Professional Documents

Culture Documents

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Uploaded by

Burhan Ahmed MayoCopyright:

Available Formats

You might also like

- Vietnam Hotel MarketView - Q1 - 2020 PDFDocument4 pagesVietnam Hotel MarketView - Q1 - 2020 PDFmtuấn_606116No ratings yet

- 2019 Mock Exam B - Afternoon SessionDocument21 pages2019 Mock Exam B - Afternoon SessionBurhan Ahmed Mayo100% (2)

- Venetian ConstitutionDocument39 pagesVenetian ConstitutionPararo ParelNo ratings yet

- % Yoy Growth 8 4: So Ur Ce: PH Ilip Pi Ne ST Ati Sti Cs Au TH OriDocument4 pages% Yoy Growth 8 4: So Ur Ce: PH Ilip Pi Ne ST Ati Sti Cs Au TH OriMichelle GozonNo ratings yet

- B1mtbe Remaining Work ScheduleDocument2 pagesB1mtbe Remaining Work ScheduleIrvanNo ratings yet

- Monthly Rainfall Data (2019) Daily Rainfall Data (September)Document1 pageMonthly Rainfall Data (2019) Daily Rainfall Data (September)Kp SridharNo ratings yet

- SGSST - Indicadores at - V1Document139 pagesSGSST - Indicadores at - V1Juan YepesNo ratings yet

- Jsil FMR Nov 2022Document25 pagesJsil FMR Nov 2022Krrish LaraieNo ratings yet

- 3.4 ExerciseDocument8 pages3.4 ExerciseayushiNo ratings yet

- Excel Critical Path TrackerDocument6 pagesExcel Critical Path Trackertotal oilNo ratings yet

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniNo ratings yet

- Presentacion-4 LIDocument30 pagesPresentacion-4 LIAlexssdud FloertsNo ratings yet

- Jsil FMR Dec 2022Document24 pagesJsil FMR Dec 2022MUHAMMAD QASIMNo ratings yet

- La Torre PerezDocument6 pagesLa Torre PerezDaniela Alejandra Noguera ValdezNo ratings yet

- Enegy DemandDocument4 pagesEnegy Demandhamza shahbazNo ratings yet

- Cheklist AparDocument1 pageCheklist AparKidung pamungkas PamungkasNo ratings yet

- November 2021 Uk Economy Property Market UpdateDocument7 pagesNovember 2021 Uk Economy Property Market Update344clothingNo ratings yet

- Derivatives ViewDocument9 pagesDerivatives Viewsubra holdingsNo ratings yet

- Hyak Graphs P06 WCDocument70 pagesHyak Graphs P06 WCJennifer BaxterNo ratings yet

- Adrian Final Presentation Thika ClusterDocument22 pagesAdrian Final Presentation Thika ClusterKabuchi WanjauNo ratings yet

- Kardex Planta QuimicosDocument18 pagesKardex Planta QuimicosAndrea RodriguezNo ratings yet

- Policy - Task 2 ContentDocument6 pagesPolicy - Task 2 ContentJadhav AmitNo ratings yet

- Global Economic Outlook 2021Document44 pagesGlobal Economic Outlook 2021malimalineeNo ratings yet

- Schedule Pekerjaan Rest Area KM 116: XXXXXXXX XXXXXXDocument1 pageSchedule Pekerjaan Rest Area KM 116: XXXXXXXX XXXXXXfebrannurNo ratings yet

- Biofuels Annual JakartaDocument20 pagesBiofuels Annual JakartaberkatmitrahandalNo ratings yet

- China Balance-of-PaymentsDocument8 pagesChina Balance-of-Paymentsdaniela.montiel.gomezNo ratings yet

- Menap PP en Reo1118Document21 pagesMenap PP en Reo1118Ангелина ВасильченкоNo ratings yet

- India Oil Prices - Research Note - FINALDocument10 pagesIndia Oil Prices - Research Note - FINALBharat NarrativesNo ratings yet

- Attendance-KSPPL - As On 06.08.2019Document30 pagesAttendance-KSPPL - As On 06.08.2019Jayaaditya BoyinaNo ratings yet

- 87 - Grafico Inicio e Fim SelecionavelDocument4 pages87 - Grafico Inicio e Fim SelecionavelMarcelo BuchNo ratings yet

