts do not have

2.01 It is a generally a settled principle

unlimited powers of amendment. The Civil

of trust law that once a trust is created

Courts permit amendment under the

with certain objects, no one has the power

doctrine of Cy pres, which means the

to delete any of the original objects. This

original intent of the settlor should prevail.

Editorial : Sanjay Patra, Executive Director, FMSF, Author : Manoj Fogla*

Team S.P. Selvi, Head, Capacity Building, FMSF

* The Author can be contacted at mfogla@yahoo.com

was also affirmed by the Madras High Court

in Sakthi Charities v. CIT [1984] 149 ITR 624/

19 Taxman 100, where a deed of The Supreme Court held this

rectification deleting certain original

amendment to be invalid

objects of a trust deed was held to be

invalid. The landmark decision on this issue because it implied alteration

was given by the Supreme Court in CIT v. in the object of the trust

Palghat Shadi Mahal Trust [2002] 254 ITR deed which was not

212/120 Taxman 889 (SC) where a trust was

contemplated by the settlor.

constituted for the educational, social and

economic advancement of backward class

Muslims. A general body resolution

extended these objects to all communities

irrespective of religion or creed. The

Supreme Court held that this amendment power to amend the trust deed, for that

would be invalid because it implied matter even the settlor does not have the

alteration in the object of the trust deed power of any subsequent amendment. The

which was not contemplated by the settlor. power to amend shall be limited to the

extent provided in the trust deed itself.

Therefore, drafting of trust deed becomes

very important and suitable clauses should

be kept for future need of changes and

contingencies. Further, care should be

THE SETTLOR OR FOUNDER HAS taken to ensure that the amendment

NO POWER TO REVOKE clauses are not too wide or discretionary

in nature which may render the trust

3.01 The Madras High Court in Thanthi invalid and revocable.

Trust v. ITO [1973] 91 ITR 261 observed, it

is well established that the subsequent

acts and conduct of the founder of trust

cannot affect the trust if there has been

already a complete dedication (complete

handover of the property). If a valid and LIMITED POWER OF

complete dedication has taken place, there RECTIFICATION BY CIVIL

would be no power left in the founder to COURT

revoke and no assertion on his part or the

subsequent conduct of himself or his 4.01 A civil court has been conferred with

descendants contrary to such dedication the power to amend a trust deed and the

would have the effect of nullifying it. If Income Tax Officer has to take notice of

the trust has been really and validly such amendment. In the case CIT v. Kamla

created, any deviation by the founder of Town Trust [1996] 217 ITR 699 (SC), [1996]

the trust or the trustees from the declared 84 Taxman 248 (SC), the Hon’ble Supreme

purposes would amount only to a breach Court held that any change in Trust Deed

of trust and would not detract from the is not possible unless the deed itself

declaration of trust. In this regard the provides for such change. Approaching the

Supreme Court ruling in the case Sri registrar or a Court of law shall only be

Agasthyar Trust v. CIT [1999] 236 ITR 23 (SC) relevant if a change is legally permissible.

is also relevant.

4.02 The Civil Courts have power to direct

3.02 It should be kept in mind that the changes in the trust deed in the spirit of

trustees inherently do not possess any

Standards & Norms, Vol. III, Issue 6 July 2010 2

the Doctrine of Cy pres which implies that

the original intent of the settlor should not

fail. However once a civil court has allowed The Income Tax Department

amendment, it is not open on the part of or any other authority

the Income Tax Officer or any other person cannot decline to accept an

to challenge such rectification.

amended deed only on the

ground that they were not

made party to such

amendment.

SECTION 26 OF SPECIFIC

RELIEF ACT IS THE REMEDY AND

NOT SECTION 34 OF TRUST ACT

ex-trustee to deliver possession of the

5.01 In the above Kamla Town case trust property to the person entitled to

(supra), the Supreme Court observed that the possession of such property, directing

the Section 34 of the Indian Trust Act, 1882 accounts and enquiries, declaring that

was not applicable as far as amendment of portion of the trust property or interest

Trust deed was concerned. It may be noted therein shall be allotted to any particular

that Section 34 of the Indian Trust Act, objects of the trust or to settle a scheme.

