Professional Documents

Culture Documents

Unit 5 Cash and Cash Equivalents Cash

Unit 5 Cash and Cash Equivalents Cash

Uploaded by

Sofia NadineOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Unit 5 Cash and Cash Equivalents Cash

Unit 5 Cash and Cash Equivalents Cash

Uploaded by

Sofia NadineCopyright:

Available Formats

-

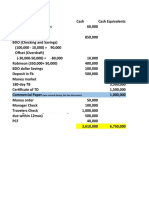

Unit 5

Cash and Cash Equivalents

Cash

Money is the standard medium of exchange in business

transactions. It refers to the currency and coins which are in

circulation and legal tender.

Accordingly, cash includes checks, bank drafts and money

orders because these are acceptable by the bank for deposit

and immediate encashment.

Cash Items includes:

Cash on hand – this includes undeposited cash collections

and other cash items awaiting deposit such as customers’

checks, cashier’s or manager’s checks, traveler’s checks, bank

drafts and money orders.

Cash in bank – this includes demand deposit or checking

account and saving deposit which are unrestricted as to

withdrawal.

Cash fund – set aside for current purposes such as petty

cash fund and dividend fund.

Cash Equivalents

Cash Equivalents are short-term and highly liquid

investments that are readily convertible into cash and so near

their maturity that they present insignificants risk of changes in

value because of changes in interest rates.

Examples of Cash Equivalents:

a. Three – month BSP treasury bill

-

b. Three – year BSP treasury bill purchased three months

before date of maturity.

c. Three – month time deposit

d. Three – month money market instrument or

commercial paper.

Equity Securities cannot qualify as cash equivalents

because shares do not have a maturity date.

Preference Shares with specified redemption date and

acquired three months before redemption date can qualify as

cash equivalents.

Note that what is important is the date of purchase which

should be three months or less before maturity.

Classification of Investment of Excess Cash

If the term is three months or less, such instruments are

classified as cash equivalents and are included in the caption

“cash and cash equivalents”.

If the term is more than three months but within one

year, such investments are classified as short-term financial

assets or temporary investments and presented separately as

current assets.

If the term is more than one year, such investments are

classified as noncurrent or long-term investments.

Cash Fund for a Certain Purpose

If the cash fund is set aside for use in current operations

or for the payment of current obligation, it is a current asset. It

is included as part of cash and cash equivalents.

-

If the cash fund is set aside for noncurrent purpose or

payment of noncurrent obligation, it is shown as long-term

investment.

Classification of Cash Fund

The classification of a cash fund as current or noncurrent

should parallel the classification of the related liability.

However, a cash fund set aside for the acquisition of a

noncurrent asset should be classified as noncurrent regardless

of the year of disbursement.

Bank Overdraft

When the cash in bank account has a credit balance, it is

sad to be an overdraft. The credit balance in the cash in bank

account results from the issuance of checks in excess of the

deposits.

A bank overdraft is classified as a current liability and

should not be offset against other bank accounts with debit

balances.

Exception to the Rule on Overdraft

When an entity maintains two or more accounts in one

bank and one account results in an overdraft, such overdraft

can be offset against the other bank account with a debit

balance in order to show “cash, net of bank overdrafts” or

“bank overdraft, net of other bank account.”

Compensating Balance

A compensating balance generally takes the form of

minimum checking or demand deposit account balance that

-

must be maintained in connection with a borrowing

arrangement with a bank.

For Example:

An entity borrows P5,000,000 from a bank and agrees to

maintain a 10% or P500,000 minimum compensating balance

in a demand deposit account.

In effect, this arrangement results in the reduction of the

amount borrowed because the compensating balance provides

a source of fund to the bank as partial compensation for the

loan extended.

Classification of Compensating Balance

If the balance is not legally restricted as to withdrawal by

the borrower it is part of cash.

If the deposit is legally restricted because of a formal

compensating balance agreement, the compensating balance is

classified separately as “cash held as compensating balance”

under current assets if the related loan is short-term.

If the related loan is long-term, the compensating

balance is classified as noncurrent investment.

Undelivered or Unreleased check

An undelivered or unreleased check is one that is merely drawn

and recorded but not given to the payee before the end of

reporting period.

There is no payment when the check is pending

delivery to the payee at the end of reporting period.

-

The check is still subject to the entity’s control and

may thus be canceled anytime before delivery at the discretion

of the entity.

