Professional Documents

Culture Documents

Fire Insurance Concept Map by Belarma

Fire Insurance Concept Map by Belarma

Uploaded by

Louis BelarmaCopyright:

Available Formats

You might also like

- Bryant Plus 80 ManualDocument8 pagesBryant Plus 80 ManualLouCypher85% (13)

- Certificate of InsuranceDocument2 pagesCertificate of Insurancejcayubo26No ratings yet

- Form 5 Maths (Chapter 3 Consumer Mathematics: Insurance)Document19 pagesForm 5 Maths (Chapter 3 Consumer Mathematics: Insurance)Xiu Yun73% (11)

- Example Pyros & Fireworks Risk Assesment SectionDocument3 pagesExample Pyros & Fireworks Risk Assesment SectionSophie-Louise MercedesNo ratings yet

- Compilation of Bar Questions and Suggested Answers Under Commercial LAW (Transportation Law)Document56 pagesCompilation of Bar Questions and Suggested Answers Under Commercial LAW (Transportation Law)Sage Lingatong92% (13)

- CCC Insurance vs. KawasakiDocument6 pagesCCC Insurance vs. Kawasakibb yattyNo ratings yet

- Fire Insurance Concept MapDocument1 pageFire Insurance Concept MapjumpincatfishNo ratings yet

- Where The Loss Took Place While Being Rescued From The PerilDocument3 pagesWhere The Loss Took Place While Being Rescued From The PerilFaith Alexis Galano100% (1)

- Concept Map Kim InsuranceDocument1 pageConcept Map Kim InsuranceKim EstalNo ratings yet

- G4-Topic 1 - Standard Fire PolicyDocument5 pagesG4-Topic 1 - Standard Fire PolicyAINNUR MYSARA ABDUL HALIMNo ratings yet

- Fire InsuranceDocument1 pageFire InsuranceBryan RicaldeNo ratings yet

- Fire InsuranceDocument4 pagesFire InsuranceAya NamuzarNo ratings yet

- Chapter 14 Marine InsuranceDocument12 pagesChapter 14 Marine InsurancePennNo ratings yet

- Digest of Vda de Gabriel V Ca GR No 103883 PDFDocument2 pagesDigest of Vda de Gabriel V Ca GR No 103883 PDFXtian HernandezNo ratings yet

- Feb 24Document18 pagesFeb 24jagadishNo ratings yet

- Hotwork JsaDocument2 pagesHotwork JsaNur Alisha AlishaNo ratings yet

- Insurance Fire Insurance Concept MapDocument1 pageInsurance Fire Insurance Concept MapPhil JaramilloNo ratings yet

- Marine: Kinds of Indemnity Policies Averages LossDocument2 pagesMarine: Kinds of Indemnity Policies Averages LossDanica CaballesNo ratings yet

- Gasification Guide Check List Final PDFDocument6 pagesGasification Guide Check List Final PDFf.BNo ratings yet

- Insurance Types - Non LifeDocument5 pagesInsurance Types - Non LifeKRNo ratings yet

- Insurance and Surety Bond - EmilyDocument14 pagesInsurance and Surety Bond - EmilyJoe WongNo ratings yet

- Assurance Contre L'incendie enDocument4 pagesAssurance Contre L'incendie enMichel erickson talom waboNo ratings yet

- Natural Disaster Preparedness PlanDocument2 pagesNatural Disaster Preparedness PlanTIKTOK TRENDSNo ratings yet

- Damage Statement Writing FrameDocument2 pagesDamage Statement Writing Framezonaah.tariqNo ratings yet

- Insurance Intro CasesDocument7 pagesInsurance Intro CasesEmily SantiagoNo ratings yet

- Fire Emergency FlowchartDocument1 pageFire Emergency FlowchartBungsu Bono100% (1)

- Torts II 2020 WinterDocument8 pagesTorts II 2020 WinterJasmine GanNo ratings yet

- Unit 7 InsuranceDocument3 pagesUnit 7 InsuranceKanishkaNo ratings yet

- Sem 10 Cia 2Document5 pagesSem 10 Cia 2124117025No ratings yet

- Fire Insurance: - Isha Chugh Assistant Professor Gargi College University of DelhiDocument22 pagesFire Insurance: - Isha Chugh Assistant Professor Gargi College University of Delhiadarsh walavalkarNo ratings yet