- Chapter 1 PDFDocument18 pagesChapter 1 PDFiqra waseemNo ratings yet

- Daily Attendance SheetDocument31 pagesDaily Attendance SheetHarshit PatilNo ratings yet

- Derivatives Weekly View: Nifty Has Major Support Near Highest Put Base of 11000Document9 pagesDerivatives Weekly View: Nifty Has Major Support Near Highest Put Base of 11000Abc XyzNo ratings yet

- Engineering Progress S Curve: Project NameDocument11 pagesEngineering Progress S Curve: Project NameAmine LehtihetNo ratings yet

- Claim Sheet FormatDocument3 pagesClaim Sheet FormatAnonymous lwVjoizRNo ratings yet

- Workers FormatDocument2 pagesWorkers Formatfacilities sohinitechparkNo ratings yet

- Name of The Team Location Responsible For 1 2 3 4 5 6 7 8 9 10 Total Ser NoDocument2 pagesName of The Team Location Responsible For 1 2 3 4 5 6 7 8 9 10 Total Ser Nofacilities sohinitechparkNo ratings yet

- CRISIL Trade First Cut-Oct2020Document4 pagesCRISIL Trade First Cut-Oct2020KARTHIK PRASADNo ratings yet

- Measuring Money SupplyDocument22 pagesMeasuring Money SupplyElvin DavidNo ratings yet

- Rsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SeruniDocument2 pagesRsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SerunitiganovNo ratings yet

- Rsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SeruniDocument2 pagesRsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SerunitiganovNo ratings yet

- Step ChartDocument2 pagesStep ChartDanilo DiazNo ratings yet

- Multiyear October 2017Document1 pageMultiyear October 2017api-285158260No ratings yet

- Figure 7 - Project Delay by WindowDocument1 pageFigure 7 - Project Delay by WindowEricNo ratings yet

- EBA Interactive Dashboard - Q4 2019Document13 pagesEBA Interactive Dashboard - Q4 2019staline03No ratings yet

- Contract No: Pom E # 22501Document13 pagesContract No: Pom E # 22501VIVEKNo ratings yet

- Gantt Bars: Month / Year Delay EventDocument3 pagesGantt Bars: Month / Year Delay EventburereyNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- Carta GanttDocument11 pagesCarta Ganttlucas ferradaNo ratings yet

- Tablas de Apoyo Conferencia Web 3Document451 pagesTablas de Apoyo Conferencia Web 3Thomas RamirezNo ratings yet

- Sat 7am-10am 4bsais-2 Camero, Liza-Mariel 2Document9 pagesSat 7am-10am 4bsais-2 Camero, Liza-Mariel 2Liza CameroNo ratings yet

- Air Transport Outlook Q23Document18 pagesAir Transport Outlook Q23Greg VenanceNo ratings yet

- Email Marketing CAC in 2019: Month CAC Month CAC LabelDocument2 pagesEmail Marketing CAC in 2019: Month CAC Month CAC LabelrahulNo ratings yet

- Eng October 2018 MCD Reo Cca PresentationDocument21 pagesEng October 2018 MCD Reo Cca PresentationAura Creative TeamNo ratings yet

- West BayDocument391 pagesWest BayAmar UfaqNo ratings yet

- Cairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadDocument14 pagesCairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadSobolNo ratings yet

- Tabla Dinamica y MacroDocument473 pagesTabla Dinamica y MacroNicolas RodriguezNo ratings yet

- Impact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaDocument10 pagesImpact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaIJAR JOURNALNo ratings yet

- Format Pelayanan Kefarmasian April 2019Document1 pageFormat Pelayanan Kefarmasian April 2019Anonymous PoYaIhLqmkNo ratings yet

- Latin American Equity Markets 2019Document80 pagesLatin American Equity Markets 2019Burhan Ahmed MayoNo ratings yet

- Bestway Cement Limited: Location of Factory / PlantDocument1 pageBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoNo ratings yet

- Selecting A Form of Business Ownership: Week 4Document24 pagesSelecting A Form of Business Ownership: Week 4Burhan Ahmed MayoNo ratings yet

- WK 7: Recruiting, Motivating, and Keeping Quality EmployeesDocument48 pagesWK 7: Recruiting, Motivating, and Keeping Quality EmployeesBurhan Ahmed MayoNo ratings yet

- Mids-Paper Numerical Questions SolutionDocument16 pagesMids-Paper Numerical Questions SolutionBurhan Ahmed MayoNo ratings yet

