Professional Documents

Culture Documents

City Refunding One-Pager

City Refunding One-Pager

Uploaded by

Ann DwyerOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

City Refunding One-Pager

City Refunding One-Pager

Uploaded by

Ann DwyerCopyright:

Available Formats

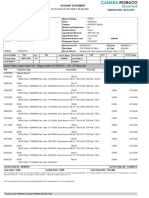

2021 REFINANCING & RESTRUCTURING

To address $450 million of the budget gap in FY2020 and $500 million in FY2021 caused by

revenue loss due to the pandemic, the City will refinance and restructure its outstanding debt

What is a Refinancing for Savings?

• The City’s refinancing for savings will Debt Refinancing

generate approximately $74 million in

savings1, which will pay for the cost of 1%

the debt restructuring

5%

4%

• The refinancing will replace the interest

rate on outstanding City bonds from 5%

to 4% Current Interest New Interest Savings from

Rate Rate Refinancing

(Expensive Debt) (Cheaper Debt)

What is a Restructuring?

• A restructuring borrows to pay for near

term debt and repays that debt over Debt Restructuring

time

• The restructuring costs $43 million1 on a

net present value basis Restructuring

$100 $105

• Combined with the $74 million of

refinancing for savings, the overall 0%

transaction will generate $31 million of FY2020 & FY2021 FY2022-2050

net present value savings1

• If federal funding becomes available, the City will not issue the debt restructuring

What is the Total Proposed Financing Package?

• The total transaction will be net present value neutral – in the current market, it

generates $31 million in net present value savings

• The transaction will result in budgetary relief of $450 million for FY2020 and $500 million

for FY2021

1 Based on current municipal bond market rates

What Will the New Debt Profile Look Like?

$1,200 Overall Debt Service Profile

Savings in 2020 and 2021 Added Debt Service

$1,000 Current Debt Service

Projected New Debt Service Payments

$800 Added Debt Service

$600

$500M

$926M

$923M

$885M

$871M

$862M

$450M

$861M

$860M

$860M

$860M

$859M

$857M

$852M

$840M

$835M

$728M

$400

$602M

$550M

$550M

$550M

$381M

$381M

$200

$233M

$233M

$233M

$233M

$233M

$227M

$206M

$0

Fiscal Year

$300

Transaction Debt Service Impact (Future Value)

$200

$90M

$88M

$88M

$80M

$80M

$80M

$80M

$80M

$80M

$80M

$71M

$70M

$68M

$61M

$55M

$207M

$207M

$207M

$40M

$40M

$40M

$40M

$40M

$40M

$36M

$10M

$100

$1M

Debt Service Payments

-

($22M)

($25M)

($100)

($450M)

($200)

($500M)

($300)

The refunding results in upfront

($400) savings of nearly $1 billion

($500)

($600)

Fiscal Year

$300

Transaction Debt Service Impact (Present Value)

$200

$66M

$64M

$61M

$43M

$40M

$39M

$37M

$37M

$36M

$35M

$34M

$34M

$34M

$33M

$33M

$32M

$32M

$31M

$30M

$30M

$29M

$28M

$28M

$27M

$26M

$10M

$100

$1M

Present Value Debt Service Payments

-

($15M)

($16M)

($100)

($450M)

($480M)

($200)

($300)

The refunding results in upfront - $1 today is worth more than $1 tomorrow

($400) savings of nearly $1 billion - $1 of costs in 30 years is only 29¢ today

- Because of this, the transaction overall has

($500)

present value savings of $31M

($600)

Fiscal Year

You might also like

- R - Nascar Chicago Park District Permit Agreement 2022-25 - Fully ExecutedDocument46 pagesR - Nascar Chicago Park District Permit Agreement 2022-25 - Fully ExecutedAnn Dwyer100% (1)

- R - Nascar Chicago Park District Permit Agreement 2022-25 - Fully ExecutedDocument46 pagesR - Nascar Chicago Park District Permit Agreement 2022-25 - Fully ExecutedAnn Dwyer100% (1)

- Chicago Access - Michigan East Project Narrative FINAL 5-23-2022Document29 pagesChicago Access - Michigan East Project Narrative FINAL 5-23-2022Ann DwyerNo ratings yet

