Professional Documents

Culture Documents

Bits and Pieces LTD

Bits and Pieces LTD

Uploaded by

Andrea SalazarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bits and Pieces LTD

Bits and Pieces LTD

Uploaded by

Andrea SalazarCopyright:

Available Formats

Bits and Pieces Ltd runs a hardware store supplying items to the wholesale trade.

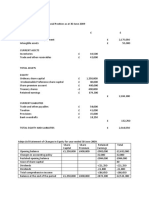

The company’s trial balance at 30 April 20X8

before any final adjustments have been made is as follows:

SALDOS AJUSTES SALDO AJUSTADO

DETALLE

DEUDOR ACREEDOR DEBE HABER DEUDOR ACREEDOR

SHOP FITTINGS: COST £ 100,000

PROVISION FOR DEPRECIATION AT 1 MAY 20X7 £ 24,000

DELIVERY VANS: COST £ 65,000

PROVISION FOR DEPRECIATION AT 1 MAY 20X7 £ 23,000

INVENTORY AT 1 MAY 20X7 AT COST £ 74,820

TRADE RECEIVABLES £ 91,250

PROVISION FOR DOUBTFUL DEBTS AT 1 MAY 20X7 £ 2,750

PREPAYMENTS AT 1 MAY 20X7 £ 3,200

CASH AT BANK £ 7,380

TRADE PAYABLES £ 48,400

12% DEBENTURE LOAN REPAYABLE IN 20Y1 £ 50,000

ORDINARY SHARE CAPITAL 70.000 SHARES OF $1 EACH £ 70,000

RETAINED PROFIT AT 1 MAY 20X7 £ 11,280

SALES £ 965,920

PURCHASES £ 643,000

WAGES AND SALARIES £ 39,500

DIRECTOR'S REMUNERATION £ 48,000

RENT £ 21,600

ELECTRICITY £ 11,800

ADMINISTRATION EXPENSES £ 26,750

DISTRIBUTION COSTS £ 57,450

INTERIM DIVIDEND PAID £ 5,600

£ 1,195,350 £ 1,195,350

The following additional information is available:

1. Depreciation is to be provided at the following rates: Shop fittings 10 per cent per year on cost. Delivery vans 20 per cent per year

using the decreasing balance method.

2. Inventory was counted at the close of business on 30 April 20X8 and was valued at cost, £71,220. This figure included £1,580 for

some damaged goods, which would normally be sold for £3,250. They were sold in a clearance sale in May 20X8 for £1,200.

3. A customer notified the company on 26 April that he was returning goods of the wrong specification for which he had been invoiced

£5,200. The returned goods were received into the shop on 2 May on which date the return was recorded in the accounting records.

The goods cost Bits and Pieces Ltd £2,580 and were returned in good condition.

4. Bad debts of £2,700 are to be written off, and the provision for doubtful debts is to be increased to £3,450.

5. The figure for prepayments in the trial balance is in respect of two months’ rent paid in advance. As from 1 January 20X8 the

company’s rent increased to £24,000 per year, payable quarterly in advance.

6. An invoice received from a supplier for £5,300 was entered in the accounting records as £3,500 in error, and this sum was paid to

the supplier.

7. Provision is to be made for the audit fee of £3,000 and for a full year’s interest on the debenture loan.

8. Corporation tax on the profit for the year to 30 April 20X8 is estimated to be £24,000.

Required

a. An income statement for Bits and Pieces Ltd for the year ended 30 April 20X8, and its statement of financial position as at 30 April

20X8, in a form suitable for the directors.

b. Bits and Pieces Ltd recently appointed a new finance director. Explain to this director why depreciation is charged on the

company’s nonfixed assets, and suggest possible reasons for the differences in the treatment of shop fittings and delivery vans.