- Police Intelligence Joperson G. Pablo, R.Crim., Reb, ReaDocument8 pagesPolice Intelligence Joperson G. Pablo, R.Crim., Reb, ReaWebster CoseNo ratings yet

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarNo ratings yet

- Chapter 1 Defining Globalization Without BGDocument11 pagesChapter 1 Defining Globalization Without BGSherelyn LumabaoNo ratings yet

- Renewals - Perry AndersonDocument172 pagesRenewals - Perry Andersonhexag1No ratings yet

- Ebook Introduction To International Relations Theory and Practice 3Rd Edition Joyce P Kaufman Online PDF All ChapterDocument69 pagesEbook Introduction To International Relations Theory and Practice 3Rd Edition Joyce P Kaufman Online PDF All Chapterfred.perry429100% (8)

- SLCC Resolution in Discrimination CaseDocument5 pagesSLCC Resolution in Discrimination CaseCourtneyNo ratings yet

- SYLLABUS Administrative Law Under Atty. Randolph PascasioDocument3 pagesSYLLABUS Administrative Law Under Atty. Randolph PascasioErica Dela CruzNo ratings yet

- ASMA JILANI Vs GOVERNMENT OF PAK CASE PLD PDFDocument11 pagesASMA JILANI Vs GOVERNMENT OF PAK CASE PLD PDFAtika LohaniNo ratings yet

- Yesenia Iveth Pacheco-Figueroa, A205 733 029 (BIA May 6, 2016)Document7 pagesYesenia Iveth Pacheco-Figueroa, A205 733 029 (BIA May 6, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Diaz-Saldago v. Anson DigestDocument1 pageDiaz-Saldago v. Anson DigestNicole CruzNo ratings yet

- Project Proposal Zara CharityDocument17 pagesProject Proposal Zara Charitysamuel teferiNo ratings yet

- Juco v. NLRCDocument2 pagesJuco v. NLRCGia DimayugaNo ratings yet

- Fluent French 2004-4 Juillet-Aout PDFDocument55 pagesFluent French 2004-4 Juillet-Aout PDFlilboyreloadedNo ratings yet

- Edward Deming - Quality GuruDocument10 pagesEdward Deming - Quality GurumichuttyNo ratings yet

- The Sunday Times - UK (2022!07!17)Document232 pagesThe Sunday Times - UK (2022!07!17)diego lover100% (1)

- Jose Cuervo Bike Competition Ts and Cs FVDocument3 pagesJose Cuervo Bike Competition Ts and Cs FVDami OgunrukuNo ratings yet

- Presidential Decree No. 46Document1 pagePresidential Decree No. 46thepocnewsNo ratings yet

- Development and CitiesDocument381 pagesDevelopment and CitiesOxfamNo ratings yet

- 390-Article Text-1288-1-10-20171123Document6 pages390-Article Text-1288-1-10-20171123Franklin EinsteinNo ratings yet

- Sample Contract: Farmland Security Zone Contract For - CountyDocument5 pagesSample Contract: Farmland Security Zone Contract For - CountyadadaNo ratings yet

- Essay FrankensteinDocument3 pagesEssay Frankensteinwaterlillypony28No ratings yet

- 2 Between Roots and Routes 2Document5 pages2 Between Roots and Routes 2Lina BerradaNo ratings yet

- Power, and BusinessDocument5 pagesPower, and BusinessthanethomsonNo ratings yet

- The Daughters of England - Sarah EllisDocument4 pagesThe Daughters of England - Sarah EllisDemiieZuuNo ratings yet

- NguyenDocument2 pagesNguyenEric NicholsonNo ratings yet

- Human Resource Development - in Post Conflict EnvironmentDocument45 pagesHuman Resource Development - in Post Conflict Environmentعمر عباسNo ratings yet

- Sources of Law in VietnamDocument9 pagesSources of Law in Vietnamtrinhngocbaotran2005No ratings yet

- SBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Document20 pagesSBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Strathmore Bel PreNo ratings yet

- YPF - Chevron Agreement: To Develop Vaca MuertaDocument18 pagesYPF - Chevron Agreement: To Develop Vaca Muertavega_843No ratings yet

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Uploaded by

Burhan Ahmed MayoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Saudi Arabia Sets The Stage For A High Stake Market Share Battle - 09 March 2020

