Professional Documents

Culture Documents

Rectification of Errors Accounting Workbooks Zaheer Swati

Rectification of Errors Accounting Workbooks Zaheer Swati

Uploaded by

Zaheer SwatiCopyright:

Available Formats

You might also like

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Ch04 SolutionDocument129 pagesCh04 Solutionak s83% (6)

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Koss Corporation Fraud Case Analysis FinalDocument28 pagesKoss Corporation Fraud Case Analysis FinalMarianeNo ratings yet

- Test & Interview MCQs Book For All Audit & Accounts JobsDocument95 pagesTest & Interview MCQs Book For All Audit & Accounts JobsNaeem0719No ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Adjustment Trial Balance UnsolvedDocument3 pagesAdjustment Trial Balance Unsolvedmarvin fajardo100% (1)

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- S. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BDocument3 pagesS. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BALI ZAFAR� LIAQAT UnknownNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Acct 4Document6 pagesAcct 4Mopur NELLORENo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Assignment 5: Q.1 SL No. Heads of Accounts Reason Debit Balance Credit BalanceDocument12 pagesAssignment 5: Q.1 SL No. Heads of Accounts Reason Debit Balance Credit BalanceAnshul SinghNo ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- Name: Lecturer: Course Name: Course CodeDocument6 pagesName: Lecturer: Course Name: Course CodeJaredNo ratings yet

- FA - Preparing A Trial BalanceDocument19 pagesFA - Preparing A Trial BalanceOwen GradyNo ratings yet

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Chapter 2 - Understanding Financial StatementsDocument44 pagesChapter 2 - Understanding Financial StatementsBích Truyền Võ ThịNo ratings yet

- Problems Trial BalanceDocument5 pagesProblems Trial BalanceMUHAMMED RABIHNo ratings yet

- 2 Problems Problem 2-1 Analyzing Various Receivable TransactionsDocument9 pages2 Problems Problem 2-1 Analyzing Various Receivable TransactionsKristina KittyNo ratings yet

- Recording and Posting 1 Answer SheetDocument4 pagesRecording and Posting 1 Answer SheetJan Bernadette AlejandroNo ratings yet

- Rahma Consulting RevisiDocument23 pagesRahma Consulting RevisiMutia AlhasanahNo ratings yet

- Partnership PQ SolDocument18 pagesPartnership PQ SolvedthkNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- Ramos and Cammayo Merch JournalsDocument7 pagesRamos and Cammayo Merch JournalsCol JuanNo ratings yet

- BACC 2021 - 22 Sem 2 - MST SolutionsDocument4 pagesBACC 2021 - 22 Sem 2 - MST Solutionsxa. vieNo ratings yet

- Allowance For Doubtful Accounts - Solutions PDFDocument5 pagesAllowance For Doubtful Accounts - Solutions PDFDarry Pascua80% (5)

- Merchandising ACTIVITY 2Document17 pagesMerchandising ACTIVITY 2Nermeen C. AlapaNo ratings yet

- Bookkeeping Mock Answers2022 - GG1712Document6 pagesBookkeeping Mock Answers2022 - GG1712Karan KhannaNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- Null PDFDocument10 pagesNull PDFDhaval SharmaNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- CacDocument218 pagesCacFirdous QureshiNo ratings yet

- Test On Trial BalanceDocument1 pageTest On Trial Balanceamitabhkumar1979No ratings yet

- MT2 Ch02Document24 pagesMT2 Ch02api-3725162No ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- 3 Partnership AccountsDocument27 pages3 Partnership AccountsNIKHIL MITTALNo ratings yet

- ActivityDocument49 pagesActivityAshanti ashley gueseNo ratings yet

- Merchandising Accounting Cycle-Rev1 - 1Document33 pagesMerchandising Accounting Cycle-Rev1 - 1Hendra Setiyawan100% (4)