- Hazard Identification & Risk Assesment (Hira) Ohs-Pr-02-03-F07 Job Safe ProcedureDocument5 pagesHazard Identification & Risk Assesment (Hira) Ohs-Pr-02-03-F07 Job Safe ProcedureMuhammad M KhanNo ratings yet

- Plot DiagramDocument2 pagesPlot DiagramthatonespeedcuberNo ratings yet

- Standard List of Threats and RisksDocument7 pagesStandard List of Threats and RisksNemattullah RahimiNo ratings yet

- Vista Operation ManualDocument28 pagesVista Operation Manualrtp4b9qtmdNo ratings yet

- Insurance First QuizDocument3 pagesInsurance First QuizronaldNo ratings yet

- Encik Luqmans Case2023112 0044Document1 pageEncik Luqmans Case2023112 0044Muhammad AssocNo ratings yet

- INSURANCE Finals ReviewerDocument4 pagesINSURANCE Finals ReviewerCloieRjNo ratings yet

- Section 90 94Document5 pagesSection 90 94Rodel Cadorniga Jr.No ratings yet

- Fire Insurance p300-309Document3 pagesFire Insurance p300-309Shasharu Fei-fei LimNo ratings yet

- Belarma 5-10Document1 pageBelarma 5-10Louis BelarmaNo ratings yet

- 28 Eusebio Vs EusebioDocument2 pages28 Eusebio Vs EusebioLouis BelarmaNo ratings yet

- Philippine Health Care Providers Inc Brief DigestDocument2 pagesPhilippine Health Care Providers Inc Brief DigestLouis BelarmaNo ratings yet

- Borromeo v. Borromeo DigestDocument3 pagesBorromeo v. Borromeo DigestLouis BelarmaNo ratings yet

- Heirs of Loreto C. Maramag vs. Maramag - CivPro - KongDocument3 pagesHeirs of Loreto C. Maramag vs. Maramag - CivPro - KongLouis BelarmaNo ratings yet

- Apelanio Vs Arcanys, Inc.Document3 pagesApelanio Vs Arcanys, Inc.Louis BelarmaNo ratings yet

- 41 Steel Corporation v. Equitable PCIBankDocument3 pages41 Steel Corporation v. Equitable PCIBankLouis Belarma100% (2)

- Dela Torre V Pepsi ColaDocument2 pagesDela Torre V Pepsi ColaLouis BelarmaNo ratings yet

- Evangelista Vs CIRDocument3 pagesEvangelista Vs CIRLouis BelarmaNo ratings yet

- Renato Diaz Vs Secretary of FinanceDocument5 pagesRenato Diaz Vs Secretary of FinanceLouis BelarmaNo ratings yet

- CIR Vs Algue DigestDocument4 pagesCIR Vs Algue DigestLouis BelarmaNo ratings yet

- Mongao Vs Pryce PropertiesDocument3 pagesMongao Vs Pryce PropertiesLouis BelarmaNo ratings yet

- H. Tambunting Pawnshop v. CIRDocument3 pagesH. Tambunting Pawnshop v. CIRLouis Belarma100% (2)

- Mercedita Coombs v. Victoria Castañeda, Virgilio Santos, Sps. Pancho & Edith Leviste, BPI, and The Register of Deeds of Muntinlupa CityDocument3 pagesMercedita Coombs v. Victoria Castañeda, Virgilio Santos, Sps. Pancho & Edith Leviste, BPI, and The Register of Deeds of Muntinlupa CityLouis BelarmaNo ratings yet

- Ayala Vs TagleDocument2 pagesAyala Vs TagleLouis BelarmaNo ratings yet

- 5 Lucero Vs COMELECDocument3 pages5 Lucero Vs COMELECLouis BelarmaNo ratings yet

- 24 Montebon Vs ComelecDocument2 pages24 Montebon Vs ComelecLouis BelarmaNo ratings yet

- Batabor Vs COMELECDocument2 pagesBatabor Vs COMELECLouis BelarmaNo ratings yet

- Wa0002.Document56 pagesWa0002.deepakkcaNo ratings yet

- Law of Torts Project WorkDocument49 pagesLaw of Torts Project WorkNikhil AradheNo ratings yet