Uploaded by

Burhan Ahmed MayoCopyright:

Available Formats

Saudi Arabia sets the stage for a high

stake market share battle – 09 March 2020

Refinitiv Oil Research

Benchmark crude prices went into a tailspin on Monday morning trade following OPEC

and its allies including Russia failing to agree on extending and deepening the output cut Ranjith Raja

which expires at the end of this month. Oil prices closed on Friday with Brent down by Oil Research Manager-

10.4% and WTI down by 7.8% w-o-w. As of 07:30 GMT this morning, Brent crude was at MENA

$33.93/MT, down by 25%, the largest single day drop since the Gulf War in 1991, while ranjith.raja@refinitiv.com

WTI was down by 26.8% at $30.22/MT. On market opening, prices dropped to an intra- +971 (0)44 536 215

day low of $31.29/MT for Brent and $27.37/MT for WTI.

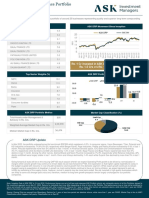

Oil exports- A tale of 3 countries:

Saudi Arabia, Russia and USA together contribute more than 30% of global oil supply

and in terms of exports while Saudi Arabia and Russia have had significant control on

the market, USA backed by growing shale oil production has seen a surge in exports. In

2019, USA exported on an average, 24% of every barrel of oil produced. Russia on the

other hand exports on an average, 40% of its total crude oil production, while Saudi

Arabian seaborne exports have typically ranged around 70% of production although the

export ratio since 2015 has ranged from a minimum of 61% to a max of 78% of production

volumes. The reliance on oil exports and the resultant income is significant for Saudi and

Russia. Following Russia’s decision to not participate in further supply cuts, Saudi Arabia

has been reported to have announced to increase their production beyond 10 million bpd

for the month of April with a possibility to touch 11 million bpd. With the ensuing battle for

opening up the cap on production, other key OPEC producers who have been limited by

the quotas and compliance over the past three years are also likely to increase production

and cut prices in a bid to maintain market share.

Saudi Arabia Russia USA

(million bpd) (million bpd) (million bpd)

11.00 12.00 14.00

10.00 12.00

9.00 10.00

8.00 10.00

7.00 8.00

6.00 8.00

6.00

5.00 6.00

4.00 4.00

3.00 4.00

2.00 2.00 2.00

1.00

0.00 0.00 0.00

Jul-19

Jul-19

Nov-19

Jan-19

Jun-19

Nov-19

Dec-19

Jan-19

Jun-19

Dec-19

Apr-19

Oct-19

Apr-19

Oct-19

Feb-19

Mar-19

May-19

Aug-19

Sep-19

Feb-19

Mar-19

May-19

Aug-19

Sep-19

Production Exports Production Exports Production Exports

Subscribe to Refinitiv Oil Research reports here.

Saudi Arabia sets the stage for a high

stake market share battle – 09 March 2020

Refinitiv Oil Research

Key Demand Centres:

Top importers of Saudi crude- 2019 Top importers of US crude- 2019

15%

23%

28%

10%

49%

9%

15%

10%

9%

8%

12% 12% South Korea Canada United Kingdom

China Japan India South Korea Egypt Others

India Netherlands Others

Top importers of Russian crude-

2019 (seaborne)

13%

11%

50%

11%

8%

7%

China Italy Netherlands South Korea Turkey Others

A scenario analysis of key Middle Eastern exporters:

Besides Saudi Arabia - Iraq, UAE and Kuwait are the three key exporters from the Middle East who have spare capacity

and the potential to ramp up production when the supply cut agreement ends in March. Of these three countries, Iraq

has the least spare capacity and has been prone to internal conflicts which reduces the reliability of spare capacity, while

Kuwait and the UAE can be expected to ramp up production with a high degree of confidence. It may be noted that

Kuwait and Saudi Arabia have also restarted production from the Neutral Zone area in February which is expected to

have the potential to reach 500 kbpd by the end of this year and could cater to refineries that have specific demand for

heavy sour crude oil. Refinitiv Oil Research has analysed the potential increase in exports that could be added to the

market based on three scenarios – (i) Low Case: Lowest exports to production ratio since 2015; (ii) Base Case: Exports

to production ratio since 2019; (iii) High Case: Highest exports to production ratio since 2015.

Follow us! @RefinitivEnergy Join the conversation!