- MidtermDocument11 pagesMidtermdumpanonymouslyNo ratings yet

- 3.2 Acco 2100 Milagros MelecioDocument11 pages3.2 Acco 2100 Milagros MelecioDorisNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Adv Acc QN Bank Compiler PDF With Imp Questions - n22Document500 pagesAdv Acc QN Bank Compiler PDF With Imp Questions - n22harshita23hrNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- Trial Balance - &yeaDocument32 pagesTrial Balance - &yeakajaleNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Bad Debts and Provision For Bad DebtsDocument7 pagesBad Debts and Provision For Bad DebtsSyed Ali HaiderNo ratings yet

- (Revised) - EL: BalanceDocument1 page(Revised) - EL: BalanceGopika G NairNo ratings yet

- Practice 1Document4 pagesPractice 1talalbashir001No ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- Unit 9Document29 pagesUnit 9Anilkumar KyNo ratings yet

- Ex 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Document9 pagesEx 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Christian Del Moral BraceroNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Closing and Worksheet: 20.1 Closing Entries For Revenue AccountsDocument8 pagesClosing and Worksheet: 20.1 Closing Entries For Revenue AccountsZaheer Swati100% (1)

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Informal Financial Statements - Accounting-Workbook - Zaheer-SwatiDocument8 pagesInformal Financial Statements - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Adjustment Entries II - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Entries II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Books of Accounts Accounting Workbooks Zaheer SwatiDocument6 pagesBooks of Accounts Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Bank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesBank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Adjustment Entries I Accounting Workbooks Zaheer SwatiDocument6 pagesAdjustment Entries I Accounting Workbooks Zaheer SwatiZaheer Swati100% (1)

- Cash Book II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesCash Book II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Variation Proforma Accounting Workbooks Zaheer SwatiDocument6 pagesVariation Proforma Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Cash Book I Accounting Workbooks Zaheer SwatiDocument4 pagesCash Book I Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Work Book Unit 13 Inventory Valuation (Unsolved)Document13 pagesWork Book Unit 13 Inventory Valuation (Unsolved)Zaheer SwatiNo ratings yet

- Foh PDFDocument10 pagesFoh PDFZaheer SwatiNo ratings yet

- 5# 4 Accounting Equation (UnSolved) PDFDocument4 pages5# 4 Accounting Equation (UnSolved) PDFZaheer SwatiNo ratings yet

- Quiz 1 AVP (UnSolved) PDFDocument1 pageQuiz 1 AVP (UnSolved) PDFZaheer SwatiNo ratings yet

- 6# 5 Variation Proforma (UnSolved) PDFDocument6 pages6# 5 Variation Proforma (UnSolved) PDFZaheer SwatiNo ratings yet

- TeachersCompetencies2010 PDFDocument11 pagesTeachersCompetencies2010 PDFZaheer SwatiNo ratings yet

- Work Book Unit 1 Accounting Equation - SolvedDocument12 pagesWork Book Unit 1 Accounting Equation - SolvedZaheer Swati33% (3)

- Work Book Unit 2 Proforma Variation - SolvedDocument12 pagesWork Book Unit 2 Proforma Variation - SolvedZaheer SwatiNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Work Book Unit 11 Cash Book Unsolved)Document9 pagesWork Book Unit 11 Cash Book Unsolved)Zaheer SwatiNo ratings yet

- Special Journal Example-Basic AccountingDocument62 pagesSpecial Journal Example-Basic AccountingJaynel LoveNo ratings yet

- Substantive Tests of Transactions and Account BalancesDocument89 pagesSubstantive Tests of Transactions and Account BalancesPia Angela ElemosNo ratings yet

- Board Paper-2022-XIDocument8 pagesBoard Paper-2022-XIRn GuptaNo ratings yet

- 12.2 ISM Internal AuditingDocument3 pages12.2 ISM Internal Auditingsimon_midjajaNo ratings yet

- Financial Specialist Job DescriptionDocument8 pagesFinancial Specialist Job Descriptionfinancemanagement702No ratings yet