- 12 Lustan vs. CA DIGESTDocument3 pages12 Lustan vs. CA DIGESTcassandra leeNo ratings yet

- Contracts 1Document16 pagesContracts 1Raghavendra NadgaudaNo ratings yet

- PROSPECTUS - Contents and Liability For MisrepresentationDocument14 pagesPROSPECTUS - Contents and Liability For MisrepresentationTarun PratapNo ratings yet

- Solicitud Prestamo InglesDocument7 pagesSolicitud Prestamo InglesGrazyna PrzyborowskaNo ratings yet

- Business Law - NMIMSDocument6 pagesBusiness Law - NMIMSlucky.idctechnologiesNo ratings yet

- Case Digest - SAURA IMPORT and EXPORT CO Vs DBPDocument6 pagesCase Digest - SAURA IMPORT and EXPORT CO Vs DBPMaricris GalingganaNo ratings yet

- LicenseDocument5 pagesLicenseYoshua SuandiNo ratings yet

- 392 2016 Commercial Registration and Licensing Council of MinistersDocument34 pages392 2016 Commercial Registration and Licensing Council of MinistersPeter MuigaiNo ratings yet

- SPECIAL POWER OF ATTORNEY CatimbangDocument2 pagesSPECIAL POWER OF ATTORNEY CatimbangAtty. R. PerezNo ratings yet

- Family Law ProjectDocument20 pagesFamily Law Projectpulkit248100% (1)

- Script For Advocacy PresentationDocument3 pagesScript For Advocacy PresentationBeth KingNo ratings yet

- Saligram Ruplal Khanna V Kanwar RajnathDocument7 pagesSaligram Ruplal Khanna V Kanwar RajnathJashan RNo ratings yet

- Banking Law Notes 10Document6 pagesBanking Law Notes 10Afiqah IsmailNo ratings yet

- 17 Interpretation of ContractsDocument113 pages17 Interpretation of ContractsEngelov AngtonivichNo ratings yet

- PEGANG MINING CO LTD V CHOONG SAM & ORS, (1969) 2 MLJ 52Document7 pagesPEGANG MINING CO LTD V CHOONG SAM & ORS, (1969) 2 MLJ 52Matthew Van HuizenNo ratings yet

- CH3 - Corporate Law PDFDocument5 pagesCH3 - Corporate Law PDFGiane Fks MarieNo ratings yet

- FIATA Documents and FormsDocument28 pagesFIATA Documents and FormsKoyoteNo ratings yet

- Tjoa Josua Evan Wahyudi - Business Law QuizDocument4 pagesTjoa Josua Evan Wahyudi - Business Law QuizPropena ButanaNo ratings yet

- Cangco v. Manila RailwayDocument2 pagesCangco v. Manila RailwayHarvey Leo RomanoNo ratings yet

- Freelance Project Contract: Scrumptious NibblesDocument2 pagesFreelance Project Contract: Scrumptious NibblesGhadeer Ahmad AlashkarNo ratings yet

- Image Rights SummaryDocument5 pagesImage Rights SummaryElle Soleil100% (1)

- Sublease AgreementDocument1 pageSublease Agreementmaimai175No ratings yet

- G.R. No. 167017 Case DigestDocument2 pagesG.R. No. 167017 Case DigestSuzette AbejuelaNo ratings yet

- LEASE AGREEMENT (Business Agreement) : This Agreement of Lease Is Made and Executed at Pune On 3 JULY, 2021Document5 pagesLEASE AGREEMENT (Business Agreement) : This Agreement of Lease Is Made and Executed at Pune On 3 JULY, 2021Somesh KulkarniNo ratings yet

- PCI-Leasing-vs-Trojan-Metal-Industries-digestDocument1 pagePCI-Leasing-vs-Trojan-Metal-Industries-digestKrister VallenteNo ratings yet

- Workmen's Compensation ActDocument14 pagesWorkmen's Compensation ActRupalita SarangiNo ratings yet

Fire Insurance Concept Map by Belarma

Fire Insurance Concept Map by Belarma

Uploaded by

Louis BelarmaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Fire Insurance Concept Map by Belarma

Fire Insurance Concept Map by Belarma

Uploaded by

Louis BelarmaCopyright:

Available Formats

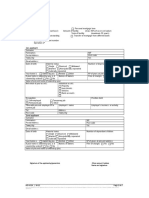

Notice of Loss

This must be

immediately

given, unless

delay is waived

expressly or Prerequisites to Recovery

impliedly by the

insurer.