Saudi Arabia sets the stage for a high

stake market share battle – 09 March 2020

Refinitiv Oil Research

Exports increase Exports increase Exports increase

Oil production

Low case Base case High case

increase (million bpd)

IRAQ (million bpd) (million bpd) (million bpd)

0.10 0.07 0.08 0.09

0.20 0.13 0.16 0.19

Exports increase Exports increase Exports increase

Oil production

Low case Base case High case

increase (million bpd)

(million bpd) (million bpd) (million bpd)

KUWAIT 0.25 0.16 0.19 0.22

0.35 0.22 0.26 0.31

0.50 0.31 0.38 0.44

0.75 0.47 0.56 0.66

Exports increase Exports increase Exports increase

Oil production

Low case Base case High case

increase (million bpd)

(million bpd) (million bpd) (million bpd)

UAE

0.25 0.18 0.24 0.29

0.35 0.25 0.33 0.40

0.50 0.36 0.47 0.57

Other players who could add more volumes:

Libya, Iran and Venezuela were exempted from the earlier supply cuts on account of struggling production and exports,

sanctions and internal strife. While Iran and Venezuela are under sanctions, Refinitiv Oil Research does not foresee an

immediate reversal on these decisions and thereby little or no possibility of a ramp in exports from these countries. Libya

on the other hand has seen exports dropping in February, largely on account its key export terminals being blocked by

rebel forces. The exports from the country have fallen by nearly 700,000 bpd from January levels. This is a potential

volume that can be brought back to the market should the disruptions end, and the rival factions come to an agreement.

Impact on pricing:

With demand remaining uncertain considering the economic impact caused by the coronavirus, any significant increase

in supply would mean producers have to compete amongst each other to retain/increase market share. This has

historically led to price cuts and the first semblance of price cuts returning to the market was witnessed over the weekend

when Saudi Arabia cut the Official Selling Prices (OSP) for April sales of crude oil to all key demand markets in the range

of $5-8/bbl. This has already led to reported interest from a few Asian buyers who are looking at the possibility of

increasing sourcing of crude oil from the region as prices are set to fall. Russia, with pipeline access to China and USA

with the advantage of trade deal negotiations have a competitive advantage for supply into the key Chinese market and

hence Middle Eastern producers would need to be extremely competitive on their pricing while also focussing on other

key Asian consumers. Other regional producers are expected to follow suit on their pricing and target market.

Arab Light OSP to Asia - $/bbl

6

4

2

0

-2

-4

Jun-10

Jun-11

Jun-12

Jun-13

Jun-14

Jun-15

Jun-16

Jun-17

Jun-18

Jun-19

Feb-10

Feb-11

Feb-12

Feb-13

Feb-14

Feb-15

Feb-16

Feb-17

Feb-18

Feb-19

Feb-20

Oct-10

Oct-11

Oct-12

Oct-13

Oct-14

Oct-15

Oct-16

Oct-17

Oct-18

Oct-19

Follow us! @RefinitivEnergy Join the conversation!

Saudi Arabia sets the stage for a high

stake market share battle – 09 March 2020

Refinitiv Oil Research

Refinitiv Oil Research MENA

Ranjith Raja – Oil Research Manager

Ranjith.Raja@refinitiv.com

+971 (0)44 536 215

Sudharsan Sarathy – Senior Analyst, Oil Research

Sudharsan.Sarathy@refinitiv.com

+971 (0)44 536 719

Rakesh Sharma – Senior Analyst, Oil Research

R.Sharma@refinitiv.com

+971 (0)44 536 543

Mohammed Yasser - Analyst, Oil Research

Mohammed.Yasser@refinitiv.com

+971 (0) 44 536 709

Follow us! @RefinitivEnergy Join the conversation!

You might also like

- Vietnam Hotel MarketView - Q1 - 2020 PDFDocument4 pagesVietnam Hotel MarketView - Q1 - 2020 PDFmtuấn_606116No ratings yet

- 2019 Mock Exam B - Afternoon SessionDocument21 pages2019 Mock Exam B - Afternoon SessionBurhan Ahmed Mayo100% (2)

- Venetian ConstitutionDocument39 pagesVenetian ConstitutionPararo ParelNo ratings yet

- % Yoy Growth 8 4: So Ur Ce: PH Ilip Pi Ne ST Ati Sti Cs Au TH OriDocument4 pages% Yoy Growth 8 4: So Ur Ce: PH Ilip Pi Ne ST Ati Sti Cs Au TH OriMichelle GozonNo ratings yet