- As Accounting Control AccountsDocument20 pagesAs Accounting Control AccountsNipuni PereraNo ratings yet

- Intermediate Accounting Volume 1 Canadian 10th Edition Kieso Test BankDocument17 pagesIntermediate Accounting Volume 1 Canadian 10th Edition Kieso Test BankMichaelSmithpomdz100% (14)

- Assurance June 2013 ICABDocument1 pageAssurance June 2013 ICABSaiful IslamNo ratings yet

- FRK 705 - Learner's ManualDocument37 pagesFRK 705 - Learner's ManualRaychelNo ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Friends Cable Jaswinder-24539Document8 pagesFriends Cable Jaswinder-24539Kanishk YadavNo ratings yet

- Financial/ Accounting Ratios: Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Accounting Ratios: Sebi Grade A & Rbi Grade Bneevedita tiwariNo ratings yet

- Intro To IADocument29 pagesIntro To IAWan Nur MahfuzahNo ratings yet

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDocument6 pagesAccounting Vocabulary: Easy-To-Learn English Terms For AccountingHamza El MissouabNo ratings yet

- Teachers Manual: EditionDocument218 pagesTeachers Manual: EditionSheng Ballon Agcaoili71% (7)

- Custody of All Financial Records of The Barangays and The Rendition of Accounts by The Barangay TreasurerDocument1 pageCustody of All Financial Records of The Barangays and The Rendition of Accounts by The Barangay TreasurerHaryeth CamsolNo ratings yet

- Vishleshan LettersDocument7 pagesVishleshan Lettersbanoth rajuNo ratings yet

- BejwnwiwkwnsnnDocument2 pagesBejwnwiwkwnsnnThomas koshyNo ratings yet

- A. C. Fair Value After Reconditioning CostDocument3 pagesA. C. Fair Value After Reconditioning CostJamie RamosNo ratings yet

- Kelompok 9 Closing EntriesDocument17 pagesKelompok 9 Closing EntriesrizkiNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Improving Public Sector Financial Management in Developing Countries and Emerging EconomiesDocument50 pagesImproving Public Sector Financial Management in Developing Countries and Emerging EconomiesAlia Al ZghoulNo ratings yet

- Cross Audit QSCDocument2 pagesCross Audit QSCPooja TripathiNo ratings yet

- GPinvestments 11396Document223 pagesGPinvestments 11396scottleeyNo ratings yet

- Assignment Brief - AP - A1.1Spring2022 - UpdatedDocument3 pagesAssignment Brief - AP - A1.1Spring2022 - UpdatedNyx MetopeNo ratings yet

- Ch14 - Audit ReportsDocument25 pagesCh14 - Audit ReportsMar Feilson Zulueta LatayanNo ratings yet

- Concept Map 2Document8 pagesConcept Map 2mike raninNo ratings yet

Rectification of Errors Accounting Workbooks Zaheer Swati

Rectification of Errors Accounting Workbooks Zaheer Swati

Uploaded by

Zaheer SwatiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rectification of Errors Accounting Workbooks Zaheer Swati

Rectification of Errors Accounting Workbooks Zaheer Swati

Uploaded by

Zaheer SwatiCopyright:

Available Formats

Rectification of Errors 10

RECTIFICATION OF ERRORS

Errors are unintentional misstatement or omission or mistake committed in book-keeping

The mistakes may be one relating to routine or one relating to Principle

Following are most common error encountered in accounting records

10.1 Errors in Trial Balance

Errors in trial balance are classified as errors disclosed by trial balance and errors not disclosed by trial balance

10.2 Locating Errors

Following nine steps will follow in order to locate errors

Step 1: Make sure balances in trial balance in correct sides

Step 2: Check whether the Debit and Credit sides added correctly by opposite direction

Step 3: Divide the difference by 9. If divisible by 9, so transposition error or slide error. If digits are place wrongly i.e.

