Professional Documents

Culture Documents

Taxable Income: Credit", As Follows

Taxable Income: Credit", As Follows

Uploaded by

Suzette VillalinoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Taxable Income: Credit", As Follows

Taxable Income: Credit", As Follows

Uploaded by

Suzette VillalinoCopyright:

Available Formats

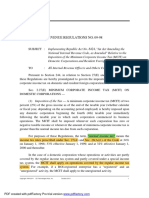

ATARA DAMA INC.

is a corporation incorporated and existing under and by virtue

of laws of the Republic of the Philippines, with business address at 1122

General Luna Street, Paco. Manila. Respondent on the other hand, is the duly

appointed Commissioner of Internal Revenue, with power, among others, 10 act

upon claims for refund or tax credit of overpaid internal revenue taxes, with

office address at the Fifth Floor, BIR National Office Building, BIR Road,

Diliman , Quezon City.

On April 16, 2017, petitioner filed its Annual Income Tax Return (ITR) for the

year ended December 31, 2016 with the Revenue District No. 34 of the Revenue

Region No. 6 of the Bureau of Internal Revenue (BIR), reflecting an income tax

overpayment of P5,159,341 computed as follows:

Sales/Revenues/Receipts/Fees P 28,808,960

Less: Cost of Sales/Services 23,834,605

Gross Income from Operation P 4,974,355

Add: Non-Operating & Other Income 5,375

Total Gross Income P 4,979,730

Less: Deductions P 4,979,730

Taxable Income -

Tax Rate (except MCIT Rate) 35%

Income Tax -

Minimum Corporate Income Tax (MCIT) P 99,595

Aggregate Income Tax Due P 99,595

Less: Tax Credits/Payments

Prior Year's Excess Credits P 2,331,102

Creditable Tax Withheld for the First

Three Quarters

Creditable Tax Withheld for the Fourth

Three Quarters 2,927,834

Total Tax Credits/Payments P 5,258,936)

Tax Payable/(Overpayment) P (5,159,341)

Subsequently, on November 14, 2017, petitioner filed an Annual ITR for the

short period fiscal year ended March 31, 2017, reflecting the income tax

overpayment of P5,159,341 from the previous period as "Prior Year’s Excess

Credit", as follows:

Sales/Revenues/Receipts/Fees 7,489,259

Less: Cost of Sales/Services 6,461,650

Gross Income from Operation 1,027,609

Add: Non-Operating & Other Income 479

Total Gross Income 1,028,088

Less: Deductions 1,206,543

Taxable Income (178,455)

Tax Rate (except MCIT Rate) 35%

Income Tax -

Minimum Corporate Income Tax (MCIT) 20,562

Aggregate Income Tax Due 20,562

Less: Tax Credits/Payments

Prior Year's Excess Credits 5,159,341

Creditable Tax Withheld for the First

1,107,228

Three Quarters

Creditable Tax Withheld for the Fourth

Quarter 6,266,569

Total Tax Credits/Payments 6,266,569

Tax Payable/(Overpayment) (6,246,007)

On the same date, petitioner filed an amended Annual ITR for the short period

fiscal year ended March 31, 2017, reflecting the removal of the amount of the

instant claim in the “Prior Year's Excess Credit”. Thus, the amount thereof

was changed from P5, 159,341 to P2,231,507.

On October 10, 2018, petitioner filed with the respondent's office, a claim

for refund and/or issuance of a Tax Credit Certificate (TCC) in the amount of

P2,927,834, representing the alleged excess and unutilized creditable

withholding taxes for 2016.

In view of the fact that respondent has not acted upon the foregoing claim for

refund/tax credit, petitioner filed with a Petition for Review on April l4,

2019 before the Court in Division.

As per CTA observation, ATARA DAMA INC. had, as of 31 December 2015, an

outstanding amount of P2,331,102 in excess and unutilized creditable

withholding taxes.

For the subsequent taxable year ending 31 December 2016, the total sum of

creditable taxes withheld on the management fees of ATARA DAMA INC. was

P2,927,834. Per its 2016 Annual Income Tax Return (ITR), ATARA DAMA INC.'s

income tax due amounted to P99,105. ATARA DAMA INC. applied its "Prior Year's

Excess Credits" of P2,331, 102 as tax credit against such 2016 Income Tax due,

leaving a balance of P2,231,507 of still unutilized excess creditable tax.

Meanwhile, the creditable taxes withheld for the year 2016 (P2,927,834)

remained intact and unutilized. In said 2016 Annual ITR, ATARA DAMA INC. chose

the option "To be issued a tax credit certificate" with respect to the amount

P2,927,834, representing unutilized excess creditable taxes for the taxable

year ending 31 December 2016. The figures are summarized in the table below:

Taxable Excess Income Tax Less Tax Balance of

Year Creditable Due Tax Credit Payable Excess CWT

Withholding

Tax (CWT)

2015 P 2,331, 102 - - - - - - - - - P 2,231,507

2016 P 2,927,834 P 99, 105 P 99,105 (A P 0 P 2,927,834

(MCIT) portion of the

excess credit of

Php2,33l,102 in

2015)

In the following year, ATARA DAMA INC. changed its taxable period from

calendar year to fiscal year ending on the last day of March. Thus, it filed

on 14 November 2017 an Annual ITR covering the short period from January 1 to

March 31 of 2017. In the original 2017 Annual ITR, ATARA DAMA INC. opted to

carry over as "Prior Year's Excess Credits" the total amount of P5,159,341

which included the 2016 unutilized creditable withholding tax of P2,927,834.

ATARA DAMA INC. amended the return by excluding the sum of P2,927,834 under

the line "Prior Year's Excess Credits" which amount is the subject of the

refund claim.

