Professional Documents

Culture Documents

ACI Diploma New Version Syllabus (10p, ACI, 2019)

ACI Diploma New Version Syllabus (10p, ACI, 2019)

Uploaded by

Farah EgalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACI Diploma New Version Syllabus (10p, ACI, 2019)

ACI Diploma New Version Syllabus (10p, ACI, 2019)

Uploaded by

Farah EgalCopyright:

Available Formats

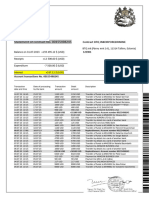

ACI Diploma

New Version

Syllabus

Effective 6 December 2019

Exam Code 003-101

“Setting the benchmark in

certifying the financial

industry globally”

8 Rue du Mail, 75002 Paris - France

T: +33 1 42975115 - www.acifma.com

Syllabus – ACI Diploma New Version

SYLLABUS

ACI Diploma New Version

Examination delivered in English

Introduction

The ACI Diploma New Version builds on the ACI Dealing Certificate and the ACI

Operations Certificate, being designed to ensure that candidates acquire a superior

theoretical and practical knowledge of the foreign exchange and money markets, their

related instruments, environment and applications, and the linkages that exist

between those markets and the practice of risk management. Candidates are

expected to have acquired a solid grounding in the core subject areas and have the

requisite skills in financial mathematics prior to matriculating for the ACI Diploma New

Version.

The course of study for the ACI Diploma New Version is designed for:

Senior foreign exchange and money market dealers

Corporate and bank treasurers

Senior operations staff

Whilst recommended, there is no obligation for candidates to have passed either the

ACI Dealing Certificate or ACI Operations Certificate in order to be eligible to register

for the examination of the ACI Diploma New Version.

There are five core subject areas in the ACI Diploma New Version:

Financial Markets Environment

Foreign Exchange

Rates (Money and Interest Rate Markets)

FICC (Fixed Income, Currency and Commodities) Derivatives

Financial Markets Applications

Syllabus – ACI Diploma New Version

1. Financial Markets Environment

Overall Objectives: Candidates will understand how the foreign exchange and

money markets operate within the constraints set by the international and domestic

policies of governments, and how they are generally implemented by central banks.

They will be able to understand and explain the role of fundamental forecasting, their

principles and methodologies.

After completing this core area, candidates will be able to:

• Outline the roles of the IMF, the BIS and the OECD

• Distinguish between fixed and floating rate regimes, recognise the graduated

nature of floating regimes, and explain the basic economic rationale for each type

of regime

• Distinguish between sterilised and unsterilised currency intervention

• Explain why and how central banks intervene in the foreign exchange market and

in their domestic money market, and understand their targets of monetary policy

• Outline the main factors affecting money market liquidity

• List the main tools of central bank money market intervention

• Explain the purpose of reserve requirements

• Explain the purpose of exchange controls

• Understand fundamental analysis

• Outline the main items in the balance of payments

• Outline the main items in the national income accounts

• Explain the links between the balance of payments and national income accounts

• Identify the economic and financial indicators that are proxies for the main items in

the national income accounts and explain the connection

Syllabus – ACI Diploma New Version

2. Foreign Exchange

Overall Objective: The objective of this area is to understand the historical evolution

and central functions of the foreign exchange market and its related financial

instruments and to acquire a broad range of practical skills such as: how to apply FX

swaps in exploiting interest arbitrage opportunities and manage spot and forward FX

positions, how to apply forward-forward FX swaps in managing interest rate risk and

how to value forward FX positions. In addition, candidates are taught to exploit

foreign exchange related instruments and understand their interrelationships. They

will learn the relevant pricing mechanisms and display a good working knowledge and

understanding of the rationale for NDFs.

After completing this core area, candidates will be able to:

• Explain the conventions for fixing the spot rate in both matched and mismatched

principal FX swaps and describe the cost or benefit of different choices to the

counterparties

• Analyse the impact of a change in the spot rate on an FX swap

• Describe how interest is managed in matched-principal FX swaps

• Calculate the cost of borrowing or lending through FX swaps and identify interest

arbitrage opportunities

• Describe how to roll over a spot FX position with tom/next FX swaps; calculate the

profit or loss, and identify the risks involved

• Roll-over a forward FX position at a historic rate

• Extend or reduce the term of an outright forward FX using FX swaps

• Describe forward-forward FX swaps, explain the strategies underlying their use

and calculate profits or losses

• Calculate both sides of the theoretical swap points from a two-way spot and the

bid and offered interest rates

• Calculate a FX cross-rate swap

• Calculate a FX swap over today and over tom

• Calculate the spot-risk hedge necessary for a forward FX position

• Outline the construction of FRAs and calculate synthetic FRAs using forward-

forward FX swaps

• Outline the hedging of a forward-forward position using FRAs and / or futures

• Define an NDF and explain its rationale

• Describe the structure and the features of NDFs as well as their pricing and

valuation

• Calculate the profit or loss on a spot FX position on T+1 for given revaluation rates

