Professional Documents

Culture Documents

Prof. Monica Roman

Prof. Monica Roman

Uploaded by

sandrageorgiaionOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Prof. Monica Roman

Prof. Monica Roman

Uploaded by

sandrageorgiaionCopyright:

Available Formats

1

Prof. Monica Roman

1. What is Autocorrelation?

2. SOURCES OF AUTOCORRELATION

3. Consequences

4. Detecting Autocorrelation

5. Correcting Autocorrelation

6. Example

7. References

Prof. Monica Roman 2

Autocorrelation occurs when assumption IV of the classical LRM

breaks down, meaning that the error term observations in a

regression are correlated

This phenomenon is common in time series data and causes OLS

estimates to lose some of their nice properties

In regressions with time series data, the errors associated with

observations typically carry over into future periods

Prof. Monica Roman 3

Regression model

Y=X

Covariance matrix

cov( 1 , 1 ) cov( 1 , 2 ) cov( 1 , n )

cov( 2 , 1 ) cov( 2 , 2 ) cov( 2 , n)

cov( n , 1 ) cov( n , 2 ) cov( n , n )

Prof. Monica Roman 4

The errors are autocorrelated

i j and cov( i, j) 0.

k order correlation coefficient:

cov( i , i k )

k k 1, n - 1

var( i ) var( i k )

Prof. Monica Roman 5

The typical form of autocorrelation is first-order serial autocorrelation

i i 1 ui

1 1 n 1

Covariance matrix 1

2 1 n 2

n 1 n 2 1

Prof. Monica Roman 6

The absence of one or more significant

variables

◦ Example:

yi a bx1i cx 2i i

◦ x3 is omitted the residual variable is explain

through this variable

i x 3i ui

Prof. Monica Roman 7

Regression model is incorrect specified

There have been performed inadequate

transformations on data

Prof. Monica Roman 8

As in the case of heteroskedasticity, autocorrelation leaves the OLS

coefficient estimates unbiased

However, the OLS estimates do not have the minimum variance (not

efficient estimates)

Autocorrelation causes OLS to underestimate the standard errors of

the coefficients leading to larger t-statistics and incorrect decisions

in hypothesis testing

Prof. Monica Roman 9

A standard test of the presence of first-order serial correlation in a

regression model is to examine the residuals from the OLS

estimation

The Durbin-Watson d statistic uses the regression residuals (e) to

test for first-order serial correlation

n

( ei ei 1 ) 2

i 2

DW n

2

ei

i 1

Prof. Monica Roman 10

The D-W statistic takes the following “extreme” values

◦ 0 if there is extreme positive serial correlation

◦ 2 if there is no serial correlation

◦ 4 if there is extreme negative serial correlation

Testing for positive serial correlation, the decision rule is not as

straightforward as in other hypothesis tests because in some cases

the D-W test can be inconclusive

Critical D-W test statistic values from tables vary with the number of

independent variables and the number of observations

Prof. Monica Roman 11

To test for positive serial correlation we take the following steps

1. Estimate the model by OLS and obtain the D-W statistic (calculated

by software package)

2. Given the sample size and the number of explanatory variables, find

the upper (dU) and lower (dL) critical values of the d statistic for a

specified level of significance from the table of the D-W statistic

3. Use the following decision rule

◦ 0 < DW < d1 positive serial correlation

◦ d1 DW d2 Inconclusive

◦ d2 < DW < 4-d2 independent

◦ 4-d2 DW 4-d1 Inconclusive

◦ 4-d1< DW <4 positive serial correlation

Prof. Monica Roman 12

Testul Durbin-Watson pentru α= 5 %.

n k=1 k=2 k=3 k=4 k=5

d1 d2 d1 d2 d1 d2 d1 d2 d1 d2

15 1,08 1,36 0,95 1,54 0,82 1,75 0,69 1,97 0,56 2,21

20 1,20 1,41 1,10 1,94 1,00 1,68 0,90 1,83 0,79 1,99

30 1,35 1,49 1,28 1,57 1,21 1,65 1,14 1,74 1,07 1,83

40 1,44 1,54 1,39 1,60 1,34 1,66 1,29 1,72 1,23 1,79

50 1,50 1,59 1,46 1,63 1,42 1,67 1,38 1,72 1,34 1,77

100 1,65 1,69 1,63 1,72 1,61 1,74 1,59 1,76 1,37 1,78

Note:

◦ d1=dL şi d2=dU

Prof. Monica Roman 13

1. We estimate the parameters of regression model using

OLS and compute the errors (ei)i=1,n

2. The error term exhibits first-order serial correlation

i i 1 ui n

e i ei 1

i 2

n

ei2 1

i 2

Prof. Monica Roman 14

p

yi 0 j x ji i

j 1

p

yi yi 1 (1 ) ( x ji x ji 1 )

3. 0

j 1

j i i 1

yi* yi yi p

yi* *

1

0 x

j ji i

Having:

x *ji x ji x ji 1

j 1

(1 ) 2

0 0

i N (0, )

4. The parameters of the new model are

estimated

Prof. Monica Roman 15

The generalized model could be estimated by OLS if we knew the

value of

One way to estimate the generalized model is the Cochrane-Orcutt

method that eliminates the problem of serial correlation

The Cochrane-Orcutt method first obtains an estimate of and then

estimates the generalized model by using OLS

The Cochrane-Orcutt method should, in general, be used, instead of

OLS when autocorrelation is present in a regression model

Prof. Monica Roman 16

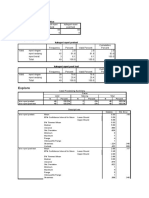

Xi yi ei ei-ei-1 (ei-ei-1)2 e 2i

1 10 2 - - 4

2 15 -0,5 -2,5 6,25 0,25

3 20 -3 -2,5 6,25 9

4 30 -0,5 2,5 6,25 0,25

5 40 2 2,5 6,25 4

15 115 - - 25 17,5

Prof. Monica Roman 17

( e i ei 1 ) 2

i 25

DWcalc 1,429

ei2 19,5

i

dL=0,610; dU=1,400.

(du=1,400)<(dcalc=1,429)<(4-1,4),

The errors are not correlated

Prof. Monica Roman 18

Andrei, T., Bourbonnais, R.- Econometrie, Ed.

Economica, Bucuresti, 2008- capitolul 7, pag.

221-239

Voineagu, V. si colectiv- Teorie si practica

econometrica, Ed. Meteor Press, 2007, cap.

6.2 pag. 282-294

Prof. Monica Roman 19

You might also like

- Doe Rls TeoríaDocument52 pagesDoe Rls TeoríaFroylan FrancoNo ratings yet

- FCDS - RA ch3 Sp21Document20 pagesFCDS - RA ch3 Sp21bashighschool888No ratings yet

- Linear ModelsDocument92 pagesLinear ModelsCART11No ratings yet

- Measures of VariationDocument31 pagesMeasures of VariationMerjie A. NunezNo ratings yet

- Autocorrelation: Dr. Prabir K. Das Indian Institute of Foreign TradeDocument54 pagesAutocorrelation: Dr. Prabir K. Das Indian Institute of Foreign TradeUttam1989No ratings yet

- Math320 T2 1437-1438Document208 pagesMath320 T2 1437-1438منصور الجهنيNo ratings yet

- Topic 1 WbleDocument58 pagesTopic 1 WbleHan YongNo ratings yet

- Sbe10 10 Simple RegressionDocument100 pagesSbe10 10 Simple RegressionRAMANo ratings yet

- 4 Curve Fitting Least Square Regression and InterpolationDocument59 pages4 Curve Fitting Least Square Regression and InterpolationEyu KalebNo ratings yet

- MAT317 - LEC1 - Linear DependenceDocument32 pagesMAT317 - LEC1 - Linear DependenceYeyelove PeterNo ratings yet

- Reading 1 - RESIDUALS AND GOODNESS OF FITDocument13 pagesReading 1 - RESIDUALS AND GOODNESS OF FITShalom FikerNo ratings yet

