Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

2 viewsTechnocrat Consultancy & Eyemark PVT LTD JV

Technocrat Consultancy & Eyemark PVT LTD JV

Uploaded by

Bright Tone Music Institutefxfhdf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NAS For MEs Model Financials - Final FormatDocument28 pagesNAS For MEs Model Financials - Final FormatBright Tone Music Institute100% (3)

- NAS For MEs Model Financials - Final FormatDocument28 pagesNAS For MEs Model Financials - Final FormatBright Tone Music Institute100% (3)

- Let'S Trip Nepal PVT LTD: 3/ Eff8F Dagwl D F) TFDocument2 pagesLet'S Trip Nepal PVT LTD: 3/ Eff8F Dagwl D F) TFBright Tone Music InstituteNo ratings yet

- Auditor's ReportDocument1 pageAuditor's ReportBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument9 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- D Mallik and Company 078Document2 pagesD Mallik and Company 078Bright Tone Music InstituteNo ratings yet

- Balance Sheet 2076-077Document17 pagesBalance Sheet 2076-077Bright Tone Music InstituteNo ratings yet

- Om Metal AmendmentDocument1 pageOm Metal AmendmentBright Tone Music InstituteNo ratings yet

- Creative Engineering Consultancy: Balance SheetDocument9 pagesCreative Engineering Consultancy: Balance SheetBright Tone Music InstituteNo ratings yet

- Dinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurDocument2 pagesDinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Naya Rastriya-Niyatra JVDocument9 pagesTechnocrat Consultancy-Naya Rastriya-Niyatra JVBright Tone Music InstituteNo ratings yet

- Birendra Mahaseth PAN: 104 556 386 Fiscal Year: 2076-077 S. No. Amount TDS Deposit Date Voucher No. Bank Paying Office Remarks Date of TransactionDocument1 pageBirendra Mahaseth PAN: 104 556 386 Fiscal Year: 2076-077 S. No. Amount TDS Deposit Date Voucher No. Bank Paying Office Remarks Date of TransactionBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument8 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Elate Engineering PVT - LTD.: Koteshwore, KathmanduDocument2 pagesElate Engineering PVT - LTD.: Koteshwore, KathmanduBright Tone Music InstituteNo ratings yet

- Elate Engineering PVT - LTD.: Koteshwore, KathmanduDocument2 pagesElate Engineering PVT - LTD.: Koteshwore, KathmanduBright Tone Music InstituteNo ratings yet

- Aakar Dental Clinic PVT LTDDocument6 pagesAakar Dental Clinic PVT LTDBright Tone Music InstituteNo ratings yet

- Birat Engineering Consultancy PVT - LTD.: Sanepa, LalitpurDocument2 pagesBirat Engineering Consultancy PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Debit Credit: Coming From: Going To: Invoice No: Order No: Salesperson: TermsDocument1 pageDebit Credit: Coming From: Going To: Invoice No: Order No: Salesperson: TermsBright Tone Music InstituteNo ratings yet

- Dinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurDocument2 pagesDinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Bill 1Document2 pagesBill 1Bright Tone Music InstituteNo ratings yet

- Visionary International PVT LTDDocument9 pagesVisionary International PVT LTDBright Tone Music InstituteNo ratings yet

- Date Particular Amount: MASS AUTO PURCHASE (Morong Auto Works)Document8 pagesDate Particular Amount: MASS AUTO PURCHASE (Morong Auto Works)Bright Tone Music InstituteNo ratings yet

Technocrat Consultancy & Eyemark PVT LTD JV

Technocrat Consultancy & Eyemark PVT LTD JV

Uploaded by

Bright Tone Music Institute0 ratings0% found this document useful (0 votes)

2 views7 pagesfxfhdf

Original Title

TECHNOCRAT CONSULTANCY & EYEMARK PVT LTD JV

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentfxfhdf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

2 views7 pagesTechnocrat Consultancy & Eyemark PVT LTD JV

Technocrat Consultancy & Eyemark PVT LTD JV

Uploaded by

Bright Tone Music Institutefxfhdf

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 7

D MALLIK AND COMPANY

Satungal , Kathmandu

ICAN Membership No. : RA~4903

COP No. : 1429

Firm Regd No. : 2352

PAN No, : 300331235

Mobile Num : 9841611508

Email: mallikdc@hotmail.com Date:

To,

The Chairman of,

Technocrat Consultancy & Eyemark Pvt Ltd JV

Kathmandu, Nepal

We have audited the attached Balance Sheet of Technocrat Consultancy & Eyemark Pvt

Ltd JV. As at Ashad 31, 2077 and attached Profit & Loss account & Cash Flow Statement for the

period ended on that date and repot that. The financial statements are the responsible of the

‘company. Our responsibility is to express an opinion on these financial statements based on our

audit.