5,760………. 5,670

Or

6,250 ………………….. 62.50 (decimal point transposition error)

Step 4: Divide the difference by 2, and check the identical amount in the bigger columns of trial balance

Step 5: Check ledger account if shows an account equal to difference

Step 6: Cross checking the amount in trial balance and ledger accounts

Step 7: Re-compute the balance of each ledger

Step 8: Check posting from journal to ledger

Step 9: Check journal entries in detail

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 51 Rectification of Errors

Rectification of Errors 10

Example # 10.1: The clerk of ABC business wrongly prepared the following Trial Balance. You are required to draw up

a trial balance correctly

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

1 Owner's Equity 60,000

2 Opening Stock 5,000

3 Discount Allowed 500

4 Commission Received 700

5 Fixed Assets 60,000

6 Sales 85,000

7 Purchases 45,000

8 Purchases Return 1,000

9 Sales Return 2,000

10 Carriage Inward 700

11 Carriage Outward 600

12 Wages & Salaries 25,000

13 Bill Receivables 7,000

14 Debtors 9,000

15 Bill Payable 7,000

16 Rent 3,000

17 Interest Paid 2,000

18 Cash 800

19 Creditors 6,900

20 Ending Stock 33,800

Total Rs. 177,500 Rs. 177,500

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

1 Owner's Equity

2 Opening Stock

3 Discount Allowed

4 Commission Received

5 Fixed Assets

6 Sales

7 Purchases

8 Purchases Return

9 Sales Return

10 Carriage Inward

11 Carriage Outward

12 Wages & Salaries

13 Bill Receivables

14 Debtors

15 Bill Payable

16 Rent

17 Interest Paid

18 Cash

19 Creditors

Total

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 52 Rectification of Errors

Rectification of Errors 10

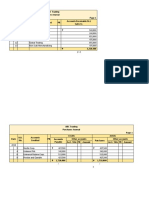

Example # 10.2: The Make corrected Trial Balance after anticipating hidden errors

Sabeela Meer

Trial Balance

As on 31st December, 2016

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

1 Owner's Equity 60,000

2 Inventory 01-01-2016 3,000

3 Wages 500

4 Commission earned 700

5 Tangible Assets 60,000

6 Sales 85,000

7 Purchases 45,000

8 Return Outward 1,000

9 Sales Return 2,000

10 Carriage Inward 700

11 Fuel and Power Expense 600

12 Wages & Salaries 25,000

13 Note Receivables 7,000

14 Account Receivable 9,000

15 Bill Payable 5,000

16 Rent 3,000

17 Discount Allowed 2,000

18 Cash 800

19 Creditors 6,900

20 Inventory 31-12-16 33,800

Total Rs. 175,500 Rs. 175,500

Errors:

(i) Credit sales of worth Rs. 4,500 was omitted to record in the book of original entry.

(ii) Wages and Salaries account should be separate to Rs. 15,000 and 10,000 respectively.

(iii) Drawing of worth Rs. 2,000 wrongly charged to Note Receivable Account.

(iv) Unearned Sales of Rs. 15,000 was incorrectly credited to Sales Account.

Following accounts are used for correction and adjusting the transactions.

Sales; Account Receivable; Wages; Salaries; Drawing; Note Receivable; Unearned Sales

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 53 Rectification of Errors

Rectification of Errors 10

Sabeela Meer

Trial Balance

As on 31st December, 2016

Amount (Rs.)

S. No Heads of Accounts Ref Dr Cr

Total

Calculations:

Sales

Account Receivable

Wages

Salaries

Drawing

Note Receivable

Unearned Sales

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 54 Rectification of Errors

Rectification of Errors 10

10.3 Rectification of Error

ö An accountant can also commit errors while recording business transactions in books of accounts, in their recording,

posting or balancing the accounts and so on

ö These errors should be located and corrected as soon as possible so that accounts give true and fair results of the

operations of the business enterprise

ö There are certain errors which will disturb the Trial Balance in the sense that the Trial Balance will not agree. These

errors are easy to detect and their rectification is also simple

ö However, there are certain errors which are not detected through a Trial Balance. In other words, a Trial Balance

would agree in spite of these errors. These errors are very difficult to detect

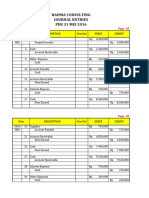

Example # 10.3: Rectify the following journal entries in the book of Aroosa & Brothers Co.