- B1mtbe Remaining Work ScheduleDocument2 pagesB1mtbe Remaining Work ScheduleIrvanNo ratings yet

- Monthly Rainfall Data (2019) Daily Rainfall Data (September)Document1 pageMonthly Rainfall Data (2019) Daily Rainfall Data (September)Kp SridharNo ratings yet

- SGSST - Indicadores at - V1Document139 pagesSGSST - Indicadores at - V1Juan YepesNo ratings yet

- Jsil FMR Nov 2022Document25 pagesJsil FMR Nov 2022Krrish LaraieNo ratings yet

- 3.4 ExerciseDocument8 pages3.4 ExerciseayushiNo ratings yet

- Excel Critical Path TrackerDocument6 pagesExcel Critical Path Trackertotal oilNo ratings yet

- The Coming Collapse of Inflation and How To Benefit From It July 2022Document29 pagesThe Coming Collapse of Inflation and How To Benefit From It July 2022Dinesh RupaniNo ratings yet

- Presentacion-4 LIDocument30 pagesPresentacion-4 LIAlexssdud FloertsNo ratings yet

- Jsil FMR Dec 2022Document24 pagesJsil FMR Dec 2022MUHAMMAD QASIMNo ratings yet

- La Torre PerezDocument6 pagesLa Torre PerezDaniela Alejandra Noguera ValdezNo ratings yet

- Enegy DemandDocument4 pagesEnegy Demandhamza shahbazNo ratings yet

- Cheklist AparDocument1 pageCheklist AparKidung pamungkas PamungkasNo ratings yet

- November 2021 Uk Economy Property Market UpdateDocument7 pagesNovember 2021 Uk Economy Property Market Update344clothingNo ratings yet

- Derivatives ViewDocument9 pagesDerivatives Viewsubra holdingsNo ratings yet

- Hyak Graphs P06 WCDocument70 pagesHyak Graphs P06 WCJennifer BaxterNo ratings yet

- Adrian Final Presentation Thika ClusterDocument22 pagesAdrian Final Presentation Thika ClusterKabuchi WanjauNo ratings yet

- Kardex Planta QuimicosDocument18 pagesKardex Planta QuimicosAndrea RodriguezNo ratings yet

- Policy - Task 2 ContentDocument6 pagesPolicy - Task 2 ContentJadhav AmitNo ratings yet

- Global Economic Outlook 2021Document44 pagesGlobal Economic Outlook 2021malimalineeNo ratings yet

- Schedule Pekerjaan Rest Area KM 116: XXXXXXXX XXXXXXDocument1 pageSchedule Pekerjaan Rest Area KM 116: XXXXXXXX XXXXXXfebrannurNo ratings yet

- Biofuels Annual JakartaDocument20 pagesBiofuels Annual JakartaberkatmitrahandalNo ratings yet

- China Balance-of-PaymentsDocument8 pagesChina Balance-of-Paymentsdaniela.montiel.gomezNo ratings yet

- Menap PP en Reo1118Document21 pagesMenap PP en Reo1118Ангелина ВасильченкоNo ratings yet

- India Oil Prices - Research Note - FINALDocument10 pagesIndia Oil Prices - Research Note - FINALBharat NarrativesNo ratings yet

- Attendance-KSPPL - As On 06.08.2019Document30 pagesAttendance-KSPPL - As On 06.08.2019Jayaaditya BoyinaNo ratings yet

- 87 - Grafico Inicio e Fim SelecionavelDocument4 pages87 - Grafico Inicio e Fim SelecionavelMarcelo BuchNo ratings yet

- Chapter 1 PDFDocument18 pagesChapter 1 PDFiqra waseemNo ratings yet

- Daily Attendance SheetDocument31 pagesDaily Attendance SheetHarshit PatilNo ratings yet

- Derivatives Weekly View: Nifty Has Major Support Near Highest Put Base of 11000Document9 pagesDerivatives Weekly View: Nifty Has Major Support Near Highest Put Base of 11000Abc XyzNo ratings yet

- Engineering Progress S Curve: Project NameDocument11 pagesEngineering Progress S Curve: Project NameAmine LehtihetNo ratings yet

- Claim Sheet FormatDocument3 pagesClaim Sheet FormatAnonymous lwVjoizRNo ratings yet