• Calculate the profit or loss on an FX swap position for given revaluation rates

• Calculate the profit or loss on an outright forward FX position at given revaluation

rates

Syllabus – ACI Diploma New Version

3. Rates

Overall Objective: Candidates will understand and be able to describe the central

features and functions of the money and interest rate markets and their relationship

with other financial markets. Candidates will learn about the cash instruments

involved, their relative value and how they are traded. Candidates will understand

how a fixed-income instrument works, how it is quoted, how to calculate its fair value

and how to measure the interest rate risk. Candidates will learn to use yield-to-

maturity, par yields and zero coupon yields in calculating the fair value of a fixed-

income instrument, learn when and how to use each type of yield and how to calculate

these yields. Candidates will demonstrate a good working knowledge of repos and

their market, be able to describe the relationship of repos to the bond market, explain

the related cashflows and understand the roles played by various market participants.

After completing this core area, candidates will be able to:

• Describe the principal comparative advantages and disadvantages of each of the

main types of cash money market instruments for typical borrowers/issuers and

lenders/investors

• Distinguish capital markets from money markets, and debt capital markets from

equity and credit (loan) capital markets, and understand how these markets are a

source of financing, a home for investment and a tool for trading

• Explain the features and conventions of CPs, CDs and T-Bills and perform the

related calculations

• Calculate the holding period yield between the purchase and the sale of a CD or a

T-Bill

• Explain the benefits of the programmed issuance of money market securities

• Explain the principal reasons for the spreads between the yields on the different

types of instruments

• Distinguish and understand the credit ratings used by the main agencies for short-

term instruments from longer-term ratings

• Describe the precise specifications of the most commonly used overnight indexes

(OI)

• Distinguish domestic, foreign and eurobond markets

• Understand and distinguish different bond types such as ABS and covered bonds,

index-linked bonds, bonds with puts, calls, etc.

• Explain the importance of government bond markets

• Explain the impact of credit risk (and credit spreads) on bond prices and swap

rates

• Understand bond quotations in both price and yield terms, including clean and dirty

prices, and calculate the accrued interest and dirty price of a bond

• Identify the day count, annual basis and compounding frequency conventions that

apply to bond and swap markets in major currencies, and be able to convert

among these conventions, and between bond and money market conventions

Syllabus – ACI Diploma New Version

• Understand bond quotes against benchmark yields, swaps and on an asset-swap

basis

• Calculate the fair value of plain vanilla and zero-coupon bonds from yield-to-

maturity, the fair value on non-coupon dates, as well as quarterly and semi-annual

coupon frequencies

• Explain the relationships between price, coupon and yield on fixed-income

instruments

• Explain the interest rate risk profile of fixed rate bonds and measure this risk on a

plain vanilla bond by calculating its duration (on a coupon date)

• Calculate the expected change in portfolio value for a given change in yield out of a

given modified duration

• Understand the relationship between yield volatility and price volatility

• Understand the concepts of and distinguish the relationship between “yield-to-

maturity”, “zero-coupon-yield” and “par-yield”, and explain the shortcomings of

yield-to-maturity as a measure of the rate of return and the assumptions

underlying its use in bond quotations

• Calculate a zero-coupon yield from a series of yields-to-maturity using the

“bootstrapping” method and calculate a par yield from zero-coupon yields

• Explain the main reasons why initial margin is taken in repo, define margin

threshold and minimum transfer amounts

• Calculate the start proceeds of a repo using the concept of the Margin Ratio in

ICMA (formerly ISMA) repo documentation and a variety of collateral

• Explain the purpose of margin maintenance and calculate the margin call on a repo

