Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

11 viewsPT Budaya - Tax Management

PT Budaya - Tax Management

Uploaded by

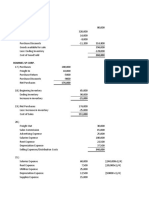

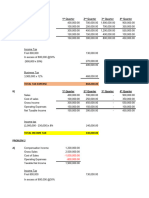

RANIA ABDUL AZIZ BARABAThis document summarizes the financial information and tax calculations for PT Budaya. It shows the company had revenue of 82 billion, costs of 46 billion, and a gross profit of 36 billion. After other costs, the net income was 19.84 billion. Applying a 25% tax rate to the taxable income of 19.04 billion results in an income tax of 4.76 billion. Various tax credits lower the amount to 1.536 billion, which will be paid by the company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Installed Cost of Proposed Machine 400,000Document5 pagesInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Output Tax 396,000Document2 pagesOutput Tax 396,000almira garciaNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingPatrick SalvadorNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex Schuldiner100% (1)

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Jawaban E4.11Document2 pagesJawaban E4.11Muhammad RafiNo ratings yet

- Nok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Document4 pagesNok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Risma AmeliaNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Assignment1 - Profit and Loss Exercise E FinanceDocument8 pagesAssignment1 - Profit and Loss Exercise E Financees.eldeebNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BDocument10 pagesProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Accounting ProjectDocument7 pagesAccounting ProjectMuskan SeherNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Jennie Ann Moderacion TpspecialDocument7 pagesJennie Ann Moderacion Tpspecialjennieann moderacionNo ratings yet

- Solution Problem On Project EvaluationDocument5 pagesSolution Problem On Project EvaluationHasanNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Practice Exam Chapters 1-8 Solutions: Problem 1Document7 pagesPractice Exam Chapters 1-8 Solutions: Problem 1Atif RehmanNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Capital Budgeting Example ExcelDocument1 pageCapital Budgeting Example ExcelNgoc Hong DuongNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Jurnal 2Document19 pagesJurnal 2RANIA ABDUL AZIZ BARABANo ratings yet

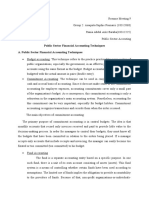

- Public Sector Financial Accounting Techniques A. Public Sector Financial Accounting TechniquesDocument3 pagesPublic Sector Financial Accounting Techniques A. Public Sector Financial Accounting TechniquesRANIA ABDUL AZIZ BARABANo ratings yet

- Mid Exam Sem. I Ta. 2020/2021Document2 pagesMid Exam Sem. I Ta. 2020/2021RANIA ABDUL AZIZ BARABANo ratings yet

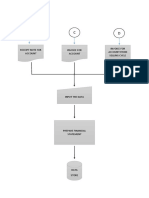

- Accounting Cycle: Invoice For Account From Selling Cycle Invoice For Account Receipt Note For AccountDocument3 pagesAccounting Cycle: Invoice For Account From Selling Cycle Invoice For Account Receipt Note For AccountRANIA ABDUL AZIZ BARABANo ratings yet

- DecemberDocument3 pagesDecemberRANIA ABDUL AZIZ BARABANo ratings yet

- Notes - Rania Abdul Aziz Baraba - 18312225 - 20201029090919Document2 pagesNotes - Rania Abdul Aziz Baraba - 18312225 - 20201029090919RANIA ABDUL AZIZ BARABANo ratings yet

- Answer Sheet Group 5Document2 pagesAnswer Sheet Group 5RANIA ABDUL AZIZ BARABANo ratings yet

- Table 1.5.2.1 Table . Process WorksheetDocument1 pageTable 1.5.2.1 Table . Process WorksheetRANIA ABDUL AZIZ BARABANo ratings yet

- B. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKDocument2 pagesB. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKRANIA ABDUL AZIZ BARABANo ratings yet

- Exercise BondDocument1 pageExercise BondRANIA ABDUL AZIZ BARABANo ratings yet

- Khs Semsetes 18312225Document1 pageKhs Semsetes 18312225RANIA ABDUL AZIZ BARABANo ratings yet

- Paper Ict As A Corporate ResourcesDocument14 pagesPaper Ict As A Corporate ResourcesRANIA ABDUL AZIZ BARABANo ratings yet

- Name: Rania Abdul Aziz Baraba Student Number: 18312225 Course: System Analysis and Design Department of AcoountingDocument4 pagesName: Rania Abdul Aziz Baraba Student Number: 18312225 Course: System Analysis and Design Department of AcoountingRANIA ABDUL AZIZ BARABANo ratings yet

