Professional Documents

Culture Documents

Capital+budgeting Unsolved

Capital+budgeting Unsolved

Uploaded by

utamiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Capital+budgeting Unsolved

Capital+budgeting Unsolved

Uploaded by

utamiCopyright:

Available Formats

Input -->

Drivers

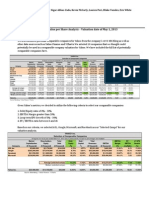

Create a capital budgeting model that uses the inputs listed below. Calculate the project's feasibility in terms of NPV, IRR, and perform a se

Selected case 1

Installed capacity (MW)

Best case 220

Base case 200

Worst case 180

Capacity factor 25%

Days in one year 365 Installed capacity (MW) x Capacity factor x Days

Hours per day 24

Inflation

Expected long-term inflation Italy 1%

Price per MWh (EUR)

Best case 220

Base case 210

Worst case 200

Opex as a % of Revenue

Best case -15%

Base case -16%

Worst case 17%

Estimated initial investment (in EUR)

Best case 500,000,000

Base case 510,000,000

Worst case 520,000,000

Useful life (years) 10

Capex after year 1 3%

Financing facilities

Senior Facility (million EUR) 300,000,000

Interest rate Senior Facility 4%

Repay Senior Facility in 10 years

Repayment schedule 0 1 2 3 4

Repayment % 0% 0% 5% 10% 10%

Tax rate 30%

Residual value of the project 100,000,000

Comparable companies Leverage (D/E) Beta

Company A 70% 0.50

Company B 80% 0.40

Company C 65% 0.35

Company X beta 0.9

Market risk premium 5.5%

Risk-free rate 2.0%

s of NPV, IRR, and perform a sensitivity analysis.

MW) x Capacity factor x Days in the year x Hours per day = Energy output (MWh)

5 6 7 8 9 10 11 12

10% 10% 10% 10% 10% 10% 10% 5%

You might also like

- MCD Stock ControlDocument6 pagesMCD Stock ControlutamiNo ratings yet

- Prject Report Financial Statement of NestleDocument14 pagesPrject Report Financial Statement of NestleSumia Hoque NovaNo ratings yet

- Sensitivity Analysis & Types of InterestsDocument45 pagesSensitivity Analysis & Types of InterestsQamar AbbasNo ratings yet

- Chap11 - Flexible Budgets and Overhead AnalysisDocument58 pagesChap11 - Flexible Budgets and Overhead AnalysisMuhammad Munim100% (1)

- Solved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofDocument1 pageSolved Jurisdiction Z Levies An Excise Tax On Retail Purchases ofAnbu jaromiaNo ratings yet

- Boe - Manual of Auditing of Banking Financial Institutions BankfrontDocument318 pagesBoe - Manual of Auditing of Banking Financial Institutions Bankfrontresprocity100% (1)

- Pricing StrategiesDocument4 pagesPricing StrategiesvinniieeNo ratings yet

- Days-Sales-Outstanding-TemplateDocument3 pagesDays-Sales-Outstanding-TemplateKaren Anne Pineda IngenteNo ratings yet

- Actuaries 4Document69 pagesActuaries 4MuradNo ratings yet

- Cost Volume Profit Analysis (Decision Making) - TaskDocument9 pagesCost Volume Profit Analysis (Decision Making) - TaskAshwin KarthikNo ratings yet

- CH - 4 - Time Value of MoneyDocument49 pagesCH - 4 - Time Value of Moneyak sNo ratings yet

- Auditing CA Final Investigation and Due DiligenceDocument26 pagesAuditing CA Final Investigation and Due Diligencevarunmonga90No ratings yet

- Pestle Analysis - Alesh and GroupDocument18 pagesPestle Analysis - Alesh and GroupJay KapoorNo ratings yet

- Val PacketDocument157 pagesVal PacketKumar PrashantNo ratings yet

- 6W2X - Business Model Canvas With ExplanationsDocument2 pages6W2X - Business Model Canvas With ExplanationstorqtechNo ratings yet

- Chapter 13 ValuationDocument23 pagesChapter 13 ValuationIndah Dwi RetnoNo ratings yet

- Feasibility Study of ProjectDocument15 pagesFeasibility Study of ProjectMauliddha RachmiNo ratings yet

- Investor Guide BookDocument169 pagesInvestor Guide BooktonyvinayakNo ratings yet

- 171 Value Proposition CanvassDocument2 pages171 Value Proposition CanvassNaruto UzumakiNo ratings yet

- MUG Business Models UplDocument23 pagesMUG Business Models UplChristoph MagistraNo ratings yet

- Cash Flows and FCFF, CalculationsDocument4 pagesCash Flows and FCFF, CalculationsNauman RashidNo ratings yet

