Professional Documents

Culture Documents

Sales Type Lease (Lessor's Books)

Sales Type Lease (Lessor's Books)

Uploaded by

Jb De GuzmanOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sales Type Lease (Lessor's Books)

Sales Type Lease (Lessor's Books)

Uploaded by

Jb De GuzmanCopyright:

Available Formats

B.

Sales Type Lease (LESSOR)

Computations/ Formulas:

Gross Investment= gross rentals for entire lease term + residual value whether guaranteed or not + bargain purchase

option, if any*

*If there is a residual value, it means there is no transfer of title; thus no bargain purchase option.

**Net Investment= Present value of rental payments + Present value of residual value whether guaranteed or not +

Present value of bargain purchase option, if any.

**Net investment is also equal to Lease receivable, net per balance sheet at the inception/beginning of the lease. (Gross

receivables less unearned interest income)

TAKE NOTE: The present value of Gross investment is equal (close) to net investment using the implicit rate.

Unearned interest income= Gross Investment less Net investment

Interest income = Lease receivables, net (at the beginning) multiply by implicit rate

Sales= present value of rental payments + PV of GUARANTEEDresidual value + PV of bargain purchase option, if any OR

fair value of asset –whichever is LOWER

Cost of sales= cost of asset + initial direct cost – PV of unguaranteed residual value, if any

Gross profit/income= Sales – cost of sales

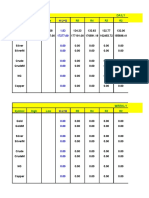

Example; Sales Type Lease

Annual rental is P 800,000 payable at the end of each year; Cost of machine is P 2,000,000; rate is 10%; Residual value is P

200,000 and Initial Direct cost is 100,000. Lease term is 5 years.

PV of an ordinary annuity of 1 at 10 for 5 periods is 3.7908

PV of 1 at 10% for 5 periods is .6209

Formula

Scenario 1: If Guaranteed Residual value

A. Gross Investment

(800K*5)+200K = 4,200,000

B. Net Investment

(800K*3.7908)+(200*.6209)= 3,156,820

C. Unearned interest income

A minus B =1,043,180

D. Lease receivable, net at beginning

A minus C= 3,156,820

E. Interest income in 1st yr

D multiply by 10%= 315,682

F. Sales

See formula above= 3,156,820

G. Cost of Sales

See formula above= 2,100,000

H. Gross profit

F minus G= 1,056,820

Example; Sales Type Lease (SAME DATA above, except that the residual value is UNGUARANTEED))

Annual rental is P 800,000 payable at the end of each year; Cost of machine is P 2,000,000; rate is 10%; Residual value is P

200,000 and Initial Direct cost is 100,000. Lease term is 5 years.

PV of an ordinary annuity of 1 at 10 for 5 periods is 3.7908

PV of 1 at 10% for 5 periods is .6209

Formula

Scenario 2: If Unguaranteed Residual value E. Interest income in 1st yr

A. Gross Investment D multiply by 10%= 315,682

(800K*5)+200K =4,200,000 F. Sales

B. Net Investment See formula above= 3,032,640

(800K*3.7908)+(200*.6209)= 3,156,820 G. Cost of Sales

C. Unearned interest income See formula above= 1,975,820

A minus B= 1,043,180 H. Gross profit

D= Lease receivable, net at beginning F minus G= 1,056,820

A minus C= 3,156,820

You might also like

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Quizzes - Chapter 4 - Types of Major Accounts.Document4 pagesQuizzes - Chapter 4 - Types of Major Accounts.Amie Jane Miranda100% (3)

- 85560539Document2 pages85560539Garp BarrocaNo ratings yet

- Investment Accounts PDFDocument35 pagesInvestment Accounts PDFRam Iyer80% (10)

- Comparing Alternatives: Prepared byDocument51 pagesComparing Alternatives: Prepared byReffisa JiruNo ratings yet

- Accounting and Finance Formulas: A Simple IntroductionFrom EverandAccounting and Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Direct Finance Lease (Lessor's Books)Document1 pageDirect Finance Lease (Lessor's Books)Jb De GuzmanNo ratings yet

- Chapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. BDocument7 pagesChapter 8: Leases Part II: Problem 4: Multiple Choice - Computational 1. D 2. Bmarriette joy abadNo ratings yet

- Leases Part IIDocument21 pagesLeases Part IICarl Adrian ValdezNo ratings yet

- 2nd Presentation On Risk Return ModifiedDocument58 pages2nd Presentation On Risk Return ModifiedpadmNo ratings yet

- Final Exam of PF 2012 (Infolink)Document5 pagesFinal Exam of PF 2012 (Infolink)samuel debebe100% (1)

- AFM RevisionDocument8 pagesAFM RevisionSomabhizinisi MazibukoNo ratings yet

- Last Practice PDFDocument6 pagesLast Practice PDFInna Rahmania d'RstNo ratings yet

- Engineering Economy ReviewerDocument5 pagesEngineering Economy ReviewerBea Abesamis100% (1)

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerJade GomezNo ratings yet

- Afar by Dr. Ferrer First Preboard Review 85Document4 pagesAfar by Dr. Ferrer First Preboard Review 85Julie Neay AfableNo ratings yet

- Afar by Dr. FerrerDocument4 pagesAfar by Dr. FerrerFrans HechanovaNo ratings yet

- Franchise & Consignment ProblemsDocument10 pagesFranchise & Consignment ProblemsCeline Marie AntonioNo ratings yet

- BTX 11112354Document6 pagesBTX 11112354maisie lane100% (1)

- 17.3-Practice Questions Break Even AnalysisDocument6 pages17.3-Practice Questions Break Even AnalysisZak OxmaniNo ratings yet

- FedTax Chapter 6 NotesDocument2 pagesFedTax Chapter 6 NotesAnnyoung93No ratings yet

- Accounting For InvestmentDocument14 pagesAccounting For Investmentefe davidNo ratings yet

- Problem 3 LessorDocument7 pagesProblem 3 LessorGelo Owss33% (9)

- DAIBB Management of AccountingDocument3 pagesDAIBB Management of Accountingdon_mahinNo ratings yet

- A4 IFRS 16 Lease Accounting LessorDocument11 pagesA4 IFRS 16 Lease Accounting LessorMarjorie PalmaNo ratings yet

- Gross Income Deductions - Lecture Handout PDFDocument4 pagesGross Income Deductions - Lecture Handout PDFKarl RendonNo ratings yet

- F9 - IPRO - Mock 1 - AnswersDocument12 pagesF9 - IPRO - Mock 1 - AnswersOlivier MNo ratings yet

- ExcelsDocument45 pagesExcelsPrashanthDalawaiNo ratings yet

- Management Control and Information System: AssignmentDocument9 pagesManagement Control and Information System: AssignmentDheerajRedENo ratings yet

- Engineering Economy ReviewerDocument5 pagesEngineering Economy ReviewerBea Abesamis100% (1)

- Income Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFDocument36 pagesIncome Tax Fundamentals 2019 37Th Edition Whittenburg Test Bank Full Chapter PDFacrania.dekle.z2kajy100% (12)

- Chapter 11 TF MC AnswersDocument6 pagesChapter 11 TF MC AnswersAngela Thrisananda KusumaNo ratings yet

- ATX Revision Notes: Income TaxDocument127 pagesATX Revision Notes: Income TaxIvaylo TsvetanovNo ratings yet

- Taxation FinalDocument8 pagesTaxation Finalnigus100% (5)

- 1 Investment F PDFDocument35 pages1 Investment F PDFShrikant Mahajan100% (2)

- Capital AllowancesDocument11 pagesCapital AllowancesnovetanNo ratings yet

- Income Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Document73 pagesIncome Tax Schemes, Accounting Periods, Accounting Methods and Reporting C4Diane CassionNo ratings yet

- Assignment Singer BDDocument5 pagesAssignment Singer BDNahid Hussain AdriNo ratings yet

- CGT 1Document5 pagesCGT 1Abhiraj RNo ratings yet

- ACCA108 Problem 15-11 To 15-14Document3 pagesACCA108 Problem 15-11 To 15-14Dominic RomeroNo ratings yet

- 05-Session 3 Assignment-LIWAG, JAICELBERNICEDocument3 pages05-Session 3 Assignment-LIWAG, JAICELBERNICEJaicel Bernice LiwagNo ratings yet

