Professional Documents

Culture Documents

Money Markets Reviewer

Money Markets Reviewer

Uploaded by

Hazel Jane Esclamada0 ratings0% found this document useful (0 votes)

272 views4 pagesThis document discusses money markets and their key components. Money markets facilitate short-term borrowing and lending between entities with excess funds and those with short-term needs. They include instruments like treasury bills, certificates of deposit, commercial paper, and interbank loans that are typically less than one year in maturity. Government debt policy and monetary policy influence money market operations. Major participants in money markets include banks, corporations, governments, and other financial institutions.

Original Description:

Original Title

MONEY MARKETS REVIEWER

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses money markets and their key components. Money markets facilitate short-term borrowing and lending between entities with excess funds and those with short-term needs. They include instruments like treasury bills, certificates of deposit, commercial paper, and interbank loans that are typically less than one year in maturity. Government debt policy and monetary policy influence money market operations. Major participants in money markets include banks, corporations, governments, and other financial institutions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

272 views4 pagesMoney Markets Reviewer

Money Markets Reviewer

Uploaded by

Hazel Jane EsclamadaThis document discusses money markets and their key components. Money markets facilitate short-term borrowing and lending between entities with excess funds and those with short-term needs. They include instruments like treasury bills, certificates of deposit, commercial paper, and interbank loans that are typically less than one year in maturity. Government debt policy and monetary policy influence money market operations. Major participants in money markets include banks, corporations, governments, and other financial institutions.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 4

Derivatives market – market for financial

MONEY MARKETS contracts whose values are derived from the

Purpose of money markets: facilitate the underlying money market instruments.

transfer of short-term funds from agents *Interbank market is defined mainly in terms of

with excess funds (corporations, financial participants while others are in terms of

institutions, individuals, government) to instruments issued and traded.*

those market participants who lack funds

for short-term needs. MONEY MARKET INSTRUMENTS

They play central role in the country’s Treasury bills and other short-term government

financial system, by influencing it securities (up to one year);

through the country’s monetary authority. Interbank loans, deposits and other bank

For financial institutions and to some liabilities;

extent to other non-financial companies Repurchase agreements and similar

money markets allow for executing such collateralized short-term loans;

functions as: Commercial papers, issued by non-deposit

Fund raising; entities (non-finance companies, finance

Cash management; companies, local government, etc. ;

Risk management; Certificates of deposit;

Speculation or position financing; Eurocurrency instruments;

Signalling; Interest rate and currency derivative

Providing access to information on instruments.

prices. MAJOR CHARACTERISTICS OF MONEY

Money markets are wholesale markets MARKET INSTRUMENTS

with very large amounts of transactions, short-term nature; low risk;

e.g. with transactions from 500 million high liquidity (in general); close to

Euro to 1 billion Euro or even larger ones. money.

This is the most active financial market in Money markets consist of tradable

terms of volumes of trading instruments as well as non-tradable

Another role of domestic money markets instruments.

is to serve public policy objectives, i.e. In terms of risk two specific money-market

financing public sector deficits and segments are:

managing the accumulated government unsecured debt instruments markets (e.g.

deficits. deposits with various maturities, ranging from

Government public debt policy is an overnight to one year);

important determinant of the money secured debt instruments markets (e.g.

markets operations, since government REPOs) with maturities also ranging from

debt typically forms a key part of the overnight to one year.

country’s money markets (as well as debt Differences in amount of risk are

markets). characteristic to the secured and the

The scope and measures of monetary unsecured segments of the money markets.

policy are also linked to the government’s Credit risk is minimized by limiting access

budget and fiscal policies. to high-quality counter-parties.

Money market consists of the market for MONEY MARKET PARTICIPANTS

short-term funds, usually with maturity mainly credit institutions and other

up to one year. It can be divided into financial intermediaries, governments, as

several major segments: well as individuals (households).

Interbank market, where banks and non- Ultimate lenders - households and companies

deposit financial institutions settle contracts with a financial surplus which they want to lend

with each other and with central bank, Ultimate borrowers - companies and

involving temporary liquidity surpluses and government with a financial deficit which need

deficits. to borrow.

Primary market, which is absorbing the issues Ultimate lenders and borrowers usually do not

and enabling borrowers to raise new funds. participate directly in the markets. As a rule

Secondary market for different short-term they deal through an intermediary, who

securities, which redistributes the ownership, performs functions of broker, dealer or

ensures liquidity, and as a result, increases the investment banker

supply of lending and reduces its price.