- Co CaseDocument1 pageCo CaseRANIA ABDUL AZIZ BARABANo ratings yet

- Keri Pearlson & Carol Saunders: Cha Pter 1Document40 pagesKeri Pearlson & Carol Saunders: Cha Pter 1RANIA ABDUL AZIZ BARABANo ratings yet

- Assignment SfaDocument2 pagesAssignment SfaRANIA ABDUL AZIZ BARABANo ratings yet

- Lkiik CompanyDocument3 pagesLkiik CompanyRANIA ABDUL AZIZ BARABANo ratings yet

- Daftar Mu'Allim Fakultas Bisnis Dan Ekonomika Uii SEMESTER GENAP TA. 2019/2020Document8 pagesDaftar Mu'Allim Fakultas Bisnis Dan Ekonomika Uii SEMESTER GENAP TA. 2019/2020RANIA ABDUL AZIZ BARABANo ratings yet

PT Budaya - Tax Management

PT Budaya - Tax Management

Uploaded by

RANIA ABDUL AZIZ BARABA0 ratings0% found this document useful (0 votes)

11 views2 pagesThis document summarizes the financial information and tax calculations for PT Budaya. It shows the company had revenue of 82 billion, costs of 46 billion, and a gross profit of 36 billion. After other costs, the net income was 19.84 billion. Applying a 25% tax rate to the taxable income of 19.04 billion results in an income tax of 4.76 billion. Various tax credits lower the amount to 1.536 billion, which will be paid by the company.

Original Description:

test

Original Title

PT BUDAYA

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document summarizes the financial information and tax calculations for PT Budaya. It shows the company had revenue of 82 billion, costs of 46 billion, and a gross profit of 36 billion. After other costs, the net income was 19.84 billion. Applying a 25% tax rate to the taxable income of 19.04 billion results in an income tax of 4.76 billion. Various tax credits lower the amount to 1.536 billion, which will be paid by the company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

11 views2 pagesPT Budaya - Tax Management

PT Budaya - Tax Management

Uploaded by

RANIA ABDUL AZIZ BARABAThis document summarizes the financial information and tax calculations for PT Budaya. It shows the company had revenue of 82 billion, costs of 46 billion, and a gross profit of 36 billion. After other costs, the net income was 19.84 billion. Applying a 25% tax rate to the taxable income of 19.04 billion results in an income tax of 4.76 billion. Various tax credits lower the amount to 1.536 billion, which will be paid by the company.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 2

PT BUDAYA – TAX MANAGEMENT

Revenue from selling goods 82.000.000.000

Cost of goods sold (46.000.000.000)

Gross Profit 36.000.000.000

Deducted by OCM

Salaries expense 12.000.000.000

Natura (120.000.000)

Depreciation expense 1.000.000.000

Promotion & Marketing expense 2.600.000.000

Office Administration expense 1.400.000.000

Total OCM (16.880.000.000)

Net Operating Income 19.120.000.000

Loss difference on exchange rates (Kurs) (40.000.000)

Net Income before Non-operation 19.080.000.000

Other Income:

Income from Dividend 110.000.000

Income from Royalty 50.000.000

Gain on selling machine 600.000.000

Net Income 19.840.000.000

Uncompensated prior year loss (800.000.000)

Taxable Income 19.040.000.000

IIT = Tariff x Taxable Income

= 25% x 19.040.000.000

= 4.760.000.000

Income Tax that can be Credited:

IT art 22 Import = 120.000.000

IT art 22 Treasurer = 1.380.000.000

IT art 23 Dividend = 16.500.000

IT art 23 Royalty = 7.500.000

IT art 24 Foreign = 200.000.000

IT art 25 Paid by self = 1.500.000.000

= 3.224.000.000

IT art 29 Underpayment = 4.760.000.000 – 3.224.000.000

= 1.536.000.000

IT art 25 Paid by self = Previous IIT – IT art 21, 22, 23, 24

= 4.760.000.000 – 1.724.000.000

= 3.036.000.000/12 = 253.000.000

You might also like

- Activities No. 2Document5 pagesActivities No. 2Joshua Cabinas60% (5)

- Accounting For Managers (Assignment One (E-Finance) ) Question OneDocument7 pagesAccounting For Managers (Assignment One (E-Finance) ) Question OnehananNo ratings yet

- Ma Bep01Document4 pagesMa Bep01Grace SimonNo ratings yet

- Business Enhancement 2nd Summative TextDocument16 pagesBusiness Enhancement 2nd Summative TextCams DlunaNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Installed Cost of Proposed Machine 400,000Document5 pagesInstalled Cost of Proposed Machine 400,000Mariame Abasola CagabhionNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- TaxationDocument5 pagesTaxationPauline Jasmine Sta AnaNo ratings yet