Accordingly, an adjusting entry is required to restore the

cash balance and set up the liability as follows:

Cash xxx

Accounts payable or appropriate account xxx

In practice, the foregoing adjustments is sometimes

ignored because the amount is not very substantial and there is

no evidence of actual cancellation of the check in the

subsequent period.

Postdated Check Delivered

A postdated check delivered is a check drawn,

recorded and already given to the payee but it bears a date

subsequent to the end of reporting period.

The original entry recording a delivered postdated

check shall also be reversed and therefore restored to the cash

balance as follows:

Cash xxx

Accounts payable or appropriate account xxx

The reason is that there is no payment until the check can

be presented to the bank for encashment or deposit.

Stale Check or Check Long Outstanding

A stale check is a check not encashed by the payee

within a relatively long period of time.

-

In banking practice, a check becomes stale if not

encashed within six months from the time of issuance. Of

course, this is a matter of entity policy.

Thus even after three months only, the entity may

issue as “stop payment order” to the bank for the

cancelation of a previously issued check.

If the amount of stale check is immaterial, it is simply

accounted for as miscellaneous income as follows:

Cash xx

Miscellaneous income xx

However, if the amount is material and liability is

expected to continue, the cash is restored and the liability is

again set up. The journal entry is as follows:

Cash xx

Accounts payable or appropriate account xx

Accounting for Cash Shortage

Where the cash count shows cash which is less than

the balance per book, there is a cash shortage to be recorded

as follows:

Cash short or over xx

Cash xx

The cash short or over account is only a temporary

or suspense account. When financial statements are

prepared the same should be adjusted.

-

Hence, if the cashier or cash custodian is held

responsible for the cash shortage, the adjustment should be:

Due from cashier xx

Cash short or over xx

However, if the reasonable efforts fail to disclose the

cause of the shortage, the adjustment is:

Loss from cash shortage xx

Cash short or over xx

Accounting for Cash Overage

Where the cash count shows cash which is more

than the balance per book, there is a cash overage to be

recorded as follows:

Cash xx

Cash short or over xx

Note that whether it is a cash shortage or cash

overage, the offsetting account is cash short or over account.

Such account should be adjusted when statements are made.

The cash overage is treated as miscellaneous income

if there is no claim on the same.

Cash short or over xx

Miscellaneous income xx

But where the cash overage is properly found to be

the money of the cashier, the journal entry is:

-

Cash short or over xx

Payable to cashier xx

Imprest System

The imprest system is a system of control of cash which

requires that all cash receipts should be deposited intact and all

cash disbursements should be made by means of check.

There are occasions when the issuance of checks

becomes impractical or inconvenient such as when small

amounts are paid or things are hurriedly bought or customers

are entertained.

Consequently, in such instances, it may be more

economical and convenient to pay in cash rather than issue

checks.

Petty Cash Fund

The petty cash fund is money set aside to pay small

expenses which cannot be paid conveniently by means of

check.

The two methods of handling the petty cash;

Imprest Fund System

Fluctuating Fund System

Imprest Fund System

The imprest fund system is the one usually followed in

handling petty cash transactions.

-

Accounting Procedures:

a. A check is drawn to establish the fund.

Petty cash fund xx

Cash in bank xx

b. Payment of expenses out of the fund.

No formal journal entries are made. The petty

cashier generally requires a signed petty cash voucher for such

payments and simply prepare memorandum entries in the

petty cash journal.

c. Replenishment of petty cash payments.

Whenever the petty cash fund runs low, a check is drawn

to replenish the fund.

The replenishment check is usually equal to the petty

cash disbursements. It is at this time that the petty cash

disbursements are recorded as follows:

Expenses xx

Cash in bank xx

It is to be pointed out that the petty cash disbursements

should be replenished only by means of checks and not from

undeposited collections.

a. At the end of the accounting period, it is necessary to

adjust the unreplenished expenses in order to state the correct

petty cash balance as follows:

-

Expenses xx

Petty cash fund xx

The adjustment is to be reversed at the beginning of

the next accounting period. The reversal is made in order that

the normal replenishment procedures may be followed by

simply debiting expenses and crediting cash in bank without

distinguishing whether the expenses pertain to the current

period or prior period.

e. An increase in the fund is recorded as follows:

Petty cash fund xx

Cash in bank xx

f. A decrease in the fund is recorded as follows:

Cash in bank xx

Petty cash xx

Illustration:

2018

Nov. 10 The entity established an imprest fund of

P10,000.