Government issue money market securities and Basis point

use the proceeds to finance state budget deficits. very fine measure of interest rates, equal to

Central bank employs money markets to one hundredth of one percentage point.

execute monetary policy. Winner’s curse

Credit institutions issue money market case, when the low bidder wins acceptance

securities to finance loans to households and of the tender, but pays a price, which is

corporations, thus supporting household higher than that of other lower bidders.

purchases and investments of corporations. ON-THE-RUN ISSUES (Secondary Market)

Large non-financial corporations issue money most actively traded issues, which are

market securities and use the proceeds to usually the ones sold through an auction

support their current operations or to expand most recently,

their activities through investments.

Other: money market funds, investment funds Price of a Treasury bill

other than money-market funds, insurance the price an investor pay for particular

companies and pension funds maturity Treasury security,

TREASURY BILLS Formula: P = PAR x (1- (d x n / 360))

short-term money market instruments - d is the yield or rate of discount,

issued by government and backed by it. - PAR is par or maturity value and

No risk - n no. of days of the investment (holding

Benchmark default-free interest rate period).

Characteristics of Treasury Bill

Typically issued at only certain maturities Yield of a Treasury bill

dependent upon the government budget determined taking into account the difference

deficit financing requirements between the selling price and the purchase price.

PRIMARY MARKET Formula : y = (PAR - P) / P x (365/n)

Securities issued via scheduled auction - d is the yield,

process - PAR – par value,

TENDER - Sealed bid - P - purchase price of the Treasury bill

BIDDERS - n no. of days of investment (holding period).

Competitive - specifies both the amount of

the security that the bidder wants to buy, as Annualized yield on Treasury bill

well as the price that the bidder wants to Formula: y = (SP - P) / P x (365/n)

pay. - y is the yield,

Non-competitive - specifies only the - SP – selling price,

amount of the security that the bidder wants - P - purchase price of the Treasury bill

to buy, without providing the price, and - n no. of days of investment (holding

automatically pay the defined price. (retail

period).

customers)

AUCTION FORMS

Treasury bill discount rate represents percent

Uniform price auction, when all bidders

discount of purchase price from par value of a

pay the same price;

new issue of a Treasury bill

Discriminatory price auction, in which

Formula: d = (PAR - P) / PAR x (360/n)

each bidder pays the bid price

- d is the yield,

*a tail – the difference between the stop yield

- PAR – par value,

and the average yield;

*a cover – the ratio between the total amount - P - purchase price of the Treasury bill

competitive and non-competitive bids tendered - n no. of days of investment (holding period).

and the total issue (i.e. the total amount of

accepted bids INTERBANK MARKET involves bank

STOP YIELD borrowing and lending of any funds in reserve

Lowest rejected bid yield (highest accepted accounts at the central bank.

bid yield) Major characteristics of the interbank

STOP-OUT PRICE - Corresponding price markets

The transfer of immediately available funds;

AVERAGE YIELD Short time horizons;

Average of all accepted competitive bids, Unsecured transfers.

weighted by amounts allocated at each Participant in IM (types of transactions)

yield reserve management transactions;

portfolio management transactions. Open REPO with no set maturity date, but

renewed each day upon agreement of both

COMMERCIAL PAPER (CP) short-term counterparties.

debt instrument issued only by large, well Term REPO with a maturity of more than one

known, creditworthy companies and is typically day.

unsecured. Reverse REPO purchase of securities by one

party from another with the agreement to sell

Major Issues of Commercial Papers them

financial institutions, (finance companies,

bank holding companies, insurance Amount of REPO

companies) REPO principal = Securities market value x

( 1 – Haircut ) Securities market value = PAR

Price of CP x ( 1 – (d x n / 360 ))

P = PAR x (1- (d x n / 360)) securities market value is current MV of

d is the yield or rate of discount, securities,

PAR is par or maturity value d is the rate of discount of the securities,

n no. of days of the investment (holding n is term of the securities,

period). PAR is the par value of the securities

Yield of CP Repurchase of the securities is made by

d = (PAR - P) / PAR x (360/n) repaying REPO loan and interest

d is the yield or rate of discount, REPO principal + Int = REPO principal ( 1 +

PAR – par value, (y x t / 360 ))

P - initial price of the CP y is the yield or rate of the REPO transaction,

n number of days of the investment (holding t is the term of the REPO transaction.

period). REPO principal = Securities market value x (1

– Haircut)

CERTIFICATE OF DEPOSIT (CD) states that Securities market value is present value of the

a deposit has been made with a bank for a fixed par value of the securities involved in the

period of time, at the end of which it will be transaction.

repaid with interest.