- Planning For Growth - Minicase Auto Saved)Document5 pagesPlanning For Growth - Minicase Auto Saved)Ahmed Salim100% (2)

- BT NLKTDocument3 pagesBT NLKTTâm NguyễnNo ratings yet

- Franchise AccountingDocument18 pagesFranchise Accountingforentertainment purposesNo ratings yet

- UntitledDocument9 pagesUntitledJanna Mari FriasNo ratings yet

- 10 - Pdfsam - AEDITED AC3059 2013&2014 All Topics Exam Solutions Part IDocument10 pages10 - Pdfsam - AEDITED AC3059 2013&2014 All Topics Exam Solutions Part IEmily TanNo ratings yet

- Unit Trust (UT) Sample Questions - Set 3Document12 pagesUnit Trust (UT) Sample Questions - Set 3joshuagohejNo ratings yet

- Notes Receivable - Part2Document41 pagesNotes Receivable - Part2Lykie Mae ParedesNo ratings yet

- Chapter 7Document8 pagesChapter 7Tshering DemaNo ratings yet

- TDS On SalariesDocument3 pagesTDS On SalariesSpUnky RohitNo ratings yet

- Managerial Accounting Assignment 1Document20 pagesManagerial Accounting Assignment 1Eagle eye ጌታ-ሁን ተስፋዬNo ratings yet

- Part 2 - Leases (Accounting by Lessors)Document31 pagesPart 2 - Leases (Accounting by Lessors)Poru SenpiiNo ratings yet

- Special CaseDocument7 pagesSpecial CaseNakkolopNo ratings yet

- Terms in This SetDocument31 pagesTerms in This SetAnna AldaveNo ratings yet

- Finance Final222Document7 pagesFinance Final222Mohamed SalamaNo ratings yet

- Chapter 8 - Leases Part 2Document5 pagesChapter 8 - Leases Part 2JEFFERSON CUTE100% (1)

- Capital Gains Tax: Use The Following Data For The Next Four (4) QuestionsDocument4 pagesCapital Gains Tax: Use The Following Data For The Next Four (4) QuestionsRosemarie CruzNo ratings yet

- Chapter 16Document22 pagesChapter 16KENTANG GORENGNo ratings yet

- Lease or Buy DecisionsDocument13 pagesLease or Buy DecisionsChristopher Anniban Salipio100% (1)

- (EE) Tài liệu gửi sauDocument31 pages(EE) Tài liệu gửi sauTrung Đức HuỳnhNo ratings yet

- Case Study The Mechanical Engineer Turned Abattoir OwnerDocument8 pagesCase Study The Mechanical Engineer Turned Abattoir OwnerJb De GuzmanNo ratings yet

- Earnings Per ShareDocument10 pagesEarnings Per ShareJb De GuzmanNo ratings yet

- Cash FlowsDocument4 pagesCash FlowsJb De GuzmanNo ratings yet

- Sales Leaseback (Lessor)Document3 pagesSales Leaseback (Lessor)Jb De GuzmanNo ratings yet

- Accounting For AppropriationDocument1 pageAccounting For AppropriationJb De GuzmanNo ratings yet

- Appropriation of Retained Earnings: Voluntary Appropriation Is A Matter of Discretion On The Part of Management. ThisDocument2 pagesAppropriation of Retained Earnings: Voluntary Appropriation Is A Matter of Discretion On The Part of Management. ThisJb De GuzmanNo ratings yet

- Direct Finance Lease (Lessor's Books)Document1 pageDirect Finance Lease (Lessor's Books)Jb De GuzmanNo ratings yet

- Accounting For Defined Contribution PlanDocument1 pageAccounting For Defined Contribution PlanJb De GuzmanNo ratings yet

- MKG (1) .MGT 1STDocument38 pagesMKG (1) .MGT 1STsfarhanmehmoodNo ratings yet

- Tender Bulletin 05 Attachment #1 Project Deliverables & Requirements...Document26 pagesTender Bulletin 05 Attachment #1 Project Deliverables & Requirements...Hamza ShujaNo ratings yet