1. How much refund can the company claim from of its 2016 excess tax credits

when it filed its income tax return indicating the option of carry-over?

a. P2,927,834 c. P2,331,102

b. P5,159,341 d. P0

2. How much can the company carry-over from of its 2016 excess tax credits

when it filed its income tax return March 31, 2017?

a. P2,927,834 c. P2,231,507

b. P5,159,341 d. P2,331,102

3. The “irrevocability rule” in taxpayer’s remedy for overpaid income tax

applies to

a. Carry-over option c. Both A and B

b. Refund option d. Neither A nor B

4. Examine the truth or falsity of the following remedies for excess VAT

payments:

I. Unused input VAT from regular VAT transaction may be refunded.

II. Unused input VAT from VAT-exempt transactions are allowed as tax

credit against output VAT from regular sales.

III. Excess input VAT from zero-rated transactions may be refunded or

carried-over.

IV. VAT refund claims should be made within 2 years from month of sale.

V. The taxpayer may file VAT refund with the CIR or the CTA.

VI. The CIR has 90 days to decide VAT claims.

VII. A taxpayer should file before CTA deemed inaction of the CIR within

30 days after the lapse of the 90-day period, otherwise the VAT claim

will be denied.

Which is incorrect?

a. I is incorrect; II, III VI are correct

b. II, VI and VII are correct; IV is incorrect

c. III, VI, and VII are correct

d. IV, V, VI are incorrect; III is correct

5. Absence of Letter of Authority makes a tax assessment

a. Rescissible c. Unenforceable

b. Voidable d. Void

6. These are administrative rulings, more specific and less general

interpretations of tax laws issued from time to time by CIR.

a. BIR Ruling c. Revenue regulation

b. Revenue Orders d. Revenue Memorandum Circulars

7. The national government elects to tax a particular area, impliedly

withholding from the local government the delegated power to tax the same

field.

a. Doctrine of processual presumption

b. Doctrine of regularity

c. Strictissimi juris

d. Doctrine of preemption

Assume these facts for loss of property used in business:

Acquisition cost P100,000

Accumulated depreciation 90,000

Estimated remaining life 5 years

Replacement cost of damaged 5,000

portion

8. How much is the deductible loss for tax purposes?

a. P5,000 c. P90,000

b. P10,000 d. P100,000

9. What is the new cost basis of the property?

a. P10,000 c. P15,000

b. P5,000 d. P0

10. Lalala bought shares of stock in 2017 at a cost of P100,000. He donated

these shares to Lololo on January 1, 2018, during which time, the said

shares have a fair market value of P1,000,000 and on the basis of such fair

market value, Lalala paid the corresponding donor’s tax. Lololo sold the

shares on January 1, 2019 for a consideration of P2,000,000.

Compute the capital gains tax.

a. P150,000 d. P240,000

b. P285,000 c. P300,000

11. Mr. X, a resident of the Province of Leyte, sold vast track of lands in

Ilocos Province. The lands, as assessed in the local office and per CIR’s

record, value at around P50,000,000 and P60,000,000, respectively. The same

property was sold for P100,000,000.

Compute the tax liability of Mr. X.

a. P6,000,000 c. P6,500,000

b. P7,500,000 d. P8,000,000

12. Alcatraz reported the following items for the taxable year:

Income from deposit substitute P 10,000

Interest income from bonds of a domestic corporation 23,000

Property dividend declared by a foreign corporation 40,000

Stock dividend declared by a domestic corporation 50,000

Compensation income, net of P10,000 withholding tax 80,000

Prize on beauty contest 15,000

Royalties from books 24,000

Interest income on personal loans granted to a friend 8,000

Salaries from a general professional partnership 30,000

Salaries from a business partnership 20,000

Compute the total amount of income subject to final tax.

a. P89,000 c. P49,000

b. P99,000 d. P69,000

Princess KT has been assessed deficiency income tax P1,000,000, exclusive

of interest and surcharges, for the taxable year 2018. The tax liability

has remained unpaid despite the lapse of June 30, 2020 (442 days), the

deadline for payment stated in the notice and demand issued by the

Commissioner. Payment was made by the taxpayer on February 10, 2021; 225

days past due date.

Note: Always use 365 days for interest computation.

13. Total tax due is:

a. P1,498,530 c. P1,799,448

b. P1,395,315 d. P1,492,192

14. Following old tax Law, total tax due is:

a. P1,498,530 c. P1,799,448

b. P1,395,315 d. P1,492,192

15. Princess KT has been assessed deficiency income tax of P1,000,000,

exclusive of interest and surcharge, for taxable year2015. The tax

liability has remained unpaid despite the lapse of June 30, 2017, the

deadline for payment stated in the notice and demand issued by the

Commissioner, Payment was made by the taxpayer only on February 10, 2018.

Total amount due on February 10, 2018 is:

a. P1,762,963 c. P1,662,141

b. P1,491,644 d. P1,498,530

Servienrey signified his intention to be taxed at “8% income tax in lieu

of the graduated income tax rates and percentage tax under Section 116”

in his 1st Quarter Income Tax. However, his gross sales/receipts during

the taxable year have exceeded the VAT threshold as follows:

Amount

January P 250,000

February 250,000

March 250,000

April 250,000

May 250,000

June 250,000

July 250,000

August 250,000

September 250,000

October P 1,000,000

November 1,000,000

December 1,000,000 3,000,000

Total gross P 5,250,000

Sales/Receipts

16. How much is the VAT payable?

a. P120,000

b. P240,000

c. P630,000

d. P360,000

17. How much is the percentage tax liability?

Mr. SIOPAO signified his intention to be taxed at 8% income tax rate on

gross sales in his 1st Quarter Income Tax Return. He has no other source of

income, His total sales for the first three (3) quarters amounted to

P3,000,000 with 4th quarter sales of P3,500,000.