Advantage to the depositor - certificate can be

tradable

Advantage to the bank - has the use of a deposit HAIRCUT OR MARGIN

for a fixed period but, because of the flexibility the function of a broker/ dealer’s securities

given to the lender, at a slightly lower price than portfolio, that can’t be traded, but ]must be held

it would have had to pay for a normal time as capital to act as a cushion against loss.

deposit.

Negotiable certificates of deposit issued by large REPO rate or yield

commercial banks and other depository y = ( PAR – P ) / P x (360 / t )

institutions as a short-term source of funds. P is the purchase price,

PAR is the agreed repurchase price and

Yield of Security t is the period of the transaction.

y = ( PAR – P )/ P x (360 / n)

Price of CD Reverse REPO reverse payment

P = PAR / (1 – (i x n / 360)) RP + Int = Reverse principal x ( 1 + (y x t /

y = (SP – Purchase Price + Interest) / 360))

Purchase Price y is the yield or REPO rate,

t is maturity of the reverse REPO.

REPURCHASE AGREEMENTS

an agreement to buy any securities from a Market participants

seller with the agreement that they will be central banks, financial institutions, non-

repurchased at some specified date and financial corporations.

price in the future Eurocurrency instrument

fully collateralize loan in which the any instrument denominated in a currency

collateral consists of marketable securities. which differs from that of the country in

which it is traded.

Eurocurrency Liabilities y yield on the basis of add-on rate,

Euro certificates of deposits (Euro CDs) PAR – par or maturity value,

negotiable deposits with a fixed time to P - the purchase price of the security

maturity. t number of days until maturity

Time deposits non negotiable deposits with a

fixed time to maturity. Due to illiquidity, yields MAIN MARKET INTEREST RATES FOR

tend to be higher than the yields on equivalent MONEY MARKET

maturity of negotiable Euro certificates of European Central Bank (ECB) interest rate

deposits. minimum bid rate, which represents the

Interbank placements short-term, often price floor, which ensures central bank

overnight, interbank loans of Eurocurrency time liquidity in the open-market operations.

deposits. EONIA (euro overnight index average)

Call money non negotiable deposits with a fixed effective overnight reference rate for the

maturity that can be withdrawn at any time. euro

computed daily as a volume-weighted

Eurocurrency Assets average of unsecured euro overnight

Euro Commercial Papers (Euro CPs) are lending transactions in the interbank

securitized short-term bearer notes issued by a market, as reported by a representative

large well-known corporation. panel of large banks.

Syndicated Euroloans are related to bank EURIBOR (euro interbank offered rate)

lending of Eurocurrency deposits to benchmark rate of the large unsecured euro

nonfinancial companies with the need for funds money market for maturities longer than

Euronotes are unsecuritized debt instruments, overnight (one week to one year) that has

substitutes for non-negotiable Euroloans. They emerged since 1999.

are short –term, most often up to one year. EUREPO (the REPO market reference rate

for the euro)

MONEY MARKET INTEREST RATES benchmark rate of the euro REPO market

AND YIELDS and has been released since March 2002.

1) Rate on a discount basis rate at which one prime bank offers funds

d = ( PAR – P ) / PAR x (360 / t ) in euros to another prime bank when the

d yield on the basis of rate of discount, funds are secured by a REPO transaction

PAR – par value, using general collateral.

P – the purchase price of the security LIBOR (London Interbank Offer Rate)

t number of days until maturity. important reference to banks of the cost of

raising immediate marginal funds.

2) Add-on rate numerous bank interest rates are therefore

y = ( PAR – P ) / P x (360 / t ) tied to LIBOR, particularly to the rate for

y yield on the basis of add-on rate, three-month deposits.

PAR – par value,

P - the purchase price of the security

t number of days until maturity

3) Bond-equivalent yield

y = ( PAR – P ) / P x (365 / t )

y is the yield,

PAR – par value,

P - the purchase price of the security

t number of days until maturity.