- PDF PDFDocument7 pagesPDF PDFMikey MadRatNo ratings yet

- Big 'J'S Supermarket Income Statement 2022Document2 pagesBig 'J'S Supermarket Income Statement 2022Stephen Francis100% (1)

- 87549654Document3 pages87549654Joel Christian Mascariña100% (1)

- Assignment Dataset 1Document19 pagesAssignment Dataset 1Chip choiNo ratings yet

- Strat Cost 8-24Document4 pagesStrat Cost 8-24Vivienne Rozenn LaytoNo ratings yet

- R - Chicago Park District - C3 Agreement Term Summary July 30 2022Document3 pagesR - Chicago Park District - C3 Agreement Term Summary July 30 2022Ann DwyerNo ratings yet

- Columbus Statue LawsuitDocument12 pagesColumbus Statue LawsuitWGN Web DeskNo ratings yet

- TESLA-financial Statement 2016-2020Document18 pagesTESLA-financial Statement 2016-2020XienaNo ratings yet

- Homework Week4Document6 pagesHomework Week4Baladashyalan Rajandran0% (1)

- Lecture-12 Capital Budgeting Review Problem (Part 2)Document2 pagesLecture-12 Capital Budgeting Review Problem (Part 2)Nazmul-Hassan SumonNo ratings yet

- Maths ProjectDocument3 pagesMaths Projectviren23212764% (33)

- Deferred Financing-BOC Presentation Aug 19 2009-FINALDocument19 pagesDeferred Financing-BOC Presentation Aug 19 2009-FINALsmf 4LAKidsNo ratings yet

- Accounting ExamDocument6 pagesAccounting Examgenn katherine gadunNo ratings yet

- Slides Fixed Income Risk and Return Duration of A Bond PortfolioDocument10 pagesSlides Fixed Income Risk and Return Duration of A Bond Portfolioabdalla hafezNo ratings yet

- Exercise 8 13 TemplateDocument4 pagesExercise 8 13 TemplateashibhallauNo ratings yet

- Borrowing Cost Sample ProblemsDocument8 pagesBorrowing Cost Sample Problemslet me live in peaceNo ratings yet

- AKM (Pert.10)Document6 pagesAKM (Pert.10)akunkampusdinaNo ratings yet

- Nguyen Thu HuyenDocument8 pagesNguyen Thu Huyenhuyền nguyễnNo ratings yet

- Evaluating Business and Engineering Assets - Part II: Professor C. S. ParkDocument8 pagesEvaluating Business and Engineering Assets - Part II: Professor C. S. ParkAlishaNo ratings yet

- ICC Trade Now AsiaDocument4 pagesICC Trade Now AsiaducvaNo ratings yet

- Free Cash Flow $ 378,400.00 $ 416,240.00Document2 pagesFree Cash Flow $ 378,400.00 $ 416,240.00Raca DesuNo ratings yet

- WPC Assignment - FM CaseDocument6 pagesWPC Assignment - FM CaseAhmed AliNo ratings yet

- Implementation of Wave Effects in The Unstructured Delft3D Suite FinalDocument24 pagesImplementation of Wave Effects in The Unstructured Delft3D Suite FinalSud HaldarNo ratings yet

- This Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewDocument2 pagesThis Study Resource Was: Question 3. Blindfold Technologies Inc. (BTI) Is Considering Whether To Introduce A NewFaradibaNo ratings yet

- Answers To Problems Problem 1: Advantages of LeasingDocument11 pagesAnswers To Problems Problem 1: Advantages of LeasingEvan AzizNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- 2011 Pre-Budget PresentationDocument25 pages2011 Pre-Budget PresentationlabradoreNo ratings yet

- May 11 Updated Admin Plan For ARPADocument2 pagesMay 11 Updated Admin Plan For ARPAWVXU NewsNo ratings yet

- US Agency Mortgage Backed Securities FINAL YB v04Document24 pagesUS Agency Mortgage Backed Securities FINAL YB v04shahzaib100% (1)

- Consolidation Entries Debi T Cred ItDocument4 pagesConsolidation Entries Debi T Cred ItsafqwfNo ratings yet

- Assignment SolutionDocument5 pagesAssignment SolutionAzmeena FezleenNo ratings yet

- Barack Home Rental Income Statement For The Period 31 October 2022Document3 pagesBarack Home Rental Income Statement For The Period 31 October 2022Stephen FrancisNo ratings yet