• Describe the ‘early termination and repricing’ method used in sell/buy backs as an

alternative to margining and calculate the payments or transfers due using this

method

• Explain why counterparty risk is the primary concern in repo and understand the

risks introduced by the usage of collateral

• Describe the working of tri-party repo

• Explain how rights of substitution work in repo

• Explain the main reasons why collateral goes on special and calculate the implied

securities lending fee from the repo rate on specials

• Calculate the forward price of a sell/buy-back and recognise this as the forward

price of the collateral

• Define an ‘open’ repo, ‘repo-to-maturity’ and ‘forward’ repo

• Explain how to construct a synthetic repo and recognise the difference in price

levels between real and synthetic repos

• Calculate the break-even on a forward interest rate position partly derived from

covered interest rate arbitrage using a US T-Bill

• Convert from the discount rate to the true yield

Syllabus – ACI Diploma New Version

4. FICC Derivatives

Overall Objective: Candidates will understand the principles underlying basic option

pricing theories, be able to explain the applications of options and describe option

trading strategies. They will learn the pricing and application of money market futures

and forward rate agreements, as well as money market swaps in hedging, risk-taking

and arbitrage, and their interrelationships, and be able to use these instruments as a

source of trading information.

At the end of this topic, candidates will be able to:

• Understand the logic underlying the Black-Scholes theory

• Outline some of the alternative pricing models available, including the binomial

theorem for major underlying asset classes (Cox-Ross-Rubinstein, Monte Carlo,

etc.)

• Define volatility as it is commonly understood in the context of options (ie standard

deviation) and distinguish between historic and implied volatility

• Calculate the standard deviation of returns on a given underlying for a specific

period

• Calculate the break-even price of an option

• Define a time option and price one from outright forward rates

• Identify the value of the underlying from the prices quoted for puts and calls at

different strike prices

• Identify the intrinsic value of an option from the prices quoted for puts and calls at

different strike prices

• Explain the skew of implied volatility

• Define put/call parity, and use it to construct synthetic cash, forward and options

positions

• Explain delta and gamma hedging, and calculate delta hedges for plain vanilla

options

• Explain the interaction of gamma and theta over the life of an option

• Describe the behaviour of the delta and gamma of in-the-money, out-of-the-

money and at-the-money plain vanilla and barrier options, when the price of the

underlying moves

• Estimate the net delta and vega of a simple options portfolio

• Explain how changes in the spot or forward price of the underlying, the time to

expiry of an option, interest rates and volatility impact on the value of an option

• Explain the structure and purpose of straddles, strangles, butterflies, bull and bear

call and put spreads, as well as risk reversals

• Define and explain caps, floors, collars as well as swaptions

• Describe the structure and purpose of the following exotic options: knock-in and

knock-out, range binary, touch, digital and compound options

Syllabus – ACI Diploma New Version

• Define a forward curve and explain the relationship between forward curves and

the contemporaneous yield curve

• Calculate the exact cost of borrowing or return on lending that is hedged with an

FRA

• Define and calculate the three types of basis between money market futures prices

and other rates

• Explain how to compensate for the basis using the concept of convergence when

hedging with futures

• Define and calculate the bid and offer price of IMM FRAs and swaps from futures

strips and explain how to use a strip of futures to price non-IMM periods

• Calculate the hedging ratio on non-IMM periods hedged with futures using simple

hedging techniques and the numbers of contracts needed

• Define and calculate the hedge ratio for futures hedges, adjusting for mismatches

between the underlying term of the contract and the term of the transaction being

hedged

• Outline the structure and purpose of strip and stack futures hedges

• Outline the structure and purpose of calendar spreads and other common types of

futures spread strategies, and calculate the profit or loss on such trades

• Explain how to use futures spread trades to hedge the basis risk on futures hedges

of non-IMM periods

• Define and explain the usefulness of the volume and open interest statistics on a

futures contract

• Define and explain bond Futures

• Identify arbitrage opportunities between FRAs, money market futures and money

market swaps

• Outline the problem of the convexity bias between futures and OTC derivatives like

FRAs and swaps

• Describe how FRAs, futures and swaps can be used to hedge and arbitrage against

each other

• Describe the applications of OIS in risk-taking, hedging and arbitrage

• Describe how OIS can be used to reduce market risk

• Describe the advantages of OIS over traditional term swaps for risk management

• Explain the characteristics of an interest rate swap (IRS) and of a cross currency

interest rate swap (CIRS)

• Carry out calculations on proceeds, valuation, pricing and hedging of interest rate

swaps (IRS) and cross currency interest rate swap (CIRS)

• Outline the features of forward swaps, amortising swaps and in arrears swaps

• Outline the features of a credit default swap (CDS)

Syllabus – ACI Diploma New Version

5. Financial Markets Applications

Overall Objective: The objective of this area is to understand the risk governance

arrangements and the risk management organisational structure of banks as well as

their main functions. Candidates will be able to describe the role of risk capital and the

structure of international capital adequacy requirements. Their understanding will

extend to the principal methods of risk measurement, including the concept of Value-

at-Risk (VaR). Candidates will also achieve a greater understanding of risk mitigation

by means of netting positions through the comparison of alternative netting methods.