S. No Wrong Entry / Transaction Correct Entry Rectifying Entry

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 55 Rectification of Errors

Rectification of Errors 10

Example # 11.4: Pass Rectification entries for the following transactions at end April, 2016

1. A builder’s bill for Rs. 4,600 for the erection of a small shed was debited to Repairs Expense Account

2. Repairs to plant amounting to Rs. 900 had been charged to Plant and Machinery Account

3. Purchase Day Book undercast by Rs. 1,000

4. Check for Rs. 750 received from Hussain Ltd. Was credit to account of Hassan Ltd

5. The total of Return Inward Book has been overcast Rs. 2,000

6. Goods to the value of Rs. 4,000 returned by X were included in closing stock, but no entry was made in the

books

7. Received Rs.2,000 from Shankar debited to his account

8. The sales book undercast by Rs.1,500

General Journal

Amount (Rs)

Date Account Title and Explanations Ref Debit Credit

2016

April 1

Total Rs. 18,750 Rs. 18,750

Practice MCQs

www.accountancyknowledge.com/rectification-of-errors-mcqs/

For Solution click www.accountancyknowledge.com/rectification-of-errors/ 56 Rectification of Errors

You might also like

- Minsupala Trading Corporation (Workbook)Document14 pagesMinsupala Trading Corporation (Workbook)Luis Melquiades P. Garcia100% (3)

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionFrom EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionRating: 5 out of 5 stars5/5 (1)

- Ch04 SolutionDocument129 pagesCh04 Solutionak s83% (6)

- Chapter 08Document26 pagesChapter 08Dan ChuaNo ratings yet

- Coursebook Answers: Answers To Test Yourself QuestionsDocument3 pagesCoursebook Answers: Answers To Test Yourself QuestionsDonatien Oulaii92% (13)

- Koss Corporation Fraud Case Analysis FinalDocument28 pagesKoss Corporation Fraud Case Analysis FinalMarianeNo ratings yet

- Test & Interview MCQs Book For All Audit & Accounts JobsDocument95 pagesTest & Interview MCQs Book For All Audit & Accounts JobsNaeem0719No ratings yet

- Problems Rectification of Errors Unsolved 1 5Document6 pagesProblems Rectification of Errors Unsolved 1 5Racquel ReyesNo ratings yet

- Adjustment Trial Balance UnsolvedDocument3 pagesAdjustment Trial Balance Unsolvedmarvin fajardo100% (1)

- Dbb1202 - Financial AccountingDocument5 pagesDbb1202 - Financial AccountingVansh JainNo ratings yet

- S. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BDocument3 pagesS. No Heads of Accounts Ref Amount (RS.) Debit Credit: P A T BALI ZAFAR� LIAQAT UnknownNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- Acct 4Document6 pagesAcct 4Mopur NELLORENo ratings yet

- Questions On Trial Balance To StudentsDocument6 pagesQuestions On Trial Balance To Studentsveraji3735No ratings yet

- Assignment 5: Q.1 SL No. Heads of Accounts Reason Debit Balance Credit BalanceDocument12 pagesAssignment 5: Q.1 SL No. Heads of Accounts Reason Debit Balance Credit BalanceAnshul SinghNo ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Kimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadDocument4 pagesKimberly Veguilla Rodríguez Prof. Ramos Martin Modulo 2. Tarea 1. Los Reportes de ContabilidadKimberly VeguillaNo ratings yet

- Name: Lecturer: Course Name: Course CodeDocument6 pagesName: Lecturer: Course Name: Course CodeJaredNo ratings yet

- FA - Preparing A Trial BalanceDocument19 pagesFA - Preparing A Trial BalanceOwen GradyNo ratings yet