You might also like

- The Brex Boys' Uncomfortable ReckoningDocument10 pagesThe Brex Boys' Uncomfortable ReckoningejmottaNo ratings yet

- HSE Policy Statement A4 ENGLISH WebDocument1 pageHSE Policy Statement A4 ENGLISH WebHunter100% (1)

- Anureev TestDocument49 pagesAnureev TestНиколай Илиаев80% (5)

- Sole Traders QuestionsDocument5 pagesSole Traders QuestionsJawad Hasan0% (1)

- CFAB - Accounting - QB - Chapter 9Document13 pagesCFAB - Accounting - QB - Chapter 9Nga Đào Thị Hằng100% (1)

- CFAB - Accounting - QB - Chapter 10Document14 pagesCFAB - Accounting - QB - Chapter 10Huy NguyenNo ratings yet

- Equity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionDocument144 pagesEquity Risk Premiums (ERP) Determinants, Estimation, and Implications - The 2021 EditionAndrea SalazarNo ratings yet

- Seminar 1 2020 SolutionsDocument2 pagesSeminar 1 2020 SolutionsAsad Ehsan WarraichNo ratings yet

- ACW366 - Tutorial Exercises 6 PDFDocument7 pagesACW366 - Tutorial Exercises 6 PDFMERINANo ratings yet

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- Danelia Testbanks Quiz 2345Document46 pagesDanelia Testbanks Quiz 2345Tinatini BakashviliNo ratings yet

- ICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPDocument28 pagesICAEW 2021 Chapter 15: Sole Trader and Partnership Financial Statements Under UK GAAPHankhnilNo ratings yet

- CFAB Accounting QB Chapter 10 C601Document14 pagesCFAB Accounting QB Chapter 10 C601VânAnh NguyễnNo ratings yet

- Unit 3 - Business Finance - AppendixDocument5 pagesUnit 3 - Business Finance - Appendixmhmir9.95No ratings yet

- IB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsDocument7 pagesIB124 Introduction To Financial Accounting Autumn Term 2020 Seminar QuestionsS3F1No ratings yet

- Accounting EQB Chapter 15 QsDocument41 pagesAccounting EQB Chapter 15 Qsnatalia hariniNo ratings yet

- Chapter 7 ExtraDocument8 pagesChapter 7 ExtraMai Lâm LêNo ratings yet

- FA2 Inventories - QDocument8 pagesFA2 Inventories - Qmiss ainaNo ratings yet

- FA 2 - Essay QuestionDocument4 pagesFA 2 - Essay QuestioncalebNo ratings yet

- Cash FlowDocument5 pagesCash FlowDivesh BabariaNo ratings yet

- trắc nghiệm part 2Document39 pagestrắc nghiệm part 2HankhnilNo ratings yet

- Final - Unit - 10 - Financial Accounting - TrangDocument5 pagesFinal - Unit - 10 - Financial Accounting - TrangKevin PhạmNo ratings yet

- c11 SelftestDocument4 pagesc11 Selftesthvu65291No ratings yet

- GA 04042022 - QuestionDocument3 pagesGA 04042022 - QuestionSakamoto HiyoriNo ratings yet

- Sec 03 - A2Document8 pagesSec 03 - A2MahmozNo ratings yet

- AccountingDocument19 pagesAccountinggigigiNo ratings yet

- CRANBERRY PLC Scenario Chapter 12Document3 pagesCRANBERRY PLC Scenario Chapter 12Nguyễn Thanh Thanh HươngNo ratings yet

- Live Session 4 - QuestionsDocument4 pagesLive Session 4 - QuestionsJack LewisNo ratings yet

- Shakespeare y KofurnDocument1 pageShakespeare y KofurnAndrea SalazarNo ratings yet

- Accounts Assignment - 041915Document5 pagesAccounts Assignment - 041915Peter irunaNo ratings yet

- 4 Tangible Fixed Assets: DR CR 000 000Document7 pages4 Tangible Fixed Assets: DR CR 000 000Fazal Rehman MandokhailNo ratings yet

- Contentitemfile Clakzwt9mx9sk0a212lma0ytv PDFDocument4 pagesContentitemfile Clakzwt9mx9sk0a212lma0ytv PDFJoseph OndariNo ratings yet

- Final Account WorksheetDocument4 pagesFinal Account Worksheetravikumarbadass0No ratings yet

- Pengakun CH 09Document10 pagesPengakun CH 09nadia salsabilaNo ratings yet

- Chapter 5 Exercises-Exercise BankDocument9 pagesChapter 5 Exercises-Exercise BankPATRICIUS ALAN WIRAYUDHA KUSUMNo ratings yet

