Professional Documents

Culture Documents

Acc 106/dec 2019/quiz 2

Acc 106/dec 2019/quiz 2

Uploaded by

NURAIN HANIS BINTI ARIFFOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Acc 106/dec 2019/quiz 2

Acc 106/dec 2019/quiz 2

Uploaded by

NURAIN HANIS BINTI ARIFFCopyright:

Available Formats

ACC 106/DEC 2019/QUIZ 2

INTRODUCTION TO FINANCIAL ACCOUNTING AND REPORTING

(ACC106)

QUIZ 2: BANK RECONCILIATION STATEMENT (5%)

The following records are extracted from the books of Gemalai Resort Sdn. Bhd.:

Gemalai Resort Sdn Bhd

Bank Reconciliation Statement as at 30 October 2019

RM RM

Balance as per adjusted cash book 10,060

Add: Unpresented cheques

Cheque No. 110378 7,450

Less: Uncredited cheques

Cheque No. 454777 (5,445)

Balance as per bank statement 12,065

Cash Receipt Journal

Date Details Cheque No. Amount (RM)

November

4 Areena 787852 200

6 Sales 712084 2,442

7 Ieda 414501 2,000

9 Sales 500644 400

15 Sendu Group Bhd. 616877 10,800

27 Azman 110386 2,400

30 Sales 500675 500

18,742

Cash Payment Journal

Date Details Cheque No. Amount (RM)

November

1 Purchases 110381 500

1 Rental 110382 2,640

2 Utility 110383 400

15 Purchases 110384 1,380

20 Purchases 110385 5,000

30 Salary 110387 2,000

11,920

ACC 106/DEC 2019/QUIZ 2

At the beginning of December 2019, Gemalai Resort Sdn. Bhd. received the bank

statement from Supperrich Bank Berhad for the month of November 2019.

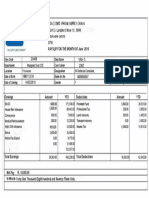

Supperrich Bank Berhad

Bank Statement as at 30 November 2019

Date Description Cheque Debit Credit Balance

No. (RM) (RM) (RM)

November

1 Balance b/f 12,065

1 Deposit 454777 5,445 17,510

1 Cheque clearing 110381 2,500 15,010

1 Cheque clearing 110382 2,460 12,550

2 Deposit 110383 400 12,950

3 Credit transfer 2,100 15,050

4 Deposit 787852 200 15,250

6 Deposit 712084 2,442 17,692

7 Deposit 414501 2,000 19,692

9 Deposit 500644 400 20,092

10 Dishonoured cheque 7,250 12,842

15 Cheque clearing 110384 1,380 11,462

15 Deposit 616877 10,800 22,262

20 Cheque clearing 110385 5,000 17,262

25 Direct debit 1,000 16,262

27 Cheque clearing 110386 2,400 13,862

28 Standing order 850 13,012

30 Bank interest 200 13,212

30 Bank charges 140 13,072

From the above records, Gemalai Resort Sdn. Bhd. noticed several errors.

a) The account clerk had wrongly recorded cheque no. 110386 as receipt instead

of payment.

b) In Cash Payment Journal, the account clerk had wrongly recorded the amount of

cheque no. 110381.

c) The bank had wrongly credited cheque no. 110383 instead of debit.

d) The bank also mistakenly recorded the amount of cheque no. 110382.

Required:

a. Prepare both unadjusted and adjusted cash book.

b. Prepare Bank Reconciliation Statement as at 30 November 2019.

c. Answer questions in i-Learn portal.