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Chapter 2 - Understanding Financial StatementsDocument44 pagesChapter 2 - Understanding Financial StatementsBích Truyền Võ ThịNo ratings yet

- Problems Trial BalanceDocument5 pagesProblems Trial BalanceMUHAMMED RABIHNo ratings yet

- 2 Problems Problem 2-1 Analyzing Various Receivable TransactionsDocument9 pages2 Problems Problem 2-1 Analyzing Various Receivable TransactionsKristina KittyNo ratings yet

- Recording and Posting 1 Answer SheetDocument4 pagesRecording and Posting 1 Answer SheetJan Bernadette AlejandroNo ratings yet

- Rahma Consulting RevisiDocument23 pagesRahma Consulting RevisiMutia AlhasanahNo ratings yet

- Partnership PQ SolDocument18 pagesPartnership PQ SolvedthkNo ratings yet

- Trial BalanceDocument14 pagesTrial Balanceswetha_makulaNo ratings yet

- Ramos and Cammayo Merch JournalsDocument7 pagesRamos and Cammayo Merch JournalsCol JuanNo ratings yet

- BACC 2021 - 22 Sem 2 - MST SolutionsDocument4 pagesBACC 2021 - 22 Sem 2 - MST Solutionsxa. vieNo ratings yet

- Allowance For Doubtful Accounts - Solutions PDFDocument5 pagesAllowance For Doubtful Accounts - Solutions PDFDarry Pascua80% (5)

- Merchandising ACTIVITY 2Document17 pagesMerchandising ACTIVITY 2Nermeen C. AlapaNo ratings yet

- Bookkeeping Mock Answers2022 - GG1712Document6 pagesBookkeeping Mock Answers2022 - GG1712Karan KhannaNo ratings yet

- Account TitlesDocument8 pagesAccount TitleskdjasldkajNo ratings yet

- Null PDFDocument10 pagesNull PDFDhaval SharmaNo ratings yet

- Accounting 10 ColumnsDocument2 pagesAccounting 10 ColumnsTRIXIEJOY INIONNo ratings yet

- Closing and Worksheet UnsolvedDocument6 pagesClosing and Worksheet UnsolvedNilda Sahibul BaclayanNo ratings yet

- CacDocument218 pagesCacFirdous QureshiNo ratings yet

- Test On Trial BalanceDocument1 pageTest On Trial Balanceamitabhkumar1979No ratings yet

- MT2 Ch02Document24 pagesMT2 Ch02api-3725162No ratings yet

- Frq-Acc-Grade 11-Set 05Document3 pagesFrq-Acc-Grade 11-Set 05itzmellowteaNo ratings yet

- 3 Partnership AccountsDocument27 pages3 Partnership AccountsNIKHIL MITTALNo ratings yet

- ActivityDocument49 pagesActivityAshanti ashley gueseNo ratings yet

- Merchandising Accounting Cycle-Rev1 - 1Document33 pagesMerchandising Accounting Cycle-Rev1 - 1Hendra Setiyawan100% (4)

- MidtermDocument11 pagesMidtermdumpanonymouslyNo ratings yet

- 3.2 Acco 2100 Milagros MelecioDocument11 pages3.2 Acco 2100 Milagros MelecioDorisNo ratings yet

- Home Assignment - Financial Accounting PGPM 2019-20Document3 pagesHome Assignment - Financial Accounting PGPM 2019-20SidharthNo ratings yet

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Adv Acc QN Bank Compiler PDF With Imp Questions - n22Document500 pagesAdv Acc QN Bank Compiler PDF With Imp Questions - n22harshita23hrNo ratings yet

- Cho Cho's - SarayDocument6 pagesCho Cho's - SarayLaiza Cristella SarayNo ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- Trial Balance - &yeaDocument32 pagesTrial Balance - &yeakajaleNo ratings yet