- Wacc MisconceptionsDocument27 pagesWacc MisconceptionsstariccoNo ratings yet

- Sensitivity Analysis TableDocument3 pagesSensitivity Analysis TableBurhanNo ratings yet

- Case Study On WCMDocument2 pagesCase Study On WCMFALAK OBERAINo ratings yet

- Valuation of New VenturesDocument53 pagesValuation of New VenturesSamara SharinNo ratings yet

- Target CostingDocument4 pagesTarget CostinganiqahazemiNo ratings yet

- Evaluation of Investment Project Using IRR and NPVDocument6 pagesEvaluation of Investment Project Using IRR and NPVchew97No ratings yet

- Financial Feasibility StudyDocument13 pagesFinancial Feasibility StudyAriadne Ramos CorderoNo ratings yet

- Free Cash FlowDocument7 pagesFree Cash FlowParvesh Aghi100% (1)

- Analysis of Financial StatementsDocument33 pagesAnalysis of Financial StatementsKushal Lapasia100% (1)

- Payback Period TemplateDocument3 pagesPayback Period TemplateSobanah ChandranNo ratings yet

- What-If Sensitivity Analysis For Linear ProgrammingDocument33 pagesWhat-If Sensitivity Analysis For Linear ProgrammingluckiestmermaidNo ratings yet

- Profitability Index Template: Strictly ConfidentialDocument4 pagesProfitability Index Template: Strictly ConfidentialLalit KheskwaniNo ratings yet

- Equity Valuation Techniques: Shazia Farooq, CFADocument54 pagesEquity Valuation Techniques: Shazia Farooq, CFAAnonymous EmV44olmNo ratings yet

- CH 14Document27 pagesCH 14ReneeNo ratings yet

- Asset Conversion CycleDocument12 pagesAsset Conversion Cyclessimi137No ratings yet

- Investment Behaviour PDFDocument44 pagesInvestment Behaviour PDFSajoy P.B.100% (1)

- Yahoo! Inc. Valuation ProjectDocument8 pagesYahoo! Inc. Valuation ProjectNigar_AbbasNo ratings yet

- Capital StructureDocument59 pagesCapital StructureRajendra MeenaNo ratings yet

- Notes On IPO & Firm ValuationDocument5 pagesNotes On IPO & Firm Valuationdennise16No ratings yet

- FCFEDocument7 pagesFCFEbang bebetNo ratings yet

- Chap 010Document9 pagesChap 010siddharth.savlodhiaNo ratings yet

- RC Equity Research Report Essentials CFA InstituteDocument3 pagesRC Equity Research Report Essentials CFA InstitutetheakjNo ratings yet

- Joint Products & by Products: Solutions To Assignment ProblemsDocument5 pagesJoint Products & by Products: Solutions To Assignment ProblemsXNo ratings yet

- Cash Flow Estimation and Capital BudgetingDocument29 pagesCash Flow Estimation and Capital BudgetingShehroz Saleem QureshiNo ratings yet

- 1 ++Marginal+CostingDocument71 pages1 ++Marginal+CostingB GANAPATHYNo ratings yet

- Risk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsDocument104 pagesRisk and Return Fundamentals: Portfolio-A Collection, or Group, of AssetsSagorNo ratings yet

- 7 - Entrepreneural FinancingDocument29 pages7 - Entrepreneural FinancingJay Fab0% (1)

- Absorption Vs Variable CostingDocument8 pagesAbsorption Vs Variable CostingMary JaneNo ratings yet

- Cash Flows and Discount RatesDocument34 pagesCash Flows and Discount RatesElliNo ratings yet

- Capital Budgeting ExamplesDocument16 pagesCapital Budgeting ExamplesMuhammad azeemNo ratings yet

- The Optimal Capital BudgetDocument1 pageThe Optimal Capital BudgetAngelica AllanicNo ratings yet

- Chapter 17 Q&PDocument98 pagesChapter 17 Q&PLe Son HuynhNo ratings yet

- Cost of Capital Part 4 - WACCDocument22 pagesCost of Capital Part 4 - WACCGowthami 20 MBANo ratings yet

- Al Rafay ProfileDocument8 pagesAl Rafay ProfileRana UsmanNo ratings yet

- Valuation Models: Aswath DamodaranDocument47 pagesValuation Models: Aswath DamodaranSumit Kumar BundelaNo ratings yet

- CH Rate of Return AnalysisDocument31 pagesCH Rate of Return Analysiseclipseband7gmailcom100% (1)

- R22 Capital Structure Q Bank PDFDocument6 pagesR22 Capital Structure Q Bank PDFZidane KhanNo ratings yet

- Chapter 3Document30 pagesChapter 3Varun ChauhanNo ratings yet

- Corporate Financial Analysis with Microsoft ExcelFrom EverandCorporate Financial Analysis with Microsoft ExcelRating: 5 out of 5 stars5/5 (1)