- Multiple Regression Analysis: y + X + X + - . - X + UDocument43 pagesMultiple Regression Analysis: y + X + X + - . - X + UMike JonesNo ratings yet

- System Identification Basics System Identification IsDocument7 pagesSystem Identification Basics System Identification IsAyyar KandasamyNo ratings yet

- Simple Linear RegressionDocument43 pagesSimple Linear RegressionLiona PatriciaNo ratings yet

- Lesson 3 Exponential Function Borrow and Edit SY 2020-21-2nd TermDocument30 pagesLesson 3 Exponential Function Borrow and Edit SY 2020-21-2nd TermJayson BaoNo ratings yet

- STAT 3001/7301: Mathematical Statistics: Week 3 - Lecture 8Document20 pagesSTAT 3001/7301: Mathematical Statistics: Week 3 - Lecture 8Li NguyenNo ratings yet

- Session 10 Simple Linear Regression: WMY Chapter 9 Parts 1-5 (Chapter 11 of Notes)Document39 pagesSession 10 Simple Linear Regression: WMY Chapter 9 Parts 1-5 (Chapter 11 of Notes)Sie KsNo ratings yet

- U1 4-RVDistributionsDocument36 pagesU1 4-RVDistributionseugene louie ibarraNo ratings yet

- Forecasting 2Document17 pagesForecasting 2Omer TunogluNo ratings yet

- Latent Class AnálysisDocument33 pagesLatent Class AnálysisGabriel MaxNo ratings yet

- Full Download Solutions Manual To Accompany Design and Analysis of Experiments 6th Edition 9780471487357 PDF Full ChapterDocument36 pagesFull Download Solutions Manual To Accompany Design and Analysis of Experiments 6th Edition 9780471487357 PDF Full Chapterkapnomar.drused.gz6n100% (23)

- Solutions Manual To Accompany Design and Analysis of Experiments 6th Edition 9780471487357Document23 pagesSolutions Manual To Accompany Design and Analysis of Experiments 6th Edition 9780471487357wakeningsandyc0x29100% (58)

- Lesson17n18 SampleMeanCLTDocument34 pagesLesson17n18 SampleMeanCLTNhi HoàngNo ratings yet

- RS T RS T: Chapter 2 Supplemental Text Material S2-1. Models For The Data and The T-TestDocument10 pagesRS T RS T: Chapter 2 Supplemental Text Material S2-1. Models For The Data and The T-Testanuppillai1No ratings yet

- Structural Equation Modeling (Sem)Document24 pagesStructural Equation Modeling (Sem)Hadi AbdillahNo ratings yet

- Nonlinear RegressionDocument21 pagesNonlinear RegressionTesfayeNo ratings yet

- Advanced Topics in Operations Management - Some Remarks About Negative Efficiencies in DEA ModelsDocument22 pagesAdvanced Topics in Operations Management - Some Remarks About Negative Efficiencies in DEA ModelsmohamedNo ratings yet

- ECON6001: Applied Econometrics S&W: Chapter 5Document62 pagesECON6001: Applied Econometrics S&W: Chapter 5cqqNo ratings yet

- CH 3Document3 pagesCH 3MohammadAboHlielNo ratings yet

- Section 2Document22 pagesSection 2HuanYuNo ratings yet

- Design of Engineering Experiments Part 2 - Basic Statistical ConceptsDocument44 pagesDesign of Engineering Experiments Part 2 - Basic Statistical ConceptsRozi YudaNo ratings yet

- Physics PyqsDocument6 pagesPhysics Pyqsnaziyaparveen20077No ratings yet

- Chapter 4Document68 pagesChapter 4Nhatty WeroNo ratings yet

- Econ-T2 EngDocument60 pagesEcon-T2 EngEnric Masclans PlanasNo ratings yet

- Two-Variable Regression Model - The Problem of EstimationDocument35 pagesTwo-Variable Regression Model - The Problem of EstimationAyesha RehmanNo ratings yet

- Lec29 StatsAndFits 2017Document28 pagesLec29 StatsAndFits 2017Tasneem MominNo ratings yet