Must be given

according to the

best evidence Liability on the part of the insurer will ensue

available. Delay Proof of Loss Yes only if there is a hostile fire. A hostile fire is

may also be one that is uncontrolled.

waived expressly Fire Hostile Fire?

or impliedly by No No liability for "friendly fire".

the insurer

If fire results, the loss is compensable

Yes because fire is the immediate cause so long

Insurer is entitled to rescind the contract. as lightning is not an excepted peril.

Lightning Did it result to fire?

Requisites:

No Loss may still be covered even if no results.

(1) The alteration is on the use or condition of Direct Loss

the thing insured;

(2) The use or condition of the thing insured In some insurance policies, the coverage for

is limited to the policy; windstorm stipulates that velocity of the

(3) The alteration is without the consent of wind. However, evidence of velocity is often

Windstorm

the insurer; absent, so currently the peril is considered in

(4) The alteration is within the control of the Yes terms of effect rather than establishing a

condition. Fire insurance covers not only damage or

insured; and

loss by fire but also allied risks if they are

(5) The alteration increases the risk.

covered by extensions and separate

Non-Fire Tornado policies.

There is an increase in the hazard or risk if

there is substantial change of conditions Alteration in the Use or Condition

affecting the risk as materially to increase it. Increase in Risk of Loss? The coverage for earthquake is usually

of a Thing Insured covered by a separate policy or extension

However, mere negligence temporarily

endangering the property does not violate rather than part of an existing coverage

the law. because it will increase the cost of policy to

Earthquake

Coverage the point that it would not be equitable.

Hence, earthquake peril is always an

Does not affect the insurance. No exclusion from an ordinary fire insurance

policy.

FIRE INSURANCE

In a valued policy, the valuation fixed in the Other Allied Risks

policy shall be binding on the parties. The

rule is the same in marine insurance. Hence, This insurance may provide that the insurer is

a valuation in a policy of fire insurance is liable for the loss suffered consisting of loss

conclusive between the parties thereto in of earnings comprising of the net profits that

adjustment of either partial or total loss, if Business Interruption Insurance

could have bee realized had the business

the insured has some interest at risk, and Valued Policy

continued and expenses that continue

there is no fraud on his part; but a valuation despite the interruption of the business.

fraudulent in fact, entitles the insurer to The indirect or consequential losses arise

rescind the contract. out of the loss of use of the property.

Indirect Loss This insurance covers extraordinary

An independent appraiser may be required to Extra Expense Insurance expenses that may be incurred in an effort to

Kinds of Policy avoid any interruption of service.

fix the value of the thing insured.

In an open policy where there is no valuation Rent Insurance This protects the insured from loss of rental

in the policy, the measure of indemnity in an income.

insurance against fire is the expense it would

be to the insured at the time of the Open Policy

commencement of the fire to replace the

thing lost or injured in the condition in which

at the time of the injury.

The parties may stipulate that the insurer

may cause the repair, rebuilding, or

replacement of the buildings or structures

wholly or partially destroyed or damaged. Option to Rebuild Clause

This clause operates as a wholesale check

upon the insured in estimating the value of

the damaged goods.

The fire insurance policy cannot be

transferred without the consent of the

insurer. Even if the alienation is allowed in

the insurance policy, it is also required that Structure of Insurance Policy

the transferee has insurable interest over the Clauses

insured property. Non-Alienation Clause

However, the "non-alienation clause" is not

violated by the execution of a chattel

mortgage. There is no alienation within the

meaning of the clause by the mortgage of

the property until foreclosure.

A co-insurance clause may likewise be

inserted in a fire insurance policy. There will Co-insurance Clause

be no co-insurance without such express

stipulation.

A policy may expressly exclude war,

invasion, civil commotion, or to the abnormal

War and Related Risks

conditions arising therefrom from the perils

insured against.