- Capital+budgeting SolvedDocument22 pagesCapital+budgeting SolvedutamiNo ratings yet

- Economics of Risk ManagementDocument29 pagesEconomics of Risk ManagementRoman RoscaNo ratings yet

- Ekonomika Vol 10 No 2 Juni 2023 Hal 308-315Document8 pagesEkonomika Vol 10 No 2 Juni 2023 Hal 308-315utamiNo ratings yet

- Video 2.5-DogamerDocument18 pagesVideo 2.5-DogamerutamiNo ratings yet

- Capital+budgeting SolvedDocument22 pagesCapital+budgeting SolvedutamiNo ratings yet

- Corporate Social Responsibility and The Cost of Corporate BondsDocument54 pagesCorporate Social Responsibility and The Cost of Corporate BondsutamiNo ratings yet

- Invoice / Packing List No.Document6 pagesInvoice / Packing List No.utamiNo ratings yet

- Intermediate Accounting 2Document18 pagesIntermediate Accounting 2Aimae Inot MalinaoNo ratings yet

- GROUP 1 - Top-Down AnalysisDocument26 pagesGROUP 1 - Top-Down AnalysisSukma Wardha0% (1)

- Fundamental Principles of LendingDocument8 pagesFundamental Principles of LendingSNo ratings yet

- FAR Bonds and Present Value TablesDocument3 pagesFAR Bonds and Present Value Tablespoet_in_christNo ratings yet

- Technical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFDocument141 pagesTechnical Analysis For Beginners (Second Edition) - Stop Blindly Following S PDFSonali100% (7)

- MCQ Parity KeyDocument6 pagesMCQ Parity Key21070653No ratings yet

- Risk Reward Analysis in Risk ArbDocument11 pagesRisk Reward Analysis in Risk ArbWilliam EnszerNo ratings yet

- Sandesh Summer ProjectDocument49 pagesSandesh Summer ProjectPrajwol ThapaNo ratings yet

- NDFDocument7 pagesNDFbaldfishNo ratings yet

- Finmene Angelyca NatasyaDocument4 pagesFinmene Angelyca NatasyaANGELYCA LAURANo ratings yet

- COCOFED vs. Republic of The Philippines, G.R. Nos. 177857-58, January 24, 2012Document50 pagesCOCOFED vs. Republic of The Philippines, G.R. Nos. 177857-58, January 24, 2012Lou Ann AncaoNo ratings yet

- Bapa 2020Document130 pagesBapa 2020Dony AdrianNo ratings yet

- PDF Afa CH 2 - CompressDocument60 pagesPDF Afa CH 2 - CompressAbdi Mucee TubeNo ratings yet

- HOW TO WRITE A-WPS OfficeDocument13 pagesHOW TO WRITE A-WPS Officeellebautista234No ratings yet

- Introduction To Financial ServicesDocument19 pagesIntroduction To Financial ServicesshailjaNo ratings yet

- Valuation of Bonds and Shares: Prepared by Priyanka GohilDocument74 pagesValuation of Bonds and Shares: Prepared by Priyanka GohilSunil Pillai100% (1)

- Zen Technologies at Rs 1032 in A Few MonthsDocument14 pagesZen Technologies at Rs 1032 in A Few MonthsKoushik SircarNo ratings yet

- Assignment PDFDocument2 pagesAssignment PDFshakeel ahmadNo ratings yet

- Classification of Business ActivityDocument1 pageClassification of Business ActivityLumpiang TogeNo ratings yet

- A Cash Management in A Supper Market StoreDocument64 pagesA Cash Management in A Supper Market Storechukwu solomon67% (3)

- 1.) The 4 Aspects of TradingDocument1 page1.) The 4 Aspects of Tradingrichie2885100% (1)

- PreliOfferDocument96 pagesPreliOfferMuhammad IbadNo ratings yet

- Assignment 1 2015Document2 pagesAssignment 1 2015marryam nawazNo ratings yet

- Paper 12Document63 pagesPaper 12Jay PatelNo ratings yet

- Valuation - Multiples and EV Value DriversDocument27 pagesValuation - Multiples and EV Value DriversstrokemeNo ratings yet

- Project On Inventory Management SystemDocument83 pagesProject On Inventory Management SystemPRATIK CHOPDENo ratings yet

- Trai Phieu 14Document6 pagesTrai Phieu 14NguyenNo ratings yet

- Profiling The Risk Tolerance of Higher Education Students in ZambiaDocument10 pagesProfiling The Risk Tolerance of Higher Education Students in ZambiaThe IjbmtNo ratings yet

- A Study On Mutual Funds in IndiaDocument40 pagesA Study On Mutual Funds in IndiaYaseer ArafathNo ratings yet