After completing this core area, candidates will be able to:

• Describe the exclusive roles of the front office, middle office (risk management

function) and back office, and explain the need for the segregation of their duties

• Describe the role of the ALCO

• Describe the role of the credit committee

• Describe the role of audits

• Define risk capital, explain its role in covering unexpected losses, distinguish

between economic and regulatory risk capital, and outline how capital is raised and

re-invested

• Explain the purpose of the Basel Committee and outline the architecture of the

Basel II Accord

• Explain the reason for the Market Risk Amendment originally released in 1996,

modified in 1997 and revised in 2005 by the Basel Committee

• Explain the purpose of the EU Capital Adequacy Directive (CAD) and understand

the BIS / CEBS capital adequacy recommendations

• Distinguish between parametric (statistical) and non-parametric measures of risk,

and between the main non-parametric methods, and explain when each approach

is appropriate

• Define Value-at-Risk (VaR)

• Explain the key assumptions in a VaR methodology (holding period, observation

period and confidence interval)

• Explain the key assumptions underlying VaR (randomness, linearity and normal

market conditions)

• Distinguish between undiversified and diversified VaR

• Explain the roles of stress testing and back testing

• Distinguish between payment netting, netting by novation and close-out & set-off

• Explain the working of a central clearing counterparty (CCP)

Syllabus – ACI Diploma New Version

Examination Procedure

Format: The examination lasts 3 hours and consists of 100 multiple-choice questions.

The overall pass level is 60% (60 correct answers), assuming that the minimum

score criteria for each Topic Basket is met. There is a minimum score criteria of

50% for each Topic Basket. One mark is given for each correctly answered question.

Calculators: Some questions will require the use of a calculator. A basic one will be

provided on the computer screen. You may also use your own hand-held calculator,

provided it is neither text programmable nor capable of displaying graphics with a size

more than 2 lines.

Total Minimum Minimum

Topic Basket Types of Number of

Number of of Correct Score

(5) Questions Questions

Questions Answers Level

Financial Markets

1 Theory 10 10 5 50%

Environment

Theory 9

2 Foreign Exchange Practical 16 8 50%

Exercises/ 7

Calculations

Theory 15

3 Rates Practical 26 13 50%

Exercises/ 11

Calculations

Theory 22

4 FICC Derivatives Practical 38 19 50%

Exercises/ 16

Calculations

Financial Markets

5 Theory 10 10 5 50%

Applications

Total 100 100 60

Grades

Pass 60% - 69.99%

Merit 70% - 79.99%

Distinction 80% and above

Examination Fee

Euro 350.00, all taxes included.

Syllabus – ACI Diploma New Version

You might also like

- CACS Paper 2 Version 2.3Document208 pagesCACS Paper 2 Version 2.3YUE DENGNo ratings yet

- OTHM - PGD A & F - Assignment Brief - Investment AnalysisDocument3 pagesOTHM - PGD A & F - Assignment Brief - Investment AnalysisIsurika PereraNo ratings yet

- CASE STUDY - Political GlobalizationDocument5 pagesCASE STUDY - Political GlobalizationMichaela CatacutanNo ratings yet

- ACI Dealing Certificate: SyllabusDocument12 pagesACI Dealing Certificate: SyllabusKhaldon AbusairNo ratings yet

- ACI DiplomaDocument10 pagesACI Diplomalinkrink6889No ratings yet

- ACI Dealing Certificate: New SyllabusDocument12 pagesACI Dealing Certificate: New Syllabusclogne3269844No ratings yet

- ACI Dealing Certificate: SyllabusDocument8 pagesACI Dealing Certificate: SyllabusElvisPresliiNo ratings yet

- ACI Dealing Certificate New Version: SyllabusDocument15 pagesACI Dealing Certificate New Version: Syllabuslayth TawilNo ratings yet