Petty cash fund 10,000

Cash in bank 10,000

29 Replenished the fund. The petty cash items

include the following:

-

Currency and coin 2,000

Supplies 5,000

Telephone 1,800

Postage 1,200

Nov. 29 The journal entry to record the replenishment is:

Supplies 5,000

Telephone 1,800

Postage 1,200

Cash in bank 8,000

Dec. 31 The fund was not replenished.

The fund is composed of the following: currency and

coin, P7,000; supplies P1,500; postage,P500miscellaneous

expense, P1,000.

Supplies 1,500

Postage 500

Miscellaneous expense 1,000

Petty cash fund 3,000

-

2019

Jan. 1 The adjustment made on December 31, 2018 is

reversed.

Petty cash fund 3,000

Supplies 1,500

Postage 500

Miscellaneous expense 1,000

2019

Feb. 1 The fund is replenished and increased to

P15,000.

The composition of the fund: currency and coin P1,000,

supplies P4,500, postage P3,000 and miscellaneous expense

P1,500.

Petty cash fund 5,000

Supplies 4,500

Postage 3,000

Miscellaneous expense 1,500

Cash in bank 14,000

The total amount of the check drawn is P14,000 representing

the petty cash disbursements of P9,000 and the fund increase

of P5,000.

-

Fluctuating fund system

The system is called “fluctuating fund system” because

the checks drawn to replenish the fund do not necessarily

equal the petty cash disbursements.

The replenishment checks are simply drawn upon the

request of the petty cashier.

Moreover, petty cash disbursement are immediately

recorded thus resulting in fluctuating petty cash balance per

book from time to time:

a. Establishment of the fund:

Petty cash fund xx

Cash in bank xx

b. Payment of expenses out of the petty cash fund:

Expenses xx

Petty cash fund xx

Under this system, the disbursements from the petty cash fund

are immediately recorded in contradistinction with the imprest

fund system where the disbursements are recorded upon the

replenishment of the fund.

c. Replenishment or increase of the fund:

Petty cash fund xx

Cash in bank xx

The replenishment check may or may not be the same as

the petty cash disbursements.

-

b. At the end of the reporting period, no adjustment is

necessary because the petty cash expenses are recorded

outright.

e. Decrease of the fund is recorded as follows:

Cash in bank xx

Petty cash fund xx

Illustration:

Nov. 10 The entity established a petty cash fund of

P10,000.

Petty cash fund 10,000

Cash in bank 10,000

Nov. 11-28 Petty cash disbursements amounted to

P8,000.

Expenses 8,000

Petty cash fund 8,000

Nov. 29 Issued a check for P10,000 to replenish the

fund.

Petty cash fund 10,000

Cash in bank 10,000

At this point, the petty cash balance per book

is P12,000.

-

Dec. 1-30 Petty cash expenses amounted to P9,000.

Expenses 9,000

Petty cash fund 9,000

31 Issued a check for P15,000 to replenish the fund.

Petty cash fund 15,000

Cash in bank 15,000

At this point, the petty cash balance is P18,000.

Activity 6 :Lets try this:

Answer briefly:

1. Distuinguised Cash from Cash Equivalents. Give examples.

2. How should we measure cash?

3. Describe the following:

a) Bank overdraft

b) Undelivered check

c) Postdated check delivered

d) Imprest system of internal control

e) Petty cash fund

4. Using your textbook Intermediate Accounting Vol.1 (2020 ed.) By:

Valix, Peralta and Valix . Answer the following:

4.1 Problem 1-2 Argentina Company page 19

4.2 Problem 1-7 Laborious company page 23

You might also like

- CCEDocument3 pagesCCESofia Nadine100% (1)

- Mathpiechart and BargraphDocument4 pagesMathpiechart and BargraphJasmine Arnejo AmadorNo ratings yet

- Chapter 3 - Bank ReconciliationDocument2 pagesChapter 3 - Bank ReconciliationJerome_JadeNo ratings yet

- Liabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasDocument158 pagesLiabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasErika Mae LegaspiNo ratings yet

- Module 5 - With SolutionsDocument12 pagesModule 5 - With SolutionsStella MarieNo ratings yet

- Merchadising MOCK QUIZDocument5 pagesMerchadising MOCK QUIZCarl Dhaniel Garcia SalenNo ratings yet

- Midterm Exam Parcor 2020Document1 pageMidterm Exam Parcor 2020John Alfred CastinoNo ratings yet

