Professional Documents

Culture Documents

Exercise - Estate Tax 2 PDF

Exercise - Estate Tax 2 PDF

Uploaded by

Mark Edgar De GuzmanOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise - Estate Tax 2 PDF

Exercise - Estate Tax 2 PDF

Uploaded by

Mark Edgar De GuzmanCopyright:

Available Formats

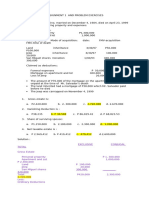

EXERCISES ON ESTATE TAXATION- PART I

A. Multiple Choices

Questions 1-4 are based on the following information. A decedent left the following properties:

Land in Italy (with 1M unpaid mortgage) 2,000,000

Land in Davao City, Phil. (zonal value 750,000) 500,000

Franchise in USA 100,000

Receivable from debtor in Phil. 50,000

Receivable from debtor in USA 100,000

Bank deposit in Phils. 20,000

Bank deposit in USA 80,000

Shares of stock of PLDT, Phils. 75,000

Shares of stocks of ABC, Foreign Corp. 125,000

75% of the business in the Philippines

Other personal properties 300,000

1. If the decedent is a non-resident citizen, his gross estate is:

a. 3,650,000 b. 3,600,000 c. 2,500,000 d. 2,650,000

2. If the decedent is a non-resident alien his, gross estate is:

a. 1,195,000 b. 945,000 c. 1,250,000 d. 1,070,000

3. If in the preceding number, reciprocity can be applied, the gross estate is:

a. 1,050,000 b. 945,000 c. 1,250,000 d. 1,070,000

4. Based on the original problem but assuming the PLDT shares of stock are not listed in the

local stock exchange and there are 1,000 shares at the time of death, the company’s

outstanding shares were 10,000. Its retained earnings was 2,000,000, par value per share was

50. The gross estate should show the said shares at:

a. Still 75,000 b. 250,000 c. 200,000 d. 0

Questions 5 & 6 are based on the following information:

Building, USA 5,000,000

House & Lot in Bulacan (500 sq.m.) zonal value is 10,000 per sq.m. 4,500,000

Life insurance proceeds, beneficiary is the wife, the administrator, irrevocable 500,000

Life insurance proceeds with another company; beneficiary, his son, irrevocable 200,000

Claims against a debtor who died a year ago (50% collectible) 50,000

Death benefits from from US veteran administration 100,000

Death benefits from SSS 40,000

Paraphernal property of his surviving wife 2,000,000

He also transferred mortis cause the following:

SP FMV-Transfer FMV-Death

Car, Manila 500,000 1,000,000 800,000

Land, Manila 1,500,000 2,000,000 1,000,000

Land, USA 2,000,000 1,800,000 3,000,000

5. If the decedent is a Filipino citizen, his gross estate is:

a. 10,850,000 b. 12,900,000 c. 10,950,000 d. 11,050,000

6. Based on the preceding no., the deductible family home is:

a. 10,000,000 b. 5,000,000 c. 2,500,000 d. 2,250,000

7. If the decedent is a non-resident alien and his country does not impose transfer tax on any

intangible properties left by a Filipino decedent, his gross estate is:

a. 5,350,000 b. 5,300,000 c. 6,500,000 d. 6,000,000

8. If the gross estate of the non-resident alien is 2,000,000, the standard deduction would be:

a. 50,000 b. 100,000 c. 500,000 d. 1,000,000

B. Classification.

9. The decedent was married at the time of death. He was survived by his wife and children. The

following were presented to you and you are asked to compute the exclusive and conjugal

properties under Conjugal Partnership of Gains (CPG) and exclusive and community

properties under Absolute Community of Properties (ACP).