4) Annual yield to maturity

y = ( PAR / P ) (365 / t ) – 1

y yield,

PAR – par or maturity value,

P - the purchase price of the security and t is the

t number of days until maturity

5) Semiannual yield to maturity

y = 2 x ( PAR / P ) (365 /2 t ) – 2

You might also like

- AFAR - PreWeek - May 2022Document31 pagesAFAR - PreWeek - May 2022Miguel ManagoNo ratings yet

- Taxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Document12 pagesTaxation Sia/Tabag TAX.2807-Income Tax On Corporations MAY 2020Ramainne Ronquillo100% (1)

- Chapter 17 Donor's TaxDocument7 pagesChapter 17 Donor's TaxHazel Jane Esclamada100% (3)

- Estate Tax PayableDocument8 pagesEstate Tax PayableHazel Jane Esclamada100% (2)

- Course Financial Management Developer and Their Background: See Assignment / Agreement SectionDocument33 pagesCourse Financial Management Developer and Their Background: See Assignment / Agreement SectionHazel Jane Esclamada100% (1)

- Chapter 10 Vat Still DueDocument7 pagesChapter 10 Vat Still DueHazel Jane EsclamadaNo ratings yet

- Chapter 9 Input VatDocument10 pagesChapter 9 Input VatHazel Jane EsclamadaNo ratings yet

- Chapter 3 Introduction To Business TaxationDocument27 pagesChapter 3 Introduction To Business TaxationHazel Jane Esclamada100% (1)

- Microeconomics Notes (Advanced)Document98 pagesMicroeconomics Notes (Advanced)rafay010100% (1)

- CHAPTER 4 ProvisionDocument3 pagesCHAPTER 4 ProvisionEyra MercadejasNo ratings yet

- 5-8 Financial Markets McqsDocument26 pages5-8 Financial Markets McqsdmangiginNo ratings yet

- Inventories - ExercisesDocument3 pagesInventories - ExercisesAleiza MalaluanNo ratings yet

- Pledge - Mortgage - Chattel MortgageDocument23 pagesPledge - Mortgage - Chattel MortgageJohn Kayle BorjaNo ratings yet

- Ch02 Premium LiabilityDocument6 pagesCh02 Premium LiabilityJessica AllyNo ratings yet

- Franchising Consignment KeyDocument22 pagesFranchising Consignment KeyMichael Jay SantosNo ratings yet

- TaxationDocument13 pagesTaxationMerEl Urbano De GuzmanNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- Chapter 3 - Income - Corporate TaxpayerDocument48 pagesChapter 3 - Income - Corporate TaxpayerJEFFERSON CUTENo ratings yet

- FINMAR Chapter 1 (Reviewer)Document4 pagesFINMAR Chapter 1 (Reviewer)Charisse VisteNo ratings yet

- Bam242 Cfe ReviewerDocument8 pagesBam242 Cfe ReviewerJanaisa BugayongNo ratings yet

- Week 1 Principles of Taxation True or FalseDocument4 pagesWeek 1 Principles of Taxation True or FalsekemeeNo ratings yet

- Chapter 1Document20 pagesChapter 1Coursehero PremiumNo ratings yet

- Title IvDocument6 pagesTitle IvCheriferDahangCoNo ratings yet

- Taxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesDocument2 pagesTaxation Sia/Tabag TAX.2812-Accounting Methods MAY 2020: Lecture NotesMay Grethel Joy PeranteNo ratings yet

- PRELIM Chapter 9 10 11Document37 pagesPRELIM Chapter 9 10 11Bisag AsaNo ratings yet

- Module 8. International Financial Market and Innovations ObjectivesDocument9 pagesModule 8. International Financial Market and Innovations ObjectivesSalma AbdullahNo ratings yet

- Strategic Cost Management ReviewerDocument8 pagesStrategic Cost Management ReviewerDosNo ratings yet

- Intermediate Accounting III ReviewerDocument3 pagesIntermediate Accounting III ReviewerRenalyn PascuaNo ratings yet

- RFBT 05 05 Law On Contract For Discussion Part One MCQs Discussion Without Answer KeyDocument11 pagesRFBT 05 05 Law On Contract For Discussion Part One MCQs Discussion Without Answer KeyAndrea ConsolacionNo ratings yet