You might also like

- Operations Management 6th Edition Test Bank Nigel SlackDocument8 pagesOperations Management 6th Edition Test Bank Nigel SlackEunice Cheslock100% (45)

- Vincent Fabella 1Document29 pagesVincent Fabella 1James Sy67% (3)

- Orca Share Media1583067447855Document6 pagesOrca Share Media1583067447855Zoya Romelle Besmonte100% (1)

- CHAPTER 3.1 - Strategic Marketing PlanningDocument55 pagesCHAPTER 3.1 - Strategic Marketing PlanningNURAIN HANIS BINTI ARIFF100% (1)

- Maruti Suzuki Final ProjectDocument63 pagesMaruti Suzuki Final ProjectMilind Singanjude75% (4)

- Extra For Final (Accounting)Document9 pagesExtra For Final (Accounting)smilyalieyna7No ratings yet

- KMKTDocument7 pagesKMKTsyahmiafndiNo ratings yet

- Acc117 Test 2 July 2022 - Tapah BRS SSDocument3 pagesAcc117 Test 2 July 2022 - Tapah BRS SSNajmuddin AzuddinNo ratings yet

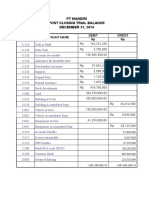

- Neraca Saldo PT - Farmaindo: No. Akun Nama Debet KreditDocument3 pagesNeraca Saldo PT - Farmaindo: No. Akun Nama Debet KreditNurma Annisa FitriaNo ratings yet

- PDJM NEW KGJGJGJKGJGJGDocument72 pagesPDJM NEW KGJGJGJKGJGJGNabila Intan SariNo ratings yet

- Topic 6 Multiple Choice QuestionDocument8 pagesTopic 6 Multiple Choice Question黄颀桓No ratings yet

- Cash ProblemsDocument5 pagesCash ProblemsAnna AldaveNo ratings yet

- Solution - Exercise Chapter 7 - ACC117Document3 pagesSolution - Exercise Chapter 7 - ACC117nurhidayah sadonNo ratings yet

- Kunci Jawaban 3Document18 pagesKunci Jawaban 3Mar YaniNo ratings yet

- Acc117 Test 2 Jan2023 - Tapah BRS SSDocument2 pagesAcc117 Test 2 Jan2023 - Tapah BRS SSNajmuddin Azuddin100% (1)

- Contract Agreement For The Installation of 8 Sets Motorized Roll Up DoorDocument3 pagesContract Agreement For The Installation of 8 Sets Motorized Roll Up DoorMelady Sison CequeñaNo ratings yet

- Rizal Heavy BombersDocument6 pagesRizal Heavy BombersArmandoNo ratings yet

- Tax Invoice/Receipt: Product and Description Qty Reference No: EGOVE8WBTI Main Applicant: Safiatou Diallo (18.10.2001)Document1 pageTax Invoice/Receipt: Product and Description Qty Reference No: EGOVE8WBTI Main Applicant: Safiatou Diallo (18.10.2001)MoutagaNo ratings yet

- GJ No. 1Document6 pagesGJ No. 1AN AdeNo ratings yet

- Practice Competency 2021 2022 1 5 1Document5 pagesPractice Competency 2021 2022 1 5 1Darlyn MaeNo ratings yet

- Lecture Workings - 29.03.2023Document3 pagesLecture Workings - 29.03.2023kasun SenadheeraNo ratings yet

- BUS FPX4060 - Assessment3 1Document10 pagesBUS FPX4060 - Assessment3 1AA TsolScholarNo ratings yet

- 132/133, Landdros Mare ST, 0699: Polokwane CentralDocument1 page132/133, Landdros Mare ST, 0699: Polokwane CentralMichael Bone-crusher PhiriNo ratings yet

- HR Welfare Society 13-10-13Document11 pagesHR Welfare Society 13-10-13WazedZayedNo ratings yet

- UntitledDocument49 pagesUntitledAdinda Lidya Rahayu SapphiraNo ratings yet

- JDA PayslipDocument1 pageJDA Payslipphaninv1294No ratings yet

- Jamuna Bank: Dailv Statement of AffairsDocument14 pagesJamuna Bank: Dailv Statement of AffairsArman Hossain WarsiNo ratings yet

- Question On Bank ReconciliationDocument2 pagesQuestion On Bank ReconciliationNor AmalinaNo ratings yet

- Materi Sebelum UTS Praktikum Akuntansi RemedDocument51 pagesMateri Sebelum UTS Praktikum Akuntansi Remedannisa rochmahNo ratings yet

- PT Tiga Cahaya PutraDocument78 pagesPT Tiga Cahaya PutraBambang RisNo ratings yet