- ACI Dealing Certificate New Version Syllabus 27 Jul 2020Document15 pagesACI Dealing Certificate New Version Syllabus 27 Jul 2020Oluwatobiloba OlayinkaNo ratings yet

- Treasury Ops SyllubusDocument15 pagesTreasury Ops SyllubusDenisNo ratings yet

- After Completing This Reading, You Should Be Able To:: Chapter 2. Insurance Companies and Pension PlansDocument13 pagesAfter Completing This Reading, You Should Be Able To:: Chapter 2. Insurance Companies and Pension PlansKrishna DwivediNo ratings yet

- Aci/ Financial Markets and Dealers CourseDocument20 pagesAci/ Financial Markets and Dealers CourseJovan SsenkandwaNo ratings yet

- Course Outline: Page 1 of 3Document3 pagesCourse Outline: Page 1 of 3Asma ABDUL kd1No ratings yet

- Economics: 2024 Level III Topic OutlinesDocument2 pagesEconomics: 2024 Level III Topic OutlinesSumantha SahaNo ratings yet

- Edu 2009 Spring Exam FMDocument5 pagesEdu 2009 Spring Exam FMDickson SieleNo ratings yet

- Investment Analysis & Portfolio ManagementDocument23 pagesInvestment Analysis & Portfolio ManagementUmair Khan Niazi75% (4)

- Fixed Income: Learning OutcomesDocument4 pagesFixed Income: Learning OutcomesBhaskar RawatNo ratings yet

- w11 Afm LectureDocument15 pagesw11 Afm Lecturekunni2348No ratings yet

- Claritas Syllabus OverviewDocument24 pagesClaritas Syllabus Overviewginos_tNo ratings yet

- CFA Ss15 Fixed IncomeDocument83 pagesCFA Ss15 Fixed IncomeDwiti PradhanNo ratings yet

- Cfa SyallbusDocument24 pagesCfa SyallbusSushil MundelNo ratings yet

- TTCK Chap9 EngDocument16 pagesTTCK Chap9 EngHải NgọcNo ratings yet

- FINANCE COURSES - Student Learning Outcomes: FIN 240: Legal Environment of BusinessDocument18 pagesFINANCE COURSES - Student Learning Outcomes: FIN 240: Legal Environment of BusinessGrant GreenNo ratings yet

- CT1 Financial MathematicsDocument6 pagesCT1 Financial MathematicsVignesh SrinivasanNo ratings yet

- Financially Traded Products Readings PDFDocument210 pagesFinancially Traded Products Readings PDFJaspreet ChawlaNo ratings yet

- Finance 301 Learning Objectives by Chapter Chapter 1: IntroductionDocument7 pagesFinance 301 Learning Objectives by Chapter Chapter 1: Introductionhughng92No ratings yet

- Fixed Income: Learning OutcomesDocument3 pagesFixed Income: Learning OutcomesCoufalík JanNo ratings yet

- DipCF Paper One CFTT Syllabus 2018 FinalDocument8 pagesDipCF Paper One CFTT Syllabus 2018 FinalMutuuNo ratings yet

- Subject CT1 Financial Mathematics Core Technical Syllabus: For The 2014 ExamsDocument6 pagesSubject CT1 Financial Mathematics Core Technical Syllabus: For The 2014 Examsapple8whiteNo ratings yet

- Investment Analysis and Portfolio Management Course ObjectiveDocument5 pagesInvestment Analysis and Portfolio Management Course ObjectiveNishantNo ratings yet

- Financial Mathematics Exam-October 2019Document10 pagesFinancial Mathematics Exam-October 2019ethernalxNo ratings yet

- Introduction To Bond Portfolio Management: by Frank J. FabozziDocument24 pagesIntroduction To Bond Portfolio Management: by Frank J. FabozziNil DonduranNo ratings yet

- Eco - Finance SyllabiDocument18 pagesEco - Finance SyllabiKJ VillNo ratings yet

- Cash Money Markets: Minimum Correct Answers For This Module: 6/12Document15 pagesCash Money Markets: Minimum Correct Answers For This Module: 6/12Jovan SsenkandwaNo ratings yet

- 2019 08 Exam FM SyllabiDocument10 pages2019 08 Exam FM SyllabiMUHAMMAD SABIH UL HAQUENo ratings yet