- Mas 02 - CVPDocument24 pagesMas 02 - CVPAlexis RiveraNo ratings yet

- Deductions From Gross Estate (Presentation Slides)Document24 pagesDeductions From Gross Estate (Presentation Slides)KezNo ratings yet

- CHAPTER 16 - IaDocument2 pagesCHAPTER 16 - IaValentina Tan DuNo ratings yet

- Chapter 4 - The Philippine Money MarketDocument42 pagesChapter 4 - The Philippine Money MarketKhristian Joshua G. Jurado100% (1)

- Introduction To Regular Income TaxationDocument45 pagesIntroduction To Regular Income Taxationcarl patNo ratings yet

- Sol. Man. - Chapter 15 - Eps - 2021Document20 pagesSol. Man. - Chapter 15 - Eps - 2021Crystal Rose TenerifeNo ratings yet

- Sim-Acc-224l v0 Cain FinalDocument87 pagesSim-Acc-224l v0 Cain FinalHord JordanNo ratings yet

- Audit of Cash ProblemsDocument23 pagesAudit of Cash ProblemsReign Ashley RamizaresNo ratings yet

- Quiz No. 1 Risks Returns and Capital StructureDocument5 pagesQuiz No. 1 Risks Returns and Capital StructureFaith CastroNo ratings yet

- Bcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)Document5 pagesBcsvillaluz: Advanced Financial Accounting & Reporting (Afar) Financial Accounting & Reporting (Far)nickoloco100% (1)

- I. MATCHING TYPE (1 Point Each) - Indicate Your Answers by Writing The Letter Representing TheDocument9 pagesI. MATCHING TYPE (1 Point Each) - Indicate Your Answers by Writing The Letter Representing TheHanabusa Kawaii IdouNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Income Tax On Partnerships - QuestionsDocument9 pagesIncome Tax On Partnerships - QuestionsJembrain CanubasNo ratings yet

- Bonus ComputationDocument4 pagesBonus ComputationSarah GNo ratings yet

- IA2 Solutions CH 8 11 Straight ProblemsDocument54 pagesIA2 Solutions CH 8 11 Straight ProblemsswiftwswiftNo ratings yet

- Debt Restructuring Theories QuestionsDocument10 pagesDebt Restructuring Theories QuestionsPushTheStart GamingNo ratings yet

- RFBT.3404 PartnershipDocument11 pagesRFBT.3404 PartnershipMonica GarciaNo ratings yet

- Final ExamDocument11 pagesFinal Examdar •No ratings yet

- Accounting 206Document3 pagesAccounting 206Evan MiñozaNo ratings yet

- Cost Concept, Terminologies and BehaviorDocument8 pagesCost Concept, Terminologies and BehaviorANDREA NICOLE DE LEONNo ratings yet

- Standard Costing & Variance AnalysisDocument10 pagesStandard Costing & Variance AnalysisMariella Antonio-NarsicoNo ratings yet

- Chap 21 AnswersDocument9 pagesChap 21 AnswersJullie-Ann YbañezNo ratings yet

- Tax - First Preboard QuestionnaireDocument14 pagesTax - First Preboard QuestionnairewithyouidkNo ratings yet

- Toaz - Info Quiz 6 With Solutiondocx PRDocument15 pagesToaz - Info Quiz 6 With Solutiondocx PRReland CastroNo ratings yet

- Compound Financial Instruments Pas 32 Pfrs 9Document14 pagesCompound Financial Instruments Pas 32 Pfrs 9SamNo ratings yet

- Competency Assessment (ACC 311) PDFDocument14 pagesCompetency Assessment (ACC 311) PDFLealyn CuestaNo ratings yet

- Chapter 003 Fundamentals of Cost-Volume-Profit Analysis: True / False QuestionsDocument39 pagesChapter 003 Fundamentals of Cost-Volume-Profit Analysis: True / False QuestionsNaddieNo ratings yet

- Acc 109 p2 Exam TeachersDocument13 pagesAcc 109 p2 Exam TeachersWilmz SalacsacanNo ratings yet

- Taxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipDocument11 pagesTaxation of Partnerships, Estates and Trusts Classification of Partnerships 1. General Professional PartnershipErika DioquinoNo ratings yet

- Summary Bonds Payable PDFDocument6 pagesSummary Bonds Payable PDFRovi PatinoNo ratings yet

- Chapter 2 - Obligations of The Partners Section 1Document12 pagesChapter 2 - Obligations of The Partners Section 1Mhae DuranNo ratings yet