- Chapter 8. Regression and CorrelationDocument37 pagesChapter 8. Regression and CorrelationNizamodden S. H. AlawiNo ratings yet

- 4 Regression IssuesDocument44 pages4 Regression IssuesarpitNo ratings yet

- Common Mistakes in Discrete Choice Modelling: A Guide To Mistakes That Even The So Called Experts MakeDocument50 pagesCommon Mistakes in Discrete Choice Modelling: A Guide To Mistakes That Even The So Called Experts MakeshankarNo ratings yet

- Differential Equations - Introduction PDFDocument35 pagesDifferential Equations - Introduction PDFVincent Allen Corbilla IINo ratings yet

- Correlation: Dibyojyoti BhattacharjeeDocument17 pagesCorrelation: Dibyojyoti BhattacharjeekhandeliavivekNo ratings yet

- Difference-Type Estimators For Estimation of Mean in The Presence of Measurement ErrorDocument21 pagesDifference-Type Estimators For Estimation of Mean in The Presence of Measurement ErrorScience DirectNo ratings yet

- Topic 7 Multiple Regression - InferenceDocument36 pagesTopic 7 Multiple Regression - Inferencedaddy's cockNo ratings yet

- Autocorrelation: y X U S Euu SDocument15 pagesAutocorrelation: y X U S Euu SRawad JumaaNo ratings yet

- 2 - Skip - Nonlinear RegressionDocument41 pages2 - Skip - Nonlinear RegressionEmdad HossainNo ratings yet

- CH 8 Response Surface Methods (Central Composite Designs, CCDS)Document34 pagesCH 8 Response Surface Methods (Central Composite Designs, CCDS)Anshu IngleNo ratings yet

- WEEK 7 Numerical Integration ODE EU RK and IBVDocument79 pagesWEEK 7 Numerical Integration ODE EU RK and IBVDemas Jati100% (1)

- Correlation & RegressionDocument24 pagesCorrelation & RegressionAnsh TalwarNo ratings yet

- Differential EquationsDocument73 pagesDifferential EquationsJhemson ELis100% (1)

- Week2 ContinuousProbabilityReviewDocument10 pagesWeek2 ContinuousProbabilityReviewLaljiNo ratings yet

- IE354 Slides 10 Chp11Document68 pagesIE354 Slides 10 Chp11Mohammad KhataybehNo ratings yet

- Statistical Modelling: Goodness of Fit TestsDocument19 pagesStatistical Modelling: Goodness of Fit TestsdwqefNo ratings yet

- Simple RegressionDocument27 pagesSimple Regressionalemu ayeneNo ratings yet

- Differential Equations: Also Known As Engineering Analysis or EngianaDocument66 pagesDifferential Equations: Also Known As Engineering Analysis or EngianaPatrice Pauline TamoriaNo ratings yet

- Phan I - C5a-Breakdown of OLS AssumptionsDocument35 pagesPhan I - C5a-Breakdown of OLS Assumptionspham nguyetNo ratings yet

- Uncertainty Calculation in Analytical Chemistry: Lu Yang and Scott Willie Chemical Metrology, INMS, NRCCDocument19 pagesUncertainty Calculation in Analytical Chemistry: Lu Yang and Scott Willie Chemical Metrology, INMS, NRCCAlin Iosif IchimNo ratings yet

- Random Fourier Series with Applications to Harmonic Analysis. (AM-101), Volume 101From EverandRandom Fourier Series with Applications to Harmonic Analysis. (AM-101), Volume 101No ratings yet

- An Introduction to Probability and StatisticsFrom EverandAn Introduction to Probability and StatisticsRating: 4 out of 5 stars4/5 (1)

- Midtermtest 158-1Document5 pagesMidtermtest 158-1minhchauNo ratings yet

- Consider All Samples of Size 6 From This PopulationDocument6 pagesConsider All Samples of Size 6 From This PopulationPurple. Queen95No ratings yet

- Descriptive Statistics PrinceDocument33 pagesDescriptive Statistics PrincepRiNcE DuDhAtRa100% (1)

