Professional Documents

Culture Documents

Actividad 3: La Evaluación de La Calidad de La Traducción Automática y La Postedición

Actividad 3: La Evaluación de La Calidad de La Traducción Automática y La Postedición

Uploaded by

María Virginia Armas RodríguezOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Actividad 3: La Evaluación de La Calidad de La Traducción Automática y La Postedición

Actividad 3: La Evaluación de La Calidad de La Traducción Automática y La Postedición

Uploaded by

María Virginia Armas RodríguezCopyright:

Available Formats

ACTIVIDAD 3:

La evaluación de la calidad de la traducción automática y la postedición

Nombre:

Apellidos:

Copia el texto traducido que juzgues que requiere el menor esfuerzo de posedición en las

dos columnas de la tabla siguiente. A continuación, activa "track changes" en Word y

posedita el texto traducido en la columna de la derecha para corregir los errores que hayas

detectado. Escribe una conclusión sobre el proceso que has realizado y comenta la

posedición realizada y si sería conveniente pasar el texto por un sistema de TA y

posteriormente poseditarlo o si sería más adecuado traducir el texto por completo.

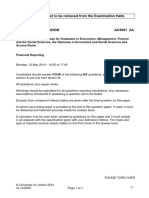

ENGLISH TEXTO TRADUCIDO POR EL SISTEMA TEXTO POSEDITADO

DE TA

Watching Your Wallet: Student loan

debt reaches all-time high

Student debt hit a record high in

2018 according to a new report

from the Institute for College

Access and Success. The

average bachelor’s degree holder

now owes about $29,200 in

student loan debt, according to

data from the Federal Reserve.

That’s up 2% from the class of

2017; the average that year was

$28,650.

For new graduates, the first

payments on those loans are

almost due.

Student Loan Grace

Period

If move-in day at colleges

around the country is a

milestone, then graduation is the

pinnacle. It’s also the time the

clock starts ticking on how much

that hard work really cost: The

six-month student loan grace

period.

One Virginia Commonwealth

University freshman, Laceilea

Kornfield, said she knows she’ll

owe about $100,000 coming out

of school.

“Financial aid helps a lot. I’ve

gotten some grants, but the loans

I will have to pay back,”

Kornfield said.

Freshman Caroline Gryder’s

debt after graduation will be

about $80,000: A number that’s

scary for her.

“Absolutely. I don’t know how

I’m going to live. Like, be able

to have a job and support myself

with all this money I have to

pay," said Gryder.

NerdWallet Personal Finance

Expert Kelsey Sheehy knows the

first loan payment can be

daunting if you’re not prepared.

She said your most important

step is being proactive and

advises you to “learn your loan."

“Before the grace period ends,

look up who your student loan

service is, what your total

balance is, what that first

payment is going to be and what

your payment options are,”

Sheehy said.

That information can all be

found on one government

website, the National Student

Loan Data System. From the

site, just click on “my student

data download.”

You have a six-month grace

period after you graduate

college, but if you start paying

early Sheehy said it will help

lower the overall balance and

save on interest.

If you can’t get that first job out

of school or if you’re headed to

grad school, you do have the

option to defer your loans. You

also have the option of

forbearance if you’re having

trouble making payments, but

Sheehy said this should be a last

resort.

“If you look at that statement,

and the amount is just too high,

it’s not feasible, look into

income-based student loan

repayments,” Sheehy said.

That type of plan can cut

monthly payments in half in

some cases. The trade-off is it’s

going to take longer to pay back

that loan, and you’ll accrue more

interest.

CONCLUSIONES

¿Qué proceso has seguido para realizar la actividad?

¿Es el texto apto para ser traducido por un sistema de TA?

¿Es rentable la posedición? ¿Por qué?

¿Qué conclusiones sacas sobre la actividad?