Description Amount CPG ACP

EXCL CONJ EXCL COMM

Cash owned by the decedent before the 5,000,000

marriage

Real property inherited by the 6,000,000

decedent during the marriage

Personal property received by the wife 400,000

as gift before the marriage

Property acquired by the decedent with 600,000

cash owned before the marriage

Clothes of the decedent purchased with 500,000

the exclusive money of the wife

Jewelry purchased with the exclusive 1,000,000

cash of the decedent

Property unidentified when and by 1,200,000

whom acquired

Cash representing income during the 2,000,000

marriage

TOTAL 9 10 11 12

You might also like

- Assignment 1 - Fundamental Principles of TaxationDocument7 pagesAssignment 1 - Fundamental Principles of TaxationEdward Glenn BaguiNo ratings yet

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- MQC PartnershipDocument4 pagesMQC PartnershipMark Edgar De Guzman0% (1)

- Tax Planning With Refrence To Employee's RemunerationDocument34 pagesTax Planning With Refrence To Employee's RemunerationRishabh Jain83% (6)

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet

- ADJUSTING Activities With AnswersDocument5 pagesADJUSTING Activities With AnswersRenz RaphNo ratings yet

- Proof+of+Cash ProblemsDocument2 pagesProof+of+Cash ProblemshelaihjsNo ratings yet

- Integrated Topic 1 (Far-004a)Document4 pagesIntegrated Topic 1 (Far-004a)lyndon delfinNo ratings yet

- Chap 5 Prob 1 3Document10 pagesChap 5 Prob 1 3Nyster Ann RebenitoNo ratings yet

- Exercise 4-6 Case StudyDocument13 pagesExercise 4-6 Case Studymariyha PalangganaNo ratings yet

- MA REV 1 Finals Dec 2017Document33 pagesMA REV 1 Finals Dec 2017Dale PonceNo ratings yet

- Problem 1: Use The Following Data For The Next (2) Two QuestionsDocument13 pagesProblem 1: Use The Following Data For The Next (2) Two QuestionscpamakerfilesNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- Modi Method UnbalancedDocument4 pagesModi Method UnbalancedRowillyn OrsalNo ratings yet

- Unit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1Document5 pagesUnit IA ID. Rematch Unit Drill On Cash and Cash Equivalents Petty Cash Bank Recon Proof of Cash 1MARK JHEN SALANGNo ratings yet

- Problem 1: Net Taxable Estate 530,000 75,000 605,000Document3 pagesProblem 1: Net Taxable Estate 530,000 75,000 605,000camscamsNo ratings yet

- Answers To Assignment 1 and Problem Exercises Taxation2Document4 pagesAnswers To Assignment 1 and Problem Exercises Taxation2Dexanne BulanNo ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Manaytay, Desiree (Unbalanced) CheckedDocument3 pagesManaytay, Desiree (Unbalanced) CheckedDesiree ManaytayNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Situation 8 11Document8 pagesSituation 8 11GuinevereNo ratings yet

- Property, Plant and EquipmentDocument40 pagesProperty, Plant and EquipmentNatalie SerranoNo ratings yet

- SOA Chapter 2Document19 pagesSOA Chapter 2GeramagliquiangNo ratings yet

- Seiler Co Purchased 6,000,000Document1 pageSeiler Co Purchased 6,000,000Zes ONo ratings yet

- Examination About Investment 12Document4 pagesExamination About Investment 12BLACKPINKLisaRoseJisooJennieNo ratings yet

- AnswerQuiz - Module 8Document4 pagesAnswerQuiz - Module 8Alyanna AlcantaraNo ratings yet

- SolutionDocument8 pagesSolutionIts meh SushiNo ratings yet

- AssignmentDocument2 pagesAssignmentLois JoseNo ratings yet

- I Need A Step-By-Step Explanation For The FollowingDocument2 pagesI Need A Step-By-Step Explanation For The Followingnicolearetano417No ratings yet

- Strategic Cost ManagementDocument7 pagesStrategic Cost ManagementAngeline RamirezNo ratings yet

- Wasting Assets - ProblemsDocument5 pagesWasting Assets - ProblemsMarkNo ratings yet

- Module Far1 Unit-1 Part-1bDocument5 pagesModule Far1 Unit-1 Part-1bHazel Jane EsclamadaNo ratings yet

- Finals Graded Exercises 002 Final Special Journals For Dist. FinalDocument4 pagesFinals Graded Exercises 002 Final Special Journals For Dist. FinalGarpt Kudasai100% (1)

- (01I) Lower of Cost and NRVDocument3 pages(01I) Lower of Cost and NRVGabriel Adrian ObungenNo ratings yet

- 6902 - Investment Property and Other InvestmentDocument3 pages6902 - Investment Property and Other InvestmentAljur SalamedaNo ratings yet