- Accounting 02182021Document4 pagesAccounting 02182021badNo ratings yet

- NyayDocument3 pagesNyayJunneth Pearl HomocNo ratings yet

- Bos 28432 CP 10Document45 pagesBos 28432 CP 10hiral dattaniNo ratings yet

- Bad Debts and Provision For Bad DebtsDocument7 pagesBad Debts and Provision For Bad DebtsSyed Ali HaiderNo ratings yet

- (Revised) - EL: BalanceDocument1 page(Revised) - EL: BalanceGopika G NairNo ratings yet

- Practice 1Document4 pagesPractice 1talalbashir001No ratings yet

- S. Roces (Closing)Document11 pagesS. Roces (Closing)Jesseric RomeroNo ratings yet

- Unit 9Document29 pagesUnit 9Anilkumar KyNo ratings yet

- Ex 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Document9 pagesEx 2-20 Identificando Errores en El Balance de Comprobación Mascot Co. July 31, 2016Christian Del Moral BraceroNo ratings yet

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- Closing and Worksheet: 20.1 Closing Entries For Revenue AccountsDocument8 pagesClosing and Worksheet: 20.1 Closing Entries For Revenue AccountsZaheer Swati100% (1)

- Adjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Trial Balance - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Informal Financial Statements - Accounting-Workbook - Zaheer-SwatiDocument8 pagesInformal Financial Statements - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Adjustment Entries II - Accounting-Workbook - Zaheer-SwatiDocument6 pagesAdjustment Entries II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Books of Accounts Accounting Workbooks Zaheer SwatiDocument6 pagesBooks of Accounts Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Ledger Account Accounting Workbooks Zaheer SwatiDocument10 pagesLedger Account Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Bank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesBank Reconciliation Statement II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Adjustment Entries I Accounting Workbooks Zaheer SwatiDocument6 pagesAdjustment Entries I Accounting Workbooks Zaheer SwatiZaheer Swati100% (1)

- Cash Book II - Accounting-Workbook - Zaheer-SwatiDocument4 pagesCash Book II - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Variation Proforma Accounting Workbooks Zaheer SwatiDocument6 pagesVariation Proforma Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Cash Book I Accounting Workbooks Zaheer SwatiDocument4 pagesCash Book I Accounting Workbooks Zaheer SwatiZaheer SwatiNo ratings yet

- Work Book Unit 13 Inventory Valuation (Unsolved)Document13 pagesWork Book Unit 13 Inventory Valuation (Unsolved)Zaheer SwatiNo ratings yet

- Foh PDFDocument10 pagesFoh PDFZaheer SwatiNo ratings yet

- 5# 4 Accounting Equation (UnSolved) PDFDocument4 pages5# 4 Accounting Equation (UnSolved) PDFZaheer SwatiNo ratings yet

- Quiz 1 AVP (UnSolved) PDFDocument1 pageQuiz 1 AVP (UnSolved) PDFZaheer SwatiNo ratings yet

- 6# 5 Variation Proforma (UnSolved) PDFDocument6 pages6# 5 Variation Proforma (UnSolved) PDFZaheer SwatiNo ratings yet

- TeachersCompetencies2010 PDFDocument11 pagesTeachersCompetencies2010 PDFZaheer SwatiNo ratings yet

- Work Book Unit 1 Accounting Equation - SolvedDocument12 pagesWork Book Unit 1 Accounting Equation - SolvedZaheer Swati33% (3)

- Work Book Unit 2 Proforma Variation - SolvedDocument12 pagesWork Book Unit 2 Proforma Variation - SolvedZaheer SwatiNo ratings yet

- Work Book Unit 12 Bank Reconcilaition Statement (Solved)Document9 pagesWork Book Unit 12 Bank Reconcilaition Statement (Solved)Zaheer SwatiNo ratings yet

- Work Book Unit 11 Cash Book Unsolved)Document9 pagesWork Book Unit 11 Cash Book Unsolved)Zaheer SwatiNo ratings yet