…

You might also like

- Student Loan Default Literature ReviewDocument4 pagesStudent Loan Default Literature Reviewddtzfavkg100% (1)

- Thesis Student Loans ContactDocument7 pagesThesis Student Loans Contactsallysteeleeverett100% (1)

- Memorandum KBYOStudentLoans FeedbackSummary Jan2012Document4 pagesMemorandum KBYOStudentLoans FeedbackSummary Jan2012bhulahNo ratings yet

- Iscollegeworthit FinalDocument4 pagesIscollegeworthit Finalapi-302030134No ratings yet

- Thesis Servicing Student LoansDocument7 pagesThesis Servicing Student Loansaliciastoddardprovo100% (2)

- Student Loans Thesis ServicingDocument4 pagesStudent Loans Thesis Servicingcheriekingtulsa100% (1)

- Dissertation LoansDocument8 pagesDissertation LoansCollegePaperServiceUK100% (1)

- Return On Investment in EducationDocument2 pagesReturn On Investment in EducationEri JorgeNo ratings yet

- Grad SchoolDocument3 pagesGrad SchoolgablahhhNo ratings yet

- Dealing With Student LoansDocument17 pagesDealing With Student LoansFredPahssenNo ratings yet

- Thesis Statement Student LoansDocument4 pagesThesis Statement Student Loansafjryccau100% (2)

- Annotated BiobliographyDocument8 pagesAnnotated Biobliographyapi-455655398No ratings yet

- AT&T Earnings TW 4-23-14Document1 pageAT&T Earnings TW 4-23-14Price LangNo ratings yet

- Thesis Statement For Student Loan DebtDocument8 pagesThesis Statement For Student Loan Debtaflohdtogglebv100% (2)

- Student Loans: The GoodDocument13 pagesStudent Loans: The GoodConnie KwokNo ratings yet

- Taylor-Jayne Annotated Bibliography Final DraftDocument9 pagesTaylor-Jayne Annotated Bibliography Final DraftTaylor-jayne MayesNo ratings yet

- Comp 2 Essay 3 Final DraftDocument3 pagesComp 2 Essay 3 Final Draftapi-456301481No ratings yet

- Student Loan Debt Research PaperDocument6 pagesStudent Loan Debt Research Paperc9spy2qz100% (1)

- Annotated BibliographyDocument5 pagesAnnotated Bibliographyapi-302862407No ratings yet

- Student Debt Thesis StatementDocument5 pagesStudent Debt Thesis Statementbsqjpnxd100% (2)

- Research Paper On Student LoansDocument7 pagesResearch Paper On Student Loansxfykuuund100% (1)

- Final ReportDocument43 pagesFinal Reportapi-465093956No ratings yet

- How to Wipe Out Your Student Loans and Be Debt Free Fast: Everything You Need to Know Explained SimplyFrom EverandHow to Wipe Out Your Student Loans and Be Debt Free Fast: Everything You Need to Know Explained SimplyNo ratings yet

- Thesis Statement On College DebtDocument5 pagesThesis Statement On College Debtaflodnyqkefbbm100% (2)

- Thesis Statement For College DebtDocument8 pagesThesis Statement For College Debtsarareedannarbor100% (2)

- Eduction LoanDocument2 pagesEduction LoanShadab KhanNo ratings yet

- Shannon Rawley EIPizzleDocument6 pagesShannon Rawley EIPizzlesph5726No ratings yet

- UntitledDocument20 pagesUntitledBusiness UpdateNo ratings yet

- Thesis College TuitionDocument5 pagesThesis College Tuitionfjcsyx0f100% (1)

- Thesis LoansDocument6 pagesThesis Loansbk32hdq7100% (2)

- Research Paper Student DebtDocument7 pagesResearch Paper Student Debtoyrzvcrif100% (1)

- Dissertation MoneyDocument6 pagesDissertation MoneyDoMyCollegePaperJackson100% (1)

- Research Paper On LoansDocument5 pagesResearch Paper On Loanskifmgbikf100% (1)

- English FinalDocument10 pagesEnglish Finalapi-519452875No ratings yet

- Application Letter For Education LoanDocument6 pagesApplication Letter For Education Loanpqdgddifg100% (2)