- 2019 12 Exam FM SyllabusDocument10 pages2019 12 Exam FM SyllabusjawwadshabirNo ratings yet

- Finance Courses Student Learning Outcomes: Updated August 2015Document19 pagesFinance Courses Student Learning Outcomes: Updated August 2015Mazhar Farid ChishtiNo ratings yet

- Financial Mathematics Exam-October 2020Document10 pagesFinancial Mathematics Exam-October 2020FENGKE LIUNo ratings yet

- IAI SA7 Syllabus 2024Document6 pagesIAI SA7 Syllabus 2024sriinaNo ratings yet

- FINC 3117 - Winter 2023 SyllabusDocument11 pagesFINC 3117 - Winter 2023 Syllabusomar mcintoshNo ratings yet

- Stock-Trak Project 2013Document4 pagesStock-Trak Project 2013viettuan91No ratings yet

- 2021 04 Exam FM SyllabiDocument10 pages2021 04 Exam FM SyllabiHông HoaNo ratings yet

- 2021 06 Exam FM SyllabiDocument10 pages2021 06 Exam FM SyllabiJoeNo ratings yet

- 2021 08 Exam FM SyllabiDocument10 pages2021 08 Exam FM Syllabichris kwanNo ratings yet

- 2021 12 Exam FM SyllabiDocument10 pages2021 12 Exam FM SyllabiTuấn Khanh NguyễnNo ratings yet

- IFoA Exam SP6 Syllabus 2024Document9 pagesIFoA Exam SP6 Syllabus 2024Tan Yee HernNo ratings yet

- Energy Risk Professional ERP Exam Course PackDocument210 pagesEnergy Risk Professional ERP Exam Course Packenyi25No ratings yet

- Certification Issued By: Arab Institute For Accountants & LegalDocument1 pageCertification Issued By: Arab Institute For Accountants & LegalJanina SerranoNo ratings yet

- Global Trade Finance Course Syllabus: Thunderbird Online's Certificate inDocument2 pagesGlobal Trade Finance Course Syllabus: Thunderbird Online's Certificate innguyen thieu quangNo ratings yet

- Protecting Financial Results from FX_May2024Document9 pagesProtecting Financial Results from FX_May2024Catherine Joy CarlosNo ratings yet

- ST5 Finance&Investment ADocument5 pagesST5 Finance&Investment AVignesh SrinivasanNo ratings yet

- NISM Equity Derivatives Study Notes-Feb-2013Document26 pagesNISM Equity Derivatives Study Notes-Feb-2013Jagadeesh VigneshNo ratings yet

- SP6 - Financial Derivatives Specialist Principles: SyllabusDocument8 pagesSP6 - Financial Derivatives Specialist Principles: SyllabusRANJAN THOMASNo ratings yet

- Subject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsDocument6 pagesSubject CT1 Financial Mathematics Core Technical Syllabus: For The 2015 ExamsnigerianhacksNo ratings yet

- IAI SP5 Syllabus 2024Document7 pagesIAI SP5 Syllabus 2024sriinaNo ratings yet

- Clarkson University Professor: Susan Young FN 475 Portfolio Management Stock Simulation: Spring 2010Document3 pagesClarkson University Professor: Susan Young FN 475 Portfolio Management Stock Simulation: Spring 2010Tu lanNo ratings yet

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- CFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyFrom EverandCFA 2012 - Exams L1 : How to Pass the CFA Exams After Studying for Two Weeks Without AnxietyRating: 3 out of 5 stars3/5 (2)

- Economics for Investment Decision Makers: Micro, Macro, and International EconomicsFrom EverandEconomics for Investment Decision Makers: Micro, Macro, and International EconomicsNo ratings yet

- A Central Bank's "Communications Strategy": The Interplay of Activity, Discourse Genres, and Technology in A Time of Organizational ChangeDocument53 pagesA Central Bank's "Communications Strategy": The Interplay of Activity, Discourse Genres, and Technology in A Time of Organizational ChangeFarah EgalNo ratings yet

- Part OneDocument43 pagesPart OneFarah EgalNo ratings yet

- Pempal-Sla Note Fin EngDocument15 pagesPempal-Sla Note Fin EngFarah EgalNo ratings yet

- DOCUMENTATION ON MONETARY POLICY INSTRUMENTS AND PROCEDURES (173p, CBI, 2019)Document173 pagesDOCUMENTATION ON MONETARY POLICY INSTRUMENTS AND PROCEDURES (173p, CBI, 2019)Farah EgalNo ratings yet