1st Quarter 2nd Quarter 3rd Quarter 4th Quarter

8% Rate 8% Rate 8% Rate

Total

P 500,000 P 500,000 P 2,000,000 P3,500,000

sales

Less: COS 300,000 300,000 1,200,000 1,200,000

Gross

P 200,000 P 200,000 P 800,000 P 2,300,000

income

Less:

Operating 120,000 120,000 480,000 720,000

expenses

Taxable

P 80,000 P 80,000 P 320,000 P 1,580,000

income

18. What is the total tax liability for the first three quarters?

a. P220,000 c. P810,000

b. P240,000 d. none of the choices

19. What is the tax liability for the whole year?

a. P520,000 c. P509,200

b. P500,000 d. P289,200

20. Popoy Corporation condoned the debt of Basha, a manager. What is the tax

consequence?

a. Compensation income tax c. Final income tax

b. Fringe benefit tax d. Donor’s tax

21. RLG Corporation, a retailer of goods uses the accrual method of accounting

in reporting its income and expenses under the calendar year basis. From

January 1 to June 30, 2018, it used the itemized deduction but decided to

use the optional standard deduction method when it filed its annual income

tax return. Its 2018 transactions show:

Jan 1 - June 30 Jul 1 - Sept 30 Oct 1 - Dec 31

Gross Sales P1,000,000 P700,000 P900,000

Cost of Sales 600,000 300,000 600,000

Business expenses 100,000 50,000 150,000

The net income of RDG is

a. P1,560,000 c. P800,000

b. P660,000 d. P720,000

MDG Corporation is engaged in trading business. The reported income and

expenses for taxable year 2018 show:

Sales P10,000,000

Cost of sales 6,000,000

General business expenses 1,000,000

Interest on time deposit (gross) 100,000

Interest expense on loans payable 180,000

22. The net taxable income is

a. P2,858,000 c. P3,000,000

b. P2,820,000 d. P2,862,000

23. A taxpayer had the following:

Year 1 Year2 Year 3 Year 4 Year 5

Gross income P450,000 P450,000 P440,000 P420,000 P490,000

Allowable Deductions 530,000 430,000 410,000 410,000 410,000

24. The income to be reported in year 2 is

a. P20,000 c. P450,000

b. P60,000 d. P0

25. The income to be reported in year 5 is

a. P60,000 c. P80,000

b. P20,000 d. P0

Gigi Na, a farmer, had the following data for the year:

Sales of livestock and farm products raised P270,000

Sales of livestock and farm products purchased 160,000

Cost of raising livestock and farm products 190,000

Cost of livestock and farm products purchased and sold 140,000

Rental income of farm equipment 105,000

Inventory of livestock and farm products, January 1 110,000

Inventory of livestock and farm products, December 31 113,000

26. Using the cash method of accounting, the income is:

a. P205,000 c. P395,000

b. P208,000 d. P202,000

27. Using the same information above, but the accrual method of accounting is

used, the income is

a. P205,000 c. P395,000

b. P208,000 d. P202,000

WATDAPAK is a PEZA-registered corporation authorized "to engage in the

business of manufacturing microprocessor unit package."

After its registration on June 29, 1998, WATDAPAK constructed buildings and

purchased machineries and equipment. As of December 31, 2009, the total

cost of the properties amounted to P3,150,925,917.

WATDAPAK "failed to commence operations." Its factory was temporarily

closed, effective October 15, 2009. On August 1, 2010, it sold its

buildings and some of its installed machineries and equipment to Ibigen

Philippines, Inc., another PEZA-registered enterprise, for ¥2,100,000,000

(P893,550,000).

WATDAPAK was dissolved on November 30, 2010.

In its quarterly income tax return for year 2010, WATDAPAK subjected the

entire gross sales of its properties to 5% final tax on PEZA registered

corporations. WATDAPAK paid taxes amounting to P44,677,500. On February 2,

2011, after requesting the cancellation of its PEZA registration and

amending its articles of incorporation to shorten its corporate term,

WATDAPAK filed an administrative claim for the refund of P44,677,500 with

the Bureauof Internal Revenue (BIR). WATDAPAK alleged that the amount was

erroneously paid. It also indicated the refundable amount in its final

income tax return filed on March 1, 2011. It also alleged that it incurred

a net loss of P2,233,464,538.

The BIR did not act on WATDAPAK’ claim, which prompted the latter to file a

petition for review before the Court of Tax Appeals on September 9, 2012.

The Court of Tax Appeals Second Division denied WATDAPAK’ claim for refund

in the decision dated December 29, 2014. The Court of Tax Appeals Second

Division found that WATDAPAK’ administrative claim for refund and the

petition for review with the Court of Tax Appeals were filed within the

two-year prescriptive period. However, fiscal incentives given to PEZA-

registered enterprises may be availed only by PEZA-registered enterprises

that had already commenced operations. Since WATDAPAK had not commenced

operations, it was not entitled to the incentives of either the income tax

holiday or the 5% preferential tax rate. Payment of the 5% preferential tax

amounting to P44,677,500 was erroneous.

After finding that WATDAPAK sold properties that were capital assets under

Section 39(A)(1) of the National Internal Revenue Code of 1997, the Court

of Tax Appeals Second Division subjected the sale of WATDAPAK’s assets to

6% capital gains tax under Section 27(D)(5) of the same Code and Section 2

of Revenue Regulations No. 8-98. It was found liable for capital gains tax

amounting to P53,613,000. Therefore, WATDAPAK must still pay the balance of

P8,935,500 as deficiency tax, "which respondent should perhaps look into."