- Measures of Relative MotionDocument20 pagesMeasures of Relative MotionBam Bam0% (1)

- Statistics With R 2014vb PDFDocument102 pagesStatistics With R 2014vb PDFkezudin1465No ratings yet

- Tolerance TableDocument4 pagesTolerance Tablemoganna730% (1)

- STA301 - Midterm MCQS Solved With References by Moaaz PDFDocument28 pagesSTA301 - Midterm MCQS Solved With References by Moaaz PDFChugtahi50% (2)

- Introduction BS FinalDocument54 pagesIntroduction BS FinalsathravguptaNo ratings yet

- Assignment 1 Data InterpretationDocument4 pagesAssignment 1 Data Interpretationjeyanthirajagur418No ratings yet

- Laporn Praktikum Uji Normalitas Dan Transformasi Data - Deva Faradina 182201028Document10 pagesLaporn Praktikum Uji Normalitas Dan Transformasi Data - Deva Faradina 182201028Deva FaradinaNo ratings yet

- Chap08 Moving Average Control Charts 2Document23 pagesChap08 Moving Average Control Charts 2john brownNo ratings yet

- MMWDocument6 pagesMMWAimee De VillaNo ratings yet

- Interpretasi Hasil SpssDocument2 pagesInterpretasi Hasil SpssMeilia JayantiNo ratings yet

- Annotated Stata Output Multiple Regression AnalysisDocument5 pagesAnnotated Stata Output Multiple Regression AnalysiscastjamNo ratings yet

- Homoscedasticity Assumption in Linear Regression vs. Concept of Studentized Residuals - Cross ValidaDocument1 pageHomoscedasticity Assumption in Linear Regression vs. Concept of Studentized Residuals - Cross ValidavaskoreNo ratings yet

- Parker & Vannest 2009 PDFDocument11 pagesParker & Vannest 2009 PDFAkire MtzNo ratings yet

- RSCH8079 - Session 09 - Data Science With RDocument69 pagesRSCH8079 - Session 09 - Data Science With RDinne RatjNo ratings yet

- Subject: STATS Test Marks: 50Document4 pagesSubject: STATS Test Marks: 50aravindreddyNo ratings yet

- Statistics and Standard DeviationDocument50 pagesStatistics and Standard DeviationRon April Custodio Frias100% (10)

- Chapter 11 Factorial ANOVADocument32 pagesChapter 11 Factorial ANOVALis GuziNo ratings yet

- Dan Shuster's Exploring Data AP StatisticsDocument3 pagesDan Shuster's Exploring Data AP Statisticsgoogle0987No ratings yet

- TABULAR AND GRAPHICAL PRESENTATIONS ObjectivesDocument13 pagesTABULAR AND GRAPHICAL PRESENTATIONS ObjectivesaliyasbradNo ratings yet

- Ada Module Chapter 1Document20 pagesAda Module Chapter 1caboboyjacintoNo ratings yet

- Robust CUSUM Control Charting PDFDocument15 pagesRobust CUSUM Control Charting PDFCarmen PatinoNo ratings yet

- Laundry CasestudyDocument5 pagesLaundry CasestudyMilan AssudaniNo ratings yet

- Note-145 Biostat Prof. Abdullah Al-ShihaDocument157 pagesNote-145 Biostat Prof. Abdullah Al-ShihaAdel Dib Al-jubeh100% (4)

- Data Hasil Pengujian Organoleptik Uji Hedonik Produk Dendeng Daging Sapi (Excell)Document11 pagesData Hasil Pengujian Organoleptik Uji Hedonik Produk Dendeng Daging Sapi (Excell)Rizki Aulia NuzullinaNo ratings yet

- STAT 251 Statistics Notes UBCDocument292 pagesSTAT 251 Statistics Notes UBChavarticanNo ratings yet

- HW1Document2 pagesHW1Ahmet GülverenNo ratings yet

- Penerapan Metode Single Exponential Smoothing Dalam Peramalan Penjualan BarangDocument9 pagesPenerapan Metode Single Exponential Smoothing Dalam Peramalan Penjualan BarangAna Nya AnaNo ratings yet