- Chapter 11 Mini Case: Cash Flow EstimationDocument60 pagesChapter 11 Mini Case: Cash Flow EstimationafiNo ratings yet

- 2009 Hosp BudgetDocument5 pages2009 Hosp BudgetfaseeNo ratings yet

- New Microsoft Excel WorksheetDocument2 pagesNew Microsoft Excel WorksheetKeresha WilliamsNo ratings yet

- BNIS Short Notes - : Still A Long Road To RecoveryDocument4 pagesBNIS Short Notes - : Still A Long Road To RecoveryYosafatNo ratings yet

- Ross Fundamentals of Corporate Finance 13e CH10 PPT AccessibleDocument38 pagesRoss Fundamentals of Corporate Finance 13e CH10 PPT AccessibleAdriana RisiNo ratings yet

- Tugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BDocument23 pagesTugas Penyelesaian 14 AIK - 0119101024 - Muhamad Adam Palmaleo - Kelas BAdam PalmaleoNo ratings yet

- Mohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingDocument7 pagesMohsin Hassan Bba Iib BUS-19F-044 Principle of AccountingMohsin HassanNo ratings yet

- Format of Bond RefundingDocument9 pagesFormat of Bond RefundingvanvunNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Null 316 346Document13 pagesNull 316 346Samson JamesNo ratings yet

- Rahul Shah 21bsp3195Document24 pagesRahul Shah 21bsp3195Charvi GosaiNo ratings yet

- Ae211 Finals QuizDocument20 pagesAe211 Finals QuizDJAN IHIAZEL DELA CUADRANo ratings yet

- Dos Bocas Refinery 1585457994Document12 pagesDos Bocas Refinery 1585457994Edwin Altúzar GNo ratings yet

- Despite A Decline in Incarceration, Correction Spending, Violence, and Use of Force Continued To Rise in FY 2018Document9 pagesDespite A Decline in Incarceration, Correction Spending, Violence, and Use of Force Continued To Rise in FY 2018ZacharyEJWilliamsNo ratings yet

- Bond RefundingDocument8 pagesBond RefundingvanvunNo ratings yet

- Aug. 16 Bond PresentationDocument18 pagesAug. 16 Bond PresentationApril ToweryNo ratings yet

- What Power Dividens HaveDocument12 pagesWhat Power Dividens HaveAlin UngureanuNo ratings yet

- Financial ManagementDocument34 pagesFinancial ManagementMediation M kskejrNo ratings yet

- KIX2002 Tutorial 6 Evaluating A Single Project Part 2Document1 pageKIX2002 Tutorial 6 Evaluating A Single Project Part 2Wen HanNo ratings yet

- Fundamentals of Accounting AssignmentDocument5 pagesFundamentals of Accounting AssignmentFiromsa Ahmednur Tesfaye100% (1)

- 28498f7dafef57b361720d949d97c384Document2 pages28498f7dafef57b361720d949d97c384priyaNo ratings yet

- Topic 2 Investment AppraisalDocument22 pagesTopic 2 Investment Appraisalwongh ka manNo ratings yet

- Resort Resort Resort Resort: Baja California SurDocument20 pagesResort Resort Resort Resort: Baja California SurWill22No ratings yet

- A Green Winter: The Case of Proposed Jiminy Peak Mountain Resort Wind TurbineDocument14 pagesA Green Winter: The Case of Proposed Jiminy Peak Mountain Resort Wind TurbineTamanna FarhanNo ratings yet

- Lyons Document Storage Corporation: Bond Accounting: Lake PushkarDocument9 pagesLyons Document Storage Corporation: Bond Accounting: Lake PushkarantonioNo ratings yet

- Video Gaming & Esports: Taking Media and Entertainment To The Next LevelDocument16 pagesVideo Gaming & Esports: Taking Media and Entertainment To The Next LevelMohamed MahmoudNo ratings yet

- 2-Page Budget Gap InfographicDocument2 pages2-Page Budget Gap InfographicShannon Margaret BlumNo ratings yet

- Introduction To Accounting and Business: Discussion QuestionsDocument46 pagesIntroduction To Accounting and Business: Discussion QuestionsCyyyNo ratings yet

- Impairment of LoanDocument4 pagesImpairment of LoanaleywaleyNo ratings yet

- September 16 - Budget AmendmentsDocument8 pagesSeptember 16 - Budget AmendmentsIvan HerreraNo ratings yet