On July 17, 2015, WATDAPAK filed a petition for review before the Court of

Tax Appeals En Banc.

It argued that the Court of Tax Appeals Second Division erroneously

assessed the 6% capital gains tax on the sale of WATDAPAK’ equipment,

machineries, and buildings. It also argued that the Court of Tax Appeals

Second Division cannot make an assessment at the first instance. Even if

the Court of Tax Appeals Second Division has such power, the period to make

an assessment had already prescribed.

In the decision promulgated on November 3, 2016, the Court of Tax Appeals

En Banc dismissed WATDAPAK’s petition and affirmed the Court of Tax Appeals

Second Division’s decision and resolution.

28. Which is incorrect as regards WATDAPAK’s entitlement to benefits given to

PEZA-registered enterprises?

a. WATDAPAK is entitled to benefits given to PEZA-registered enterprises,

including the 5% preferential tax rate.

b. Three percent (3%) of the 5% preferential tax is paid to the national

government.

c. The fiscal incentives and the 5% preferential tax rate are available

only to businesses operating within the Ecozone.

d. WATDAPAK is subject to ordinary tax rates under the National Internal

Revenue Code of 1997.

29. Which is incorrect as regards the capital assets of WATDAPAK?

a. Individuals are taxed on capital gains from sale of all real properties

located in the Philippines and classified as capital assets.

b. Domestic corporations are imposed a 6% capital gains tax only on the

presumed gain realized from the sale of lands and/or buildings.

c. The income from the sale of petitioner’s machineries and equipment is

not subject to the provisions on normal corporate income tax.

d. For domestic corporations, the National Internal Revenue Code of 1997

does not impose the 6% capital gains tax on the gains realized from the

sale of machineries and equipment.

A Corporation has the following data for the year 20l8:

Gross income, Philippines P1,000,000

Gross income, USA 500,000

Gross income, Japan 500,000

Expenes, Philippines 300,000

Expenses, USA 200,000

Expenses, Japan 100,000

Other income:

Dividend from San Miguel Corp 70,000

Dividend from Ford Motors, USA 120,000

Gain, sale of San Miguel shares directly to buyer 150,000

Royalties, Philippines 50,000

Royalties, USA 100,000

Interest (other than from banks) 60,000

Rent, land in USA 250,000

Other rent income 100,000

Prize, contest in Manila 200,000

30. The total liability as a domestic corporation is:

a. P689,000 b. P669,000 c. P679,750 d. P699,500

31. Based on e above problem, its total tax liability if it is a resident

corporation is

a. P318,000 b. P338,000 c. P328,750 d. P348,520

32. And if it i a non-resident corporation, its total tax liability is

a. P433,500 b. P443,500 c. P338,500 d. P353,500

A Corporation's records show:

Normal Excess

Taxes Excess MCIT

Quarter income Withholding Tax

Withheld Prior Year

tax MCIT Prior Year

First P100,000 P80,000 P20,000 P30,000 P10,000

Second 120,000 250,000 30,000

Third 250,000 100,000 40,000

Fourth 200,000 100,000 35,000

33. The income tax due for the first quarter is

a. Pl00,000 b. P80,000 c. P50,000 d. P40,000

34. The income tax due for the second quarter is

a. Pl20,000 b. P250,000 c.Pl50,000 d. P230,000

35. The income tax due for the third quarter is

a. P250,000 b. Pl00,000 c. P140,000 d. P70,000

36. The income tax due for the year is

a. P200,000 b. Pl00,000 c. Pl35,000 d. P165,000

37. Using the preceding problem except that the normal income tax for the

fourth quarter is P50,000 (instead of P200,000),the income tax due for the

year is

a. Pl20,000 b. P55,000 c.P45,000 d. P75,000

38. CPA University, a private educational institution organized in 2000, had

the following data for 2018.

Tuition fees P850,000

Rental income (net of 5% cwt) 142,500

School related expenses 820,000

The income tax still due for 2018 is

a. P 54,000 b. P 10,500 c. P 18,000 d. P 46,500

39. CPA College, a private educational institution organized in 2000, hadthe

following data for 2018.

Tuition fees P480,000

Rental income (net of 5% cwt) 494,000

School related expenses 945,000

The income tax still due for 2018 is

a. P 16,500 b. (P 9,500) c. (P 6,000) d P 20,000

A corporation , a resident corporation, provided the following data for

taxable year 2006

Philippines USA

Gross income P40M P20M

Dividends from:

Domestic corporation 5M

Foreign corporation 4M

Business expenses 12M 8M

40. The corporation remitted to its head office the P5M dividend income and

40% of its net profit to its head office in USA. The corporation’s total

tax liability including the tax on the profit remitted is

a. P10,240,000 b. P11,545,600 c. P15,960,000 d. P12,448,000

41. In the foregoing problem, if it is registered with PEZA, its total tax

liability is

a. P10,240,000 b. P0 c. P11,200,000 d. P15,960,000

A corporation has the following data for the year 2017:

Gross Income, Philippines P1,000,000

Gross income, USA 500,000

Gross income, Japan 500,000

Expenses, Philippines 300,000

Expenses, USA 200,000

Expenses, Japan 100,000

Other Income:

Dividend from San Miguel Corp 70,000

Dividend from Ford Motors, USA 120,000

Gain, sale of San Miguel shares directly to buyer 150,000

Royalties, Philippines 50,000

Royalties, USA 100,000

Interest (other than from banks) 60,000

Rent, land USA 250,000

Other rent income 100,000

Prize, contest in Manila 200,000

Land sold in the Philippines (selling prize) 2,000,000

42. The cost of the land which is not used in business is P1M, while FMV is

P3M, Its total tax liability as a domestic corporation is:

a. P780,500 b. P913,600 c. P963,600 d. P980,500

43. Based on the above problem, its total tax liability if it is a resident

corporation is

a. P721,000 b. P679,200 c. P659,200 d.P741,000

44. And if it is a non-resident corporation, its total tax liability is

a. P843,500 b.791,700 c. P791,200 d.P846,000

WPM is a rice dealer. His total annual gross sales and/or receipts do not

exceed Three Million (P3,000,000), allowing him to avail the following:

Statement 1: WPM is a VAT-exempt taxpayer. He may elect to avail of the

optional registration for VAT of exempt person under Section 236 (H) of the

1997 Tax Code, as amended. Upon election of such option, he shall not be

entitled to cancel his VAT registration for the next three (3) years;

Statement 2: WPM may elect to pay the 8% commuted tax rate on gross sales

or receipts and other non-operating income in lieu of the graduated income

tax rates and the percentage tax under Section 24(A)(2)(b) of the 1997 Tax

Code, as amended, since his gross sales or receipts did not exceed Three

Million Pesos (P3,000,000) during the taxable year.

Statement 3: If he elects to pay the 8% commuted tax, he shall not be

allowed to avail of the optional registration for VAT of exempt person

provided by Section 236(H) of the 1997 Tax Code, as amended.

45. Which is correct?

a. Statements 1 and 2 are correct; 3 is incorrect

b. Only statement 2 and 3 are correct

c. Only statements 1 and 3

d. All are correct

Examine the following transactions:

I. Sale of gold to the Bangko Sentral ng Pilipinas.

II. Sale of drugs and medicines prescribed for diabetes, high

cholesterol, and hypertension to beginning January 1, 2019 as

determined by the Department of Health.

III. Sale or lease of goods or properties or the performance of

services other than the transactions mentioned in the preceding

paragraphs, the gross annual sales and/or receipts do not exceed the

amount of Three Million Pesos (P3,000,000).

IV. Importation of fuel, goods and supplies by persons engaged in

international shipping or air transport operations: Provided, That the

fuel, goods and supplies shall be used for international shipping or

air transport operations.

V. Services of banks, non-bank financial intermediaries performing

quasi-banking functions, and other non-bank financial intermediaries

such as money changers and pawnshops, subject to other percentage tax.

VI. Lease of residential units with a monthly rental per unit not

exceeding Fifteen Thousand Pesos (P15,000).

VII. Sale of residential lot valued at One Million Five Hundred

Thousand Pesos (P1,500,000.00) and below, or house & lot and other

residential dwellings valued at Two Million Five Hundred Thousand

Pesos (P2,500,000.00) and below.

46. Which is incorrect?

a. I, II, III are VAT-exempt.

b. III, IV, VI, and VII are VAT-exempt.

c. I, VI, and VII are VAT-exempt.

d. All are VAT-exempt, except V.

47. WBV Company (a domestic employer/company) granted Ms. Leni (a Filipino

branch manager employee), in addition to her basic salaries, P5,000 cash

per quarter for her personal membership fees at Country Golf Club. The

Fringe Benefits Tax (FBT) shall be?

a. P5,000 c. P2,692.31

b. P7,692.31 d. P0

48. Same facts but the employee is a non-resident alien individual not engaged

in trade or business within the Philippines:

a. P6,666.67 c. P2,692.31

b. P7,692.31 d. P1,666.67

49. Ms. Grace received the following compensation for the year:

a. Monthly Basic Salary P 50,000.00

b. Overtime pay for November 10,000.00

c. Thirteenth Month Pay 50,000.00

d. Other Benefits 10,000.00

e. Withholding Tax (Jan-Nov) 73,334.25

Compute the compensation tax to be withheld in December 2018.

a. P73,334.25 c. P9,165.75

b. P82,500 d. Some other amount

50. Mr. Gerry, hired on July 1, 2018, received the following compensation for

the year:

a. Monthly Basic Salary P25,000.00

b. Thirteenth Month Pay 25,000.00

c. Other Benefits 5,000.00

d. Salary from previous employer (Jan-May 2018) 125,000.00

e. Withholding tax from previous employer 4,167.00

f. Withholding tax (Jul-Nov) 4,167.00

a. P8,334 c. P3,334

b. P5,000 d. Some other amount

51. A non-VAT retail business exceeded the VAT threshold on October 31, 2016.

On that date, it had the following lists of goods on hand which it acquired

from VAT suppliers:

Snacks foods and grocery items P 76,500

Frozen meat and eggs 30,200

Fruits and vegetables 20,360

Shampoos, soaps and detergents 12,100

Baked bread 6,040

Compute the transitional input VAT.

a. P 0 c. P 9,493

b. P 2,904 d. P 10,140

52. A VAT taxpayer had the following data regarding its sales and input VAT

during a particular quarter:

Sales Amount Traceable input VAT

Regular sales P 800,000 P 40,000

Export sales 400,000 18,000

Sales to government 200,000 15,000

Exempt sales 100,000 8,000

Total P 1,500,000 P 81,000

Non-traceable input VAT totaled P 24,000. Input VAT applied for tax refund

totaled P 6,000.