- Research Paper On Personal LoansDocument8 pagesResearch Paper On Personal Loanstozvnfvnd100% (1)

- Student Loan Debt 1Document10 pagesStudent Loan Debt 1api-483681351No ratings yet

- Student Loan Debt ThesisDocument8 pagesStudent Loan Debt Thesissandrawoodtopeka100% (2)

- Student Debt Proposal Final PaperDocument13 pagesStudent Debt Proposal Final Paperapi-252210869No ratings yet

- How To Gain Acceptance Into Top Graduate Programs: Best Kept Admission Secrets No MoreFrom EverandHow To Gain Acceptance Into Top Graduate Programs: Best Kept Admission Secrets No MoreRating: 4 out of 5 stars4/5 (1)

- Student Loan Company ThesisDocument4 pagesStudent Loan Company ThesisHannah Baker100% (2)

- Essay of Cause and EffectDocument6 pagesEssay of Cause and Effectb723e05c100% (2)

- Is College Worth It 1Document9 pagesIs College Worth It 1api-582812728No ratings yet

- Multivariate Data Analysis ProjectDocument26 pagesMultivariate Data Analysis Projectpreston_may210% (1)

- College Tuition: Collecting Debt Before Establishing CreditDocument9 pagesCollege Tuition: Collecting Debt Before Establishing CreditllopizleNo ratings yet

- Thesis Statement For Student LoansDocument6 pagesThesis Statement For Student Loansfjgjdhzd100% (2)

- Thesis Student Loans Deferment FormDocument7 pagesThesis Student Loans Deferment Formgjhr3grk100% (2)

- The Economics of Student Loan Borrowing and RepaymentDocument10 pagesThe Economics of Student Loan Borrowing and RepaymentSteven HansenNo ratings yet

- Me, The Applicant, and The 500,000-Pound Gorilla: A Challenge in Orthodontic EducationDocument3 pagesMe, The Applicant, and The 500,000-Pound Gorilla: A Challenge in Orthodontic EducationAlla MushkeyNo ratings yet

- University of Toronto School of Graduate Studies Thesis TemplateDocument8 pagesUniversity of Toronto School of Graduate Studies Thesis Templatemariapolitepalmdale100% (2)

- Student Debt and The Cost of EducationDocument7 pagesStudent Debt and The Cost of Educationapi-284734136No ratings yet

- Mwa 3 CorrectionsDocument4 pagesMwa 3 Correctionsapi-301967405No ratings yet

- Argument Document Final - PortfolioDocument6 pagesArgument Document Final - Portfolioapi-310911560No ratings yet

- Term Paper On Credit ManagementDocument7 pagesTerm Paper On Credit Managementea428adh100% (1)

- CollegetuitionDocument8 pagesCollegetuitionapi-266092088No ratings yet

- Your Education Success Kit: AchieveDocument37 pagesYour Education Success Kit: AchieveajswyterNo ratings yet

- Research Logs English Final ScribdDocument8 pagesResearch Logs English Final ScribdAiden RodriguezNo ratings yet

- Student LoanDocument8 pagesStudent LoanCEStampa1No ratings yet

- Research Paper On Student DebtDocument8 pagesResearch Paper On Student Debttitamyg1p1j2100% (1)

- Determinants of Non Performing Loans The Case of Ethiopian BanksDocument169 pagesDeterminants of Non Performing Loans The Case of Ethiopian BanksEdlamu AlemieNo ratings yet

- Torts Notes - Dean Joan Largo4Document35 pagesTorts Notes - Dean Joan Largo4RC Farms TalakagNo ratings yet

- Unit 2 Comparative, Commonsize and Trend Analysis - 24 - 12 - 2021 - 01 - 44 - 49Document6 pagesUnit 2 Comparative, Commonsize and Trend Analysis - 24 - 12 - 2021 - 01 - 44 - 49Tushara VenkateshNo ratings yet

- Ratio by Ghaffar BugtiDocument15 pagesRatio by Ghaffar Bugtighaffar_bugtiNo ratings yet