- Chapter7 BankReconDocument32 pagesChapter7 BankReconShingson MuzadzieNo ratings yet

- Condensed Quarterly Accounts (Un-Audited)Document10 pagesCondensed Quarterly Accounts (Un-Audited)Perah ShaikhNo ratings yet

- SPREEDSHEETDocument27 pagesSPREEDSHEETnigussieabagazNo ratings yet

- 110309_2023_Exam Soln for StreamDocument8 pages110309_2023_Exam Soln for Streamjoehe2625No ratings yet

- Kunci Ukk 2022 P2-ModifikasiDocument86 pagesKunci Ukk 2022 P2-ModifikasiAlfata RFNo ratings yet

- Book 1Document1 pageBook 1yuhazelmaeNo ratings yet

- Workshop For L2: Financial Statement Analysis: Ebit 1,230 1,607 1,858Document2 pagesWorkshop For L2: Financial Statement Analysis: Ebit 1,230 1,607 1,858Linh NguyễnNo ratings yet

- Chapter 3 Sample ProblemDocument2 pagesChapter 3 Sample ProblemGalang, Princess T.No ratings yet

- Aamir Ali Bba Viii ADocument9 pagesAamir Ali Bba Viii Aaamir aliNo ratings yet

- 20 Devt Fund PPSBDocument103 pages20 Devt Fund PPSBAljo FernandezNo ratings yet

- Week 5 Tutorial Questions and SolutionsDocument12 pagesWeek 5 Tutorial Questions and Solutionsمزمل اشرف ملکNo ratings yet

- Statement - PDF - Debit Card - Credit CardDocument3 pagesStatement - PDF - Debit Card - Credit Cardannawiewiora79No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Ifs 2024Document1 pageIfs 2024rafiqueahmad9898No ratings yet

- Ibra Fa 1Document8 pagesIbra Fa 1Michael KitongaNo ratings yet

- Tugas Kuis Remed Pa 1Document9 pagesTugas Kuis Remed Pa 1Ibangg bangNo ratings yet

- Praktikum FinancialDocument22 pagesPraktikum Financiallisa amaliaNo ratings yet

- Attachment computation sakshi sahni 2023-2024Document4 pagesAttachment computation sakshi sahni 2023-2024av1225No ratings yet

- As Per Our Report Attached For and On Behalf of The Board of DirectorsDocument26 pagesAs Per Our Report Attached For and On Behalf of The Board of DirectorsAnup Kumar SharmaNo ratings yet

- Datasets 523573 961112 Costco-DataDocument4 pagesDatasets 523573 961112 Costco-DataAnish DalmiaNo ratings yet

- The Correct Cash and Cash Equivalent Balance On December 31, 2018 IsDocument7 pagesThe Correct Cash and Cash Equivalent Balance On December 31, 2018 IsAldrin ZolinaNo ratings yet

- Manufaktur DJDocument39 pagesManufaktur DJDIA JULIANTINo ratings yet

- Ljukk SiswaDocument18 pagesLjukk SiswaPeachybananaNo ratings yet

- PT Bateeq CantiqDocument89 pagesPT Bateeq CantiqMuhammad Anwar Hamkan MaulanaNo ratings yet

- Kunci Ukk 2022 P2-ModifikasiDocument86 pagesKunci Ukk 2022 P2-ModifikasimukhlisNo ratings yet

- Tab C (1 of 2) - Condensed Financial StatementsDocument4 pagesTab C (1 of 2) - Condensed Financial Statementsarellano lawschoolNo ratings yet

- Lembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Document24 pagesLembar Kerja Mengelola Buku Jurnal: Praktek Akuntansi Keuangan (Manual)Sri UtamiNo ratings yet

- Cash Flow StatementDocument3 pagesCash Flow StatementPratik ParmarNo ratings yet

- Acc PaperDocument4 pagesAcc PaperYUSRINA MOHD YUSOFFNo ratings yet

- NM1603 Resit - ISBSDocument4 pagesNM1603 Resit - ISBSrecovaNo ratings yet

- Tab D - Detailed Financial StatementsDocument13 pagesTab D - Detailed Financial Statementsarellano lawschoolNo ratings yet