- Guabna Aldyn Bookkeeping TransactionsDocument40 pagesGuabna Aldyn Bookkeeping TransactionsSHIENNA MAE ALVIS100% (1)

- FAR.2903 - Estimating Inventories.Document4 pagesFAR.2903 - Estimating Inventories.music niNo ratings yet

- Assignment02 PDFDocument2 pagesAssignment02 PDFAilene MendozaNo ratings yet

- 1 Cash and Cash EquivalentsDocument3 pages1 Cash and Cash EquivalentsJohn Aries Reyes100% (1)

- Cash and Cash Equivalents (IA)Document9 pagesCash and Cash Equivalents (IA)rufamaegarcia07No ratings yet

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument6 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionAIENNA GABRIELLE FABRO100% (1)

- Cash & Cash Equivalent: If The Problem Is Silent, Daily, They Are Part of Cash and Cash EquivalentsDocument30 pagesCash & Cash Equivalent: If The Problem Is Silent, Daily, They Are Part of Cash and Cash EquivalentsKim Audrey JalalainNo ratings yet

- Cash and Cash Equivalents: Prepared by Erin Julia BalanagDocument10 pagesCash and Cash Equivalents: Prepared by Erin Julia BalanagAngela Mae Balanon Rafanan100% (1)

- Quiz - Cash and Cash Equivalents (3.3.22)Document5 pagesQuiz - Cash and Cash Equivalents (3.3.22)Nicole ValentinoNo ratings yet

- Intermediate Accounting 2 CompressDocument84 pagesIntermediate Accounting 2 Compressngxbao0211suyaNo ratings yet

- Conceptual Framework and Accounting Standards - Chapter 2 - NotesDocument5 pagesConceptual Framework and Accounting Standards - Chapter 2 - NotesKhey KheyNo ratings yet

- Davao - Eagle - Com JOSEPHDocument6 pagesDavao - Eagle - Com JOSEPHablay logeneNo ratings yet

- Acc106 Period 1 Suggested AnswersDocument67 pagesAcc106 Period 1 Suggested AnswersZhou LayNo ratings yet

- MEDINA - Homework 1 No. 14Document7 pagesMEDINA - Homework 1 No. 14Von Andrei MedinaNo ratings yet

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Chapter 4 - Accounts ReceivableDocument2 pagesChapter 4 - Accounts ReceivableJerome_JadeNo ratings yet

- Property, Plant and Equipment Chapter 15Document9 pagesProperty, Plant and Equipment Chapter 15Kiminosunoo LelNo ratings yet

- Financial Accounting and Reporting AnswersDocument32 pagesFinancial Accounting and Reporting Answerszjen3owrene3rongavilNo ratings yet

- Theories and Problem Solving AKDocument19 pagesTheories and Problem Solving AKJob CastonesNo ratings yet

- Xy95lywmi - Midterm Exam FarDocument12 pagesXy95lywmi - Midterm Exam FarLyra Mae De BotonNo ratings yet

- Intermediate Accounting 1 - Practice QuizDocument12 pagesIntermediate Accounting 1 - Practice QuizJesaiah PalmaNo ratings yet

- p2 Quiz Acc 103Document4 pagesp2 Quiz Acc 103Ariane Grace Hiteroza Margajay100% (1)

- CFAS Chapter 4 - Cash and Cash EquivalentsDocument3 pagesCFAS Chapter 4 - Cash and Cash EquivalentsAngelaMariePeñarandaNo ratings yet

- 8 Inventory EstimationDocument3 pages8 Inventory EstimationJorufel PapasinNo ratings yet

- Problems: Problem 4 - 1Document4 pagesProblems: Problem 4 - 1KioNo ratings yet

- Pre FinactDocument6 pagesPre FinactMenardNo ratings yet

- Chapter 2 Accounting 300 Exam ReviewDocument2 pagesChapter 2 Accounting 300 Exam Reviewagm25No ratings yet

- Receivables Discussion QuestionDocument17 pagesReceivables Discussion QuestionAngelica TalledoNo ratings yet

- Sol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aDocument11 pagesSol. Man. - Chapter 5 - Notes Receivable - Ia Part 1aKaisser Niel Mari FormentoNo ratings yet

- AC 3 - Intermediate Acctg' 1 (Ate Jan Ver)Document119 pagesAC 3 - Intermediate Acctg' 1 (Ate Jan Ver)John Renier Bernardo100% (1)