Compute the total Output VAT.

a. P 180,000 c. P 120,000

b. P 168,000 d. P 96,000

53. Compute the total creditable input VAT.

a. P 99,000 c. P 91,200

b. P 95,400 d. P 85,200

54. Compute the VAT still due.

a. P 81,000 c. P 34,800

b. P 76,800 d. P 24,800

55. A non-VAT taxpayer secured the services of a foreign consultant to solve

one of its recurring business problems. It contracted to pay P1,000,000 for

the consultancy services. Compute the final withholding VAT and the

creditable input VAT.

a. P 0; P 0 c. P 120,000; P 120,000

b. P 0; P 120,000 d. P 120,000; P 0

56. The sale of a VAT registered taxpayer for the last 12 months failed to

exceed the VAT threshold. It made the following sales during the month:

Sales of rice P 80,000

Sale of flour 20,000

Sale of fertilizers and seeds 40,000

Total P 140,000

Compute the output VAT.

a. P 0 c. P 7,200

b. P 2,400 d. P 16,800

57. A non-VAT professional service provider which exceeded the VAT threshold

had the following revenue and collections during the quarter:

Total collections, inclusive of P13,440 advances P 268,800

Total revenue 392,000

Compute the total output VAT.

a. P 0 c. P 28,800

b. P 27,360 d. P 42,000

58. An international carrier generated the following receipts:

Incoming Outgoing

Passengers P 1,000,000 P 2,000,000

Cargoes, mails; excess baggage 500,000 400,000

Compute the percentage tax.

a. P 72,000 c. P 12,000

b. P 60,000 d. P 0

59. Mr. and Mrs. Smith have the following children:

Damulag, the family’s cook, 23 years old deaf-mute

MJ, 21 years old and working as part-time office assistant

Pretty Boy, 16 years old young artist of ABS-CBN

Minnie, 14 year old BS. Biology student at Harvard University

Doraymund, 12 year old Math genius studying at the elite University of

Kalinga

Mr. and Mrs. Smith has salaries from employment of P150,000 and P100,000,

respectively. Mrs. Smith paid P3,000 health insurance for the family.

Compute the taxable income of Mr. and Mrs. Smith, respectively.

a. P75,000; P50,000 c. P50,000; P47,600

b. P50,000; P47,600 d. P25,000; P50,000

60. Intrepid, Inc. showed the following computation of its taxable income in

2016.

Gross income P 4,000,000

Less: Other deductions from gross income 2,000,000

Net operating loss carry over 1,000,000

Taxable income P 1,000,000

This was the first time Intrepid, Inc. reports taxable income since its

inception in 2010. Intrepid, Inc. paid P200,000 MCIT in the last two years.

During the current year, taxes withheld by clients evidenced by BIR Form

2307 totaled P25,000.

Compute the 2016 income tax payable of Intrepid, Inc.

a. P300,000 c. P100,000

b. P275,000 d. P75,000

--- END OF FIRST PRE-BOARD ---

Income Tax Table (R.A. 10963)

RANGE OF TAXABLE

TAX DUE = a + (b x c)

INCOME

OVER NOT OVER BASIC ADDITIONAL EXCESS

- 250,000 - - -

250,000 400,000 - 20% 250,000

400,000 800,000 30,000 25% 400,000

800,000 2,000,000 130,000 30% 800,000

2,000,000 8,000,000 490,000 32% 2,000,000

8,000,000 - 2,410,000 35% 8,000,000

You might also like

- Chapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemDocument8 pagesChapter 3. Solution To End-of-Chapter Comprehensive/Spreadsheet ProblemBen Harris100% (1)

- ACP 311 My Test Bank Problem SolvingDocument22 pagesACP 311 My Test Bank Problem SolvingJamaica DavidNo ratings yet

- SMChap 018Document32 pagesSMChap 018testbank100% (10)

- VI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleDocument3 pagesVI. 80% Owned-Subsidiary: Cost Model - Full Goodwill Approach Downstream and Upstream of Property, Unrealized Gain and Realized Gain On SaleMa'arifa HussainNo ratings yet

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- Chapter 11 Test Bank PDFDocument29 pagesChapter 11 Test Bank PDFYing LiuNo ratings yet

- 8.0 TVM Financial PlanningDocument2 pages8.0 TVM Financial PlanningYashvi MahajanNo ratings yet

- Franchise AccountingDocument2 pagesFranchise AccountingChristopher NogotNo ratings yet

- PESTEL Analysis On China and FinlandDocument26 pagesPESTEL Analysis On China and FinlandAmeer Shafiq89% (18)

- Which of The Following Is/are False?: Taxation EasyDocument5 pagesWhich of The Following Is/are False?: Taxation EasysophiaNo ratings yet

- Exercises - Percentage TaxesDocument2 pagesExercises - Percentage TaxesMaristella GatonNo ratings yet

- A Government Employee May Claim The Tax InformerDocument3 pagesA Government Employee May Claim The Tax InformerYuno NanaseNo ratings yet

- Corresponding Supporting ScheduleDocument3 pagesCorresponding Supporting Schedulealmira garciaNo ratings yet

- AST FinalsDocument20 pagesAST FinalsMica Ella San DiegoNo ratings yet

- Quiz - 5B 2Document3 pagesQuiz - 5B 2Jao FloresNo ratings yet

- This Study Resource Was: VAT PAYABLE - Assignment Part 1Document9 pagesThis Study Resource Was: VAT PAYABLE - Assignment Part 1Hina SanNo ratings yet

- Problem 1: Total Assets 937,500 Total Liab &she 937,500Document14 pagesProblem 1: Total Assets 937,500 Total Liab &she 937,500Kez MaxNo ratings yet

- Problem 1: Use The Following Data For The Next (2) Two QuestionsDocument13 pagesProblem 1: Use The Following Data For The Next (2) Two QuestionscpamakerfilesNo ratings yet

- IA3 Chapter 22 29Document5 pagesIA3 Chapter 22 29ZicoNo ratings yet

- 8 - PFRS 15 Five Step Model PDFDocument6 pages8 - PFRS 15 Five Step Model PDFDarlene Faye Cabral RosalesNo ratings yet