- Workers FormatDocument2 pagesWorkers Formatfacilities sohinitechparkNo ratings yet

- Name of The Team Location Responsible For 1 2 3 4 5 6 7 8 9 10 Total Ser NoDocument2 pagesName of The Team Location Responsible For 1 2 3 4 5 6 7 8 9 10 Total Ser Nofacilities sohinitechparkNo ratings yet

- CRISIL Trade First Cut-Oct2020Document4 pagesCRISIL Trade First Cut-Oct2020KARTHIK PRASADNo ratings yet

- Measuring Money SupplyDocument22 pagesMeasuring Money SupplyElvin DavidNo ratings yet

- Rsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SeruniDocument2 pagesRsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SerunitiganovNo ratings yet

- Rsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SeruniDocument2 pagesRsud Kraton Kabupaten Pekalongan Formulir Harian Surveilans Infeksi Nosokomial Ruang SerunitiganovNo ratings yet

- Step ChartDocument2 pagesStep ChartDanilo DiazNo ratings yet

- Multiyear October 2017Document1 pageMultiyear October 2017api-285158260No ratings yet

- Figure 7 - Project Delay by WindowDocument1 pageFigure 7 - Project Delay by WindowEricNo ratings yet

- EBA Interactive Dashboard - Q4 2019Document13 pagesEBA Interactive Dashboard - Q4 2019staline03No ratings yet

- Contract No: Pom E # 22501Document13 pagesContract No: Pom E # 22501VIVEKNo ratings yet

- Gantt Bars: Month / Year Delay EventDocument3 pagesGantt Bars: Month / Year Delay EventburereyNo ratings yet

- Mar 23Document2 pagesMar 23coureNo ratings yet

- Et - Mar 23Document2 pagesEt - Mar 23coureNo ratings yet

- Carta GanttDocument11 pagesCarta Ganttlucas ferradaNo ratings yet

- Tablas de Apoyo Conferencia Web 3Document451 pagesTablas de Apoyo Conferencia Web 3Thomas RamirezNo ratings yet

- Sat 7am-10am 4bsais-2 Camero, Liza-Mariel 2Document9 pagesSat 7am-10am 4bsais-2 Camero, Liza-Mariel 2Liza CameroNo ratings yet

- Air Transport Outlook Q23Document18 pagesAir Transport Outlook Q23Greg VenanceNo ratings yet

- Email Marketing CAC in 2019: Month CAC Month CAC LabelDocument2 pagesEmail Marketing CAC in 2019: Month CAC Month CAC LabelrahulNo ratings yet

- Eng October 2018 MCD Reo Cca PresentationDocument21 pagesEng October 2018 MCD Reo Cca PresentationAura Creative TeamNo ratings yet

- West BayDocument391 pagesWest BayAmar UfaqNo ratings yet

- Cairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadDocument14 pagesCairo For Investment & Real Estate Development (CIRA) : Initiation of Coverage A Promising Decade AheadSobolNo ratings yet

- Tabla Dinamica y MacroDocument473 pagesTabla Dinamica y MacroNicolas RodriguezNo ratings yet

- Impact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaDocument10 pagesImpact and Challenges of Covid-19 On Healthcare Waste Management in A Tertiary Care Teaching Hospital, Hyderabad IndiaIJAR JOURNALNo ratings yet

- Format Pelayanan Kefarmasian April 2019Document1 pageFormat Pelayanan Kefarmasian April 2019Anonymous PoYaIhLqmkNo ratings yet

- Latin American Equity Markets 2019Document80 pagesLatin American Equity Markets 2019Burhan Ahmed MayoNo ratings yet

- Bestway Cement Limited: Location of Factory / PlantDocument1 pageBestway Cement Limited: Location of Factory / PlantBurhan Ahmed MayoNo ratings yet

- Selecting A Form of Business Ownership: Week 4Document24 pagesSelecting A Form of Business Ownership: Week 4Burhan Ahmed MayoNo ratings yet

- WK 7: Recruiting, Motivating, and Keeping Quality EmployeesDocument48 pagesWK 7: Recruiting, Motivating, and Keeping Quality EmployeesBurhan Ahmed MayoNo ratings yet

- Mids-Paper Numerical Questions SolutionDocument16 pagesMids-Paper Numerical Questions SolutionBurhan Ahmed MayoNo ratings yet