- Tax BmbeDocument7 pagesTax BmbeRuiz, CherryjaneNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- Fringe Benefits ScenariosDocument2 pagesFringe Benefits ScenariosKatherine BorjaNo ratings yet

- Week 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGDocument23 pagesWeek 7 Module 7 TAX2 - Business and Transfer Taxation - PADAYHAGfernan opeliñaNo ratings yet

- Obligations-of-Partners Art 1784-1796Document6 pagesObligations-of-Partners Art 1784-1796Aysayah JeanNo ratings yet

- Financial Markets and Institutions - PART1Document75 pagesFinancial Markets and Institutions - PART1shweta_46664100% (3)

- SEBI Financial MarketDocument79 pagesSEBI Financial MarketVishvajeet SuryawanshiNo ratings yet

- Photography 3 (Updated)Document28 pagesPhotography 3 (Updated)Hazel Jane EsclamadaNo ratings yet

- Introduction To Financial ManagementDocument43 pagesIntroduction To Financial ManagementHazel Jane EsclamadaNo ratings yet

- Report - Roles of CEODocument2 pagesReport - Roles of CEOHazel Jane EsclamadaNo ratings yet

- Photography 2Document48 pagesPhotography 2Hazel Jane EsclamadaNo ratings yet

- Topic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesDocument36 pagesTopic 3 & 4 - EXERCISES3 - Working Capital Management - TheoriesHazel Jane EsclamadaNo ratings yet

- Introduction To Donor's TaxDocument7 pagesIntroduction To Donor's TaxHazel Jane EsclamadaNo ratings yet

- MAS-3-Roque - Answer KeyDocument6 pagesMAS-3-Roque - Answer KeyHazel Jane Esclamada100% (1)

- Mas 3 Module 1 Fs AnalysisDocument19 pagesMas 3 Module 1 Fs AnalysisHazel Jane EsclamadaNo ratings yet

- Warranties, Provisions and Contingent LiabilitiesDocument31 pagesWarranties, Provisions and Contingent LiabilitiesHazel Jane EsclamadaNo ratings yet

- Inventory Management: Multiple Choice QuestionsDocument3 pagesInventory Management: Multiple Choice QuestionsHazel Jane Esclamada33% (3)

- Topic 4 - EXERCISES6 - Capital Current Liabilities ManagementDocument36 pagesTopic 4 - EXERCISES6 - Capital Current Liabilities ManagementHazel Jane Esclamada100% (1)

- MODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Document19 pagesMODULE FinalTerm FAR 3 Operating Segment Interim Reporting Events After Reporting Period 1Hazel Jane Esclamada0% (1)

- Working Capital FinanceDocument12 pagesWorking Capital FinanceYeoh Mae100% (4)

- Module 2.1 (Property, Plant, and Equipment)Document15 pagesModule 2.1 (Property, Plant, and Equipment)Hazel Jane EsclamadaNo ratings yet

- Module Far1 Unit-1 Part-1c.1Document6 pagesModule Far1 Unit-1 Part-1c.1Hazel Jane EsclamadaNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Concept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Document12 pagesConcept of Succession and Estate Tax and Gross Estate Common Rules & Special Rules (Married Decedents)Hazel Jane Esclamada100% (1)

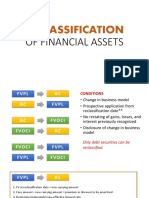

- Reclassification: of Financial AssetsDocument15 pagesReclassification: of Financial AssetsHazel Jane EsclamadaNo ratings yet

- Topic 7 Transfer PricingDocument3 pagesTopic 7 Transfer PricingHazel Jane EsclamadaNo ratings yet

- Topic 4 - Current Liabilities Sample ProblemsDocument8 pagesTopic 4 - Current Liabilities Sample ProblemsHazel Jane EsclamadaNo ratings yet

- Introduction To Transfer TaxationDocument6 pagesIntroduction To Transfer TaxationHazel Jane EsclamadaNo ratings yet

- Chapter 1 Tax 2Document5 pagesChapter 1 Tax 2Hazel Jane EsclamadaNo ratings yet

- What To Do With Perceived Environmental ViolationsDocument15 pagesWhat To Do With Perceived Environmental ViolationsHazel Jane EsclamadaNo ratings yet