1882 provides the right to apply to court Thus, the court has got power to allocate

for opinion in management of Trust the trust properties to any particular field

property. The apex court was of the opinion of the trust. In this case the Civil Court

that section 34 was confined only to had deleted from the trust deed certain

management of trust property and could objects so as to enable the trustees to

not be invoked for amendment in the deed claim the benefit of exemption under the

and objects. It was also observed that the Income Tax Act, 1961. It was held that

right legal provision was section 26 of the section 92 of CPC was not the appropriate

Specific Relief Act, 1963 under which an section / statute for amendment of Trust

application for amendment to trust deed Deed. Under section 92 of CPC, the court

could be made. can give a direction which is necessary for

the administration of any trust. However,

it can only exercise the powers expressly

set out thereunder, and by exercising the

power under section 92, it cannot alter

the objects of the trust deed.

SECTION 92 OF CIVIL

PROCEDURE CODE (CPC)

6.01 In Kamla Town Trust v. CIT [1982]

133 ITR 632 (All.), the question debated

was whether the Civil Court had the power REVENUE NEED NOT BE A PARTY

to rectify the trust deed under section 92. TO RECTIFICATION

It was observed that Section 92 nowhere

enables the Civil Court to alter or rectify 7.01 The Income Tax Department or any

the terms of a trust. It only enables the other authority cannot decline to accept

Civil Court in suitable cases to remove any an amended deed only on the ground that

trustee, appoint a new trustee, vesting they were not made party to such

any property in a trustee, directing any amendment. In the case CIT v. Kamla Town

Standards & Norms, Vol. III, Issue 6 July 2010 3

Trust [1996] 217 ITR 699 (SC), [1996] 84 that any rectification would have only

Taxman 248 (SC) one of the contentions of prospective operation and would not

the revenue was that the rectification affect the assessment years in question,

decree of the trust deed was in personam which were prior to the date of the Civil

and not in rem to which the revenue was Court’s decree.

not a party and, therefore, it was not

binding on the income-tax authorities. It

was held that in such proceedings, the

order granting rectification of such

instrument of trust would certainly remain

relevant. Consequently, it cannot be said SUPPLEMENTARY TRUST DEEDS

that such rectification orders passed by

Civil Courts permitting rectifications of 9.01 In the case Laxmi Narain Lath Trust

trust deeds under the relevant provisions v. CIT [2000] 244 ITR 272 (Raj.), it was held

of the Specific Relief Act could not be that a supplementary trust deed permitted

relied upon by the assessee-trust in by appropriate civil court was legally valid

assessment proceedings before the and binding on the department. The court

Income Tax Officer (ITO) even though the relied on the assessee’s own case for the

revenue or the ITO was not a party to such assessment year 1972-73 in Laxminarain

rectification proceedings. The ITO has to Lath Trust v. CIT [1988] 170 ITR 375/[1987]

consider the real scope and ambit of the 33 Taxman 194, where it had held that the

trust deed as presented to him in rectified supplementary deed bound the trustees

form with a view to finding out whether who were parties to the said deed as well

on the basis of such a rectified as future trustees of the assessee-trust

instrument, the assessee-trust had earned and in view of the supplementary deed it

exemption from payment of income-tax was no longer permissible for the trustees

under the relevant provisions. of the assessee to use the trust funds.

7.02 In this context it is pertinent to

note that a judgment in rem is a

judgement pronounced on the status of

some particular subject or property or thing

(as opposed to one pronounced on SUM UP POINTS

persons). In the case of amendment of

Trust Deed, though the rectification orders • It is important to provide the

of the Civil Court is not judgments in rem, amendment clause in the Trust

still it is binding in assessment proceedings Deed itself.

before the ITO and will have to be given

effect to for whatever they are worth. • If there is no amendment clause in

the Trust Deed, any amendment has

to be done with the permission of

a Civil Court.

