Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

3K viewsIA Valix 2020 (Problem 4-2 Answer Key)

IA Valix 2020 (Problem 4-2 Answer Key)

Uploaded by

Baby MushroomAccounts receivable on January 1 was $600,000. After charges, collections, returns, write-offs and allowances, accounts receivable was $1,200,000. Subscription receivables were $150,000, with a deposit on contract of $120,000 and claims against carriers of $60,000, leaving receivables of $490,000. Total trade and other receivables was $1,320,000. The document provides guidance that deposit on contract should be classified as non-current, cash advances to affiliates as long-term investments, and subscription receivables deducted from share capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Document8 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Rodolfo Manalac100% (1)

- Chapter 4: Accounting For Accounts Receivables: Problem 4-1 Dreamer CompanyDocument4 pagesChapter 4: Accounting For Accounts Receivables: Problem 4-1 Dreamer CompanyDarry Pascua96% (25)

- VALIX - IA 1 (2020 Ver.) Government GrantDocument9 pagesVALIX - IA 1 (2020 Ver.) Government GrantAriean Joy DequiñaNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- Intermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesDocument6 pagesIntermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesJennilyn BercasioNo ratings yet

- Problem 12-2 To 6Document3 pagesProblem 12-2 To 6MYCO PONCE PAQUENo ratings yet

- ACC 101 - Accounts Receivable Sample ProblemsDocument2 pagesACC 101 - Accounts Receivable Sample ProblemsAdyang71% (7)

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- IA 1 Valix 2020 Ver. Accounts ReceivableDocument8 pagesIA 1 Valix 2020 Ver. Accounts ReceivableAriean Joy DequiñaNo ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- Intermediate Accounting 1 Valix Chapter 17Document2 pagesIntermediate Accounting 1 Valix Chapter 17Captain Shield100% (1)

- IA Activity 6 AssDocument6 pagesIA Activity 6 AssWeStan LegendsNo ratings yet

- Problem 5-4 5-5Document4 pagesProblem 5-4 5-5Jicelle MendozaNo ratings yet

- IA 1 Valix 2020 Ver. Problem 28Document6 pagesIA 1 Valix 2020 Ver. Problem 28Ariean Joy DequiñaNo ratings yet

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Sacrosanct Company Problem 26 - 5 (INTACCS Problem)Document1 pageSacrosanct Company Problem 26 - 5 (INTACCS Problem)Ya NaNo ratings yet

- Affectionate CompanyDocument1 pageAffectionate CompanyAnonnNo ratings yet

- Chapter 1Document10 pagesChapter 1Lyca ArcenaNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Intermediate Accounting 3 2023 - Chap 1-9 Answer KeyDocument23 pagesIntermediate Accounting 3 2023 - Chap 1-9 Answer Keymain.krisselynreigne.moralesNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Proof of Cash and Bank Reconciliation - Formula and ExampleDocument5 pagesProof of Cash and Bank Reconciliation - Formula and ExampleJoyce Ericka P. BalonNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- PPE Sample ProblemsDocument5 pagesPPE Sample ProblemsKathleen FrondozoNo ratings yet

- Chapter 2 Conceptual FrameworkDocument8 pagesChapter 2 Conceptual Frameworkdaniella chynnNo ratings yet

- Inventories Part 1 With AnswersDocument9 pagesInventories Part 1 With AnswersDyenNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Prelim Exam Accounting 2Document3 pagesPrelim Exam Accounting 2JM Singco Canoy100% (1)

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- Hilarious Company Required 1 300,000 12 Years Required 2Document10 pagesHilarious Company Required 1 300,000 12 Years Required 2Anonn0% (1)

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Unit 2 Illustration ProblemDocument1 pageUnit 2 Illustration ProblemCharlene RodrigoNo ratings yet

- Problem 1 2 IAADocument1 pageProblem 1 2 IAAJUARE MaxineNo ratings yet

- Problem 4-2 (IAA)Document6 pagesProblem 4-2 (IAA)Rose Aubrey A CordovaNo ratings yet

- Chapter 4 To Chapter 5Document24 pagesChapter 4 To Chapter 5XENA LOPEZNo ratings yet

- Chap 4 and 5Document18 pagesChap 4 and 5Jerome MonserratNo ratings yet

- RECEIVABLESDocument64 pagesRECEIVABLESKimberly MonserratNo ratings yet

- Activity 4Document2 pagesActivity 4Bernadeth Adelaine DomingoNo ratings yet

- Chapter 5 (Exercise 1-7) CabreraDocument17 pagesChapter 5 (Exercise 1-7) CabreraBaby MushroomNo ratings yet