- Trial Balance FinalDocument2 pagesTrial Balance FinalsenbrosNo ratings yet

- MCT Berhad Annual Report 2018 (PM)Document204 pagesMCT Berhad Annual Report 2018 (PM)NURAIN HANIS BINTI ARIFFNo ratings yet

- Rem213 Kuliah 9Document13 pagesRem213 Kuliah 9NURAIN HANIS BINTI ARIFFNo ratings yet

- RES 551 (B) : Conventional TechniqueDocument16 pagesRES 551 (B) : Conventional TechniqueNURAIN HANIS BINTI ARIFFNo ratings yet

- Skypark Floor Plan (Tower 5 & Tower 6)Document17 pagesSkypark Floor Plan (Tower 5 & Tower 6)NURAIN HANIS BINTI ARIFFNo ratings yet

- Script ElcDocument4 pagesScript ElcNURAIN HANIS BINTI ARIFFNo ratings yet

- UNITED ALLIED EMPIRE SDN BHD v. PENGARAH TANAH 2017 8 CLJ 173Document22 pagesUNITED ALLIED EMPIRE SDN BHD v. PENGARAH TANAH 2017 8 CLJ 173NURAIN HANIS BINTI ARIFFNo ratings yet

- Communicating To Large Power Customers: VOL: 02 /11 KDN: PP8515/1/2012Document20 pagesCommunicating To Large Power Customers: VOL: 02 /11 KDN: PP8515/1/2012NURAIN HANIS BINTI ARIFFNo ratings yet

- Lecture 3 RES551 (B) - Conv Technique Case Study 1Document16 pagesLecture 3 RES551 (B) - Conv Technique Case Study 1NURAIN HANIS BINTI ARIFFNo ratings yet

- SPEAK MANDARIN FORMULA 29 PagesDocument29 pagesSPEAK MANDARIN FORMULA 29 PagesNURAIN HANIS BINTI ARIFF100% (1)

- Lecture 1 (B) - Introduction To Development AppraisalDocument17 pagesLecture 1 (B) - Introduction To Development AppraisalNURAIN HANIS BINTI ARIFFNo ratings yet

- REM313 Jun 2018Document4 pagesREM313 Jun 2018NURAIN HANIS BINTI ARIFFNo ratings yet

- Introduction To Property DevelopmentDocument13 pagesIntroduction To Property DevelopmentNURAIN HANIS BINTI ARIFFNo ratings yet

- Perak-1 PDFDocument94 pagesPerak-1 PDFNURAIN HANIS BINTI ARIFFNo ratings yet

- Principles and Practice of MarketingDocument16 pagesPrinciples and Practice of MarketingNURAIN HANIS BINTI ARIFFNo ratings yet

- REM213 Kuliah 3Document48 pagesREM213 Kuliah 3NURAIN HANIS BINTI ARIFF100% (1)

- Week 3 - The MarketDocument24 pagesWeek 3 - The MarketNURAIN HANIS BINTI ARIFFNo ratings yet

- REM317 Topic 3 Act 757 1Document37 pagesREM317 Topic 3 Act 757 1NURAIN HANIS BINTI ARIFFNo ratings yet

- Property Development FinanceDocument8 pagesProperty Development FinanceNURAIN HANIS BINTI ARIFFNo ratings yet

- 4 - Notes of Land EconomicsDocument36 pages4 - Notes of Land EconomicsNURAIN HANIS BINTI ARIFFNo ratings yet

- Py July 2017 (Res519) PDFDocument3 pagesPy July 2017 (Res519) PDFNURAIN HANIS BINTI ARIFFNo ratings yet

- Assignment REM315Document4 pagesAssignment REM315NURAIN HANIS BINTI ARIFFNo ratings yet

- Week 3 - Real Estate MarketingDocument18 pagesWeek 3 - Real Estate MarketingNURAIN HANIS BINTI ARIFFNo ratings yet

- The Marketing Environment Dr. Hilmi MasriDocument50 pagesThe Marketing Environment Dr. Hilmi MasriNURAIN HANIS BINTI ARIFFNo ratings yet