- Chapter 8Document5 pagesChapter 8Misherene MagpileNo ratings yet

- AP 001 A.1 Bank Reconciliation Prob 1Document2 pagesAP 001 A.1 Bank Reconciliation Prob 1Loid Gumera LenchicoNo ratings yet

- Answer:: TotalDocument2 pagesAnswer:: TotalCarla Jane ApolinarioNo ratings yet

- Department of Accountancy: Inventory EstimationDocument2 pagesDepartment of Accountancy: Inventory EstimationAiza S. Maca-umbosNo ratings yet

- Drill#1Document5 pagesDrill#1Leslie BustanteNo ratings yet

- Problem 7 - 22Document3 pagesProblem 7 - 22Jao FloresNo ratings yet

- Audit Practice Accrual Solution PDFDocument19 pagesAudit Practice Accrual Solution PDFEISEN BELWIGANNo ratings yet

- Pre-Test 9Document3 pagesPre-Test 9BLACKPINKLisaRoseJisooJennieNo ratings yet

- AIS Prelim ExamDocument4 pagesAIS Prelim Examsharielles /No ratings yet

- Chapter 13 - Gross Profit MethodDocument7 pagesChapter 13 - Gross Profit MethodLorence IbañezNo ratings yet

- q2 SolutionsDocument19 pagesq2 SolutionsjangjangNo ratings yet

- Final PreboardsDocument14 pagesFinal Preboardsrandomlungs121223No ratings yet

- Acc7 q1Document2 pagesAcc7 q1Jao FloresNo ratings yet

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelNo ratings yet

- Investment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Document6 pagesInvestment in Equity Securities - Problem 16-2, 16-3, 16-10. and 16-11Jessie Dela CruzNo ratings yet

- Problems CCEDocument10 pagesProblems CCERafael Renz DayaoNo ratings yet

- P1-01 Cash and Cash EquivalentsDocument5 pagesP1-01 Cash and Cash EquivalentsRachel LeachonNo ratings yet

- DepreciationDocument14 pagesDepreciationKris Hazel RentonNo ratings yet

- Homework #3-Business Transfer TaxesDocument9 pagesHomework #3-Business Transfer TaxesQuendrick SurbanNo ratings yet

- AE 22 M TEST 3 With AnswersDocument6 pagesAE 22 M TEST 3 With AnswersJerome MonserratNo ratings yet

- Opening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000Document3 pagesOpening Entries (Partnership Books) : (80 000 X 10%) Decrease in Allowance 72 000AAAAANo ratings yet

- Reviewer in Financial MarketDocument10 pagesReviewer in Financial MarketJhonalyn MaraonNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- Ar&Inventory ManagementDocument10 pagesAr&Inventory ManagementKarlo D. ReclaNo ratings yet

- EXAMINATION ON INVENTORY MaDocument5 pagesEXAMINATION ON INVENTORY Macriszel4sobejanaNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax Qrick owensNo ratings yet

- Exercise-2-Estate-Tax QDocument2 pagesExercise-2-Estate-Tax QJaypee Verzo SaltaNo ratings yet

- Transfer & Business TaxDocument5 pagesTransfer & Business TaxAlif FabianNo ratings yet

- Exercise 2 Estate Tax Pt1.5Document4 pagesExercise 2 Estate Tax Pt1.5Angelica Nicole TamayoNo ratings yet

- Current Assets PAS 1 Paragraph 66 Provides That An Entity ShouldDocument1 pageCurrent Assets PAS 1 Paragraph 66 Provides That An Entity ShouldMark Edgar De GuzmanNo ratings yet

- Handout No. 9Document5 pagesHandout No. 9Mark Edgar De GuzmanNo ratings yet

- Exercise - Estate Tax 2Document2 pagesExercise - Estate Tax 2Mark Edgar De GuzmanNo ratings yet

- Philippine Financial Reporting Standards Number Title Effective DateDocument4 pagesPhilippine Financial Reporting Standards Number Title Effective DateMark Edgar De GuzmanNo ratings yet

- Span2 AlfabetosDocument7 pagesSpan2 AlfabetosMark Edgar De GuzmanNo ratings yet

- Tax Exam SolDocument3 pagesTax Exam SolMark Edgar De GuzmanNo ratings yet

- Blue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Document7 pagesBlue and Rubi Are Partners Who Share Profits and Losses in The Ratio of 6Mark Edgar De Guzman100% (1)