- 10 Essential Cooking MethodDocument4 pages10 Essential Cooking MethodBaby MushroomNo ratings yet

- What Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodDocument2 pagesWhat Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodBaby MushroomNo ratings yet

- 101 Tips For CookingDocument8 pages101 Tips For CookingBaby MushroomNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- Cost Accounting Exercise2 3Document2 pagesCost Accounting Exercise2 3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)

- Cost Accounting Chapter 10 Exercise 1 6Document5 pagesCost Accounting Chapter 10 Exercise 1 6Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-2 Answer Key)Document6 pagesIA Valix 2020 (Problem 4-2 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)

IA Valix 2020 (Problem 4-2 Answer Key)

IA Valix 2020 (Problem 4-2 Answer Key)

Uploaded by

Baby Mushroom0 ratings0% found this document useful (0 votes)

3K views6 pagesAccounts receivable on January 1 was $600,000. After charges, collections, returns, write-offs and allowances, accounts receivable was $1,200,000. Subscription receivables were $150,000, with a deposit on contract of $120,000 and claims against carriers of $60,000, leaving receivables of $490,000. Total trade and other receivables was $1,320,000. The document provides guidance that deposit on contract should be classified as non-current, cash advances to affiliates as long-term investments, and subscription receivables deducted from share capital.

Original Description:

Intermediate Accounting Valix2020 Chapter 4 answer key

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounts receivable on January 1 was $600,000. After charges, collections, returns, write-offs and allowances, accounts receivable was $1,200,000. Subscription receivables were $150,000, with a deposit on contract of $120,000 and claims against carriers of $60,000, leaving receivables of $490,000. Total trade and other receivables was $1,320,000. The document provides guidance that deposit on contract should be classified as non-current, cash advances to affiliates as long-term investments, and subscription receivables deducted from share capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3K views6 pagesIA Valix 2020 (Problem 4-2 Answer Key)

IA Valix 2020 (Problem 4-2 Answer Key)

Uploaded by

Baby MushroomAccounts receivable on January 1 was $600,000. After charges, collections, returns, write-offs and allowances, accounts receivable was $1,200,000. Subscription receivables were $150,000, with a deposit on contract of $120,000 and claims against carriers of $60,000, leaving receivables of $490,000. Total trade and other receivables was $1,320,000. The document provides guidance that deposit on contract should be classified as non-current, cash advances to affiliates as long-term investments, and subscription receivables deducted from share capital.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 6

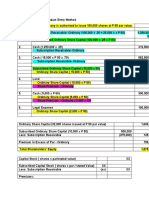

Problem 4-2

a. Accounts receivable- Jan. 1 600,000

charges sales 6,000,000

Less: Collection from customers 5,300,000

Merchandisereturn 40,000

Write off 35,000

Allowances to customer 25,000 (5,400,000)

Accounts receivables 1,200,000

b. Subscribtion receivables 150,000 200K-50K

Deposit in contract 120,000

Claims against common carrier for damages 60,000 100K-40k

IOUs from employees 10,000

cash advance to affiliates 100,000

Advances to a supplier 50,000

Accounts receivables 490,000

c. Accounts receivable 1,200,000

Claims against common carrier for damages 60,000

Advances to a supplier 50,000

IOUs from customers 10,000

Total rade and other Receivables 1,320,000

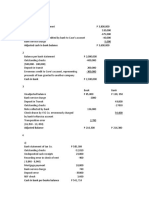

d. Depositon contract should classfied as non-current and presented as other non-current asset.

Cash advance to affilites should be presented as long-term investment and classified as

noncurrent.

Subscribtion receivables should be deducted from subscribed share capital.