- Week 4 - Marketing Concept OrientationDocument32 pagesWeek 4 - Marketing Concept OrientationNURAIN HANIS BINTI ARIFFNo ratings yet

- Souce Najib LeadershipDocument12 pagesSouce Najib LeadershipSharanya Ramasamy100% (1)

- WWW Thestalkingofsarahdegeyter Com 2020-09-26 Wikileaks Founder Julian Assange RDocument6 pagesWWW Thestalkingofsarahdegeyter Com 2020-09-26 Wikileaks Founder Julian Assange RKeith LankfordNo ratings yet

- Marketing Plan of AirconDocument16 pagesMarketing Plan of AirconJewel Virata100% (1)

- Surface WarfareDocument65 pagesSurface WarfareLobbyist_Myo100% (5)

- Licom AlphaCamDocument27 pagesLicom AlphaCamdrx11100% (1)

- Chap 6-Supply, Demand & Government PoliciesDocument30 pagesChap 6-Supply, Demand & Government PoliciesKhánh AnNo ratings yet

- DS - 20201123 - MVS3150-LV Datasheet - V1.2.2 - ENDocument2 pagesDS - 20201123 - MVS3150-LV Datasheet - V1.2.2 - ENGabooNo ratings yet

- Lecture Notes-Basic Electrical and Electronics Engineering Notes PDFDocument30 pagesLecture Notes-Basic Electrical and Electronics Engineering Notes PDFMDR PRAPHU100% (1)

- History of Insurance-WWW - SELUR.TKDocument9 pagesHistory of Insurance-WWW - SELUR.TKselurtimaNo ratings yet

- Building SpecificationsDocument5 pagesBuilding Specificationsjologscresencia100% (1)

- 570 Academic Word ListDocument5 pages570 Academic Word ListTrà MyNo ratings yet

- Vol.11 Issue 46 March 23-29, 2019Document32 pagesVol.11 Issue 46 March 23-29, 2019Thesouthasian TimesNo ratings yet

- Bearing Supports-1Document145 pagesBearing Supports-1Papaleguas gamesNo ratings yet

- Cambridge O Level: Business Studies 7115/21Document21 pagesCambridge O Level: Business Studies 7115/21mariejocalouNo ratings yet

- Solar Charge Controller User Manual: I Functional CharacteristicsDocument5 pagesSolar Charge Controller User Manual: I Functional CharacteristicsAmer WarrakNo ratings yet

- Adaptive Multi RateDocument16 pagesAdaptive Multi RateRogelio HernandezNo ratings yet

- Athul AjiDocument5 pagesAthul AjiAsif SNo ratings yet

- Succeeding at WorkDocument11 pagesSucceeding at WorkLai RaymundoNo ratings yet

- State of The Art Review of CO2 Storage Site Selection and Characterisation MethodsDocument132 pagesState of The Art Review of CO2 Storage Site Selection and Characterisation MethodsApostolos ArvanitisNo ratings yet

- Investment and Portfolio Management: ACFN 3201Document16 pagesInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNo ratings yet

- Chapter 13 - Basic DerivativesDocument59 pagesChapter 13 - Basic Derivativesjelyn bermudezNo ratings yet

- Visual IdentityDocument38 pagesVisual IdentityyannaNo ratings yet

- Wagner Power Steamer ManualDocument8 pagesWagner Power Steamer ManualagsmarioNo ratings yet

- Sagarika Sinha: Senior Systems Engineer - Infosys, PuneDocument1 pageSagarika Sinha: Senior Systems Engineer - Infosys, PunePari RastogiNo ratings yet

- Amendment of Information, Formal Vs SubstantialDocument2 pagesAmendment of Information, Formal Vs SubstantialNikkoCataquiz100% (3)

- Input Data Required For Pipe Stress AnalysisDocument4 pagesInput Data Required For Pipe Stress Analysisnor azman ab aziz100% (1)

- ICC Air 2009 CL387 - SrpskiDocument2 pagesICC Air 2009 CL387 - SrpskiZoran DimitrijevicNo ratings yet

- Customer Satisfaction Employee InvolvementDocument35 pagesCustomer Satisfaction Employee InvolvementSARA JANE CAMBRONERONo ratings yet