We conducted our audit in accordance with Nepal Standards and Company Law 2064 on

Auditing. Those standards require that plan and perform the audit to obtain reasonable

assurance about weather the financial statement is free of material misstatement. An audit

includes examining on a test basis, evidence supporting the amounts and disclosures in the

financial statement presentation. We believe that our audit provides a reasonable basis for our

In our opinion, proper books of account as required by law have been kept by the Company &

Financial statement comply with Nepal Accounting Standers & relevant statue and law so far as

appears from our examination of the books.

|n our opinion, the financial statement gives a true and fair view of the financial position of the

company as of Ashad 31, 2077 and of the result of its operation and its cash flow for the year

ended on that date. The financial statements are prepared under the historical cost convention

in accordance with certain relevant accounting standards and requirement of Nepal Company

Act, 2053 and Income Tax Act 2058.

UDIN NO : 201104RA04903ypTYw

Date: 2077-0).23

Place: Kathmandu

'RNo. 2352 \Z

[Scan s803)2.

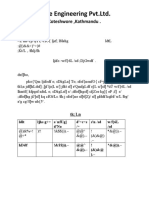

TECHNOCRAT CONSULTANCY IMARK PVT LTD JV

GOTHATAR, KATHMANDU

NEPAL

BALANCE SHEET

FY 2076/2077

FY: 1ST OF SHRAWAN 2076 TO END OF ASHADH 2077

For and on behalf of the Board

Accountant,

As per our report of even date

7RNo 2369

metres

ry pain sci, [CURRENT YEAR | PREVIOUS YEAR

076/077 075/076

—___ SQURCE OF FUND.

T]CAPITAL FUND 100000.09 100000.00]

2|SECURED LOAN 0.00] 0.09

S|UNSECURED LOAN '50000.00] 0000.00]

4] RESERVE AND SURPLUS (148908.00) (143908.00)|

TOTAL SOURCE OF FUND 1092.00] 6092.00]

‘ATNON-CURRENT ASSETS

A]PROPERTY, PLANT & EQUIPMENT 0.09] 0.00]

TOTAL NON-CURRENT ASSETS 0.00] 0.09}

[CURRENT ASSETS

a]SUNDRY DEBTORS. 0.09] 0.00

2|ADVANCE , DEPOSIT & RECEIVABLES 0.09] 0.00

B|INVENTORIES: 0.09] 0.00

4|CASH & CASH EQUIVALENTS 6092.00] 71092.09

TOTAL CURRENT ASSETS (CA) 6092.00] 11082.00]

C[GURRENT ABILITIES

T]TOS PAYABLE 75.00 75:00

2[TRADE & OTHER PAVABLE 4925.00 4925.00]

- TOTAL CURRENT LIABILITIES (CL) 5000.00 5000.09]

NET WORKING CAPITAL ( CA-CL_) 1092.00] 6092.00}

TOTAL APPLICATION OF FUND. 1092.00] 6092.00

a

|

3)

TECHNOCRAT CONSULTANCY IMARK PVT LTD JV

GOTHATAR, KATHMANDU

NEPAL

INCOME STATEMENT

Fy 2076/2077

FY: 1ST OF SHRAWAN 2076 TO END OF ASHADH 2077

CURRENT YEAR [PREVIOUS YEAR

SN iid = 076/077 075/076

-AISALES 0.00]

BILESS: SALES RETURN 0.00]

TOTAL SALES 0.00]

(C[LESS: COST OF SALES 0. a

GROSS PROFIT 0.00!