You might also like

- INTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Document8 pagesINTERMEDIATE ACCOUNTING Vol. 1 (2021 Edition) - Valix, Peralta & Valix - XLSX Chapter 2Rodolfo Manalac100% (1)

- Chapter 4: Accounting For Accounts Receivables: Problem 4-1 Dreamer CompanyDocument4 pagesChapter 4: Accounting For Accounts Receivables: Problem 4-1 Dreamer CompanyDarry Pascua96% (25)

- VALIX - IA 1 (2020 Ver.) Government GrantDocument9 pagesVALIX - IA 1 (2020 Ver.) Government GrantAriean Joy DequiñaNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- Intermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesDocument6 pagesIntermediate Accounting 1 (Far 3) Accounting For Trade and Other ReceivablesJennilyn BercasioNo ratings yet

- Problem 12-2 To 6Document3 pagesProblem 12-2 To 6MYCO PONCE PAQUENo ratings yet

- ACC 101 - Accounts Receivable Sample ProblemsDocument2 pagesACC 101 - Accounts Receivable Sample ProblemsAdyang71% (7)

- Cost Accounting Chapter5 Exercise1 7Document16 pagesCost Accounting Chapter5 Exercise1 7Baby MushroomNo ratings yet

- Chapter 6 Cost Accounting Problem 1-3Document6 pagesChapter 6 Cost Accounting Problem 1-3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-5 To 4-13 Answer Key)Baby Mushroom67% (3)

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)

- IA Activity 2 Chapter 4&5Document9 pagesIA Activity 2 Chapter 4&5Sunghoon SsiNo ratings yet

- IA 1 Valix 2020 Ver. Accounts ReceivableDocument8 pagesIA 1 Valix 2020 Ver. Accounts ReceivableAriean Joy DequiñaNo ratings yet

- Chapter4 IA Midterm BuenaventuraDocument10 pagesChapter4 IA Midterm BuenaventuraAnonnNo ratings yet

- Ia-Chap 4&5 SolutionsDocument18 pagesIa-Chap 4&5 SolutionsRoselyn IgartaNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- Cabael-Ae109-Proof of CashDocument4 pagesCabael-Ae109-Proof of CashJanine MadriagaNo ratings yet

- Chapter 3-5 To 3-13Document9 pagesChapter 3-5 To 3-13XENA LOPEZNo ratings yet

- Problem 7 - 6 & 7Document2 pagesProblem 7 - 6 & 7Micah April SabularseNo ratings yet

- Intermediate Accounting 1 Valix Chapter 17Document2 pagesIntermediate Accounting 1 Valix Chapter 17Captain Shield100% (1)

- IA Activity 6 AssDocument6 pagesIA Activity 6 AssWeStan LegendsNo ratings yet

- Problem 5-4 5-5Document4 pagesProblem 5-4 5-5Jicelle MendozaNo ratings yet

- IA 1 Valix 2020 Ver. Problem 28Document6 pagesIA 1 Valix 2020 Ver. Problem 28Ariean Joy DequiñaNo ratings yet

- Valix Chapter 20Document22 pagesValix Chapter 20criszel4sobejanaNo ratings yet

- Padernal BSA 1A SW Problem 3 11Document1 pagePadernal BSA 1A SW Problem 3 11Fly ThoughtsNo ratings yet

- Assignment No. 2 (Solution)Document5 pagesAssignment No. 2 (Solution)Christine MalayoNo ratings yet

- Sacrosanct Company Problem 26 - 5 (INTACCS Problem)Document1 pageSacrosanct Company Problem 26 - 5 (INTACCS Problem)Ya NaNo ratings yet

- Affectionate CompanyDocument1 pageAffectionate CompanyAnonnNo ratings yet

- Chapter 1Document10 pagesChapter 1Lyca ArcenaNo ratings yet

- WatatapsDocument29 pagesWatatapsjessa mae zerdaNo ratings yet

- Chapter 33Document7 pagesChapter 33Shane Ivory ClaudioNo ratings yet

- Intermediate Accounting 3 2023 - Chap 1-9 Answer KeyDocument23 pagesIntermediate Accounting 3 2023 - Chap 1-9 Answer Keymain.krisselynreigne.moralesNo ratings yet

- MachineryDocument4 pagesMachineryDianna DayawonNo ratings yet

- Depletion of Universal CompanyDocument2 pagesDepletion of Universal CompanyJerbert JesalvaNo ratings yet

- Dainty Company Requirement: Prepare Journal Entries Debit CreditDocument1 pageDainty Company Requirement: Prepare Journal Entries Debit CreditAnonnNo ratings yet

- Chapter 31Document7 pagesChapter 31AnonnNo ratings yet

- Solution Chapter 20 Intermediate Accounting ValixDocument5 pagesSolution Chapter 20 Intermediate Accounting Valixnameless0% (1)

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- Problem 9-1, 2 & 3Document3 pagesProblem 9-1, 2 & 3Micah April SabularseNo ratings yet