- Lim Tax 5 Quiz AnswerDocument4 pagesLim Tax 5 Quiz AnswerIvan AnaboNo ratings yet

- Answer Midterm Finals Quizes SET A PDFDocument117 pagesAnswer Midterm Finals Quizes SET A PDFMary DenizeNo ratings yet

- Home Office Chap. 1Document20 pagesHome Office Chap. 1Rei GaculaNo ratings yet

- 2601 PartnershipsDocument57 pages2601 PartnershipsMerdzNo ratings yet

- Tax LQ1 2Document21 pagesTax LQ1 2Maddy EscuderoNo ratings yet

- Pre Week MaterialsDocument44 pagesPre Week MaterialsMarjorie PalmaNo ratings yet

- Petite Company Reported The Following Current Assets On December 31Document1 pagePetite Company Reported The Following Current Assets On December 31Katrina Dela CruzNo ratings yet

- Exercises Tax2Document9 pagesExercises Tax2Helen Faith EstanteNo ratings yet

- A Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsDocument1 pageA Citizen and Resident of The Philippines Died Leaving The Following Properties and RightsAmie Jane MirandaNo ratings yet

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNo ratings yet

- Module 5 - Donors TaxDocument5 pagesModule 5 - Donors TaxBella RonahNo ratings yet

- This Study Resource Was: F-ACADL-01Document8 pagesThis Study Resource Was: F-ACADL-01Marjorie PalmaNo ratings yet

- This Study Resource Was: Problem 1Document7 pagesThis Study Resource Was: Problem 1?????No ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Let's Analyze: Pacalna, Anifah BDocument2 pagesLet's Analyze: Pacalna, Anifah BAnifahchannie PacalnaNo ratings yet

- Review - Practical Accounting 1Document2 pagesReview - Practical Accounting 1Kath LeynesNo ratings yet

- Chapter 9 - Auditing ResourcesDocument10 pagesChapter 9 - Auditing ResourcesSteffany RoqueNo ratings yet

- San Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimDocument5 pagesSan Sebastian College Recoletos de Cavite Management Accounting Finals Christopher C. LimAllyssa Kassandra LucesNo ratings yet

- Chapter 1Document13 pagesChapter 1Ella Marie WicoNo ratings yet

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoNo ratings yet

- There May Be A Property Relationship of Conjugal PDocument6 pagesThere May Be A Property Relationship of Conjugal PJunho ChaNo ratings yet

- Estate QuizDocument6 pagesEstate QuizJedi DuenasNo ratings yet

- Homework Number 4Document8 pagesHomework Number 4ARISNo ratings yet

- Semi Quiz 1Document2 pagesSemi Quiz 1jp careNo ratings yet

- AC 300 Activity - 04.11.2023 Groupings: Group 1 Group 2 Group 3 Group 4 Group 5 Group 6Document2 pagesAC 300 Activity - 04.11.2023 Groupings: Group 1 Group 2 Group 3 Group 4 Group 5 Group 6Frencis A. EsquierdoNo ratings yet

- FINAMAA Topic 2 Additional ActivityDocument2 pagesFINAMAA Topic 2 Additional ActivityJeasmine Andrea Diane PayumoNo ratings yet

- Coursehero 12Document2 pagesCoursehero 12nhbNo ratings yet

- 221 ExamsDocument10 pages221 ExamsElla Mae AgoniaNo ratings yet

- INCOTAX - Multiple Choices - Problems Part 1Document3 pagesINCOTAX - Multiple Choices - Problems Part 1Harvey100% (1)

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Joana MagtuboNo ratings yet

- Answer: The Company Remitted P 22,400 VAT To The BIR. SolutionDocument3 pagesAnswer: The Company Remitted P 22,400 VAT To The BIR. SolutionGreyzon AbdonNo ratings yet

- Define Business Combination, Identify Its ElementsDocument4 pagesDefine Business Combination, Identify Its ElementsAljenika Moncada GupiteoNo ratings yet

- Document 3 PDFDocument50 pagesDocument 3 PDFChristine Jane AbangNo ratings yet

- 1.20PP Partnership Formation and DissolutionDocument16 pages1.20PP Partnership Formation and DissolutionMarcley BataoilNo ratings yet

- Taxation (Input Taxes)Document30 pagesTaxation (Input Taxes)Lara Joy Junio100% (4)

- Mutual Aid Pact Internally Provided Backup Empty Shell Recovery Operations Center ConsiderationsDocument2 pagesMutual Aid Pact Internally Provided Backup Empty Shell Recovery Operations Center ConsiderationsRedNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Finals Quiz 2 Buscom Version 2Document3 pagesFinals Quiz 2 Buscom Version 2Kristina Angelina ReyesNo ratings yet

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionNo ratings yet

- Income Tax AccountingDocument3 pagesIncome Tax Accountinghae1234No ratings yet

- University Physician Services M V CIRDocument15 pagesUniversity Physician Services M V CIRYoo Si JinNo ratings yet

- 2017 - 2018 Supreme Court DecisionsDocument1,412 pages2017 - 2018 Supreme Court DecisionsJerwin DaveNo ratings yet

- Ethics in The Workplace: Business Ethics Is Considered An "Oxymoron", A Combination of Contradictory WordsDocument23 pagesEthics in The Workplace: Business Ethics Is Considered An "Oxymoron", A Combination of Contradictory WordsSuzette VillalinoNo ratings yet

- Writing International LettersDocument33 pagesWriting International LettersSuzette VillalinoNo ratings yet

- Take-Home Diagnostic Examination (MS) : Accountancy ProgramDocument10 pagesTake-Home Diagnostic Examination (MS) : Accountancy ProgramSuzette VillalinoNo ratings yet