- Special Journal Example-Basic AccountingDocument62 pagesSpecial Journal Example-Basic AccountingJaynel LoveNo ratings yet

- Substantive Tests of Transactions and Account BalancesDocument89 pagesSubstantive Tests of Transactions and Account BalancesPia Angela ElemosNo ratings yet

- Board Paper-2022-XIDocument8 pagesBoard Paper-2022-XIRn GuptaNo ratings yet

- 12.2 ISM Internal AuditingDocument3 pages12.2 ISM Internal Auditingsimon_midjajaNo ratings yet

- Financial Specialist Job DescriptionDocument8 pagesFinancial Specialist Job Descriptionfinancemanagement702No ratings yet

- As Accounting Control AccountsDocument20 pagesAs Accounting Control AccountsNipuni PereraNo ratings yet

- Intermediate Accounting Volume 1 Canadian 10th Edition Kieso Test BankDocument17 pagesIntermediate Accounting Volume 1 Canadian 10th Edition Kieso Test BankMichaelSmithpomdz100% (14)

- Assurance June 2013 ICABDocument1 pageAssurance June 2013 ICABSaiful IslamNo ratings yet

- FRK 705 - Learner's ManualDocument37 pagesFRK 705 - Learner's ManualRaychelNo ratings yet

- Partnership - Changes in Ownership Structures (Galaxy Sports - Exercise)Document6 pagesPartnership - Changes in Ownership Structures (Galaxy Sports - Exercise)PetrinaNo ratings yet

- Friends Cable Jaswinder-24539Document8 pagesFriends Cable Jaswinder-24539Kanishk YadavNo ratings yet

- Financial/ Accounting Ratios: Sebi Grade A & Rbi Grade BDocument10 pagesFinancial/ Accounting Ratios: Sebi Grade A & Rbi Grade Bneevedita tiwariNo ratings yet

- Intro To IADocument29 pagesIntro To IAWan Nur MahfuzahNo ratings yet

- Accounting Vocabulary: Easy-To-Learn English Terms For AccountingDocument6 pagesAccounting Vocabulary: Easy-To-Learn English Terms For AccountingHamza El MissouabNo ratings yet

- Teachers Manual: EditionDocument218 pagesTeachers Manual: EditionSheng Ballon Agcaoili71% (7)

- Custody of All Financial Records of The Barangays and The Rendition of Accounts by The Barangay TreasurerDocument1 pageCustody of All Financial Records of The Barangays and The Rendition of Accounts by The Barangay TreasurerHaryeth CamsolNo ratings yet

- Vishleshan LettersDocument7 pagesVishleshan Lettersbanoth rajuNo ratings yet

- BejwnwiwkwnsnnDocument2 pagesBejwnwiwkwnsnnThomas koshyNo ratings yet

- A. C. Fair Value After Reconditioning CostDocument3 pagesA. C. Fair Value After Reconditioning CostJamie RamosNo ratings yet

- Kelompok 9 Closing EntriesDocument17 pagesKelompok 9 Closing EntriesrizkiNo ratings yet

- Preparing Financial StatementsDocument15 pagesPreparing Financial StatementsAUDITOR97No ratings yet

- Improving Public Sector Financial Management in Developing Countries and Emerging EconomiesDocument50 pagesImproving Public Sector Financial Management in Developing Countries and Emerging EconomiesAlia Al ZghoulNo ratings yet

- Cross Audit QSCDocument2 pagesCross Audit QSCPooja TripathiNo ratings yet

- GPinvestments 11396Document223 pagesGPinvestments 11396scottleeyNo ratings yet

- Assignment Brief - AP - A1.1Spring2022 - UpdatedDocument3 pagesAssignment Brief - AP - A1.1Spring2022 - UpdatedNyx MetopeNo ratings yet

- Ch14 - Audit ReportsDocument25 pagesCh14 - Audit ReportsMar Feilson Zulueta LatayanNo ratings yet

- Concept Map 2Document8 pagesConcept Map 2mike raninNo ratings yet