Exceptions

Even in the absence of stipulation, the

insurer may refuse to pay if the loss was the Intentional Act

result of intentional act of the insured. Exceptions and Warranties

In addition to statutory provisions regarding

alterations, the insurance policy may likewise Warranties

include express warranties regarding the use

and condition of the insured premises.

You might also like

- Bryant Plus 80 ManualDocument8 pagesBryant Plus 80 ManualLouCypher85% (13)

- Certificate of InsuranceDocument2 pagesCertificate of Insurancejcayubo26No ratings yet

- Form 5 Maths (Chapter 3 Consumer Mathematics: Insurance)Document19 pagesForm 5 Maths (Chapter 3 Consumer Mathematics: Insurance)Xiu Yun73% (11)

- Example Pyros & Fireworks Risk Assesment SectionDocument3 pagesExample Pyros & Fireworks Risk Assesment SectionSophie-Louise MercedesNo ratings yet

- Compilation of Bar Questions and Suggested Answers Under Commercial LAW (Transportation Law)Document56 pagesCompilation of Bar Questions and Suggested Answers Under Commercial LAW (Transportation Law)Sage Lingatong92% (13)

- CCC Insurance vs. KawasakiDocument6 pagesCCC Insurance vs. Kawasakibb yattyNo ratings yet

- Fire Insurance Concept MapDocument1 pageFire Insurance Concept MapjumpincatfishNo ratings yet

- Where The Loss Took Place While Being Rescued From The PerilDocument3 pagesWhere The Loss Took Place While Being Rescued From The PerilFaith Alexis Galano100% (1)

- Concept Map Kim InsuranceDocument1 pageConcept Map Kim InsuranceKim EstalNo ratings yet

- G4-Topic 1 - Standard Fire PolicyDocument5 pagesG4-Topic 1 - Standard Fire PolicyAINNUR MYSARA ABDUL HALIMNo ratings yet

- Fire InsuranceDocument1 pageFire InsuranceBryan RicaldeNo ratings yet

- Fire InsuranceDocument4 pagesFire InsuranceAya NamuzarNo ratings yet

- Chapter 14 Marine InsuranceDocument12 pagesChapter 14 Marine InsurancePennNo ratings yet

- Digest of Vda de Gabriel V Ca GR No 103883 PDFDocument2 pagesDigest of Vda de Gabriel V Ca GR No 103883 PDFXtian HernandezNo ratings yet

- Feb 24Document18 pagesFeb 24jagadishNo ratings yet

- Hotwork JsaDocument2 pagesHotwork JsaNur Alisha AlishaNo ratings yet

- Insurance Fire Insurance Concept MapDocument1 pageInsurance Fire Insurance Concept MapPhil JaramilloNo ratings yet

- Marine: Kinds of Indemnity Policies Averages LossDocument2 pagesMarine: Kinds of Indemnity Policies Averages LossDanica CaballesNo ratings yet

- Gasification Guide Check List Final PDFDocument6 pagesGasification Guide Check List Final PDFf.BNo ratings yet

- Insurance Types - Non LifeDocument5 pagesInsurance Types - Non LifeKRNo ratings yet

- Insurance and Surety Bond - EmilyDocument14 pagesInsurance and Surety Bond - EmilyJoe WongNo ratings yet

- Assurance Contre L'incendie enDocument4 pagesAssurance Contre L'incendie enMichel erickson talom waboNo ratings yet

- Natural Disaster Preparedness PlanDocument2 pagesNatural Disaster Preparedness PlanTIKTOK TRENDSNo ratings yet

- Damage Statement Writing FrameDocument2 pagesDamage Statement Writing Framezonaah.tariqNo ratings yet

- Insurance Intro CasesDocument7 pagesInsurance Intro CasesEmily SantiagoNo ratings yet

- Fire Emergency FlowchartDocument1 pageFire Emergency FlowchartBungsu Bono100% (1)

- Torts II 2020 WinterDocument8 pagesTorts II 2020 WinterJasmine GanNo ratings yet