- Adjusted Bank BalanceDocument2 pagesAdjusted Bank BalanceChristy HabelNo ratings yet

- Proof of Cash and Bank Reconciliation - Formula and ExampleDocument5 pagesProof of Cash and Bank Reconciliation - Formula and ExampleJoyce Ericka P. BalonNo ratings yet

- IA Activity 1Document13 pagesIA Activity 1Sunghoon SsiNo ratings yet

- PPE Sample ProblemsDocument5 pagesPPE Sample ProblemsKathleen FrondozoNo ratings yet

- Chapter 2 Conceptual FrameworkDocument8 pagesChapter 2 Conceptual Frameworkdaniella chynnNo ratings yet

- Inventories Part 1 With AnswersDocument9 pagesInventories Part 1 With AnswersDyenNo ratings yet

- Royalty Company Required1 Required5 2020 Required2Document2 pagesRoyalty Company Required1 Required5 2020 Required2AnonnNo ratings yet

- Prelim Exam Accounting 2Document3 pagesPrelim Exam Accounting 2JM Singco Canoy100% (1)

- Chapter 3 (IA Proof Od Cash) PDFDocument6 pagesChapter 3 (IA Proof Od Cash) PDFBaby MushroomNo ratings yet

- Notes ReceivableDocument2 pagesNotes ReceivableGee Lysa Pascua VilbarNo ratings yet

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- Hilarious Company Required 1 300,000 12 Years Required 2Document10 pagesHilarious Company Required 1 300,000 12 Years Required 2Anonn0% (1)

- Ia Problem SolvingDocument3 pagesIa Problem SolvingApple RoncalNo ratings yet

- SUMMARY For INTERMEDIATE ACCOUNTING 2 PDFDocument20 pagesSUMMARY For INTERMEDIATE ACCOUNTING 2 PDFArtisan100% (1)

- Trade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofDocument11 pagesTrade and Other Receivables 1. On December 31, 2013, The Accounts Receivable of Harem Company Had A Balance ofJude SantosNo ratings yet

- Unit 2 Illustration ProblemDocument1 pageUnit 2 Illustration ProblemCharlene RodrigoNo ratings yet

- Problem 1 2 IAADocument1 pageProblem 1 2 IAAJUARE MaxineNo ratings yet

- Problem 4-2 (IAA)Document6 pagesProblem 4-2 (IAA)Rose Aubrey A CordovaNo ratings yet

- Chapter 4 To Chapter 5Document24 pagesChapter 4 To Chapter 5XENA LOPEZNo ratings yet

- Chap 4 and 5Document18 pagesChap 4 and 5Jerome MonserratNo ratings yet

- RECEIVABLESDocument64 pagesRECEIVABLESKimberly MonserratNo ratings yet

- Activity 4Document2 pagesActivity 4Bernadeth Adelaine DomingoNo ratings yet

- Chapter 5 (Exercise 1-7) CabreraDocument17 pagesChapter 5 (Exercise 1-7) CabreraBaby MushroomNo ratings yet

- 10 Essential Cooking MethodDocument4 pages10 Essential Cooking MethodBaby MushroomNo ratings yet

- What Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodDocument2 pagesWhat Is Carbonara?: Crispy Pancetta Is My Absolute Favorite Member of The Vegetable FoodBaby MushroomNo ratings yet

- 101 Tips For CookingDocument8 pages101 Tips For CookingBaby MushroomNo ratings yet

- Cost Accounting Chapter5 Problem1 3Document9 pagesCost Accounting Chapter5 Problem1 3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- Cost Accounting Exercise2 3Document2 pagesCost Accounting Exercise2 3Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)

- Cost Accounting Chapter 10 Exercise 1 6Document5 pagesCost Accounting Chapter 10 Exercise 1 6Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-3 Answer Key) PDFDocument4 pagesIA Valix 2020 (Problem 4-3 Answer Key) PDFBaby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-2 Answer Key)Document6 pagesIA Valix 2020 (Problem 4-2 Answer Key)Baby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-4 Answer Key)Document3 pagesIA Valix 2020 (Problem 4-4 Answer Key)Baby MushroomNo ratings yet

- Chapter 3 (Problem 3-5-13) PDFDocument9 pagesChapter 3 (Problem 3-5-13) PDFBaby MushroomNo ratings yet

- IA Valix 2020 (Problem 4-1 Answer)Document8 pagesIA Valix 2020 (Problem 4-1 Answer)Baby Mushroom100% (1)