- Orca Share Media1540033147945Document17 pagesOrca Share Media1540033147945Melady Sison CequeñaNo ratings yet

- Allowable DeductionsDocument9 pagesAllowable DeductionsLyka RoguelNo ratings yet

- Output Tax 396,000Document2 pagesOutput Tax 396,000almira garciaNo ratings yet

- Sol. Man. - Chapter 2 - Statement of Comprehensive IncomeDocument15 pagesSol. Man. - Chapter 2 - Statement of Comprehensive IncomeKATHRYN CLAUDETTE RESENTE100% (1)

- 268,800 Rommel SP CorpDocument10 pages268,800 Rommel SP CorpnovyNo ratings yet

- Assignment 1 - Taxation On Individuals-SolutionsDocument5 pagesAssignment 1 - Taxation On Individuals-SolutionsCleofe Mae Piñero AseñasNo ratings yet

- Relevant CostingDocument3 pagesRelevant CostingPatrick SalvadorNo ratings yet

- Gross Reportable Compensation Income 285,000Document3 pagesGross Reportable Compensation Income 285,000WenjunNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument3 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpa100% (2)

- 115,200.00 Two 100,200.00 TwoDocument19 pages115,200.00 Two 100,200.00 TwoAlexandra Nicole IsaacNo ratings yet

- Sol. Man. - Chapter 9 - Interim Financial ReportingDocument6 pagesSol. Man. - Chapter 9 - Interim Financial ReportingAEDRIAN LEE DERECHONo ratings yet

- Intermediate Accounting Exam 2 SolutionsDocument5 pagesIntermediate Accounting Exam 2 SolutionsAlex Schuldiner100% (1)

- Itemized: Gross Income From OperationsDocument9 pagesItemized: Gross Income From OperationsLyka RoguelNo ratings yet

- Novelyn AIDocument3 pagesNovelyn AInovyNo ratings yet

- 06 Quiz 1 Income TaxDocument1 page06 Quiz 1 Income TaxKarylle ComiaNo ratings yet

- TAX Final Preboard Examination - Solutions PDFDocument15 pagesTAX Final Preboard Examination - Solutions PDF813 cafeNo ratings yet

- Final Activity Income TaxationDocument6 pagesFinal Activity Income TaxationPrincess MarianoNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Jawaban E4.11Document2 pagesJawaban E4.11Muhammad RafiNo ratings yet

- Nok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Document4 pagesNok Siti Nur Hasanah - 202047005 - Tugas 3.1 3.2 3.3 3.4Risma AmeliaNo ratings yet

- Intermediate Accounting Exam 3 SolutionsDocument7 pagesIntermediate Accounting Exam 3 SolutionsAlex SchuldinerNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- Assignment1 - Profit and Loss Exercise E FinanceDocument8 pagesAssignment1 - Profit and Loss Exercise E Financees.eldeebNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseMarjorieNo ratings yet

- Interim Financial ReportingDocument7 pagesInterim Financial ReportingRey Joyce AbuelNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument7 pagesInterim Financial Reporting: Problem 45-1: True or FalseXyverbel Ocampo RegNo ratings yet

- GainersDocument17 pagesGainersborn2grow100% (1)

- Problem 3: Multiple Choice - COMPUTATIONAL 1. BDocument10 pagesProblem 3: Multiple Choice - COMPUTATIONAL 1. BCharizza Amor TejadaNo ratings yet

- Insurance Expense Allocated To The Quarter: SolutionDocument4 pagesInsurance Expense Allocated To The Quarter: Solutionasdfghjkl zxcvbnmNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Accounting ProjectDocument7 pagesAccounting ProjectMuskan SeherNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- Income Statement and OCI - Exercises - AnswerDocument3 pagesIncome Statement and OCI - Exercises - AnswerYstefani ValderamaNo ratings yet

- PROBLEM 9 (Net Present Value)Document8 pagesPROBLEM 9 (Net Present Value)Kathlyn TajadaNo ratings yet

- Jennie Ann Moderacion TpspecialDocument7 pagesJennie Ann Moderacion Tpspecialjennieann moderacionNo ratings yet

- Solution Problem On Project EvaluationDocument5 pagesSolution Problem On Project EvaluationHasanNo ratings yet

- Ma - Bep01 - LucioDocument4 pagesMa - Bep01 - LucioGrace SimonNo ratings yet

- Approaches in Calculating GDPDocument3 pagesApproaches in Calculating GDPAsahi My loveNo ratings yet