2] TURE

AJADMINISTRATIVE & OTHER EXPENSES: 5000.00

BIDEPRECIATION. 0.00] 0.09

‘C|BANK INTEREST 0.09] 0.00]

DJREPAIR & MAINTENANCE 0.00} 0.00}

TOTAL EXPENDITURE 5000.00! 5000.00}

3] NET PRORIE LOSS ACCOUNT

A] PROFIT/LOSS BEFORE TAX. (5000.00) (5000.00))

BILESS: INCOME TAX PROVISION 0.00] 0.09]

CNET PROFIT/LOSS AFTER TAX (5000.00) (5000.00)

D|NET PROFIT/LOSS PREVIOUS YEAR (143908.00)} (138907.00)}

SUB TOTAL (148908.00)| (143907.00)|

NET PROFIT/LOSS TO BALANCE SHEET (148908.00)] (243908.00)

‘As per our report of even date

Dinesh Chandra Mallik (D [

For and on behalf of the Board

‘Accountant, Chairman

TECHNOCRAT CONSULTANCY IMARK PVT LTD JV

GOTHATAR, KATHMANDU

NEPAL

ADMINISTRATIVE EXPENSES

FY 2076/2077

FY: 1ST OF SHRAWAN 2076 TO END OF ASHADH 2077

[PARTICULAR [CURRENT YEAR [PREVIOUS YEAR

[SALARY & ALLOWANCES 0.00}

HOUSE RENT 0.00]

[TOURS & TRAVEL 0.00]

[STATIONARY

[TELEPHONE & COMMUNICATION

[INSURANCE

MISCELLANEOUS EXPENSES

[AUDIT FEE

TOTAL

& Company)

For and on behalf of the Board

Accountant

TECHNOCRAT CONSULTANCY IMARK PVT LTD JV

GOTHATAR, KATHMANDU,

NEPAL

SCHEDULE RELATED TO BALANCE SHEET

FY 2076/2077

FY: 1ST OF SHRAWAN 2076 TO END OF ASHADH 2077

‘TDS PAYABLE SCHEDULE:

PARTICULAR [CURRENTYEAR [PREVIOUS YEAR

[TDS PAYABLE ON SALARY 0.09]

[TDS PAYABLE ON HOUSE RENT 0.09]

[TDS PAYABLE ON AUDIT FEE 75.00]

TOTAL 75.00]

PARTICULAR [CURRENT YEAR

[AUDIT FEE PAYABLE 4925.00|

INCOME TAX PROVISION 0.09]

[VAT PAVABLE 0.09]

[OTHER PAYABLE 0.09]

TOTAL 4925.00]

ADVANCE & DEPOSIT ‘SCHEDULE:3

[PARTICULAR [CURRENT YEAR [PREVIOUS YEAR

AJADVANCE & DEPOSIT 10.09] 0.09]

TOTAL 0.00) 0.00]

COST OF GOODS SOLD. ‘SCHEDULE:4

[PARTICULAR [CURRENTYEAR [PREVIOUS YEAR

JOPENING. 0.00) 0.00}

[ADD:PURCHASE 0.00] 0.00]

[LESS:CLOSING STOCK 0.00) 0.00}

TOTAL 0.00) 0.09]

‘As per our report of even date

<< oh & "AN

Dinesh Chandra Mallik (D Mallik & Con{paby),

Ne

For and on behalf of the Board Registered Auditor

Sxarn.

Accountant Chairman.

TECHNOCRAT CONSULTANCY IMARK PVT LTD JV

GOTHATAR, KATHMANDU

NEPAL

(CASH FLOW STATEMENT

FY 2076/2077

FY: 1ST OF SHRAWAN 2076 TO END OF ASHADH 2077

PARTICULAR AMOUNT. [AMOUNT

OPENING CASH & BANK BALANCE 11092.00}

T]cASHIN FLOW,

AICHANGE IN SHARE CAPITAL 009

BICHANGE IN SECURED LOAN 0.00]

[CHANGE IV UNSECURED LOAN 0.00

DICHANGE IN RESERVE & SURPLUS (5000.00)}

[CHANGE IN CURRENT UABILTIES 0.00

TOTAL (5000.00),

TOTAL CASH INFLOW 3092.00

z

AICHANGE IN FIKED ASSETS 709

B|CHANGE IN ADVANCE & DEPOSIT 0.00

CICHANGE IN CLOSING STOCK 0.00

D|GHANGE IN SUNDRY DEBTORS i: 2.00

TOTAL CASH OUTFLOW 2.