- Unit 7 InsuranceDocument3 pagesUnit 7 InsuranceKanishkaNo ratings yet

- Sem 10 Cia 2Document5 pagesSem 10 Cia 2124117025No ratings yet

- Fire Insurance: - Isha Chugh Assistant Professor Gargi College University of DelhiDocument22 pagesFire Insurance: - Isha Chugh Assistant Professor Gargi College University of Delhiadarsh walavalkarNo ratings yet

- Hazard Identification & Risk Assesment (Hira) Ohs-Pr-02-03-F07 Job Safe ProcedureDocument5 pagesHazard Identification & Risk Assesment (Hira) Ohs-Pr-02-03-F07 Job Safe ProcedureMuhammad M KhanNo ratings yet

- Plot DiagramDocument2 pagesPlot DiagramthatonespeedcuberNo ratings yet

- Standard List of Threats and RisksDocument7 pagesStandard List of Threats and RisksNemattullah RahimiNo ratings yet

- Vista Operation ManualDocument28 pagesVista Operation Manualrtp4b9qtmdNo ratings yet

- Insurance First QuizDocument3 pagesInsurance First QuizronaldNo ratings yet

- Encik Luqmans Case2023112 0044Document1 pageEncik Luqmans Case2023112 0044Muhammad AssocNo ratings yet

- INSURANCE Finals ReviewerDocument4 pagesINSURANCE Finals ReviewerCloieRjNo ratings yet

- Section 90 94Document5 pagesSection 90 94Rodel Cadorniga Jr.No ratings yet

- Fire Insurance p300-309Document3 pagesFire Insurance p300-309Shasharu Fei-fei LimNo ratings yet

- Belarma 5-10Document1 pageBelarma 5-10Louis BelarmaNo ratings yet

- 28 Eusebio Vs EusebioDocument2 pages28 Eusebio Vs EusebioLouis BelarmaNo ratings yet

- Philippine Health Care Providers Inc Brief DigestDocument2 pagesPhilippine Health Care Providers Inc Brief DigestLouis BelarmaNo ratings yet

- Borromeo v. Borromeo DigestDocument3 pagesBorromeo v. Borromeo DigestLouis BelarmaNo ratings yet

- Heirs of Loreto C. Maramag vs. Maramag - CivPro - KongDocument3 pagesHeirs of Loreto C. Maramag vs. Maramag - CivPro - KongLouis BelarmaNo ratings yet

- Apelanio Vs Arcanys, Inc.Document3 pagesApelanio Vs Arcanys, Inc.Louis BelarmaNo ratings yet

- 41 Steel Corporation v. Equitable PCIBankDocument3 pages41 Steel Corporation v. Equitable PCIBankLouis Belarma100% (2)

- Dela Torre V Pepsi ColaDocument2 pagesDela Torre V Pepsi ColaLouis BelarmaNo ratings yet

- Evangelista Vs CIRDocument3 pagesEvangelista Vs CIRLouis BelarmaNo ratings yet

- Renato Diaz Vs Secretary of FinanceDocument5 pagesRenato Diaz Vs Secretary of FinanceLouis BelarmaNo ratings yet

- CIR Vs Algue DigestDocument4 pagesCIR Vs Algue DigestLouis BelarmaNo ratings yet

- Mongao Vs Pryce PropertiesDocument3 pagesMongao Vs Pryce PropertiesLouis BelarmaNo ratings yet

- H. Tambunting Pawnshop v. CIRDocument3 pagesH. Tambunting Pawnshop v. CIRLouis Belarma100% (2)

- Mercedita Coombs v. Victoria Castañeda, Virgilio Santos, Sps. Pancho & Edith Leviste, BPI, and The Register of Deeds of Muntinlupa CityDocument3 pagesMercedita Coombs v. Victoria Castañeda, Virgilio Santos, Sps. Pancho & Edith Leviste, BPI, and The Register of Deeds of Muntinlupa CityLouis BelarmaNo ratings yet

- Ayala Vs TagleDocument2 pagesAyala Vs TagleLouis BelarmaNo ratings yet

- 5 Lucero Vs COMELECDocument3 pages5 Lucero Vs COMELECLouis BelarmaNo ratings yet

- 24 Montebon Vs ComelecDocument2 pages24 Montebon Vs ComelecLouis BelarmaNo ratings yet