- Capital Budgeting WorkShop 2 2020-1Document3 pagesCapital Budgeting WorkShop 2 2020-1Valentina Barreto Puerta0% (1)

- FY 2023 Budget SummaryDocument193 pagesFY 2023 Budget SummaryAnn DwyerNo ratings yet

- Complaint For Equitable Relief Under The Clayton Act: See USA v. Madigan, 1:22-cr-00115 (N.D. Ill.)Document9 pagesComplaint For Equitable Relief Under The Clayton Act: See USA v. Madigan, 1:22-cr-00115 (N.D. Ill.)Ann DwyerNo ratings yet

- We Stand For Democracy.: A Government of The People, by The PeopleDocument1 pageWe Stand For Democracy.: A Government of The People, by The PeopleAnn DwyerNo ratings yet

- 2022-04-12.CBM RK To Khan-FTC Re Washington CommandersDocument20 pages2022-04-12.CBM RK To Khan-FTC Re Washington CommandersAnn DwyerNo ratings yet

- A Letter From Joe Mansueto and Kunal Kapoor - MorningstarDocument4 pagesA Letter From Joe Mansueto and Kunal Kapoor - MorningstarAnn DwyerNo ratings yet

- UIC Human Trafficking FactsheetDocument6 pagesUIC Human Trafficking FactsheetAnn DwyerNo ratings yet

- Changes at BasecampDocument4 pagesChanges at BasecampAnn DwyerNo ratings yet

- Seeding by Ceding - by MacKenzie Scott - Jun, 2021 - MediumDocument18 pagesSeeding by Ceding - by MacKenzie Scott - Jun, 2021 - MediumAnn DwyerNo ratings yet

- HHRG 117 BA00 Wstate GriffinK 20210218Document3 pagesHHRG 117 BA00 Wstate GriffinK 20210218Ann DwyerNo ratings yet

- Bronzeville Lakefront HreDocument15 pagesBronzeville Lakefront HreAnn DwyerNo ratings yet

- CEO Report 2 15 22 Casino Proposals FinalDocument33 pagesCEO Report 2 15 22 Casino Proposals FinalAnn DwyerNo ratings yet

- The Honorable Lori E. Lightfoot Mayor of Chicago: City HallDocument2 pagesThe Honorable Lori E. Lightfoot Mayor of Chicago: City HallAnn DwyerNo ratings yet

- Tom Ricketts, Executive Chairman, Chicago CubsDocument1 pageTom Ricketts, Executive Chairman, Chicago CubsAnn DwyerNo ratings yet

- TH TH THDocument3 pagesTH TH THAnn DwyerNo ratings yet

- Support For MotionDocument48 pagesSupport For MotionAnn DwyerNo ratings yet

- An UpdateDocument2 pagesAn UpdateAnn DwyerNo ratings yet

- St. Sabina Letter Notifying Them of Allegation Against Fr. PflegerDocument1 pageSt. Sabina Letter Notifying Them of Allegation Against Fr. PflegerWGN Web Desk100% (1)

- 1 PDFsam CompStat Public 2020 Week 50Document1 page1 PDFsam CompStat Public 2020 Week 50Ann DwyerNo ratings yet

- Business Leaders Call On Congress To Accept The Electoral College Results - Partnership For New York CityDocument6 pagesBusiness Leaders Call On Congress To Accept The Electoral College Results - Partnership For New York CityAnn DwyerNo ratings yet

- CTU DemandsDocument1 pageCTU DemandsAnn DwyerNo ratings yet

- Estimated Full Value of Real Property in Cook County 2009 - 2018Document21 pagesEstimated Full Value of Real Property in Cook County 2009 - 2018Ann DwyerNo ratings yet

- Duckworth-Durbin Joint Letter To USAO Re. Prosecuting IL Capitol Rioters - FinalDocument2 pagesDuckworth-Durbin Joint Letter To USAO Re. Prosecuting IL Capitol Rioters - FinalAnn DwyerNo ratings yet

- Stefani's Pier Front Inc. Petition For Tro & Inj ReliefDocument204 pagesStefani's Pier Front Inc. Petition For Tro & Inj ReliefAnn DwyerNo ratings yet