- BSL102 - Company Law 1Document19 pagesBSL102 - Company Law 1Usman VpNo ratings yet

- Cover Letter For Legal Assistant Position With ExperienceDocument8 pagesCover Letter For Legal Assistant Position With Experienceusuoezegf100% (1)

- Accenture Life Trends 2024 ReportDocument56 pagesAccenture Life Trends 2024 ReportirgalyanoNo ratings yet

- Test Bank For Nutrition Essentials A Personal Approach 3rd Edition Wendy SchiffDocument24 pagesTest Bank For Nutrition Essentials A Personal Approach 3rd Edition Wendy Schiffcurlerbedye7dlv100% (41)

- Tugas P18-5 - AKLDocument4 pagesTugas P18-5 - AKLNovie AriyantiNo ratings yet

- Symbol High Low R5 R4 R3 R2: DailyDocument8 pagesSymbol High Low R5 R4 R3 R2: Daily257597 rmp.mech.16No ratings yet

- Innovation Day Assessment Rubric 2020-2021Document6 pagesInnovation Day Assessment Rubric 2020-2021Becca BambergerNo ratings yet

- Chapter 18Document11 pagesChapter 18Ngân HàNo ratings yet

- Professional Scrum Master Level IDocument39 pagesProfessional Scrum Master Level Ipravin devaNo ratings yet

- Enterprenuership AssignmentDocument10 pagesEnterprenuership AssignmenthamzahNo ratings yet

- Cost Sheet Miracle MileDocument1 pageCost Sheet Miracle Milesushil aroraNo ratings yet

- PD Insurers Takaful Operators Repairers Code of Conduct Dec23Document31 pagesPD Insurers Takaful Operators Repairers Code of Conduct Dec23alpha speculationNo ratings yet

- Argudo V Parea - 7071 Notice - CaguateDocument10 pagesArgudo V Parea - 7071 Notice - CaguateAlejandro RodriguezNo ratings yet

- Question 1: Read The Following Case and Attempt The Questions BelowDocument4 pagesQuestion 1: Read The Following Case and Attempt The Questions BelowShubham Aggarwal0% (1)

- Cc9222 Integrated Manufacturing Systems r9Document2 pagesCc9222 Integrated Manufacturing Systems r9SUBRAMANIAN PMNo ratings yet

- MC 2016 069 Guidelines and Procedures On The Lease of PNP Owned Occupied and Managed Lots Buildings and SpacesDocument14 pagesMC 2016 069 Guidelines and Procedures On The Lease of PNP Owned Occupied and Managed Lots Buildings and Spacescheryl talisikNo ratings yet

- INSTA July 2022 Current Affairs Quiz QuestionsDocument21 pagesINSTA July 2022 Current Affairs Quiz Questionsprashanth kenchotiNo ratings yet

- The Role of Machinery in IndustrializationDocument2 pagesThe Role of Machinery in IndustrializationSujan ChapagainNo ratings yet

- The Future of Air Travel (ARUP)Document24 pagesThe Future of Air Travel (ARUP)scribd.awning407No ratings yet

- Attendance 2.0 Present 2.1 Absent With ApologyDocument3 pagesAttendance 2.0 Present 2.1 Absent With ApologyPaul NumbeNo ratings yet

- Total Cost of Ownership ExerciseDocument3 pagesTotal Cost of Ownership ExerciseAnkit MehtaNo ratings yet

- Business Process Framework (eTOM) : Frameworx How-To GuideDocument34 pagesBusiness Process Framework (eTOM) : Frameworx How-To Guideserap topacNo ratings yet

- Auditing Human Resource and People RisksDocument88 pagesAuditing Human Resource and People Riskssakharkar umair100% (2)

- Practical Guide To Project ManagementDocument236 pagesPractical Guide To Project Managementsantosh_kecNo ratings yet

- Profile MST Engineering Global - 21.02.2022Document90 pagesProfile MST Engineering Global - 21.02.2022thirupathi mookaiahNo ratings yet

- RBNZ SecuritiesDocument28 pagesRBNZ SecuritiesIzhan Abd RahimNo ratings yet

- Acquiring Sales TalentsDocument14 pagesAcquiring Sales TalentsMariam ShereshashviliNo ratings yet