- Digital First: A Central Bank For A Digital CanadaDocument22 pagesDigital First: A Central Bank For A Digital CanadaFarah EgalNo ratings yet

- @wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupDocument30 pages@wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupFarah EgalNo ratings yet

- Myanmar: Technical Assistance Report-Banking Supervision and RegulationDocument22 pagesMyanmar: Technical Assistance Report-Banking Supervision and RegulationFarah EgalNo ratings yet

- Central Bank Circular No. 905: General ProvisionsDocument6 pagesCentral Bank Circular No. 905: General ProvisionsRaezel Louise VelayoNo ratings yet

- Bus 2101 - Chapter 2Document24 pagesBus 2101 - Chapter 2HarshaBorresAlamoNo ratings yet

- KMF PDFDocument77 pagesKMF PDFManjunath AgastyaNo ratings yet

- Bank AuditDocument16 pagesBank AuditThunderHeadNo ratings yet

- General Port Regulations of The PPADocument15 pagesGeneral Port Regulations of The PPAjana2324No ratings yet

- ED - Structure - Supratim DeyDocument3 pagesED - Structure - Supratim DeyVinay KumarNo ratings yet

- Taxation Midterm Exam With Answer KeyDocument25 pagesTaxation Midterm Exam With Answer Keychelissamaerojas100% (1)

- CH 18Document9 pagesCH 18MBASTUDENTPUPNo ratings yet

- Resume 5Document3 pagesResume 5Zahid HussainNo ratings yet

- Module 2-3Document9 pagesModule 2-3Rizwan FaridNo ratings yet

- The Cost of CapitalDocument12 pagesThe Cost of CapitalLeyla Malijan100% (1)

- After Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedDocument68 pagesAfter Sales Services of Selected Car Insurance Companies - Chapter 1 5 - RevisedMariel AdventoNo ratings yet

- Bahrain BayDocument3 pagesBahrain BaylyndahopeNo ratings yet

- Asean Integration 2015: Challenges and Opportunities For EducatorsDocument19 pagesAsean Integration 2015: Challenges and Opportunities For EducatorsButch CrisostomoNo ratings yet

- Environmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForDocument13 pagesEnvironmental Product Declaration: in Accordance With ISO 14025 and EN 15804 ForLaichul MachfudhorNo ratings yet

- AmazonDocument3 pagesAmazonDominicNo ratings yet

- Neo Checklist For Credit InvestigatorDocument2 pagesNeo Checklist For Credit Investigatorjandy salazarNo ratings yet

- Syllabus CPM DiplomaDocument6 pagesSyllabus CPM DiplomaGirman ranaNo ratings yet

- eFDS 25 Pangunahing Kaalaman Sa PagbabangkoDocument5 pageseFDS 25 Pangunahing Kaalaman Sa PagbabangkoShai SdmpNo ratings yet

- Engaging Hotel Associates in The New Normal by Rakesh KatyayaniDocument1 pageEngaging Hotel Associates in The New Normal by Rakesh KatyayaniEclatNo ratings yet

- Income Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Document1 pageIncome Tax - What Is Meant by A Cross Border Doctrine' and How Does It Apply To Customs Territory.Star RamirezNo ratings yet

- Tata-Digital-India-Fun0 2222233333333Document42 pagesTata-Digital-India-Fun0 2222233333333yasirNo ratings yet

- Aggregate Planning Example SolvedDocument16 pagesAggregate Planning Example SolvedAbdullah ShahidNo ratings yet

- IBC ProjectDocument9 pagesIBC Project19144 ISHAN KAULNo ratings yet

- Suitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisDocument8 pagesSuitability of Pavement Type For Developing Countries From An Economic Perspective Using Life Cycle Cost AnalysisAlazar DestaNo ratings yet

- Statemant HSBCDocument1 pageStatemant HSBCVera DedkovskaNo ratings yet

- Macro Economics 2023 Short Cheat SheetDocument7 pagesMacro Economics 2023 Short Cheat Sheetnarane rampNo ratings yet

- A Case Study Report On Plastic Industries IncDocument8 pagesA Case Study Report On Plastic Industries IncShraddha SharmaNo ratings yet

- DSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkDocument3 pagesDSP App - Dspfinance - Com - A Document Received As Part of A Job Scam, Likely A Cheque Fraud NetworkJames BarlowNo ratings yet