- Lecture 8-Sources of Funding June 2021 PerakDocument91 pagesLecture 8-Sources of Funding June 2021 PerakKHAIRIEL IZZAT AZMANNo ratings yet

- Power Point Presentation Financial ManagementDocument22 pagesPower Point Presentation Financial ManagementElena GlotonNo ratings yet

- Credit Rating Agencies in IndiaDocument6 pagesCredit Rating Agencies in IndiaSumit SoniNo ratings yet

- Lee V Bangkok BankDocument3 pagesLee V Bangkok BankAllen Windel Bernabe100% (1)

- Journal Entries For PartnershipsDocument11 pagesJournal Entries For PartnershipsRosette Revilala100% (1)

- Sanction Letter For Overdraft Against Fixed DepositDocument4 pagesSanction Letter For Overdraft Against Fixed Depositjyotigunu817No ratings yet

- Simple Interest and Compound Interest: Additional ExamplesDocument5 pagesSimple Interest and Compound Interest: Additional ExamplesmkrNo ratings yet

- Siochi Fishery vs. BPI PDFDocument8 pagesSiochi Fishery vs. BPI PDFJm BrjNo ratings yet

- Bohn, H. (1998) The Behaviour of US Public Debt andDocument15 pagesBohn, H. (1998) The Behaviour of US Public Debt andsami kamlNo ratings yet

- Chapter 6 - Principles Products Services of IFDocument54 pagesChapter 6 - Principles Products Services of IFYaaga DharsiniNo ratings yet

- Assignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Document7 pagesAssignment 1 - Case Study Analysis: ECON1193B: Business Statistics 1Phong LữNo ratings yet

- Integ Case 1 FsDocument7 pagesInteg Case 1 FsIra BenitoNo ratings yet

- Chapter 2: Accounting Equation and The Double-Entry SystemDocument15 pagesChapter 2: Accounting Equation and The Double-Entry SystemSteffane Mae SasutilNo ratings yet

- MAKEEN Energy: Responsible Energy Solutions For People and PlanetDocument7 pagesMAKEEN Energy: Responsible Energy Solutions For People and PlanetSuresh KumarNo ratings yet

- Shahnawaz PtojectDocument46 pagesShahnawaz Ptojectmirsami838No ratings yet

- Ishares 20 Year Treasury Bond ETF - FundDocument1,530 pagesIshares 20 Year Treasury Bond ETF - FundSABUESO FINANCIERONo ratings yet

- Basic CommerceDocument5 pagesBasic CommerceRahul Gupta100% (1)

- AnswerQuiz - Module 6Document4 pagesAnswerQuiz - Module 6Alyanna Alcantara100% (1)

- Covering LetterDocument2 pagesCovering LetterNarayan SinghaNo ratings yet

- Tugas 2 Bahasa Inggris NiagaDocument2 pagesTugas 2 Bahasa Inggris NiagaXyaNo ratings yet

- 2014 CommentaryDocument46 pages2014 Commentaryduong duongNo ratings yet

- RFBT Q1Q2Document9 pagesRFBT Q1Q2Mojan VianaNo ratings yet

- 4ESGF ACG Février International Accounting Rattrapage N°2 Novembre 2020....Document8 pages4ESGF ACG Février International Accounting Rattrapage N°2 Novembre 2020....Sara MafueniNo ratings yet

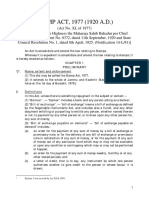

- Documents: STAMP ACT, 1977 (1920 A.D.)Document32 pagesDocuments: STAMP ACT, 1977 (1920 A.D.)Андрей КрайниковNo ratings yet

- BookkeepingDocument7 pagesBookkeepingAyu NingsihNo ratings yet

- 14 - Cruz vs. Filipinas Investment & Finance Corp.Document1 page14 - Cruz vs. Filipinas Investment & Finance Corp.Juvial Guevarra BostonNo ratings yet