- EPDIRACDocument1 pageEPDIRACSuzette VillalinoNo ratings yet

- Mas Theories 2018Document18 pagesMas Theories 2018Suzette VillalinoNo ratings yet

- Auditing Theory-2018Document26 pagesAuditing Theory-2018Suzette VillalinoNo ratings yet

- Mas Theories 2018Document18 pagesMas Theories 2018Suzette VillalinoNo ratings yet

- Bank Secrecy LawDocument17 pagesBank Secrecy LawSuzette VillalinoNo ratings yet

- Community TaxDocument3 pagesCommunity TaxSuzette VillalinoNo ratings yet

- Engagement Letter SampleDocument2 pagesEngagement Letter SampleSuzette VillalinoNo ratings yet

- Intellectual PropertyDocument103 pagesIntellectual PropertySuzette VillalinoNo ratings yet

- PDIC LawDocument27 pagesPDIC LawSuzette VillalinoNo ratings yet

- AP 5903Q PPE IntangiblesDocument5 pagesAP 5903Q PPE IntangiblesSuzette VillalinoNo ratings yet

- Shareholders' Equity: 2. Journal Entry MethodDocument5 pagesShareholders' Equity: 2. Journal Entry MethodSuzette VillalinoNo ratings yet

- Interim Reporting 1Document21 pagesInterim Reporting 1Suzette VillalinoNo ratings yet

- Toacrev July 1 2019Document10 pagesToacrev July 1 2019Suzette VillalinoNo ratings yet

- RMC No. 50-2018 WTWDocument21 pagesRMC No. 50-2018 WTWAris Basco DuroyNo ratings yet

- RMC No 67-2012Document5 pagesRMC No 67-2012evilminionsattackNo ratings yet

- BIR Form 1702QDocument3 pagesBIR Form 1702QMique VillanuevaNo ratings yet

- Accountancy Department: Taxation Quizzer (Transfer and Business Tax)Document2 pagesAccountancy Department: Taxation Quizzer (Transfer and Business Tax)Kenneth Bryan Tegerero Tegio100% (1)

- Swedish Match Philippines Vs TreasurerDocument2 pagesSwedish Match Philippines Vs TreasurerAliyah SandersNo ratings yet

- Final MBA - 3rd Semester-22Document38 pagesFinal MBA - 3rd Semester-22rajjurajnish0% (1)

- CIR V Estate of Benigno Toda JRDocument9 pagesCIR V Estate of Benigno Toda JRParis LisonNo ratings yet

- Taxes: Orduna Santos Dumalag PinesDocument56 pagesTaxes: Orduna Santos Dumalag PinesJosh DumalagNo ratings yet

- Module 2 - Individuals Estates and Trusts Without Answer-2Document12 pagesModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesNo ratings yet

- Deloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFDocument228 pagesDeloitte CN CSG Guide To Taxation in Se Asia 2019 Bilingual 190806 PDFLevina WijayaNo ratings yet

- Corporate Income TaxDocument24 pagesCorporate Income TaxRIRI RUMAIZHANo ratings yet

- City of Manila, Et Al. vs. Hon. Colet and Malaysian Airline System G.R. No. 120051 December 10, 2014 Leonardo-De Castro, J.Document1 pageCity of Manila, Et Al. vs. Hon. Colet and Malaysian Airline System G.R. No. 120051 December 10, 2014 Leonardo-De Castro, J.Maraipol Trading Corp.No ratings yet

- Vietnam Law On Corporate Income TaxDocument22 pagesVietnam Law On Corporate Income TaxFTU.CS2 Triệu Thạnh KhangNo ratings yet

- Final Tax Planning ProjectDocument14 pagesFinal Tax Planning ProjectyashNo ratings yet

- RR No. 9-1998Document10 pagesRR No. 9-1998Rhinnell RiveraNo ratings yet

- Win22 Pill2 Budget Taxation HDT MrunalDocument43 pagesWin22 Pill2 Budget Taxation HDT MrunalSmart BoyzNo ratings yet

- Krishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaDocument20 pagesKrishna Swaroop Ayush Srivastava Sheeba Singh Nikhil Suyesh Arya Vikram SrivastavaSheeba Singh RanaNo ratings yet

- Advanced Taxation Novmock2019 PDFDocument13 pagesAdvanced Taxation Novmock2019 PDFAndy AsanteNo ratings yet

- Philippine Reclamation Authority Executive Summary 2021Document5 pagesPhilippine Reclamation Authority Executive Summary 2021Paolo LimNo ratings yet

- Vietnam Tax Legal HandbookDocument52 pagesVietnam Tax Legal HandbookaNo ratings yet

- Taxation Q and ADocument195 pagesTaxation Q and AJames OcampoNo ratings yet

- The Effect of Corporate Tax On Dividend Policy of Listed Consumer Goods Companies in NigeriaDocument9 pagesThe Effect of Corporate Tax On Dividend Policy of Listed Consumer Goods Companies in NigeriaMayaz AhmedNo ratings yet

- Taxtion II Nov Dec 2014Document5 pagesTaxtion II Nov Dec 2014Md HasanNo ratings yet

- Etextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates TrustsDocument62 pagesEtextbook 978 0134105857 Prentice Halls Federal Taxation 2016 Corporations Partnerships Estates Trustslashawn.fain938100% (57)

- Mixed Income EarnersDocument6 pagesMixed Income EarnersEzi AngelesNo ratings yet

- Corporate Tax Policy PDFDocument4 pagesCorporate Tax Policy PDFBasavarajNo ratings yet

- MNB - GNP - Tax Pocket 2023 - EngDocument23 pagesMNB - GNP - Tax Pocket 2023 - EngTiểu Phong ThầnNo ratings yet