CLOSING CASH & BANK 6092.00}

‘As per our report of even date

Dinesh Chandra

Registered Auditor

For and on behalf of the Board

Accountant Chairman

Technocrat Consultancy & Imark Pvt Ltd JV

Gothatar, Kathmandu

Nepal

Not C01

1, Accounting Convention:

The Final reports are prepared under the historical cost convention in accordance with

certain relevant accounting standards and requirements of relevant act.

2. Fixed Assets:

There is no purchase of Fixed Assets during this Year.

3. Depreciation:

Depreciation is not called on this Year.

4, Sales / Income:

There is no any transaction of Sales/Income on this Year.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5820)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (898)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- NAS For MEs Model Financials - Final FormatDocument28 pagesNAS For MEs Model Financials - Final FormatBright Tone Music Institute100% (3)

- NAS For MEs Model Financials - Final FormatDocument28 pagesNAS For MEs Model Financials - Final FormatBright Tone Music Institute100% (3)

- Let'S Trip Nepal PVT LTD: 3/ Eff8F Dagwl D F) TFDocument2 pagesLet'S Trip Nepal PVT LTD: 3/ Eff8F Dagwl D F) TFBright Tone Music InstituteNo ratings yet

- Auditor's ReportDocument1 pageAuditor's ReportBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument9 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- D Mallik and Company 078Document2 pagesD Mallik and Company 078Bright Tone Music InstituteNo ratings yet

- Balance Sheet 2076-077Document17 pagesBalance Sheet 2076-077Bright Tone Music InstituteNo ratings yet

- Om Metal AmendmentDocument1 pageOm Metal AmendmentBright Tone Music InstituteNo ratings yet

- Creative Engineering Consultancy: Balance SheetDocument9 pagesCreative Engineering Consultancy: Balance SheetBright Tone Music InstituteNo ratings yet

- Dinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurDocument2 pagesDinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Naya Rastriya-Niyatra JVDocument9 pagesTechnocrat Consultancy-Naya Rastriya-Niyatra JVBright Tone Music InstituteNo ratings yet

- Birendra Mahaseth PAN: 104 556 386 Fiscal Year: 2076-077 S. No. Amount TDS Deposit Date Voucher No. Bank Paying Office Remarks Date of TransactionDocument1 pageBirendra Mahaseth PAN: 104 556 386 Fiscal Year: 2076-077 S. No. Amount TDS Deposit Date Voucher No. Bank Paying Office Remarks Date of TransactionBright Tone Music InstituteNo ratings yet

- Technocrat Consultancy-Rs Engineering Consultancy JVDocument8 pagesTechnocrat Consultancy-Rs Engineering Consultancy JVBright Tone Music InstituteNo ratings yet

- Elate Engineering PVT - LTD.: Koteshwore, KathmanduDocument2 pagesElate Engineering PVT - LTD.: Koteshwore, KathmanduBright Tone Music InstituteNo ratings yet

- Elate Engineering PVT - LTD.: Koteshwore, KathmanduDocument2 pagesElate Engineering PVT - LTD.: Koteshwore, KathmanduBright Tone Music InstituteNo ratings yet

- Aakar Dental Clinic PVT LTDDocument6 pagesAakar Dental Clinic PVT LTDBright Tone Music InstituteNo ratings yet

- Birat Engineering Consultancy PVT - LTD.: Sanepa, LalitpurDocument2 pagesBirat Engineering Consultancy PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Debit Credit: Coming From: Going To: Invoice No: Order No: Salesperson: TermsDocument1 pageDebit Credit: Coming From: Going To: Invoice No: Order No: Salesperson: TermsBright Tone Music InstituteNo ratings yet

- Dinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurDocument2 pagesDinaram Bhadri Construction PVT - LTD.: Sanepa, LalitpurBright Tone Music InstituteNo ratings yet

- Bill 1Document2 pagesBill 1Bright Tone Music InstituteNo ratings yet

- Visionary International PVT LTDDocument9 pagesVisionary International PVT LTDBright Tone Music InstituteNo ratings yet

- Date Particular Amount: MASS AUTO PURCHASE (Morong Auto Works)Document8 pagesDate Particular Amount: MASS AUTO PURCHASE (Morong Auto Works)Bright Tone Music InstituteNo ratings yet