- Cannabis - Lottery.mandamus MOTDocument55 pagesCannabis - Lottery.mandamus MOTAnn DwyerNo ratings yet

- Pedro SotoDocument4 pagesPedro SotoAnn DwyerNo ratings yet

- Banking Law 2Document18 pagesBanking Law 2ShiyaNo ratings yet

- BBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsDocument22 pagesBBMF 3183 Strategic Financial Management: 13 Corporate ReorganizationsKarthina RishiNo ratings yet

- Personal Finance Canadian Canadian 6th Edition Kapoor Test BankDocument8 pagesPersonal Finance Canadian Canadian 6th Edition Kapoor Test BankDrAnnaHubbardDVMitaj100% (38)

- How The Pandemic Has Affected The Macroeconomic VariablesDocument3 pagesHow The Pandemic Has Affected The Macroeconomic VariablesShruti GangarNo ratings yet

- NeerajDocument2 pagesNeerajSheelu SinghNo ratings yet

- Financial Accounting: Wipro Ratio AnalysisDocument21 pagesFinancial Accounting: Wipro Ratio AnalysisSawarmal ChoudharyNo ratings yet

- Water and Sewerage Department: 2,992 Gallons 0 GallonsDocument2 pagesWater and Sewerage Department: 2,992 Gallons 0 GallonsAce MereriaNo ratings yet

- HDFC BankDocument2 pagesHDFC BankAbhilash KumarNo ratings yet

- This Is A System-Generated Statement. Hence, It Does Not Require Any SignatureDocument4 pagesThis Is A System-Generated Statement. Hence, It Does Not Require Any Signatureyour mdrahamanNo ratings yet

- Year-End Report - CBC MidDocument544 pagesYear-End Report - CBC MidYurih Khei Jham AluminumNo ratings yet

- Account Detail - Wells FargoDocument1 pageAccount Detail - Wells Fargoashley BrunnerNo ratings yet

- Synopsis - Manjit GogoiDocument6 pagesSynopsis - Manjit GogoiManjit GogoiNo ratings yet

- Domain Aptitude Quiz, Suprise TestDocument2 pagesDomain Aptitude Quiz, Suprise TestMesiya AnastasiabarusNo ratings yet

- ECO561 EconomicsDocument14 pagesECO561 EconomicsG JhaNo ratings yet

- Economics Coursework QuestionsDocument7 pagesEconomics Coursework Questionsf5dgrnzh100% (2)

- Report On Online BankingDocument67 pagesReport On Online BankingJahadul IslamNo ratings yet

- Lesson 10 Assignment 4Document4 pagesLesson 10 Assignment 4marcied357No ratings yet

- Canara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068Document2 pagesCanara Robeco Equity Hybrid Fund - Regular Monthly IDCW (GBDP) - ISIN: INF760K01068brotoNo ratings yet

- Banking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andDocument10 pagesBanking System Is Composed of Universal and Commercial Banks, Thrift Banks, Rural andgalilleagalillee100% (1)

- Currency War - Reasons and RepercussionsDocument15 pagesCurrency War - Reasons and RepercussionsRaja Raja92% (13)

- MnA India TaxPerspectiveDocument36 pagesMnA India TaxPerspectiveGamer LastNo ratings yet

- Account Statement From 1 Apr 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument3 pagesAccount Statement From 1 Apr 2023 To 31 Oct 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceBhavik NasitNo ratings yet

- ASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheDocument5 pagesASSIGNMENT (30 Marks) Task 1 (8) : Mics To TheJiaXinLimNo ratings yet

- Faisah Bandrang: Preciosa CelestinaDocument4 pagesFaisah Bandrang: Preciosa CelestinaBarangay MukasNo ratings yet

- Open-Economy Macroeconomics: The Balance of Payments and Exchange RatesDocument53 pagesOpen-Economy Macroeconomics: The Balance of Payments and Exchange RatesNikita KhandelwalNo ratings yet

- Quiz 1 On Applied AuditingDocument4 pagesQuiz 1 On Applied AuditingVixen Aaron EnriquezNo ratings yet

- Piramal Fund Management Domestic Real Estate Strategy IDocument31 pagesPiramal Fund Management Domestic Real Estate Strategy IkanikaNo ratings yet

- Final Report - Payments ProcessDocument32 pagesFinal Report - Payments Processmrshami7754No ratings yet