- TSU PNP New Rank Classification The Meaning of The Symbols in The Seal and Badge of The PNPDocument3 pagesTSU PNP New Rank Classification The Meaning of The Symbols in The Seal and Badge of The PNPHazel Jane EsclamadaNo ratings yet

- DFT TopicsDocument3 pagesDFT TopicsRedouaneTahraouiNo ratings yet

- E15-7 AdmissionDocument12 pagesE15-7 AdmissionBorussian RamaNo ratings yet

- Narrative Report About Social ExperimentDocument1 pageNarrative Report About Social ExperimentIshya100% (1)

- Deed FormatDocument6 pagesDeed FormatBiju PerinkottilNo ratings yet

- Milk LedgerDocument17 pagesMilk Ledgerhammad engineeringNo ratings yet

- Company Profile Monjil PrivateDocument2 pagesCompany Profile Monjil PrivateYousuf MunniNo ratings yet

- John Highter ResumeDocument1 pageJohn Highter Resumeapi-284455343No ratings yet

- Cat. 6 4x2x267 AWG SFTP Work Area PVC - 9828026107 - V - 1 - R - 2Document2 pagesCat. 6 4x2x267 AWG SFTP Work Area PVC - 9828026107 - V - 1 - R - 2Inɡ Elvis RodríguezNo ratings yet

- QC PL 0006Document1 pageQC PL 0006AmeerNo ratings yet

- Wakaf (Penerbit Universitas Indonesia, 1988), 29.: Mohammad Daud Ali, Sistem Ekonomi Islam: Zakat DanDocument15 pagesWakaf (Penerbit Universitas Indonesia, 1988), 29.: Mohammad Daud Ali, Sistem Ekonomi Islam: Zakat DanNurul ChomariahNo ratings yet

- Delivery ApplicationDocument13 pagesDelivery Applicationzenfirdaus15No ratings yet

- Operating Instructions Automatic Air Inlet ValveDocument4 pagesOperating Instructions Automatic Air Inlet ValveelecbaNo ratings yet

- Chap 4 CVDDocument126 pagesChap 4 CVDMichael KaoNo ratings yet

- 3 Examples of An Action Plan - SimplicableDocument3 pages3 Examples of An Action Plan - SimplicableBob KaneNo ratings yet

- Trainning ReportDocument81 pagesTrainning ReportRohan PandeNo ratings yet

- Master Plan Engineering Design Criteria Deliverable#15Document113 pagesMaster Plan Engineering Design Criteria Deliverable#15Misama NedianNo ratings yet

- How To Get Yourself To Do The Thing: Brent HurasDocument9 pagesHow To Get Yourself To Do The Thing: Brent HurasShahuwadikar Supatre100% (1)

- Movil 75 SANY STC300HDocument9 pagesMovil 75 SANY STC300HGermán CampoyNo ratings yet

- CORDIC Based BPSK ModulatorDocument5 pagesCORDIC Based BPSK ModulatorPuneet BansalNo ratings yet

- Organizational DevelopmentDocument16 pagesOrganizational Developmentsagar09No ratings yet

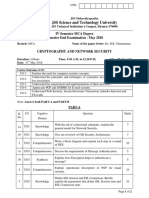

- Cryptography SEE 2018Document2 pagesCryptography SEE 2018Darshan.B.C YadavNo ratings yet

- B.Tech / M.tech Lab Report Format For CSE Department, NIT MizoramDocument7 pagesB.Tech / M.tech Lab Report Format For CSE Department, NIT MizoramAaron StoneNo ratings yet

- For Questions 1-12, Read The Text Below and Decide Which Answer Best Each GapDocument2 pagesFor Questions 1-12, Read The Text Below and Decide Which Answer Best Each Gapjaszmina hosszuNo ratings yet

- Sitio PDVSADocument2 pagesSitio PDVSAxgimsrleyNo ratings yet

- MD30C User's ManualDocument17 pagesMD30C User's ManualAMIR GHASEMINo ratings yet

- Tour Program: Day 01: India - SingaporeDocument3 pagesTour Program: Day 01: India - SingaporeHemant Kumar GangwarNo ratings yet

- Class 7 ComputerDocument11 pagesClass 7 ComputerNobody GamingNo ratings yet

- Private Label Sourcing For: Lessons, Mistakes and StrategiesDocument15 pagesPrivate Label Sourcing For: Lessons, Mistakes and StrategiesДенис АкуляковNo ratings yet