- PartnershipDocument3 pagesPartnershipMark Edgar De Guzman0% (1)

- Budget at A GlanceDocument5 pagesBudget at A GlanceHarshal AjmeraNo ratings yet

- Impact of GST in Textile Sector: Group 1 (Girls)Document29 pagesImpact of GST in Textile Sector: Group 1 (Girls)SREYANo ratings yet

- Indicative Taxnet Profile: Personal InformationDocument3 pagesIndicative Taxnet Profile: Personal InformationNaveed Ahmad MushtaqNo ratings yet

- BBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesDocument66 pagesBBA.5 (Unit.1 Introduction To Direct Tax, Residential Status and Income Under The Head of SalariesMihir AsnaniNo ratings yet

- Vistaar Financial Services Private Limited: Payslip For The Month of February 2018Document1 pageVistaar Financial Services Private Limited: Payslip For The Month of February 2018AlleoungddghNo ratings yet

- Dress Bill 02.07.2023Document2 pagesDress Bill 02.07.2023Vrushabendra GadgimathNo ratings yet

- Rutansh Final Itr 2022-23 - 2Document1 pageRutansh Final Itr 2022-23 - 2Rutansh JagtapNo ratings yet

- Module 7 Public FiinanceDocument12 pagesModule 7 Public FiinancecuramenceciliaNo ratings yet

- Obillos Vs CIRDocument2 pagesObillos Vs CIRGeorge HabaconNo ratings yet

- Perlakuan Pajak PMSEDocument34 pagesPerlakuan Pajak PMSEekomedan ekoNo ratings yet

- Common Mistakes On Claims For S14Q DeductionDocument2 pagesCommon Mistakes On Claims For S14Q DeductionHari ChandranNo ratings yet

- Public Sector Financial ManagementDocument201 pagesPublic Sector Financial Managementdodopdf31No ratings yet

- Rti FormDocument2 pagesRti FormKumar GauravNo ratings yet

- GR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTADocument3 pagesGR No. 125704 PHILEX MINING CORP V COMMISSIONER OF INTERNAL REVENUE, CTAtanniebangbang882No ratings yet

- Indian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Document1 pageIndian Income Tax Return Acknowledgement: Acknowledgement Number:611395890220723 Date of Filing: 22-Jul-2023Respect InfinityNo ratings yet

- ACT August InvoiceDocument2 pagesACT August InvoicePabitra SahuNo ratings yet

- Econ6049 Economic Analysis, S1 2021: Week 10: Unit14 - Unemployment and Fiscal Policy (Part B)Document24 pagesEcon6049 Economic Analysis, S1 2021: Week 10: Unit14 - Unemployment and Fiscal Policy (Part B)Tom WongNo ratings yet

- Export Invoice: Item Description: Qty: UOM: Curr Unit PriceDocument4 pagesExport Invoice: Item Description: Qty: UOM: Curr Unit PriceAdam GreenNo ratings yet

- Income TaxDocument14 pagesIncome TaxJack ReacherNo ratings yet

- ACCC Helsinki Conductor-Bill of QuantitiesDocument1 pageACCC Helsinki Conductor-Bill of QuantitiesGopal BhattaraiNo ratings yet

- Income From House PropertyDocument13 pagesIncome From House PropertyVicky DNo ratings yet

- Casasola Tax ReviewerDocument221 pagesCasasola Tax ReviewerROMMIE ACOPIADONo ratings yet

- Complete GST NotesDocument102 pagesComplete GST Noteslawsaba6No ratings yet

- Tax Certificate 2020-2021Document1 pageTax Certificate 2020-2021marco.kozilekgoweNo ratings yet

- L A S T P A y C e R T I F I C A T eDocument7 pagesL A S T P A y C e R T I F I C A T eapi-3710215No ratings yet

- Public Education Finances: 2015 Economic Reimbursable Surveys Division Reports Issued June 2017Document65 pagesPublic Education Finances: 2015 Economic Reimbursable Surveys Division Reports Issued June 2017FOX45No ratings yet

- Property Taxes in NYS 2019Document4 pagesProperty Taxes in NYS 2019Cayla HarrisNo ratings yet

- Gruber2e ch08Document21 pagesGruber2e ch08economisticaNo ratings yet