- Acounting Revision QuestionsDocument10 pagesAcounting Revision QuestionsJoseph KabiruNo ratings yet

- Bản inDocument23 pagesBản inTrang VũNo ratings yet

- Ent 2 5Document6 pagesEnt 2 5mukembomeddie8No ratings yet

- Quiz 5 - QuesDocument14 pagesQuiz 5 - QuesPhán Tiêu TiềnNo ratings yet

- Foreign Exchange Question With SolutionsDocument3 pagesForeign Exchange Question With SolutionsPrince Daniels TutorNo ratings yet

- SECTION 3 (80 Marks) : Page 8 of 8Document1 pageSECTION 3 (80 Marks) : Page 8 of 8Muhammad Salim Ullah KhanNo ratings yet

- Review Questions Volume 1 - Chapter 28Document2 pagesReview Questions Volume 1 - Chapter 28YelenochkaNo ratings yet

- Chapter IAS 02 - Chapter 7 -QB only câu hỏiDocument7 pagesChapter IAS 02 - Chapter 7 -QB only câu hỏiMai LinhNo ratings yet

- Total Mark: 32.5Document5 pagesTotal Mark: 32.5phithuhang2909No ratings yet

- CAPI Suggested June 2014Document25 pagesCAPI Suggested June 2014Meghraj AryalNo ratings yet

- AccountingDocument12 pagesAccountingsunlightNo ratings yet

- ACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021Document3 pagesACCT3050 Comprehensive Question Graded (20%) Updated 28 March 2021TashaNo ratings yet

- Financial Accounting AssignmentDocument6 pagesFinancial Accounting Assignmentpunya guptaNo ratings yet

- FMA Question PackDocument67 pagesFMA Question PackAhamed NabeelNo ratings yet

- Chapter 1 - Question 1Document4 pagesChapter 1 - Question 1Sophie ChopraNo ratings yet

- Group Assignment On FSDocument4 pagesGroup Assignment On FSHuyền TrangNo ratings yet

- Task 2 12024Document2 pagesTask 2 12024poeou sanNo ratings yet

- Accounting - Higherlevel: Leaving Certificate Examination, 2000Document10 pagesAccounting - Higherlevel: Leaving Certificate Examination, 2000meelas123No ratings yet

- Accounting Final Mock 1 2023Document13 pagesAccounting Final Mock 1 2023diya pNo ratings yet

- Zoom SlidesDocument10 pagesZoom SlidesTuấn Kiệt NguyễnNo ratings yet

- Accounting: The Institute of Chartered Accountants in England and WalesDocument26 pagesAccounting: The Institute of Chartered Accountants in England and WalesPhuong ThanhNo ratings yet

- L7 Consolidation 3 Lecture ExamplesDocument4 pagesL7 Consolidation 3 Lecture ExamplesrohmasspamNo ratings yet

- Lecture 6 - Practice Questions-1Document4 pagesLecture 6 - Practice Questions-1donkhalif13No ratings yet

- RU QuestionSolutionDocument2 pagesRU QuestionSolutioned900No ratings yet

- TAXATION 2B Past PaperDocument8 pagesTAXATION 2B Past PaperAmithNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- Unit IDocument10 pagesUnit IkuselvNo ratings yet

- Cap 3 - MT-PerrigoDocument4 pagesCap 3 - MT-PerrigoAndrea SalazarNo ratings yet

- Charter - Time WarnerDocument3 pagesCharter - Time WarnerAndrea SalazarNo ratings yet

- Shakespeare y KofurnDocument1 pageShakespeare y KofurnAndrea SalazarNo ratings yet

- Novena Shirts LimitedDocument1 pageNovena Shirts LimitedAndrea SalazarNo ratings yet

- Jagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheDocument1 pageJagger PLC Prepares Its Financial Statements For The Year Ended 31 March. The Company Has Extracted TheAndrea SalazarNo ratings yet

- Jagger y SidneyDocument1 pageJagger y SidneyAndrea SalazarNo ratings yet

- Invention of The InternetDocument1 pageInvention of The InternetAndrea SalazarNo ratings yet

- MIDCDocument5 pagesMIDCAtharvaNo ratings yet

- 2008 Macro FRQDocument8 pages2008 Macro FRQsachinneha143No ratings yet

- Ipsas 1 - Handbook Ipsas 2018 Vol 1Document922 pagesIpsas 1 - Handbook Ipsas 2018 Vol 1anisaNo ratings yet