- Basic Principles in Taxation: BAM 127: Income Taxation For BA Module #1Document14 pagesBasic Principles in Taxation: BAM 127: Income Taxation For BA Module #1Mylene SantiagoNo ratings yet

- Acc-106 Sas 3Document12 pagesAcc-106 Sas 3hello millieNo ratings yet

- Exam Questionaire in IntermediateDocument5 pagesExam Questionaire in IntermediateJester IlaganNo ratings yet

- Chapter 5 - Intermediate Accounting Volume 1Document11 pagesChapter 5 - Intermediate Accounting Volume 1Buenaventura, Elijah B.No ratings yet

- Accounts Receivable: QuizDocument4 pagesAccounts Receivable: QuizRisa Castillo MiguelNo ratings yet

- Acct-111e - Quiz CompDocument18 pagesAcct-111e - Quiz CompJap Keren LirazanNo ratings yet

- Chapter 5 (Estimation of Doubtful Accounts)Document8 pagesChapter 5 (Estimation of Doubtful Accounts)Joan LeonorNo ratings yet

- CF Qualitative CharacteristicsDocument3 pagesCF Qualitative Characteristicspanda 1No ratings yet

- GEN 010 For BSA INVESTMENTS IN ASSOCIATESDocument6 pagesGEN 010 For BSA INVESTMENTS IN ASSOCIATESShamuel AlasNo ratings yet

- Intermediate Accounting 1 Second Grading Examination Key AnswersDocument12 pagesIntermediate Accounting 1 Second Grading Examination Key AnswersAbegail Joy De GuzmanNo ratings yet

- The Simplex Minimization MethodDocument13 pagesThe Simplex Minimization MethodJean HipolitoNo ratings yet

- GROUP 6 Problem 3 7 To 3 9Document24 pagesGROUP 6 Problem 3 7 To 3 9Hans ManaliliNo ratings yet

- Answer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionDocument8 pagesAnswer To Problems On Cash & Cash Equivalents - Reinforcement DiscussionAnnie RapanutNo ratings yet

- NSTP 2 RiviewerDocument5 pagesNSTP 2 RiviewerZeny DalumpinesNo ratings yet

- Illustration 5Document2 pagesIllustration 5Bea Nicole BaltazarNo ratings yet

- ACC 101 - 3rd QuizDocument3 pagesACC 101 - 3rd QuizAdyangNo ratings yet

- Problem 11-4 (Vicente, Kate Iannel C.)Document1 pageProblem 11-4 (Vicente, Kate Iannel C.)Kate Iannel VicenteNo ratings yet

- Receivable FinancingDocument15 pagesReceivable FinancingshaneNo ratings yet

- Cfas Theories QuizletDocument4 pagesCfas Theories Quizletagm25No ratings yet

- This Study Resource Was: Problem IDocument8 pagesThis Study Resource Was: Problem IMs VampireNo ratings yet

- Partnership OperationDocument18 pagesPartnership OperationSol LunaNo ratings yet

- Sol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionDocument12 pagesSol. Man. - Chapter 1 - The Accounting Process - Ia Part 1a - 2020 EditionChristine Jean MajestradoNo ratings yet

- CASH & CASH EQUIVALENTS Part 1 - StudentsDocument27 pagesCASH & CASH EQUIVALENTS Part 1 - StudentsAngel PulvinarNo ratings yet

- Module1-Cash and Cash Equivalents: Learning ObjectivesDocument16 pagesModule1-Cash and Cash Equivalents: Learning ObjectivesSaclao John Mark GalangNo ratings yet

- Art 1173-1174Document61 pagesArt 1173-1174Sofia Nadine100% (3)

- Essential Requisites of An Obligation PDFDocument1 pageEssential Requisites of An Obligation PDFSofia NadineNo ratings yet

- Trisa Grace T. Cawaling (Bsba 2-A)Document3 pagesTrisa Grace T. Cawaling (Bsba 2-A)Sofia NadineNo ratings yet

- Getting To Know MathematicsDocument43 pagesGetting To Know MathematicsSofia NadineNo ratings yet

- The Basic Analysis of Demand and SupplyDocument4 pagesThe Basic Analysis of Demand and SupplySofia NadineNo ratings yet

- The Nature of Mathematics: Mathematical Language and SymbolsDocument51 pagesThe Nature of Mathematics: Mathematical Language and SymbolsSofia NadineNo ratings yet

- Kartilla NG KatipunanDocument3 pagesKartilla NG KatipunanSofia Nadine100% (1)