- Police Intelligence Joperson G. Pablo, R.Crim., Reb, ReaDocument8 pagesPolice Intelligence Joperson G. Pablo, R.Crim., Reb, ReaWebster CoseNo ratings yet

- Article Vi: The Legislative DepartmentDocument4 pagesArticle Vi: The Legislative DepartmentJun MarNo ratings yet

- Chapter 1 Defining Globalization Without BGDocument11 pagesChapter 1 Defining Globalization Without BGSherelyn LumabaoNo ratings yet

- Renewals - Perry AndersonDocument172 pagesRenewals - Perry Andersonhexag1No ratings yet

- Ebook Introduction To International Relations Theory and Practice 3Rd Edition Joyce P Kaufman Online PDF All ChapterDocument69 pagesEbook Introduction To International Relations Theory and Practice 3Rd Edition Joyce P Kaufman Online PDF All Chapterfred.perry429100% (8)

- SLCC Resolution in Discrimination CaseDocument5 pagesSLCC Resolution in Discrimination CaseCourtneyNo ratings yet

- SYLLABUS Administrative Law Under Atty. Randolph PascasioDocument3 pagesSYLLABUS Administrative Law Under Atty. Randolph PascasioErica Dela CruzNo ratings yet

- ASMA JILANI Vs GOVERNMENT OF PAK CASE PLD PDFDocument11 pagesASMA JILANI Vs GOVERNMENT OF PAK CASE PLD PDFAtika LohaniNo ratings yet

- Yesenia Iveth Pacheco-Figueroa, A205 733 029 (BIA May 6, 2016)Document7 pagesYesenia Iveth Pacheco-Figueroa, A205 733 029 (BIA May 6, 2016)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Diaz-Saldago v. Anson DigestDocument1 pageDiaz-Saldago v. Anson DigestNicole CruzNo ratings yet

- Project Proposal Zara CharityDocument17 pagesProject Proposal Zara Charitysamuel teferiNo ratings yet

- Juco v. NLRCDocument2 pagesJuco v. NLRCGia DimayugaNo ratings yet

- Fluent French 2004-4 Juillet-Aout PDFDocument55 pagesFluent French 2004-4 Juillet-Aout PDFlilboyreloadedNo ratings yet

- Edward Deming - Quality GuruDocument10 pagesEdward Deming - Quality GurumichuttyNo ratings yet

- The Sunday Times - UK (2022!07!17)Document232 pagesThe Sunday Times - UK (2022!07!17)diego lover100% (1)

- Jose Cuervo Bike Competition Ts and Cs FVDocument3 pagesJose Cuervo Bike Competition Ts and Cs FVDami OgunrukuNo ratings yet

- Presidential Decree No. 46Document1 pagePresidential Decree No. 46thepocnewsNo ratings yet

- Development and CitiesDocument381 pagesDevelopment and CitiesOxfamNo ratings yet

- 390-Article Text-1288-1-10-20171123Document6 pages390-Article Text-1288-1-10-20171123Franklin EinsteinNo ratings yet

- Sample Contract: Farmland Security Zone Contract For - CountyDocument5 pagesSample Contract: Farmland Security Zone Contract For - CountyadadaNo ratings yet

- Essay FrankensteinDocument3 pagesEssay Frankensteinwaterlillypony28No ratings yet

- 2 Between Roots and Routes 2Document5 pages2 Between Roots and Routes 2Lina BerradaNo ratings yet

- Power, and BusinessDocument5 pagesPower, and BusinessthanethomsonNo ratings yet

- The Daughters of England - Sarah EllisDocument4 pagesThe Daughters of England - Sarah EllisDemiieZuuNo ratings yet

- NguyenDocument2 pagesNguyenEric NicholsonNo ratings yet

- Human Resource Development - in Post Conflict EnvironmentDocument45 pagesHuman Resource Development - in Post Conflict Environmentعمر عباسNo ratings yet

- Sources of Law in VietnamDocument9 pagesSources of Law in Vietnamtrinhngocbaotran2005No ratings yet

- SBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Document20 pagesSBP Bugle Issue 11.02 (Vol. 43, No. 2), Spring 2011Strathmore Bel PreNo ratings yet

- YPF - Chevron Agreement: To Develop Vaca MuertaDocument18 pagesYPF - Chevron Agreement: To Develop Vaca Muertavega_843No ratings yet