• Once the Civil Court has allowed

THE EFFECT OF RECTIFICATION permission for amendment, it is not

IS NOT RETROSPECTIVE open on the part of the Income Tax

Officer or any other person to

8.01 In the case Bhriguraj Charity Trust challenge such amendment.

v. CIT [1997] 228 ITR 50 (Del.)(FB), the full

bench of the Delhi High Court observed • Amendments made should be in line

with the original intention of the

Standards & Norms, Vol. III, Issue 6 July 2010 4

Settlor and should not negate or • The Income Tax Department or any

deviate from the original intention other authority cannot decline to

of the Settlor. accept an amended Trust Deed only

on the ground that they were not

• To form a valid trust the trust

made party to such amendment.

property has to be completely

handed over, thereafter the • The Assessee Trust for Income Tax

founder or the Settlor do not have purposes, can rely on the amended

any powers to revoke or nullify the Trust Deed for availing Income Tax

objects of the Trust. exemptions, even though the

• Section 26 of the Specific Relief Income Tax Department was not

Act, 1963 is the appropriate party to the amendment carried

statutory provision under which an out.

application for amendment to Trust

• The amendment to Trust Deed

Deed can be made. It may be noted

made with a Civil Court order, takes

that the Section 34 of the Indian

onward effect from the date of the

Trust Act, 1882 only provides the

Civil Court’s decree and does not

right to apply to court for direction

bind the operation of those

in the management/administration

assessment years which were prior

of the Trust.

to that date.

• Similarly, a Civil Court cannot alter

the objects of the Trust Deed by • Supplementary Trust Deed is also

exercising its power under Section permitted by Civil Court. The

92 of the Civil Procedure Code (CPC) Supplementary Trust Deed is also

under this provision it can only give binding on the Trustees in the

direction for administration of any manner the original Trust Deed

Trust. binds.

Reference Book : Taxation of Trust and NGOs with FCRA and FEMA, 5th Edition 2010 by Manoj Fogla, published by TAXMANN Publications, New Delhi

Standards & Norms aims to provide relevant informations and guidance on NGO governance, Financial Management and Legal Regulations. The

informations provided are correct and relevant to the best of the knowledge of the author and contributor. It is suggested that the reader should cross check

all the facts, law and contents before using them. The author or the publisher will not be responsible for any loss or damage to any one, in any manner.

fmsf

Published by Mr. Sanjay Patra on behalf of

FINANCIAL MANAGEMENT SERVICE FOUNDATION

Accountability House, A-5, Sector 26, Noida - 201 301,

website : fmsfindia.org, e-mail : fmsf@fmsfindia.org

Standards & Norms, Vol. III, Issue 6 July 2010 5

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5823)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Moot Proposition 2019Document4 pagesMoot Proposition 2019Aswin NandaNo ratings yet

- Heirs of Florencio Vs Heirs of de Leon DigestDocument2 pagesHeirs of Florencio Vs Heirs of de Leon DigestEula MinesNo ratings yet

- First Elegalam Sentencing MemoDocument7 pagesFirst Elegalam Sentencing Memosarah_larimerNo ratings yet

- GramDocument3 pagesGramAswin NandaNo ratings yet

- Ea 1128 PDFDocument1 pageEa 1128 PDFAswin NandaNo ratings yet

- Judicial Review of Administrative Discretion in India (Part A)Document14 pagesJudicial Review of Administrative Discretion in India (Part A)Aswin NandaNo ratings yet

- 5 5 54 839 PDFDocument4 pages5 5 54 839 PDFAswin NandaNo ratings yet

- In The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Document6 pagesIn The High Court of Delhi at New Delhi: Date of Judgment: 02 December, 2020Aswin NandaNo ratings yet

- SJRCT: (The (Sazette of 3ndiaDocument2 pagesSJRCT: (The (Sazette of 3ndiaAswin NandaNo ratings yet

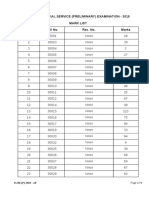

- Kerala Judicial Service (Preliminary) Examination - 2019 Mark ListDocument79 pagesKerala Judicial Service (Preliminary) Examination - 2019 Mark ListAswin NandaNo ratings yet

- Rules and RegulationsDocument3 pagesRules and RegulationsAswin NandaNo ratings yet

- Kerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListDocument15 pagesKerala Judicial Service Main (Written) Examination - 2017 (Nca & Regular Recruitments) Mark ListAswin NandaNo ratings yet