- Batabor Vs COMELECDocument2 pagesBatabor Vs COMELECLouis BelarmaNo ratings yet

- Wa0002.Document56 pagesWa0002.deepakkcaNo ratings yet

- Law of Torts Project WorkDocument49 pagesLaw of Torts Project WorkNikhil AradheNo ratings yet

- 12 Lustan vs. CA DIGESTDocument3 pages12 Lustan vs. CA DIGESTcassandra leeNo ratings yet

- Contracts 1Document16 pagesContracts 1Raghavendra NadgaudaNo ratings yet

- PROSPECTUS - Contents and Liability For MisrepresentationDocument14 pagesPROSPECTUS - Contents and Liability For MisrepresentationTarun PratapNo ratings yet

- Solicitud Prestamo InglesDocument7 pagesSolicitud Prestamo InglesGrazyna PrzyborowskaNo ratings yet

- Business Law - NMIMSDocument6 pagesBusiness Law - NMIMSlucky.idctechnologiesNo ratings yet

- Case Digest - SAURA IMPORT and EXPORT CO Vs DBPDocument6 pagesCase Digest - SAURA IMPORT and EXPORT CO Vs DBPMaricris GalingganaNo ratings yet

- LicenseDocument5 pagesLicenseYoshua SuandiNo ratings yet

- 392 2016 Commercial Registration and Licensing Council of MinistersDocument34 pages392 2016 Commercial Registration and Licensing Council of MinistersPeter MuigaiNo ratings yet

- SPECIAL POWER OF ATTORNEY CatimbangDocument2 pagesSPECIAL POWER OF ATTORNEY CatimbangAtty. R. PerezNo ratings yet

- Family Law ProjectDocument20 pagesFamily Law Projectpulkit248100% (1)

- Script For Advocacy PresentationDocument3 pagesScript For Advocacy PresentationBeth KingNo ratings yet

- Saligram Ruplal Khanna V Kanwar RajnathDocument7 pagesSaligram Ruplal Khanna V Kanwar RajnathJashan RNo ratings yet

- Banking Law Notes 10Document6 pagesBanking Law Notes 10Afiqah IsmailNo ratings yet

- 17 Interpretation of ContractsDocument113 pages17 Interpretation of ContractsEngelov AngtonivichNo ratings yet

- PEGANG MINING CO LTD V CHOONG SAM & ORS, (1969) 2 MLJ 52Document7 pagesPEGANG MINING CO LTD V CHOONG SAM & ORS, (1969) 2 MLJ 52Matthew Van HuizenNo ratings yet

- CH3 - Corporate Law PDFDocument5 pagesCH3 - Corporate Law PDFGiane Fks MarieNo ratings yet

- FIATA Documents and FormsDocument28 pagesFIATA Documents and FormsKoyoteNo ratings yet

- Tjoa Josua Evan Wahyudi - Business Law QuizDocument4 pagesTjoa Josua Evan Wahyudi - Business Law QuizPropena ButanaNo ratings yet

- Cangco v. Manila RailwayDocument2 pagesCangco v. Manila RailwayHarvey Leo RomanoNo ratings yet

- Freelance Project Contract: Scrumptious NibblesDocument2 pagesFreelance Project Contract: Scrumptious NibblesGhadeer Ahmad AlashkarNo ratings yet

- Image Rights SummaryDocument5 pagesImage Rights SummaryElle Soleil100% (1)

- Sublease AgreementDocument1 pageSublease Agreementmaimai175No ratings yet

- G.R. No. 167017 Case DigestDocument2 pagesG.R. No. 167017 Case DigestSuzette AbejuelaNo ratings yet

- LEASE AGREEMENT (Business Agreement) : This Agreement of Lease Is Made and Executed at Pune On 3 JULY, 2021Document5 pagesLEASE AGREEMENT (Business Agreement) : This Agreement of Lease Is Made and Executed at Pune On 3 JULY, 2021Somesh KulkarniNo ratings yet

- PCI-Leasing-vs-Trojan-Metal-Industries-digestDocument1 pagePCI-Leasing-vs-Trojan-Metal-Industries-digestKrister VallenteNo ratings yet

- Workmen's Compensation ActDocument14 pagesWorkmen's Compensation ActRupalita SarangiNo ratings yet