- Advancing Sustainable Urban Transformation: Mccormick, Kes Anderberg, Stefan Coenen, Lars Neij, LenaDocument23 pagesAdvancing Sustainable Urban Transformation: Mccormick, Kes Anderberg, Stefan Coenen, Lars Neij, LenaZiroat ToshevaNo ratings yet

- Basic Information About YemenDocument24 pagesBasic Information About Yemenمؤسسة رفعة للتطوير المجتمعي والبشري ذمار - الجمهورية اليمنية. Rifa’ Organization for Community anNo ratings yet

- Luxasia Pte. Ltd. and Its Subsidiaries Directors' Statement and Financial Statements Year Ended December 31, 2018Document73 pagesLuxasia Pte. Ltd. and Its Subsidiaries Directors' Statement and Financial Statements Year Ended December 31, 2018Joyce ChongNo ratings yet

- Agriculture On Economic DevelopmentDocument16 pagesAgriculture On Economic DevelopmentAGRI CULTURENo ratings yet

- Retail PromotionDocument25 pagesRetail Promotionshahinamalick50% (2)

- Full Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full ChapterDocument36 pagesFull Download Advanced Accounting Beams 12th Edition Solutions Manual PDF Full Chapterbeatencadiemha94100% (21)

- Advacc Midterm ExamDocument13 pagesAdvacc Midterm ExamJosh TanNo ratings yet

- Banking & Economy PDF - March 2021 by AffairsCloud 1Document218 pagesBanking & Economy PDF - March 2021 by AffairsCloud 1most funny videoNo ratings yet

- Iimjobs Harshita GoenkaDocument1 pageIimjobs Harshita Goenkasanandreas989898No ratings yet

- Backward and Forward Linkage Between The Agriculture, EcoDocument11 pagesBackward and Forward Linkage Between The Agriculture, Ecomediquip50% (4)

- تحليل نماذج الادارة الاستراتيجية للموارد البشريةDocument17 pagesتحليل نماذج الادارة الاستراتيجية للموارد البشريةkarim lehroucheNo ratings yet

- Ch-Iii BDocument51 pagesCh-Iii BrresaNo ratings yet

- Market Structure Worksheets and AnswersDocument16 pagesMarket Structure Worksheets and AnswersNate ChenNo ratings yet

- Multiple-Choice QuestionsDocument9 pagesMultiple-Choice QuestionsEsra'a Al-momaniNo ratings yet

- Sumski Fond AustrijeDocument11 pagesSumski Fond AustrijeBogdan BukaraNo ratings yet

- A COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205Document10 pagesA COMPARATIVE STUDY OF HOME LOANS OF STATE BANK OF INDIA S B I AND HOUSING DEVELOPMENT FINANCE CORPORATION H D F C BANKS AN EMPERICAL STUDY OF BATHINDA PUNJAB Ijariie6205prakash kambleNo ratings yet

- Bài tập ôn tập chapter 4 Ms.TrangDocument8 pagesBài tập ôn tập chapter 4 Ms.TrangNgọc Trung Học 20No ratings yet

- Course Code Part Sem Paper Code Paper NameDocument3 pagesCourse Code Part Sem Paper Code Paper Nameshiv mishraNo ratings yet

- Kayonza 2013-2018Document101 pagesKayonza 2013-2018avinash kotaNo ratings yet

- Notes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinDocument10 pagesNotes: Taxation On Individuals: Individual Taxpayers Are Natural Persons With Income Derived From WithinJohn BanzonNo ratings yet

- NSSFDocument170 pagesNSSFIbra Said100% (1)

- A Note On Islamic Economics-Abbas Mirakhor PDFDocument56 pagesA Note On Islamic Economics-Abbas Mirakhor PDFPurnama PutraNo ratings yet

- Cornerstones of Financial Accounting 2nd Edition Rich Test BankDocument25 pagesCornerstones of Financial Accounting 2nd Edition Rich Test BankCynthiaWhiteisyp100% (54)

- Cooperative SocietyDocument10 pagesCooperative SocietyMeenakshi HandaNo ratings yet