- Bryant L. GreenDocument4 pagesBryant L. GreenThe PitchNo ratings yet

- Estate Planning QuestionnaireDocument17 pagesEstate Planning Questionnairedanjackson7100% (4)

- Background Verification (: (To Be Completed by Hiring Manager) (Please Print)Document2 pagesBackground Verification (: (To Be Completed by Hiring Manager) (Please Print)KarthikNo ratings yet

- Consulting AgreementDocument6 pagesConsulting AgreementRocketLawyer80% (10)

- Util and Deontology - Gonzaga 2013Document23 pagesUtil and Deontology - Gonzaga 2013Dennis SavillNo ratings yet

- CH Online-Veiling Algemene-Voorwaarden NLDocument5 pagesCH Online-Veiling Algemene-Voorwaarden NLthanh vanNo ratings yet

- Grievance and DiciplineDocument19 pagesGrievance and DiciplineJim MathilakathuNo ratings yet

- Salonga Chap 3-8Document14 pagesSalonga Chap 3-8unicamor2No ratings yet

- United States v. Courtney Townsend Taylor, 217 F.2d 397, 2d Cir. (1954)Document3 pagesUnited States v. Courtney Townsend Taylor, 217 F.2d 397, 2d Cir. (1954)Scribd Government DocsNo ratings yet

- Takeovers Code (HK)Document335 pagesTakeovers Code (HK)JustinTangNo ratings yet

- Constitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveDocument7 pagesConstitution Statutes Executive Issuances Judicial Issuances Other Issuances Jurisprudence International Legal Resources AUSL ExclusiveAnronishNo ratings yet

- PDIC Vs BIR, G.R. No. 172892, June 13, 2013Document8 pagesPDIC Vs BIR, G.R. No. 172892, June 13, 2013j0d3No ratings yet

- Spa Pag IbigDocument1 pageSpa Pag IbigasyoumoveonNo ratings yet

- Winding UpDocument20 pagesWinding UpmusingNo ratings yet

- Mp3tag File OverviewDocument24 pagesMp3tag File OverviewBrunno CostaNo ratings yet

- BP Blg. 6 JurisprudenceDocument9 pagesBP Blg. 6 JurisprudenceCresencio Dela Cruz Jr.No ratings yet

- Law 345Document12 pagesLaw 345Khaled RehmanNo ratings yet

- Writing History in International Criminal Trials PDFDocument272 pagesWriting History in International Criminal Trials PDFRafael Braga da SilvaNo ratings yet

- Spouses Del Campo v. Abesia PDFDocument5 pagesSpouses Del Campo v. Abesia PDFnewin12No ratings yet

- Is The Law On Intellectual Property Law Is Effective To Combat Fight Unethical Practices of Intellectual Property in MalaysiaDocument7 pagesIs The Law On Intellectual Property Law Is Effective To Combat Fight Unethical Practices of Intellectual Property in Malaysiasnowgul100% (1)

- 2012 09 29 237Document213 pages2012 09 29 237Almas KhanNo ratings yet

- Jurisdiction IN Criminal Courts: NtroductionDocument5 pagesJurisdiction IN Criminal Courts: NtroductionDeepali MahawarNo ratings yet

- Angara V Electoral Commission, 63 Phil. 139, 158 (1936)Document1 pageAngara V Electoral Commission, 63 Phil. 139, 158 (1936)RafNo ratings yet

- People Vs Mandolado - FCDocument14 pagesPeople Vs Mandolado - FCBryle DrioNo ratings yet

- Kwok v. ASOS - ComplaintDocument9 pagesKwok v. ASOS - ComplaintSarah BursteinNo ratings yet

- Labor Law Review Assignment Unfair Labor Practice 2017Document9 pagesLabor Law Review Assignment Unfair Labor Practice 2017KM MacNo ratings yet

- Sps. Rudy Paragas and Corazon B. Paragas Vs Heirs of Dominador BalacanoDocument9 pagesSps. Rudy Paragas and Corazon B. Paragas Vs Heirs of Dominador BalacanoKay AvilesNo ratings yet

- No Inquiry/ Disciplinary Case Pending CertificateDocument3 pagesNo Inquiry/ Disciplinary Case Pending CertificateDR-Muhammad ZahidNo ratings yet