- Customs of The TagalogDocument4 pagesCustoms of The TagalogSofia Nadine100% (1)

- HRM AbstractDocument6 pagesHRM AbstractSofia NadineNo ratings yet

- Group 9 Organizational MarketDocument2 pagesGroup 9 Organizational MarketSofia NadineNo ratings yet

- Assessment # 2 True/FalseDocument3 pagesAssessment # 2 True/FalseJacie TupasNo ratings yet

- Principles of Accounting 1st Year MCQs and Short Questions NotesDocument28 pagesPrinciples of Accounting 1st Year MCQs and Short Questions NotesMuhammad MasoodNo ratings yet

- Doraville AssemblyDocument46 pagesDoraville AssemblyZachary HansenNo ratings yet

- Allowable Deductions From Gross Income - ReviewerDocument4 pagesAllowable Deductions From Gross Income - RevieweryzaNo ratings yet

- Topic: Partnershi P FormationDocument63 pagesTopic: Partnershi P FormationAllen Hendrick SantiagoNo ratings yet

- WSS 9 Case Studies Blended FinanceDocument36 pagesWSS 9 Case Studies Blended FinanceAbdullahi Mohamed HusseinNo ratings yet

- BLT 101Document14 pagesBLT 101NIMOTHI LASENo ratings yet

- MIDTERM BLAWRE Jhanyltitong 1Document3 pagesMIDTERM BLAWRE Jhanyltitong 1Jhanyl TitongNo ratings yet

- Audit of Trade Receivables and Sales BalancesDocument2 pagesAudit of Trade Receivables and Sales BalancesDiane VillarmaNo ratings yet

- Accounting Theory and PractiseDocument9 pagesAccounting Theory and PractiseDiana And hakimNo ratings yet

- ObligationsDocument3 pagesObligationsJohn ChuaNo ratings yet

- Group #1 - Presentation - Super Sports - QuestionDocument8 pagesGroup #1 - Presentation - Super Sports - QuestionNaruto MangaNo ratings yet

- BalldaFAR ToFDocument12 pagesBalldaFAR ToFsantosemmanueljoseph2324No ratings yet

- The Case of The Starr Motor SurvivalDocument11 pagesThe Case of The Starr Motor SurvivalKeanette Jay ManosNo ratings yet

- 12 PAS 1 Presentation of Financial Statements Part 1Document4 pages12 PAS 1 Presentation of Financial Statements Part 1Keanlyn UnwinNo ratings yet

- Financial Ratio Analysis AssignmentDocument10 pagesFinancial Ratio Analysis AssignmentRahim BakhshNo ratings yet

- Financial Statement Analysis: RatiosDocument23 pagesFinancial Statement Analysis: RatiosHerraNo ratings yet

- Audit Fot Liability Problem #10Document2 pagesAudit Fot Liability Problem #10Ma Teresa B. CerezoNo ratings yet

- MPC Chap 5,6,7Document15 pagesMPC Chap 5,6,7Ngọc Mỹ Huỳnh ThịNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument2 pagesSworn Statement of Assets, Liabilities and Net WorthRoxette MarieNo ratings yet

- Debenture Application Form Version 2.0Document5 pagesDebenture Application Form Version 2.0ask1968No ratings yet

- ComparitiveDocument6 pagesComparitivesanath vsNo ratings yet

- Compensacion Vendor Customer F110 SAPDocument6 pagesCompensacion Vendor Customer F110 SAPfoodstyleNo ratings yet

- CHAPTER 2 - PPT Acct 4 MgrsDocument18 pagesCHAPTER 2 - PPT Acct 4 MgrsGondar City Industry Development TeamNo ratings yet

- ACC 312 - Financial Management Lecture NotesDocument239 pagesACC 312 - Financial Management Lecture NotesAmber MomentNo ratings yet

- Final ExamDocument13 pagesFinal ExamddddddaaaaeeeeNo ratings yet

- Business Unit 3 NotesDocument45 pagesBusiness Unit 3 Notesamir dargahiNo ratings yet

- Research Paper On Financial Performance AnalysisDocument7 pagesResearch Paper On Financial Performance AnalysisxfeivdsifNo ratings yet

- Solution To P23.5 and P24.1Document5 pagesSolution To P23.5 and P24.1Fiyo DarmawanNo ratings yet

- Class-Xii Accountancy (2020-2021) General InstructionsDocument10 pagesClass-Xii Accountancy (2020-2021) General InstructionsSaad AhmadNo ratings yet