- Ventura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Document7 pagesVentura, Mary Mickaella R - Comprehensive Income - p.88 - Group3Mary VenturaNo ratings yet

- Act 4 Masay Company (SCGS)Document4 pagesAct 4 Masay Company (SCGS)Reginald MundoNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- Capital Budgeting Sample ProblemsDocument10 pagesCapital Budgeting Sample ProblemsMark Gelo WinchesterNo ratings yet

- Practice Exam Chapters 1-8 Solutions: Problem 1Document7 pagesPractice Exam Chapters 1-8 Solutions: Problem 1Atif RehmanNo ratings yet

- Vergara, Gian Bianca F. BSAT-4A Recitation: Compensation IncomeDocument4 pagesVergara, Gian Bianca F. BSAT-4A Recitation: Compensation Incomelena cpaNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Interim Financial Reporting: Problem 45-1: True or FalseDocument9 pagesInterim Financial Reporting: Problem 45-1: True or FalseAudrey AganNo ratings yet

- Capital Budgeting Example ExcelDocument1 pageCapital Budgeting Example ExcelNgoc Hong DuongNo ratings yet

- Untitled SpreadsheetDocument9 pagesUntitled SpreadsheetMiguel BautistaNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Jurnal 2Document19 pagesJurnal 2RANIA ABDUL AZIZ BARABANo ratings yet

- Public Sector Financial Accounting Techniques A. Public Sector Financial Accounting TechniquesDocument3 pagesPublic Sector Financial Accounting Techniques A. Public Sector Financial Accounting TechniquesRANIA ABDUL AZIZ BARABANo ratings yet

- Mid Exam Sem. I Ta. 2020/2021Document2 pagesMid Exam Sem. I Ta. 2020/2021RANIA ABDUL AZIZ BARABANo ratings yet

- Accounting Cycle: Invoice For Account From Selling Cycle Invoice For Account Receipt Note For AccountDocument3 pagesAccounting Cycle: Invoice For Account From Selling Cycle Invoice For Account Receipt Note For AccountRANIA ABDUL AZIZ BARABANo ratings yet

- DecemberDocument3 pagesDecemberRANIA ABDUL AZIZ BARABANo ratings yet

- Notes - Rania Abdul Aziz Baraba - 18312225 - 20201029090919Document2 pagesNotes - Rania Abdul Aziz Baraba - 18312225 - 20201029090919RANIA ABDUL AZIZ BARABANo ratings yet

- Answer Sheet Group 5Document2 pagesAnswer Sheet Group 5RANIA ABDUL AZIZ BARABANo ratings yet

- Table 1.5.2.1 Table . Process WorksheetDocument1 pageTable 1.5.2.1 Table . Process WorksheetRANIA ABDUL AZIZ BARABANo ratings yet

- B. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKDocument2 pagesB. Lingkungan Internal Bisnis 1. Critical Success Factor PT - Indofood Sukses Makmur TBKRANIA ABDUL AZIZ BARABANo ratings yet

- Exercise BondDocument1 pageExercise BondRANIA ABDUL AZIZ BARABANo ratings yet

- Khs Semsetes 18312225Document1 pageKhs Semsetes 18312225RANIA ABDUL AZIZ BARABANo ratings yet

- Paper Ict As A Corporate ResourcesDocument14 pagesPaper Ict As A Corporate ResourcesRANIA ABDUL AZIZ BARABANo ratings yet

- Name: Rania Abdul Aziz Baraba Student Number: 18312225 Course: System Analysis and Design Department of AcoountingDocument4 pagesName: Rania Abdul Aziz Baraba Student Number: 18312225 Course: System Analysis and Design Department of AcoountingRANIA ABDUL AZIZ BARABANo ratings yet

- Co CaseDocument1 pageCo CaseRANIA ABDUL AZIZ BARABANo ratings yet

- Keri Pearlson & Carol Saunders: Cha Pter 1Document40 pagesKeri Pearlson & Carol Saunders: Cha Pter 1RANIA ABDUL AZIZ BARABANo ratings yet

- Assignment SfaDocument2 pagesAssignment SfaRANIA ABDUL AZIZ BARABANo ratings yet

- Lkiik CompanyDocument3 pagesLkiik CompanyRANIA ABDUL AZIZ BARABANo ratings yet

- Daftar Mu'Allim Fakultas Bisnis Dan Ekonomika Uii SEMESTER GENAP TA. 2019/2020Document8 pagesDaftar Mu'Allim Fakultas Bisnis Dan Ekonomika Uii SEMESTER GENAP TA. 2019/2020RANIA ABDUL AZIZ BARABANo ratings yet